Market Overview

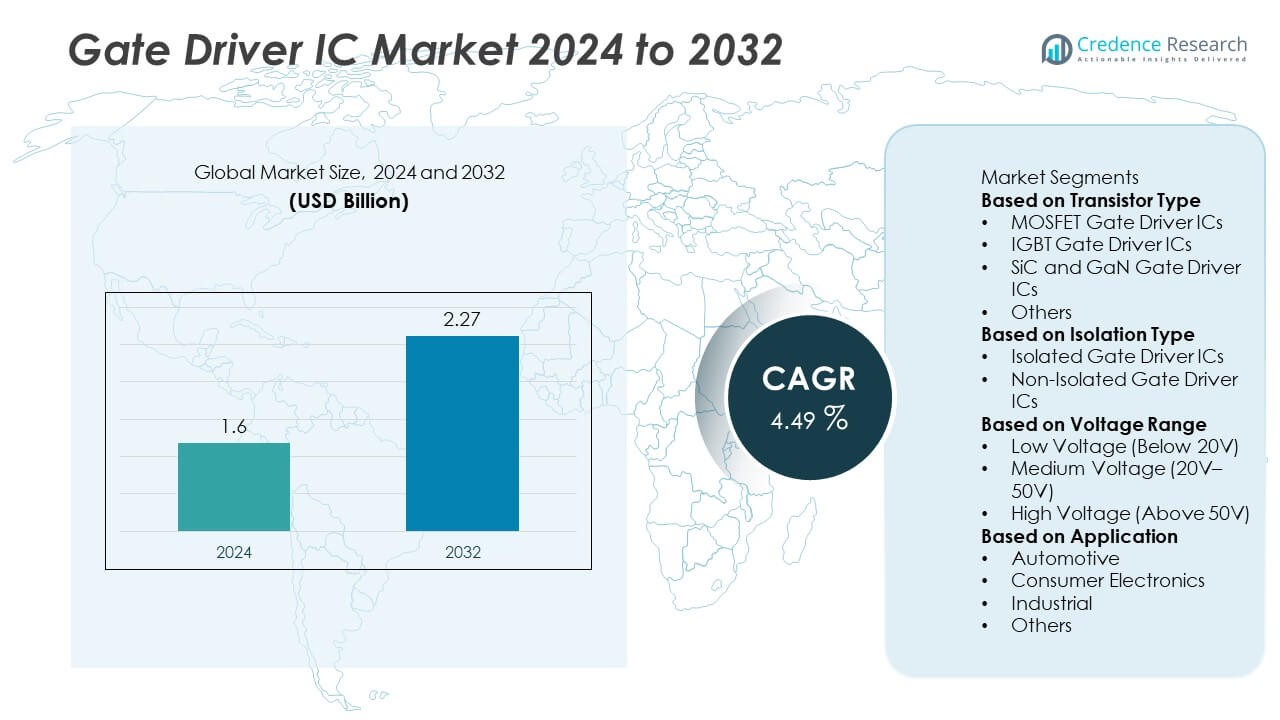

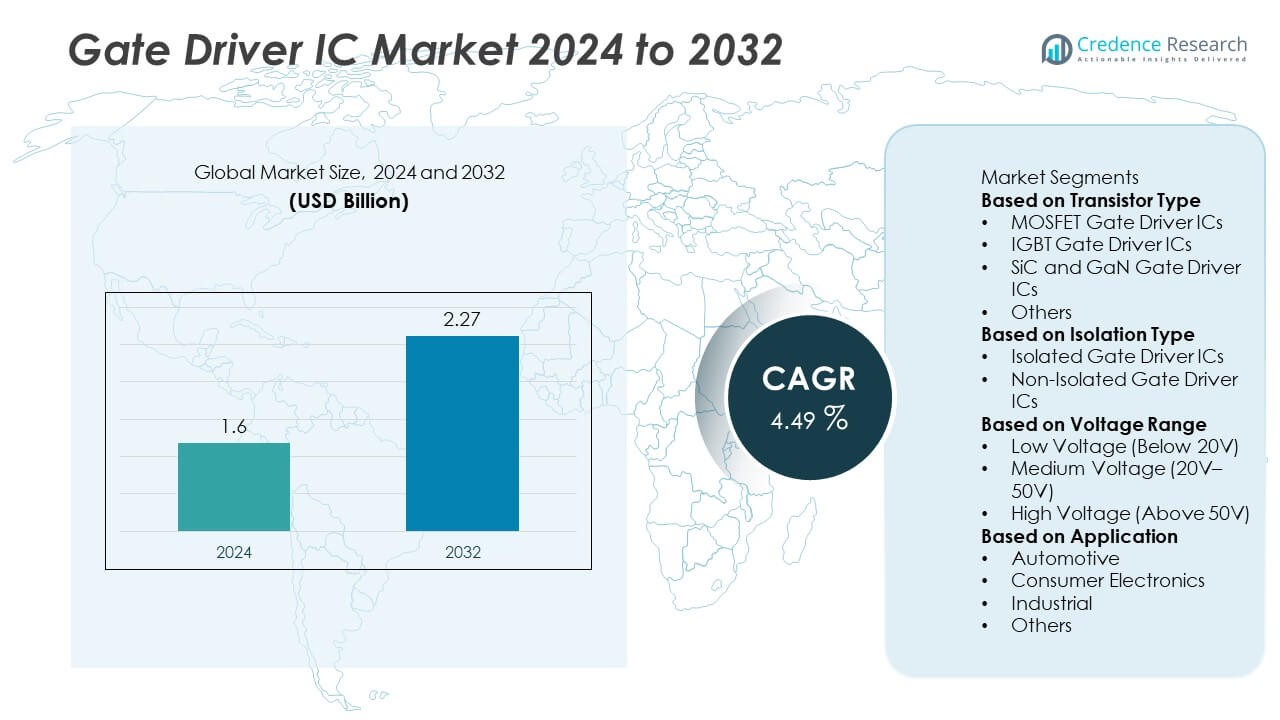

The Gate Driver IC market was valued at USD 1.6 billion in 2024 and is projected to reach USD 2.27 billion by 2032, growing at a CAGR of 4.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gate Driver IC market Size 2024 |

USD 1.6 Billion |

| Gate Driver IC market, CAGR |

4.49% |

| Gate Driver IC market Size 2032 |

USD 2.27 Billion |

The Gate Driver IC market is led by major companies including Infineon Technologies AG, Texas Instruments Incorporated, ON Semiconductor Corporation, STMicroelectronics N.V., ROHM Semiconductor, NXP Semiconductors N.V., Toshiba Electronic Devices & Storage Corporation, Renesas Electronics Corporation, Power Integrations, Inc., and Analog Devices, Inc. These players focus on enhancing power efficiency, thermal stability, and switching performance across automotive, industrial, and consumer electronics applications. North America dominated the market in 2024 with a 37% share, driven by strong adoption in electric vehicles and renewable energy systems. Europe held a 29% share, supported by automotive electrification initiatives, while Asia Pacific accounted for 26%, driven by expanding semiconductor manufacturing and high demand from industrial automation and consumer electronics sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Gate Driver IC market was valued at USD 1.6 billion in 2024 and is projected to reach USD 2.27 billion by 2032, growing at a CAGR of 4.49%.

- Rising demand for electric vehicles, renewable energy systems, and industrial automation is driving the adoption of high-efficiency gate driver ICs globally.

- Growing use of SiC and GaN gate driver ICs represents a key trend, improving switching speed, power density, and system performance across automotive and consumer electronics sectors.

- Leading companies such as Infineon Technologies, Texas Instruments, and ON Semiconductor focus on R&D in wide-bandgap semiconductors and integrated isolation solutions to strengthen competitiveness.

- North America led the market with 37% share in 2024, followed by Europe (29%) and Asia Pacific (26%); the MOSFET gate driver IC segment dominated with 41% share due to its widespread use in automotive and power management applications.

Market Segmentation Analysis:

By Transistor Type

The MOSFET Gate Driver IC segment dominated the Gate Driver IC market in 2024 with a 48% share. MOSFET drivers are widely adopted in low to medium power applications due to their fast switching speed, low conduction loss, and cost efficiency. Their extensive use in automotive, consumer electronics, and industrial systems supports steady growth. The increasing integration of MOSFET-based drivers in electric vehicles and portable devices enhances performance and energy efficiency. Meanwhile, SiC and GaN gate driver ICs are gaining traction for high-power, high-frequency applications, driven by their superior thermal stability and switching performance.

- For instance, ON Semiconductor developed the NCP51705 gate driver IC optimized for SiC MOSFETs, delivering a peak current drive capability of 6 A and handling high switching frequencies. The driver improves turn-on efficiency in 1,200 V SiC devices used in power conversion modules and electric mobility systems.

By Isolation Type

The isolated gate driver IC segment held a leading 62% share of the market in 2024. Isolated drivers are essential for ensuring signal integrity and safety in high-voltage applications, especially in electric vehicles, renewable energy systems, and industrial automation. Their ability to provide galvanic isolation between control and power circuits minimizes electrical noise and enhances system reliability. The rising adoption of high-power electronics and wide-bandgap semiconductors has further accelerated demand for isolated gate drivers. Non-isolated gate drivers continue to find use in low-voltage and compact consumer devices where size and cost efficiency are key considerations.

- For instance, Texas Instruments launched the UCC21750-Q1 isolated gate driver with reinforced isolation voltage of 5,700 V RMS, and a maximum propagation delay of 130 ns. The device supports SiC and IGBT transistors in EV traction inverters, improving switching precision and ensuring robust operation in systems up to 2,121 V DC operating voltage.

By Voltage Range

The medium voltage segment, ranging between 20V and 50V, dominated the Gate Driver IC market in 2024 with a 46% share. These ICs are preferred in automotive powertrains, motor control units, and industrial inverters due to their balance of performance and reliability. Medium voltage drivers enable efficient switching for both IGBT and MOSFET devices, improving system stability in high-frequency applications. The growing need for precise voltage regulation and energy efficiency in electric vehicles and smart grid systems supports steady growth. High-voltage gate drivers are also expanding rapidly, driven by their increasing adoption in renewable and industrial power systems.

Key Growth Drivers

Rising Adoption of Electric and Hybrid Vehicles

The expanding electric and hybrid vehicle market is a major driver for Gate Driver ICs. These ICs play a vital role in controlling power modules in traction inverters, battery management systems, and motor drives. As automakers prioritize higher energy efficiency and reduced power losses, demand for advanced gate drivers has surged. The shift toward wide-bandgap semiconductors like SiC and GaN further supports adoption, as they enable compact, high-efficiency vehicle designs. Government incentives and stricter emission standards globally continue to accelerate EV production, strengthening market growth.

- For instance, Infineon released EiceDRIVER isolated gate drivers with a 20 A output stage that drive traction inverters handling up to 300 kW, supporting both IGBT and SiC modules in EV powertrains.

Increasing Demand for Energy Efficiency in Industrial Systems

Industrial automation and energy-efficient motor control systems are boosting demand for Gate Driver ICs. These components enable precise switching and power conversion, enhancing performance in industrial drives, robotics, and renewable energy inverters. As industries transition toward smart manufacturing, efficient gate control becomes essential for reducing energy waste and maintenance costs. The rising integration of IGBTs and SiC transistors in industrial power systems, coupled with digital control capabilities, supports improved thermal management and operational reliability, driving sustained adoption across industrial applications.

- For instance, STMicroelectronics offers the STGAP2SiCS isolated gate driver with 4 A source/sink capability, 1.2 kV bus support, and an input-to-output propagation delay under 75 ns—ideal for industrial SiC inverter systems.

Expansion of Renewable Energy and Power Infrastructure

The growth of renewable energy projects, particularly solar and wind power, has intensified the need for Gate Driver ICs. These ICs ensure efficient conversion and management of high-voltage power in inverters and converters. Their role in maintaining energy stability and minimizing losses makes them indispensable in renewable energy systems. As governments invest heavily in sustainable power infrastructure and smart grids, manufacturers are developing high-voltage, isolated gate drivers optimized for power efficiency. The demand for durable and high-temperature-tolerant devices continues to rise across energy and utility sectors.

Key Trends and Opportunities

Integration of SiC and GaN Technologies

The adoption of silicon carbide (SiC) and gallium nitride (GaN) technologies is reshaping the Gate Driver IC market. These wide-bandgap materials offer superior switching efficiency, higher thermal conductivity, and compact design potential. Gate drivers designed for SiC and GaN transistors enable faster response times and improved power density. As industries seek higher efficiency in automotive, renewable, and telecom power systems, manufacturers are developing customized drivers to optimize performance. This trend represents a key opportunity for innovation in high-frequency, low-loss applications across multiple sectors.

- For instance, ROHM Semiconductor introduced its BM3G0xxMUV-LB gate driver IC series compatible with SiC and GaN devices, achieving switching frequencies up to 2 MHz and peak output current of 4 A. These ICs are deployed in on-board chargers and DC/DC converters, reducing power loss and improving conversion efficiency in EV platforms.

Advancements in Miniaturization and Integrated Design

Miniaturization and integration trends are driving the development of compact Gate Driver ICs with embedded protection and monitoring features. These ICs reduce system complexity and improve reliability, making them ideal for portable electronics and automotive power modules. Integration with diagnostic and fault detection capabilities enhances safety and performance. Manufacturers are focusing on mixed-signal designs and multi-channel configurations to optimize power control. This evolution aligns with the global demand for smaller, energy-efficient devices across consumer electronics, EVs, and renewable power systems.

- For instance, NXP Semiconductors developed the GD3160 single-channel isolated gate driver in a compact 14 mm × 14 mm package with programmable dead-time control and DESAT protection. It supports up to 1,700 V SiC MOSFETs and includes integrated diagnostics for thermal and overcurrent faults, streamlining inverter design for electric vehicles and industrial systems.

Key Challenges

High Design Complexity and Thermal Management Issues

Gate Driver ICs face increasing design challenges due to rising power density and switching speeds. Managing heat dissipation and ensuring stable operation under high-voltage conditions remain key technical hurdles. Improper thermal management can degrade efficiency and reliability, especially in EVs and industrial applications. Engineers must balance high-speed switching with system safety and electromagnetic interference control. Developing advanced packaging and cooling solutions continues to be critical for maintaining performance consistency in demanding power electronics environments.

Stringent Regulatory Standards and Supply Chain Constraints

The market faces challenges related to evolving safety and environmental regulations governing semiconductor materials and production processes. Compliance with standards such as RoHS and REACH increases production costs and time-to-market. Additionally, supply chain disruptions and semiconductor shortages affect the availability of critical components. Manufacturers must invest in resilient sourcing and regional manufacturing strategies to reduce dependency on limited suppliers. Balancing compliance with cost efficiency and product scalability remains a pressing challenge for gate driver IC developers worldwide.

Regional Analysis

North America

North America held a 37% share of the Gate Driver IC market in 2024, driven by rapid adoption of electric vehicles, industrial automation, and renewable energy systems. The United States leads regional demand, supported by strong investments in EV manufacturing and grid modernization. The presence of major semiconductor manufacturers and research facilities strengthens innovation in high-efficiency and SiC-based gate drivers. Canada contributes through its growing renewable energy projects and industrial automation initiatives. Government policies promoting clean energy and advanced electronics production continue to support sustained regional growth across automotive and power sectors.

Europe

Europe accounted for 28% of the Gate Driver IC market in 2024, supported by the region’s focus on electric mobility, energy efficiency, and carbon reduction targets. Germany, France, and the United Kingdom lead adoption through strong automotive and renewable energy investments. The European Union’s emission regulations and support for EV infrastructure drive demand for advanced gate driver solutions. Manufacturers in the region are developing high-voltage and isolated gate drivers tailored for automotive and industrial applications. Continuous R&D in wide-bandgap semiconductor technologies reinforces Europe’s position as a key innovator in the global gate driver market.

Asia Pacific

Asia Pacific captured a 25% share of the Gate Driver IC market in 2024 and remains the fastest-growing region. China, Japan, South Korea, and India drive strong demand through rapid industrialization and electric vehicle expansion. The region’s dominance in electronics manufacturing, combined with large-scale renewable energy projects, boosts consumption of gate drivers across end-user industries. Local semiconductor firms are increasing production capacity for MOSFET and SiC-based drivers. Government initiatives promoting clean energy and electric mobility are further propelling market growth, positioning Asia Pacific as a global hub for power electronics innovation.

Latin America

Latin America held a 6% share of the Gate Driver IC market in 2024. The region’s growth is supported by increasing investments in renewable energy, automotive electrification, and industrial automation. Brazil and Mexico lead demand due to expanding manufacturing sectors and rising adoption of smart energy systems. Gate driver ICs are gaining traction in solar inverters and motor control applications. However, limited semiconductor production infrastructure and high import dependency pose challenges. Ongoing partnerships with international technology providers are helping regional players integrate advanced gate driver solutions and improve operational efficiency in key industries.

Middle East and Africa

The Middle East and Africa together accounted for a 4% share of the Gate Driver IC market in 2024. Growth in the region is driven by renewable energy expansion, smart grid projects, and increasing industrial electrification. Gulf Cooperation Council (GCC) countries, led by Saudi Arabia and the UAE, are investing in solar power and electric mobility initiatives, boosting demand for high-performance gate drivers. Africa’s adoption remains gradual due to limited manufacturing capabilities but is improving with infrastructure development. Global semiconductor partnerships and renewable energy integration continue to support modest yet steady market growth across the region.

Market Segmentations:

By Transistor Type

- MOSFET Gate Driver ICs

- IGBT Gate Driver ICs

- SiC and GaN Gate Driver ICs

- Others

By Isolation Type

- Isolated Gate Driver ICs

- Non-Isolated Gate Driver ICs

By Voltage Range

- Low Voltage (Below 20V)

- Medium Voltage (20V–50V)

- High Voltage (Above 50V)

By Application

- Automotive

- Consumer Electronics

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Gate Driver IC market includes key players such as Infineon Technologies AG, Texas Instruments Incorporated, ON Semiconductor Corporation, STMicroelectronics N.V., ROHM Semiconductor, NXP Semiconductors N.V., Toshiba Electronic Devices & Storage Corporation, Renesas Electronics Corporation, Power Integrations, Inc., and Analog Devices, Inc. These companies dominate through advanced product portfolios, strong manufacturing capabilities, and continuous innovation in high-efficiency semiconductor solutions. Leading players focus on developing gate driver ICs optimized for SiC and GaN power devices to support next-generation electric vehicles, renewable energy systems, and industrial automation. Strategic mergers, technology collaborations, and investments in wide-bandgap semiconductor technologies are expanding their market presence. Companies are also enhancing product reliability, isolation performance, and thermal efficiency to meet growing demand across automotive, telecom, and consumer electronics sectors, maintaining competitive strength in both developed and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Infineon Technologies AG

- Texas Instruments Incorporated

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- ROHM Semiconductor

- NXP Semiconductors N.V.

- Toshiba Electronic Devices & Storage Corporation

- Renesas Electronics Corporation

- Power Integrations, Inc.

- Analog Devices, Inc.

Recent Developments

- In March 2025, Toshiba Electronic Devices & Storage began mass production of the TB9103FTG gate driver IC for automotive brushed DC motors. It includes a built-in charge pump, gate monitoring, sleep function, and is housed in a 4.0 × 4.0 mm VQFN24 package.

- In January 2025, Infineon Technologies AG introduced new EiceDRIVER™ isolated gate driver ICs tailored for traction inverters, boosting output stage current to 20 A for inverters up to 300 kW.

- In 2025, STMicroelectronics launched the L98GD8 eight-channel gate driver built for 48 V automotive systems. It operates from a 58 V supply and supports configurable high-side and low-side MOSFET driving with diagnostics.

- In October 2024, Infineon rolled out an ASIL-D compliant 3-phase gate driver IC for EV braking and electric power steering applications.

Report Coverage

The research report offers an in-depth analysis based on Transistor Type, Isolation Type, Voltage Range, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for gate driver ICs will grow with rising adoption of electric vehicles worldwide.

- SiC and GaN-based driver ICs will gain traction due to efficiency and high-speed switching.

- Industrial automation and robotics will continue to drive usage in motor control systems.

- The renewable energy sector will expand applications in solar inverters and wind turbines.

- Integration of gate drivers with protection circuits will improve system reliability and safety.

- Asia Pacific will emerge as the fastest-growing regional market due to manufacturing expansion.

- Miniaturization trends will lead to compact, high-performance gate driver designs.

- Automotive electronics will remain a key growth driver due to electrification trends.

- Companies will invest in wide-bandgap semiconductor technology for better thermal performance.

- Ongoing R&D in intelligent power modules will enhance adoption in energy-efficient systems.