Market Overview

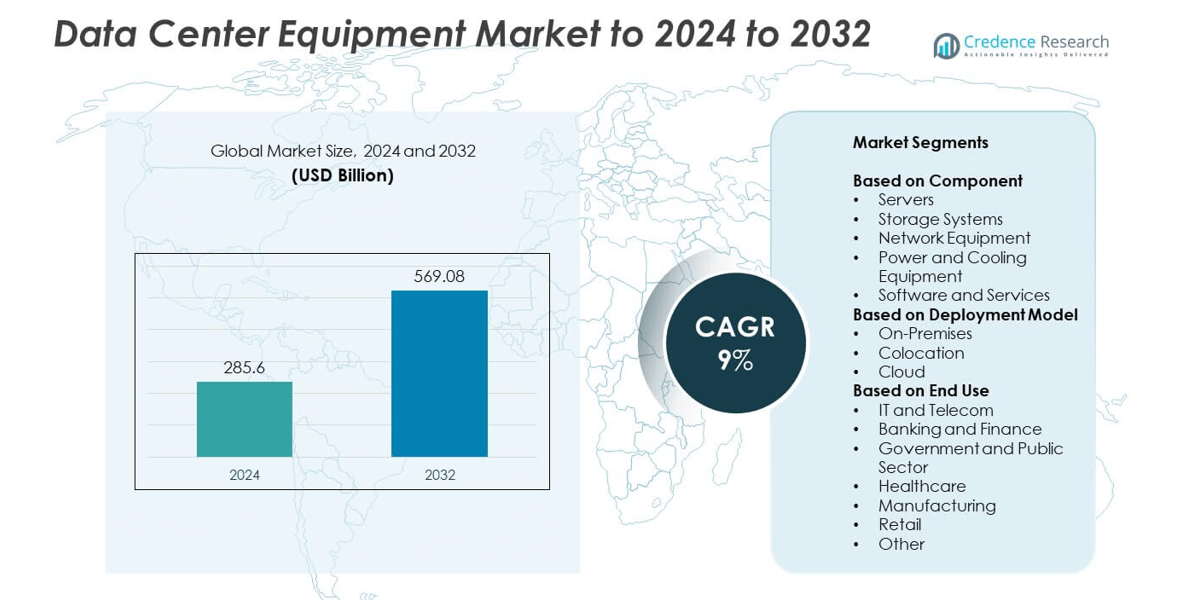

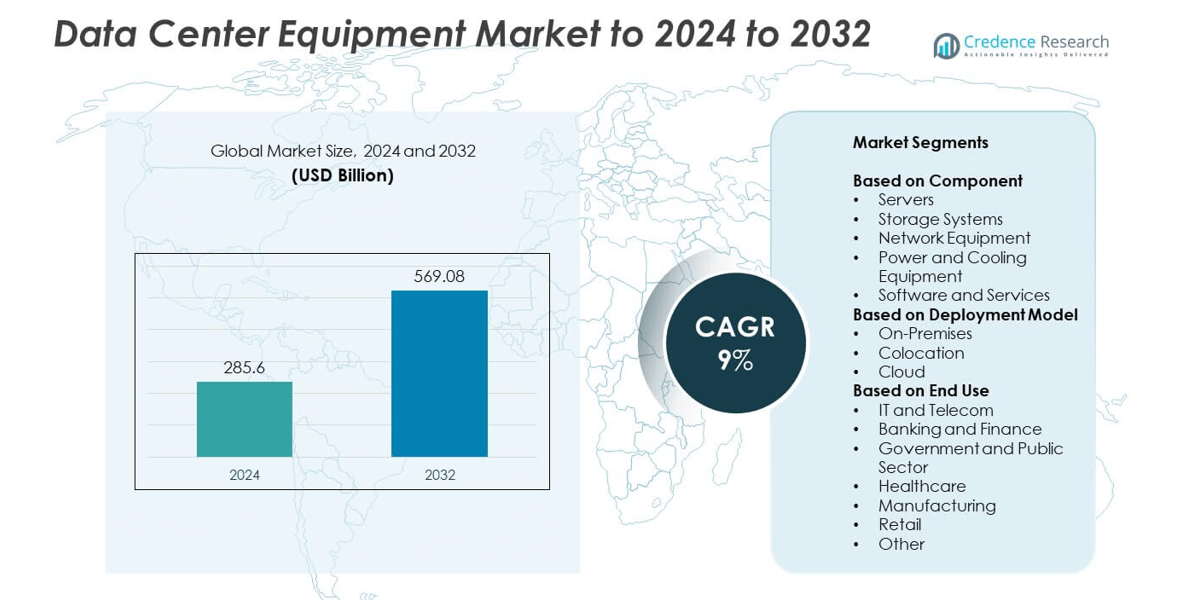

The Data Center Equipment Market size was valued at USD 285.6 billion in 2024 and is anticipated to reach USD 569.08 billion by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Equipment Market Size 2024 |

USD 285.6 billion |

| Data Center Equipment Market, CAGR |

9% |

| Data Center Equipment Market Size 2032 |

USD 569.08 billion |

The data center equipment market is highly competitive, with key players such as Huawei Technologies, Vertiv, Hewlett Packard Enterprise, Schneider Electric, Dell Technologies, ABB, Siemens, Cisco Systems, Eaton, IBM, Foxconn, General Electric, Rittal, Emerson Electric Co., and S Electric driving global growth. These companies focus on innovation in servers, power management, and cooling technologies to meet the rising demand for cloud computing, AI processing, and data storage. North America led the market in 2024 with a 37% share, supported by strong investments in hyperscale facilities and digital infrastructure. Asia Pacific followed closely, fueled by rapid digitalization, cloud expansion, and smart city development.

Market Insights

- The data center equipment market was valued at USD 285.6 billion in 2024 and is projected to reach USD 569.08 billion by 2032, growing at a CAGR of 9%.

- Rising adoption of cloud computing, AI workloads, and digital transformation initiatives are driving demand for advanced servers and power-efficient systems.

- Key trends include the shift toward hyperscale and edge data centers, adoption of modular infrastructure, and increasing use of energy-efficient cooling technologies.

- The market is highly competitive, with major players focusing on sustainable solutions, automation, and hybrid cloud integration to strengthen their global footprint.

- North America dominated the market with a 37% share in 2024, followed by Asia Pacific at 29% and Europe at 27%, while the servers segment led by component with a 34% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The servers segment dominated the data center equipment market in 2024 with a 34% share. The growth is driven by increasing demand for high-performance computing, AI workloads, and cloud-based applications. Modern enterprises are upgrading to energy-efficient and scalable servers to support expanding digital workloads. The integration of GPU-based and ARM-based processors enhances computational efficiency and reduces latency in data processing. Rising adoption of edge data centers and hyperscale facilities continues to strengthen the demand for advanced server architectures worldwide.

- For instance, the HPE Cray EX supercomputer “Frontier,” located at the Oak Ridge National Laboratory, has a total of 8,730,112 combined CPU and GPU cores. The system, which features AMD EPYC processors and AMD Instinct MI250X accelerators, was the first to break the exascale speed barrier when it debuted in 2022.

By Deployment Model

The cloud segment led the market in 2024, accounting for nearly 46% of the total share. Organizations across industries are shifting to cloud-based infrastructure to enhance scalability, flexibility, and cost efficiency. The surge in remote work, AI analytics, and SaaS adoption further fuels this preference. Cloud providers are expanding global data centers to meet rising storage and computing demands. The trend toward hybrid and multi-cloud strategies also boosts investments in cloud-based data center solutions, supporting efficient resource management and reduced capital expenditure.

- For instance, as of October 2025, AWS operates 120 Availability Zonesacross 38 geographic Regions

By End Use

The IT and telecom segment held the largest share of about 38% in 2024. This dominance is attributed to the rapid growth of 5G networks, IoT deployments, and data traffic expansion. Telecom operators and IT service providers are investing heavily in next-generation data centers to ensure low-latency communication and uninterrupted connectivity. Rising digital transformation initiatives and the need for reliable storage and computing resources further support this segment. Continuous upgrades to cloud and edge infrastructures sustain the leadership of IT and telecom within the global data center equipment market.

Key Growth Drivers

Rising Cloud Adoption and Digital Transformation

The rapid adoption of cloud computing remains a key growth driver for the data center equipment market. Enterprises are migrating workloads to cloud-based platforms to enhance scalability, agility, and cost efficiency. This shift has increased demand for high-performance servers, storage, and networking solutions. The acceleration of digital transformation initiatives across industries such as banking, healthcare, and retail further supports equipment upgrades. As organizations embrace hybrid and multi-cloud strategies, the need for robust, energy-efficient, and scalable data center infrastructure continues to rise globally.

- For instance, Microsoft Azure spans 70+ regions and 400+ datacenters.

Expanding Data Generation and Storage Needs

Explosive data generation from connected devices, IoT systems, and digital platforms drives significant infrastructure demand. Organizations are investing in advanced storage systems and high-capacity servers to manage and analyze large data volumes efficiently. The rise of AI, machine learning, and real-time analytics increases storage and processing requirements. Data-intensive sectors like telecom, manufacturing, and e-commerce are expanding their data center footprints to ensure secure and rapid data access, propelling sustained demand for modern, high-density data center equipment.

- For instance, Western Digital shipped 190 exabytes of storage in the fiscal fourth quarter of 2025.

Government and Corporate Investments in Infrastructure

Rising government and corporate investments in digital infrastructure projects act as another major growth catalyst. Several countries are establishing large-scale data center parks and green data zones to support the digital economy. Corporations are also modernizing existing facilities with energy-efficient cooling systems and smart monitoring technologies. Supportive regulatory policies, tax incentives, and public-private partnerships further encourage the establishment of data centers. These initiatives collectively strengthen the global data center ecosystem and create favorable conditions for equipment manufacturers and service providers.

Key Trends and Opportunities

Shift Toward Edge and Hyperscale Data Centers

The growing focus on edge and hyperscale data centers is a key market trend. Edge facilities are being deployed closer to end-users to reduce latency and enhance data processing speeds for applications like IoT and 5G. Hyperscale data centers, designed for massive scalability, are witnessing large investments from cloud giants. This dual growth presents opportunities for modular server systems, intelligent networking hardware, and advanced cooling technologies. The trend also aligns with the increasing need for decentralized and high-performance computing infrastructure.

- For instance, Cloudflare’s network, one of the largest and most interconnected in the world, spans more than 330 cities across over 120 countries.

Adoption of Energy-Efficient and Sustainable Equipment

Sustainability has become a strategic priority for data center operators, creating new opportunities for eco-friendly equipment providers. Growing concerns about power consumption and carbon emissions are driving the use of energy-efficient cooling, renewable energy integration, and liquid cooling solutions. Manufacturers are designing low-power servers and intelligent power distribution units to reduce operational costs. The trend toward green data centers aligns with global carbon neutrality targets, encouraging wider adoption of efficient technologies that balance performance with environmental responsibility.

- For instance, Google reports a fleet-wide average Power Usage Effectiveness (PUE) of 09in 2024 for its global fleet of data centers.

Key Challenges

High Capital and Operational Costs

One of the major challenges in the data center equipment market is the high capital and operational cost associated with infrastructure development. Establishing advanced data centers requires substantial investment in servers, power systems, cooling equipment, and software solutions. Additionally, continuous upgrades, energy expenses, and maintenance add financial pressure on operators. Smaller enterprises face difficulties entering the market due to these high entry barriers, prompting many to rely on colocation or cloud partnerships instead of owning data center infrastructure.

Growing Cybersecurity and Data Privacy Concerns

Rising cyber threats and data breaches present significant challenges for data center operators. As data centers handle sensitive corporate and consumer information, they remain prime targets for cyberattacks. Strengthening cybersecurity infrastructure requires investment in advanced firewalls, encryption systems, and intrusion detection solutions. Compliance with evolving data protection regulations across regions further complicates operations. The increasing sophistication of cyber threats demands continuous innovation in data protection measures, making cybersecurity a critical concern for long-term industry stability and trust.

Regional Analysis

North America

North America dominated the data center equipment market in 2024 with a 37% share. The region’s leadership is driven by strong investments from cloud service providers, hyperscale operators, and major technology firms. The United States remains the primary hub due to its advanced IT infrastructure, high data consumption, and focus on AI-driven analytics. Canada is also emerging as a strategic location for green data centers supported by renewable energy availability. Government initiatives promoting digitalization and reliable connectivity further boost equipment demand across the region.

Europe

Europe accounted for around 27% of the global data center equipment market in 2024. The region’s growth is supported by strong emphasis on data sovereignty, energy-efficient operations, and sustainability targets. Countries like Germany, the Netherlands, and the United Kingdom are expanding their hyperscale and colocation facilities. The European Union’s Green Deal and stricter carbon regulations drive adoption of advanced cooling and power solutions. Rising demand from financial institutions and public sector digital programs also contributes to steady expansion of the European data center ecosystem.

Asia Pacific

Asia Pacific held a 29% share of the data center equipment market in 2024, showing strong growth potential. The expansion is fueled by rapid digitalization, growing internet penetration, and cloud adoption across economies such as China, India, Japan, and Singapore. Increased data traffic from e-commerce, 5G deployment, and enterprise digital transformation enhances infrastructure investments. Government-backed smart city initiatives and domestic data localization policies also support market expansion. The region is witnessing a surge in hyperscale construction, making it one of the fastest-growing data center hubs globally.

Latin America

Latin America captured about 4% of the data center equipment market in 2024. Growth is supported by increasing investments from global cloud providers and telecom operators expanding infrastructure in countries like Brazil, Mexico, and Chile. Rising internet usage and adoption of cloud-based enterprise services drive equipment demand. Regulatory support for data localization and digital transformation programs further enhance regional prospects. However, challenges such as high energy costs and limited grid reliability persist, encouraging operators to adopt energy-efficient systems and renewable-powered facilities to maintain competitiveness.

Middle East and Africa

The Middle East and Africa region accounted for a 3% share of the global data center equipment market in 2024. Growing digital economies, government-backed smart infrastructure projects, and the expansion of hyperscale data centers in the UAE, Saudi Arabia, and South Africa drive demand. Increasing adoption of cloud and edge computing across enterprises boosts equipment installation. Efforts to diversify economies through digital transformation and data localization laws further encourage investments. The region is emerging as an important frontier for data center expansion supported by renewable energy development and connectivity improvements.

Market Segmentations:

By Component

- Servers

- Storage Systems

- Network Equipment

- Power and Cooling Equipment

- Software and Services

By Deployment Model

- On-Premises

- Colocation

- Cloud

By End Use

- IT and Telecom

- Banking and Finance

- Government and Public Sector

- Healthcare

- Manufacturing

- Retail

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The data center equipment market features strong competition among leading players such as Huawei Technologies, Vertiv, Hewlett Packard Enterprise, General Electric, Foxconn, Schneider Electric, Dell Technologies, ABB, Rittal, Siemens, Cisco Systems, Eaton, IBM, S Electric, and Emerson Electric Co. The market is characterized by continuous innovation, focusing on high-efficiency servers, intelligent cooling systems, and scalable networking infrastructure. Companies are investing heavily in automation, modular designs, and edge computing capabilities to address growing cloud and AI-driven workloads. Strategic partnerships and mergers are helping firms expand their product portfolios and regional presence. Many players are prioritizing sustainable solutions, emphasizing energy-efficient and carbon-neutral data center operations. The competitive landscape is also shaped by rising demand for integrated software management and predictive maintenance technologies, driving collaboration between hardware and software providers. Global expansion through data center parks, colocation facilities, and hyperscale projects remains a key strategy to capture emerging market opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huawei Technologies

- Vertiv

- Hewlett Packard Enterprise

- General Electric

- Foxconn

- Schneider Electric

- Dell Technologies

- ABB

- Rittal

- Siemens

- Cisco Systems

- Eaton

- IBM

- S Electric

- Emerson Electric Co.

Recent Developments

- In 2024, Cisco Systems launched its first edge data centers in Indonesia to expand its security footprint in Asia. The facilities were designed to help customers comply with local data regulations.

- In 2023, Foxconn In collaboration with NVIDIA focused on creating AI factories, particularly those centered on autonomous platforms.

- In 2022, Dell and NVIDIA announced the NVIDIA and VMware AI-Ready Enterprise Platform for Dell PowerEdge servers

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of AI and machine learning workloads will drive demand for high-performance servers.

- Expansion of 5G networks will increase the need for edge data centers and low-latency infrastructure.

- Rising focus on sustainability will promote the use of energy-efficient cooling and power systems.

- The shift toward modular and prefabricated data centers will enhance deployment speed and scalability.

- Increasing use of liquid cooling systems will improve thermal efficiency in hyperscale facilities.

- Adoption of automation and AI-based monitoring tools will optimize data center operations.

- Cloud and colocation models will continue to gain dominance over traditional on-premises setups.

- Expansion in emerging economies will create new opportunities for infrastructure development.

- Cybersecurity advancements will become essential to protect expanding digital ecosystems.

- Integration of renewable energy sources will play a key role in achieving carbon neutrality goals.