Market Overview

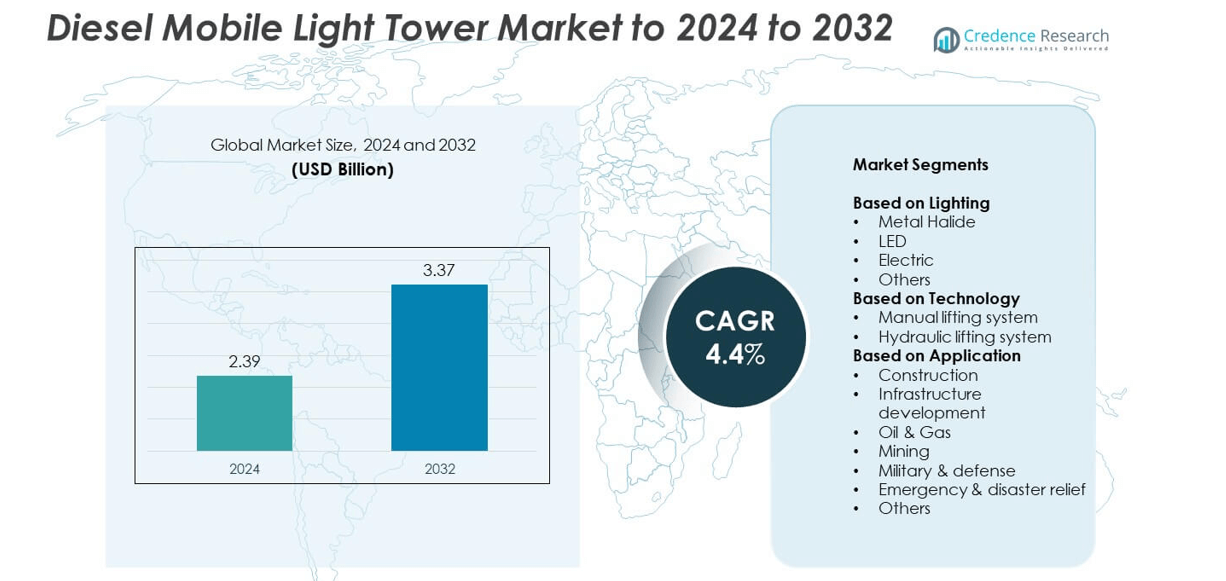

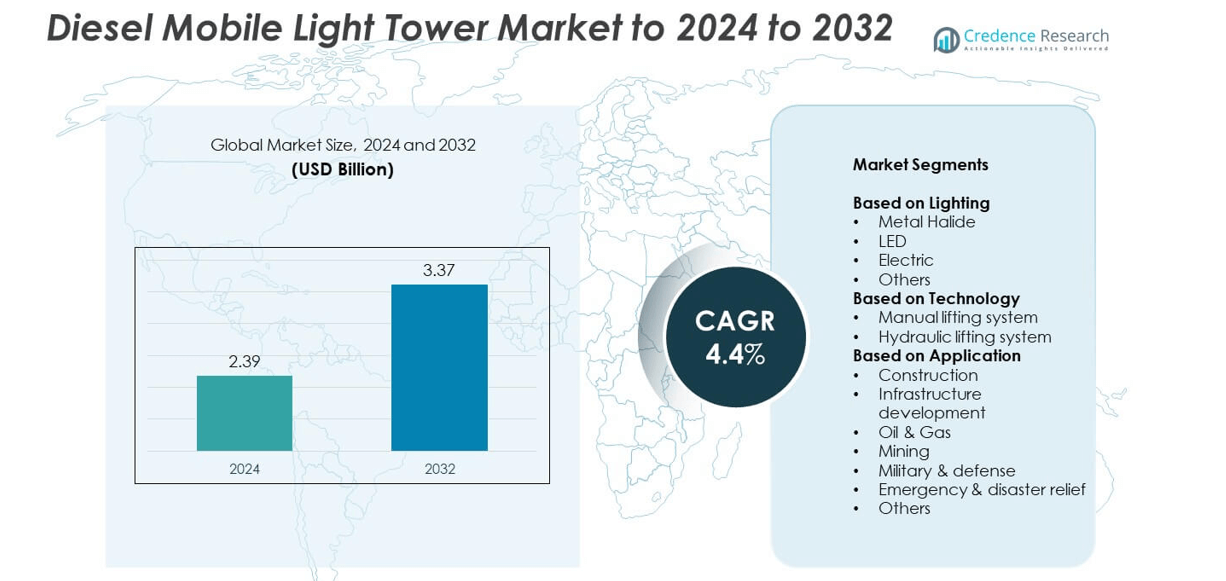

The Diesel Mobile Light Tower market size was valued at USD 2.39 billion in 2024 and is anticipated to reach USD 3.37 billion by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Mobile Light Tower Market Size 2024 |

USD 2.39 billion |

| Diesel Mobile Light Tower Market, CAGR |

4.4% |

| Diesel Mobile Light Tower Market Size 2032 |

USD 3.37 billion |

The diesel mobile light tower market is led by prominent players including Caterpillar, Trime, Atlas Copco, United Rentals, Generac Power Systems, Wacker Neuson, Doosan Portable Power, and Allmand Bros. These companies maintain their competitiveness through advanced product designs, integration of LED and hybrid lighting systems, and expansion into rental-based services. Strategic investments in telematics, emission reduction technologies, and durable tower designs have strengthened their global presence. North America remained the leading regional market in 2024, holding a 34% share, followed by Europe at 27% and Asia Pacific at 25%, driven by large-scale infrastructure and industrial development projects.

Market Insights

- The diesel mobile light tower market was valued at USD 2.39 billion in 2024 and is projected to reach USD 3.37 billion by 2032, growing at a CAGR of 4.4%.

- Rising infrastructure development, oilfield expansion, and increased use in construction and mining projects are key drivers boosting global demand.

- The market is shifting toward LED and hybrid-powered light towers, offering higher efficiency, reduced emissions, and improved durability for remote operations.

- Leading companies are focusing on product innovation and rental-based services, with the LED segment accounting for around 62% market share in 2024.

- North America led the global market with a 34% share, followed by Europe at 27% and Asia Pacific at 25%, driven by strong adoption in industrial, mining, and emergency response applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Lighting

The lighting segment of the diesel mobile light tower market is dominated by the LED sub-segment, accounting for around 62% share in 2024. LED light towers are preferred for their high energy efficiency, long operational life, and reduced maintenance needs compared to metal halide and electric variants. Growing adoption across construction, mining, and emergency operations is driven by the demand for sustainable and low-emission lighting solutions. LED systems also support hybrid and solar-assisted configurations, aligning with global emission reduction goals and enhancing reliability in remote field operations.

- For instance, the Atlas Copco HiLight PE3 electric light tower features four dimmable 120W SMD LED floodlights and has a rated power (PRP) of 0.48 kW during operation.

By Technology

The hydraulic lifting system segment held the dominant position in 2024, representing about 58% of the market share. Hydraulic systems are favored for their faster setup, higher load stability, and ability to operate in challenging terrain conditions. Their growing demand in large-scale construction and oilfield projects is supported by the need for enhanced safety and operational efficiency. In contrast, manual systems remain popular in smaller applications due to lower cost and easy maintenance, though technological upgrades are gradually shifting preferences toward automated hydraulic solutions.

- For instance, Trime’s X-Smart EL1250H raises its hydraulic mast in 10 seconds. The tower carries 4×320-W LED lamps and has 1,000-hour engine service intervals.

By Application

The construction segment led the diesel mobile light tower market in 2024, capturing nearly 41% share. Rising infrastructure investments, nighttime roadwork, and large-scale project expansions have fueled demand across developing economies. These towers ensure continuous illumination in remote or off-grid sites, supporting worker safety and operational efficiency. Additionally, the oil and gas and mining segments are witnessing steady growth due to expanding exploration activities and round-the-clock production schedules. Emergency and defense applications are also increasing, driven by growing requirements for mobile lighting in disaster recovery and field operations.

Key Growth Drivers

Rising Construction and Infrastructure Development

Expanding construction and infrastructure projects across developing and developed nations are driving the diesel mobile light tower market. Large-scale road, bridge, and urban infrastructure activities require continuous lighting for night operations. The growing number of smart city projects and industrial expansion further supports market demand. Mobile light towers are also widely used in temporary and remote locations, ensuring safety and efficiency in 24-hour construction cycles. This widespread adoption makes infrastructure development one of the strongest drivers of long-term market growth.

- For instance, Sunbelt Rentals offers a 4,000-W tower lighting up to 4 acres. Its adjustable mast reaches 30 ft for night roadworks and sites.

Increasing Demand from Mining and Oil & Gas Operations

Diesel mobile light towers are vital for mining and oilfield activities operating in remote and off-grid locations. Their portability, durability, and fuel efficiency enable effective illumination for nighttime drilling, excavation, and safety operations. Rising global energy demand and increasing mining exploration projects in Africa, Australia, and Latin America are fueling this growth. The combination of rugged design and operational reliability under extreme conditions makes diesel-based towers a preferred lighting solution for these sectors.

- For instance, Allight deployed 650+ lighting towers across Pilbara operations. A further 56 units were supplied for the Hope Downs sites.

Growing Shift Toward Rental and Fleet Management Services

The rental market for diesel mobile light towers has grown significantly due to cost efficiency and operational flexibility. Construction and event management companies increasingly prefer short-term rental options to minimize capital expenditure. Integration of telematics and IoT-based monitoring systems enhances fleet management, enabling operators to track fuel usage and maintenance schedules. This trend reduces downtime, increases productivity, and strengthens adoption across industries, positioning rental services as a major growth driver in the evolving market landscape.

Key Trends and Opportunities

Adoption of LED and Hybrid Lighting Systems

The transition from conventional metal halide to LED-based diesel mobile light towers is accelerating. LED systems provide longer service life, lower emissions, and up to 50% higher energy efficiency. Manufacturers are also developing hybrid and solar-assisted diesel towers to meet stringent environmental regulations and reduce fuel dependency. This shift creates strong opportunities for companies investing in energy-efficient lighting technologies while addressing global sustainability goals. The integration of renewable energy elements further enhances product competitiveness in eco-sensitive markets.

- For instance, Generac Mobile’s V20 PRO outputs up to 139,200 lumens. Hybrid mode runtime reaches 471 hours with staged LED dimming.

Integration of Digital Telematics and Remote Monitoring

The growing integration of digital telematics allows real-time performance monitoring and predictive maintenance of mobile light towers. Remote diagnostics help operators optimize fuel consumption and reduce operational costs. The adoption of connected systems enables rental companies and construction firms to manage large fleets efficiently. This trend supports data-driven decision-making and aligns with the broader shift toward Industry 4.0 in equipment management. Such digitalization presents a strong opportunity for technological differentiation among key market players.

- For instance, United Rentals fitted telematics to 335,000+ fleet assets. The connected data enables fuel and maintenance optimisation at scale.

Key Challenges

Environmental Concerns and Emission Regulations

Stringent environmental regulations targeting diesel emissions pose a challenge to market expansion. Governments in Europe and North America are enforcing strict emission norms, compelling manufacturers to develop low-emission or hybrid alternatives. The high cost of compliance and the gradual shift toward electric or solar lighting systems pressure diesel tower manufacturers. These changes increase production expenses and require ongoing innovation to meet sustainability standards while maintaining competitive pricing.

Operational and Maintenance Costs

Diesel mobile light towers face challenges related to fuel consumption, frequent maintenance, and operational downtime. High fuel costs directly impact profitability, especially for large fleets and continuous-use applications. Regular servicing is essential to maintain performance, which adds to overall operational expenses. In remote or extreme environments, access to spare parts and skilled technicians further increases maintenance complexity. These factors limit adoption in cost-sensitive sectors, driving interest toward hybrid and energy-efficient lighting alternatives.

Regional Analysis

North America

North America dominated the diesel mobile light tower market with a 34% share in 2024. The region benefits from extensive infrastructure renovation, highway development, and strong oilfield operations across the U.S. and Canada. High adoption in construction, mining, and emergency response applications supports consistent demand. The presence of leading manufacturers and established rental networks further strengthens market growth. Ongoing technological advancements, such as LED integration and smart fleet monitoring, enhance operational efficiency. Government investments in industrial and public infrastructure projects continue to reinforce the region’s leadership position through 2032.

Europe

Europe accounted for 27% of the diesel mobile light tower market in 2024. Growing adoption in construction, infrastructure modernization, and event management industries drives regional demand. Strict emission regulations are accelerating the shift toward hybrid and energy-efficient light towers. The United Kingdom, Germany, and France are major contributors, emphasizing sustainability and operational reliability. Advancements in noise-reduction technology and the development of rental-based business models are supporting wider adoption. Increased government investments in public safety and emergency response systems are expected to further expand market opportunities across European economies.

Asia Pacific

Asia Pacific held a 25% market share in 2024, driven by rapid urbanization, industrialization, and expanding construction activities. Countries such as China, India, Japan, and Australia are witnessing strong demand for diesel mobile light towers in large-scale infrastructure and mining projects. Growing investments in oil exploration and public works are further boosting market growth. Rental-based deployment is becoming popular among small and medium construction firms due to cost efficiency. The region’s increasing focus on energy-efficient LED lighting and hybrid solutions offers significant growth potential for manufacturers over the forecast period.

Latin America

Latin America represented around 8% of the global diesel mobile light tower market in 2024. Brazil and Mexico are key contributors, driven by rising construction and mining activities. Expanding oil and gas exploration projects, especially offshore operations, create additional demand for mobile lighting systems. The growth of rental services and government-funded infrastructure programs supports steady adoption. However, challenges such as currency fluctuations and high import dependency affect pricing and supply. Gradual economic stabilization and foreign investments in industrial sectors are expected to strengthen market growth through 2032.

Middle East & Africa

The Middle East and Africa accounted for 6% of the diesel mobile light tower market in 2024. Strong oil and gas production, mining, and infrastructure development projects drive regional growth. The Gulf Cooperation Council countries are major adopters, supported by continuous energy exploration and large-scale construction activities. In Africa, South Africa and Nigeria show increasing utilization in mining and disaster management. Harsh environmental conditions and remote operation sites favor diesel-powered lighting due to reliability and durability. Ongoing industrial diversification and infrastructure initiatives are expected to boost demand further across the region.

Market Segmentations:

By Lighting

- Metal Halide

- LED

- Electric

- Others

By Technology

- Manual lifting system

- Hydraulic lifting system

By Application

- Construction

- Infrastructure development

- Oil & Gas

- Mining

- Military & defense

- Emergency & disaster relief

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The diesel mobile light tower market features strong competition among key players such as Caterpillar, Trime, Atlas Copco, United Rentals, Larson Electronics, J C Bamford Excavators, Doosan Portable Power, Allmand Bros, Wacker Neuson, Generac Power Systems, Chicago Pneumatic, Multiquip, Colorado Standby, Aska Equipments, and Inmesol Gensets. These companies compete through product innovation, energy-efficient designs, and strategic partnerships with rental service providers. Manufacturers focus on LED integration, hybrid systems, and telematics to improve operational efficiency and sustainability. Continuous R&D investment supports advancements in fuel optimization and low-emission technologies. Many players are expanding manufacturing facilities and distribution networks in emerging economies to strengthen global presence. Competitive differentiation also arises from digital fleet monitoring, aftersales support, and compliance with emission regulations. Strategic mergers and collaborations enhance market reach, while rental-focused business models continue to gain traction, reflecting the industry’s shift toward flexible, cost-effective lighting solutions for large-scale and remote operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caterpillar

- Trime

- Atlas Copco

- United Rentals

- Larson Electronics

- J C Bamford Excavators

- Doosan Portable Power

- Allmand Bros

- Wacker Neuson

- Generac Power Systems

- Chicago Pneumatic

- Multiquip

- Colorado Standby

- Aska Equipments

- Inmesol Gensets

Recent Developments

- In January 2024, Generac Mobile introduced the GLT Series of mobile light towers.

- In 2024, Larson Electronics introduced a portable mini-LED light tower for tough environments.

- In 2023, Atlas Copco continued to push for more sustainable solutions by launching its HiLight BI+ 4 hybrid light tower.

Report Coverage

The research report offers an in-depth analysis based on Lighting, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The diesel mobile light tower market will experience steady growth driven by global infrastructure expansion.

- Rising adoption of LED and hybrid lighting technologies will enhance efficiency and sustainability.

- Rental and leasing models will continue to dominate due to cost and operational flexibility.

- Integration of IoT and telematics will improve fleet management and performance monitoring.

- Demand from construction, mining, and oilfield sectors will remain the key revenue source.

- Manufacturers will focus on low-emission and fuel-efficient models to meet stricter regulations.

- Emerging economies in Asia Pacific and Africa will offer strong market expansion opportunities.

- Technological upgrades in noise reduction and automation will improve product competitiveness.

- Collaboration between manufacturers and rental service providers will strengthen distribution networks.

- Increasing shift toward hybrid and solar-assisted diesel towers will redefine market sustainability goals.