Market Overview

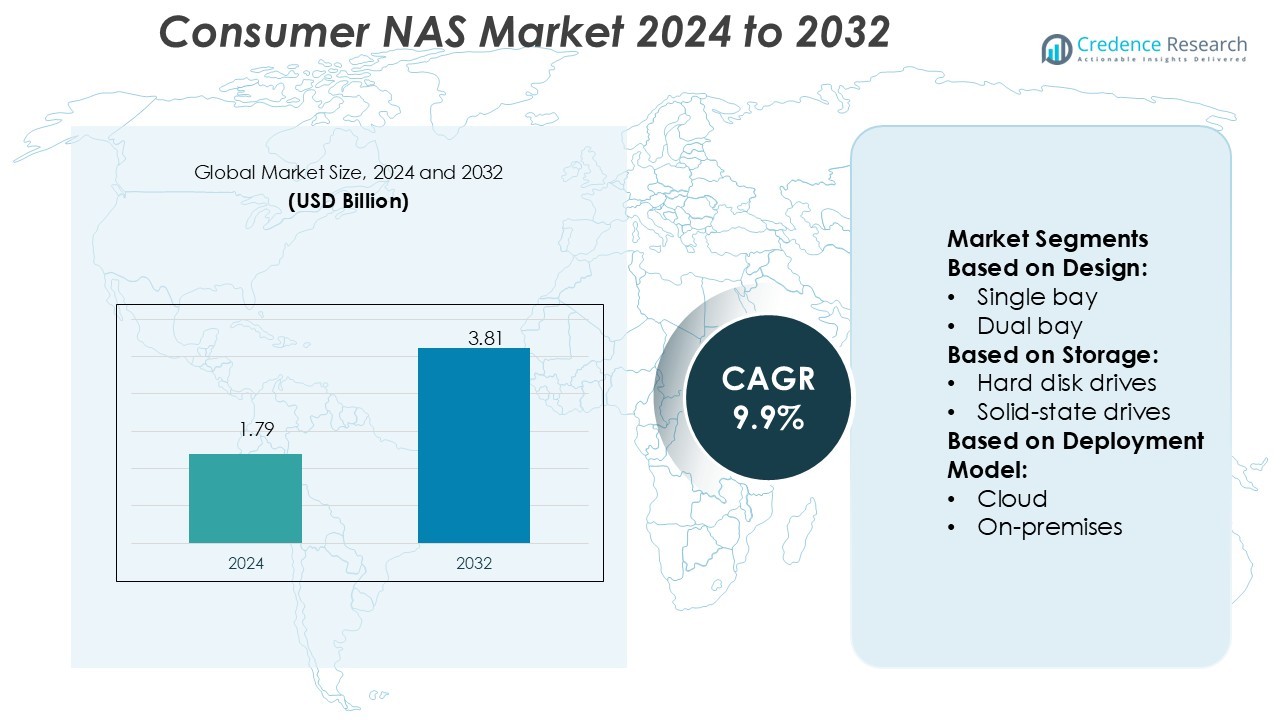

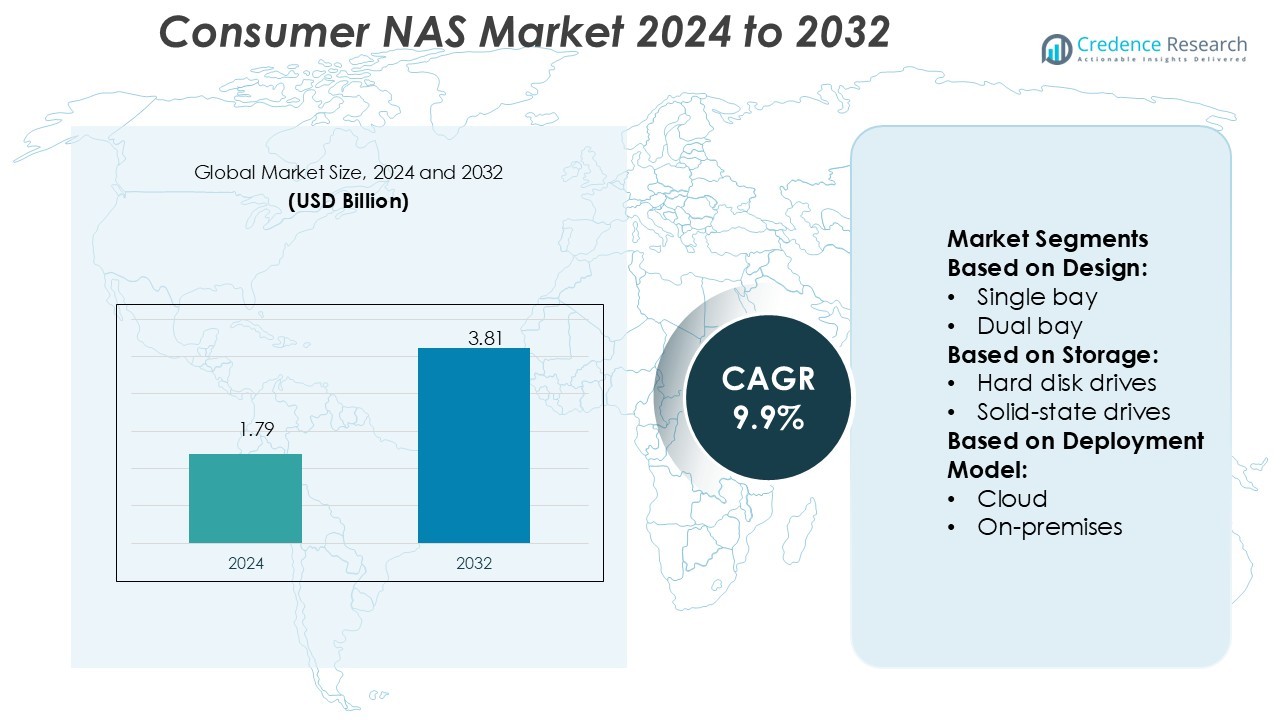

Consumer NAS Market was valued USD 1.79 billion in 2024 and is anticipated to reach USD 3.81 billion by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Consumer NAS Market Size 2024 |

USD 1.79 Billion |

| Consumer NAS Market, CAGR |

9.9% |

| Consumer NAS Market Size 2032 |

USD 3.81 Billion |

The Consumer NAS Market is driven by strong competition among top players such as Seagate Technology LLC, Huawei Technologies Co., Ltd., ASUSTOR Inc., ZyXEL Communications Corp., D-Link Corporation, Synology Inc., Thecus.COM, LaCie, Dell Inc., and Acer Inc. These companies focus on innovation in storage capacity, connectivity, and security to meet rising consumer demand. Synology and Seagate lead with advanced multi-bay systems and cloud integration, while other players strengthen their positions through cost-effective, user-friendly solutions. Strategic partnerships, product diversification, and smart home compatibility are key competitive strategies. Asia Pacific leads the global market with a 34% share, supported by rapid digitalization, smart home expansion, and growing consumer demand for secure, scalable storage solutions. This strong regional growth reinforces the dominance of leading vendors and drives continuous product advancements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Consumer NAS Market was valued at USD 1.79 billion in 2024 and is expected to reach USD 3.81 billion by 2032, growing at a CAGR of 9.9%.

- Rising demand for secure and scalable data storage solutions is driving market growth, supported by smart home expansion and hybrid storage adoption.

- Strong competition among leading players focuses on product innovation, connectivity, and security enhancements, with Synology and Seagate leading in advanced multi-bay systems.

- High initial costs and technical complexity remain key restraints, especially in price-sensitive regions, limiting faster adoption.

- Asia Pacific holds 34% of the global share, leading the market through rapid digitalization, while multi-bay NAS systems dominate the segment with strong demand from residential and small business users.

Market Segmentation Analysis:

By Design

The multiple bay segment dominates the Consumer NAS market with a 41.6% share in 2024. This segment leads due to its higher storage capacity and better data redundancy options through RAID configurations. Households with large media libraries and small businesses prefer multiple bay systems for efficient file sharing and backup. Leading manufacturers such as Synology and QNAP integrate multi-bay enclosures with high-speed connectivity, including 2.5GbE and 10GbE ports, enabling faster data transfer rates. Demand continues to rise as users prioritize flexible expansion and improved performance for personal and small office storage environments.

- For instance, Seagate Technology LLC offers the IronWolf Pro NAS drives with capacities of 22 TB per drive, optimized for multi-bay systems. Synology’s DiskStation DS3622xs+ supports 12 bays and achieves sequential read speeds of 4,700 MB/s, enhancing performance for high-volume users.

By Storage

The hard disk drives (HDD) segment holds the largest market share at 62.3% in 2024. HDD-based NAS solutions remain the most popular option due to their lower cost per terabyte and large storage capacity. Many consumer NAS models support 8TB to 20TB HDDs, which are suitable for media streaming, backups, and surveillance storage. Brands like Western Digital and Seagate have expanded their NAS-grade HDD lines with enhanced endurance and vibration protection. HDDs offer reliable long-term storage, making them a preferred choice for users who prioritize capacity over speed.

- For instance, Huawei has developed a magneto-electric disk (MED) hybrid storage drive combining SSD and tape, with a capacity of 72 TB in a single unit, used for warm and cold data tiers.

By Deployment Model

The on-premises segment dominates the market with a 54.7% share in 2024. Consumers prefer local storage for better privacy control, faster access speeds, and reduced dependence on internet connectivity. On-premises NAS systems offer direct file management, media streaming, and automated backup, which appeal to home users and small offices. Vendors such as Synology and TerraMaster enhance on-premises models with integrated mobile apps and AI-driven security features. Growing concerns over data sovereignty and subscription costs further strengthen the shift toward on-premises solutions over cloud-only deployments.

Key Growth Drivers

Rising Home Data Storage Needs

Increasing volumes of personal media files are driving demand for consumer NAS solutions. Households are generating more high-definition photos, 4K videos, and digital documents. Consumers prefer NAS over external drives for faster access, centralized management, and enhanced security. The growing use of smart TVs and IoT devices further amplifies the need for reliable local storage. Major players like Synology and QNAP offer scalable multi-bay NAS systems, supporting large capacities and faster transfer speeds, which strengthen adoption in the residential segment.

- For instance, Synology’s RackStation RS822RP+/RS822+ delivers 2,103 MB/s sequential read and 1,074 MB/s write throughput, with built-in four Gigabit ports and optional 10/25GbE expansion.

Advancements in Connectivity and Speed

The transition to Wi-Fi 6 and faster Ethernet standards is improving NAS performance. Enhanced bandwidth enables seamless data access, backup, and multimedia streaming across multiple devices. Manufacturers are integrating multi-gigabit Ethernet ports and faster processors to support high-speed file transfers. For example, QNAP’s TS-464 NAS supports 2.5GbE connectivity, offering smoother media playback and remote access. These technological upgrades make NAS systems more efficient, boosting their appeal for households and small offices.

- For instance, Thecus NAS units support 7 modes of link aggregation (Load Balance, Failover, 802.3ad, Balance-XOR, Balance-TLB, Balance-ALB, Broadcast) to maximize throughput.

Growing Demand for Data Privacy and Backup

Rising cybersecurity threats and cloud privacy concerns are increasing the demand for private storage solutions. NAS provides secure, on-premises storage with advanced encryption and access control. Users can automate backups from multiple devices without relying on third-party cloud providers. Synology’s NAS systems feature AES 256-bit encryption and secure remote access tools. These features give consumers greater control over their personal data, supporting wider NAS adoption in privacy-focused segments.

Key Trends & Opportunities

Integration with Cloud Services

Hybrid NAS solutions are gaining momentum by combining local storage with public cloud platforms. Users can back up files locally and sync with services like Google Drive, Dropbox, or OneDrive. This approach ensures data redundancy and easy remote access. Synology Hybrid Share, for example, merges on-premises NAS with cloud infrastructure to optimize storage usage. This trend creates strong growth opportunities for vendors offering flexible hybrid storage models.

- For instance, LaCie’s 5big NAS Pro Hybrid Cloud RAID uses a dual-core 2.13 GHz Intel Atom processor and 4 GB DDR3 RAM, and supports integrated Wuala secure cloud storage for hybrid file access.

Expansion of Smart Home Ecosystems

The rapid adoption of smart home technologies is increasing the role of NAS as a central data hub. NAS systems are being integrated with security cameras, smart speakers, and streaming platforms. Real-time access to recordings, multimedia files, and backups is becoming standard. QNAP’s integration with Apple HomeKit and Alexa demonstrates this shift. This growing ecosystem is creating new demand across residential and small business segments.

- For instance, Acer’s networking wing unveiled the Wave 7 mesh router supporting Wi-Fi 7 with 6,400 Mbps peak throughput and 320 MHz channels, enabling multi-device high-bandwidth connectivity.

AI-Driven Media Management

NAS vendors are integrating AI-powered tools for better content indexing and search. These features allow automatic tagging, facial recognition, and file categorization. Synology Photos uses AI to organize large photo libraries efficiently. Such capabilities improve the user experience and make NAS systems more appealing to households with large multimedia collections, driving further market growth.

Key Challenges

High Initial Setup Costs

Consumer NAS systems often require a significant upfront investment in hardware and storage drives. Multi-bay NAS devices with enterprise-grade features can be costly for average households. Additional expenses for drives, network upgrades, and maintenance increase total ownership costs. This financial barrier limits adoption among price-sensitive consumers, especially in emerging markets.

Technical Complexity for Non-Expert Users

Many NAS solutions still demand basic IT knowledge for installation, configuration, and maintenance. Tasks like network setup, RAID configuration, and security settings can be challenging for average consumers. Despite improved interfaces, complexity remains a deterrent for first-time buyers. This technical gap creates a need for more simplified, plug-and-play NAS solutions to drive mass adoption.

Regional Analysis

North America

North America holds a 32% share of the Consumer NAS Market in 2024. The region’s strong digital infrastructure and high adoption of connected devices drive steady growth. Households and small businesses are increasingly using NAS for media streaming, data storage, and automated backups. High broadband penetration enables smooth remote access and cloud synchronization. Companies like Synology and Western Digital dominate with feature-rich multi-bay NAS systems tailored for tech-savvy consumers. The growing demand for privacy-focused and hybrid storage solutions further supports market expansion across the U.S. and Canada.

Europe

Europe accounts for 27% of the global Consumer NAS Market. Rising data privacy concerns and strict regulatory standards, such as GDPR, are fueling strong adoption. Consumers prefer local NAS solutions over public cloud for secure storage. The market benefits from widespread fiber connectivity, increasing smart home penetration, and advanced digital ecosystems. Germany, the UK, and France are key contributors, supported by leading players like QNAP and Synology. The adoption of hybrid NAS solutions integrating cloud backup and edge storage is gaining momentum, driving sustainable market growth across the region.

Asia Pacific

Asia Pacific leads the Consumer NAS Market with a 34% share in 2024. Rapid digitalization, urbanization, and rising middle-class income levels are boosting demand for home data storage solutions. Countries like China, Japan, and South Korea are major growth hubs, supported by advanced broadband infrastructure and smart home expansion. Local manufacturers offer competitively priced NAS systems, increasing affordability for mass consumers. Rising demand for hybrid cloud-NAS integration and secure personal storage is strengthening the regional market position. Strategic partnerships and localized product innovation continue to enhance regional competitiveness.

Latin America

Latin America captures a 4% share of the Consumer NAS Market. The region is experiencing gradual adoption driven by increasing internet penetration and the rise of smart home devices. Brazil and Mexico lead the demand, supported by growing awareness of personal data privacy and local storage benefits. Price-sensitive consumers prefer entry-level single-bay NAS systems with basic backup and streaming capabilities. Limited infrastructure and slower broadband speeds remain constraints, but improving connectivity and rising urban household incomes are expected to create new growth opportunities in the forecast period.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the Consumer NAS Market. Adoption is growing steadily due to expanding broadband access and increasing digital device usage. The UAE and Saudi Arabia are key contributors, supported by strong smart home adoption and rising data privacy awareness. Entry-level and mid-range NAS solutions are gaining traction among households and small businesses. However, high equipment costs and limited technical expertise pose challenges. As infrastructure improves, hybrid NAS solutions and localized service offerings are expected to accelerate market penetration in the coming years.

Market Segmentations:

By Design:

By Storage:

- Hard disk drives

- Solid-state drives

By Deployment Model:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Consumer NAS Market is shaped by major players such as Seagate Technology LLC, Huawei Technologies Co., Ltd., ASUSTOR Inc., ZyXEL Communications Corp., D-Link Corporation, Synology Inc., Thecus.COM, LaCie, Dell Inc., and Acer Inc. The Consumer NAS Market is defined by intense innovation and strategic positioning. Companies are focusing on developing high-performance, energy-efficient NAS systems with advanced connectivity features. Product differentiation is centered around faster data transfer speeds, enhanced security protocols, and seamless integration with cloud platforms. Vendors are investing in AI-driven content management and smart home compatibility to meet evolving consumer preferences. Competitive strategies include partnerships with technology providers, regional expansion, and user-friendly software enhancements. Continuous innovation in hybrid storage models and remote access capabilities is helping companies strengthen their market presence and build long-term customer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2024, Western Digital Corporation launched a novel AI Data Cycle Storage Framework. Through this product launch, the company will support customers in planning and developing advanced storage infrastructures to improve efficiency and increase their AI investment.

- In June 2024, Hitachi Vantara partnered with AMD to develop energy-efficient and high-performance hybrid cloud and database solutions supported by AMD EPYC processors.

- In February 2024, Dell Technologies collaborated with Subaru Corporation to develop a powerful grouping of AI and high-performance storage solutions to improve safety for drivers, passengers, and pedestrians.

- In January 2024, Ugreen, recognized for its smartphone and computer accessories, expanded into NAS with the launch of the Ugreen NASync series at CES 2024. This series includes six NAS devices featuring the Intel Core i5-1235U processor, Thunderbolt 4 connectivity, a user-friendly management system, and dual 10 GbE ports for enhanced performance and efficiency.

Report Coverage

The research report offers an in-depth analysis based on Design, Storage, Deployment Model and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see growing adoption of hybrid NAS solutions integrating cloud and local storage.

- AI-powered content management will enhance data organization and user experience.

- Demand for high-speed connectivity and multi-gigabit NAS systems will increase.

- Smart home expansion will drive NAS integration with connected devices.

- Security and encryption features will become a core differentiator for vendors.

- Compact and energy-efficient NAS devices will gain traction among home users.

- Subscription-based services and software upgrades will strengthen revenue streams.

- Edge computing integration will improve performance and data accessibility.

- Regional manufacturing will rise to meet growing demand in emerging markets.

- Partnerships with cloud providers will shape new storage ecosystems.