Market Overview:

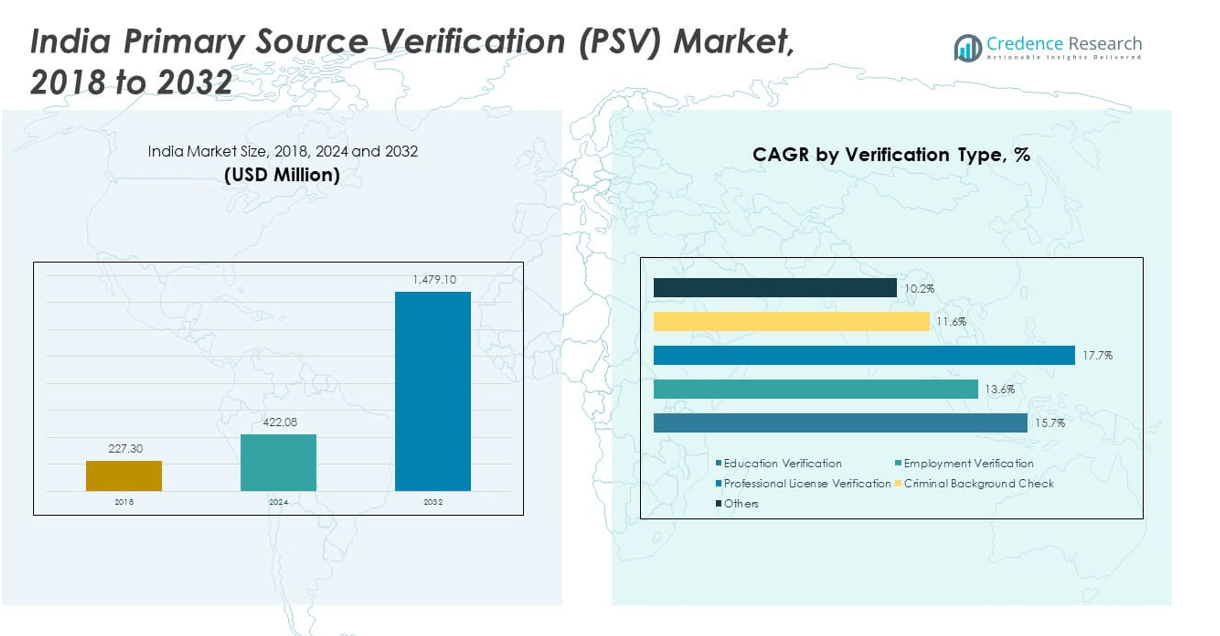

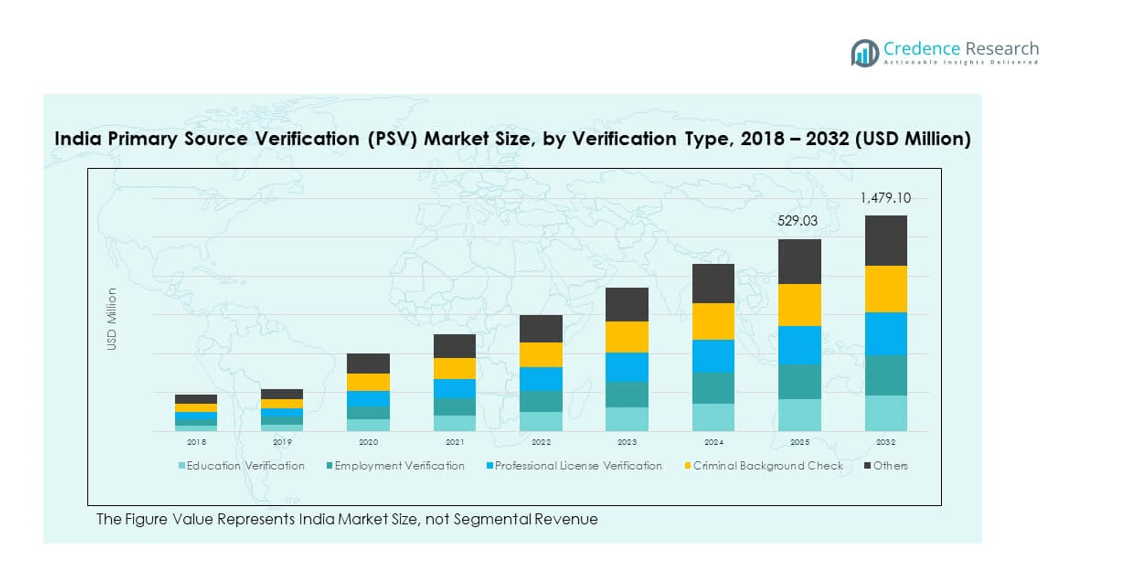

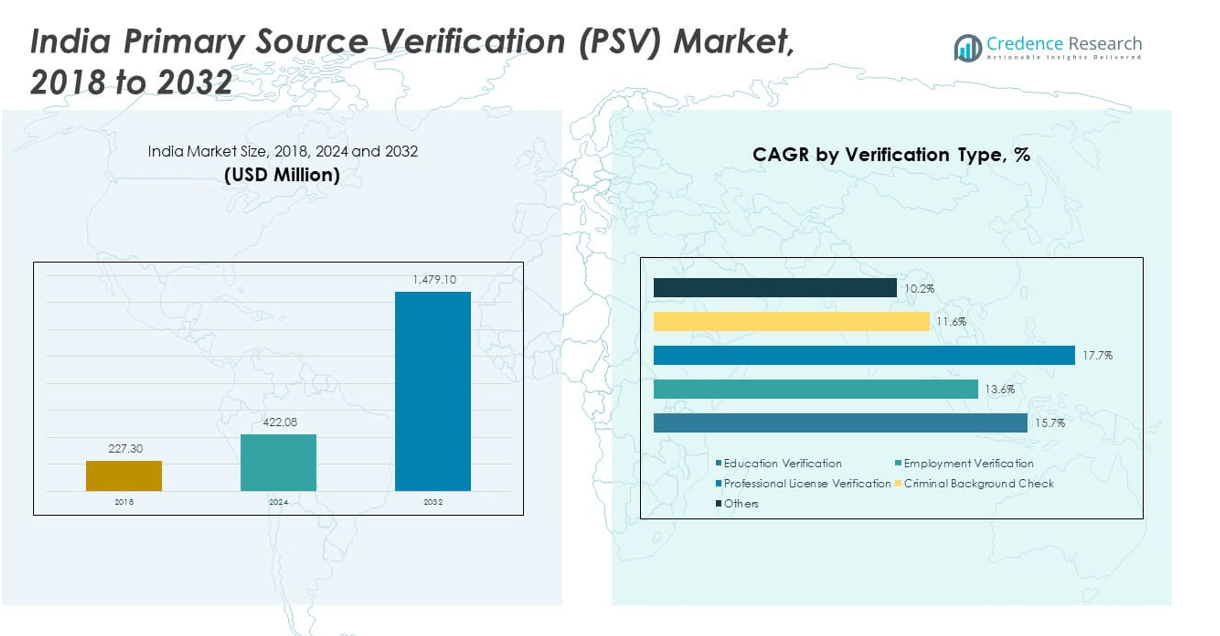

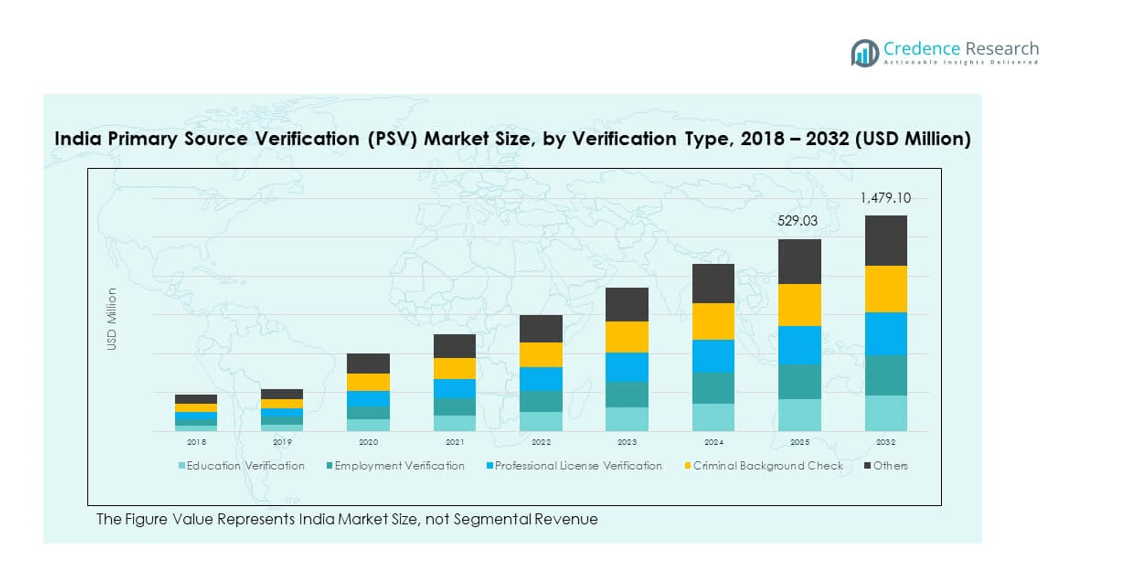

The India Primary Source Verification (PSV) Market size was valued at USD 227.30 million in 2018, increased to USD 422.08 million in 2024, and is anticipated to reach USD 1,479.10 million by 2032, at a CAGR of 15.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Primary Source Verification (PSV) Market Size 2024 |

USD 422.08 million |

| India Primary Source Verification (PSV) Market, CAGR |

15.82% |

| India Primary Source Verification (PSV) Market Size 2032 |

USD 1,479.10million |

Growing cross-border employment and strict international regulatory compliance drive market demand. Institutions and employers in India increasingly rely on PSV services to verify qualifications, licenses, and certifications directly from issuing authorities. This helps reduce fraud, ensures professional credibility, and aligns with global accreditation standards. The rise of digital platforms, automation, and government-backed digital identity programs further enhance verification efficiency and adoption.

The market sees higher concentration in regions such as Delhi, Maharashtra, and Karnataka, where major healthcare, education, and IT organizations operate. Southern and Western India lead due to high demand for global employment verification, while Northern India emerges as a growing region with expanding educational and licensing institutions. Increasing globalization and digitized record systems strengthen regional participation across tier-2 cities.

Market Insights:

- The India Primary Source Verification (PSV) Market was valued at USD 227.30 million in 2018, reached USD 422.08 million in 2024, and is projected to attain USD 1,479.10 million by 2032, registering a CAGR of 15.82% during 2024–2032.

- North and West India dominate the market with a 58% share, supported by the presence of corporate hubs, universities, and strong verification infrastructure, while South India follows with 27%, driven by IT and educational sector growth.

- East and Central India hold about 15% share, showing steady progress due to rising digital inclusion and growing public-sector verification initiatives, while South India remains the fastest-growing region due to technological adoption and workforce expansion.

- By verification type, Education Verification accounts for nearly 35% share, fueled by increasing demand from universities and professional councils for academic authenticity.

- Employment Verification follows with around 25% share, driven by corporate hiring expansion and compliance requirements across IT, BFSI, and government sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Cross-Border Employment and Regulatory Compliance Requirements

The India Primary Source Verification (PSV) Market grows strongly due to rising global workforce mobility. Professionals from healthcare, education, and engineering sectors seek overseas employment, increasing demand for credential validation. Employers and licensing authorities require verified qualifications to comply with international standards. It helps minimize fraud and ensures professional authenticity. The demand is reinforced by strict compliance guidelines from global accreditation bodies. Increasing foreign recruitment by Indian professionals drives continuous verification activity. Government-backed digitization further accelerates document access and validation speed. The emphasis on authenticity and regulatory alignment supports sustained growth.

- For instance, DataFlow Group, a global PSV provider, leverages its tech-driven credential checks to substantially reduce fraud risk for clients recruiting internationally, thereby enhancing recruitment security by utilizing digital tools and direct-source validation. The company has an established presence and ongoing initiatives in India, including supporting the government’s paperless initiative by accepting DigiLocker-verified documents.

Expansion of Healthcare and Education Credential Verification Systems

Healthcare and education sectors play a major role in driving PSV adoption in India. Hospitals and universities require verified records for doctors, nurses, and faculty to maintain trust and accreditation. Global mobility in medical and teaching professions increases verification requests to prevent fraudulent documentation. It ensures that institutions meet both domestic and international compliance standards. Technology-enabled platforms simplify the verification process and improve transparency. Increased collaboration between verification agencies and institutions enhances operational reach. The rise in foreign-trained professionals working in India also raises verification needs. Growth in these sectors continues to boost service utilization.

- For instance, Veremark, a global background screening firm, partnered with Emerald Technology in April 2025 to deliver integrated verification for clients across India and simplified the validation of academic and medical records during global hiring, resulting in faster, standardized checks implemented at the enterprise level.

Rapid Digital Transformation and Integration of Automated Verification Technologies

Widespread digital transformation supports the expansion of verification services in India. Companies adopt cloud-based and AI-driven tools to automate document validation. It helps minimize manual errors and shorten processing time. Automated systems also enhance security by tracking verification chains. Growing reliance on digital databases improves information retrieval and real-time validation. Government initiatives promoting e-governance and digital identity verification add efficiency. This shift reduces paper dependency while ensuring higher data accuracy. The increasing preference for fast and secure verification methods strengthens the market position.

Rising Demand for Fraud Prevention and Institutional Accountability

Organizations across sectors prioritize risk reduction and data security in hiring and licensing. The India Primary Source Verification (PSV) Market gains traction due to its ability to detect forged or altered credentials. It protects institutional credibility and public safety. Enhanced background screening reduces regulatory and reputational risks for employers. Growth in cyber fraud and fake certificate networks fuels the need for robust verification systems. Integration with national databases enables faster and more reliable results. Institutional accountability drives continuous improvement in verification standards. These combined efforts promote integrity and trust in credential management.

Market Trends:

Adoption of Blockchain and AI Technologies in Verification Systems

The India Primary Source Verification (PSV) Market witnesses a technological shift with blockchain and AI integration. These technologies enable tamper-proof and transparent data exchange between institutions. Blockchain ensures authenticity of records without intermediaries. AI-powered systems automate pattern recognition to detect document anomalies. It improves accuracy while reducing manual intervention. The use of smart contracts enhances operational transparency and auditability. Growing reliance on secure data management tools strengthens verification confidence. This trend positions India among global adopters of digital verification infrastructure.

- For instance, the National Assessment and Accreditation Council (NAAC) announced in August 2025 the launch of an AI-powered accreditation system, replacing manual inspections with digital verification and data analytics for improved quality checks and increased coverage among higher educational institutions in India.

Increasing Partnerships Between Verification Agencies and Educational Institutions

Collaborations between verification firms and universities improve verification speed and scope. Many institutions now embed verification systems within admission and recruitment workflows. It helps maintain institutional integrity and meet global quality standards. Universities benefit from reduced administrative load and quicker validation cycles. These partnerships extend to international accrediting organizations and regulatory bodies. Growing student mobility further increases verification demand across cross-border academic programs. Institutions that automate verification processes gain reputational advantage. Such collaborations reflect the growing maturity of India’s verification ecosystem.

- For instance, Veremark announced in April 2025 a partnership with Emerald Technology to offer unified background verification to support global expansion, delivering faster onboarding and streamlined compliance for universities and their global recruiters.

Emergence of Centralized Digital Databases for Professional Credentials

India’s growing digital infrastructure supports centralized data management for professional records. Public and private organizations collaborate to build unified repositories for credential storage. It allows instant verification across regions and industries. The integration of Aadhaar-linked identity systems adds another layer of reliability. It streamlines access and reduces processing time for applicants and authorities. Centralized systems enhance transparency and reduce duplication of verification efforts. They enable standardized data exchange between agencies and employers. This structural change modernizes how professional authenticity is maintained nationwide.

Expansion of Verification Services into Non-Traditional Sectors

Verification services are extending beyond healthcare and education into finance, construction, and IT. Companies in these sectors face stricter compliance expectations from clients and regulators. It drives adoption of PSV systems to validate workforce qualifications. Freelance professionals and gig workers also require document verification for remote contracts. The market adapts to verify digital certifications and skill credentials from e-learning platforms. Service providers now tailor solutions for sector-specific needs. This expansion diversifies revenue streams and strengthens market resilience. Broader industry participation reflects growing trust in digital verification services.

Market Challenges Analysis:

Data Privacy Concerns and Complex Verification Regulations

The India Primary Source Verification (PSV) Market faces regulatory challenges related to data protection and compliance. Handling sensitive academic and professional data requires strict adherence to privacy laws. Variations in international regulations complicate the exchange of verified information. It limits data sharing between countries and slows verification processes. Maintaining confidentiality while ensuring transparency becomes a key operational balance. Differences in documentation standards across institutions cause additional delays. The absence of a unified verification policy across sectors increases complexity. Service providers must continuously align with evolving global data governance frameworks.

Limited Digital Infrastructure and Verification Accessibility in Rural Areas

India’s regional disparities affect the efficiency of verification processes. Many smaller institutions lack digital record systems or secure databases. It increases manual processing time and verification errors. Rural educational and licensing authorities often depend on paper-based archives. Limited internet access further slows digital verification efforts. It creates challenges for agencies handling large-scale credential checks. Building awareness about PSV benefits among small institutions remains critical. The lack of skilled personnel for digital operations also hinders smooth implementation. These gaps restrict the nationwide reach of verification services.

Market Opportunities:

Rising Global Demand for Credential Validation Services

Growing cross-border employment and international education create new business opportunities. The India Primary Source Verification (PSV) Market benefits from rising foreign verification requests. Professionals migrating to countries with strict compliance standards require validated documentation. It enables agencies to expand global partnerships with accreditation bodies. Increasing digitization in credential management further simplifies international operations. The sector can attract investments through technology innovation and service expansion.

Government-Led Digital Initiatives and Institutional Modernization Efforts

India’s push toward digital governance and secure data exchange offers major growth prospects. Integration with national identity systems and e-verification platforms accelerates adoption. It encourages government institutions to standardize verification frameworks. Public-private partnerships can strengthen infrastructure and coverage. The modernization of universities, hospitals, and licensing boards will create long-term demand. Continuous focus on transparency and efficiency reinforces market stability.

Market Segmentation Analysis:

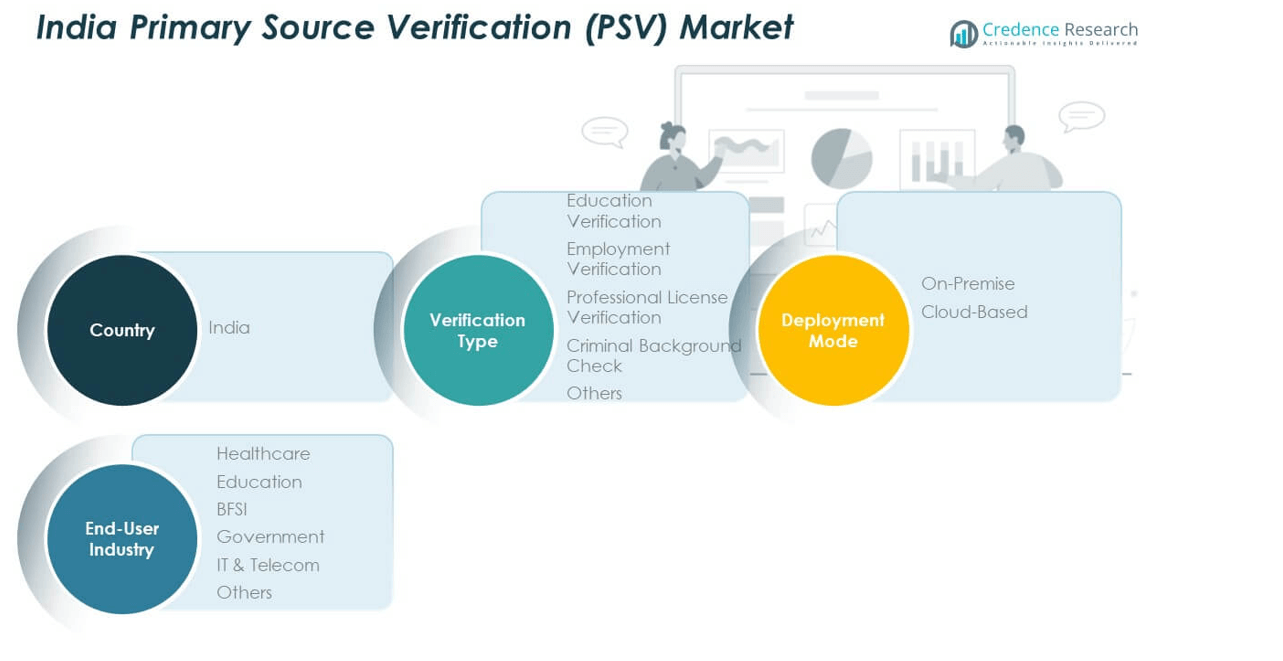

By Verification Type

The India Primary Source Verification (PSV) Market includes education, employment, professional license, and criminal background verification. Education verification holds a major share due to rising academic fraud and global mobility of students. Employment verification grows rapidly as companies focus on hiring authenticity and compliance. Professional license verification gains momentum across healthcare and legal sectors to ensure credential integrity. Criminal background checks expand due to increased safety regulations across industries. The “Others” category includes address and identity checks, driven by digital onboarding and e-verification trends.

- For instance, Veremark has expanded cross-border offering with GoGlobal in October 2025, enabling clients in India to accelerate verified hiring and compliance checks for diverse professional categories via integrated digital solutions.

By Deployment Mode

The market is divided into on-premise and cloud-based deployment models. Cloud-based verification dominates due to flexibility, cost-efficiency, and scalability. It supports real-time data validation and remote accessibility for enterprises. On-premise solutions remain relevant among government and large institutions prioritizing data control. It offers enhanced customization but requires higher infrastructure investment. The ongoing digital transformation in HR and compliance functions continues to accelerate the shift toward cloud deployment models.

- For instance, Veremark integrates with a range of existing hiring software, allowing users to initiate and track background checks directly within their current platforms to streamline workflows.

By End-User Industry

Healthcare and education sectors lead adoption due to regulatory and accreditation requirements. BFSI uses PSV to verify employee and customer identities to reduce financial risk. Government agencies rely on it for secure recruitment and license validation. IT & Telecom adopt verification for large-scale workforce screening and vendor compliance. Other sectors, including logistics and manufacturing, integrate PSV solutions for workforce integrity and operational transparency.

Segmentation:

By Verification Type:

- Education Verification

- Employment Verification

- Professional License Verification

- Criminal Background Check

- Others

By Deployment Mode:

By End-User Industry:

- Healthcare

- Education

- BFSI

- Government

- IT & Telecom

- Others

Regional Analysis:

North and West India – Major Verification Hubs

North and West India collectively dominate the India Primary Source Verification (PSV) Market with around 58% share in 2024. Delhi, Maharashtra, and Gujarat lead due to the strong presence of corporate headquarters, universities, and regulatory bodies. These regions serve as the key operational centers for PSV service providers. High adoption of digital identity systems and integration with global verification standards strengthen their market position. It benefits from government-driven compliance programs and institutional modernization. Expanding corporate workforce and cross-border employment contribute to sustained verification demand. Strong infrastructure and advanced IT capabilities further support market growth in these regions.

South India – Fastest Growing Verification Landscape

South India holds about 27% market share and is the fastest-growing region in the country. States like Karnataka, Tamil Nadu, and Telangana drive the growth through a concentration of IT, healthcare, and education institutions. It witnesses strong demand from multinational corporations conducting large-scale employee verification. The rise of digital employment and outsourcing platforms increases verification frequency. Enhanced collaboration between verification agencies and universities strengthens data reliability. Government initiatives promoting e-verification support this regional expansion. Continuous technological integration and workforce globalization maintain its upward growth trajectory.

East and Central India – Emerging Verification Territories

East and Central India account for nearly 15% share of the total market. These regions show growing demand driven by public sector recruitment and educational verification activities. It gains traction due to expanding industrial zones and professional licensing needs. States like West Bengal and Madhya Pradesh invest in digital record management and data transparency. The ongoing digital inclusion programs enable smaller institutions to participate in verified credential systems. Rural digitization and private employment growth continue to unlock new opportunities. Increased awareness of verification benefits helps these regions gradually strengthen their market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The India Primary Source Verification (PSV) Market is moderately consolidated with key players such as AuthBridge, DataFlow Group, HireRight, and FactSuite leading the space. These companies maintain dominance through technological expertise, robust databases, and compliance-driven service models. It is characterized by high competition in digital verification, focusing on automation, security, and accuracy. Emerging firms like SpringVerify and Quinfy expand through niche services targeting startups and small enterprises. Global partnerships and localized platforms enhance competitiveness. Market participants invest in AI-based authentication tools and secure data integration to strengthen trust and reduce verification turnaround time.

Recent Developments:

- In September 2025, AuthBridge introduced significant updates to its TruthScreen product, focusing on advanced fraud and forgery detection in digital verification workflows for Indian businesses. Key enhancements include deepfake image analysis using computer vision and GAN technology, as well as robust document forensics leveraging OCR and AI algorithms.

- In June 2025, DataFlow Group expanded its Indian operations with the opening of a new office in Hyderabad. This strategic move supports its mission to deliver advanced primary source verification services and cater to a broader client base in India and surrounding regions.

- In April 2025, HireRight announced the acquisition of ClearChecks, targeting the small and medium-sized business market with an integrated background screening platform. The addition will enhance automated and compliant verification solutions for businesses operating in India, optimizing candidate screenings and onboarding processes.

- In November 2024, SpringVerify partnered with SutraHR, a leading recruitment firm, to deliver seamless and rapid recruitment along with reliable background verification services. The collaboration integrates SpringVerify’s real-time verification capabilities into the broader SutraHR recruitment system, reducing manual processing and expediting hiring workflows across India.

Report Coverage:

The research report offers an in-depth analysis based on Verification Type, Deployment Mode, and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing adoption of AI and blockchain will enhance verification accuracy and transparency.

- Expansion of digital verification platforms will strengthen service accessibility across sectors.

- Healthcare and education industries will remain primary revenue drivers in the coming years.

- Cloud-based systems will dominate due to scalability and real-time authentication benefits.

- Increased cross-border employment will drive higher demand for credential validation.

- Government initiatives promoting digital record systems will expand market penetration.

- Partnerships between verification firms and institutions will create stronger service ecosystems.

- Regional growth in South India will accelerate with IT and education-led demand.

- Rising focus on cybersecurity and data protection will shape future compliance frameworks.

- Innovation in verification automation will reduce costs and enhance market efficiency.