Market Overview

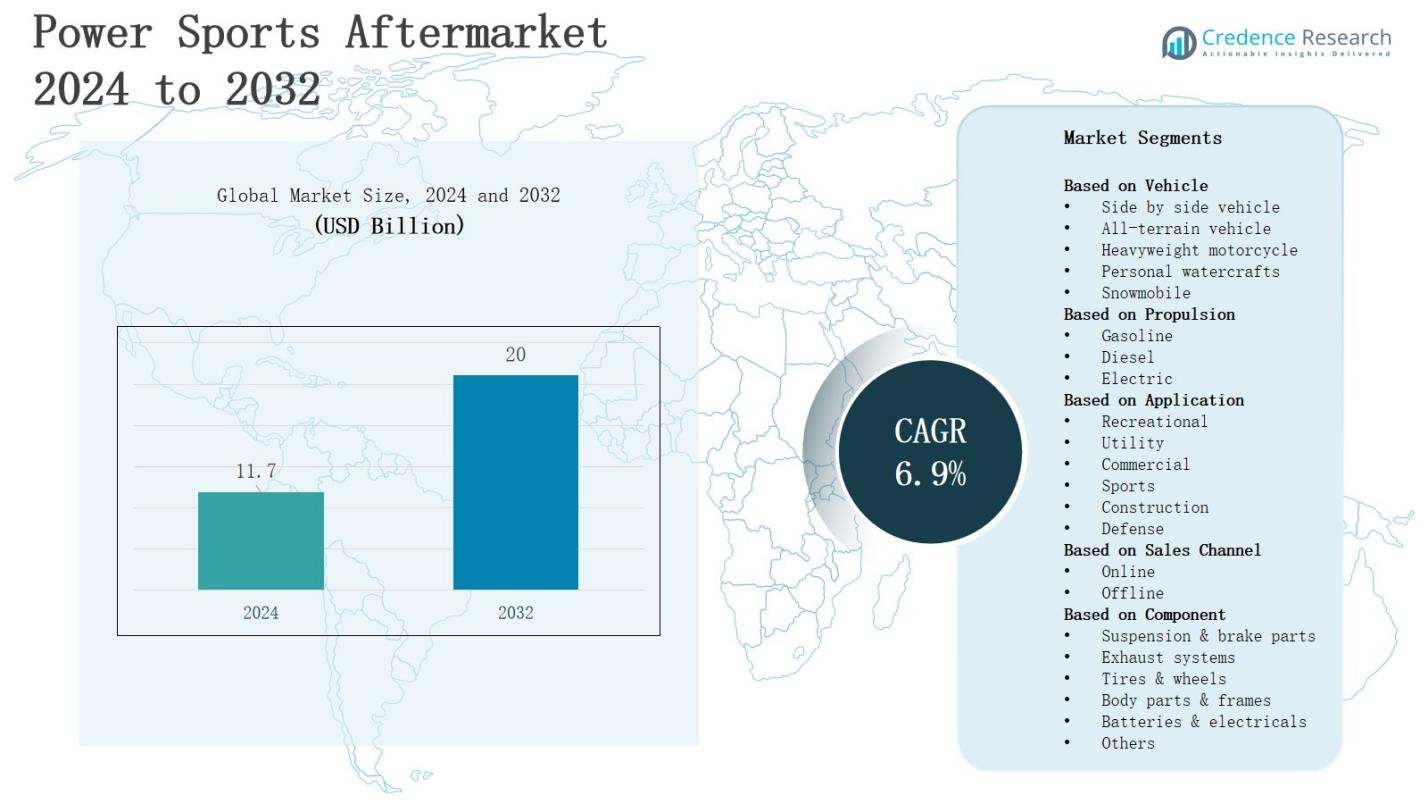

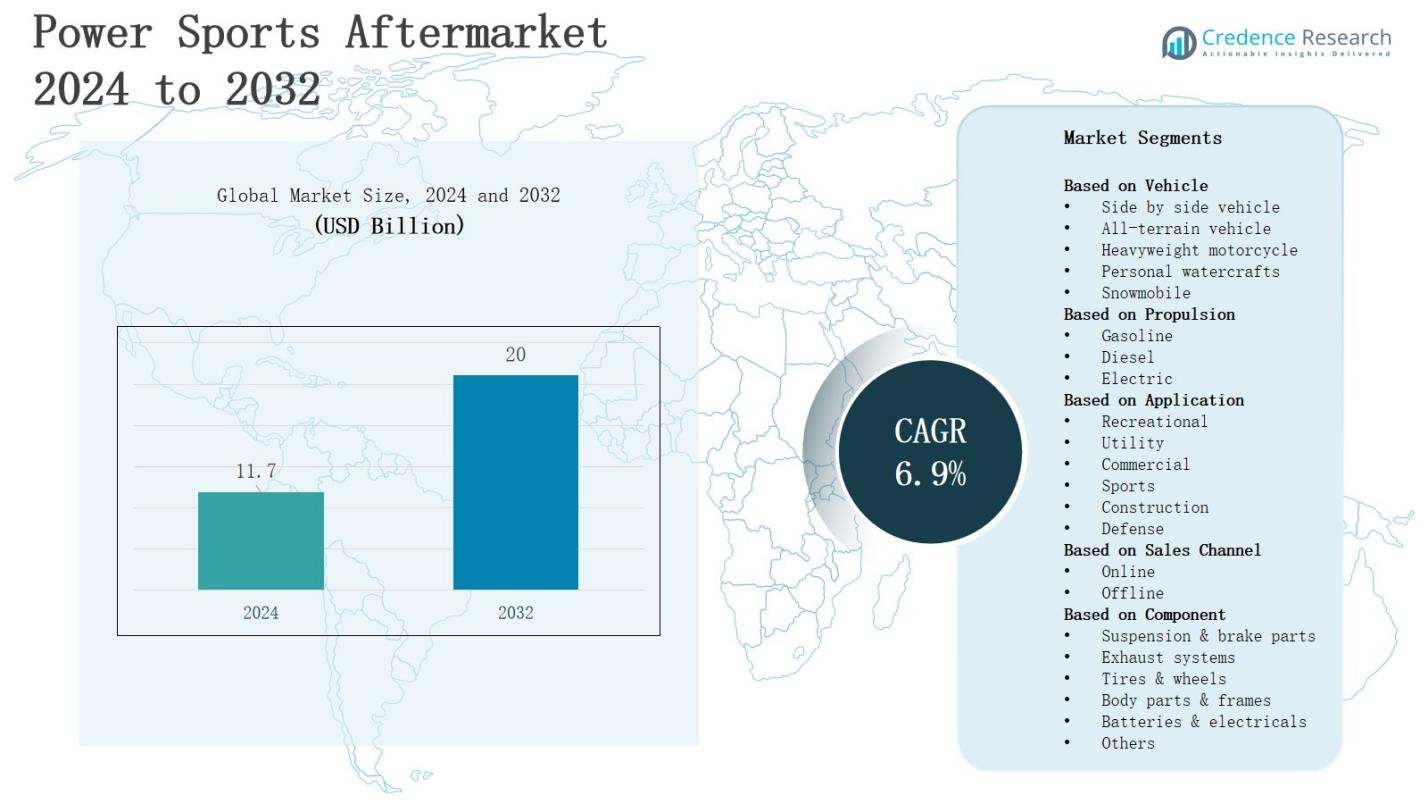

The power sports aftermarket is projected to grow from USD 11.7 billion in 2024 to USD 20 billion by 2032, registering a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Sports Aftermarket Size 2024 |

USD 11.7 Billion |

| Power Sports Aftermarket, CAGR |

6.9% |

| Power Sports Aftermarket Size 2032 |

USD 20 Billion |

The power sports aftermarket grows as rising consumer demand for customization, performance upgrades, and replacement parts drives steady adoption across motorcycles, ATVs, snowmobiles, and personal watercraft. Increasing disposable income and recreational interest strengthen sales of accessories and high-performance components, while the expansion of e-commerce platforms improves accessibility and product availability. Technological advancements, including advanced suspension systems, electronic control units, and lightweight materials, enhance aftermarket value. Sustainability trends such as eco-friendly parts and electric power sports vehicles further shape innovation, positioning the market to benefit from evolving consumer preferences, broader distribution networks, and ongoing product diversification.

The Power sports aftermarket shows strong geographical diversity, with North America leading at 38% driven by high recreational spending, while Europe holds 27% with strong motorcycle and snowmobile demand. Asia Pacific accounts for 22% supported by rising disposable incomes and electric mobility adoption. Latin America captures 7% with growing utility and recreational usage, and Middle East & Africa represent 6% fueled by off-road sports and tourism. Key players include Polaris, Yamaha Motor, Suzuki Motor, Arctic Cat, BRP, Parts Unlimited, Dayco, S&S Cycle, Vance & Hines, and K&N Engineering.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The power sports aftermarket is projected to grow from USD 11.7 billion in 2024 to USD 20 billion by 2032, recording a CAGR of 6.9% during the forecast period.

- Rising consumer demand for customization, performance upgrades, and replacement parts drives adoption across motorcycles, ATVs, snowmobiles, and personal watercraft.

- Increasing disposable income and recreational participation strengthen demand for premium accessories, while lifestyle shifts promote steady aftermarket growth.

- Technological advancements such as advanced suspensions, lightweight composites, and smart electronics improve performance, safety, and durability.

- High costs of advanced components, regulatory compliance, and counterfeit products challenge affordability, reliability, and brand trust.

- Geographically, North America leads with 38%, Europe follows with 27%, Asia Pacific holds 22%, Latin America accounts for 7%, and the Middle East & Africa represents 6%.

- Key players such as Polaris, Yamaha Motor, Suzuki Motor, Arctic Cat, BRP, Parts Unlimited, Dayco, S&S Cycle, Vance & Hines, and K&N Engineering focus on innovation, distribution, and premium product offerings.

Market Drivers

Rising Demand for Customization and Performance Enhancements

The Power sports aftermarket grows strongly due to increasing consumer preference for vehicle personalization and high-performance upgrades. Riders and enthusiasts seek aftermarket parts such as exhaust systems, advanced suspensions, and electronic tuners to enhance speed, comfort, and aesthetics. It benefits from shifting lifestyles that prioritize adventure and outdoor recreational activities. The trend of individual expression through vehicle modification expands opportunities, making customization a central growth driver in the industry.

- For instance, Dowling Tractor Co. offers aftermarket exhaust systems for ATVs that improve power, torque, and acceleration, while also enhancing sound for a more aggressive tone.

Expanding Recreational Activities and Lifestyle Shifts

The Power sports aftermarket gains momentum with rising participation in outdoor and adventure sports such as off-road racing, snowmobiling, and water-based recreation. Higher disposable income encourages consumers to invest in premium accessories and upgrades that enhance both performance and safety. It thrives as younger demographics view power sports as part of an active lifestyle. This shift creates consistent demand for aftermarket components that support diverse recreational experiences across multiple vehicle categories.

- For instance, Polaris introduced its RZR Pro R Factory race-ready side-by-side in 2023, designed specifically for desert racing, which has fueled demand for aftermarket suspension and performance upgrades.

Advancements in Technology and Material Innovation

The Power sports aftermarket expands through innovations in materials and electronic technologies that elevate vehicle performance. Manufacturers introduce lightweight composites, advanced braking systems, and smart electronics to meet consumer expectations. It accelerates growth by improving durability, fuel efficiency, and handling capabilities across motorcycles, ATVs, and other vehicles. Integration of digital technologies such as GPS navigation and Bluetooth connectivity strengthens aftermarket value, creating a robust market for high-tech upgrades and replacements.

Growth of E-Commerce and Distribution Networks

The Power sports aftermarket benefits from rapid expansion of e-commerce and improved global distribution channels. Online platforms allow consumers to easily compare, purchase, and install aftermarket products, creating significant sales momentum. It leverages partnerships between retailers and manufacturers to expand accessibility across regions. Wider availability of performance kits, accessories, and spare parts strengthens customer adoption. This development ensures sustained demand and encourages both large and niche suppliers to innovate and scale.

Market Trends

Rising Integration of Advanced Electronics and Smart Features

The Power sports aftermarket shows strong momentum with growing adoption of electronic systems that enhance rider safety, performance, and convenience. Consumers increasingly demand GPS-enabled devices, Bluetooth communication, and digital dashboards for motorcycles, ATVs, and personal watercraft. It thrives as connectivity and smart features become a standard expectation across recreational vehicles. Advanced electronic control units also enable precision tuning, ensuring consistent demand for high-tech aftermarket upgrades that improve both functionality and user experience.

- For instance, Bosch offers advanced rider assistance systems (ARAS) featuring adaptive cruise control, collision warning, and ABS tailored for motorcycles and ATVs, significantly boosting rider safety.

Shift Toward Eco-Friendly and Electric Power Sports Vehicles

The Power sports aftermarket adapts to sustainability trends by focusing on eco-friendly components and the growing penetration of electric vehicles. Demand rises for low-emission exhaust systems, lightweight materials, and recyclable parts that align with environmental regulations. It expands as manufacturers and suppliers introduce specialized aftermarket kits for electric ATVs, motorcycles, and watercraft. Consumers seeking green mobility solutions drive innovation in energy-efficient accessories, ensuring aftermarket relevance in an evolving regulatory and consumer-driven landscape.

- For instance, Yamaha incorporates recycled polypropylene in its commuter motorcycles and scooters for ASEAN markets, reducing plastic waste while maintaining durability.

Growth of Premiumization and High-Performance Accessories

The Power sports aftermarket experiences strong traction from consumer preference for premium accessories that enhance performance and luxury appeal. Advanced braking systems, custom suspension kits, and high-quality exhausts remain in high demand. It benefits from a market where enthusiasts prioritize both aesthetics and performance, investing in durable and technologically advanced upgrades. The premiumization trend supports rising sales in specialty segments, encouraging manufacturers to expand product lines catering to performance-driven and style-conscious buyers.

Expansion of Online Retail and Direct-to-Consumer Channels

The Power sports aftermarket increasingly leverages digital platforms and direct-to-consumer channels to reach wider audiences. Online marketplaces provide consumers with access to diverse aftermarket products, enabling easy price comparison and quick delivery. It capitalizes on rising e-commerce adoption by offering personalized recommendations and installation guides. Strong digital presence also strengthens brand loyalty and customer engagement. This trend reshapes distribution, making aftermarket parts more accessible and supporting steady sales growth across global markets.

Market Challenges Analysis

High Costs and Regulatory Pressures on Aftermarket Products

The Power sports aftermarket faces challenges from high costs of advanced components and stringent regulatory standards. Consumers often hesitate to invest in premium upgrades due to elevated pricing, especially in developing regions with limited disposable income. It encounters further obstacles from emissions regulations, safety certifications, and environmental policies that restrict the design and availability of certain aftermarket parts. Compliance raises operational expenses for suppliers, limiting affordability and slowing widespread adoption across multiple vehicle categories.

Counterfeit Products and Supply Chain Disruptions

The Power sports aftermarket struggles with counterfeit and low-quality parts that undermine consumer trust and brand credibility. Inconsistent quality across unauthorized channels creates safety risks and hampers customer loyalty. It also experiences disruptions from global supply chain issues, raw material shortages, and logistics constraints that delay product availability. These challenges weaken aftermarket growth by restricting timely access to genuine components, increasing costs for manufacturers, and creating volatility in product distribution across markets.

Market Opportunities

Rising Adoption of Electric and Eco-Friendly Power Sports Vehicles

The Power sports aftermarket gains significant opportunity from the rapid adoption of electric motorcycles, ATVs, and watercraft that require specialized components. Demand for battery management systems, charging accessories, and lightweight materials is increasing, creating new avenues for suppliers. It benefits from government incentives supporting clean mobility and consumer preference for sustainable solutions. Manufacturers that develop eco-friendly performance upgrades and recyclable parts can capture strong growth potential in an evolving and environmentally conscious market landscape.

Expansion into Emerging Markets and Digital Sales Channels

The Power sports aftermarket holds strong potential in emerging economies where rising disposable incomes and urbanization drive demand for recreational vehicles. Growing awareness of outdoor activities and lifestyle-focused sports expands the need for accessible aftermarket parts. It leverages e-commerce platforms and direct-to-consumer sales models to reach a broader audience with tailored offerings. Companies investing in localized distribution networks, regional partnerships, and digital platforms can strengthen global presence while capturing untapped customer segments effectively.

Market Segmentation Analysis:

By Vehicle

The Power sports aftermarket expands across diverse vehicle categories including side-by-side vehicles, all-terrain vehicles, heavyweight motorcycles, personal watercrafts, and snowmobiles. Side-by-side and ATVs dominate due to their popularity in off-road recreation and utility applications. Heavyweight motorcycles drive aftermarket demand with strong interest in performance upgrades and customization. Personal watercrafts and snowmobiles create seasonal demand patterns but sustain steady sales in regions with established recreational cultures. It benefits from consumers seeking enhanced safety, durability, and performance across all vehicle types.

- For instance, S&S Cycle offers aftermarket air intake and exhaust systems that improve performance and fuel economy for heavyweight motorcycles by optimizing airflow and engine tuning, widely used by riders seeking both power and reliability improvements.

By Propulsion

The Power sports aftermarket develops across gasoline, diesel, and electric propulsion systems. Gasoline-powered vehicles lead the segment due to widespread usage and established aftermarket networks. Diesel vehicles serve niche demand in heavy-duty applications, supporting upgrades for durability and fuel efficiency. Electric vehicles represent a fast-growing segment as sustainability trends accelerate adoption. It capitalizes on the need for specialized components such as charging kits, battery systems, and eco-friendly parts, driving new opportunities for suppliers in evolving mobility ecosystems.

- For instance, BRP (Bombardier Recreational Products) launched the all-electric Can-Am Origin and Pulse motorcycles in 2024, prompting demand for aftermarket charging kits, advanced battery management systems, and eco-friendly accessories from specialized suppliers.

By Application

The Power sports aftermarket spans recreational, utility, commercial, sports, construction, and defense applications. Recreational use remains the largest segment, fueled by rising adventure sports and leisure activities. Utility and commercial uses strengthen aftermarket demand in agriculture, forestry, and transport. Sports and competitive racing create premium demand for performance-focused components. Construction and defense highlight applications where durability and reliability are critical. It gains consistent momentum as each application diversifies aftermarket requirements across global markets.

Segments:

Based on Vehicle

- Side by side vehicle

- All-terrain vehicle

- Heavyweight motorcycle

- Personal watercrafts

- Snowmobile

Based on Propulsion

Based on Application

- Recreational

- Utility

- Commercial

- Sports

- Construction

- Defense

Based on Sales Channel

Based on Component

- Suspension & brake parts

- Exhaust systems

- Tires & wheels

- Body parts & frames

- Batteries & electricals

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The Power sports aftermarket in North America holds the largest share at 38%, supported by a strong culture of recreational vehicle use and high consumer spending on customization. The region benefits from widespread popularity of ATVs, side-by-side vehicles, and heavyweight motorcycles, particularly in the United States and Canada. It thrives on well-established distribution networks and advanced aftermarket services. Demand for performance upgrades, safety features, and premium accessories remains strong, reinforcing North America’s leadership in aftermarket revenues.

Europe

Europe accounts for 27% of the Power sports aftermarket, driven by strong demand for motorcycles, snowmobiles, and utility vehicles. Countries such as Germany, France, and Italy lead adoption due to robust automotive industries and consumer interest in premium recreational activities. It gains traction through strict safety regulations that create consistent demand for certified aftermarket parts. The presence of global manufacturers and growing popularity of electric recreational vehicles also support expansion, strengthening the region’s competitive position.

Asia Pacific

Asia Pacific captures 22% of the Power sports aftermarket, fueled by rising disposable incomes, urbanization, and growing adoption of motorcycles and ATVs. China, India, and Japan represent key markets where recreational and utility applications are expanding rapidly. It grows through increased penetration of e-commerce platforms and affordable aftermarket solutions that appeal to diverse consumers. The region’s fast adoption of electric mobility further accelerates demand, creating opportunities for suppliers to expand across both developed and emerging economies.

Latin America

Latin America holds 7% of the Power sports aftermarket, supported by rising demand for motorcycles and ATVs in countries such as Brazil and Mexico. It expands as consumers increasingly participate in outdoor sports and off-road activities. Local suppliers and distributors play a critical role in meeting demand for affordable parts and accessories. The region shows steady growth potential, particularly in the utility and recreational segments, where aftermarket customization and performance enhancement attract consistent investment.

Middle East & Africa

The Power sports aftermarket in the Middle East & Africa represents 6% of global share, with growing interest in off-road vehicles, desert sports, and motorcycles. Gulf countries such as UAE and Saudi Arabia drive aftermarket demand with strong recreational cultures. It benefits from rising tourism and motorsport activities that boost adoption of performance-oriented upgrades. Africa contributes gradually with growing motorcycle penetration in both commercial and utility applications, highlighting long-term potential for aftermarket development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- VANCE & HINES

- Suzuki Motor

- Polaris

- Parts Unlimited

- Yamaha Motor

- Arctic Cat

- S&S Cycle

- BRP

- K&N Engineering

- Dayco

Competitive Analysis

The Power sports aftermarket demonstrates a competitive landscape shaped by established OEMs, specialized aftermarket manufacturers, and distribution networks that compete on performance, innovation, and brand loyalty. Key players such as Polaris, Yamaha Motor, Suzuki Motor, and Arctic Cat strengthen market influence through wide product portfolios and strong customer engagement. It thrives on partnerships between suppliers and retailers, with Parts Unlimited and Dayco ensuring large-scale distribution and availability of essential components. Performance-oriented brands like S&S Cycle, Vance & Hines, and K&N Engineering focus on premium exhausts, filtration systems, and engine upgrades that appeal to enthusiasts seeking customization and power. BRP continues to innovate across personal watercraft and snowmobile aftermarket solutions, expanding global reach and enhancing service offerings. The market remains fragmented but highly dynamic, where companies differentiate through advanced technologies, sustainable product development, and competitive pricing strategies. Strong focus on e-commerce, rider-focused innovations, and premium quality upgrades ensures that the Power sports aftermarket continues to attract both recreational and utility-driven customers, consolidating its position as a fast-evolving industry.

Recent Developments

- In August 2025, BRP revealed the 2026 Can-Am Outlander Electric ATV, its first production electric ATV powered by the Rotax E-Power modular powerpack, marking a significant aftermarket opportunity.

- In 2025, Polaris introduced six new purpose-built ATV models to its lineup, including the 850 and XP 1000 Mud Edition, Scrambler 850, Scrambler XP 1000 S, and Sportsman Touring 850 and Touring XP 1000.

- In August 2025, AFCO Performance Group announced the acquisition of Custom Dynamics, a leading LED motorcycle lighting and electrical components company, expanding its aftermarket product portfolio and market presence.

- In June 2025, Hudl acquired Titan Sports, a provider of wearable technology and software, to strengthen its video analysis and data collection capabilities through Titan’s GPS tracking system for athletic performance monitoring.

Market Concentration & Characteristics

The Power sports aftermarket displays a moderately fragmented structure with a mix of global OEMs, regional suppliers, and niche performance brands competing across multiple vehicle categories. Large companies such as Polaris, Yamaha Motor, Suzuki Motor, and BRP strengthen their market position through wide product portfolios, strong distribution networks, and customer loyalty programs. It features a growing base of specialty manufacturers like S&S Cycle, Vance & Hines, and K&N Engineering that focus on performance-oriented upgrades and customization. Distribution networks, including Parts Unlimited and Dayco, play a critical role in ensuring product availability across diverse markets. The industry is characterized by high consumer demand for customization, rapid technological innovation, and expanding e-commerce channels that improve accessibility. It demonstrates regional diversity, with North America leading in recreational use, Europe emphasizing safety and premium demand, and Asia Pacific gaining traction through affordability and electric vehicle adoption, creating a dynamic and competitive aftermarket environment.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Propulsion, Application, Sales Channel, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for customization and personalization will continue to drive steady aftermarket sales.

- Electric power sports vehicles will create new opportunities for specialized parts and accessories.

- E-commerce platforms will expand as a dominant distribution channel for aftermarket products.

- Advanced technologies such as smart electronics and lightweight composites will strengthen product innovation.

- Regulatory focus on emissions and safety will influence product design and certification.

- Premiumization trends will boost sales of high-performance and luxury aftermarket components.

- Emerging markets will expand adoption with growing recreational and utility applications.

- Supply chain optimization will remain critical to ensure timely product availability and affordability.

- Collaboration between OEMs and aftermarket suppliers will enhance product variety and service offerings.

- Sustainability and eco-friendly solutions will become central in shaping aftermarket strategies.