Market Overview

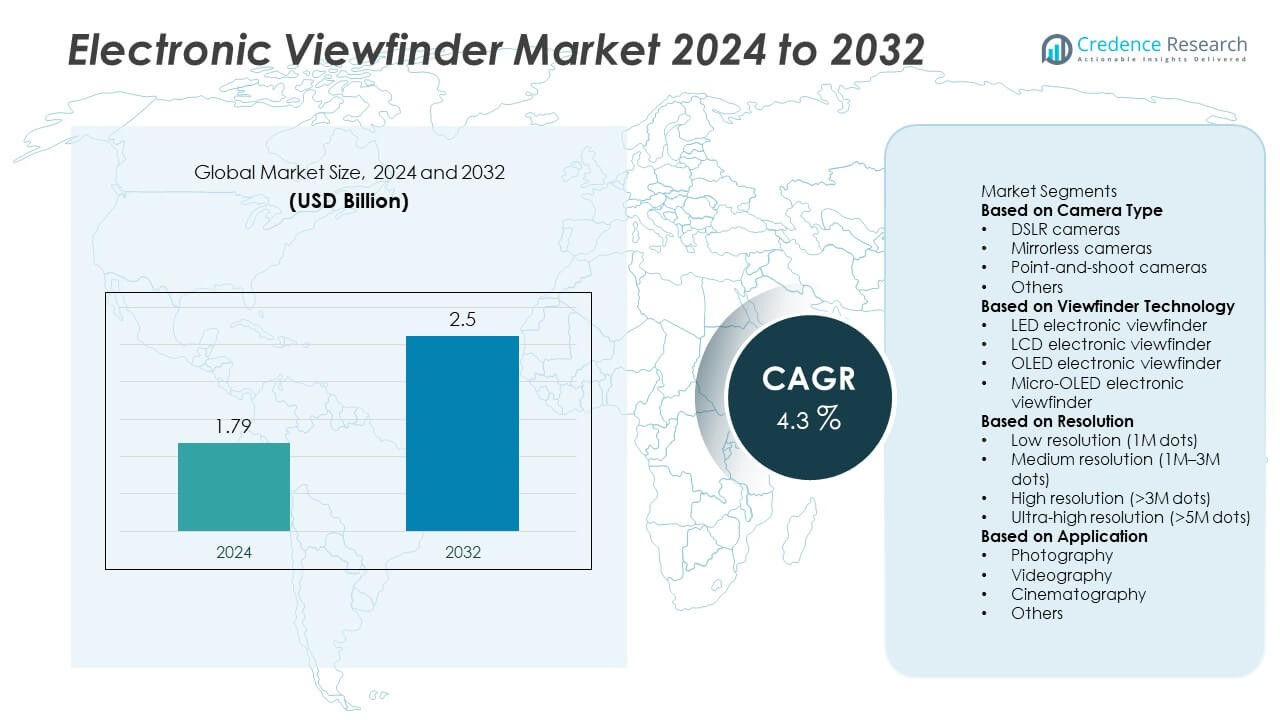

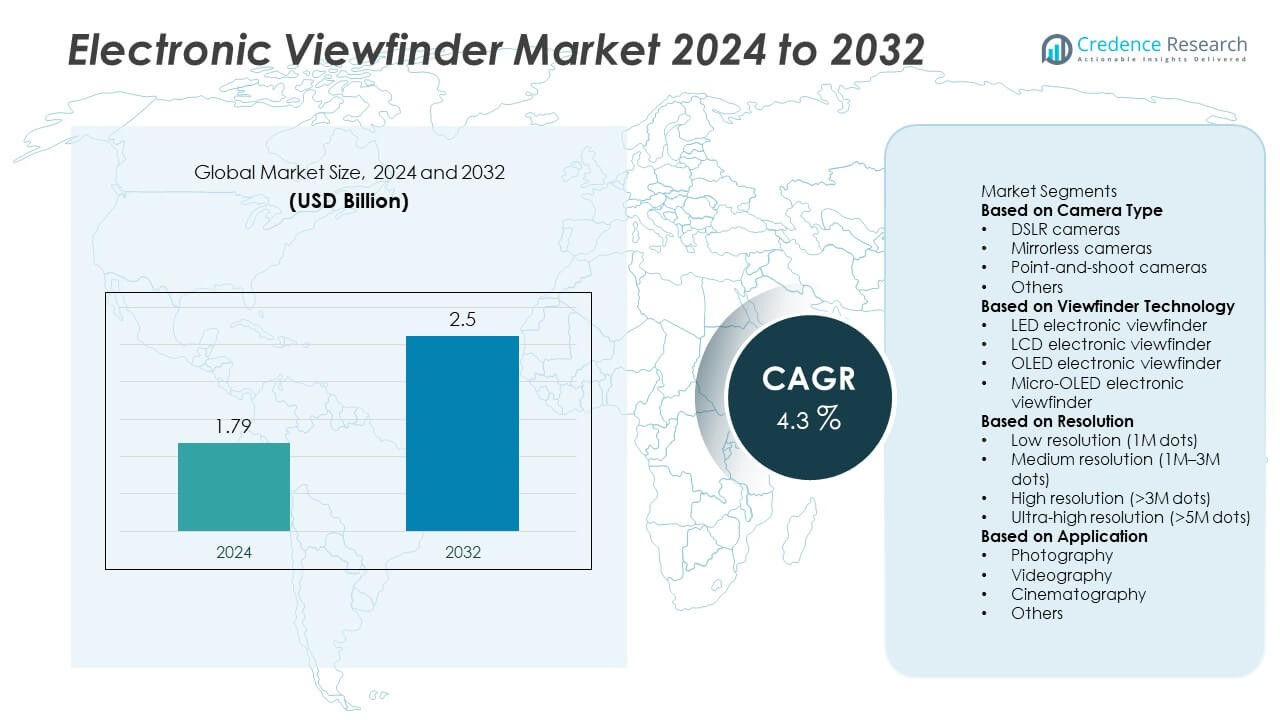

The Electronic Viewfinder market was valued at USD 1.79 billion in 2024 and is projected to reach USD 2.5 billion by 2032, expanding at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Viewfinder market Size 2024 |

USD 1.79 Billion |

| Electronic Viewfinder market, CAGR |

4.3% |

| Electronic Viewfinder market Size 2032 |

USD 2.5 Billion |

The electronic viewfinder market is led by major companies such as Sony Corporation, Canon Inc., Nikon Corporation, Panasonic Corporation, Fujifilm Holdings Corporation, Olympus Corporation, Leica Camera AG, Ricoh Imaging Company Ltd., Sigma Corporation, and Sharp Corporation. These players dominate through advancements in OLED and micro-OLED technologies that enhance resolution, brightness, and real-time image accuracy. North America held the largest share of 34% in 2024, driven by high adoption of professional mirrorless and DSLR cameras. Asia-Pacific followed with a 31% share, supported by expanding camera manufacturing hubs in Japan, China, and South Korea. Europe accounted for a 27% share, emphasizing precision optics and premium imaging systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electronic viewfinder market was valued at USD 1.79 billion in 2024 and is projected to reach USD 2.5 billion by 2032, growing at a CAGR of 4.3%.

- Rising demand for mirrorless and high-performance cameras is driving market growth, supported by professional and enthusiast photography segments.

- Advancements in OLED and micro-OLED technologies are key trends enhancing color accuracy, contrast, and real-time viewing precision.

- The market is moderately competitive, with Sony, Canon, and Nikon leading through innovations in compact, high-resolution viewfinder modules.

- North America led the market with a 34% share in 2024, followed by Asia-Pacific with 31%, while the mirrorless camera segment dominated with a 46% share due to growing preference for lightweight and advanced imaging systems.

Market Segmentation Analysis:

By Camera Type

The mirrorless cameras segment dominated the electronic viewfinder market with a 75% share in 2024. This dominance is driven by the global shift from DSLR to mirrorless designs, which rely entirely on EVFs for image framing. These cameras offer compact form factors, high-speed autofocus, and accurate real-time previews, making them popular among professionals and enthusiasts. DSLR cameras follow, supported by hybrid models, while point-and-shoot devices continue to serve casual photographers seeking portability and convenience.

- For instance, Fujifilm’s X-H2S included a blackout-free EVF with 5.76 million dots and 0.8× magnification, significantly improving subject tracking in burst shooting.

By Viewfinder Technology

The LCD electronic viewfinder segment held the largest market share of 48% in 2024. Its dominance stems from its cost-effectiveness, widespread availability, and use in mid-range and entry-level cameras. LCD EVFs provide adequate image clarity and brightness while keeping manufacturing costs low. However, OLED and micro-OLED technologies are rapidly expanding due to their superior contrast, color accuracy, and power efficiency, making them the preferred choice in high-end professional and mirrorless cameras.

- For instance, the Leica SL2-S features a high-resolution 5.76-million-dot electronic viewfinder with a 120 fps refresh rate, powered by an OLED panel, offering a natural and immersive viewing experience.

By Resolution

The high-resolution segment, defined as EVFs with over 3 million dots, captured a 42% share in 2024. This segment’s strength lies in the rising demand for premium imaging quality in professional cameras. High-resolution EVFs enhance focus precision, image clarity, and framing accuracy, which are crucial for photographers and videographers. Manufacturers are developing ultra-high-resolution viewfinders exceeding 5 million dots to meet professional requirements, although their adoption remains limited due to high production costs.

Key Growth Drivers

Rising Adoption of Mirrorless Cameras

The growing popularity of mirrorless cameras is the primary driver of the electronic viewfinder market. Mirrorless models rely entirely on EVFs for image preview and focus adjustment, enhancing precision and real-time framing. Leading camera brands are integrating high-resolution and fast-refresh EVFs to match professional expectations. The segment’s growth is reinforced by compact design trends and advanced autofocus systems, increasing demand among both professionals and hobbyists.

- For instance, Sony introduced its α9 III mirrorless camera featuring a 9.44-million-dot OLED electronic viewfinder with a 120 fps refresh rate, enabling blackout-free continuous shooting.

Technological Advancements in Display Quality

Continuous improvements in OLED and micro-OLED technologies are significantly enhancing EVF performance. These innovations deliver superior contrast, higher pixel density, and faster refresh rates for seamless real-time viewing. Camera manufacturers are adopting advanced display drivers and energy-efficient panels to enhance visual experience and reduce lag. Such advancements are particularly valuable for high-speed photography, videography, and outdoor use, driving broader adoption across professional and consumer-grade cameras.

- For instance, the Panasonic Lumix S1H employs a 5.76-million-dot OLED EVF with a changeable 60 Hz or 120 Hz refresh rate. This feature, combined with its ability to record 6K video, is effective for clear motion tracking, particularly for professional cinematography.

Increasing Demand for Real-Time Shooting and Video Recording

The demand for real-time visual accuracy in photography and videography is fueling EVF adoption. Modern EVFs provide exposure simulation, focus peaking, and instant playback features that enhance workflow efficiency. Videographers prefer EVFs with minimal latency and accurate color reproduction to ensure precise framing during recording. As social media and content creation continue to expand, EVFs offering seamless performance in dynamic lighting conditions are gaining strong market traction.

Key Trends & Opportunities

Integration of AI and Augmented Display Features

AI integration in electronic viewfinders is emerging as a major trend in camera technology. New-generation EVFs leverage artificial intelligence for real-time object tracking, facial recognition, and focus adjustment. Some high-end models incorporate augmented overlays that display critical shooting data within the viewfinder, improving decision-making speed. These features enhance accuracy, efficiency, and overall user experience, creating new opportunities for innovation in both professional and consumer camera markets.

- For instance, the Canon EOS R5 employs its Dual Pixel CMOS AF II system, which uses deep learning algorithms to recognize and track subjects, including animals, with continuous focus accuracy at 20 frames per second.

Shift Toward Lightweight and Energy-Efficient Components

Manufacturers are increasingly focusing on developing compact and power-efficient EVFs. The use of micro-OLED displays and low-power ICs reduces energy consumption without compromising brightness or clarity. This shift supports longer battery life in portable and mirrorless cameras, addressing one of the key consumer concerns. The demand for smaller, more efficient components aligns with trends in travel and action photography, where lightweight equipment is preferred.

- For instance, the OM System OM-1 features a 5.76-million-dot OLED EVF with a new, higher-capacity BLX-1 battery that offers a 25% improvement in CIPA-rated shots per charge compared to its predecessor, the E-M1 Mark III.

Key Challenges

High Production Costs of Advanced Viewfinder Technologies

Producing high-resolution OLED and micro-OLED EVFs involves complex manufacturing processes and expensive materials, leading to elevated costs. This makes integration into mid-range and entry-level cameras difficult, limiting mass adoption. Manufacturers face the challenge of balancing premium quality with affordability to maintain competitiveness. The cost barrier also slows down technological upgrades in lower-priced camera models, restricting overall market penetration.

Rising Competition from LCD and Smartphone Displays

The growing sophistication of smartphone cameras and external LCD screens poses a challenge to EVF adoption. Smartphones offer real-time previews and high-definition displays that rival traditional viewfinder performance for casual photography. Additionally, many entry-level cameras rely on LCD screens instead of EVFs to reduce cost and weight. This substitution trend, particularly among budget-conscious consumers, limits the potential market expansion for electronic viewfinders.

Regional Analysis

North America

North America held a 34% share of the electronic viewfinder market in 2024. The region’s leadership is driven by high adoption of professional and mirrorless cameras among photographers, filmmakers, and vloggers. The U.S. dominates due to strong demand for high-end camera systems in media, entertainment, and sports photography. Manufacturers are investing in OLED and micro-OLED technologies to deliver improved visual clarity and energy efficiency. Growing content creation trends and the expansion of digital media platforms further boost EVF adoption across both professional and consumer markets.

Europe

Europe accounted for a 27% share of the electronic viewfinder market in 2024. The region’s growth is supported by strong demand for advanced imaging equipment in commercial photography and film production. Countries such as Germany, the U.K., and France lead in adopting premium mirrorless and DSLR cameras integrated with high-resolution EVFs. European consumers value precision and sustainability, encouraging manufacturers to innovate with energy-efficient and eco-friendly components. The growing popularity of travel and wildlife photography across the region continues to drive investment in high-performance camera systems equipped with EVFs.

Asia-Pacific

Asia-Pacific captured a 29% share of the electronic viewfinder market in 2024. The region’s growth is driven by rising disposable incomes, increasing photography culture, and strong camera production bases in Japan, China, and South Korea. Japan remains the leading hub for EVF innovation, with manufacturers developing OLED and micro-OLED viewfinders offering superior image quality. Expanding vlogging and social media activity across India and Southeast Asia further drives market growth. The region also benefits from high camera exports and rapid adoption of mirrorless systems among emerging professional photographers.

Middle East & Africa

The Middle East & Africa region held a 5% share of the electronic viewfinder market in 2024. The market is expanding as digital photography gains traction among consumers and professionals in countries like the UAE, Saudi Arabia, and South Africa. Growth is supported by rising tourism, which drives demand for high-quality camera equipment. Camera manufacturers are targeting the region with mid-range models featuring energy-efficient EVFs. Increasing digital media coverage of events and the expansion of e-commerce platforms are also encouraging greater adoption of advanced photographic tools.

Latin America

Latin America accounted for a 5% share of the electronic viewfinder market in 2024. Growth is driven by rising popularity of photography and videography in Brazil, Mexico, and Argentina. Regional consumers are increasingly adopting mirrorless and high-resolution cameras for social media content creation and professional use. Camera brands are expanding distribution networks and introducing affordable EVF-integrated models to capture this demand. Supportive government initiatives promoting creative industries and local digital content production are also contributing to steady market growth across Latin America’s emerging economies.

Market Segmentations:

By Camera Type

- DSLR cameras

- Mirrorless cameras

- Point-and-shoot cameras

- Others

By Viewfinder Technology

- LED electronic viewfinder

- LCD electronic viewfinder

- OLED electronic viewfinder

- Micro-OLED electronic viewfinder

By Resolution

- Low resolution (1M dots)

- Medium resolution (1M–3M dots)

- High resolution (>3M dots)

- Ultra-high resolution (>5M dots)

By Application

- Photography

- Videography

- Cinematography

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electronic viewfinder market includes key players such as Sony Corporation, Canon Inc., Nikon Corporation, Panasonic Corporation, Fujifilm Holdings Corporation, Olympus Corporation, Leica Camera AG, Ricoh Imaging Company Ltd., Sigma Corporation, and Sharp Corporation. These companies compete through advancements in micro-OLED technology, high-resolution imaging, and real-time display precision. Market leaders focus on integrating electronic viewfinders with advanced autofocus systems and enhanced frame rates to improve user experience in professional and consumer cameras. Continuous R&D investments aim to enhance brightness, latency reduction, and battery efficiency. Collaborations with camera and display manufacturers support product innovation, while miniaturization and digital connectivity features strengthen brand competitiveness. The market’s evolution is also shaped by growing demand for hybrid and mirrorless cameras that rely heavily on advanced electronic viewfinders for accuracy, durability, and superior image visualization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Sony Corporation registered two new cameras, one of which is reported to feature a built-in tilting EVF – a first for Sony.

- In 2025, Canon Inc.’s Integrated Report described company-wide concurrent development systems, covering imaging products including EVF-enabled devices, signalling strategic focus though not a specific EVF launch date.

- In 2025, Panasonic Corporation teased a major Lumix product announcement for 17 Oct, potentially involving EVF-enabled cameras though details are yet undisclosed.

Report Coverage

The research report offers an in-depth analysis based on Camera Type, Viewfinder Technology, Resolution, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing adoption of mirrorless and compact digital cameras.

- Advancements in OLED and micro-OLED technologies will enhance image clarity and contrast.

- Integration of AI-based scene recognition will improve real-time image adjustments.

- Manufacturers will focus on lightweight and energy-efficient viewfinder designs.

- Demand from videographers and content creators will strengthen global market growth.

- Asia-Pacific will emerge as the fastest-growing region due to expanding camera production.

- North America will retain dominance driven by professional photography adoption.

- Augmented reality overlays and eye-tracking features will shape future innovations.

- Partnerships between camera brands and display technology firms will increase.

- Enhanced durability and weather-sealed viewfinders will cater to outdoor and professional users.