Market Overview

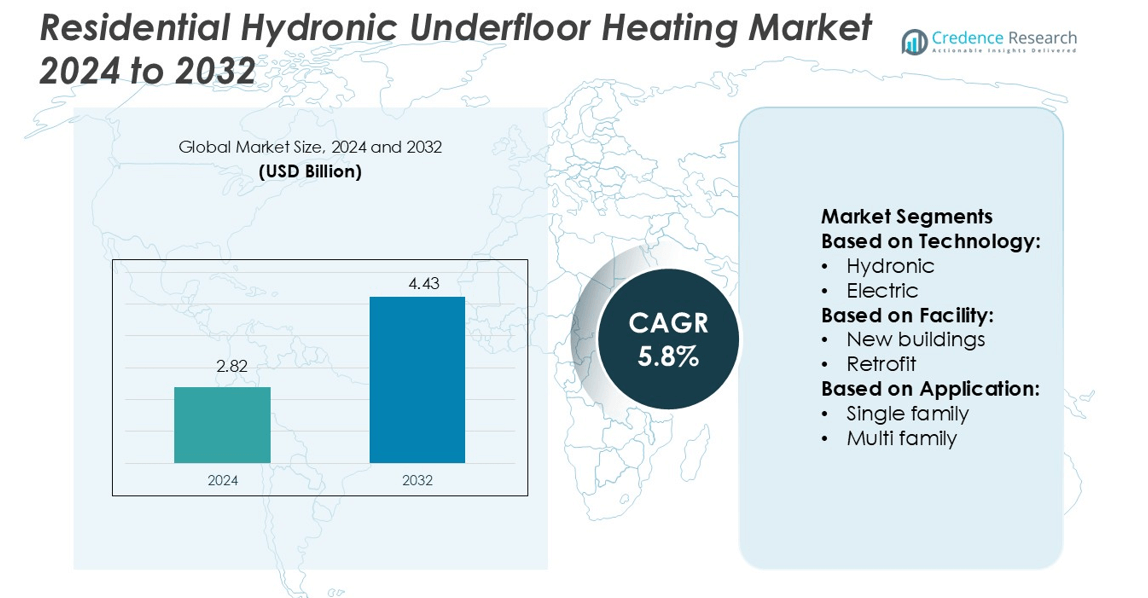

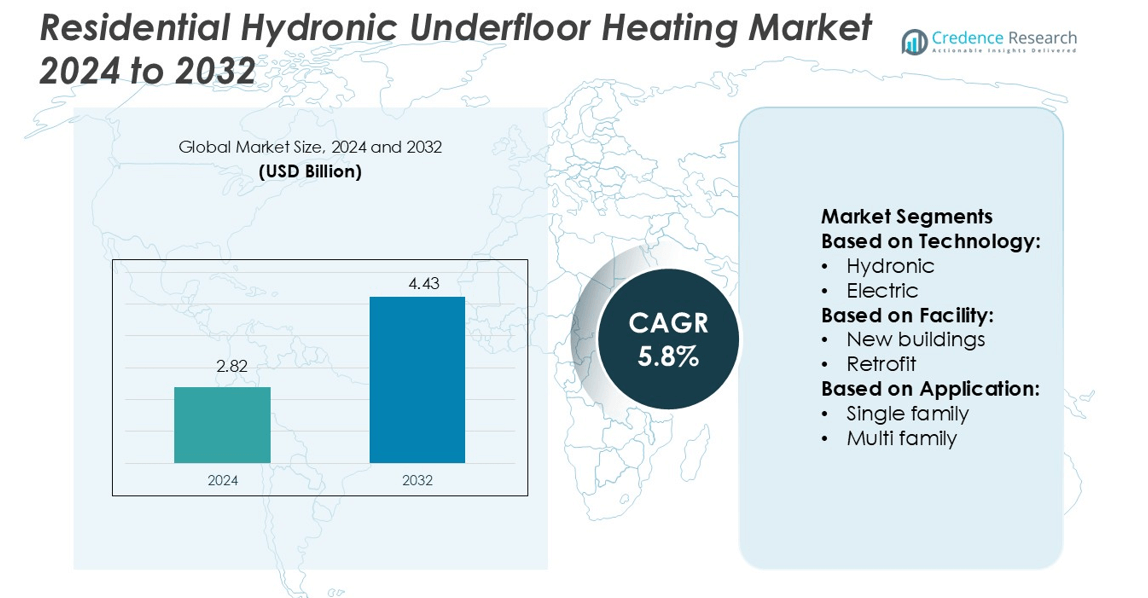

Residential Hydronic Underfloor Heating Market size was valued USD 2.82 billion in 2024 and is anticipated to reach USD 4.43 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Hydronic Underfloor Heating Market Size 2024 |

USD 2.82 billion |

| Residential Hydronic Underfloor Heating Market, CAGR |

5.8% |

| Residential Hydronic Underfloor Heating Market Size 2032 |

USD 4.43 billion |

The Residential Hydronic Underfloor Heating Market is characterized by strong competition and continuous innovation. Top companies focus on delivering energy-efficient systems, smart control technologies, and renewable energy integration to strengthen their market positions. Their strategies include product innovation, strategic partnerships, and expanding service networks to enhance installation and maintenance support. Regional analysis indicates that North America leads the market with a 36% share, supported by strong policy incentives, growing smart home adoption, and a well-developed construction sector. High consumer preference for sustainable heating systems and ongoing retrofit programs further consolidate this region’s leadership position in the global market.

Market Insights

- The Residential Hydronic Underfloor Heating Market was valued at USD 2.82 billion in 2024 and is expected to reach USD 4.43 billion by 2032, growing at a CAGR of 5.8%.

- Energy efficiency and growing demand for low-carbon heating systems are major drivers, supported by strong government incentives and green building standards.

- Integration of smart home technologies and renewable energy sources is a key trend, boosting adoption in both new constructions and retrofit projects.

- Intense competition pushes companies to innovate, expand partnerships, and improve service networks, while high installation costs remain a restraint in cost-sensitive markets.

- North America leads with a 36% market share, followed by Europe at 33% and Asia Pacific at 21%, with the hydronic segment dominating due to high energy performance and compatibility with modern building standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Hydronic systems dominate the Residential Hydronic Underfloor Heating Market with a market share of 63%. This segment benefits from higher energy efficiency and consistent heat distribution compared to electric systems. Hydronic technology uses heated water through pipes, reducing long-term operational costs and supporting sustainable building standards. Rising energy prices and regulatory pressure to adopt low-emission solutions further strengthen the demand. Electric systems, while easier to install, remain less competitive in large-scale residential projects due to higher operating costs.

- For instance, Uponor Oyj installed approximately 42 miles (about 68 km) of PEX tubing in its radiant heating and cooling system at the National Renewable Energy Laboratory (NREL) Research Support Facility, enabling that project to increase its campus area by 60 % while only raising energy use by 6 %.

By Facility

New buildings hold the dominant position in the Residential Hydronic Underfloor Heating Market with a 58% share. This dominance is driven by increased integration of energy-efficient heating solutions during initial construction. Developers prioritize hydronic systems to meet green building standards and lower energy use. Government incentives and stricter building codes also support adoption in new residential complexes. Retrofit installations are growing steadily, supported by home renovation trends and improved retrofit-compatible hydronic solutions.

- For instance, Uponor’s “PEX Pipes Blue” line is made using renewable feedstock through an ISCC Plus certified mass balance approach, which allows for a verified CO₂ footprint reduction of “up to 90%” compared with fossil-based PEX pipes.

By Application

Single-family homes lead the Residential Hydronic Underfloor Heating Market with a 66% share. This segment benefits from higher flexibility in installation and greater homeowner investment in energy-efficient heating. Rising demand for comfortable, uniform heating in detached and semi-detached houses drives growth. Single-family property owners prefer hydronic systems for lower running costs and long system lifespan. Multi-family buildings follow, supported by urban housing projects that integrate shared hydronic heating infrastructure for multiple units.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating

Residential hydronic underfloor heating systems deliver consistent warmth at lower temperatures than conventional heating. This enhances energy efficiency and reduces overall utility costs. Governments across Europe and North America are offering incentives and rebates to promote sustainable heating solutions. The growing shift toward low-carbon buildings further boosts demand. Consumers prefer hydronic systems for their uniform heat distribution, low maintenance, and compatibility with renewable energy sources such as heat pumps. This rising focus on energy efficiency remains a key driver of market growth.

- For instance, Watts’ SmartTrac™ Panels are designed for ⅜-inch PEX/PERT tubing and are 80 % lighter than a comparable thin-slab solution.Watts product descriptions, SmartTrac panels are 80% lighter, which eliminates the need for structural reinforcement in many applications.

Increased Adoption in New Residential Constructions

Hydronic underfloor heating is becoming a preferred choice in new residential projects. Builders and homeowners value its hidden installation, silent operation, and comfort. The system integrates well with modern architectural designs that use efficient insulation and glazing. Many construction firms include underfloor heating as a standard feature in premium homes. Rapid urbanization and increasing investment in residential infrastructure further accelerate installations. This trend strongly supports market expansion, particularly in developed and fast-growing urban regions.

- For instance, Warmboard-S panels are 1 ⅛ inches (≈ 28 mm) thick, measure 4 × 8 ft (1219 × 2438 mm), and feature 12-inch tubing spacing with ½-inch (13 mm) PEX tubing channels.

Government Support and Regulatory Push

Government policies and energy regulations encourage sustainable building technologies. Green building certifications such as LEED and BREEAM promote efficient heating solutions like hydronic systems. Several countries offer tax credits, grants, or subsidies for installing renewable-compatible heating systems. These initiatives lower upfront costs and encourage wider adoption among homeowners. Regulatory standards targeting carbon reduction also make hydronic heating more attractive for both retrofits and new constructions. As a result, policy-driven support plays a vital role in market development.

Key Trends & Opportunities

Integration with Renewable Energy Systems

Hydronic underfloor heating works efficiently with renewable energy sources like geothermal and solar thermal systems. This integration aligns with global carbon reduction goals and rising environmental awareness. Homeowners are increasingly installing heat pumps alongside underfloor heating to maximize efficiency. Technology improvements make these hybrid systems more affordable and easier to install. This trend creates strong opportunities for manufacturers to offer integrated heating solutions that reduce emissions and enhance comfort.

- For instance, OMNIE’s “LowBoard 2 Standard” overlay panel has a total build-up height of 18mm and supports 150mm pipe centres, making it a suitable low-profile solution for retrofitting existing timber or concrete floors.

Smart Control and IoT-Enabled Heating Systems

Smart thermostats and connected home solutions are transforming how homeowners manage heating systems. IoT-enabled hydronic underfloor heating allows precise temperature control and energy monitoring through mobile apps. This capability enhances user convenience and optimizes energy use. Manufacturers are introducing advanced control interfaces compatible with voice assistants and home automation platforms. The growing demand for smart homes drives adoption, opening new opportunities for innovation and system upgrades.

- For instance, REHAU’s NEA SMART 2.0 base station supports up to 8 room units connected via wired or wireless technology. The NEA SMART 2.0 room unit offers a target-temperature resolution of 0.25 K and actual-temperature measuring of internal sensor range 0-40 °C with accuracy ±0.3 K.

Growing Retrofit Opportunities in Existing Homes

Retrofitting underfloor heating in existing buildings is emerging as a key growth area. New installation techniques and flexible piping systems simplify integration without major structural changes. Homeowners seeking comfort and energy savings are driving this demand. Governments offering retrofit incentives further boost adoption. This trend creates strong opportunities for specialized installation services and cost-effective system designs targeting older residential buildings.

Key Challenges

High Upfront Installation Costs

Hydronic underfloor heating systems involve higher initial installation costs compared to traditional heating. Expenses include piping, insulation, heat source integration, and skilled labor. This cost factor can discourage adoption, especially in budget-sensitive housing projects. While operational savings offset costs over time, many homeowners still prefer cheaper alternatives. Overcoming this challenge requires cost-effective technologies and financing options that make the system more accessible.

Complex Installation and Skilled Labor Shortage

Installing hydronic underfloor heating demands technical expertise and careful planning. Integration with boilers, pumps, or heat sources requires skilled professionals. However, the shortage of trained installers often delays projects or raises service costs. This issue is more pronounced in regions with lower market penetration. To address this, industry players must invest in training programs and simplified system designs that reduce complexity and speed up installation.

Regional Analysis

North America

North America leads the Residential Hydronic Underfloor Heating Market with a 36% share in 2024. The region benefits from strong regulatory support for energy-efficient heating and high adoption of sustainable building technologies. Demand is driven by extreme winter conditions in Canada and northern U.S. states. Homeowners prefer hydronic systems for their comfort, efficiency, and compatibility with heat pumps. The U.S. market sees growing adoption in both new constructions and retrofits. Incentives and tax credits accelerate installations, while rising smart home integration enhances system appeal. Leading manufacturers actively expand their distribution and service networks.

Europe

Europe holds a 33% market share, making it the second-largest regional market. The region has well-established energy efficiency policies and early adoption of low-carbon heating technologies. Countries like Germany, the UK, and the Nordics have high installation rates due to stringent building codes and sustainability goals. Hydronic underfloor heating is a preferred choice in both single-family and multi-family housing segments. The strong emphasis on decarbonization and renewable integration drives widespread use. Additionally, government subsidies and retrofit initiatives encourage homeowners to shift from traditional radiators to efficient hydronic systems.

Asia Pacific

Asia Pacific accounts for a 21% market share, with rapid growth expected over the forecast period. Rising disposable income, urbanization, and expanding middle-class populations are boosting demand for modern home comfort systems. Countries like China, Japan, South Korea, and Australia are seeing increased installations, especially in premium residential projects. Energy-saving concerns and growing interest in smart home technologies support the trend. Developers in urban centers integrate hydronic systems into new buildings to meet higher energy performance standards. Manufacturers are expanding local production and distribution to meet rising regional demand.

Latin America

Latin America holds an 8% market share, driven by increasing adoption in cooler regions such as Chile and Argentina. While the market remains relatively small, demand is growing steadily with the expansion of modern residential construction. Rising awareness of energy-efficient heating solutions supports gradual penetration. Government programs promoting sustainable housing add momentum. Developers in urban areas are incorporating underfloor systems into high-end housing projects. Limited infrastructure and cost sensitivity are key constraints, but growing renewable energy integration presents new opportunities for future market expansion.

Middle East & Africa

The Middle East & Africa region represents a 2% market share, with growth mainly concentrated in colder high-altitude or temperate zones. Select markets such as South Africa and parts of the Middle East with seasonal temperature variations are adopting hydronic heating systems in premium residential segments. While warm climates limit widespread demand, luxury developments and sustainable building initiatives are driving small but steady growth. Government-led green building programs are beginning to support energy-efficient technologies. However, high costs and limited installer availability remain key challenges restraining market penetration.

Market Segmentations:

By Technology:

By Facility:

By Application:

- Single family

- Multi family

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Residential Hydronic Underfloor Heating Market features leading players such as Warmup, Robert Bosch GmbH, Uponor Corporation, Watts, Warmboard, Inc., OMNIE, REHAU AG, Mitsubishi Electric Corporation, Schluter Systems, and Therma-HEXX Corporation. The Residential Hydronic Underfloor Heating Market is marked by strong technological innovation and strategic expansion. Companies focus on developing energy-efficient systems that integrate seamlessly with renewable energy sources, such as solar thermal and heat pumps. Smart control technologies and IoT-enabled features are becoming major differentiators, improving comfort and operational efficiency. Manufacturers are also emphasizing modular and lightweight installation solutions to reduce labor time and overall project costs. Strategic collaborations with builders, distributors, and technology providers are expanding market reach. A strong emphasis on sustainability, regulatory compliance, and advanced system design continues to drive competition and shape market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Warmup

- Robert Bosch GmbH

- Uponor Corporation

- Watts

- Warmboard, Inc.

- OMNIE

- REHAU AG

- Mitsubishi Electric Corporation

- Schluter Systems

- Therma-HEXX Corporation

Recent Developments

- In July 2025, Panasonic launched a versatile hydronic heating solution that combines home heating, cooling, and hot water production in a single system, ideal for both new builds and retrofit projects. The Air to Water Heat Pump eliminates the need for an indoor unit, simplifying installation with only hydraulic piping.

- In April 2025, UFHN, a provider of electric and hydronic and underfloor heating systems announced its acquisition by the PURMO Group. This strategic move will enhance the company’s capabilities and expand its market reach in the UK. By joining Purmo Group, the company will integrate its capabilities into sustainable climate solutions portfolio and gain access to extensive resources, research, and development capabilities.

- In February 2025, HeatUp, a Swedish company that excels in delivering comprehensive UFH systems along with sanitary hot and cold-water distribution solutions, along with pre-insulated flexible tubing systems, has become part of Elydan Group, Europe based enterprise with expertise in fluid distribution systems.

- In September 2024, Schneider Electric rolled out an AI-powered update to its Wiser Home app, enhancing control over household energy use, including electric heating. The upgrade uses real-time weather data, energy pricing, and user habits to automate energy management

Report Coverage

The research report offers an in-depth analysis based on Technology, Facility, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption driven by energy efficiency targets.

- Integration with renewable energy sources will accelerate system deployment.

- Smart home technologies will enhance system control and energy optimization.

- Retrofits in existing buildings will become a major revenue stream.

- Government incentives and green building standards will support wider adoption.

- Modular installation systems will reduce cost and speed up project timelines.

- Demand will increase in urban housing and premium residential projects.

- Manufacturers will focus on advanced materials to boost performance and durability.

- Partnerships with builders and HVAC contractors will strengthen market penetration.

- Innovation in IoT and automation will shape the next growth phase.