Market Overview

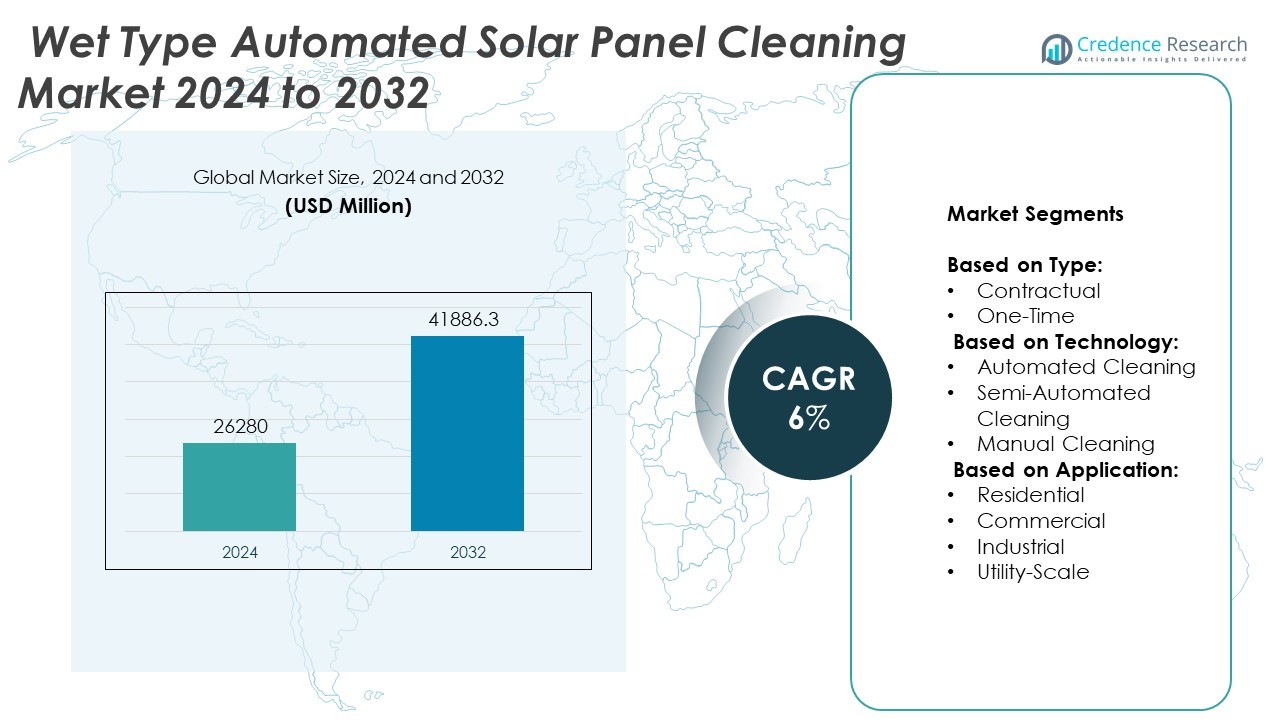

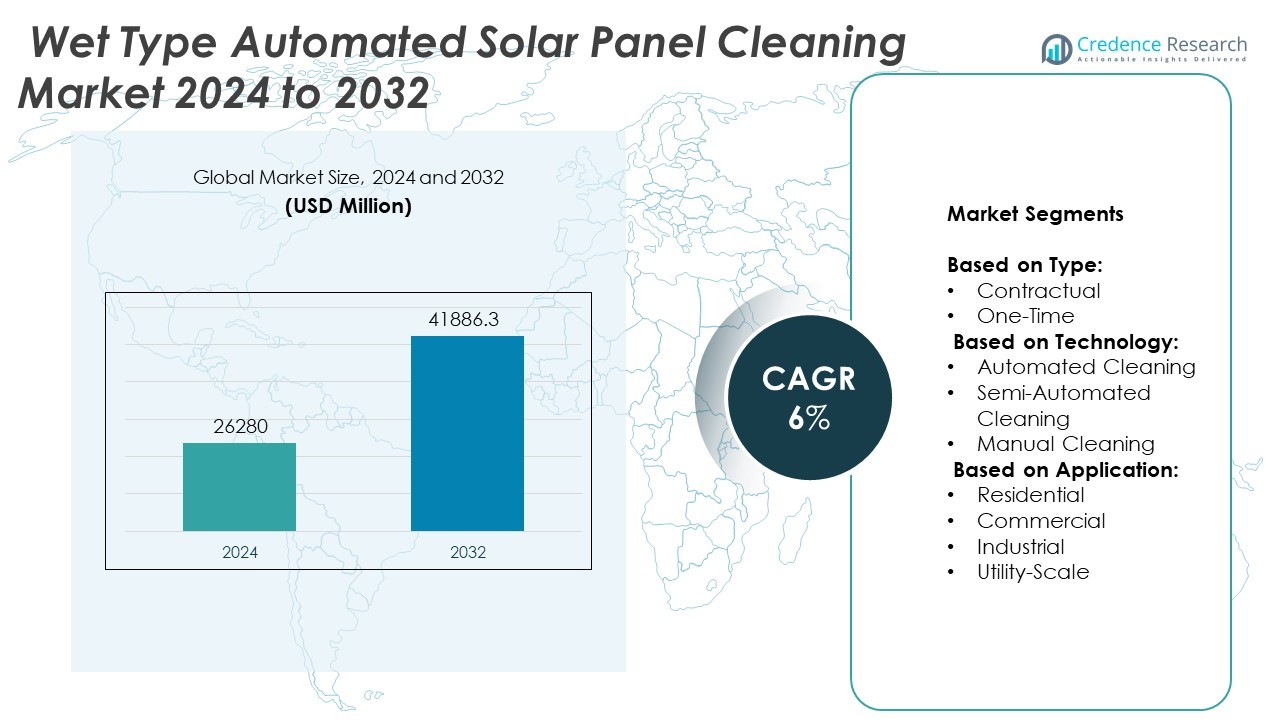

Wet Type Automated Solar Panel Cleaning Market size was valued at USD 26,280 million in 2024 and is anticipated to reach USD 41,886.3 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wet Type Automated Solar Panel Cleaning Market Size 2024 |

USD 26,280 Million |

| Wet Type Automated Solar Panel Cleaning Market, CAGR |

6% |

| Wet Type Automated Solar Panel Cleaning Market Size 2032 |

USD 41,886.3 Million |

The Wet Type Automated Solar Panel Cleaning market advances on the back of rising utility-scale solar installations, growing demand for efficient energy output, and increasing focus on water-saving technologies. Project developers and asset managers adopt automated wet cleaning systems to reduce manual labor, minimize downtime, and comply with environmental regulations. Trends show strong momentum toward IoT-enabled robotic units, hybrid cleaning technologies, and service-based maintenance models. The integration of smart sensors and remote monitoring improves operational control, while demand continues to grow in arid and dust-prone regions where regular panel cleaning is essential for maintaining photovoltaic performance and system reliability.

Asia-Pacific leads the Wet Type Automated Solar Panel Cleaning market due to widespread solar deployment in China, India, and Australia, followed by steady growth in North America and Europe. The Middle East shows strong adoption across desert-based solar farms, while Latin America and Africa present emerging opportunities. Key players operating across these regions include Ecoppia, SunBrush mobil GmbH, Langfang Sol-Bright, and Karcher, each offering advanced automated cleaning technologies tailored to regional climate conditions and solar infrastructure requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Wet Type Automated Solar Panel Cleaning market was valued at USD 26,280 million in 2024 and is projected to reach USD 41,886.3 million by 2032, growing at a CAGR of 6%.

- Increasing utility-scale solar projects and rising focus on maintaining panel efficiency are key drivers of market growth.

- IoT-enabled robotic systems, water-saving designs, and hybrid wet-dry cleaning solutions are gaining traction as major industry trends.

- Companies like Ecoppia, SunBrush mobil GmbH, Langfang Sol-Bright, and Karcher lead the market with advanced automation and contract-based service offerings.

- High initial capital costs and limited water availability in arid regions restrict the adoption of wet cleaning systems in some locations.

- Asia-Pacific dominates the market due to large-scale solar capacity additions in China, India, and Australia, with North America and Europe showing steady expansion.

- The market sees growing demand for long-term service models, remote diagnostics, and localized solutions tailored to varying site conditions and regulatory standards.

Market Drivers

Rising Solar Panel Installations Across Utility and Commercial Sectors

The growing deployment of solar energy infrastructure across utility-scale and commercial installations drives sustained demand for effective cleaning systems. Large solar farms in arid and semi-arid regions experience high dust accumulation, reducing panel efficiency. The Wet Type Automated Solar Panel Cleaning market responds to this need by offering water-based, automated cleaning solutions that maintain optimal power output. Project developers and EPC contractors increasingly integrate automated cleaning to reduce manual labor and improve operational continuity. Urban commercial buildings with rooftop solar arrays also adopt these systems to ensure consistent performance. The market aligns with global trends toward decarbonization, where governments and private firms invest heavily in solar power generation.

- For instance, Langfang Sol-Bright deployed over 900 robotic cleaning systems at the 3.5 GW Khavda solar project in Gujarat, ensuring automated daily cleaning across one of India’s largest solar installations.

Water-Efficient Cleaning Technologies Supporting Sustainable Operations

Growing water scarcity across several regions compels operators to seek cleaning systems that minimize water usage while maintaining effectiveness. Wet type automated systems evolve with features such as high-pressure misting, optimized nozzles, and closed-loop recycling units that reduce water wastage. It allows operators in water-stressed geographies to maintain panels without violating local water regulations. These capabilities position wet systems as a reliable, eco-compliant choice for large-scale installations. The market benefits from regulatory encouragement for water-smart technologies, particularly in the Middle East, North Africa, and parts of Asia. Sustainable water management remains a top priority for solar asset operators, bolstering long-term adoption.

- For instance, Ecoppia deployed its T4 robotic units across a 181.25 MWac solar plant in Chile, reducing manual labor requirements by over 90% while enabling fully autonomous night-time operation.

Decline in Manual Labor Efficiency and Rising O&M Costs

Manual solar panel cleaning proves inefficient, risky, and costly at scale, especially in large solar farms or on hard-to-reach rooftop arrays. Labor shortages and increasing wages in several countries limit the viability of manual cleaning approaches. It makes automated systems a more cost-effective and scalable alternative. Wet type technologies further improve return on investment by reducing cleaning downtime and extending panel life. Automation also minimizes human error and ensures uniform cleaning quality across arrays. The market benefits from solar asset owners prioritizing long-term operational efficiency and predictable maintenance costs.

Favorable Government Policies and Renewable Energy Mandates

National clean energy goals and subsidy frameworks indirectly boost demand for automated cleaning systems. Governments incentivize solar deployment through feed-in tariffs, tax credits, and renewable portfolio standards, increasing solar farm density. The Wet Type Automated Solar Panel Cleaning market gains momentum as asset owners seek to maintain peak generation efficiency to capitalize on incentives. Public sector procurement also includes cleaning automation in solar installation tenders. Policy mandates in countries like India, China, the UAE, and Australia promote best practices in solar asset management. This regulatory backdrop sustains steady investments in cleaning technologies throughout the forecast period.

Market Trends

Integration of IoT and Smart Monitoring Systems in Cleaning Equipment

Manufacturers introduce IoT-enabled cleaning units with sensors and data analytics to optimize cleaning cycles. These systems assess dust accumulation, humidity, and temperature to trigger automated cleaning only when required. It helps reduce unnecessary water usage and operational costs, supporting sustainability and efficiency. Real-time performance monitoring allows asset managers to evaluate cleaning effectiveness and improve maintenance schedules. Smart controls integrated into solar SCADA systems enable centralized management of multiple installations. This trend strengthens the position of wet automated systems in large-scale solar projects where predictive maintenance plays a critical role.

- For instance, Solar PV cleaning specialist, Clean Solar Solutions has signed a two-year contract with inverter manufacturer, SMA for the annual cleaning of 110,000 solar Panels.

Growing Adoption of Hybrid Cleaning Models in Challenging Environments

Solar developers adopt hybrid models that combine wet and dry automated techniques, especially in desert climates where dust settles rapidly. These systems enable flexible operation by using minimal water in areas with limited supply. The Wet Type Automated Solar Panel Cleaning market adapts to such demand through modular designs and smart switching mechanisms. Hybrid units support both scheduled and condition-based cleaning, extending system versatility. Their use is expanding across the Middle East, North Africa, and Western Australia. This trend aligns with the need for high-performance, region-specific cleaning systems.

- For instance, Serbot AG pv Clean STANDARD robot delivers up to 1,440 m² of cleaning per hour via rotating brushes with demineralized water, with an average rate of around 600 m² per hour

Expansion of Robotic Cleaning Fleets for Utility-Scale Installations

Robotic solutions dominate the utility segment with self-powered, rail-mounted, or autonomous vehicles designed for wet cleaning. Solar plant operators deploy fleets of such robots across large arrays to achieve uniform results without manual intervention. It improves cleaning precision while ensuring minimal disruption to energy output. Manufacturers invest in lightweight, corrosion-resistant materials to withstand prolonged outdoor use. These robotic systems are now engineered to handle uneven terrains and panel inclination. Their growing reliability positions them as a long-term solution in O&M strategies.

Increasing Preference for Contract-Based Cleaning Services

Solar asset owners outsource panel maintenance to third-party service providers offering turnkey wet cleaning packages. These contracts include equipment provision, operational oversight, and performance guarantees. The Wet Type Automated Solar Panel Cleaning market sees rising demand for service-based models that reduce ownership burden. It allows plant operators to shift from CAPEX to OPEX frameworks while ensuring consistent cleaning quality. Providers tailor packages based on site size, panel orientation, and climate conditions. This trend supports predictable operational costs and scalable deployment.

Market Challenges Analysis

Limited Water Availability in Arid and Semi-Arid Regions

The dependence on water for cleaning creates operational constraints in regions facing chronic water scarcity. Several high-insolation zones suitable for solar installations—such as the Middle East, parts of Africa, and western India—struggle to allocate water resources for panel maintenance. The Wet Type Automated Solar Panel Cleaning market encounters resistance in these areas where regulatory bodies enforce strict water conservation policies. Asset operators must seek advanced water-recycling or ultra-low consumption technologies to comply with local norms. This challenge slows adoption rates and increases the cost of deployment in environmentally sensitive zones. It places pressure on manufacturers to innovate sustainable water-use solutions without sacrificing cleaning efficiency.

High Initial Capital Investment and Retrofit Compatibility Issues

Automated wet cleaning systems involve significant upfront costs, particularly for custom robotic solutions and integrated control units. Small and mid-sized solar farms often hesitate to invest due to limited budgets and longer payback periods. The Wet Type Automated Solar Panel Cleaning market faces barriers when retrofitting existing installations, where space constraints or mounting configurations limit equipment compatibility. System downtime during installation or integration also impacts production schedules, creating reluctance among asset managers. The market must address these cost-performance trade-offs to expand its footprint among smaller operators and older solar assets. Technological standardization and modular product lines could help mitigate this barrier.

Market Opportunities

Emergence of Solar-Heavy Economies in Asia and Africa

Rapid solar adoption in developing economies such as India, Vietnam, Egypt, and South Africa creates strong growth prospects for automated cleaning technologies. Governments invest in large-scale solar farms to meet rising electricity demand and climate goals, often in dry, dusty regions. The Wet Type Automated Solar Panel Cleaning market gains from this trend as new installations require efficient cleaning systems to protect energy yield. Public tenders increasingly include automated maintenance provisions, expanding vendor participation. Foreign investors and multilateral agencies fund utility-scale projects that prioritize long-term operational efficiency. This global shift in solar infrastructure geography opens new frontiers for wet cleaning providers.

Rising Demand for Long-Term Service Models and Performance Guarantees

Asset operators seek end-to-end maintenance contracts that cover not just cleaning equipment but ongoing service delivery with measurable performance metrics. The Wet Type Automated Solar Panel Cleaning market evolves with business models that offer leasing, revenue-sharing, or O&M bundling to lower entry barriers. These frameworks appeal to solar developers aiming to reduce upfront investment while maintaining uptime. Vendors who deliver reliability, transparency, and data-backed service outcomes attract long-term agreements across commercial and industrial segments. Software-enabled monitoring platforms and remote diagnostics further enhance service appeal. These integrated solutions position vendors as strategic partners in the solar value chain.

Market Segmentation Analysis:

By Type:

The contractual segment leads the market due to increasing demand for ongoing maintenance services across utility-scale and commercial installations. Long-term contracts provide consistent revenue streams for service providers and ensure uninterrupted cleaning schedules for asset owners. It appeals to operators seeking predictable performance, particularly in remote or high-dust locations. One-time cleaning services cater to smaller installations and regions with less frequent soiling. These services often target residential and small commercial users who prefer on-demand maintenance over recurring expenses. The one-time segment shows moderate growth but lacks the scalability and operational stability of the contractual model.

- For instance, IFBOT deployed M20 robotic units in a commercial solar farm that cleaned over 1,500 m² per hour, reducing reliance on manual drop‑in services.

By Technology:

Automated cleaning dominates due to its efficiency, consistency, and integration with smart monitoring systems. It reduces human intervention, optimizes water use, and minimizes panel downtime. The Wet Type Automated Solar Panel Cleaning market expands rapidly in this segment as utility operators and large commercial clients adopt rail-mounted or autonomous robotic solutions. Semi-automated systems offer a balance between manual effort and machine support, gaining traction in mid-sized industrial and rooftop arrays. Manual cleaning continues to serve budget-sensitive installations but faces limitations in coverage, efficiency, and labor availability. Its relevance declines where automation delivers measurable performance gains.

- For instance, Ecoppia’s T4 robot cleans up to 400 m² nightly with no water use, ensuring over 99 percent dust removal from panels.

By Application:

Utility-scale projects hold the largest share due to their size, exposure to harsh environments, and need for high energy yield. These installations require robust, automated wet cleaning systems that operate across large arrays with minimal disruption. The commercial segment shows strong uptake, driven by rooftop solar adoption in corporate campuses, malls, and institutional buildings. It values automated solutions for safety and reliability. Industrial facilities adopt cleaning systems to maintain output in manufacturing zones where airborne particles reduce panel efficiency. Residential users represent a smaller portion, limited by budget and system size, but offer future growth potential with scalable, modular solutions.

Segments:

Based on Type:

Based on Technology:

- Automated Cleaning

- Semi-Automated Cleaning

- Manual Cleaning

Based on Application:

- Residential

- Commercial

- Industrial

- Utility-Scale

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 23.6% in the Wet Type Automated Solar Panel Cleaning market. The region’s growth stems from widespread adoption of commercial and utility-scale solar installations across the United States and Canada. The U.S. leads in utility-scale projects, particularly in states like California, Texas, and Arizona, where dust accumulation impacts energy yield. Asset operators invest in automated wet cleaning systems to maintain system performance under high solar irradiation and low rainfall. Technological advancement, labor cost optimization, and strong O&M strategies accelerate demand. Canada follows with rooftop solar adoption in commercial and industrial sectors, creating niche opportunities for semi-automated and mobile cleaning units. Market players expand contract-based service offerings, aligning with increasing energy production goals in both countries.

Europe

Europe accounts for 21.1% of the Wet Type Automated Solar Panel Cleaning market. The region exhibits steady growth driven by strong environmental regulations and clean energy targets under the EU Green Deal. Southern European countries such as Spain, Italy, and Greece contribute significantly due to high solar potential and large-scale solar farms. These areas experience moderate to high dust and pollen accumulation, necessitating regular cleaning to ensure system efficiency. Germany and France prioritize rooftop commercial systems, where wet cleaning is implemented under scheduled service models. Market participants benefit from public-private partnerships and performance-based EPC contracts that include integrated cleaning solutions. The emphasis on sustainable water use and automation fosters interest in closed-loop wet cleaning systems.

Asia-Pacific

Asia-Pacific leads the global market with a dominant share of 34.7%, supported by large-scale solar deployment in China, India, Japan, and Australia. China contributes the largest volume of installations and actively adopts automated cleaning technologies in vast solar parks across desert regions. India focuses on water-efficient wet cleaning systems due to limited water resources in key solar-producing states like Rajasthan and Gujarat. Japan supports rooftop and ground-mount arrays with automated and semi-automated solutions, emphasizing compact and efficient designs. Australia accelerates deployment in commercial and utility projects, particularly in arid zones, where dust and bird droppings impact panel performance. Strong government policies and localized manufacturing support vendors offering tailored wet cleaning systems in the region.

Middle East & Africa

The Middle East & Africa region holds a market share of 13.4%, primarily driven by expanding solar capacity in the UAE, Saudi Arabia, Egypt, and South Africa. Harsh desert environments in the Middle East create continuous demand for automated wet cleaning systems with water-saving features. Projects like Noor Abu Dhabi and Mohammed bin Rashid Al Maktoum Solar Park integrate smart robotic cleaning units to maintain high output. Africa shows early-stage adoption, with Egypt and South Africa investing in utility-scale solar parks that rely on efficient cleaning methods. Service providers develop hybrid cleaning models suited to arid climates and limited water availability.

Latin America

Latin America represents 7.2% of the global market, with Brazil, Mexico, and Chile leading solar energy growth. Mexico deploys wet automated cleaning in solar clusters located in high-dust zones, aiming to protect panel output and reduce manual labor dependency. Brazil shows interest in commercial-scale solutions driven by corporate sustainability goals and favorable solar economics. Chile’s Atacama Desert installations benefit from robotic wet systems designed to withstand extreme dryness and UV exposure. The market in this region develops gradually, supported by international investors and regional service providers offering performance-based maintenance contracts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Indisolar Products Private Limited

- BladeRanger

- Solar Service Professionals

- UT Pumps & Systems Private Limited

- Ecoppia

- Langfang Sol-Bright

- Clean Solar Solutions Ltd.

- Hekabot

- Serbot AG

- NOMADD

- Premier Solar Cleaning, LLC

- Karcher

- Boson Robotics Ltd.

- SunBrush mobil GmbH

- Heliotex

- Sharp Corporation

- Saint-Gobain Surface Conditioning

Competitive Analysis

Ecoppia, Boson Robotics Ltd., BladeRanger, Clean Solar Solutions Ltd., Heliotex, Indisolar Products Private Limited, Karcher, Langfang Sol-Bright, NOMADD, Premier Solar Cleaning, LLC, Sharp Corporation, Serbot AG, Saint-Gobain Surface Conditioning, SunBrush mobil GmbH, Solar Service Professionals, and UT Pumps & Systems Private Limited are key players in the Wet Type Automated Solar Panel Cleaning market. These companies compete by offering advanced cleaning technologies that improve efficiency and reduce water usage. Ecoppia and BladeRanger lead in robotic solutions for large solar farms, while Karcher and Serbot AG focus on versatile systems suitable for both commercial and residential use. Clean Solar Solutions Ltd. and Solar Service Professionals specialize in service-based models, offering both equipment and maintenance contracts. NOMADD and Langfang Sol-Bright develop solutions for harsh desert conditions, addressing water scarcity challenges. Sharp Corporation and Saint-Gobain bring engineering strength and product durability to the market. Companies like Indisolar and UT Pumps support regional demand with cost-effective and customizable systems. Overall, competition is driven by innovation, reliability, ease of deployment, and ability to serve diverse applications from utility-scale to rooftop installations.

Recent Developments

- In 2024, Langfang Sol‑Bright signed a contract to supply its water‑free robotic cleaning systems for AMP Energy India’s SECI 8 project in Rajasthan, scheduled for commissioning.

- In 2024, Clean Solar Solutions Ltd. received a Special Commendation at the Energy Efficiency Awards, recognizing its leadership in solar operations and maintenance

- In 2023, Ecoppia announced that it secured multiple contracts for deploying its autonomous cleaning robots across large solar projects in the Middle East and India

Market Concentration & Characteristics

The Wet Type Automated Solar Panel Cleaning market shows moderate concentration, with a mix of global players and regional specialists competing on technology, water efficiency, and service integration. A few firms like Ecoppia and SunBrush mobil GmbH hold significant presence in large-scale deployments, particularly across utility-scale installations in arid and semi-arid zones. It features a strong emphasis on automation, with demand favoring robotic and semi-autonomous systems that reduce manual labor and water consumption. The market values operational reliability, environmental compliance, and compatibility with varied panel configurations, including fixed-tilt and single-axis tracking systems. Companies differentiate through service models, IoT-enabled solutions, and performance guarantees tailored to the O&M needs of industrial, commercial, and utility clients. Regional players gain traction by offering localized support, cost-effective retrofits, and climate-specific product designs. The Wet Type Automated Solar Panel Cleaning market remains dynamic, with growing investment in hybrid cleaning technologies and strategic partnerships that expand geographic footprint and technological capabilities.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption of AI-integrated robotic cleaning systems for improved performance monitoring and automation.

- Demand for water-efficient cleaning technologies will grow in response to rising environmental regulations and water scarcity.

- Utility-scale solar farms will continue to drive major installations of wet automated cleaning systems.

- Companies will expand service-based business models offering long-term maintenance contracts and operational guarantees.

- Hybrid cleaning systems combining wet and dry methods will gain traction in regions with extreme dust and low water availability.

- Emerging markets in Asia, Africa, and Latin America will create new opportunities for modular and cost-effective cleaning solutions.

- Integration of IoT platforms will enhance remote diagnostics, usage analytics, and predictive maintenance.

- Retrofitting solutions for existing solar projects will become more commercially viable and widely adopted.

- Competitive dynamics will shift as regional players form alliances to serve expanding local demand efficiently.

- Manufacturers will focus on lightweight, energy-efficient, and terrain-adaptive equipment designs to support diverse site conditions.