Market Overview:

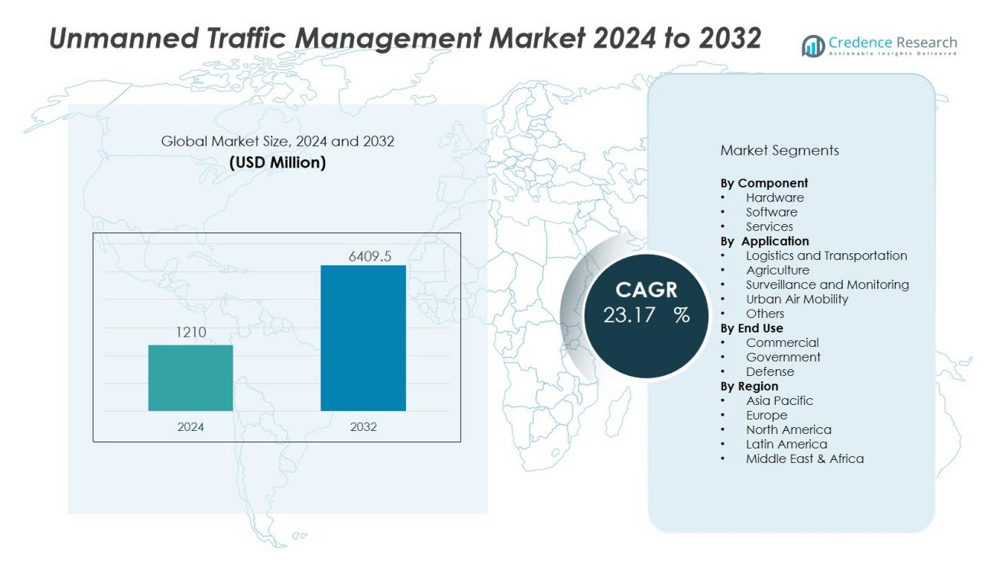

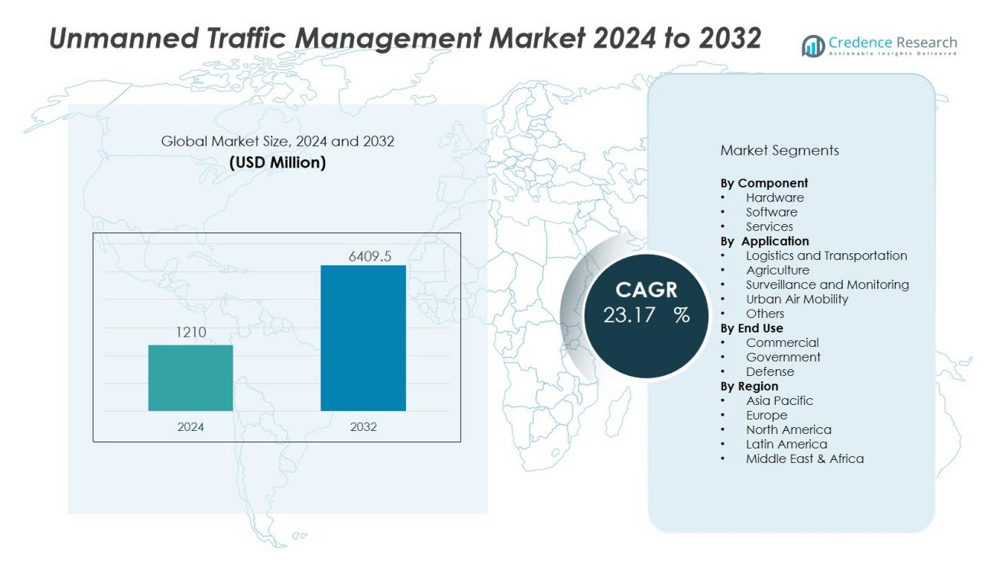

The unmanned traffic management market size was valued at USD 1210 million in 2024 and is anticipated to reach USD 6409.5 million by 2032, at a CAGR of 23.17% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Unmanned Traffic Management Market Size 2024 |

USD 1210 million |

| Unmanned Traffic Management Market, CAGR |

23.17% |

| Unmanned Traffic Management Market Size 2032 |

USD 6409.5 million |

The market is driven by the increasing deployment of drones in critical sectors such as e-commerce delivery, disaster management, and infrastructure monitoring. Growing government support through drone regulations and airspace modernization initiatives is further accelerating UTM adoption. The rising emphasis on beyond-visual-line-of-sight (BVLOS) operations and the development of advanced communication and navigation technologies also strengthen market expansion. Strategic collaborations between drone operators, technology providers, and regulatory bodies are shaping standardized frameworks for large-scale implementation.

Regionally, North America dominates the UTM market, supported by favorable regulatory frameworks from the Federal Aviation Administration (FAA) and strong participation from technology companies. Europe follows closely, driven by the European Union’s U-space initiative and robust investment in urban air mobility projects. Asia-Pacific is emerging as the fastest-growing region, propelled by high drone adoption in China, Japan, and India for logistics and agriculture, making it a critical growth hub in the global landscape.

Market Insights:

- The unmanned traffic management market was valued at USD 1210 million in 2024 and is projected to reach USD 6409.5 million by 2032, growing at a CAGR of 23.17% during 2024–2032.

- Rising drone adoption in logistics, agriculture, surveillance, and infrastructure inspection is creating strong demand for scalable UTM systems that ensure safe and efficient fleet coordination.

- Supportive regulatory frameworks such as the FAA’s Remote ID in the U.S. and the EU’s U-space initiative are accelerating large-scale implementation of UTM solutions worldwide.

- Advances in 5G connectivity, satellite navigation, and AI are enhancing real-time communication, enabling beyond-visual-line-of-sight operations and reducing risks of mid-air conflicts.

- North America leads with a share exceeding 35%, Europe follows with nearly 30%, and Asia-Pacific emerges as the fastest-growing region driven by adoption in China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Drones Across Commercial and Industrial Applications:

The unmanned traffic management market is gaining momentum due to the increasing use of drones in sectors such as logistics, agriculture, surveillance, and infrastructure monitoring. Companies are deploying drones for last-mile deliveries, precision farming, and inspection of critical assets like power lines and pipelines. The surge in commercial adoption creates significant demand for efficient UTM systems to manage large-scale operations. It ensures safe coordination of growing drone fleets in both urban and rural environments.

- For instance, DJI Agriculture has deployed over 400,000 agricultural drones globally by 2024, covering more than 500 million hectares of farmland and achieving water savings of 222 million tons.

Government Regulations and Supportive Policy Frameworks:

Governments across the globe are introducing clear regulatory frameworks to support drone integration into national airspace. The Federal Aviation Administration in the U.S. and the European Union’s U-space initiative highlight structured approaches to enhance operational safety. Such policies encourage investment in UTM technologies while providing a foundation for standardized implementation. The unmanned traffic management market benefits from these policies as they drive compliance and accelerate adoption. It positions UTM as a critical enabler of safe drone ecosystem expansion.

- For instance, Norway’s Avinor selected Thales to deploy the country’s next-generation nationwide UTM system in December 2024, utilizing the Topsky-UAS platform powered by AstraUTM technology.

Technological Advancements in Communication and Navigation Systems:

Advances in 5G connectivity, satellite navigation, and artificial intelligence are enabling more reliable and scalable UTM solutions. Real-time communication between drones, ground stations, and control systems enhances situational awareness. It supports beyond-visual-line-of-sight operations, which are crucial for applications like delivery and surveillance. These innovations make traffic management more accurate and reduce risks of mid-air conflicts. The unmanned traffic management market leverages these technologies to strengthen safety and efficiency.

Growing Investments in Urban Air Mobility and Future Air Transport:

The push toward urban air mobility, including passenger drones and air taxis, is creating new opportunities for UTM solutions. Major aerospace and technology firms are investing in projects that envision drones operating in densely populated cities. UTM systems are essential to ensure controlled, secure, and coordinated flights in such complex environments. It drives collaborations among aviation authorities, technology providers, and drone operators. The unmanned traffic management market stands at the core of enabling this next phase of aerial transport innovation.

Market Trends:

Integration of Artificial Intelligence, Automation, and Cloud-Based Solutions:

The unmanned traffic management market is witnessing a strong shift toward AI-driven and automated platforms that improve airspace coordination. Companies are deploying machine learning algorithms to predict traffic patterns, optimize flight routes, and prevent potential conflicts. Cloud-based solutions are being widely adopted to enable real-time data exchange between drones, operators, and regulators. It creates an ecosystem where traffic control is faster, more accurate, and scalable across regions. Automation also supports complex operations such as swarm drone flights and beyond-visual-line-of-sight missions. These advancements are transforming UTM systems into intelligent platforms that enhance both safety and efficiency.

- For instance, Google’s Wing demonstrated real-time route planning capabilities through its OpenSky UTM platform that automatically managed flight paths of 3 Wing aircraft and multiple third-party drones simultaneously during Virginia Tech tests, preventing conflicts through automated algorithm-based routing without manual pilot intervention.

Expansion of Urban Air Mobility and Cross-Industry Collaborations:

The growing focus on urban air mobility is shaping a new trend where UTM solutions extend beyond traditional drone operations to include passenger drones and air taxis. Aerospace companies, telecom providers, and drone manufacturers are forming strategic alliances to create integrated ecosystems. It strengthens innovation by combining expertise in aviation, connectivity, and digital infrastructure. Governments and regulators are actively partnering with industry leaders to establish testbeds and pilot programs for advanced air mobility. The unmanned traffic management market is evolving into a critical enabler for future aerial transport networks. These collaborations are driving standardized protocols, ensuring scalability and safe operations in congested urban skies.

- For instance, Lilium has partnered with GE Aerospace since October 2024 to integrate their Event Measurement System platform into Lilium’s POWER-ON aftermarket offering, with GE’s EMS platform currently serving more than 60 airlines and over 500 business jet operators globally for flight data monitoring.

Market Challenges Analysis:

Regulatory Uncertainty and Complex Airspace Integration:

The unmanned traffic management market faces significant challenges due to varying regulatory frameworks across regions. Governments are still developing unified policies to integrate drones into national and international airspace. Lack of standardization creates operational delays and increases compliance costs for drone operators and technology providers. It restricts seamless cross-border operations and slows the adoption of advanced UTM solutions. Concerns over safety, liability, and privacy also complicate large-scale deployment. Without harmonized regulations, the market struggles to achieve consistent global scalability.

High Implementation Costs and Cybersecurity Risks:

Deploying UTM systems requires substantial investment in infrastructure, advanced communication networks, and cloud-based platforms. Smaller enterprises and emerging markets often find these costs prohibitive, limiting widespread adoption. It creates disparities in drone ecosystem development across regions. At the same time, growing reliance on digital platforms exposes UTM systems to cybersecurity threats. Risks such as data breaches, GPS spoofing, and unauthorized access undermine trust and safety in drone operations. The unmanned traffic management market must address these vulnerabilities while balancing cost efficiency to ensure sustainable growth.

Market Opportunities:

Expansion of Drone Applications in Commercial and Public Sectors

The unmanned traffic management market holds strong opportunities with the rapid expansion of drone applications across logistics, agriculture, healthcare, and emergency services. Growing use of drones for last-mile delivery, medical supply transport, and disaster response demands advanced traffic coordination systems. It creates new revenue streams for UTM providers through scalable and adaptable solutions. Public sector adoption, including law enforcement and environmental monitoring, further widens the scope of deployment. Rising investment in smart city projects also supports the integration of UTM systems into broader urban infrastructure. These developments highlight UTM’s role in enabling safe and efficient large-scale drone operations.

Growing Focus on Urban Air Mobility and Advanced Air Transport

The shift toward urban air mobility presents a transformative growth opportunity for UTM providers. Companies developing passenger drones and air taxis require reliable systems to manage high-density traffic in metropolitan areas. It positions UTM solutions as essential for the next phase of air transport innovation. Partnerships between aerospace firms, telecom providers, and regulators are accelerating pilot projects in advanced air mobility. Emerging economies with rising urbanization and demand for innovative transport are expected to adopt UTM solutions rapidly. The unmanned traffic management market is poised to benefit from this shift, creating long-term prospects for technological advancement and global expansion.

Market Segmentation Analysis:

By Component

The unmanned traffic management market is segmented into hardware, software, and services. Software dominates due to the rising demand for cloud-based platforms, real-time data sharing, and AI-driven analytics that enable safe and efficient drone operations. Hardware, including communication devices and surveillance systems, supports critical functions such as tracking and navigation. Services are expanding with growing reliance on managed solutions, consultancy, and integration support. It creates opportunities for providers to deliver end-to-end traffic management systems tailored to diverse operational needs.

- For instance, uAvionix’s Ping200X transponder, certified in 2022, weighs only 50 grams while meeting full ADS-B OUT standards, enabling drones to integrate into controlled airspace without compromising payload capacity.

By Application

The market covers applications in agriculture, logistics and transportation, surveillance and monitoring, and urban air mobility. Logistics and transportation lead the segment with high adoption of drones for last-mile delivery and cargo transport. Agriculture leverages UTM for precision farming and crop monitoring, driving efficiency in rural operations. Surveillance and monitoring support public safety, infrastructure inspection, and disaster management. It highlights UTM’s role in enabling safe and controlled drone flights across both commercial and public domains.

- For instance, in 2023, Alphabet’s Wing completed over 300,000 drone deliveries globally, showcasing the scalability of drone-based logistics supported by advanced traffic management systems.

By End Use

The end-use segmentation includes commercial, government, and defense sectors. Commercial applications dominate due to rapid adoption in e-commerce, healthcare logistics, and infrastructure services. Government entities invest in UTM for urban planning, law enforcement, and environmental monitoring. Defense forces employ UTM to coordinate unmanned aerial systems in surveillance and tactical missions. It strengthens operational efficiency while ensuring compliance with evolving regulatory frameworks.

Segmentations:

By Component:

- Hardware

- Software

- Services

By Application:

- Logistics and Transportation

- Agriculture

- Surveillance and Monitoring

- Urban Air Mobility

- Others

By End Use:

- Commercial

- Government

- Defense

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds a market share exceeding 35% in the unmanned traffic management market, driven by advanced regulatory frameworks and strong industry adoption. The Federal Aviation Administration plays a critical role in enabling large-scale drone integration through initiatives such as Remote ID and beyond-visual-line-of-sight approvals. The region benefits from the presence of leading technology providers and drone manufacturers, fostering innovation and large pilot programs. It also witnesses strong investment in urban air mobility, with multiple projects testing passenger drones and delivery networks. The United States remains the largest contributor, supported by government funding and private sector partnerships. Canada complements growth with active use of drones in energy, mining, and environmental monitoring.

Europe :

Europe accounts for a market share of nearly 30% in the unmanned traffic management market, supported by the European Union’s U-space initiative. This framework establishes standardized approaches for drone integration into shared airspace, creating consistency across member states. Countries such as Germany, France, and the United Kingdom are leading investment in UTM infrastructure and advanced mobility projects. It drives demand for scalable solutions capable of managing increasing drone traffic in both rural and urban environments. Strong participation from aerospace firms and telecom companies accelerates collaborative innovation. Government-backed testbeds for air taxi operations reinforce Europe’s position as a leader in advanced drone management systems.

Asia-Pacific:

Asia-Pacific captures a market share of close to 25% in the unmanned traffic management market, with rapid expansion fueled by drone adoption in logistics, agriculture, and public safety. China drives regional growth through its dominance in drone manufacturing and government-backed UTM projects. Japan and South Korea are investing heavily in urban air mobility initiatives, while India advances through supportive policies under its Digital Sky platform. It benefits from rising demand for smart city infrastructure and aerial transport solutions. The region’s strong manufacturing ecosystem and growing technological investments position it as a future hub for large-scale drone operations. Emerging economies in Southeast Asia are also creating demand for UTM solutions, strengthening Asia-Pacific’s role as the fastest-growing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

- Thales Group

- Lockheed Martin Corporation

- Unifly NV

- Airbus SE

- Frequentis AG

- OneSky Systems

- AirMap, Inc.

- RTX Corporation

Competitive Analysis:

The unmanned traffic management market is highly competitive, with global aerospace leaders and specialized technology firms driving innovation through strategic partnerships and advanced solutions. Key players include Leonardo S.p.A., L3Harris Technologies, Inc., Thales Group, Lockheed Martin Corporation, Unifly NV, Airbus SE, and Frequentis AG. These companies focus on integrating artificial intelligence, 5G, and cloud-based platforms to enhance safety, scalability, and regulatory compliance in drone operations. It is shaped by collaborations with regulators and aviation authorities to establish standardized frameworks for large-scale adoption. Competition is defined by investments in pilot projects, urban air mobility programs, and interoperability initiatives that strengthen global positioning. Leading firms leverage their expertise in aerospace and digital technologies to deliver end-to-end solutions, making UTM a cornerstone of future airspace management.

Recent Developments:

- In March 2025, At Verticon 2025, Leonardo announced new orders for nearly 30 commercial helicopters of various models for delivery between 2026 and 2028, valued at approximately EUR 370 million.

- In February 2025, EDGE Group and Leonardo signed a groundbreaking collaboration agreement to jointly develop future technologies and solutions in defense and security.

- In April 2025, L3Harris partnered with Kuiper Government Solutions to deliver hybrid SATCOM low-latency global connectivity solutions to government and military customers.

Market Concentration & Characteristics:

The unmanned traffic management market reflects a moderately concentrated structure, with leading players driving innovation through partnerships, pilot programs, and regulatory collaborations. It is characterized by a mix of established aerospace companies, technology providers, and emerging startups that focus on software, communication systems, and integration platforms. Competition intensifies through advancements in artificial intelligence, 5G connectivity, and cloud-based traffic management solutions. The market emphasizes safety, scalability, and compliance with evolving government regulations, shaping the pace of adoption. Regional variations in policy frameworks create diverse growth opportunities, while urban air mobility projects add a new dimension to demand. The industry continues to evolve through strategic alliances that strengthen global interoperability and position UTM as a cornerstone of the future airspace ecosystem.

Report Coverage:

The research report offers an in-depth analysis based on Component, Application, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The unmanned traffic management market will evolve into a critical enabler of safe large-scale drone operations across commercial, defense, and public sectors.

- Governments will strengthen regulatory frameworks to ensure standardized airspace integration and support long-term industry growth.

- Integration of artificial intelligence and machine learning will enhance predictive traffic management and improve operational efficiency.

- Cloud-based platforms and 5G connectivity will enable real-time communication between drones, operators, and regulators.

- Urban air mobility, including passenger drones and air taxis, will drive new demand for scalable UTM systems in metropolitan areas.

- Strategic collaborations among aerospace firms, telecom providers, and regulators will accelerate adoption of interoperable solutions.

- Cybersecurity solutions will become essential as digital traffic management systems face growing risks of data breaches and GPS spoofing.

- Emerging economies will adopt UTM rapidly, supported by smart city projects and expanding drone use in agriculture, logistics, and infrastructure.

- Investments in research and pilot programs will shape future business models, creating new opportunities for service providers.

- The unmanned traffic management market will transform into a global ecosystem, supporting advanced aerial transport and shaping the future of connected airspace.