Market Overview

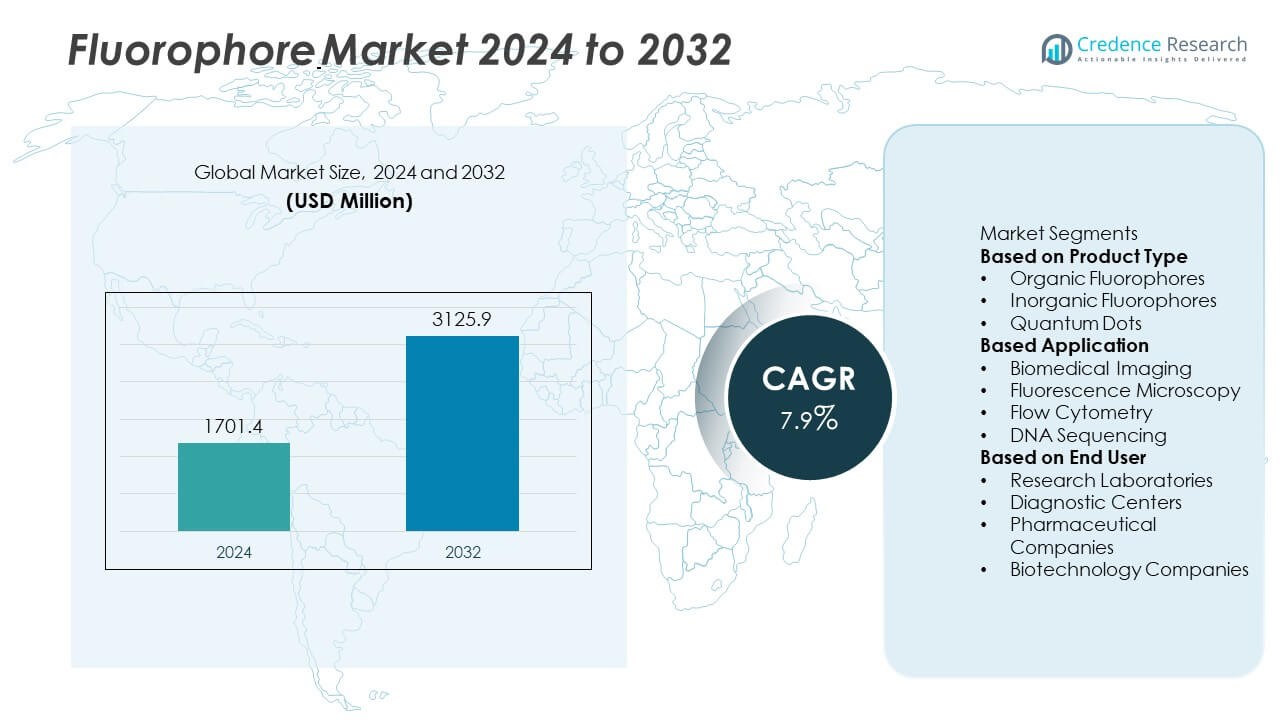

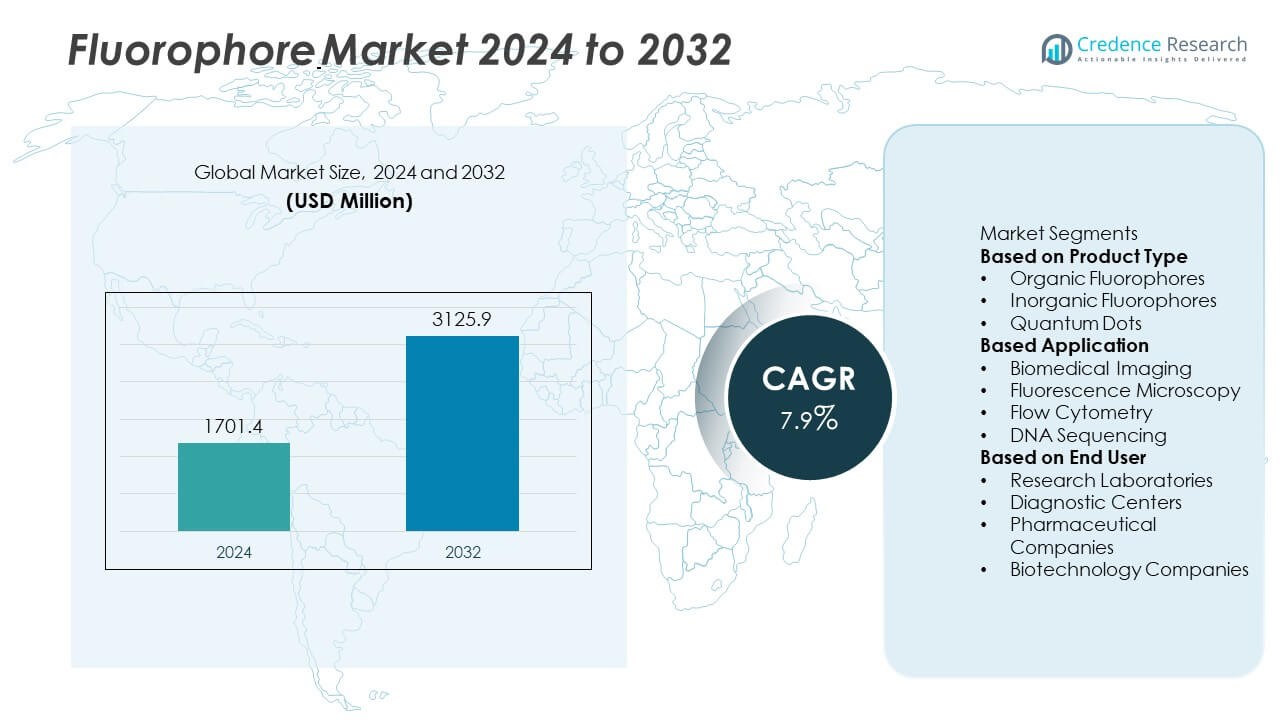

The Fluorophore market was valued at USD 1,701.4 million in 2024 and is projected to reach USD 3,125.9 million by 2032, expanding at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluorophore Market Size 2024 |

USD 1,701.4 Million |

| Fluorophore Market, CAGR |

7.9% |

| Fluorophore Market Size 2032 |

USD 3,125.9 Million |

The Fluorophore Market grows steadily, driven by rising demand in medical diagnostics, life sciences research, and advanced imaging technologies. Increasing adoption of fluorescence-based assays in disease detection and drug discovery strengthens its relevance across healthcare and biotechnology sectors. It benefits from continuous advancements in photostable and high-intensity compounds, enabling precise molecular tracking and multiplex imaging.

The Fluorophore Market demonstrates strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with North America leading due to advanced healthcare infrastructure, high research funding, and widespread adoption of fluorescence-based diagnostics. Europe follows with strong academic research networks and biotechnology innovation, while Asia-Pacific experiences rapid growth supported by expanding pharmaceutical and life sciences sectors. Latin America and the Middle East & Africa show rising adoption in clinical diagnostics and environmental testing. Key players shaping the market include Thermo Fisher Scientific, Merck KGaA, Agilent Technologies, and BioLegend. These companies focus on developing high-performance, photostable fluorophores, expanding product portfolios, and enhancing application-specific solutions. Continuous investment in R&D, coupled with strategic collaborations with research institutions, strengthens their market position and enables them to address the evolving needs of biotechnology, clinical research.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fluorophore Market was valued at USD 1701.4 million in 2024 and is projected to reach USD 3125.9 million by 2032, growing at a CAGR of 7.9% during the forecast period.

- Rising demand for fluorescence-based diagnostic tools, advanced imaging systems, and molecular assays drives the market’s expansion, supported by increasing applications in medical diagnostics and life sciences research.

- Trends indicate strong adoption of photostable, high-intensity fluorophores, integration with nanotechnology, and development of biocompatible formulations to enhance imaging accuracy and regulatory compliance.

- Competitive dynamics are shaped by innovation-driven strategies, with leading players focusing on expanding product portfolios, improving spectral properties, and forming collaborations with research institutes and biotechnology firms.

- High production costs and strict regulatory standards for chemical safety and environmental impact act as restraints, impacting the speed of new product introductions.

- Regionally, North America dominates due to advanced R&D infrastructure and strong healthcare investment, followed by Europe’s robust biotechnology ecosystem and Asia-Pacific’s growing pharmaceutical manufacturing and research base.

- Emerging markets in Latin America and the Middle East & Africa present growth potential through increased adoption in clinical diagnostics, environmental testing, and material sciences applications.

Market Drivers

Rising Demand for Advanced Diagnostic Imaging and Biomedical Research

The Fluorophore Market grows with the increasing adoption of fluorescence-based imaging techniques in clinical diagnostics and biomedical research. It supports early disease detection, cellular imaging, and molecular tracking with high sensitivity. Hospitals and research laboratories utilize it to enhance the accuracy of diagnostic assays and in vivo imaging. Advancements in microscopy technologies expand the application scope for these compounds. Strong demand in oncology, neurology, and immunology drives innovation in biocompatible and photostable fluorophores. It enables precise visualization of biological structures at the molecular level, improving research efficiency and diagnostic outcomes.

- For instance, Thermo Fisher Scientific’s Alexa Fluor Plus secondary antibodies demonstrate enhanced signal-to-noise ratios—offering up to 4.2-fold higher in immunofluorescence and up to 5.8-fold in fluorescent Western blot compared to traditional Alexa Fluor secondary conjugates

Growing Adoption in Drug Discovery and High-Throughput Screening

The Fluorophore Market benefits from its critical role in pharmaceutical research and high-throughput screening applications. It facilitates the detection of molecular interactions, enzyme activity, and receptor binding in drug development pipelines. Researchers use it in fluorescence-based assays to rapidly evaluate compound efficacy and toxicity. The trend toward personalized medicine increases the need for sensitive and specific labeling agents. It supports miniaturized assay formats, reducing sample and reagent consumption while maintaining accuracy. Expanding drug discovery programs worldwide continues to fuel the demand for innovative fluorophore solutions.

- For instance, Biomarkers Alliance reports that the Orion multiplexed imaging system enables 16‑ to 18‑plex immunofluorescence on a single tissue slide at 0.325 µm resolution using multiple excitation sources and computational signal unmixing to accelerate biomarker analysis workflows

Technological Advancements in Fluorescent Probes and Dyes

Continuous innovation in fluorescent probe chemistry strengthens the capabilities of the Fluorophore Market. Development of near-infrared (NIR) fluorophores, environment-sensitive dyes, and quantum dot-based systems enhances signal strength and reduces background noise. It offers higher photostability, improved brightness, and extended imaging durations. Integration with advanced imaging platforms such as confocal and super-resolution microscopy expands usability in complex biological studies. Researchers leverage it for multiplex imaging, enabling simultaneous detection of multiple biomarkers. These technological advancements elevate the precision and efficiency of scientific investigations.

Expanding Applications in Life Sciences and Environmental Monitoring

The Fluorophore Market diversifies with rising use in environmental analysis, food safety testing, and industrial monitoring. It supports detection of contaminants, pathogens, and chemical residues with high sensitivity. Environmental agencies employ it in fluorescence-based sensors to track pollutants in water and soil samples. Food quality laboratories use it for rapid microbial detection and product authentication. Its versatility extends to agricultural biotechnology, where it aids in plant pathogen identification and genetic studies. The broadening application landscape strengthens its role across multiple scientific and industrial sectors.

Market Trends

Shift Toward Near-Infrared and Far-Red Fluorophores

The Fluorophore Market experiences a notable transition toward near-infrared (NIR) and far-red emitting dyes for deeper tissue penetration and reduced background autofluorescence. These fluorophores improve in vivo imaging resolution, making them valuable for preclinical and clinical research. It supports enhanced sensitivity in detecting low-abundance targets in complex biological samples. Researchers increasingly adopt them for multiplexed imaging, enabling simultaneous analysis of multiple biomarkers. Advances in dye chemistry expand photostability and brightness, extending imaging duration without signal loss. The trend strengthens the application of fluorescence imaging in oncology, neuroscience, and regenerative medicine.

- For instance, Thermo Fisher Scientific’s Alexa Fluor 750 dye exhibits excitation at approximately 752 nm and emission near 776 nm, maintaining stable fluorescence in buffer and antifade media—commonly used in STORM and dSTORM super‑resolution microscopy

Rising Use of Environment-Sensitive and pH-Responsive Probes

Demand grows for fluorophores that change emission properties based on environmental factors such as pH, polarity, or ion concentration. The Fluorophore Market benefits from their use in tracking cellular processes and monitoring biochemical reactions in real time. It enables precise mapping of microenvironmental changes within cells and tissues. These probes find applications in disease mechanism studies, drug delivery research, and biosensor development. The integration of ratiometric dyes enhances quantitative imaging capabilities. Research institutions and biotech companies invest in such technologies to improve diagnostic and therapeutic monitoring.

- For instance, Sigma-Aldrich’s BioTracker Orange-NHS Live Cell pH dye (catalog SCT214) increases fluorescence intensity nearly twenty‑fold under acidic conditions—making it highly effective for live-cell imaging of lysosomes and endosomes

Integration of Fluorophores with Nanotechnology Platforms

Combining fluorophores with nanoparticles, quantum dots, and nanocarriers drives innovation in imaging and targeted delivery systems. The Fluorophore Market gains from enhanced brightness, tunable emission wavelengths, and multifunctional properties offered by nanotechnology. It enables simultaneous imaging and therapeutic delivery in theranostic applications. Surface modification techniques improve biocompatibility and targeting specificity. These hybrid systems support advanced applications in cancer detection, pathogen identification, and environmental sensing. The convergence of nanomaterials and fluorophore chemistry is shaping next-generation imaging tools.

Adoption of Fluorophores in Point-of-Care and Portable Diagnostics

Miniaturized diagnostic devices increasingly incorporate fluorophore-based detection for rapid and accurate testing. The Fluorophore Market sees growth from integration into lateral flow assays, microfluidic chips, and handheld fluorescence readers. It allows real-time analysis in clinical, field, and home settings. The portability of these devices supports infectious disease control, environmental monitoring, and food safety inspections. Advances in low-cost, high-sensitivity fluorescent labels make them accessible for decentralized testing. The trend aligns with global efforts to expand rapid diagnostics and improve healthcare accessibility.

Market Challenges Analysis

Photobleaching and Stability Limitations

Photobleaching remains a major challenge for the Fluorophore Market, particularly in long-term imaging and high-intensity illumination applications. Many dyes lose fluorescence intensity over time, reducing the accuracy and reliability of experimental results. It creates constraints in live-cell imaging, super-resolution microscopy, and extended tracking studies. Researchers and manufacturers face the task of developing more photostable formulations without compromising brightness or biocompatibility. Limited stability under certain pH or temperature conditions further narrows the usability of some fluorophores. Addressing these durability issues is critical for expanding their adoption in advanced research and clinical diagnostics.

Regulatory Barriers and Safety Concerns

Strict regulatory requirements for chemical safety, biocompatibility, and environmental impact pose hurdles for the Fluorophore Market. It must comply with global standards governing the use of potentially hazardous compounds in medical and environmental applications. Some fluorophores involve heavy metals or toxic components, limiting their use in vivo or in sensitive biological systems. Meeting safety standards often extends product development timelines and increases costs. Disposal regulations for certain dye classes also add operational complexity for laboratories and manufacturers. Overcoming these challenges requires investment in safer, sustainable alternatives that still deliver high-performance imaging capabilities.

Market Opportunities

Advancements in Biomedical Imaging and Diagnostics

Rising adoption of advanced imaging technologies creates significant opportunities for the Fluorophore Market. It benefits from the increasing use of fluorescence-based methods in early disease detection, molecular diagnostics, and personalized medicine. Development of near-infrared and far-red fluorophores expands imaging depth, enabling non-invasive visualization of internal tissues. Demand for targeted probes in cancer diagnostics and neuroimaging continues to grow. Integration with high-resolution microscopy and flow cytometry enhances analytical precision. The shift toward point-of-care testing solutions further supports the adoption of portable fluorescence-based diagnostic devices.

Expansion into Emerging Life Sciences Applications

Emerging research fields offer new growth avenues for the Fluorophore Market, particularly in genomics, proteomics, and synthetic biology. It plays a crucial role in labeling biomolecules for real-time monitoring of cellular processes. Increasing application in drug discovery accelerates high-throughput screening capabilities. Adoption in environmental monitoring and food safety testing broadens its scope beyond healthcare. Development of fluorophores with tunable emission properties supports multiplexed assays, improving efficiency in research workflows. Collaborations between academic institutions and biotechnology firms drive innovation, creating specialized dyes for niche applications.

Market Segmentation Analysis:

By Product Type

The Fluorophore Market segments by product type into organic dyes, inorganic fluorophores, and fluorescent proteins. Organic dyes dominate due to their versatility, brightness, and broad spectral range suitable for various imaging platforms. Inorganic fluorophores, including quantum dots and rare-earth complexes, gain traction for their superior photostability and tunable optical properties. Fluorescent proteins remain essential in live-cell imaging, offering genetic encodability and minimal cytotoxicity. It provides researchers with options tailored to specific experimental needs, from short-term assays to long-term in vivo studies. The availability of specialized chemistries within each category supports precise targeting and multiplexing in complex biological systems.

- For instance, Thermo Fisher’s Alexa Fluor 647 dye offers an extinction coefficient of approximately 270,000 cm⁻¹·M⁻¹ and excitation/emission peaks at 650/668 nm, offering high brightness and excellent spectral compatibility across imaging systems

By Application

The Fluorophore Market serves applications in medical diagnostics, biotechnology research, environmental monitoring, and material sciences. Medical diagnostics lead the segment, driven by fluorescence-based assays in clinical testing, imaging, and surgical guidance. Biotechnology research extensively employs fluorophores for molecular labeling, gene expression tracking, and protein-protein interaction studies. Environmental monitoring applications rely on fluorescence for detecting pollutants and tracking microbial activity in water and soil. It plays a critical role in materials research, where fluorescent tagging aids in nanomaterial characterization and polymer studies. The diversity of applications underscores its importance across healthcare, environmental, and industrial sectors.

- For instance, quantum dots provide outstanding photostability compared to traditional dyes, enabling continuous imaging sessions without signal degradation—ideal for long-duration live-cell or environmental monitoring workflows.

By End User

The Fluorophore Market caters to end users such as academic and research institutes, pharmaceutical and biotechnology companies, diagnostic laboratories, and environmental agencies. Academic and research institutes represent a major consumer group, leveraging fluorophores for basic and applied life sciences studies. Pharmaceutical and biotechnology companies integrate these tools into drug discovery pipelines, high-throughput screening, and biomarker validation. Diagnostic laboratories use them for rapid and sensitive detection in clinical workflows. Environmental agencies adopt fluorescence methods for monitoring contamination and ecosystem health. It addresses the distinct operational priorities of each end-user group, ensuring tailored solutions that meet performance, safety, and regulatory standards.

Segments:

Based on Product Type

- Organic Fluorophores

- Inorganic Fluorophores

- Quantum Dots

Based Application

- Biomedical Imaging

- Fluorescence Microscopy

- Flow Cytometry

- DNA Sequencing

Based on End User

- Research Laboratories

- Diagnostic Centers

- Pharmaceutical Companies

- Biotechnology Companies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 36.2% of the global fluorophore market share, supported by a strong presence of advanced research facilities, leading biotechnology firms, and high adoption of fluorescence-based technologies. The United States drives most of the regional demand, with extensive usage in genomics, proteomics, and clinical diagnostics. Large-scale investments in imaging platforms, coupled with robust funding for academic and industrial research, sustain market growth. Canada contributes with active research in environmental monitoring and biomedical imaging, supported by government-backed innovation programs. The region benefits from a strong distribution network and collaborations between universities and private companies. It continues to lead in innovation, particularly in the development of next-generation fluorophores with improved stability and reduced toxicity.

Europe

Europe accounts for 28.5% of the global fluorophore market share, fueled by strong life sciences research, stringent regulatory compliance, and advanced diagnostic infrastructure. Germany, the United Kingdom, and France remain the largest contributors, leveraging fluorophores in cancer diagnostics, drug discovery, and neuroscience studies. The European Union’s emphasis on sustainable and safe chemical formulations influences the design of eco-friendly fluorophores. Demand is also growing in Eastern Europe, where expanding biotechnology sectors are increasing the use of fluorescence techniques. The presence of specialized manufacturers and active participation in international research collaborations strengthen the region’s market position. It benefits from a well-established network of research consortia and cross-border clinical studies.

Asia-Pacific

Asia-Pacific holds 23.4% of the global fluorophore market share, with rapid expansion driven by rising investment in healthcare, diagnostics, and life sciences research. China and Japan lead in adoption, supported by large-scale government initiatives for biotechnology advancement and disease surveillance programs. India shows strong growth potential through increased spending on molecular diagnostics and academic research. The region’s manufacturing capabilities provide cost-effective production of both organic and inorganic fluorophores, enhancing accessibility. Emerging economies in Southeast Asia are integrating fluorescence-based testing in clinical settings, especially for infectious disease management. It remains a fast-growing market segment, supported by expanding R&D infrastructure and cross-border technology transfer.

Latin America

Latin America represents 7.1% of the global fluorophore market share, with Brazil and Mexico leading in adoption across clinical diagnostics, agricultural monitoring, and environmental testing. Growth is driven by rising awareness of advanced diagnostic techniques and gradual improvements in healthcare infrastructure. Research collaborations with North American and European institutions are boosting access to advanced fluorescence technologies. Governments in the region are supporting initiatives to modernize laboratory facilities and train skilled professionals in fluorescence-based techniques. It continues to face challenges related to funding and technology adoption speed but shows steady demand growth in specialized applications.

Middle East & Africa

The Middle East & Africa hold 4.8% of the global fluorophore market share, led by countries such as South Africa, Saudi Arabia, and the United Arab Emirates. Adoption is concentrated in academic research centers, advanced hospitals, and specialized diagnostic laboratories. The region is expanding its biotechnology and healthcare capabilities, with investments in modern laboratory infrastructure. Cross-border collaborations and partnerships with global suppliers are helping to improve access to advanced fluorophore products. Environmental monitoring and agricultural testing are emerging application areas in parts of Africa. It remains a developing market with significant potential for growth as healthcare modernization continues.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- QIAGEN

- Cell Signaling Technology

- Agilent Technologies

- Santa Cruz Biotechnology

- Invitrogen (Thermo Fisher Scientific)

- BioLegend

- Merck KGaA

- Abcam

- GE Healthcare

- Thermo Fisher Scientific

Competitive Analysis

The competitive landscape of the Fluorophore Market is defined by innovation, technological advancement, and strategic collaborations among major players. Companies such as QIAGEN, Cell Signaling Technology, Agilent Technologies, Santa Cruz Biotechnology, Invitrogen (Thermo Fisher Scientific), BioLegend, Merck KGaA, Abcam, GE Healthcare, and Thermo Fisher Scientific maintain a strong presence through diversified product portfolios and advanced fluorophore technologies. These players invest heavily in R&D to develop photostable, high-sensitivity fluorophores with enhanced quantum yields and compatibility for multiplexing in imaging systems. Strategic partnerships with academic and clinical research institutions support product validation and broaden application areas. Many companies focus on expanding their product lines for flow cytometry, immunofluorescence, and next-generation sequencing platforms. Continuous improvements in spectral range, biocompatibility, and stability under varying conditions provide a competitive edge. Global distribution networks and targeted marketing in emerging markets further strengthen their market positions. The competitive environment remains dynamic, with differentiation driven by product performance, innovation speed, and regulatory compliance.

Recent Developments

- In July 2025, Thermo Fisher Scientific released two new additions to their Alexa Fluor Plus antibody lineup: Alexa Fluor Plus 555 and Alexa Fluor Plus 647. These secondary antibodies are designed for enhanced signal-to-noise ratios in various cell analysis and protein analysis applications, including immunohistochemistry, immunocytochemistry, and fluorescent western blotting.

- In January 2025, QIAGEN launched the QIAcuity High Multiplex Probe PCR Kit, which allows users of the QIAcuity digital PCR system to analyze up to 12 targets simultaneously from a single biological sample

- In February 2024, Thermo Fisher launched its Alexa Fluor Plus dye series under the Invitrogen brand. These new dyes offer improved brightness, enhanced photostability, and higher signal-to-noise ratios compared to the original Alexa Fluor line

Market Concentration & Characteristics

The Fluorophore Market shows a moderately consolidated structure, with a mix of global life sciences leaders and specialized reagent developers competing on innovation, product quality, and application-specific performance. It is characterized by continuous product advancements in brightness, photostability, and spectral range to meet the growing demands of microscopy, flow cytometry, and molecular diagnostics. Market participants invest heavily in R&D to create proprietary dye chemistries, multiplexing capabilities, and conjugation technologies that address both research and clinical requirements. Regulatory compliance and quality assurance standards play a central role, influencing manufacturing processes and product certifications. The market demonstrates high barriers to entry due to intellectual property protections, technical expertise, and established distribution networks. It maintains a balance between standardized fluorophore products for broad adoption and highly customized solutions for niche applications in advanced imaging and targeted biomarker detection.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fluorophores will grow with the expansion of advanced imaging techniques in life sciences research.

- Adoption will increase in clinical diagnostics as precision medicine gains wider application.

- Multiplexed detection capabilities will become a standard requirement in immunoassays and flow cytometry.

- Development of brighter and more photostable fluorophores will enhance performance in super-resolution microscopy.

- Custom conjugation services will expand to cater to specialized biomarker detection needs.

- Environmentally sustainable fluorophore production processes will gain priority in manufacturing.

- Integration with AI-driven image analysis platforms will improve research accuracy and throughput.

- Near-infrared and far-red fluorophores will see higher adoption for deep-tissue imaging.

- Global collaborations between reagent suppliers and diagnostic companies will strengthen product portfolios.

- Continuous innovation in fluorophore chemistry will maintain competitive differentiation among key players.