Market Overview:

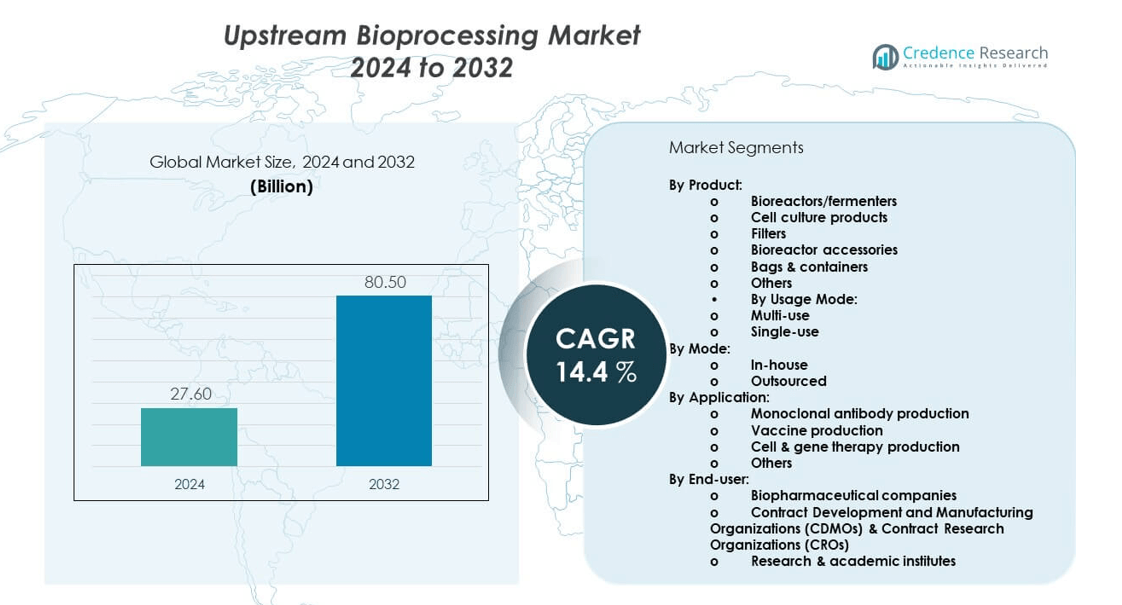

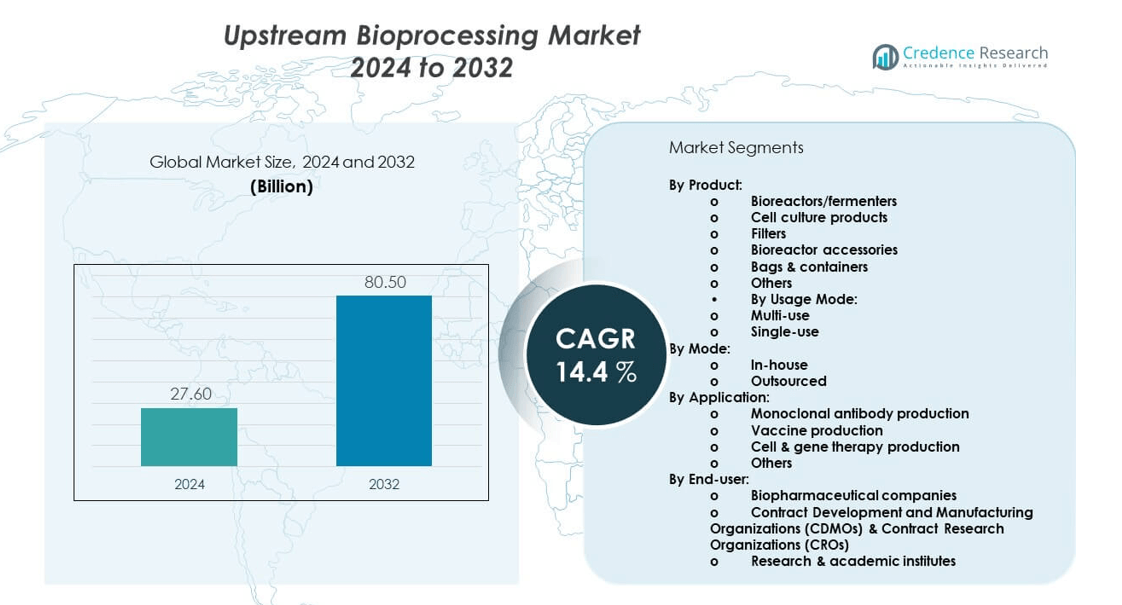

The upstream bioprocessing market is projected to grow from USD 27.6 billion in 2024 to an estimated USD 80.5 billion by 2032, with a compound annual growth rate (CAGR) of 14.34% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Upstream Bioprocessing Market Size 2024 |

USD 27.6 billion |

| Upstream Bioprocessing Market, CAGR |

14.34% |

| Upstream Bioprocessing Market Size 2032 |

USD 80.5 billion |

The upstream bioprocessing market is fueled by strong demand for monoclonal antibodies, vaccines, and recombinant proteins, particularly in the treatment of chronic and infectious diseases. Pharmaceutical and biotechnology companies are actively expanding their manufacturing capacities and investing in high-performance expression systems to enhance yields. Government support for biologics research, coupled with increased R&D spending, is further accelerating growth. The adoption of advanced sensors, digital monitoring, and AI-driven process optimization strengthens the reliability and consistency of upstream operations.

North America holds a leading share in the upstream bioprocessing market, supported by its established biopharmaceutical industry, strong R&D ecosystem, and advanced manufacturing infrastructure. Europe follows closely, driven by regulatory support and investments in biosimilar development. The Asia Pacific region is emerging as the fastest-growing market, with China, India, and South Korea investing heavily in biomanufacturing capacity and contract development organizations (CDMOs). Latin America and the Middle East are also witnessing steady growth as local governments encourage biopharma investments and partnerships with global players.

Market Insights:

- The upstream bioprocessing market is projected to grow from USD 27.6 billion in 2024 to USD 80.5 billion by 2032, registering a strong CAGR of 34% during the forecast period.

- Growing demand for biologics, biosimilars, and vaccines is driving adoption of advanced cell culture systems, single-use technologies, and scalable bioreactors.

- Strong R&D investments and government support for biopharmaceutical innovation are accelerating advancements in upstream technologies.

- High production costs, process complexity, and supply chain disruptions for raw materials and single-use components restrain growth potential.

- Regulatory hurdles, long approval timelines, and the shortage of skilled workforce add challenges to consistent market expansion.

- North America leads due to its strong biopharma ecosystem and advanced manufacturing facilities, while Europe follows with robust biosimilar adoption.

- Asia Pacific is emerging as the fastest-growing region, driven by expanding biomanufacturing hubs in China, India, and South Korea, supported by favorable investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Biologics and Biosimilars:

The upstream bioprocessing market is experiencing strong growth due to the rising global demand for biologics and biosimilars in therapeutic applications. Pharmaceutical and biotechnology companies are focusing on monoclonal antibodies, recombinant proteins, and advanced vaccines, which require robust upstream processes for large-scale production. It is expanding further as healthcare systems prioritize precision medicines for chronic and rare diseases. The shift toward biologics over traditional chemical drugs is increasing reliance on advanced bioprocessing technologies. Market players are investing in next-generation cell culture systems to meet the surge in demand. Strong pipelines for biologic drugs are accelerating adoption of flexible bioreactor systems. Growth in biosimilar approvals is also strengthening the role of upstream technologies in cost-effective production. It continues to gain momentum as companies streamline operations to achieve higher productivity and scalability.

- For instance, Sartorius’ ambr® 250 modular bioreactor system is designed for therapeutic cell lines and enables accelerated process development. It supports working volumes of 100-250 mL and facilitates optimal growth of single cell suspensions, aggregates, or adherent cells. It has demonstrated better cell culture performance and scalability compared to traditional spinner or T-flask models in regenerative medicine trials.

Advancements in Single-Use Technologies and Automation:

The adoption of single-use technologies is one of the most significant drivers in the upstream bioprocessing market. These systems enhance flexibility, reduce contamination risk, and minimize turnaround times compared to stainless-steel systems. Biopharma manufacturers are increasingly deploying single-use bioreactors, filters, and bags to improve efficiency and lower operational costs. Automation and digital process control are transforming the upstream segment by enabling consistent yields and real-time monitoring. It is creating opportunities for manufacturers to scale processes rapidly while maintaining compliance with regulatory requirements. Artificial intelligence and machine learning are further enhancing predictive capabilities in production cycles. Growing preference for modular facilities with pre-validated single-use equipment supports faster product launches. Continuous investments in smart bioprocessing tools are solidifying market adoption.

- For instance, Thermo Fisher Scientific’s single-use bioreactor platform offers operational flexibility and improved facility efficiency by enabling high turn-down ratios (e.g., 5:1), which reduces operator labor by about 15–25% and allows nimble process scheduling, resulting in faster batch turnovers.

Government Support and Growing R&D Investments:

The upstream bioprocessing market benefits from extensive government support and rising investments in biotechnology research. National health authorities and funding agencies are encouraging the development of biologics for oncology, infectious diseases, and rare conditions. Public-private partnerships are fostering the creation of state-of-the-art biomanufacturing hubs. Companies are allocating significant budgets to research high-yield cell lines and culture media formulations. It is strengthening industry confidence in the ability to deliver reliable biologic therapies. Universities and research institutes are collaborating with industry leaders to accelerate bioprocess innovation. Grants and subsidies are also boosting regional biomanufacturing ecosystems, particularly in North America, Europe, and Asia-Pacific. Strong government backing helps biopharma firms build capacity to meet growing global demand.

Expanding Contract Manufacturing and Outsourcing:

Contract development and manufacturing organizations (CDMOs) are playing a critical role in the upstream bioprocessing market. Pharmaceutical and biotech companies are outsourcing production to CDMOs to reduce costs, increase flexibility, and speed up time to market. This trend is particularly evident among smaller firms that lack the infrastructure to manage large-scale upstream operations. It allows companies to focus resources on R&D while relying on CDMOs for scalable production. CDMOs are expanding capacity with advanced bioreactors, optimized culture systems, and flexible single-use setups. Outsourcing helps companies respond quickly to market demand, particularly in vaccine and biosimilar production. Global CDMO players are establishing facilities in emerging markets to serve local and international clients. The growing reliance on outsourcing continues to fuel upstream market expansion.

Market Trends:

Integration of Digital Twins and AI-Driven Bioprocessing:

A major trend shaping the upstream bioprocessing market is the integration of digital twins and artificial intelligence in process optimization. Companies are using digital replicas of bioreactors and culture systems to predict outcomes and improve process efficiency. It helps manufacturers monitor variability in real-time and reduce risks associated with scaling up. Machine learning algorithms analyze large datasets to improve cell culture productivity. Predictive models are being deployed to ensure consistency in biologic production. AI-powered systems are enabling autonomous decision-making and reducing dependence on manual interventions. This trend is expected to redefine the way upstream operations are managed in the future. The combination of AI and digital twins enhances cost efficiency and reliability across manufacturing cycles.

- For instance, Cytiva uses AI-driven digital twins in their bioprocessing which have improved cell culture yield consistency by 12% across commercial-scale campaigns by monitoring variability and optimizing process parameters.

Shift Toward Continuous Bioprocessing Models:

The industry is witnessing a shift from traditional batch production to continuous upstream bioprocessing models. Continuous systems allow uninterrupted production, higher productivity, and improved resource utilization. It is gaining traction among companies seeking to accelerate time to market and reduce capital costs. Continuous culture platforms provide consistent product quality while lowering risks of contamination. Manufacturers are adopting perfusion bioreactors that enable sustained growth and high cell densities. The trend supports higher throughput and reduces downtime associated with cleaning and validation. Regulatory agencies are encouraging the transition by developing guidelines that support continuous manufacturing. The shift is transforming upstream operations into more efficient and flexible processes.

- For instance, Pall Corporation’s Allegro™ XRS20 perfusion bioreactor demonstrated stable viable cell densities above 20 million cells per milliliter during continuous operation over 15 days, highlighting its capacity for consistent high-throughput biologics manufacturing.

Growing Demand for Personalized and Cell-Based Therapies:

The rise of personalized medicine and cell-based therapies is creating new growth opportunities for the upstream bioprocessing market. Advanced therapies such as CAR-T and stem cell treatments require highly specialized upstream processes. It is encouraging companies to develop flexible platforms capable of handling small-batch, patient-specific production. Novel culture systems and bioreactors are being designed for cell therapy applications. The demand for precision biologics is also pushing manufacturers to invest in smaller, modular facilities. Integration of single-use technologies is supporting the cost-efficient production of cell therapies. Growing pipelines of advanced therapies are reshaping the upstream landscape. This trend underscores the critical role of upstream bioprocessing in supporting next-generation healthcare.

Adoption of Modular and Flexible Biomanufacturing Facilities:

The upstream bioprocessing market is experiencing increased adoption of modular and flexible biomanufacturing facilities. These facilities are designed to accommodate rapid scaling and diverse product pipelines. It allows companies to adapt production lines to changing regulatory and therapeutic requirements. Modular systems reduce construction timelines and investment risks compared to traditional facilities. Companies are investing in hybrid designs that combine single-use and stainless-steel systems for greater efficiency. The flexibility enables firms to diversify their biologic portfolios without incurring major capital costs. This trend is particularly strong in emerging markets where demand for rapid capacity expansion is rising. It strengthens the ability of manufacturers to compete globally with dynamic product offerings.

Market Challenges Analysis:

High Production Costs and Process Complexity:

The upstream bioprocessing market faces significant challenges due to high production costs and the complexity of processes. Biologic manufacturing requires expensive raw materials, culture media, and specialized bioreactors. It creates financial pressure on smaller firms that lack the resources of large biopharma companies. The cost of maintaining compliance with stringent regulatory standards further adds to the burden. Complex cell culture systems demand skilled labor, which is in short supply in many regions. Process optimization is often time-consuming and resource-intensive, limiting efficiency. Scale-up challenges increase risks of variability and inconsistent product quality. Rising energy and infrastructure costs also put strain on manufacturers. These factors collectively challenge the market’s ability to achieve cost-effective large-scale production.

Regulatory Barriers and Supply Chain Disruptions:

The upstream bioprocessing market is also constrained by regulatory barriers and supply chain disruptions. Biologics must comply with strict safety and efficacy requirements, often leading to long approval cycles. It creates delays in scaling up and commercializing new therapies. Supply chain issues, particularly for single-use components and raw materials, have caused bottlenecks in recent years. Dependence on global suppliers exposes firms to risks related to geopolitical tensions and trade restrictions. Regulatory uncertainties in emerging markets add to operational complexity. Companies face challenges in aligning regional compliance with global production standards. Supply shortages disrupt timelines and increase costs, especially for high-demand biologics. These barriers slow the pace of growth despite rising global demand for biologics.

Market Opportunities:

Expansion in Emerging Markets and Biomanufacturing Hubs:

The upstream bioprocessing market is positioned for significant opportunities in emerging economies where governments are investing in healthcare and biotechnology infrastructure. Countries such as China, India, and South Korea are establishing large-scale biomanufacturing hubs to support domestic and global demand. It enables global players to expand partnerships and build local capacity. Growing middle-class populations and rising healthcare needs in these regions support demand for biologics. CDMOs are also targeting these markets to provide cost-efficient services to multinational firms. Favorable regulatory reforms are creating an attractive environment for investment. Emerging economies present opportunities for long-term growth and diversification of supply networks.

Technological Innovation and Adoption of Next-Generation Bioreactors:

Opportunities are also growing from rapid technological innovation and the adoption of next-generation bioreactors. The upstream bioprocessing market benefits from advances in perfusion bioreactors, microcarrier systems, and high-performance culture media. It provides manufacturers with the tools to improve yields, lower costs, and enhance product quality. Companies that integrate advanced monitoring and control systems are achieving significant competitive advantages. The trend toward connected and automated bioprocessing solutions is creating strong market potential. Investments in digital bioprocessing technologies are positioning firms for future growth. These innovations offer new pathways for scalable and sustainable production of biologics.

Market Segmentation Analysis:

By Product

Bioreactors and fermenters lead the upstream bioprocessing market as they form the backbone of biologics manufacturing. Cell culture products and filters remain critical for ensuring optimal yields and product purity. Bioreactor accessories, including sensors and probes, strengthen process monitoring and control. Bags and containers are witnessing rising adoption, driven by the shift toward single-use technologies. Other ancillary tools contribute to operational efficiency and scalability across different production stages.

- For instance, Merck KGaA’s Millipore Express® SHF filters demonstrate bacterial retention at a log reduction value (LRV) of at least 9.7 logs during long duration filtration, confirming high sterilizing performance and product safety.

By Usage Mode

Single-use systems are expanding rapidly due to their flexibility, reduced cleaning needs, and minimized contamination risks. Multi-use systems continue to hold significance in large-scale, long-term manufacturing where durability and high-volume output are prioritized. It is shaping demand for hybrid solutions that combine both approaches.

- For instance, GE Healthcare’s Xcellerex™ single-use bioreactors are credited with reducing operator labor and cleaning validation time by up to 32%, facilitating faster turnover and greater manufacturing flexibility.

By Mode

In-house operations dominate the market as biopharmaceutical firms invest heavily in infrastructure to secure quality and intellectual property. Outsourced operations are gaining momentum through CDMOs and CROs that provide scalability, expertise, and cost advantages to smaller firms and new entrants.

By Application

Monoclonal antibody production accounts for the largest share, supported by rising demand in oncology and autoimmune treatments. Vaccine production remains strong due to global immunization programs and preparedness initiatives. Cell and gene therapy production is emerging as the fastest-growing application segment, reflecting growth in personalized medicine. Other applications such as recombinant proteins also contribute to market expansion.

By End-user

Biopharmaceutical companies dominate due to extensive biologics pipelines and investments in upstream facilities. CDMOs and CROs are expanding their presence by offering flexible outsourcing solutions to global clients. Research and academic institutes continue to play a crucial role in innovation, pilot projects, and early-stage technology development.

Segmentation:

- By Product:

- Bioreactors/fermenters

- Cell culture products

- Filters

- Bioreactor accessories

- Bags & containers

- Others

- By Usage Mode:

- By Mode:

- By Application:

- Monoclonal antibody production

- Vaccine production

- Cell & gene therapy production

- Others

- By End-user:

- Biopharmaceutical companies

- Contract Development and Manufacturing Organizations (CDMOs) & Contract Research Organizations (CROs)

- Research & academic institutes

- By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the upstream bioprocessing market, accounting for 38% of the global value. Strong presence of established biopharmaceutical companies, advanced manufacturing facilities, and high R&D spending support its leadership. It benefits from robust regulatory frameworks that encourage biologics development and commercialization. The United States dominates the region with a well-developed healthcare infrastructure and consistent government support for biologics and biosimilars. Canada contributes through growing investments in biomanufacturing and academic research partnerships. The region continues to attract global players seeking access to a mature market and advanced technology base. Strategic collaborations between industry and academic institutions strengthen innovation and scalability.

Europe

Europe represents 30% of the upstream bioprocessing market, driven by increasing biosimilar approvals and strong government support for biologics research. Countries such as Germany, Switzerland, and the United Kingdom lead in capacity expansion and innovation. It benefits from a well-established network of CDMOs offering cost-effective outsourcing services. EU regulatory authorities encourage biosimilar development, supporting growth in monoclonal antibody and vaccine production. Strong investments in automation and single-use technologies further enhance regional competitiveness. Demand for sustainable and efficient bioprocessing solutions is driving partnerships with global suppliers. Europe’s focus on personalized medicine is also boosting demand for advanced upstream technologies.

Asia Pacific

Asia Pacific accounts for 22% of the upstream bioprocessing market and is the fastest-growing region, supported by heavy investments in biomanufacturing hubs across China, India, and South Korea. It benefits from favorable government policies, cost advantages, and a rapidly growing healthcare sector. China has become a leading hub for biologics and biosimilars, supported by national initiatives to expand domestic biopharma capacity. India is strengthening its presence through contract research and manufacturing services. South Korea is recognized for its advanced infrastructure and focus on biosimilar production. Regional players are forming partnerships with global companies to accelerate technology transfer and enhance local production capacity. Expanding middle-class populations and rising demand for biologics further accelerate growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Corning, Inc.

- Sartorius AG

- Eppendorf AG

- Danaher Corporation (including Cytiva)

- Boehringer Ingelheim GmbH

- Applikon Biotechnology

- PBS Biotech, Inc.

- Lonza Group Ltd

- CellGenix GmbH

- Getinge AB

- Avantor Inc.

- Repligen Corporation

- Entegris Inc.

- Meissner Filtration Products

- Kuhner AG

Competitive Analysis:

The upstream bioprocessing market is highly competitive, with global leaders and specialized players focusing on innovation, scalability, and cost efficiency. Companies such as Thermo Fisher Scientific, Merck KGaA, Sartorius AG, Danaher Corporation, and Lonza dominate through comprehensive product portfolios, strong R&D, and large customer bases. It is shaped by intense competition in single-use technologies, bioreactors, and advanced filtration systems. Niche players like PBS Biotech and Meissner Filtration strengthen the landscape by offering specialized solutions for cell therapy and contamination control. Collaborations, mergers, and product innovations are key strategies as companies aim to enhance process efficiency, reduce costs, and meet growing biologics demand worldwide.

Recent Developments:

- In 2025, Thermo Fisher Scientific Inc. is expanding its upstream bioprocessing capabilities by bringing eight new bioreactors online—four 5,000L single-use bioreactors in Lengnau, Switzerland, and four 2,000L units in St. Louis, Missouri—to meet growing demand for biologics production. Additionally, Thermo Fisher is collaborating with biotech company Elektrofi to establish a platform cGMP line for clinical trials of self-injectable therapies. The company is also set to complete a $4.1 billion acquisition of Solventum’s purification and filtration business by the end of 2025, which will enhance its bioprocessing portfolio with complementary filtration technologies.

- In August 2024, Merck KGaA completed the acquisition of Mirus Bio for approximately $600 million. Mirus Bio specializes in GMP transfection reagents critical for viral vector-based gene therapies, thereby strengthening Merck’s upstream bioprocessing offerings and advancing its integrated solutions for viral vector manufacturing. This acquisition supports Merck’s commitment to cell and gene therapy development from preclinical to commercial production.

Market Concentration & Characteristics:

The upstream bioprocessing market is moderately concentrated, with a few multinational corporations holding significant market shares alongside regional specialists. It is characterized by rapid technological innovation, strong demand for single-use solutions, and increasing outsourcing to CDMOs. Entry barriers remain high due to capital-intensive infrastructure, regulatory compliance, and complex process development requirements. The market shows strong buyer-supplier interdependence, where large biopharma companies rely on established vendors for consistent quality, while suppliers invest in innovation to retain market leadership.

Report Coverage:

The research report offers an in-depth analysis based on By Product, By Usage Mode, By Mode, By Application, and By End-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for biologics will expand large-scale upstream manufacturing capacity.

- Single-use bioreactors will gain dominance across production facilities.

- Outsourcing to CDMOs will increase as smaller firms focus on R&D.

- Digital twins and AI-driven systems will enhance process efficiency.

- Continuous upstream processing will become more widely adopted.

- Cell and gene therapies will drive innovation in culture systems.

- Regulatory reforms will shape global manufacturing strategies.

- Asia Pacific will emerge as the fastest-growing biomanufacturing hub.

- Sustainability and eco-efficient technologies will influence product design.

- Strategic collaborations will define competitive positioning across regions.