Market Overview

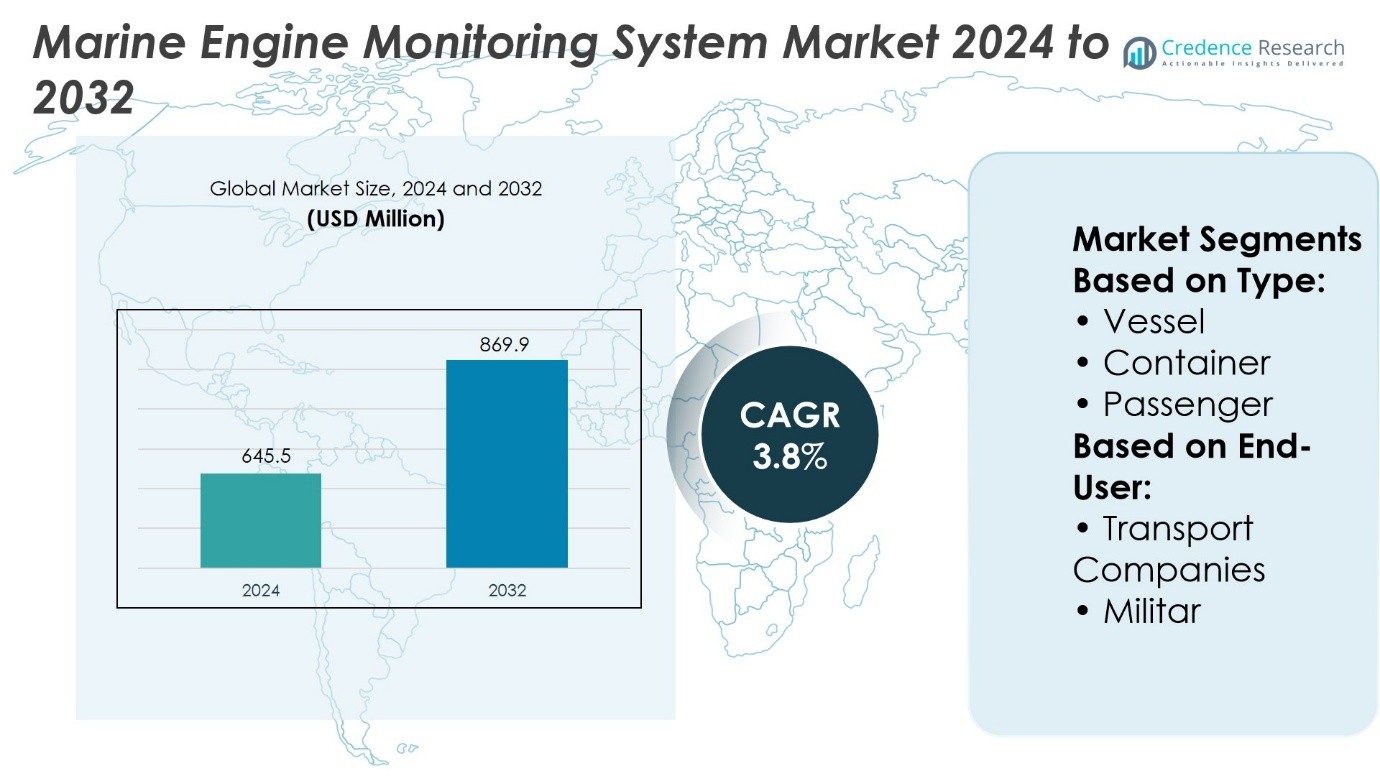

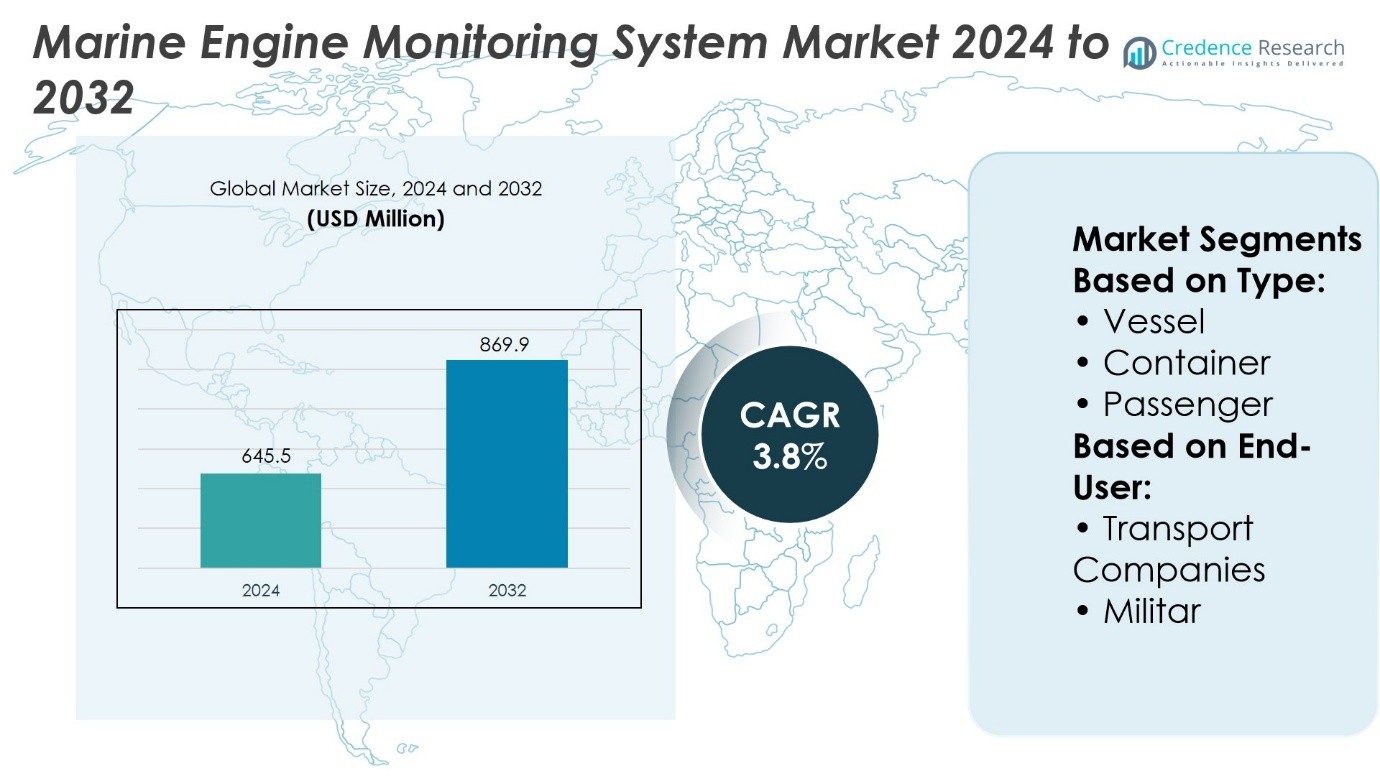

Marine Engine Monitoring System Market size was valued at USD 645.5 million in 2024 and is anticipated to reach USD 869.9 million by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Engine Monitoring System Market Size 2024 |

USD 645.5 Million |

| Marine Engine Monitoring System Market, CAGR |

3.8% |

| Marine Engine Monitoring System Market Size 2032 |

USD 869.9 Million |

The Marine Engine Monitoring System Market grows on strong regulatory enforcement, rising fuel optimization needs, and expanding digitalization across global fleets. Drivers include stricter emission standards, demand for predictive maintenance, and investments in naval modernization that emphasize real-time diagnostics. Trends highlight rapid integration of AI-based analytics, cloud connectivity, and digital twin technologies that enhance efficiency and sustainability. Operators increasingly adopt remote monitoring platforms to centralize fleet control and reduce downtime. It reflects a market shifting toward smart shipping ecosystems where innovation, compliance, and cost reduction define long-term adoption across commercial and defense maritime sectors.

The Marine Engine Monitoring System Market shows strong geographical presence with North America and Europe leading through advanced maritime infrastructure and strict regulatory compliance, while Asia-Pacific emerges as a high-growth region driven by shipbuilding and expanding trade routes. Latin America and the Middle East & Africa demonstrate steady adoption supported by energy trade and naval investments. Key players include Wärtsilä, Mitsubishi, Rolls-Royce, Caterpillar, MAN Energy Solutions, Siemens, Cummins, ABB, General Electric, and Kongsberg Maritime, all focusing on innovation and digital integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Marine Engine Monitoring System Market was valued at USD 645.5 million in 2024 and is projected to reach USD 869.9 million by 2032, registering a CAGR of 3.8%.

- Strong regulatory enforcement and rising demand for fuel optimization drive steady adoption across global fleets.

- Rapid integration of AI-based analytics, cloud platforms, and digital twin solutions shapes key technology trends.

- Competition remains intense, with global leaders focusing on innovation, service networks, and digital integration to secure market share.

- High implementation costs and integration challenges in legacy fleets act as restraints for faster adoption.

- North America and Europe lead the market through advanced maritime infrastructure, while Asia-Pacific grows strongly through shipbuilding and trade expansion.

- Latin America and the Middle East & Africa show gradual adoption supported by energy exports, naval modernization, and regional fleet upgrades.

Market Drivers

Growing Emphasis on Vessel Safety and Compliance with Stringent Maritime Regulations

The Marine Engine Monitoring System Market benefits from rising global focus on vessel safety and strict maritime regulatory frameworks. International Maritime Organization (IMO) rules demand continuous monitoring of engine performance and emissions to reduce risks at sea. Ship operators adopt monitoring systems to track parameters such as fuel pressure, temperature, and lubrication quality in real time. Compliance requirements drive integration of automated alarm functions and predictive diagnostics. Shipowners prioritize investments in systems that ensure regulatory audits are met without disruption. It positions monitoring technology as a critical enabler of maritime safety compliance.

- For instance, Wärtsilä introduced its “Expert Insight” predictive maintenance platform that leverages AI-based analytics to monitor over 900 connected vessels in real time, reporting a 50 million data point analysis capacity per day, which enables early detection of deviations and helps operators meet IMO Tier III compliance standards.

Rising Demand for Fuel Efficiency and Optimization of Fleet Operations

Fuel remains the largest operating cost for commercial and naval fleets, creating pressure to optimize consumption. The Marine Engine Monitoring System Market addresses this challenge by enabling operators to analyze combustion efficiency, load balance, and power output. Real-time data access allows fleet managers to adjust navigation routes and engine loads to reduce fuel use. Technology adoption directly links to measurable reductions in consumption per voyage. Companies seek systems that integrate fuel monitoring with voyage planning software. It supports improved profitability through cost-effective fleet operations.

- For instance, MAN Energy Solutions deployed its “PrimeServ Assist” digital monitoring service across 450 vessels in 2023, enabling operators to achieve verified fuel savings of 12 million liters annually through continuous engine performance optimization and predictive adjustment of propulsion loads.

Expanding Role of Digitalization and Advanced Sensor Integration in Ship Engines

The industry shifts toward digital platforms that connect engine performance with centralized control systems. The Marine Engine Monitoring System Market leverages IoT-enabled sensors, cloud connectivity, and advanced analytics to enhance reliability. Operators track engine wear, vibration patterns, and emissions data on integrated dashboards. Automation reduces manual inspection requirements while increasing operational visibility. Maritime companies adopt solutions that allow remote diagnostics and fleet-wide performance benchmarking. It strengthens operational resilience through predictive maintenance capabilities.

Increasing Investments in Naval and Commercial Shipbuilding Programs Globally

Governments and private operators expand shipbuilding programs to modernize fleets and strengthen trade capacity. The Marine Engine Monitoring System Market benefits from integration of monitoring solutions into new builds at design stage. Defense agencies prioritize monitoring technology to extend operational readiness of naval assets. Commercial yards incorporate monitoring features into bulk carriers, LNG vessels, and container ships. Integration at construction stage reduces lifecycle costs and improves maintenance schedules. It ensures long-term adoption across both defense and commercial maritime segments.

Market Trends

Integration of Predictive Analytics and AI-Based Monitoring Solutions

The Marine Engine Monitoring System Market demonstrates a strong trend toward predictive analytics supported by artificial intelligence. Operators rely on data-driven models to forecast component wear, reduce unplanned downtime, and extend engine life. Advanced algorithms process vibration and thermal data to detect anomalies at early stages. Shipowners increasingly prefer systems capable of offering automated maintenance scheduling. Integration of AI allows faster decision-making and minimizes reliance on manual diagnostics. It creates a pathway toward smarter and more resilient maritime operations.

- For instance, Rolls-Royce’s R² DataLabs applied AI-driven analytics to monitor over 13,000 marine engines, processing 70 million sensor data points daily.

Growing Adoption of Remote Monitoring Platforms and Cloud Connectivity

Remote monitoring gains momentum as fleets expand across international waters with limited technical resources on board. The Marine Engine Monitoring System Market leverages cloud-based connectivity to provide real-time visibility of engine performance to onshore command centers. Ship operators benefit from reduced inspection costs and faster response to technical issues. Remote dashboards enhance communication between vessels and maintenance hubs. Companies adopt scalable platforms that support multi-vessel data integration across global operations. It underscores the shift toward centralized management of fleet health.

- For instance, ABB Marine & Ports confirmed that its Remote Diagnostic Service Centers connected to over 1,200 vessels transmitted 28 million performance and fault-event.

Rising Focus on Green Shipping and Reduction of Carbon Emissions

Sustainability targets influence technology upgrades across the maritime sector. The Marine Engine Monitoring System Market aligns with this priority by enabling continuous tracking of emissions, fuel efficiency, and compliance with IMO 2020 regulations. Shipowners deploy emission monitoring modules to validate sulfur and nitrogen oxide levels. Integration of real-time fuel consumption data allows optimization of voyage planning to reduce carbon footprint. Companies invest in monitoring tools that certify adherence to environmental audits. It strengthens the role of monitoring systems in supporting green shipping strategies.

Expansion of Digital Twin Technology and Simulation for Fleet Optimization

Digital twin solutions are increasingly integrated into marine engine monitoring frameworks. The Marine Engine Monitoring System Market incorporates simulation tools that replicate engine performance under varied operating conditions. Operators test fuel blends, load variations, and engine responses without disrupting voyages. Simulation-based insights support optimized maintenance planning and lifecycle management. Digital twins enable accurate benchmarking of vessel performance across large fleets. It positions the technology as a key enabler of next-generation maritime efficiency.

Market Challenges Analysis

High Implementation Costs and Integration Complexity Across Existing Fleets

The Marine Engine Monitoring System Market faces significant barriers due to the high capital required for installation and integration. Retrofitting older vessels with advanced sensors and digital monitoring platforms demands structural modifications and skilled labor. Many shipping companies delay adoption because of uncertainty over return on investment in competitive freight markets. Integration with legacy control systems remains technically challenging and time intensive. Operators often face downtime during upgrades, which reduces fleet availability and revenue. It limits faster penetration of advanced monitoring systems in cost-sensitive segments of the maritime industry.

Shortage of Skilled Workforce and Concerns Over Cybersecurity Vulnerabilities

Growing reliance on digital platforms introduces new risks that ship operators must manage carefully. The Marine Engine Monitoring System Market encounters hurdles from a shortage of technical personnel trained in predictive analytics, IoT platforms, and advanced diagnostics. Many shipping companies struggle to manage large volumes of data generated by modern systems. Cybersecurity threats present another challenge, with potential risks to vessel operations and sensitive commercial data. Investment in secure networks and continuous training programs becomes essential but adds recurring costs. It restricts adoption speed, particularly among small and medium operators with limited resources.

Market Opportunities

Expansion of Smart Shipping Infrastructure and Digital Transformation Initiatives

The Marine Engine Monitoring System Market holds strong opportunities through the global expansion of smart shipping programs. Governments and private operators invest in digital transformation to enhance fleet efficiency, safety, and sustainability. Monitoring solutions linked with smart ports, automated logistics platforms, and IoT ecosystems offer new growth potential. Integration of real-time engine diagnostics with predictive maintenance tools creates value for both shipowners and regulators. Technology providers gain scope to supply modular systems that align with ongoing maritime digitalization projects. It positions monitoring platforms as central to the evolution of intelligent fleet operations worldwide.

Rising Demand from Offshore Energy, LNG Transport, and Naval Modernization

Growing offshore exploration, LNG trade, and naval modernization initiatives generate fresh demand for monitoring solutions. The Marine Engine Monitoring System Market benefits from requirements for high-performance vessels operating in demanding environments. Offshore supply ships and LNG carriers prioritize continuous monitoring to manage safety and reduce operational risks. Defense agencies modernize naval fleets with advanced diagnostic tools to extend asset lifecycle and ensure readiness. Commercial operators seek systems tailored to specialized vessels handling critical cargoes. It creates opportunities for providers to expand into niche maritime sectors with customized engine monitoring solutions.

Market Segmentation Analysis:

By Type

The Marine Engine Monitoring System Market demonstrates diverse adoption across vessel types, with cargo and bulk vessels accounting for significant deployment due to their long voyages and high operational intensity. Container ships adopt monitoring solutions to improve fuel efficiency and ensure compliance with emissions control zones. Passenger ships, including ferries and cruise liners, rely on continuous monitoring to enhance safety and maintain uninterrupted services for travelers. Advanced diagnostics support engine reliability and reduce the risk of costly disruptions in large passenger fleets. Smaller vessels and specialized categories under “others” integrate modular systems that provide cost-effective solutions for regional operations. It establishes monitoring systems as a necessary component across multiple vessel classes, each with tailored functional requirements.

- For instance, Kongsberg Digital reported that its “Vessel Insight” monitoring platform was installed across 750 cargo and bulk carriers in 2023, generating more than 35 million real-time engine and equipment data records per day to optimize voyage efficiency and ensure compliance.

By End User

The Marine Engine Monitoring System Market shows strong adoption across transport companies and military operators. Transport companies implement monitoring solutions to reduce fuel consumption, minimize downtime, and optimize fleet performance across global trade routes. Centralized dashboards and predictive diagnostics allow them to manage large fleets efficiently while meeting environmental compliance targets. Military organizations integrate advanced systems into naval modernization programs, ensuring real-time diagnostics and mission readiness for combat vessels and patrol fleets. Secure, customized platforms support operations under extreme conditions. It highlights how commercial efficiency and defense reliability together drive sustained demand for monitoring systems across end-user segments.

- For instance, Mitsui O.S.K. Lines (MOL) equipped over 200 of its transport vessels with Wärtsilä’s “Fleet Operations Solution,” which processed more than 42 million voyage and engine performance data points.

Segments:

Based on Type:

- Vessel

- Container

- Passenger

Based on End-User:

- Transport Companies

- Militar

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 32% of the Marine Engine Monitoring System Market, supported by a strong presence of commercial fleets, naval modernization projects, and advanced maritime infrastructure. The United States leads regional adoption through its extensive shipping network and continuous investment in naval vessels. Strict emission norms under the Environmental Protection Agency (EPA) accelerate deployment of advanced monitoring tools that track fuel efficiency and emissions in real time. Major ports such as Los Angeles, New York, and Houston serve as hubs where operators integrate monitoring systems for container and bulk carriers. Canada complements growth through its emphasis on Arctic shipping routes, requiring robust systems for harsh environmental conditions. It reflects a mature market where compliance and technology leadership position monitoring systems as a strategic requirement.

Europe

Europe accounts for 29% of the Marine Engine Monitoring System Market, driven by strong regulatory pressure and the prominence of shipbuilding nations. The International Maritime Organization (IMO) directives, reinforced by the European Union’s decarbonization agenda, encourage rapid integration of monitoring platforms across fleets. Germany, Norway, and the Netherlands lead adoption through advanced shipping companies and naval programs. Mediterranean ports in Spain, Italy, and Greece extend opportunities, particularly for container and passenger ships. Offshore wind development also creates demand for specialized vessels equipped with advanced diagnostics to maintain uptime in demanding sea conditions. It positions Europe as a critical region where sustainability goals and technological adoption converge.

Asia-Pacific

Asia-Pacific secures 25% of the Marine Engine Monitoring System Market, supported by the region’s dominance in shipbuilding and growing maritime trade volume. China, Japan, and South Korea anchor adoption with large shipyards that integrate monitoring technology into new builds. Rising LNG transport from Australia and Southeast Asia further stimulates demand for advanced monitoring to ensure cargo safety. India expands adoption through its naval modernization and the growth of commercial shipping fleets under the Sagarmala program. Ports in Singapore and Hong Kong accelerate deployment as they position themselves as smart shipping hubs. It reflects a rapidly growing market where industrial expansion and digitalization fuel technology uptake.

Latin America

Latin America represents 8% of the Marine Engine Monitoring System Market, with Brazil, Mexico, and Chile driving adoption. Expanding trade routes and offshore energy projects in Brazil strengthen demand for monitoring solutions. Mexican ports handling significant container traffic integrate monitoring systems to improve efficiency and compliance with international standards. Chilean shipping companies adopt technology to manage long-haul operations along the Pacific coast. Regional growth is supported by modernization of naval fleets to enhance security and patrol capacity. It demonstrates a market in transition where increasing maritime trade links drive gradual integration of monitoring platforms.

Middle East & Africa

The Middle East & Africa account for 6% of the Marine Engine Monitoring System Market, supported by growing energy exports and naval fleet upgrades. The United Arab Emirates and Saudi Arabia invest in advanced monitoring systems for vessels transporting oil and LNG to international markets. South Africa emerges as a key market with its strategic ports such as Durban and Cape Town supporting container and bulk shipping. Naval investments in Gulf countries further increase demand for secure monitoring technologies. Offshore exploration projects along West Africa expand opportunities for specialized vessel monitoring solutions. It highlights a market with steady progress where energy trade and strategic defense needs shape adoption patterns.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Marine Engine Monitoring System Market features by Wärtsilä, Mitsubishi, Rolls-Royce, Caterpillar, MAN Energy Solutions, Siemens, Cummins, ABB, General Electric, and Kongsberg Maritime. The Marine Engine Monitoring System Market is characterized by intense competition, with companies focusing on digital innovation, regulatory compliance, and lifecycle value to strengthen their positions. Vendors emphasize predictive maintenance, real-time diagnostics, and fuel optimization as core differentiators, supported by integration with digital twin technologies and IoT-enabled platforms. Advanced monitoring solutions are increasingly designed to align with global decarbonization targets, giving suppliers a competitive edge with shipowners seeking sustainability. Global service networks and aftersales support remain critical factors in winning long-term contracts, especially in commercial shipping and naval modernization programs. Firms compete by offering modular platforms that scale across vessel categories, from large container ships to passenger fleets, while integrating seamlessly with broader automation and control systems. The competitive environment continues to evolve, with innovation, data-driven performance, and the ability to reduce operational costs emerging as the key determinants of market leadership.

Recent Developments

- In February 2025, Wärtsilä introduced the next-generation Wärtsilä 46TS large-bore engine designed to balance renewable energy and improve power plant performance. This engine features advanced monitoring and control systems to optimize fuel efficiency, emissions, and operational flexibility.

- In November 2024, Automation Anywhere entered into a strategic alliance with PwC India to co-develop GenAI-powered RPA training programs.

- In April 2023, DNV launched Emissions Connect, a data verification engine and data management system targeted at the maritime industry to accurately measure and interact with emissions data.

- In November 2023, Emerson Electric Co. invested strategically in Denmark-based Frugal Technologies, a leader in maritime fuel optimization.

Market Concentration & Characteristics

The Marine Engine Monitoring System Market demonstrates a moderately concentrated structure where a limited number of multinational suppliers dominate global share through extensive product portfolios and service networks. It reflects characteristics of a technology-driven industry where innovation, regulatory alignment, and integration capabilities define competitive strength. Market leaders focus on digital platforms, predictive analytics, and real-time diagnostic solutions that enhance efficiency and ensure compliance with emission regulations. Regional players compete by offering cost-effective and specialized solutions tailored to local fleets, but their presence remains limited compared to established global firms. The market is capital intensive, with significant investment required for research, development, and integration into complex vessel systems, which restricts entry of new participants. It remains highly service oriented, with aftersales support, maintenance contracts, and lifecycle management influencing purchasing decisions across commercial and naval fleets. The industry continues to evolve toward sustainability and digitalization, positioning monitoring systems as critical assets that improve operational reliability, reduce costs, and strengthen fleet readiness.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Integration of AI-driven predictive maintenance will strengthen fleet reliability.

- Remote monitoring platforms will gain wider adoption across global shipping routes.

- Demand for emission tracking systems will rise under stricter maritime regulations.

- Digital twin technology will expand for simulation and lifecycle management.

- Naval modernization programs will create consistent demand for advanced monitoring.

- Smart shipping initiatives will accelerate integration of connected engine diagnostics.

- Modular solutions will see higher adoption among regional and mid-sized operators.

- Cybersecurity frameworks will become critical for protecting maritime digital platforms.

- Growth in LNG transport and offshore energy vessels will increase specialized system use.

- Sustainability targets will push operators toward comprehensive digital monitoring adoption.