Market Overview

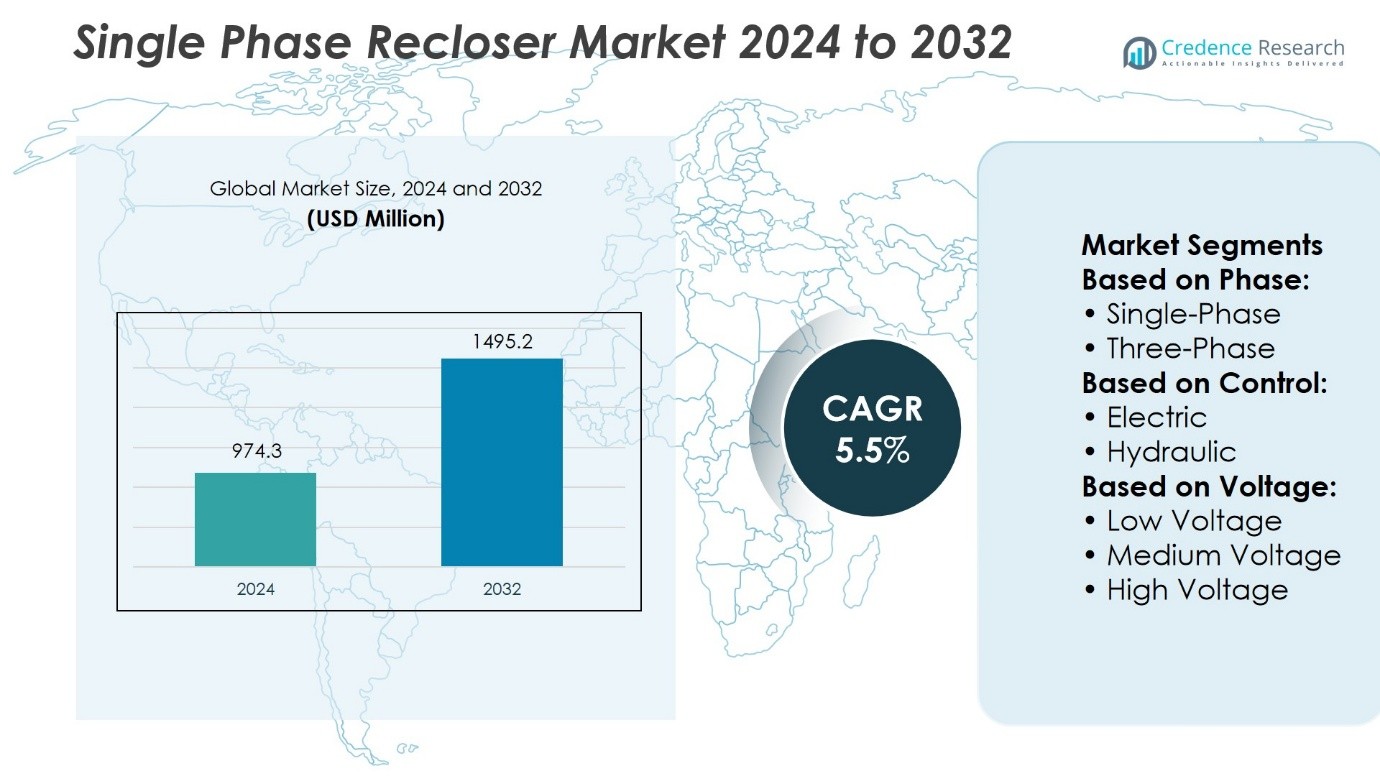

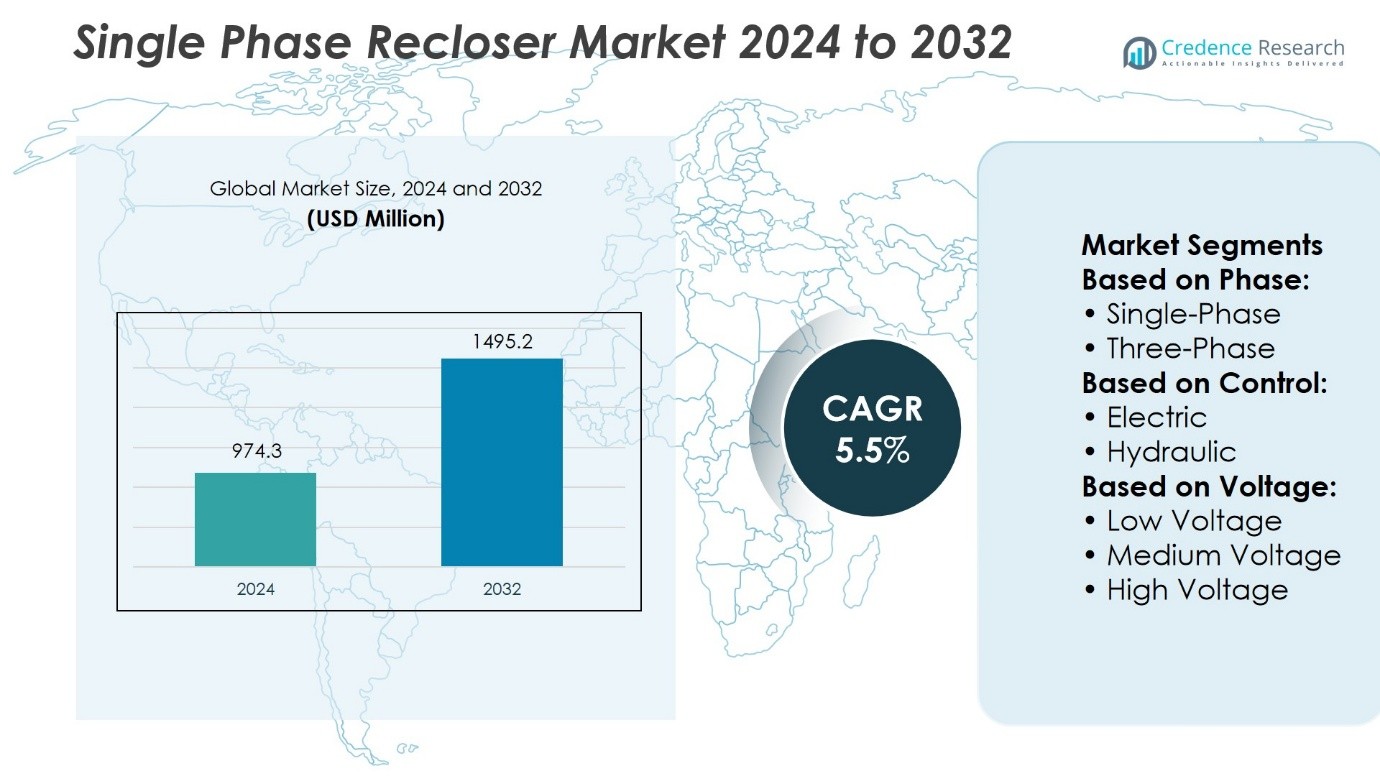

Single Phase Recloser Market size was valued at USD 974.3 million in 2024 and is anticipated to reach USD 1495.2 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single Phase Recloser Market Size 2024 |

USD 974.3 Million |

| Single Phase Recloser Market, CAGR |

5.5% |

| Single Phase Recloser Market Size 2032 |

USD 1495.2 Million |

The Single Phase Recloser Market is driven by rising demand for grid reliability, rural electrification, and automation initiatives that enhance fault detection and outage management. It gains support from growing renewable energy integration, where reclosers manage bidirectional power flows and maintain stability in distribution networks. Increasing preference for cost-effective, low-maintenance equipment encourages adoption across developing regions. The market also reflects trends toward smart grid technologies, IoT-enabled monitoring, and interoperability with advanced communication protocols. It continues to evolve with innovations in compact modular designs and vacuum-based interruption systems, reinforcing its role in modern and sustainable power distribution networks.

The Single Phase Recloser Market demonstrates strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with North America leading due to extensive grid modernization and automation projects. Europe emphasizes renewable integration and environmental compliance, while Asia Pacific shows rapid growth driven by rural electrification and rising power demand. Latin America and the Middle East & Africa gradually adopt reclosers to improve reliability. Key players include ABB, Eaton Corporation, NOJA Power Switchgear, Hubbell, and G&W Electric.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Single Phase Recloser Market size was valued at USD 974.3 million in 2024 and is projected to reach USD 1495.2 million by 2032, growing at a CAGR of 5.5%.

- Rising demand for grid reliability, rural electrification, and automated fault management drives market adoption.

- Smart grid technologies, IoT-enabled monitoring, and digital communication protocols define key market trends.

- Competitive intensity remains high with global and regional players focusing on renewable-ready and low-maintenance designs.

- High initial investment and integration complexity act as restraints for widespread adoption in cost-sensitive regions.

- North America leads with modernization projects, Europe emphasizes renewable integration, and Asia Pacific shows rapid expansion through electrification.

- Latin America and the Middle East & Africa gradually adopt reclosers to strengthen reliability and support rural power distribution.

Market Drivers

Rising Emphasis on Grid Reliability and Distribution Automation

The Single Phase Recloser Market gains momentum from the rising demand for reliable power distribution in residential and rural networks. Utilities prioritize equipment that ensures automatic fault clearance and rapid restoration to minimize outage durations. It reduces manual intervention during line faults, which supports operational efficiency for grid operators. Distribution automation initiatives by governments and utilities create favorable conditions for large-scale deployment. Smart reclosers enable real-time monitoring, which aligns with digital grid modernization goals. This emphasis on reliability strengthens the role of single phase reclosers in power networks.

- For instance, Siemens’ Compact Modular Recloser (CMR) achieves automatic tri‑cycle reclosing on medium‑voltage lines rated up to 38 kV, powered directly via line voltage with zero auxiliary power requirement a tangible step toward reducing downtime and manual intervention.

Increasing Integration of Renewable Energy Sources into Distribution Networks

The Single Phase Recloser Market benefits from the increasing penetration of renewable power across rural and semi-urban regions. It manages bidirectional power flows that emerge from distributed solar and wind energy systems. Utilities require protective devices capable of adapting to intermittent generation patterns. Reclosers maintain grid stability by isolating faults without disrupting renewable power injection. Integration of renewables highlights the importance of flexible and intelligent protection equipment. This trend underscores the relevance of single phase reclosers in future-oriented grid systems.

- For instance, NOJA Power has deployed more than 92,000 automatic circuit reclosers worldwide, with its RC-20 controllers enabling remote monitoring and control across feeders up to 38 kV, reducing average fault restoration times by over 1,200 seconds per event in utility networks.

Rising Demand for Cost-Effective and Low-Maintenance Distribution Solutions

The Single Phase Recloser Market expands due to the growing focus on cost-effective grid equipment with minimal maintenance needs. It provides utilities with long service life, which reduces the overall cost of ownership. Automated reclosing functionality lowers the frequency of manual inspections. Compact design ensures easier installation in rural and remote areas with limited infrastructure. Manufacturers develop units with self-powered control systems that minimize auxiliary power requirements. These attributes make single phase reclosers a preferred solution for utilities working with tight budgets.

Advancements in Smart Grid Technologies and Remote Control Capabilities

The Single Phase Recloser Market evolves with the adoption of smart grid infrastructure and remote operation technologies. It enables utilities to control and monitor fault conditions from central control rooms. Integration of communication protocols allows quick identification of fault locations. Remote operation shortens outage restoration times, which improves customer satisfaction. Utilities gain enhanced visibility across distribution networks through advanced data analytics. This integration of smart features elevates the value proposition of single phase reclosers in modern grids.

Market Trends

Growing Deployment of Intelligent Reclosers with Advanced Control Features

The Single Phase Recloser Market observes a strong trend toward intelligent devices equipped with advanced control and monitoring capabilities. Utilities adopt reclosers integrated with microprocessor-based relays and fault detection technologies. It enables real-time data acquisition, which supports predictive maintenance and improved network reliability. Digital interfaces provide utilities with precise operational data that enhance decision-making for fault management. Growing focus on automation pushes the demand for reclosers that support self-diagnostic and adaptive reclosing functions. This shift reflects the increasing alignment of reclosers with digital grid strategies.

- For instance, Hughes Power System has installed over 12,000 single-phase auto reclosers in European and Asian utility grids, each unit equipped with 32-bit microprocessor controllers capable.

Rising Adoption of IoT and Communication Protocols in Distribution Networks

The Single Phase Recloser Market aligns with the broader trend of IoT integration and standardized communication protocols. Utilities emphasize devices that connect seamlessly with SCADA systems and smart grid platforms. It strengthens remote visibility, enabling faster fault isolation and system recovery. Adoption of IEC 61850 and DNP3 communication standards enhances interoperability across diverse grid assets. Remote connectivity reduces downtime and enhances operational efficiency for grid operators. This integration of IoT-driven control solutions highlights the modernization path for distribution networks.

- For instance, NOJA Power reported in 2023 that more than 92,000 reclosers have been installed globally, supporting IEC 61850 interoperability and capable of transmitting over 20,000 data points daily to SCADA and IoT platforms, enabling utilities to cut outage restoration times by up to 1,200 seconds per fault event.

Expanding Use of Renewable-Compatible Protection Systems

The Single Phase Recloser Market benefits from the trend of adapting equipment to accommodate renewable energy integration. Distributed solar and wind installations require fault management solutions capable of handling variable generation. It ensures stability by managing bidirectional flows without compromising grid safety. Reclosers designed with renewable-friendly settings support smoother transition toward cleaner energy systems. Manufacturers invest in innovations that address the unique challenges of intermittent power supply. This trend positions single phase reclosers as essential enablers of sustainable distribution networks.

Increasing Focus on Compact, Modular, and Low-Cost Designs

The Single Phase Recloser Market advances with a trend toward compact and modular designs that simplify installation and reduce lifecycle costs. Utilities favor reclosers that offer plug-and-play configurations suitable for rural and semi-urban areas. It supports quicker deployment where infrastructure constraints exist. Modular systems allow scalability, which provides flexibility in expanding distribution capacity. Low-maintenance features strengthen adoption among utilities working with limited resources. This trend underscores the market’s focus on delivering practical and cost-efficient grid protection solutions.

Market Challenges Analysis

High Initial Costs and Limited Budget Allocations for Utilities

The Single Phase Recloser Market faces challenges linked to high upfront investment required for advanced models with smart grid compatibility. Utilities operating in developing regions often prioritize basic infrastructure expansion, which limits funding for recloser deployment. It becomes difficult for smaller utilities to justify the purchase of reclosers with advanced communication features when budgets remain constrained. The lack of financing mechanisms further slows adoption in cost-sensitive markets. Manufacturers attempt to address this issue by designing modular and lower-cost versions, but affordability remains a barrier. These cost pressures restrict the pace of modernization in rural and semi-urban power distribution networks.

Technical Complexity and Integration Barriers in Modern Grids

The Single Phase Recloser Market also encounters difficulties related to technical complexity and system integration. It requires compatibility with a wide range of communication protocols and existing grid automation tools, which can increase deployment time. Utilities must invest in skilled workforce training to manage installation and maintenance of these devices effectively. Integration with renewable energy sources adds another layer of challenge due to fluctuating power inputs. Cybersecurity risks also emerge when reclosers connect to digital platforms for remote operation. These technical and operational hurdles slow down broader adoption and demand consistent innovation from manufacturers to simplify deployment.

Market Opportunities

Expansion of Smart Grid Infrastructure and Rural Electrification Projects

The Single Phase Recloser Market holds significant opportunities through the expansion of smart grid programs and rural electrification initiatives. Utilities in both developed and emerging economies invest in automation systems that demand reliable protection and fault management equipment. It supports utilities in improving outage response times while enhancing grid visibility. Rural electrification projects across Asia, Africa, and Latin America create demand for cost-effective reclosers that can operate in low-density distribution networks. Governments promote these deployments through targeted policies and funding for modern distribution assets. This expansion presents strong prospects for recloser manufacturers to address both advanced and underserved markets.

Growing Demand for Renewable Integration and Digital Monitoring Solutions

The Single Phase Recloser Market benefits from rising demand for renewable energy integration into distribution networks. It ensures stability during intermittent generation and facilitates smooth handling of bidirectional power flows from solar and wind systems. Utilities also seek reclosers with digital monitoring capabilities that enable predictive maintenance and remote diagnostics. These advanced features align with the long-term goal of reducing downtime and improving customer reliability indices. Manufacturers that develop renewable-compatible and IoT-enabled designs capture opportunities in rapidly modernizing grids. This convergence of renewable adoption and digitalization strengthens the growth potential of single phase reclosers worldwide.

Market Segmentation Analysis:

By Phase

The Single Phase Recloser Market remains critical in rural and residential networks where distribution lines require cost-efficient fault management solutions. Single-phase units dominate in areas with limited load density, offering reliable protection for small-scale distribution. Three-phase reclosers hold importance in urban and industrial zones where higher loads and complex networks demand advanced protection. Other specialized configurations serve niche applications in mixed or isolated networks. It ensures utilities can match recloser design to grid characteristics, improving operational resilience across varied geographies. This segmentation underscores the versatility of reclosers in serving diverse power distribution environments.

- For instance, ENTEC’s single‑phase solid automatic circuit recloser models (EPR‑1/EPR‑2/EPR‑3) are designed to operate on overhead lines and substations at voltage classes up to 15.5 kV, 27 kV, and 38 kV, and utilize vacuum interrupters within HCEP‑insulated bushings to ensure maintenance‑free operation even in harsh, humid, or corrosive environments.

By Control

The control mechanism defines operational performance, with electric reclosers gaining preference due to automation compatibility. Electric units integrate with SCADA systems, supporting remote monitoring and fault detection, which aligns with grid modernization trends. Hydraulic reclosers continue to serve utilities in regions prioritizing cost-effective and rugged solutions without digital integration. Other control types, though less common, address specific regional or technical needs. It reflects the balance between advanced digital requirements and traditional low-maintenance demands. This mix provides utilities with flexibility in choosing control systems based on budget and infrastructure maturity.

- For instance, Arteche’s vacuum‑recloser portfolio includes devices designed for medium‑voltage lines up to 38 kV, and over 30,000 units have been deployed worldwide across operational grids.

By Voltage

Voltage classification shapes deployment scenarios, with medium voltage reclosers widely adopted in distribution networks. Low voltage units serve secondary distribution applications and localized networks where protection requirements remain minimal. High voltage reclosers play a role in long-distance transmission and regional substations with critical fault management needs. It supports utilities in customizing equipment based on grid architecture and load profiles. The emphasis on medium voltage demonstrates the alignment of reclosers with mainstream distribution demands. This segment highlights the adaptability of reclosers to multiple voltage classes across utility operations.

Segments:

Based on Phase:

Based on Control:

Based on Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the leading share of the Single Phase Recloser Market at 34%, supported by well-established utility infrastructure and strong emphasis on grid modernization. The United States drives adoption with its extensive deployment of smart grids and distribution automation projects aimed at reducing outage durations and improving fault management. Canada follows closely with a strong focus on renewable energy integration and rural electrification in remote provinces. It benefits from government programs that encourage utilities to adopt advanced fault detection and reclosing solutions. Utilities across the region invest in reclosers that feature remote monitoring, SCADA compatibility, and real-time diagnostics, aligning with digital transformation goals. The region’s strong regulatory framework, emphasis on service reliability, and willingness to invest in advanced equipment continue to secure its leadership in the global market.

Europe

Europe accounts for 26% of the Single Phase Recloser Market, driven by initiatives supporting renewable energy penetration and advanced grid protection systems. Germany, France, and the United Kingdom lead in adoption, with utilities prioritizing digital control reclosers that integrate seamlessly with smart distribution networks. It gains momentum from strict environmental regulations that encourage the shift from oil-based interruption to vacuum technologies. European utilities adopt single phase reclosers in semi-urban and rural areas to strengthen power reliability while integrating distributed renewable energy resources such as solar and wind. Eastern European nations also expand their usage due to ongoing infrastructure upgrades and EU-funded rural electrification projects. The region demonstrates consistent demand for advanced reclosers that balance sustainability, efficiency, and regulatory compliance.

Asia Pacific

Asia Pacific commands 28% of the Single Phase Recloser Market, reflecting the rapid expansion of power distribution networks across emerging economies. China leads adoption with aggressive investments in rural electrification and renewable integration programs. India follows with government-backed initiatives to modernize its power sector and reduce technical losses in rural and semi-urban grids. It benefits from strong demand in Southeast Asian countries, where infrastructure development remains a priority. Japan, South Korea, and Australia contribute to advanced deployments, particularly in smart grid and renewable-ready applications. The region’s large population, rising power consumption, and emphasis on cost-effective solutions ensure strong growth potential. Asia Pacific continues to position itself as a dynamic hub for recloser adoption across both developing and developed economies.

Latin America

Latin America holds 7% of the Single Phase Recloser Market, with growth led by Brazil, Mexico, and Chile. It reflects the demand for rural electrification and grid reliability improvements in remote communities. Governments in the region promote investments in automation technologies to minimize outage durations and improve distribution efficiency. Brazil remains a focal point due to its reliance on distributed renewable energy systems, which require advanced recloser technologies to manage fluctuations. Mexico’s power sector reforms and Chile’s renewable adoption also contribute to regional demand. Despite economic challenges, the region continues to embrace single phase reclosers as essential equipment for long-term distribution resilience.

Middle East & Africa

The Middle East & Africa collectively represent 5% of the Single Phase Recloser Market, shaped by rural electrification and emerging renewable energy projects. Gulf nations invest in advanced recloser technologies to support smart grid expansion, while African nations prioritize basic grid reliability improvements. South Africa leads adoption in the continent, supported by initiatives to reduce outages in its struggling power sector. It gains traction in countries like Kenya and Nigeria, where rural electrification and off-grid renewable programs demand cost-effective recloser deployment. The Middle East focuses on enhancing fault management for urban and industrial loads, particularly in Saudi Arabia and the UAE. While the region’s overall share remains modest, it demonstrates significant potential due to rising investment in both renewable integration and grid reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Single Phase Recloser Market include ABB, ARTECHE, Eaton Corporation, ENSTO, ENTEC Electric & Electronic, G&W Electric, Hubbell, Hughes Power System, L&R Electric Group, and NOJA Power Switchgear Pty Ltd. The Single Phase Recloser Market is characterized by strong competition driven by innovation, regional expansion, and the shift toward smart grid adoption. Companies compete by developing reclosers with advanced monitoring, fault detection, and communication capabilities that align with modern distribution automation needs. The market emphasizes renewable integration, pushing manufacturers to design equipment capable of handling variable and bidirectional power flows. Compact, modular, and low-maintenance solutions gain preference among utilities in cost-sensitive regions, creating opportunities for differentiation. Digitalization and remote-control features serve as critical factors for competitive advantage, as utilities seek to improve operational efficiency and outage management. The overall landscape reflects a balance between established players offering advanced technologies and regional manufacturers providing affordable, customized solutions tailored to specific grid requirements.

Recent Developments

- In March 2024, NOJA Power Switchgear Pvt Ltd announced the expansion of their Brisbane headquarters to include a new Distribution Centre Facility. The manufacturing floorspace, allowing the organization to meet growing demand for the Australian made NOJA Power switchgear products.

- In February 2024, The U.S. Department of Energy (DOE) has announced a significant investment of USD 1.2 billion to accelerate the construction of large-scale transmission lines across the country. This funding is aimed at enhancing the nation’s electrical grid infrastructure, ensuring a more reliable and resilient power supply.

- In February 2024, NOJA Power, an Australian engineering firm specializing in switchgear, has officially announced the successful deployment of their 38 kV OSM Recloser switchgear in Moldova. This installation signifies a significant step in the country’s endeavour to modernize its electricity distribution grid, aligning with Moldova’s goals of advancing renewable energy initiatives.

- In August 2023, Eaton Corporation declared that it will invest $500 million in the construction of electrical production and distribution facilities in North America. The business intends to utilize the money to boost sales of its in-demand intelligent solutions.

Market Concentration & Characteristics

The Single Phase Recloser Market reflects a moderately concentrated structure where a mix of global leaders and regional manufacturers compete to address diverse grid requirements. It features companies with strong portfolios in smart grid technologies, renewable-ready solutions, and advanced control systems, alongside regional firms that deliver cost-effective and rugged products for local utilities. Competition emphasizes innovation in automation, remote operation, and communication integration, which remain critical for utilities modernizing distribution networks. It demonstrates characteristics of steady demand across rural and semi-urban areas where grid reliability and fault management are essential. Market dynamics highlight the balance between high-performance reclosers suited for advanced economies and practical, low-maintenance designs preferred in developing regions. It continues to evolve through the adoption of vacuum interruption technology, compact modular designs, and digital control systems that enhance efficiency and sustainability in power distribution.

Report Coverage

The research report offers an in-depth analysis based on Phase, Control, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Single Phase Recloser Market will expand with rising demand for grid automation in rural and semi-urban areas.

- It will gain momentum from renewable energy integration that requires advanced protection solutions.

- Utilities will prefer reclosers with IoT-enabled monitoring and predictive maintenance features.

- It will benefit from increasing investments in smart grid modernization projects worldwide.

- Manufacturers will focus on compact and modular designs to simplify installation and reduce costs.

- It will see stronger adoption of vacuum-based interruption technology for durability and environmental safety.

- Utilities will prioritize reclosers with interoperability across multiple communication protocols.

- It will witness growth in developing regions driven by government-backed electrification programs.

- Cybersecurity will emerge as a key design factor for reclosers connected to digital control systems.

- It will continue to evolve through digitalization, supporting faster outage response and improved reliability.