Market Overview

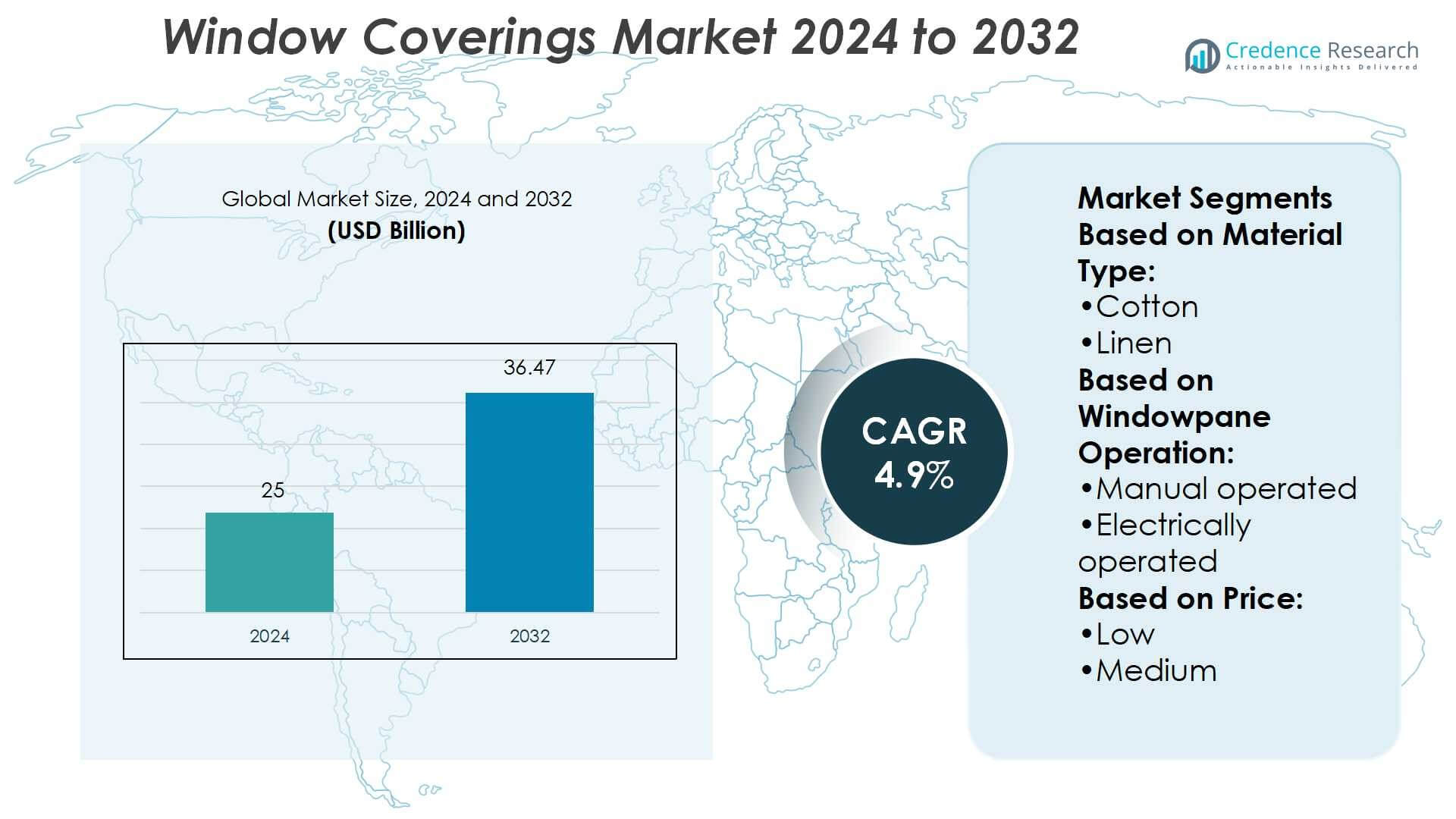

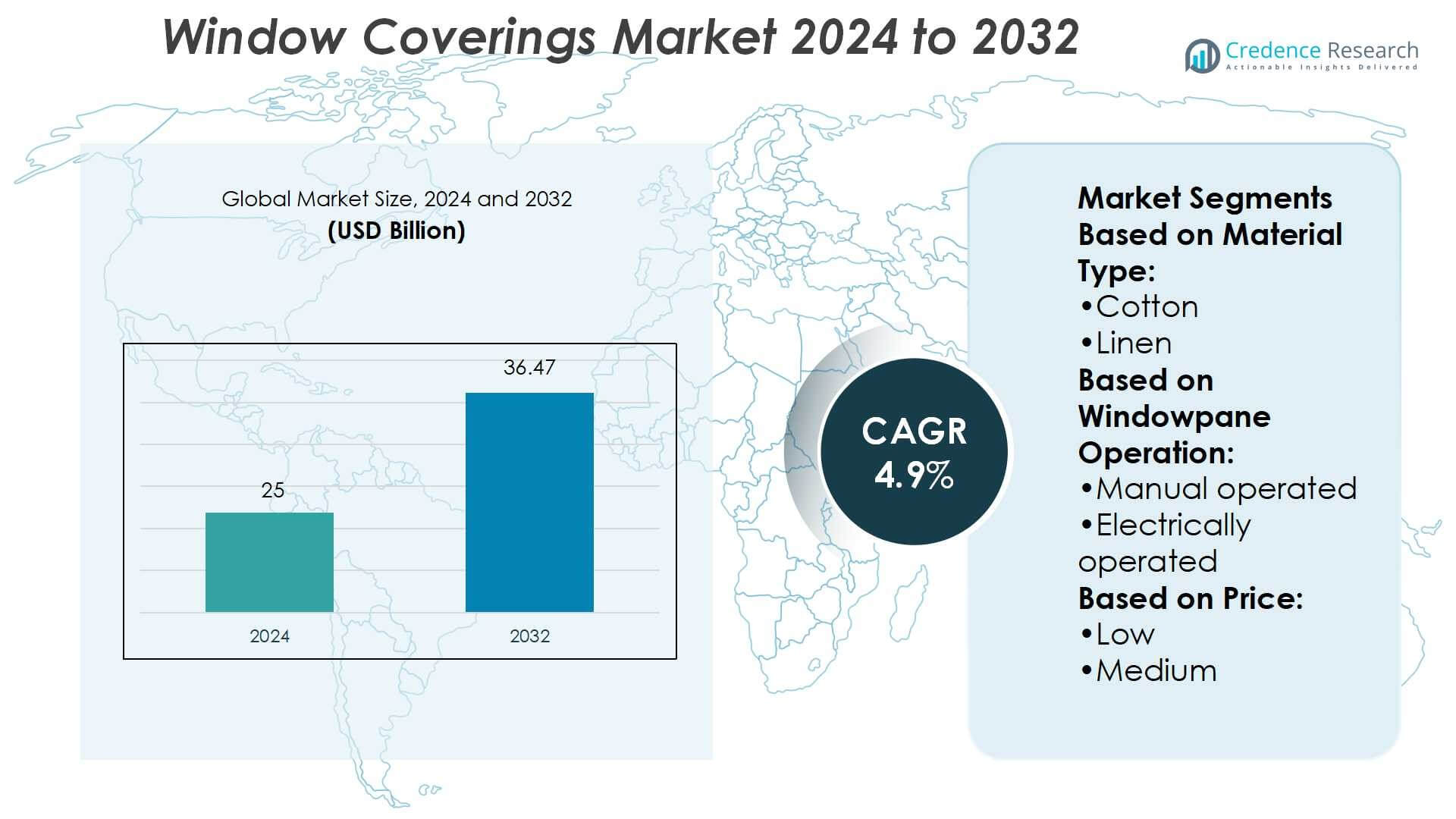

Window Coverings Market was valued USD 25 billion in 2024 and is anticipated to reach USD 36.47 billion by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Window Coverings Market Size 2024 |

USD 25 Billion |

| Window Coverings Market, CAGR |

4.9% |

| Window Coverings Market Size 2032 |

USD 36.47 Billion |

The window coverings market features strong competition among global and regional players, with leading companies including Hunter Douglas, IKEA, Graber, Hillarys, Budget Blinds, 3 Day Blinds, Aluvert Blinds, Comfortex Window Fashions, Advanced Window Blinds, and Aspect Blinds. These players focus on expanding portfolios through smart automation, eco-friendly fabrics, and customized solutions to capture diverse consumer segments. North America leads the global market with a 34% share, supported by high demand for premium designs, strong adoption of motorized systems, and robust renovation activities. The region’s purchasing power, sustainability focus, and advanced retail channels reinforce its dominant position.

Market Insights

- The Window Coverings Market was valued at USD 25 billion in 2024 and is projected to reach USD 36.47 billion by 2032, growing at a CAGR of 4.9%.

- Rising demand for smart and automated solutions, combined with eco-friendly fabrics, is driving adoption across both residential and commercial segments, with medium-priced products holding the largest segment share at 47%.

- The market remains highly competitive with global leaders and regional players expanding through innovation, customization, and partnerships, while cost-focused competitors challenge premium brands.

- High initial costs of motorized systems and the dominance of low-cost unorganized players act as restraints, limiting faster penetration in emerging economies.

- North America leads with a 34% market share, followed by Europe at 28% and Asia-Pacific at 25%, with North America’s dominance supported by premium adoption and renovation demand, while Asia-Pacific emerges as the fastest-growing region due to rapid urbanization and rising middle-class spending.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Cotton leads the window coverings market with a 32% share, driven by its durability, breathability, and affordability. Consumers prefer cotton blinds and curtains for their ease of maintenance and versatile design options. Linen and polyester follow closely, appealing to premium and mid-range buyers due to their texture and wrinkle resistance. Wood and PVC are strong in eco-friendly and modern interior settings, while metal finds niche use in commercial spaces. Cotton’s dominance is further supported by high adoption in residential projects, where demand for natural and cost-effective solutions continues to expand.

- For instance, Comfortex’s Color Lux line offers more than 800 color choices and over 3,500 fabric patterns for its cellular and roller shades, with fabric options that can include linen-weave polyester to allow precise matching for consumer preference.

By Windowpane Operation

Manual operated coverings dominate this segment with a 68% share, largely due to their cost-effectiveness and wide availability across product categories. Consumers favor manual blinds and curtains in both residential and commercial use, as they require no installation of motors or wiring. Electrically operated coverings, though gaining traction, remain concentrated in premium households and smart homes. Rising adoption of IoT and smart automation is expected to gradually shift the balance toward motorized systems. However, manual options maintain leadership by combining low price points with functional reliability.

- For instance, Hillarys’ FAQs state that for a Somfy powered electric wooden blind sized 120 cm × 120 cm, with operation twice per day, the motor battery lasts 6 to 9 months, depending on size and usage.

By Price

The medium price segment holds the largest share at 47%, supported by rising demand for affordable yet stylish window coverings among middle-income households. Medium-priced products balance cost, durability, and design variety, making them popular across both urban and semi-urban markets. The low-price segment retains importance in emerging regions, where cost-sensitive consumers prioritize function over style. High-priced coverings capture affluent buyers, boosted by luxury real estate projects and preference for premium materials like wood and linen. The medium range continues to dominate, as it addresses the mass-market need for quality at reasonable pricing.

Key Growth Drivers

Rising Demand for Home Renovation and Interior Design

The growing focus on modern home aesthetics is driving strong demand for window coverings. Consumers increasingly invest in blinds, shades, and curtains to enhance interior appeal and energy efficiency. The rise of urban housing projects and remodeling activities further boosts product adoption. Affordable options in cotton and polyester attract cost-conscious buyers, while premium designs in wood and linen appeal to higher-income groups. This combination of affordability and luxury is strengthening the market’s position across residential and commercial applications.

- For instance, 3 Day Blinds offers motorized shades that work with its Smart Hub, enabling timed operation and scenes via the 3 Day Blinds app or voice assistants; its rechargeable battery motors require charging only every 3 to 4 months when controlled twice daily across typical window sizes.

Adoption of Smart and Automated Solutions

The integration of smart home technologies is a key growth driver for the window coverings market. Electrically operated and automated coverings are gaining traction in urban households, supported by IoT and voice-control compatibility. Brands are introducing motorized blinds and smart shades that align with energy-saving goals and enhance convenience. Growing awareness of sustainability and consumer preference for modern living solutions further support this adoption. Although concentrated in premium markets, falling hardware costs are expected to expand accessibility over the forecast period.

Rising Urbanization and Middle-Class Expansion

Expanding urban populations and the growing middle-class segment are fueling the demand for window coverings. Rising disposable incomes allow consumers to allocate more spending toward home décor and functional solutions. The medium price segment benefits most, offering stylish yet cost-effective coverings suitable for mass-market adoption. Rapid construction of residential complexes, coupled with increased renovation activities in developed regions, adds momentum. This demographic shift is creating a sustained demand base, particularly for products balancing durability, affordability, and visual appeal.

Key Trends & Opportunities

Sustainability and Eco-Friendly Materials

A major trend is the shift toward sustainable window coverings made from eco-friendly materials like organic cotton, bamboo, and recycled fabrics. Consumers and regulators alike push for greener solutions to reduce environmental impact. This trend creates opportunities for manufacturers to differentiate through innovation in natural fibers and recyclable products. Brands that position themselves with strong sustainability credentials can gain significant traction, particularly in markets with high awareness of environmental standards and green certifications.

- For instance, IKEA’s product support pages state that with “normal usage (raising and lowering the blinds once a day), a fully charged battery should last 4 to 6 months before needing to be recharged.

Customization and Design Innovation

The growing preference for personalized interiors is fueling demand for customized window coverings. Consumers seek tailored solutions in terms of fabric, color, texture, and operation style. Digital design tools and online platforms allow buyers to visualize products before purchase, boosting confidence and sales. This trend benefits manufacturers offering flexible product portfolios that cater to individual tastes and evolving home design concepts. Customization also enables companies to expand into niche markets with unique value propositions.

- For instance, Graber specifies that the UltraLite Lift System can reduce the functional weight of shades by up to 40% compared to standard cordless systems. This reduction is a key feature that makes manual operation easier and smoother.

Key Challenges

High Costs of Smart and Premium Products

Despite strong interest in automation, high upfront costs limit the adoption of smart window coverings. Electrically operated and premium material products remain unaffordable for price-sensitive buyers, especially in developing regions. The requirement for additional hardware, installation, and maintenance further increases barriers. This cost factor constrains large-scale penetration, confining adoption to luxury homes and commercial spaces. Unless prices decline, cost-conscious consumers will continue to favor manual and low-cost alternatives.

Intense Competition from Low-Cost Alternatives

The window coverings market faces heavy competition from low-cost, unorganized manufacturers, especially in emerging economies. These players offer basic cotton and polyester products at significantly lower prices, appealing to budget-conscious consumers. This pressure forces established brands to constantly balance quality with affordability, impacting profit margins. Additionally, online marketplaces increase accessibility to cheaper alternatives, intensifying competition. To maintain leadership, branded players must focus on differentiation through innovation, sustainability, and customer service rather than relying solely on pricing strategies.

Regional Analysis

North America

North America holds a 34% share of the global window coverings market, driven by high demand for smart and automated solutions. Consumers increasingly prefer motorized blinds and shades integrated with home automation systems. Rising renovation projects in the United States and Canada further fuel adoption, particularly in residential spaces. Strong purchasing power supports growth in premium materials such as wood and linen. Energy efficiency standards and eco-friendly preferences also encourage the uptake of sustainable coverings. The region’s advanced retail infrastructure and strong presence of established brands continue to reinforce its market leadership.

Europe

Europe accounts for 28% of the market, supported by strong demand for eco-friendly and design-focused window coverings. Countries such as Germany, the UK, and France drive adoption of sustainable fabrics and wood-based products. Consumers in this region prioritize aesthetic appeal alongside functional benefits like insulation and energy savings. Growing popularity of customized solutions, particularly in urban housing projects, contributes to steady growth. Regulatory emphasis on energy efficiency encourages manufacturers to innovate with advanced fabrics. Europe’s strong home décor culture and consumer preference for premium-quality products sustain its significant position in the global market.

Asia-Pacific

Asia-Pacific commands a 25% market share, fueled by rapid urbanization and expansion of the middle-class population. Countries like China, India, and Japan show strong demand for affordable yet stylish window coverings. The region benefits from large-scale residential construction and increased renovation activity in urban areas. Medium-priced cotton and polyester dominate, while rising disposable incomes are gradually boosting sales of premium products. Growing e-commerce penetration enhances accessibility, particularly in tier-two and tier-three cities. Asia-Pacific’s expanding consumer base and preference for functional, cost-effective solutions make it one of the fastest-growing markets globally.

Latin America

Latin America holds a 7% share of the global market, with growth driven by increasing residential construction and rising consumer spending on home décor. Brazil and Mexico remain the largest contributors, where consumers favor medium-priced products for affordability and style. Demand for cotton and polyester coverings dominates due to cost sensitivity, though premium options see gradual growth in urban centers. Expanding retail networks and online platforms improve access to diverse product ranges. Economic challenges and currency fluctuations pose risks, but the region’s rising middle class supports steady demand for both functional and decorative window coverings.

Middle East & Africa

The Middle East & Africa account for 6% of the global market, supported by growth in luxury housing and commercial projects. Gulf countries such as the UAE and Saudi Arabia lead adoption, with high demand for premium wood and linen coverings. Rising investments in smart city projects boost interest in automated solutions. In Africa, cost-effective manual coverings dominate due to lower purchasing power. Growing urbanization and infrastructure development gradually increase demand for medium-priced products. The region’s market remains fragmented, but rising construction activity and premium lifestyle trends in the Middle East sustain its long-term potential.Top of Form

Market Segmentations:

By Material Type:

By Windowpane Operation:

- Manual operated

- Electrically operated

By Price:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The window coverings market players such as Aluvert Blinds, Comfortex Window Fashions, Hillarys, 3 Day Blinds, IKEA, Graber, Advanced Window Blinds, Hunter Douglas, Aspect Blinds, and Budget Blinds. The window coverings market is characterized by intense competition, with global and regional players striving to strengthen their positions. Companies differentiate themselves through product innovation, offering advanced motorized systems, eco-friendly fabrics, and customized design options to meet evolving consumer needs. The rise of smart home integration has further pushed manufacturers to invest in automated solutions compatible with IoT platforms. Distribution strategies, including partnerships with real estate developers, expansion in retail networks, and growing e-commerce channels, play a crucial role in market reach. While premium brands focus on sustainability and advanced features, value-driven players capture cost-sensitive segments. This dynamic landscape drives continuous innovation, ensuring a balance between functionality, style, and affordability across product categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aluvert Blinds

- Comfortex Window Fashions

- Hillarys

- 3 Day Blinds

- IKEA

- Graber

- Advanced Window Blinds

- Hunter Douglas

- Aspect Blinds

- Budget Blinds

Recent Developments

- In March 2025, Hunter Douglas launched its current rebate promotion offering rebates per shade on qualifying Silhouette or Pirouette Window Shades with PowerView Automation, running through March 31, 2025, demonstrating continued investment in smart home technology adoption.

- In December 2024, Springs Window Fashions successfully completed capital restructuring and debt refinancing, extending key debt instrument maturity from 2026 to 2028 while enhancing liquidity to capitalize on market recovery opportunities.

- In November 2023, Blinds by AD, a Bengaluru, India-based blinds manufacturer, introduced its new range of over 500 environment-friendly fabrics for windows featuring varied prints, textures, and colors suitable for both commercial and residential spaces.

- In July 2023, F. Schumacher & Co. established its new office in the historic Devlin building, situated at the heart of Manhattan’s vibrant Soho neighborhood. This relocation mirrors the company’s identity as a forward-thinking design hub fueled by innovation, housing renowned brands like Schumacher, Patterson Flynn, Backdrop, and Frederic magazine.

- In April 2023, the Romo Group collaborated with Alice Temperley, founder and creative director of Temperley London, to release a collection of wallpapers, pillows, fabric, and trimmings. Wallpapers were launched in 12 different patterns, ranging from animal prints to exotic chinoiserie to botanicals.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Windowpane Operation, Price and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady adoption of smart and automated window coverings in urban households.

- Demand for eco-friendly and sustainable fabrics will expand across residential and commercial applications.

- Customization and personalized design options will remain a key growth focus for manufacturers.

- E-commerce and digital visualization tools will enhance consumer engagement and product accessibility.

- Medium-priced window coverings will continue to dominate due to rising middle-class spending.

- Premium products will gain traction in luxury housing and commercial projects in developed markets.

- Emerging economies will drive significant growth through expanding urbanization and construction activities.

- Energy-efficient and insulating window coverings will attract demand amid stricter efficiency standards.

- Competitive differentiation will increasingly rely on sustainability, automation, and design versatility.

- Strategic collaborations with real estate developers will strengthen sales channels and product reach.