Market Overview

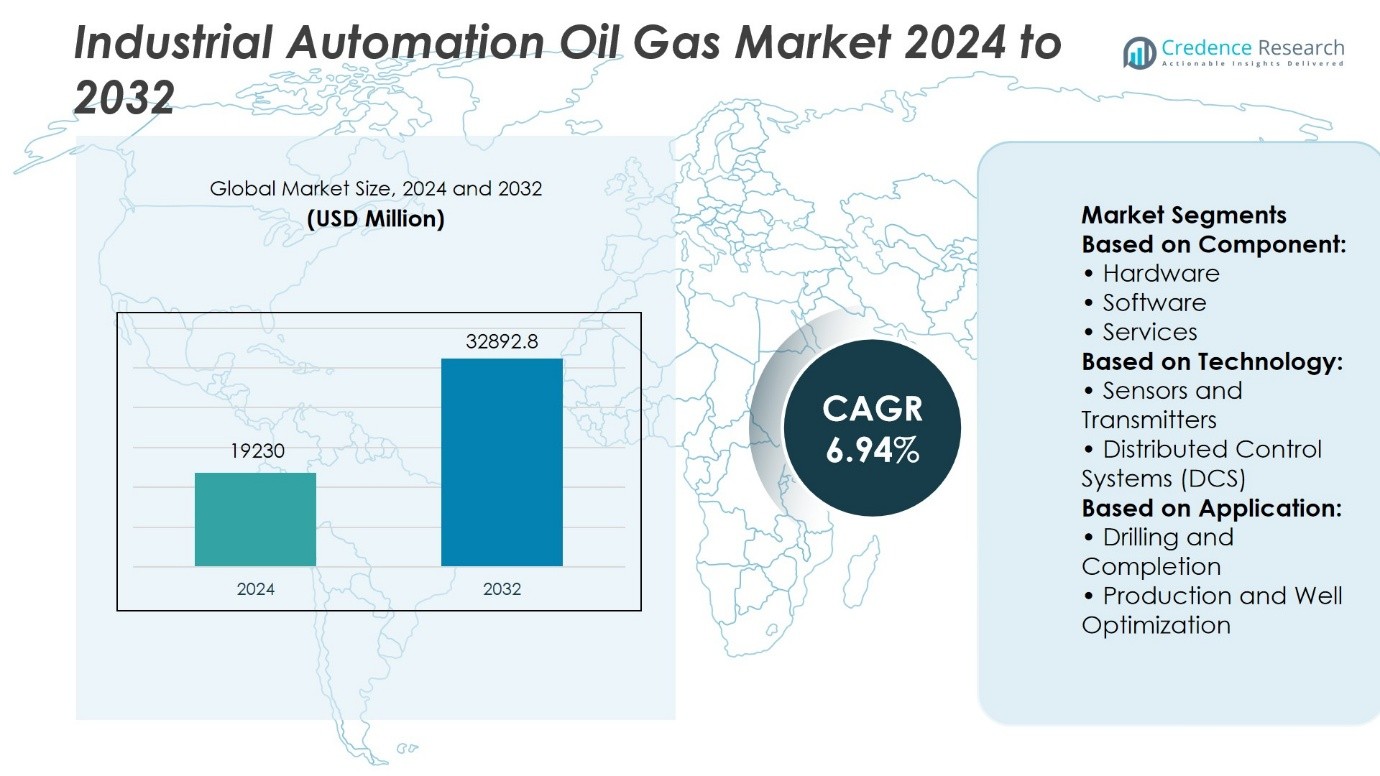

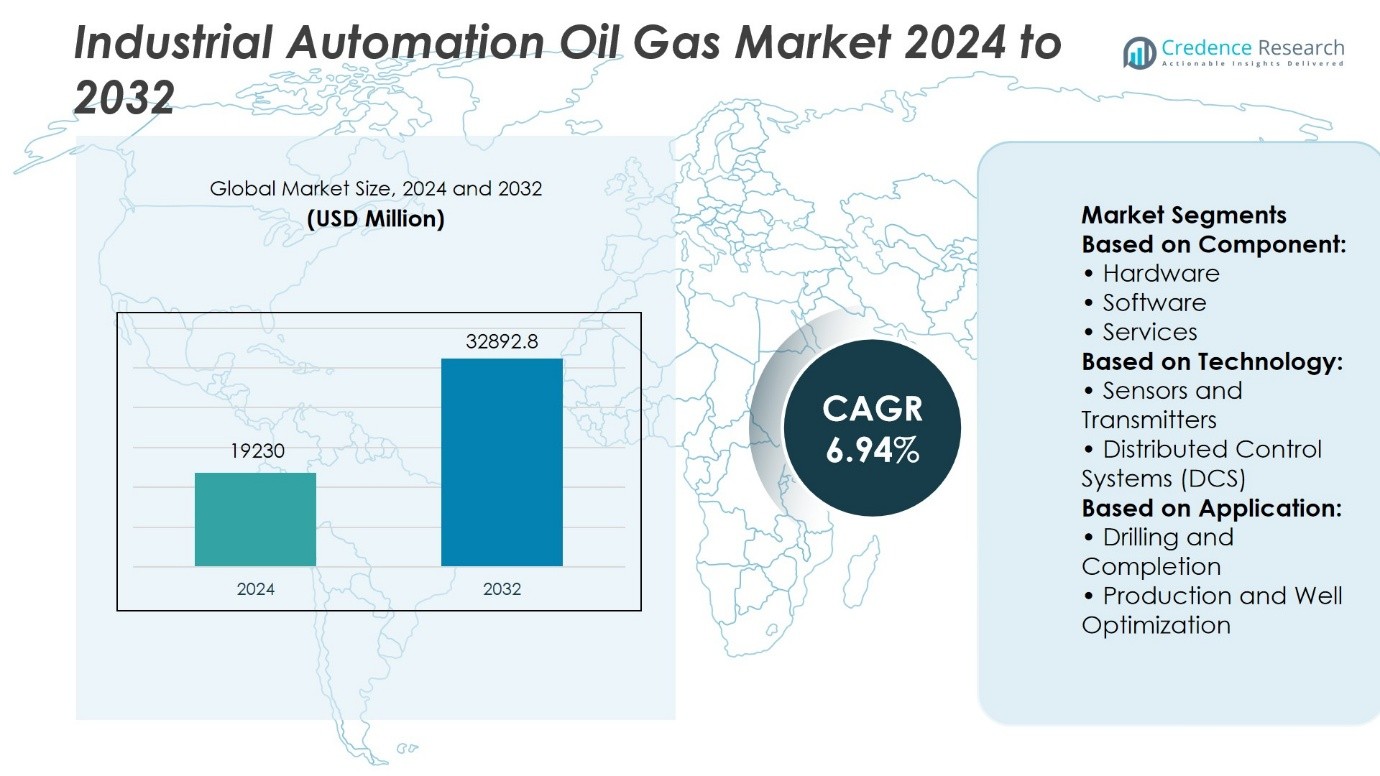

Industrial Automation Oil & Gas Market size was valued at USD 19230 million in 2024 and is anticipated to reach USD 32892.8 million by 2032, at a CAGR of 6.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Automation Oil & Gas Market Size 2024 |

USD 19230 Million |

| Industrial Automation Oil & Gas Market , CAGR |

6.94% |

| Industrial Automation Oil & Gas Market Size 2032 |

USD 32892.8 Million |

The Industrial Automation Oil & Gas Market advances through strong drivers and evolving trends that redefine operational efficiency and safety. Rising demand for cost optimization, predictive maintenance, and real-time monitoring strengthens adoption across upstream, midstream, and downstream operations. It gains momentum from regulatory compliance requirements, energy transition initiatives, and the push for sustainable production. Emerging trends include wider use of digital twins, robotics, and AI-powered analytics that enhance decision-making and reduce downtime. IoT-enabled connectivity and cloud-based platforms expand integration, while cybersecurity emerges as a core priority. The market reflects a decisive shift toward data-driven, automated, and resilient oil and gas operations.

The Industrial Automation Oil Gas Market shows diverse geographical adoption, with North America leading growth through advanced shale production and digitalized refineries, while Europe emphasizes offshore automation and strict regulatory compliance. Asia-Pacific expands rapidly with large-scale investments in refining, petrochemicals, and LNG projects, supported by China, India, and Southeast Asia. The Middle East and Africa strengthen adoption in high-capacity oilfields, while Latin America focuses on offshore reserves. Key players include ABB, Siemens, Honeywell, Schneider Electric, Yokogawa, and Rockwell Automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Industrial Automation Oil Gas Market size was valued at USD 19,230 million in 2024 and is anticipated to reach USD 32,892.8 million by 2032, at a CAGR of 6.94%.

- Rising demand for cost optimization, predictive maintenance, and real-time monitoring drives automation adoption across the sector.

- Digital twins, robotics, AI-based analytics, and IoT-enabled platforms define key market trends enhancing operational efficiency.

- Leading players compete through integrated automation portfolios, advanced software platforms, and long-term service contracts.

- High capital intensity, integration challenges with legacy infrastructure, and cybersecurity risks act as restraints.

- North America leads with shale production and digital refineries, while Europe focuses on offshore automation and compliance.

- Asia-Pacific grows with investments in refining and LNG, Middle East & Africa strengthen oilfield automation, and Latin America advances in offshore reserves.

Market Drivers

Rising Demand for Operational Efficiency and Cost Optimization

The Industrial Automation Oil Gas Market advances through the urgent need for higher operational efficiency and cost control across exploration, production, and refining. Companies adopt advanced automation systems to reduce downtime, optimize workflows, and minimize human error. It improves asset utilization by enabling predictive maintenance and real-time monitoring of critical equipment. Automation technologies lower operational expenditure by streamlining processes that traditionally required extensive manpower. Oil and gas producers focus on maintaining profitability under volatile energy prices, which reinforces adoption of digital control systems. The market reflects growing preference for integrated platforms that deliver reliable performance while reducing long-term operating costs.

- For instance, GE Vernova SmartSignal predictive analytics software detected an inlet filter obstruction in a 9HA.02 gas turbine via its digital twin, preventing production loss and equipment damage valued at approximately $543,120.

Expansion of Digital Technologies and Smart Solutions

The Industrial Automation Oil Gas Market gains strength from the integration of digital technologies such as AI, IoT, and cloud-based platforms. It enables operators to collect and analyze large volumes of data for better decision-making. Real-time analytics enhance visibility across upstream, midstream, and downstream activities. Automation systems support remote operations in offshore and onshore facilities, improving worker safety and efficiency. Cyber-physical systems create smart oilfields that adapt quickly to changing production dynamics. The adoption of advanced software and control units demonstrates how digitalization transforms the energy sector.

- For instance, Siemens customers implementing predictive maintenance strategies have achieved reductions in unplanned downtime by up to 50 units, while also realizing improvements in productivity totaling 20 units.

Growing Emphasis on Safety and Risk Management

The Industrial Automation Oil Gas Market expands with a strong focus on safety and compliance. It ensures adherence to strict environmental and occupational standards imposed by global regulators. Automation reduces exposure to hazardous environments by limiting the need for manual interventions. Systems monitor pipelines, storage facilities, and drilling platforms to detect leaks or faults in real time. Companies integrate advanced safety instrumented systems that prevent catastrophic failures and improve reliability. Safety-driven automation strengthens corporate reputation and secures operational continuity.

Increasing Investment in Renewable Integration and Energy Transition

The Industrial Automation Oil Gas Market evolves with rising investments in renewable integration and sustainable practices. It helps oil and gas companies balance traditional operations with emerging clean energy requirements. Automation supports hybrid projects where gas and renewables function within shared infrastructure. Advanced process controls enhance energy efficiency and lower carbon intensity across industrial facilities. Utilities and operators deploy automation to align with global net-zero targets and regulatory frameworks. The transition toward greener energy sources underscores automation’s strategic role in shaping the future of the sector.

Market Trends

Advancement of Artificial Intelligence and Machine Learning in Process Automation

The Industrial Automation Oil Gas Market shows a rising trend toward adopting artificial intelligence and machine learning for predictive insights. It supports real-time optimization of drilling, refining, and pipeline operations. Algorithms analyze historical and live data to anticipate failures and improve resource allocation. Companies integrate AI-driven solutions into control systems to maximize throughput and minimize downtime. Automation vendors expand their offerings with machine learning models that adapt to changing operating environments. This trend reflects the industry’s move toward data-driven operations with measurable performance gains.

- For instance, GE Digital’s APM solutions combining digital twins and advanced visualizations have delivered operational gains in Oil & Gas by boosting asset availability by up to 6 units and enabling reductions in reactive maintenance efforts by up to 40 units, according to customer reports.

Increased Adoption of Industrial Internet of Things and Connected Assets

The Industrial Automation Oil Gas Market benefits from widespread deployment of industrial IoT solutions. It links sensors, machines, and control platforms into unified networks for seamless communication. Real-time connectivity provides greater visibility into equipment performance and energy use. Operators leverage IoT-enabled devices to extend asset lifecycles and reduce maintenance costs. Cloud integration strengthens collaboration across distributed oilfield and refinery sites. The trend demonstrates the growing reliance on connected infrastructure to support efficiency and resilience.

- For instance, GE Power’s predictive maintenance study indicated that deploying predictive analytics on gas turbines can extend their operational lifespan by up to 20 units, reducing wear-related maintenance and replacement activities.

Rising Deployment of Robotics and Remote Operations Technology

The Industrial Automation Oil Gas Market advances with broader use of robotics and remote operation systems. It reduces the human presence in hazardous areas such as offshore rigs and high-pressure pipelines. Robotic inspection tools deliver precise data from inaccessible sites with minimal risk. Remote operation centers manage drilling and production activities from centralized hubs. Companies invest in autonomous vehicles and drones to enhance inspection and monitoring. This trend underlines the importance of automation in strengthening safety while improving productivity.

Strong Focus on Cybersecurity and Secure Digital Infrastructure

The Industrial Automation Oil Gas Market highlights a growing trend of prioritizing cybersecurity within digital operations. It addresses the risks associated with connected assets and cloud-based platforms. Companies implement advanced firewalls, encryption, and threat detection tools to safeguard industrial control systems. Cybersecurity frameworks ensure compliance with global standards and protect critical infrastructure. Vendors design automation platforms with built-in security to counter sophisticated attacks. This trend emphasizes the vital role of secure digital infrastructure in sustaining operational reliability.

Market Challenges Analysis

High Capital Costs and Complex Integration with Legacy Infrastructure

The Industrial Automation Oil Gas Market faces significant challenges due to the high capital investment required for advanced automation systems. It demands substantial expenditure on hardware, software, and skilled workforce, which restricts adoption among smaller operators. Integration with legacy infrastructure complicates deployment, as older facilities require customization and upgrades to accommodate modern technologies. Compatibility issues extend project timelines and increase engineering complexity. Companies must allocate resources to both system modernization and ongoing operations, which creates financial strain. This challenge slows down large-scale automation adoption across diverse oil and gas segments.

Shortage of Skilled Workforce and Rising Cybersecurity Concerns

The Industrial Automation Oil Gas Market contends with a shortage of skilled professionals capable of managing advanced digital platforms. It highlights the gap between rapid technology development and workforce readiness. Operators struggle to recruit engineers proficient in AI, robotics, and industrial IoT, which delays full-scale automation projects. Rising cybersecurity risks further challenge implementation, as connected systems remain exposed to sophisticated threats. Companies must invest heavily in training and security measures to ensure uninterrupted operations. These challenges emphasize the need for continuous capability development and robust defense strategies to sustain long-term digital transformation.

Market Opportunities

Expansion of Digital Twin Technology and Predictive Analytics

The Industrial Automation Oil Gas Market presents strong opportunities through the adoption of digital twin platforms and predictive analytics. It allows operators to simulate assets, optimize production strategies, and anticipate failures before they disrupt operations. Digital replicas of pipelines, refineries, and offshore rigs provide actionable insights for cost savings and performance improvements. Predictive analytics supports efficient maintenance scheduling, reducing unplanned outages and extending equipment life cycles. Vendors offering integrated digital twin solutions position themselves to capture new contracts across upstream and downstream facilities. This opportunity enhances long-term competitiveness by driving smarter and safer decision-making.

Rising Demand for Renewable Integration and Sustainable Operations

The Industrial Automation Oil Gas Market creates growth opportunities through its role in renewable energy integration and sustainability. It enables hybrid systems where oil and gas facilities incorporate wind, solar, and hydrogen within existing operations. Advanced automation solutions optimize energy consumption, lowering emissions and improving compliance with global climate regulations. Companies leverage automation to manage carbon capture and storage projects at scale. Operators exploring energy transition strategies depend on automation to achieve efficiency without sacrificing reliability. This opportunity strengthens the relevance of automation technologies in shaping the future energy ecosystem.

Market Segmentation Analysis:

By Component

The Industrial Automation Oil Gas Market divides by component into hardware, software, and services. Hardware includes programmable logic controllers, sensors, actuators, and control devices that ensure accurate monitoring and process execution. Software plays a critical role in managing workflows, integrating real-time analytics, and supporting decision-making. Services involve system integration, maintenance, and consulting that drive seamless adoption across complex facilities. It reflects the growing importance of end-to-end solutions where hardware stability, software intelligence, and service support function together to maximize operational value.

- For instance, Honeywell’s HercuLine® electric actuators, designed for precise quarter-turn valve positioning, are applied in harsh environments one deployment featured 27 actuators operating continuously in sub-zero winter conditions without failure over a 3,200-hour period.

By Technology

The Industrial Automation Oil Gas Market classifies technology into sensors and transmitters, distributed control systems (DCS), and other advanced platforms such as SCADA and PLCs. Sensors and transmitters enable precise data acquisition for pressure, temperature, and flow parameters across assets. DCS offers centralized control and flexibility to manage large-scale production plants. SCADA systems provide real-time supervisory control, while PLCs ensure quick and accurate control over repetitive processes. It highlights the combined role of these technologies in ensuring efficiency, safety, and scalability across diverse facilities.

- For instance, Siemens Energy’s WEPS‑100 subsea sensor series has seen over 14,000 units produced to date (handling up to 15,000 psi and temperatures of 180 °C), demonstrating its reliability and extensive deployment in subsea applications.

By Application

The market divides by application into drilling and completion, production and well optimization, refining, and other downstream processes. Drilling and completion benefit from automation through improved accuracy, reduced downtime, and safer rig operations. Production and well optimization rely on smart systems that balance output with reservoir sustainability. Refining integrates process automation to reduce energy intensity while maintaining product quality. It underscores how application-specific automation addresses the unique technical and operational needs of each oil and gas activity.

Segments:

Based on Component:

- Hardware

- Software

- Services

Based on Technology:

- Sensors and Transmitters

- Distributed Control Systems (DCS)

Based on Application:

- Drilling and Completion

- Production and Well Optimization

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 32% share of the Industrial Automation Oil Gas Market, driven by advanced infrastructure and high adoption of digital technologies across upstream and downstream operations. The United States leads regional deployment with extensive shale gas and offshore oil production that require advanced control and monitoring systems. Automation supports efficiency across the Gulf of Mexico’s offshore rigs and large-scale refineries in Texas and Louisiana. Canada contributes through investments in oil sands projects and the adoption of distributed control systems to manage complex operations. Service providers and technology vendors in the region integrate IoT-enabled solutions, predictive analytics, and robotics to improve production reliability. The strong presence of global automation leaders in the U.S. strengthens innovation and accelerates modernization of oil and gas facilities.

Europe

Europe accounts for 27% of the Industrial Automation Oil Gas Market, supported by strict regulatory frameworks and strong sustainability mandates. The United Kingdom and Norway remain central to offshore automation projects, where robotics and remote monitoring improve safety in harsh marine environments. Germany and the Netherlands invest in advanced refining technologies that use distributed control systems and predictive maintenance tools. It reflects the region’s commitment to cleaner operations while maintaining oil and gas output. Companies adopt automation platforms to comply with stringent emission norms while ensuring process efficiency. Europe also witnesses rising integration of automation with renewable and hydrogen projects, creating hybrid operational models. The region’s focus on energy transition increases demand for flexible and scalable automation systems.

Asia-Pacific

Asia-Pacific secures a 24% share of the Industrial Automation Oil Gas Market, fueled by rapid industrialization and expanding energy demand. China drives the largest adoption with investments in refining, petrochemicals, and offshore drilling projects supported by advanced control technologies. India focuses on automation for pipeline monitoring and refineries to meet growing fuel consumption. Japan and South Korea lead in deploying robotics and digital twins for LNG terminals and offshore exploration. Southeast Asian countries, including Indonesia and Malaysia, emphasize automation in offshore rigs and refining plants to enhance operational efficiency. It demonstrates how diverse economies within the region integrate automation to balance rising consumption with sustainable practices. Asia-Pacific shows consistent expansion, supported by government-backed infrastructure projects and regional collaborations with global automation vendors.

Latin America

Latin America captures a 7% share of the Industrial Automation Oil Gas Market, with Brazil and Mexico leading regional growth. Brazil’s offshore oilfields, particularly in pre-salt reserves, rely on automation for safe and efficient operations. Mexico integrates automation technologies into upstream and refining projects to modernize aging infrastructure. Argentina contributes through shale oil and gas projects in the Vaca Muerta basin supported by digital monitoring tools. Smaller economies adopt automation gradually, driven by international partnerships and investments in oil production. The region emphasizes automation as a means to increase efficiency, reduce risks, and meet export demands. It underscores the role of automation in upgrading Latin America’s oil and gas value chain.

Middle East & Africa

The Middle East & Africa region holds a 10% share of the Industrial Automation Oil Gas Market, dominated by large-scale oil producers such as Saudi Arabia, the UAE, and Qatar. It reflects ongoing investments in advanced automation systems to sustain high production volumes and enhance refining capacities. Saudi Aramco invests heavily in digital control systems, predictive maintenance, and smart drilling technologies to strengthen efficiency. The UAE integrates automation across offshore rigs and downstream petrochemical projects, improving reliability under demanding conditions. Africa contributes through Nigeria and Angola, where automation supports pipeline monitoring and leak detection systems. The region demonstrates how automation helps overcome operational challenges in both mature and emerging oil markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aker Solutions

- Rockwell Automation

- Mitsubishi Electric

- Petrofac

- Honeywell

- Yokogawa

- General Electric (GE)

- ABB

- Siemens

- Schneider Electric

Competitive Analysis

The Industrial Automation Oil Gas Market features including ABB, Siemens, Honeywell, Schneider Electric, Yokogawa, Mitsubishi Electric, Rockwell Automation, General Electric (GE), Aker Solutions, and Petrofac. The Industrial Automation Oil Gas Market remains highly competitive, defined by a mix of multinational automation providers and regional engineering firms. Companies focus on delivering integrated solutions that combine hardware, software, and services tailored to upstream, midstream, and downstream operations. Competition revolves around advancing digital platforms, including distributed control systems, predictive analytics, and IoT-enabled monitoring tools that improve efficiency and safety. Service contracts and long-term partnerships with operators strengthen market presence, while innovation in areas such as digital twins, robotics, and cybersecurity creates new avenues for differentiation. The market shows steady consolidation through strategic alliances and acquisitions that enhance global reach and technological capabilities. Vendors compete not only on technical expertise but also on the ability to align solutions with sustainability targets and energy transition initiatives.

Recent Developments

- In May 2025, Schneider Electric partnered with TotalEnergies to deploy EcoStruxure™ Automation Expert, a software-centric DCS (Distributed Control System) for decarbonized upstream operations.

- In March 2025, Siemens and Microsoft entered into a strategic partnership to integrate Microsoft’s Azure IoT and AI technologies with Siemens’ industrial automation and digitalization portfolio.

- In January 2024, ABB, a leading industrial automation company, announced the launch of its new Ability Smart Sensor, an edge computing device designed to transform data from machines into actionable insights. This innovative product was showcased at the World Economic Forum in Davos, Switzerland.

- In April 2023, Schneider Electric acquired AVEVA, a leading provider of industrial automation software, to strengthen its position in the oil and gas automation market.

Market Concentration & Characteristics

The Industrial Automation Oil Gas Market shows moderate concentration, with competition shaped by a few global automation providers and specialized regional firms. It reflects high capital intensity, reliance on advanced engineering, and strong entry barriers that limit new participants. The market emphasizes integrated offerings that combine hardware, software, and services to support upstream, midstream, and downstream operations. It highlights demand for distributed control systems, sensors, process safety solutions, and predictive analytics platforms that ensure efficiency and reliability. Long-term service contracts and strong customer relationships define vendor strategies, creating stability and repeat revenue streams. It demonstrates how regulatory requirements, sustainability targets, and digital transformation trends influence both technology adoption and competitive positioning across the sector.

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing adoption of digital twin platforms for asset optimization.

- Artificial intelligence will play a stronger role in predictive maintenance and operational efficiency.

- IoT-enabled devices will enhance real-time monitoring across upstream, midstream, and downstream operations.

- Robotics and autonomous systems will gain traction in hazardous and offshore environments.

- Cloud-based platforms will support scalability and remote operations across global facilities.

- Cybersecurity will remain a critical investment area to protect connected assets and control systems.

- Renewable integration will drive demand for hybrid automation systems in oil and gas operations.

- Advanced sensors and transmitters will improve accuracy in drilling, refining, and pipeline monitoring.

- Workforce training and skill development will accelerate to match the pace of digital transformation.

- Strategic partnerships and collaborations will shape innovation and strengthen market competitiveness.