Market Overview

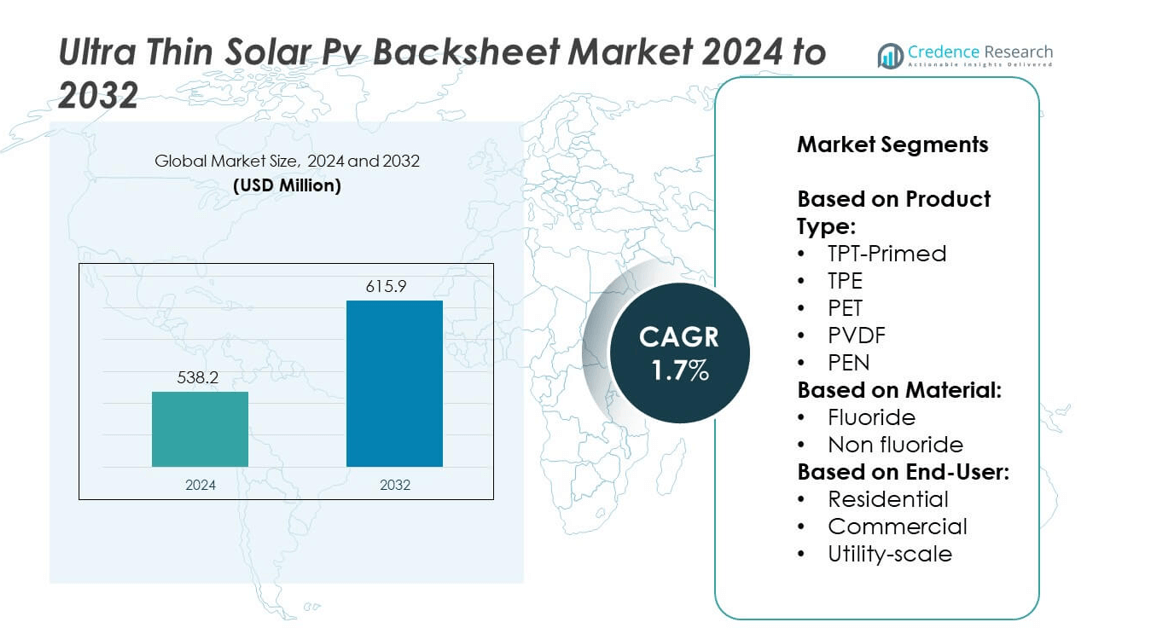

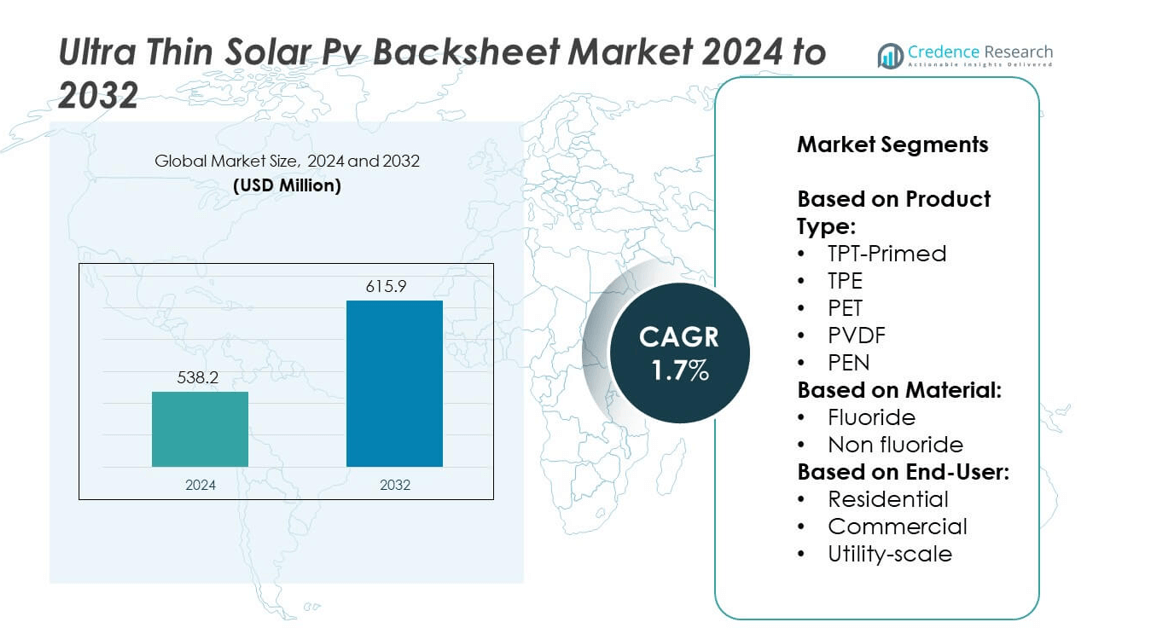

The Ultra Thin Solar PV Backsheet market size was valued at USD 538.2 million in 2024 and is projected to reach USD 615.9 million by 2032, expanding at a CAGR of 1.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultra Thin Solar PV Backsheet Market Size 2024 |

USD 538.2 million |

| Ultra Thin Solar PV Backsheet Market, CAGR |

1.7% |

| Ultra Thin Solar PV Backsheet Market Size 2032 |

USD 615.9 million |

The Ultra Thin Solar PV Backsheet market grows through strong drivers such as rising demand for lightweight and flexible solar components, advancements in high-performance barrier coatings, and supportive government policies promoting renewable adoption. It benefits from expanding applications in residential, commercial, and utility-scale projects where durability and efficiency remain critical. Key trends include the integration of recyclable and eco-friendly materials, adoption of advanced polymer formulations.

The Ultra Thin Solar PV Backsheet market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each region advancing adoption through renewable energy programs and solar infrastructure investments. North America emphasizes rooftop and utility projects, while Europe drives demand with sustainable construction and regulatory compliance. Asia-Pacific leads in manufacturing and large-scale deployments, supported by growing solar capacity in China and India. Key players such as Coveme, Endurans Solar, and 3M actively innovate in materials and coatings, while RenewSys India strengthens its position through cost-effective and scalable production capabilities.

Market Insights

- The Ultra Thin Solar PV Backsheet market size was valued at USD 538.2 million in 2024 and is projected to reach USD 615.9 million by 2032, expanding at a CAGR of 1.7% during the forecast period.

- The market grows on rising demand for lightweight, durable, and flexible solar components that reduce structural load and improve efficiency, especially across rooftop, building-integrated, and portable applications.

- Key trends include the integration of recyclable and eco-friendly materials, wider adoption of high-performance barrier coatings, and increasing use in innovative applications such as floating solar, agrivoltaics, and energy-efficient buildings.

- Competitive analysis highlights the presence of established players such as 3M, Coveme, Endurans Solar, RenewSys India, and Targray, all focusing on advanced material innovation, cost optimization, and expansion into global markets.

- The market faces restraints in the form of high production costs, raw material price fluctuations, and performance challenges under extreme environmental conditions such as high humidity, UV radiation, and temperature variations.

- Regional growth remains strong across Asia-Pacific, North America, and Europe, supported by renewable energy programs and solar adoption initiatives, while Latin America and the Middle East & Africa show gradual expansion through utility-scale projects and off-grid applications.

- The market outlook reflects consistent innovation, supported by government incentives and industry efforts to enhance durability, sustainability, and cost competitiveness, ensuring steady adoption across residential, commercial, and utility-scale sectors worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Lightweight and Flexible Solar Components

The Ultra Thin Solar PV Backsheet market benefits from the growing emphasis on lightweight solar components that simplify installation and reduce structural load. It offers improved flexibility, making it suitable for modern building-integrated photovoltaics and portable energy systems. Manufacturers focus on reducing material thickness while maintaining mechanical strength, which supports efficiency and cost savings. The trend aligns with the expansion of rooftop solar and space-limited applications where weight reduction is critical. It creates opportunities for broader adoption in both residential and commercial projects. The market gains traction as stakeholders prioritize designs that combine durability with flexibility.

- For instance, Coveme introduced its DyMat® Light series, which reduced thickness to 260 microns while maintaining tensile strength above 200 MPa, enhancing ease of installation for rooftop applications.

Advancements in Material Technology and Durability

Technological progress in polymer formulations and advanced coatings drives the Ultra Thin Solar PV Backsheet market forward. It improves resistance to UV radiation, moisture, and extreme temperatures, extending module lifespan and reducing maintenance costs. Companies integrate barrier layers that enhance performance under harsh environmental conditions. The demand for high-reliability backsheet materials grows with global solar capacity expansion. It allows manufacturers to differentiate their offerings through durability and long-term stability. The adoption of advanced materials secures greater confidence among project developers and investors.

- For instance, Endurans Solar launched its Endurans HPF backsheet with water vapor transmission rate below 1.5 g/m²/day, improving module durability in high-humidity conditions.

Supportive Government Policies and Renewable Energy Targets

Strong regulatory frameworks and renewable energy commitments support the growth of the Ultra Thin Solar PV Backsheet market. Governments implement subsidy programs, tax benefits, and solar adoption mandates that encourage investments in advanced photovoltaic components. It helps bridge the cost gap between conventional and innovative materials, making ultra-thin backsheets more competitive. Policies aimed at achieving carbon neutrality create long-term demand for efficient and sustainable solar technologies. It positions the market as a key beneficiary of global clean energy transitions. Strategic partnerships between public and private stakeholders strengthen the supply chain and accelerate adoption.

Growing Adoption in Utility-Scale and Emerging Applications

The Ultra Thin Solar PV Backsheet market expands through rising demand from large-scale solar farms and emerging applications. It meets the requirements of high-capacity projects by ensuring performance stability and efficiency under diverse operating conditions. Growing interest in floating solar, agrivoltaics, and off-grid energy solutions drives demand for advanced backsheets. It allows developers to deploy modules in challenging environments without compromising longevity. The market responds to these needs by offering backsheets that balance performance with cost-effectiveness. Continuous innovations secure opportunities for broader penetration in both mature and developing regions.

Market Trends

Integration of Sustainable and Recyclable Materials

The Ultra Thin Solar PV Backsheet market reflects a growing shift toward sustainable materials that align with global environmental goals. Manufacturers focus on incorporating recyclable polymers and eco-friendly coatings to reduce carbon footprints. It strengthens the appeal of solar modules in markets where sustainability certifications influence procurement decisions. The trend also responds to rising regulatory pressure for circular economy practices in renewable energy. Companies invest in research to create backsheets that balance high durability with low environmental impact. It accelerates the transition toward greener and more responsible solar component production.

- For instance, RenewSys India expanded its manufacturing capacity to 3 GW of backsheet production, supported by policy-driven solar demand in domestic and export markets.

Adoption of High-Performance Barrier Coatings

Advances in coating technologies define a key trend in the Ultra Thin Solar PV Backsheet market. It emphasizes improved resistance against moisture, UV radiation, and thermal stress to extend the service life of photovoltaic modules. Manufacturers increasingly use fluoropolymer and non-fluoropolymer alternatives to achieve cost efficiency while maintaining protection. The trend addresses the growing need for backsheets capable of withstanding diverse climatic conditions. It ensures consistent performance in regions with extreme temperatures and high humidity. The adoption of these coatings enhances reliability and boosts long-term investor confidence.

- For instance, the Palo Alto Research Center (PARC) has developed a co-extrusion printing process for manufacturing solar cell gridlines that is capable of directly depositing features as small as 1 micrometer without contacting the substrate.

Rising Demand from Building-Integrated Photovoltaics (BIPV)

Integration of photovoltaic technology into building structures creates significant opportunities in the Ultra Thin Solar PV Backsheet market. It provides lightweight and flexible solutions that fit seamlessly into façades, rooftops, and windows. The trend aligns with urbanization and the demand for energy-efficient construction materials. Architects and developers increasingly seek backsheets that combine visual appeal with functional efficiency. It supports the expansion of BIPV applications across commercial and residential projects. Growing emphasis on energy self-sufficiency further drives interest in advanced backsheet technologies.

Expansion in Emerging Solar Applications

The Ultra Thin Solar PV Backsheet market records strong traction in non-traditional applications such as floating solar and agrivoltaics. It delivers the durability and flexibility needed for installations in water-based and agricultural environments. Developers explore ultra-thin solutions to reduce maintenance while maximizing energy output. The trend reflects diversification of solar energy deployment beyond conventional ground-mounted systems. It highlights the adaptability of advanced backsheets to varied operating conditions. Expanding application scope strengthens long-term growth potential across both mature and emerging regions.

Market Challenges Analysis

High Production Costs and Price Sensitivity

The Ultra Thin Solar PV Backsheet market faces the challenge of balancing advanced material performance with cost competitiveness. It requires sophisticated manufacturing processes and specialized raw materials that increase overall production expenses. Price-sensitive markets in developing regions often struggle to adopt these solutions due to higher upfront costs. Intense competition from traditional backsheet materials limits the speed of adoption. It pressures manufacturers to optimize production efficiency while ensuring durability and reliability. Achieving cost reductions without compromising performance remains a critical hurdle for long-term growth.

Performance Limitations in Extreme Environments

The Ultra Thin Solar PV Backsheet market encounters difficulties in maintaining consistent performance under extreme weather conditions. It may face issues such as delamination, cracking, or reduced protective capability when exposed to high humidity, UV radiation, or temperature fluctuations. These limitations affect investor confidence in large-scale deployments, particularly in tropical and arid regions. The need for rigorous testing and certification increases time-to-market and development costs. It also creates barriers for smaller players aiming to compete with established manufacturers. Addressing these performance concerns is essential to expand adoption across diverse geographies.

Market Opportunities

Growing Potential in Emerging Solar Applications

The Ultra Thin Solar PV Backsheet market holds significant opportunities through its application in emerging solar segments such as floating solar, agrivoltaics, and portable energy systems. It provides durability and flexibility that suit unconventional installation environments where standard backsheets may underperform. Rising investment in off-grid solutions across rural and remote regions creates new avenues for adoption. It strengthens the role of ultra-thin backsheets in projects that demand lightweight and resilient materials. Expanding integration into niche applications increases the technology’s adaptability and long-term value.

Rising Adoption in Building-Integrated Photovoltaics (BIPV)

The Ultra Thin Solar PV Backsheet market benefits from the growing demand for BIPV solutions in urban infrastructure. It enables seamless incorporation of solar technologies into rooftops, façades, and windows while maintaining design aesthetics. Expanding emphasis on energy-efficient buildings and sustainable construction accelerates the use of advanced backsheets. It positions manufacturers to capture demand from architects and developers seeking innovative energy solutions. Global regulations promoting green building practices further amplify market prospects. Strong alignment with urban energy transition goals secures long-term opportunities for expansion.

Market Segmentation Analysis:

By Product Type:

The Ultra Thin Solar PV Backsheet market demonstrates strong diversity across material categories tailored to different performance needs. TPT-Primed backsheets remain widely used due to their proven balance of mechanical strength and weather resistance. TPE variants gain momentum with their flexibility and lightweight properties, making them suitable for advanced applications such as building-integrated photovoltaics. PET-based backsheets dominate in cost-sensitive markets by offering affordability with moderate durability. PVDF products secure adoption in harsh climatic conditions where chemical resistance and UV stability are critical. PEN-based backsheets show growth potential with superior thermal endurance, supporting long-term performance in high-efficiency modules. It reflects an industry trend toward customization to match varied solar deployment requirements.

- For instance, DuPont introduced Tedlar® PVF films with recyclability certification under UL 2809, enabling module recyclers to recover over 85% of polymer content.

By Material:

The Ultra Thin Solar PV Backsheet market divides between fluoride and non-fluoride solutions. Fluoride-based backsheets provide exceptional weatherability and extended lifespan, often chosen for utility-scale projects requiring reliable output over decades. Non-fluoride options attract interest due to their lower cost and environmental benefits, supporting compliance with sustainable material standards. It creates a competitive space where manufacturers innovate to enhance durability and efficiency without increasing costs. Non-fluoride materials also gain traction in regions prioritizing eco-friendly energy infrastructure. The balance between performance and affordability drives steady growth across both categories.

- For instance, 3M developed its Advanced Film Layer technology, achieving UV reflectivity above 92% and maintaining less than 2% degradation after 2,000 hours of damp heat testing.

By End-User:

The Ultra Thin Solar PV Backsheet market serves residential, commercial, and utility-scale sectors. Residential installations benefit from lightweight and flexible products that ease rooftop integration and support design aesthetics. Commercial projects adopt ultra-thin backsheets to maximize energy yield while minimizing system load on building structures. It offers significant advantages for utility-scale installations by ensuring long-term stability, efficiency, and reduced maintenance under varied environmental conditions. The rising emphasis on renewable adoption in urban and rural settings supports consistent growth across end-user categories. Expanding applications across all three segments position ultra-thin backsheets as a versatile solution in the evolving solar landscape.

Segments:

Based on Product Type:

- TPT-Primed

- TPE

- PET

- PVDF

- PEN

Based on Material:

Based on End-User:

- Residential

- Commercial

- Utility-scale

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a substantial position in the Ultra Thin Solar PV Backsheet market, accounting for 28% of the global share in 2024. The region benefits from strong adoption of solar energy technologies, particularly in the United States where federal tax incentives and state-level renewable portfolio standards drive investment. It also leverages advanced research and development in solar materials, enabling the integration of durable and efficient backsheets into high-performance modules. Residential rooftop installations continue to expand, supported by policies encouraging distributed energy generation. Commercial and utility-scale sectors further strengthen demand, especially in states with high solar penetration such as California and Texas. The presence of established photovoltaic manufacturers and growing collaborations with material innovators consolidate the region’s dominance, while Canada contributes through renewable-focused policies in its urban centers.

Europe

Europe secures 25% of the Ultra Thin Solar PV Backsheet market share, supported by stringent environmental regulations and ambitious renewable energy targets under the European Green Deal. The region emphasizes sustainable material use, which accelerates demand for non-fluoride backsheets. Germany, Spain, and France lead installations across residential and commercial projects, with large-scale utility projects expanding in southern Europe due to favorable solar irradiance. It experiences strong momentum from building-integrated photovoltaics as urban areas prioritize energy-efficient construction. Manufacturers in the region focus on producing recyclable and eco-friendly backsheets to align with evolving environmental policies. Ongoing innovation in coating technologies and module integration enhances the competitiveness of European suppliers in both domestic and export markets.

Asia-Pacific

Asia-Pacific dominates the Ultra Thin Solar PV Backsheet market with 35% share in 2024, reflecting its leadership in global solar manufacturing and deployment. China remains the largest contributor, driven by extensive solar farm development and strong government support for renewable expansion. India demonstrates rapid growth in both utility-scale and rooftop projects, supported by national solar missions and declining module costs. Japan and South Korea continue to focus on advanced materials, incorporating ultra-thin backsheets into high-efficiency modules for domestic and international markets. It also benefits from the presence of large-scale manufacturers that reduce costs through economies of scale. Urbanization and rising energy demand in emerging economies further accelerate regional adoption, making Asia-Pacific the most influential hub for backsheet innovation and supply.

Latin America

Latin America captures 7% of the Ultra Thin Solar PV Backsheet market, driven by increasing solar energy investments across Brazil, Mexico, and Chile. Governments implement renewable energy auctions and incentive programs that stimulate demand for advanced photovoltaic components. It particularly gains traction in utility-scale projects where high solar irradiance provides optimal conditions for large installations. Residential adoption grows steadily in urban areas, although economic factors limit rapid expansion compared to other regions. Regional manufacturers and international suppliers are building partnerships to enhance affordability and accessibility of ultra-thin backsheets. Expansion into off-grid applications also supports adoption in remote areas, strengthening market presence.

Middle East & Africa

The Middle East & Africa region represents 5% of the Ultra Thin Solar PV Backsheet market share, but it demonstrates promising potential with ambitious solar capacity targets. Countries such as the United Arab Emirates and Saudi Arabia lead in utility-scale solar projects integrated into national diversification strategies. South Africa emerges as a key market in Africa with growing demand for distributed and large-scale solar systems. It faces challenges related to infrastructure and financing but continues to benefit from high solar irradiance levels. Adoption of ultra-thin backsheets grows in large desert-based projects where durability against heat and UV exposure is critical. Partnerships with global manufacturers ensure technology transfer and enable gradual strengthening of the regional market base.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coveme

- Endurans Solar

- RenewSys India

- Targray

- DUNMORE

- SILFAB SOLAR

- Astenik Solar

- Krempel GmbH

- Cybrid Technologies

- 3M

Competitive Analysis

The leading players in the Ultra Thin Solar PV Backsheet market include 3M, Coveme, Endurans Solar, RenewSys India, Targray, DUNMORE, SILFAB SOLAR, Astenik Solar, Krempel GmbH, and Cybrid Technologies. These companies compete by focusing on material innovation, cost efficiency, and global supply chain strength. They invest in advanced polymer formulations and high-performance coatings to deliver backsheets with superior weather resistance, durability, and flexibility. Strategic partnerships and collaborations with module manufacturers allow them to expand market penetration and secure long-term contracts. Many players emphasize sustainable and recyclable materials to align with evolving environmental regulations and green building initiatives. Competition also extends to pricing strategies, as producers work to lower costs while maintaining product reliability for diverse end-users. Regional expansions and capacity enhancements ensure stronger positions in fast-growing solar markets such as Asia-Pacific and Europe. Continuous R&D investments, combined with efforts to enhance performance in extreme conditions, strengthen their competitive edge and reinforce leadership in the evolving photovoltaic ecosystem.

Recent Developments

- In July 2024, Coveris launched a new range of fibre-based hot-to-go packs designed for the heat-in-pack, eat-in-pack segment.

- In February 2023, Silfab Solar has launched its Elite Series, a U.S.-made line of residential solar modules. The Silfab Elite 410 BG, featuring a proprietary x-pattern technology and conductive backsheet, delivers 410 W with 21.4% efficiency and a maximum system voltage of 1,000 V (DC). It includes a 25-year product warranty and a 30-year linear power performance guarantee.

- In July 2022, A subsidiary of Worthen Industries, Endurans Solar is expanding its U.S. production of co-extruded, lamination-free backsheets made from fully recyclable polyolefin formulations. These ultra-thin backsheets are known for their superior protective qualities and lower carbon footprint compared to traditional laminated backsheets.

Market Concentration & Characteristics

The Ultra Thin Solar PV Backsheet market displays a moderately concentrated structure with competition led by a mix of global corporations and specialized regional players. It reflects characteristics of high entry barriers due to the need for advanced manufacturing capabilities, material innovation, and compliance with strict durability and safety standards. Leading companies maintain dominance through strong research investments, diversified product portfolios, and established partnerships with photovoltaic module manufacturers. It is characterized by continuous technological advancements, particularly in barrier coatings, recyclable polymers, and non-fluoride alternatives that address sustainability concerns. Market participants compete on durability, efficiency, and cost optimization while also focusing on regional expansion to capture demand in emerging solar markets. It demonstrates steady growth driven by renewable energy targets, with established players leveraging scale advantages and smaller firms differentiating through niche applications and innovative product features. This combination of innovation-driven competition and sustainability alignment defines the evolving structure of the industry.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising adoption of lightweight and flexible solar components across diverse applications.

- It will see stronger demand for recyclable and eco-friendly materials to align with global sustainability targets.

- Manufacturers will increase investment in advanced polymer formulations to enhance durability and weather resistance.

- Building-integrated photovoltaics will emerge as a major growth area, driving need for ultra-thin and aesthetic backsheets.

- Utility-scale projects will adopt high-performance backsheets that ensure long-term stability under extreme environments.

- The market will benefit from government incentives and policies promoting renewable energy adoption.

- Cost optimization and efficiency improvements will remain critical for wider adoption in price-sensitive regions.

- Emerging applications such as floating solar and agrivoltaics will create new opportunities for backsheet integration.

- Global players will expand their presence in Asia-Pacific and other high-growth regions through strategic collaborations.

- Innovation in sustainable materials and long-lasting protective layers will define competitive differentiation in the industry.