| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airport Kiosk Market Size 2024 |

USD 1,917.0 million |

| Airport Kiosk Market, CAGR |

8.17% |

| Airport Kiosk Market Size 2032 |

USD 3,606.1 million |

Market Overview

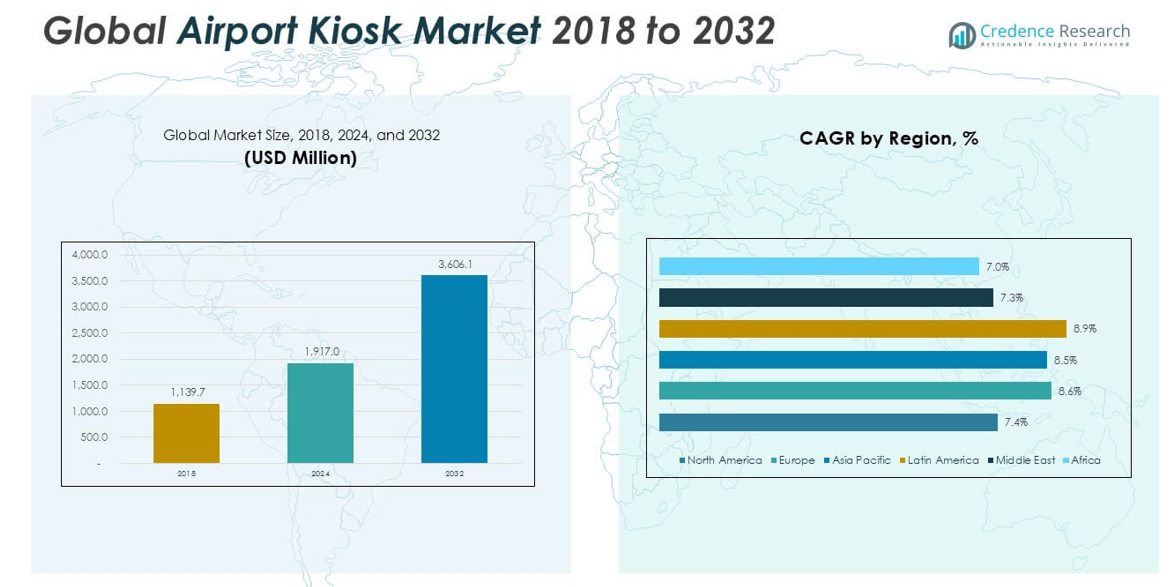

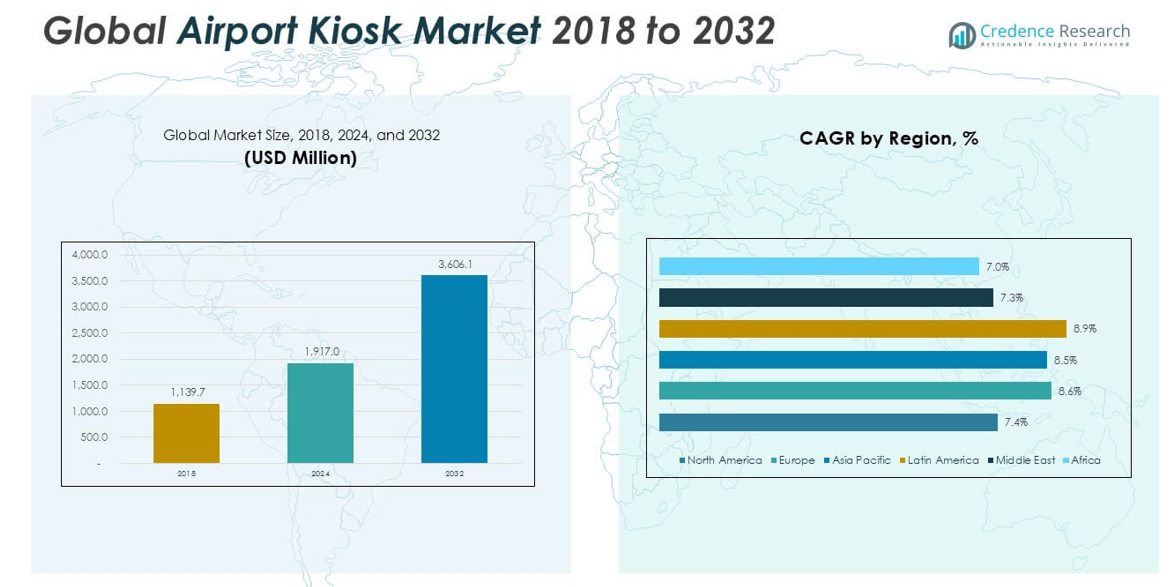

The Global Airport Kiosk Market is projected to grow from USD 1,917.0 million in 2024 to an estimated USD 3,606.1 million by 2032, with a compound annual growth rate (CAGR) of 8.17% from 2025 to 2032.

Market growth is further supported by technological advancements such as biometric-enabled kiosks, contactless interfaces, and integration with mobile applications, which enhance passenger experience and operational efficiency. Trends such as the rise of smart airports, increased passenger expectations for quick processing, and growing investments in airport modernization projects are positively impacting the adoption of self-service kiosks. Furthermore, the emphasis on reducing labor costs and improving airport security through touchless and automated systems continues to push the market forward.

Geographically, North America holds a significant share of the airport kiosk market, owing to its well-established aviation infrastructure and early adoption of advanced technologies. However, the Asia Pacific region is anticipated to witness the highest growth during the forecast period, driven by rapid airport developments in countries such as China and India. Key players operating in the global market include SITA, NCR Corporation, Embross, IER, Materna IPS, Fujitsu, and Rockwell Collins, who are actively focusing on innovation and strategic partnerships to strengthen their market presence.

Market Insights

- The Global Airport Kiosk Market is projected to grow from USD 1,917.0 million in 2024 to USD 3,606.1 million by 2032, at a CAGR of 8.17% from 2025 to 2032.

- Increasing demand for contactless travel, self-service solutions, and faster passenger processing is a key market driver.

- Technological advancements such as biometric-enabled and AI-integrated kiosks are enhancing user experience and airport efficiency.

- High initial investment costs and integration challenges with legacy airport systems continue to restrain market adoption.

- North America holds a significant market share due to mature aviation infrastructure and early adoption of digital technologies.

- Asia Pacific is expected to register the highest growth, supported by rapid airport development in China and India.

- Key market players focus on innovation, customization, and strategic partnerships to strengthen their global footprint.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Contactless Solutions and Faster Passenger Processing

The Global Airport Kiosk Market is experiencing strong growth due to the increasing preference for contactless solutions. Airports are focusing on reducing physical interaction between passengers and staff to enhance safety and hygiene. Self-service kiosks streamline passenger processing, including check-in, baggage tagging, and boarding, which improves operational efficiency. Travelers expect faster and more seamless airport experiences, prompting airport authorities to deploy more kiosks. These systems reduce waiting time and congestion at counters. It supports large passenger volumes while maintaining compliance with health protocols.

- For instance, major airports saw average check-in wait times drop from 27 minutes to under 20 minutes after deploying self-service kiosks at 26 locations, according to industry analysis

Technological Advancements Enhancing User Experience and Security

Advanced technologies such as biometrics, facial recognition, and AI integration have made airport kiosks more efficient and secure. The Global Airport Kiosk Market benefits from innovations that allow faster identification and reduce dependency on manual verification. These systems improve passenger flow while enhancing security and personalization. Kiosks equipped with multilingual support and intuitive interfaces help airports serve diverse passenger demographics. It drives adoption in international terminals with high footfall. Continuous upgrades in software and hardware ensure compatibility with new security protocols.

- For instance, in 2024, the Producer Price Index (PPI) for airport operations in the U.S. was recorded at 173.30, and the PPI for scheduled air transportation reached 315.14, reflecting increased investment in technology upgrades including biometric and AI-enabled kiosks

Cost Efficiency and Labor Optimization for Airports and Airlines

Airports are investing in kiosks to reduce labor costs and optimize resource allocation. Automated kiosks handle repetitive tasks such as check-ins and ticket printing, which allows staff to focus on high-priority services. The Global Airport Kiosk Market gains traction because it supports 24/7 operation with minimal maintenance. It reduces the dependency on manual counters, which helps manage peak-time passenger flow. Lower operational costs lead to higher return on investment. Airlines and airport operators view kiosks as essential tools in long-term cost control strategies.

Expansion of Smart Airports and Modern Infrastructure Projects

Governments and airport authorities are prioritizing the development of smart airports globally. Infrastructure modernization initiatives include the deployment of digital systems such as self-service kiosks. The Global Airport Kiosk Market is supported by rising investments in airport automation and passenger-centric services. It aligns with broader goals of improving airport efficiency and competitiveness. New terminals are being designed with built-in self-service areas to support future scalability. The demand for automated passenger handling solutions continues to grow across both developed and emerging markets.

Market Trends

Integration of Biometric Authentication and Identity Management

The integration of biometric technology is becoming a key trend in the Global Airport Kiosk Market. Airports are adopting facial recognition, fingerprint scanning, and iris detection to enhance security and streamline passenger verification. These systems reduce the need for physical documents and enable faster passenger movement through checkpoints. It strengthens border control procedures and improves overall safety. Biometric kiosks are being deployed in both domestic and international terminals to meet rising security demands. Their ability to deliver a seamless and contactless experience is driving widespread adoption.

- For instance, according to the 2024 IATA Global Passenger Survey, 46% of passengers used biometrics at the airport in 2024, and 73% expressed a preference for using biometric data instead of passports and boarding passes. Additionally, Singapore Changi Airport’s full rollout of biometric-based check-ins led to a 30% reduction in check-in times.

Growth in Touchless and Mobile-Enabled Kiosk Interfaces

Airports are focusing on deploying kiosks with touchless interfaces and mobile connectivity to align with passenger expectations for safer interactions. The Global Airport Kiosk Market is shifting towards gesture-based controls, QR code scanning, and voice-enabled systems to eliminate direct physical contact. Kiosks that integrate with mobile apps allow travelers to complete check-ins or access boarding passes without using shared screens. It supports public health initiatives and builds passenger confidence. Touchless technologies are no longer optional features but standard requirements in new kiosk deployments. This trend is reshaping product design and user interface priorities.

- For instance, a 2024 industry survey found that 66% of airports are planning to implement touchless technologies, and 32% have already deployed biometric-enabled digital identity systems, with another 43% planning to do so before 2028.

Wider Adoption Across Mid-Sized and Regional Airports

Smaller and regional airports are beginning to invest in self-service kiosks to improve passenger experience and operational efficiency. The Global Airport Kiosk Market is expanding beyond major international hubs as cost-effective and scalable kiosk solutions become more accessible. These systems help airports handle growing traffic without major infrastructure expansion. It offers a practical solution for reducing queues and speeding up boarding processes. Vendors are offering modular kiosks tailored to the needs of smaller terminals. This shift is helping to standardize passenger processing systems across the aviation industry.

Customizable Kiosk Solutions and Multi-Functional Capabilities

Vendors are focusing on developing customizable kiosk systems with multi-functional capabilities. The Global Airport Kiosk Market is seeing demand for kiosks that handle check-in, baggage tagging, passport scanning, and wayfinding in a single unit. Airports prefer systems that can integrate easily with existing platforms and adapt to future upgrades. It increases efficiency while reducing the number of physical touchpoints needed for passenger processing. The ability to tailor kiosks based on airport size, traffic volume, and service offerings is becoming a competitive advantage. This trend is pushing manufacturers to enhance software flexibility and hardware modularity.

Market Challenges

High Initial Investment and Integration Complexity for Airports

The deployment of airport kiosks involves significant upfront costs related to hardware, software, and system integration. Many airports, especially in developing regions, face budget limitations that slow adoption. The Global Airport Kiosk Market encounters challenges when existing infrastructure lacks compatibility with new technologies. It becomes difficult for operators to justify the investment without clear short-term returns. Integrating kiosks with security systems, airline databases, and legacy platforms adds to the complexity. These integration hurdles can delay implementation and reduce operational efficiency.

- For instance, a typical self-service kiosk installation at a major airport can require an initial investment of $15,000 to $25,000 per unit, with large terminals often deploying dozens or even hundreds of kiosks to meet passenger demand.

Cybersecurity Risks and Passenger Data Privacy Concerns

Kiosks collect and process sensitive passenger data, making them targets for cyberattacks. The Global Airport Kiosk Market must address increasing concerns around data protection and compliance with international privacy regulations. It requires constant monitoring, software updates, and robust encryption protocols. Any breach can undermine passenger trust and damage the airport’s reputation. Regulatory changes related to data handling and cross-border information flow create uncertainty for vendors and operators. Ensuring security without compromising performance remains a key operational challenge.

Market Opportunities

Expansion in Emerging Markets Driven by Growing Air Traffic and Infrastructure Development

The Global Airport Kiosk Market presents significant growth opportunities in emerging economies with rising air travel demand. Rapid urbanization and increased disposable income fuel passenger traffic, prompting airports to upgrade facilities. It allows operators to introduce self-service kiosks that improve efficiency and passenger satisfaction. Governments in Asia, Latin America, and the Middle East are investing heavily in airport modernization projects. These initiatives create a favorable environment for kiosk manufacturers to expand their footprint. The growing number of low-cost carriers also encourages airports to adopt automated solutions. Penetrating these markets offers substantial revenue potential.

Advancements in AI and IoT Technologies Enabling Smarter Kiosk Solutions

The integration of artificial intelligence (AI) and the Internet of Things (IoT) opens new avenues for innovation in the Global Airport Kiosk Market. Smart kiosks equipped with AI can predict passenger needs, optimize queue management, and provide personalized assistance. It improves operational efficiency and enhances user experience. IoT connectivity enables real-time monitoring and maintenance, reducing downtime and costs. Vendors investing in these technologies can differentiate their offerings and capture more market share. The trend toward digital transformation in airports supports continuous adoption of intelligent kiosks. This creates a strong platform for future growth and service diversification.

Market Segmentation Analysis

By Component

The Global Airport Kiosk Market is segmented into hardware and software & services. Hardware holds the larger revenue share due to the high demand for physical infrastructure such as screens, printers, scanners, and biometric devices. It forms the foundation of kiosk deployment, especially in high-traffic airports requiring durable and efficient systems. Software and services are gaining momentum with increasing demand for cloud integration, real-time data processing, and user interface customization. It allows airports to upgrade functionality and ensure regulatory compliance. As digital transformation accelerates across the aviation sector, software-driven enhancements and maintenance services are expected to play a critical role in overall market growth.

- For instance, more than 25,000 airport self-service hardware kiosks were deployed globally as of 2023, supporting millions of passenger check-ins and security screenings each year.

By Application

The application segment of the Global Airport Kiosk Market includes check-in kiosks, automated passport control, bag drop systems, and others. Check-in kiosks dominate the market due to their widespread use in streamlining passenger processing and reducing manual intervention. Automated passport control is expanding rapidly, driven by growing security concerns and increased international travel. Bag drop kiosks are becoming more prevalent in large and mid-sized airports, helping reduce queue times and improve baggage handling efficiency. Other applications, including wayfinding and information kiosks, support passenger engagement and improve airport navigation. It reflects the broader shift toward automation and improved passenger experience.

- For instance, over 1,200 airports worldwide had installed check-in kiosks by 2023, with major hubs averaging more than 150 kiosks each to handle peak passenger volumes.

Segments

Based on Component

- Hardware

- Software and Services

Based on Application

- Check-in Kiosk

- Automated Passport Control

- Bag Drop

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Airport Kiosk Market

North America grew from USD 226.69 million in 2018 to USD 365.76 million in 2024 and will reach USD 649.10 million by 2032. It accounts for approximately 17% market share in 2024, rising slightly by 2032. The Airport Kiosk Market benefits from advanced aviation infrastructure, high passenger volumes, and early adoption of self-service kiosks. It supports large hubs in the U.S. and Canada and leads in hardware spending. It encourages innovation in biometric and touchless interfaces to meet evolving traveler expectations. It drives investments from both airlines and airport authorities to optimize passenger flow and reduce operational costs.

Europe Airport Kiosk Market

Europe expanded from USD 255.29 million in 2018 to USD 438.93 million in 2024 and will grow to USD 849.60 million by 2032. It represents roughly 20% share in 2024, increasing to nearly 22% by 2032. The Airport Kiosk Market thrives on regulatory emphasis on airport modernization and strong focus on passenger security. It supports biometric passport control, multilingual kiosks, and EU‑level standardization. It encourages integration across airlines and border control systems. It shapes vendor strategies around high reliability and compliance with privacy laws.

Asia Pacific Airport Kiosk Market

Asia Pacific rose from USD 384.08 million in 2018 to USD 656.70 million in 2024 and is forecast to reach USD 1,262.14 million by 2032. It accounts for approximately 30% market share in 2024, projected to grow further by 2032. The region benefits from rapidly expanding airports, rising middle‑class travel, and government-backed infrastructure programs. It supports kiosk deployments in China, India, Southeast Asia, and emerging markets. It fuels demand for cost‑efficient and scalable kiosk models. It fuels competition among local and international vendors to offer localized features and services.

Latin America Airport Kiosk Market

Latin America moved from USD 119.90 million in 2018 to USD 210.21 million in 2024 and will grow to USD 416.87 million by 2032. It contributes around 9% share in 2024, growing modestly by 2032. The Airport Kiosk Market benefits from rising low‑cost carrier growth, moderate airport upgrades, and urbanization. It promotes adoption in regional capitals and secondary airports. It enables faster check-in and baggage processing to manage growing passenger queues. It pushes vendors to offer modular, low‑maintenance kiosk solutions for budget‑constrained operators.

Middle East Airport Kiosk Market

Middle East increased from USD 89.13 million in 2018 to USD 143.17 million in 2024 and will reach USD 252.43 million by 2032. It holds roughly 6% market share in 2024, rising gradually by 2032. The Airport Kiosk Market gains from large international transit hubs and ongoing airport expansions in GCC countries. It encourages adoption of advanced systems with biometric and multilingual support. It benefits from government investments and tourism‑driven growth. It supports premium solutions to serve high volumes of transit travelers efficiently.

Africa Airport Kiosk Market

Africa developed from USD 64.62 million in 2018 to USD 102.20 million in 2024 and is expected to reach USD 175.98 million by 2032. It holds about 5% market share in 2024, with modest growth through 2032. The Airport Kiosk Market faces slower adoption due to limited infrastructure and funding. It supports kiosk deployment in major urban airports and government pilot initiatives. It offers opportunities for low‑cost, rugged kiosks suited to local conditions. It encourages partnerships to build awareness and demonstrate ROI in regional hubs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Embross

- SITA

- Zamzar AG

- IER

- NCR Corporation

- Fujitsu Ltd.

- Phoenix Kiosks

- Toshiba Tec Corporation

- Rockwell Collins, Inc.

- Wincor Nixdorf International GmbH

Competitive Analysis

The Global Airport Kiosk Market is highly competitive with established players focusing on innovation, product customization, and system integration. Companies such as Embross, SITA, and NCR Corporation lead through strong portfolios and global deployments. It sees increased investment in AI, biometrics, and touchless technologies to meet evolving passenger and airport requirements. Strategic partnerships with airports and airlines help vendors expand market reach. Regional players compete through cost-effective solutions and tailored services. The competition intensifies as airports demand modular, scalable, and secure systems to enhance efficiency and passenger experience.

Recent Developments

- In late 2024, Taipei Taoyuan International Airport partnered with SITA to upgrade 80 kiosks across Terminals 1 and 2 with Common Use Self-Service (CUSS), Common Use Terminal Equipment (CUTE), and Local Departure Control System (LDCS) technologies. This multi-year agreement aims to enhance passenger processing and improve the overall airport experience by leveraging SITA’s expertise in these areas.

- In December 2024, Embross and the Port of Oakland expanded their partnership, deploying Embross’s V1 CUSS (Common Use Self-Service) kiosks at the Port’s airport facilities to enhance passenger check-in and improve overall passenger flow, according to Embross. This deployment aims to streamline the check-in process and optimize passenger movement within the airport.

Market Concentration and Characteristics

The Global Airport Kiosk Market is moderately concentrated, with a few key players holding significant market share. It is characterized by high technological intensity, rapid innovation cycles, and growing demand for automation in passenger processing. Vendors compete on system reliability, integration capabilities, and support services. The market favors companies that offer customizable, scalable, and secure kiosk solutions tailored to airport-specific needs. It features long-term partnerships between solution providers and airport authorities, often influenced by compliance, data security, and passenger experience standards. Entry barriers remain high due to capital requirements, regulatory constraints, and the complexity of airport IT infrastructure.

Report Coverage

The research report offers an in-depth analysis based on Component, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience sustained demand as airports increasingly invest in automation to improve passenger throughput and reduce operational delays.

- AI-powered kiosks will become standard, offering predictive assistance, real-time data analytics, and enhanced personalization for improved passenger interaction.

- Facial recognition and biometric authentication will continue to expand, enhancing identity verification processes and supporting faster security clearances.

- Smaller and regional airports will adopt kiosk systems to manage rising traffic and optimize operations without expanding physical infrastructure.

- Kiosk vendors will increasingly offer cloud-enabled solutions, allowing real-time updates, diagnostics, and system monitoring from centralized control rooms.

- Future airport kiosks will feature more modular and customizable designs to meet specific space, application, and branding requirements for each airport.

- Airports and manufacturers will adopt energy-efficient hardware and recyclable materials to align with sustainability goals and regulatory mandates.

- Kiosk systems will incorporate universal design principles, supporting multilingual access, touchless features, and user-friendly interfaces for wider demographic usability.

- Governments and airport authorities will increasingly collaborate with private vendors through long-term contracts to modernize airport infrastructure.

- With demand rising globally, new entrants may emerge, but established players will pursue mergers, acquisitions, and strategic alliances to maintain market dominance.