Market Overview

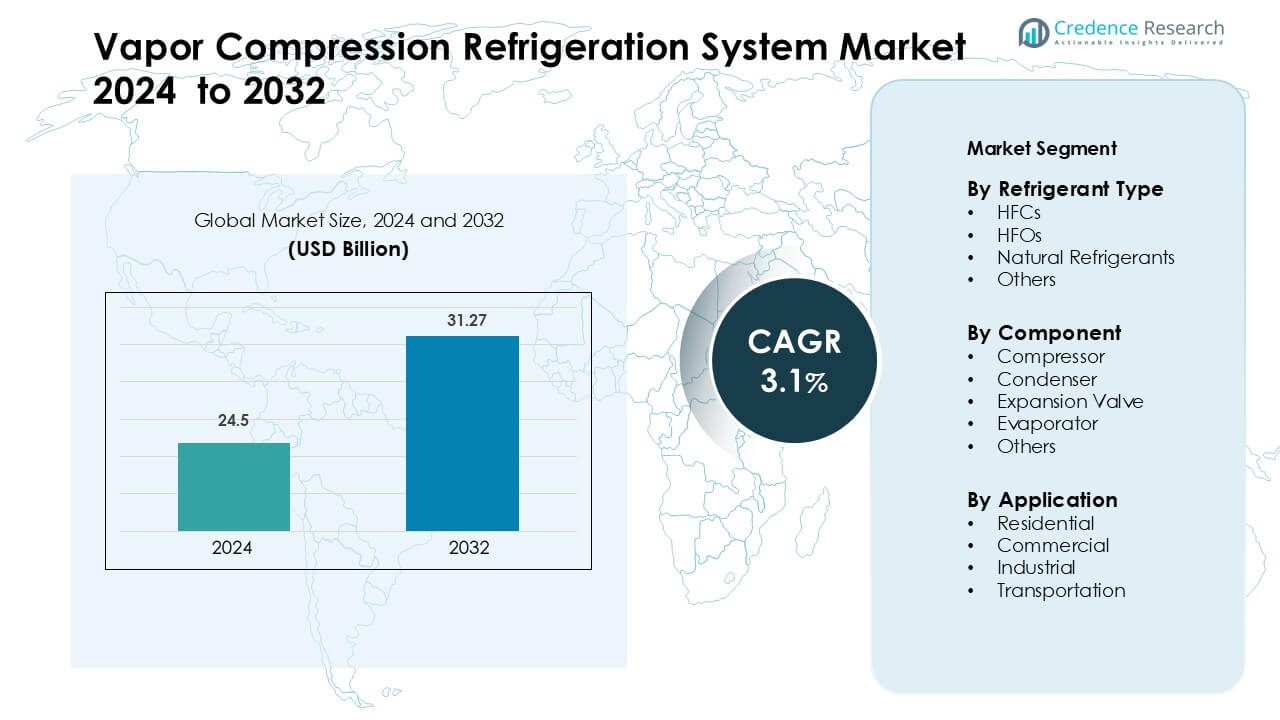

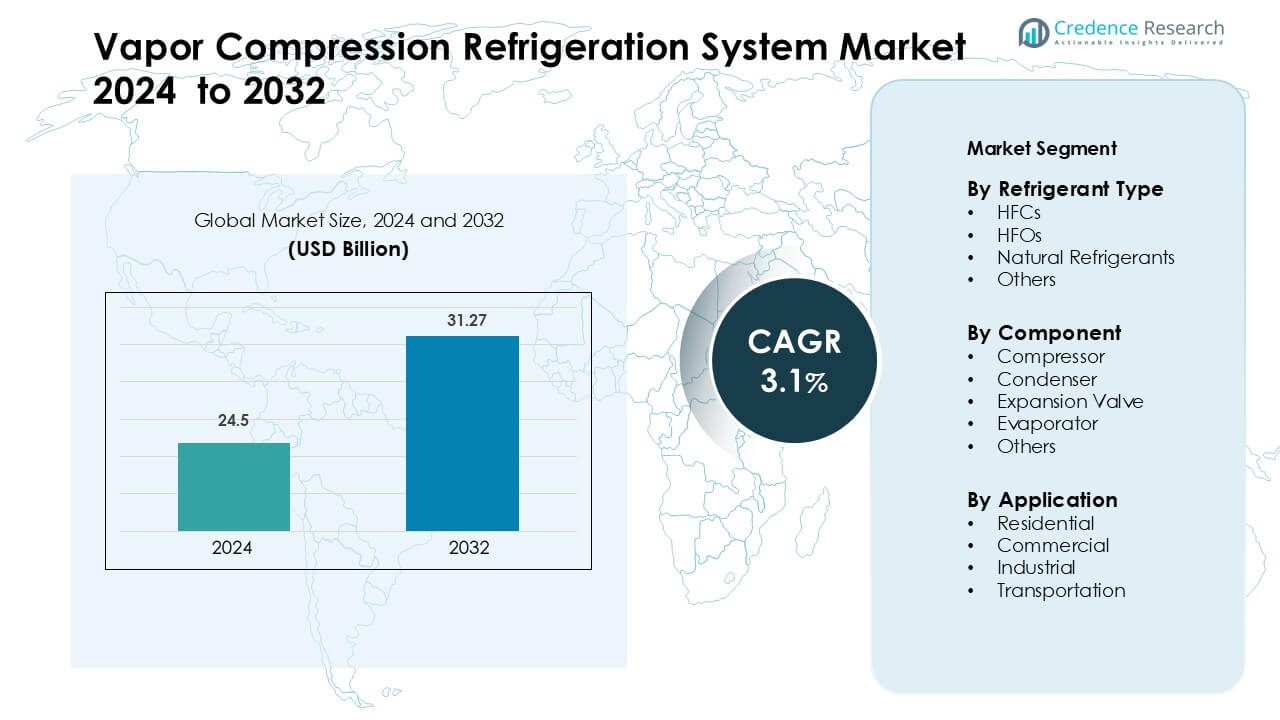

Vapor Compression Refrigeration System Market was valued at USD 24.5 billion in 2024 and is anticipated to reach USD 31.27 billion by 2032, growing at a CAGR of 3.1 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vapor Compression Refrigeration System Market Size 2024 |

USD 24.5 Billion |

| Vapor Compression Refrigeration System Market , CAGR |

3.1 % |

| Vapor Compression Refrigeration System Market Size 2032 |

USD 31.27 Billion |

The Vapor Compression Refrigeration System Market is shaped by major companies such as Whirlpool Corporation, Mitsubishi Electric Corporation, Samsung Electronics Co., Ltd., Johnson Controls International plc, Daikin Industries, Ltd., Trane Technologies plc, Panasonic Corporation, Emerson Electric Co., LG Electronics Inc., and Carrier Corporation. These players strengthen their position through high-efficiency compressors, smart control integration, and rapid adoption of low-GWP refrigerant technologies. North America leads the global market with about 34% share in 2024, supported by strong commercial refrigeration demand, expanding cold-chain networks, and strict energy-efficiency regulations that drive continuous upgrades across residential, commercial, and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Vapor Compression Refrigeration System Market was valued at USD 24.5 billion in 2024 and is anticipated to reach USD 31.27 billion by 2032, growing at a CAGR of 3.1 % during the forecast period.

- Energy-efficient cooling demand acts as the main driver, supported by strong adoption of advanced compressors and low-GWP refrigerants across residential, commercial, and industrial segments.

- Smart controls, IoT-based monitoring, and rapid heat-pump expansion shape market trends, while commercial applications hold the largest share at about 39% due to high use in retail, cold storage, and HVAC systems.

- Leading companies such as Whirlpool, Mitsubishi Electric, Samsung Electronics, Johnson Controls, and Daikin compete through high-efficiency systems, smart connectivity, and regulatory-compliant refrigerant technologies; however, high upfront costs restrain adoption in developing markets.

- North America leads with nearly 34% share, followed by Asia Pacific at around 31%, while HFCs remain the dominant refrigerant type with about 41% share in 2024.

Market Segmentation Analysis:

By Refrigerant Type

HFCs hold the dominant share at about 41% in 2024 due to wide system compatibility, stable performance, and long-standing use across residential and light-commercial cooling units. Adoption remains steady as manufacturers upgrade equipment to meet global energy rules without major design shifts. Natural refrigerants grow fast as industries adopt low-GWP options like CO₂ and ammonia for sustainable operations. HFOs gain momentum in commercial and industrial setups because they offer low emissions and strong cooling efficiency under rising regulatory pressure.

- For instance, Daikin Industries reported offering free access to 93 patents for its R-32 based air conditioners, which has contributed to a collective emissions reduction of approximately 590 million metric tons CO2-equivalent from the roughly 370 million R-32 units sold by all manufacturers worldwide (as of March 2025).

By Component

Compressors lead this segment with nearly 46% share in 2024 because they determine cooling capacity and system efficiency in residential, commercial, and industrial applications. Demand rises as users prefer high-efficiency scroll and screw compressors that reduce power use and meet regional emission norms. Condensers follow with strong use in large commercial units, while expansion valves grow through wider adoption of electronic valves that enhance load control. Evaporators show steady growth as cold-chain and food-processing facilities expand.

- For instance, Danfoss’s commercial scroll compressors using their Intermediate Discharge Valve (IDV) technology modulate capacity in six stages between 17% and 100%, and in a 385kW chiller they showed a reduction of 3,707 kWh/year versus a standard scroll design.

By Application

Commercial applications dominate with about 39% share in 2024 due to strong demand from supermarkets, cold storage, restaurants, and HVAC systems in offices and retail spaces. Growth strengthens as businesses invest in energy-efficient chillers and refrigerated display cases to reduce operating costs. Residential use rises with increased adoption of split ACs and heat pumps, while industrial demand expands through food processing, pharmaceuticals, and chemical sectors. Transportation shows steady growth as refrigerated trucks and marine containers adopt low-GWP refrigerants and advanced cooling units.

Key Growth Drivers

Rising Demand for Energy-Efficient Cooling Solutions

Growing reliance on cooling across homes, commercial buildings, and industries drives strong adoption of vapor compression refrigeration systems. Consumers and enterprises seek units that lower electricity use, reduce bills, and meet tightening global energy rules. Governments promote high-efficiency systems through incentives and strict performance ratings, which accelerates upgrades from older models. HVAC manufacturers now focus on advanced compressors, optimized heat exchangers, and smart controls that reduce load fluctuations and improve seasonal efficiency. Cold-chain expansion across food, pharma, and logistics also boosts demand for reliable and efficient systems. This shift toward energy-conscious cooling remains a major long-term growth driver for the market.

- For instance, Danfoss’ Turbocor TT700 compressor delivers a cooling output of 200 tons while operating with a motor input of about 260 kW, offering a low-power magnetic-bearing design suited for high-efficiency chiller systems.

Rapid Expansion of Cold-Chain Infrastructure

Growth in perishable food distribution, biopharmaceutical storage, and online grocery delivery increases the need for advanced refrigerated warehouses and transport cooling. Vapor compression systems support temperature-sensitive goods across long distances, making them vital for modern supply chains. Countries invest in large-scale cold-chain networks to reduce spoilage and meet safety norms, strengthening system demand in developing regions. Rising vaccine distribution and biologics handling further increase reliance on precision-controlled refrigeration. Global food exporters also upgrade facilities to meet international safety standards. This rising infrastructure footprint ensures sustained growth for industrial and commercial vapor compression systems across multiple applications.

- For instance, Lineage Logistics, the world’s largest cold-storage REIT, operates over 482 facilities with a combined capacity of about 3 billion cubic feet of temperature-controlled space.

Shift Toward Low-GWP and Eco-Friendly Refrigerants

Environmental concerns and global regulatory pressure drive the adoption of low-global-warming refrigerants in vapor compression systems. Governments enforce phasedown of high-GWP HFCs under frameworks like the Kigali Amendment, pushing manufacturers toward alternatives such as HFOs and natural refrigerants. Companies redesign systems to improve efficiency while meeting emission limits, which increases demand for advanced components and optimized system architecture. Retail chains, industrial plants, and transport operators adopt eco-friendly cooling to meet internal sustainability goals. This transition stimulates innovation in compressors, heat exchangers, and control systems that support low-GWP refrigerant operation. The regulatory shift remains a decisive factor shaping market expansion.

Key Trend & Opportunity

Integration of Smart Controls and IoT-Enabled Monitoring

IoT-based monitoring, adaptive control algorithms, and predictive maintenance tools are becoming mainstream in vapor compression systems. These features help users track performance, detect faults early, and manage energy consumption across multiple units. Commercial buildings and cold-chain networks adopt centralized platforms to optimize cooling loads and extend equipment life. Smart sensors enable dynamic adjustment of compressors, valves, and fans, improving efficiency in variable-load environments. Remote diagnostics reduce service downtime and lower operational costs for large facilities. This digital shift creates strong opportunities for OEMs and technology providers to supply connected cooling solutions.

- For instance, Johnson Controls’ OpenBlue Services for Chillers collects data from over 200 points per chiller to analyze performance in real time and pre-emptively detect faults.

Growth of Heat Pumps for Sustainable Heating & Cooling

Heat pumps using vapor compression technology gain strong traction as countries push for low-carbon heating. They deliver both cooling and heating, offering a cleaner alternative to fossil-fuel boilers. Residential and commercial installations rise as governments offer incentives and efficiency targets for clean-heat adoption. Manufacturers develop next-generation heat pumps capable of operating in colder climates and handling variable load conditions. Expanding use in Europe, North America, and parts of Asia creates major opportunities for system suppliers and component manufacturers. Heat pump demand continues rising as nations upgrade building infrastructure toward net-zero goals.

- For instance, Daikin launched its Altherma 4 H residential air-to-water heat pump in 2024, which delivers up to 13.3 kW of heating even at −7 °C, and can generate hot water up to 75 °C.

Key Challenge

High Upfront Costs and Complex Retrofitting Needs

Advanced vapor compression systems require significant initial investment, especially those using low-GWP refrigerants or high-efficiency components. Many facilities still operate older units because replacement costs, installation complexity, and downtime concerns slow adoption. Retrofitting to newer refrigerants often demands changes in compressors, valves, safety systems, and piping, raising project cost. Small businesses and residential users delay upgrades due to budget limits. Industrial plants also face challenges in replacing large installed bases without disrupting operations. These financial and technical constraints limit market penetration of modern systems, especially in developing regions.

Regulatory Compliance and Technical Skill Shortages

Refrigerant rules, safety requirements, and efficiency standards evolve quickly, demanding continuous adaptation from OEMs and service providers. Compliance with regional and global regulations increases design complexity and certification costs. Systems using natural refrigerants like CO₂ and ammonia require special handling and trained technicians due to higher pressures and safety considerations. Many regions lack skilled personnel capable of installing and maintaining advanced systems. This shortage slows adoption of new technologies and increases service costs for businesses. As regulations tighten further, the gap between required and available technical expertise remains a significant challenge for the industry.

Regional Analysis

North America

North America holds the leading share at about 34% in 2024, driven by strong adoption across residential HVAC, commercial refrigeration, and expanding cold-chain networks. The United States leads demand with large supermarkets, food logistics, and data centers that use high-efficiency vapor compression systems. Regional policies promoting low-GWP refrigerants strengthen upgrades in supermarkets and industrial plants. Heat pump adoption also rises as buildings shift toward cleaner heating and cooling. Manufacturers invest in advanced compressors, optimized heat exchangers, and IoT-enabled controls to meet strict efficiency rules, supporting steady system replacement cycles across the region.

Europe

Europe accounts for roughly 27% share in 2024 due to strict environmental regulations and rapid adoption of low-GWP refrigerant systems. The EU F-Gas rules accelerate the shift toward natural and HFO-based refrigerants, prompting widespread equipment upgrades in retail, cold storage, and commercial HVAC. Countries such as Germany, the UK, and France lead installations of heat pumps and energy-efficient chillers as part of regional decarbonization goals. Food processing and pharmaceutical sectors also create steady demand. High compliance standards push manufacturers to supply advanced, efficient, and eco-friendly vapor compression systems across the continent.

Asia Pacific

Asia Pacific holds about 31% share in 2024 and remains the fastest-growing region due to rapid industrialization, strong residential cooling demand, and expanding cold-chain capacity. China, India, Japan, and Southeast Asia invest heavily in food logistics, frozen storage, and retail refrigeration. Rising urbanization drives adoption of air conditioners and heat pumps, strengthening the need for compressors, condensers, and high-efficiency units. Government energy rules and refrigerant phase-down policies encourage transitions to advanced systems. Large-scale manufacturing presence supports competitive pricing and wider regional adoption, making Asia Pacific a major long-term growth engine.

Latin America

Latin America captures nearly 5% share in 2024, driven by gradual expansion of commercial refrigeration and growing cold-storage needs for agriculture and pharmaceuticals. Brazil and Mexico lead demand with rising supermarket chains and food export industries that require reliable, efficient cooling. Adoption of energy-efficient units increases as electricity costs rise and environmental policies tighten. Growth also stems from new infrastructure in logistics, hospitality, and retail sectors. However, slower economic cycles and high system costs limit rapid upgrades. Despite these constraints, the region shows steady long-term adoption potential.

Middle East & Africa

The Middle East & Africa region holds about 3% share in 2024, shaped by strong cooling requirements due to high temperatures and expanding construction activity. GCC countries drive demand for large commercial HVAC systems, district cooling networks, and cold-chain facilities for food imports. Industrial projects in the UAE and Saudi Arabia support installations of advanced vapor compression units with high efficiency ratings. Africa sees rising adoption in supermarkets, healthcare, and food logistics, though cost barriers slow broader upgrades. Growing urbanization and rising energy-efficiency policies gradually support market expansion across the region.

Market Segmentations:

By Refrigerant Type

- HFCs

- HFOs

- Natural Refrigerants

- Others

By Component

- Compressor

- Condenser

- Expansion Valve

- Evaporator

- Others

By Application

- Residential

- Commercial

- Industrial

- Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Vapor Compression Refrigeration System Market features leading companies such as Whirlpool Corporation, Mitsubishi Electric Corporation, Samsung Electronics Co., Ltd., Johnson Controls International plc, Daikin Industries, Ltd., Trane Technologies plc, Panasonic Corporation, Emerson Electric Co., LG Electronics Inc., and Carrier Corporation. These players compete through advanced compressor technologies, high-efficiency heat exchangers, and integration of smart controls that improve system performance and energy use. Many companies accelerate innovation to support low-GWP and natural refrigerants, driven by global emission rules. Strategic actions focus on expanding HVAC portfolios, strengthening cold-chain solutions, and enhancing digital service platforms for predictive maintenance. Partnerships with commercial and industrial users help improve adoption of connected refrigeration systems. Manufacturers also expand production in Asia and North America to meet rising residential and commercial demand. This competitive environment pushes continuous upgrades in system efficiency, reliability, and regulatory compliance across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Panasonic Corporation showcased its latest cold-chain and HVAC solutions (including updated condensing-unit offerings for CO₂, HFO and HFC refrigerants) at REFCOLD India and announced production/expansion moves in its HVAC/cold-chain business to support commercial refrigeration and heat-pump lines.

- In 2025, LG Electronics Inc. expanded availability of a next-generation air-cooled inverter scroll chiller (R32 refrigerant, twin all-inverter compressors and vapor-injection technology) designed to keep stable heating/cooling capacity across wide ambient ranges positioned for commercial chillers and large HVACR applications.

- In July 2025, Mitsubishi Electric Corporation introduced the MSZ-RZ R290 wall-mounted inverter heat pump system. The unit uses low-GWP R290 refrigerant and delivers year-round efficient heating and cooling for residential applications.

Report Coverage

The research report offers an in-depth analysis based on Refrigerant Type, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift rapidly toward low-GWP refrigerants as global regulations tighten.

- Heat pump adoption will rise as countries push for clean and efficient building heating.

- Smart, IoT-enabled refrigeration systems will become standard in commercial and industrial applications.

- Energy-efficient compressors and advanced heat exchangers will drive most new system upgrades.

- Cold-chain expansion for food, pharma, and e-commerce will boost industrial system demand.

- Retail and supermarket refrigeration will transition to natural refrigerant-based systems at a faster rate.

- Predictive maintenance and remote monitoring will reduce operational downtime across facilities.

- Manufacturers will expand regional production to meet rising demand in Asia Pacific and North America.

- Transportation refrigeration will grow as logistics networks modernize and require temperature-controlled fleets.

- System retrofitting will accelerate as older units are replaced to meet efficiency and emission standards.