| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Linseed Oil Market Size 2024 |

USD 9,365.47 million |

| Linseed Oil Market, CAGR |

5.92% |

| Linseed Oil Market Size 2032 |

USD 14,798.94 million |

Market Overview:

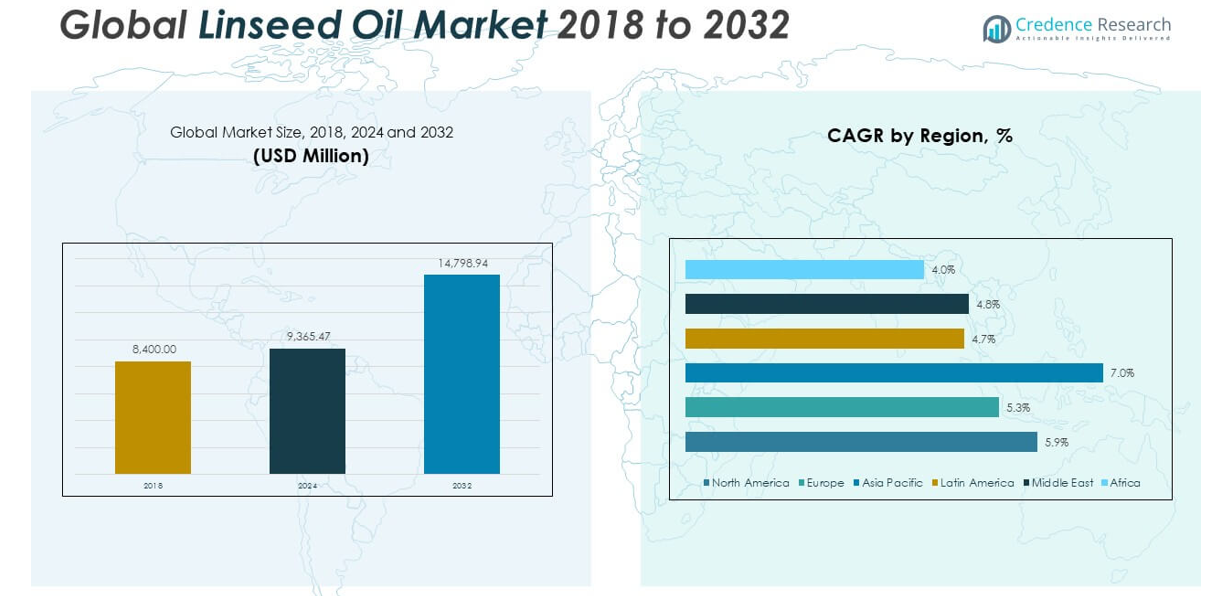

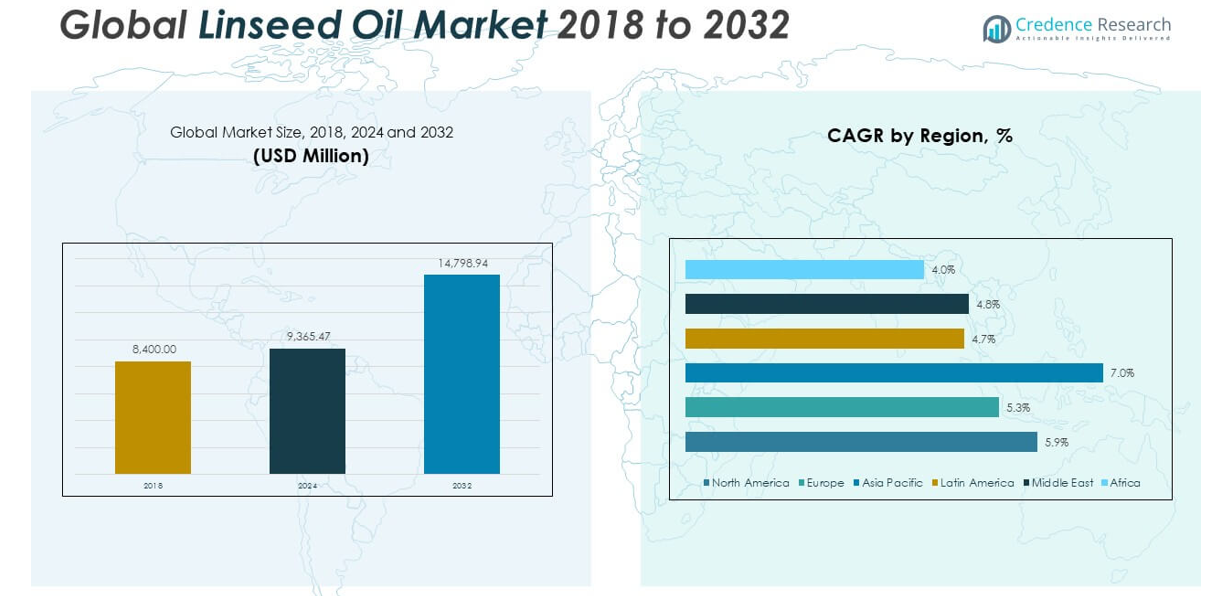

The Global Linseed Oil Market size was valued at USD 8,400.00 million in 2018 to USD 9,365.47 million in 2024 and is anticipated to reach USD 14,798.94 million by 2032, at a CAGR of 5.92% during the forecast period.

Several factors are actively driving the global linseed oil market. Industrial applications remain the largest demand source, especially in wood finishing, paints, and coatings, where linseed oil is prized for its drying and film-forming properties. Simultaneously, the nutraceutical sector is embracing linseed oil due to its high concentration of alpha-linolenic acid (ALA), a plant-based omega-3 fatty acid linked to cardiovascular and anti-inflammatory benefits. Consumers are increasingly seeking natural dietary supplements and functional foods, prompting food manufacturers to incorporate linseed oil into health-oriented product lines. Furthermore, the cosmetic and personal care industries are expanding their use of cold-pressed linseed oil, favored for its antioxidant and skin-nourishing properties. Advances in oil extraction technology—such as cold pressing and solvent-free refining—have improved product purity, shelf life, and processing efficiency, making high-quality linseed oil more widely accessible. In addition, regulatory support in the form of FDA approvals and organic certifications across regions has made it easier for manufacturers to promote linseed oil in diverse applications.

Regionally, the linseed oil market demonstrates varied growth dynamics. North America holds the dominant share of the global market, supported by a well-developed flaxseed supply chain in the U.S. and Canada, along with strong demand in the paints, coatings, and health supplement industries. Europe closely follows, driven by its environmental policies and consumer preference for sustainable and organic products. Countries such as Germany, France, and the UK contribute significantly to regional demand. The most rapid growth is expected in the Asia-Pacific region, where rising population, expanding construction activities, increasing awareness of plant-based health products, and growing cosmetic consumption in countries like China and India are stimulating market expansion. Meanwhile, Latin America, the Middle East, and Africa are gradually emerging as new markets for linseed oil, benefitting from rising industrial investments and increased health-consciousness. Overall, as manufacturers focus on regional strategies and product innovation, the global linseed oil market is set to witness sustained growth in the years ahead.

Market Insights:

- The Global Linseed Oil Market was valued at USD 8,400.00 million in 2018, reached USD 9,365.47 million in 2024, and is expected to reach USD 14,798.94 million by 2032, registering a CAGR of 5.92% during the forecast period.

- Industrial applications such as paints, coatings, wood finishes, and varnishes continue to dominate demand due to linseed oil’s drying and film-forming capabilities.

- The nutraceutical sector is expanding use of linseed oil, driven by its high alpha-linolenic acid (ALA) content, which supports cardiovascular and anti-inflammatory health benefits.

- Consumers are increasingly adopting plant-based supplements and functional foods, prompting food manufacturers to use linseed oil in dietary blends, beverages, and nutrition bars.

- The cosmetics and personal care industry is integrating cold-pressed linseed oil into organic skincare and haircare products, favored for its moisturizing and antioxidant properties.

- Advances in cold-pressing and solvent-free refining technology are improving oil purity, shelf life, and production efficiency, expanding its use across diverse applications.

- North America holds the largest market share, followed by Europe, while Asia-Pacific shows the fastest growth, driven by rising health awareness, population growth, and increased demand in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Eco-Friendly Industrial Raw Materials across Paints, Coatings, and Wood Finishing Sectors:

The growing emphasis on sustainable industrial practices is a major driver behind the adoption of linseed oil in paints, varnishes, wood coatings, and linoleum flooring. Industries are replacing synthetic solvents with plant-based alternatives to comply with environmental regulations and reduce volatile organic compound (VOC) emissions. Linseed oil’s film-forming and quick-drying properties make it highly suitable for eco-conscious product formulations. The construction and renovation sectors increasingly prefer bio-based coatings that offer durability, low toxicity, and reduced carbon footprints. The Global Linseed Oil Market benefits from these industrial trends, particularly in North America and Europe, where sustainability mandates are stringent. Manufacturers are integrating linseed oil into product lines to align with green building codes and obtain certification under eco-labeling programs.

- For instance, AkzoNobel’s bio-based wood coatings utilize linseed oil to achieve volatile organic compound (VOC) emissions below 50 g/L, meeting stringent EU environmental regulations.

Accelerating Adoption of Plant-Based Nutraceuticals and Omega-3 Supplements in Consumer Health Products:

Consumer demand for plant-derived health supplements continues to grow, especially among vegetarian and vegan populations seeking omega-3 sources. Linseed oil is rich in alpha-linolenic acid (ALA), a precursor to EPA and DHA, which supports heart health, brain function, and anti-inflammatory responses. Functional food manufacturers are incorporating linseed oil into dietary supplements, fortified beverages, and nutritional bars. Its recognition by health authorities, such as the FDA and EFSA, has strengthened its appeal among consumers and formulators alike. It helps companies cater to clean-label trends and allergen-free product requirements. The increased focus on preventive healthcare and natural remedies continues to expand the market footprint for linseed oil in the global wellness industry.

- For instance, Barlean’s Organic Oils offers cold-pressed flaxseed oil supplements with an alpha-linolenic acid (ALA) content of 7,200 mg per serving, certified USDA Organic and Non-GMO Project Verified.

Expanding Applications in Natural and Organic Cosmetic and Personal Care Formulations:

The personal care and cosmetics industry has witnessed rising incorporation of linseed oil due to its moisturizing, anti-aging, and anti-inflammatory properties. It is used in skin creams, hair oils, soaps, and lotions, particularly those marketed as organic, cruelty-free, or botanical-based. The cold-pressed variant is especially favored in formulations that target sensitive skin and scalp conditions. The Global Linseed Oil Market leverages this demand, driven by heightened consumer awareness of chemical-free beauty products and the rise of niche brands focused on transparency and sustainability. Beauty product developers value its high fatty acid content and antioxidant profile. It plays a crucial role in natural emulsions, helping brands differentiate in a competitive landscape.

Growing Technological Advancements in Extraction, Refinement, and Product Standardization:

Improvements in cold-press and solvent-free extraction techniques are enhancing the purity and consistency of linseed oil used across various industries. Modern processing methods improve stability and extend shelf life without compromising nutritional value or performance. Manufacturers are investing in precision refining processes to meet regulatory and quality benchmarks in food, cosmetic, and industrial applications. It enables scalable production of high-grade oil that complies with international standards for bio-based inputs. These technological advancements make linseed oil more appealing for high-value end-use applications. Innovation in packaging and preservation techniques also supports broader market penetration and longer distribution cycles.

Market Trends:

Increasing Penetration of Cold-Pressed and Organic Linseed Oil in Premium Product Categories:

The demand for cold-pressed and organic linseed oil is gaining momentum, particularly in premium food, health, and cosmetic products. Consumers associate cold-pressed variants with higher nutritional integrity and minimal processing, aligning with clean-label expectations. Organic certification also enhances trust and marketability, especially in regions where chemical-free production holds strong appeal. Brands are leveraging these attributes to position their products in higher-value market segments with better margins. The Global Linseed Oil Market is adapting by expanding certified organic cultivation and refining practices. It benefits from growing retailer interest in stocking premium, traceable, and health-focused oils across specialty and wellness-focused retail channels.

- For instance, Flora’s cold-pressed organic flaxseed oil is certified organic by third-party organizations and is recognized for its high omega-3 and omega-6 essential fatty acid content.

Growing Use of Linseed Oil in Composite Materials and Eco-Friendly Polymers:

Manufacturers in the automotive and packaging industries are increasingly experimenting with linseed oil in biopolymers and natural fiber composites. It offers flexibility, biodegradability, and compatibility with various fillers and resins used in developing green alternatives to conventional plastics. Research institutions and industrial innovators are testing linseed oil in polyurethane foams, adhesives, and thermoplastic formulations. The trend aligns with the push to reduce dependency on petroleum-based chemicals. The Global Linseed Oil Market is witnessing a gradual shift in demand toward non-traditional sectors that value renewable, low-toxicity raw materials. It supports innovation pipelines aimed at low-emission manufacturing and recyclable product development.

- For instance, recent research has demonstrated that bio-based non-isocyanate polyurethane thermosets synthesized from cyclic carbonate linseed oil can achieve tensile strengths as high as 69.2 MPa and elongation at break of 15.4%.

Emergence of Linseed Oil-Based Animal Nutrition Solutions in Livestock and Pet Food Sectors:

Linseed oil is finding new applications in the animal nutrition sector, where it serves as a source of essential fatty acids in feed formulations. It supports immune function, coat quality, and metabolic health in livestock, poultry, and companion animals. Producers are introducing it into functional feed blends and pet food as a natural alternative to fish oil or synthetic lipid sources. Veterinary research increasingly recognizes the nutritional value of plant-based omega-3 oils in animal health, which broadens the product’s utility. The Global Linseed Oil Market is capitalizing on this trend by expanding supply chains to serve the animal feed industry. It reflects a diversification strategy that enhances resilience across commodity cycles.

Adoption of Blockchain and Digital Tools for Supply Chain Transparency and Traceability:

Leading players are adopting blockchain technology and digital tracking systems to ensure supply chain transparency from farm to finished product. These tools help verify the origin, cultivation practices, and processing methods of linseed oil, addressing growing consumer and regulatory demand for traceability. Digital platforms provide QR code access to product histories, boosting buyer confidence in quality and sourcing integrity. It strengthens brand positioning in competitive markets where ethical sourcing and environmental accountability are critical. The Global Linseed Oil Market is moving toward more data-driven operations that support compliance, recall management, and sustainability audits. It creates value for both producers and end consumers by improving trust and operational efficiency.

Market Challenges Analysis:

Volatile Flaxseed Supply and Price Instability Impacting Production Economics and Profit Margins:

The linseed oil market is highly dependent on flaxseed cultivation, which is vulnerable to climatic variations, limited harvesting regions, and inconsistent yield cycles. Fluctuations in raw material availability lead to erratic pricing, directly affecting production planning and profit margins for oil processors and manufacturers. Smaller players often struggle to maintain stable supply chains, especially when global demand surges or regional crop failures occur. The Global Linseed Oil Market experiences periodic disruptions due to these agricultural uncertainties, making long-term contracts and pricing strategies difficult to manage. It also faces challenges in aligning with buyer expectations on price stability, particularly in cost-sensitive industrial applications. These dynamics force companies to invest in buffer inventories, alternative sourcing, and risk-mitigation strategies, increasing operational complexity.

Limited Consumer Awareness and Product Differentiation in Price-Sensitive Markets:

Despite linseed oil’s nutritional and functional benefits, awareness remains relatively low in many developing and underpenetrated regions. Consumers often confuse it with less expensive edible oils, limiting its perceived value and slowing its adoption across new demographics. Marketing linseed oil effectively requires educational efforts, which add to branding costs, especially for SMEs entering new geographies. The Global Linseed Oil Market also faces difficulties in differentiating products across competing variants, such as cold-pressed, organic, or refined oils, when pricing remains a primary concern. It constrains premium product uptake and discourages investment in innovation and value-added formats. Without robust consumer outreach and regulatory support, broader penetration into mass markets may remain limited.

Market Opportunities:

Expansion into Functional Foods and Fortified Consumer Health Products:

The increasing global focus on preventive health and nutrition presents a significant opportunity for linseed oil in fortified food and beverage categories. Its high omega-3 content, anti-inflammatory benefits, and clean-label appeal make it suitable for use in cereals, dairy alternatives, salad dressings, and nutraceuticals. The Global Linseed Oil Market can capitalize on this demand by targeting functional food manufacturers seeking plant-based alternatives to fish oil. Brands that emphasize health claims and nutritional transparency can build stronger consumer trust. It also benefits from the rising popularity of vegan and allergen-free diets, especially in urban and health-conscious segments. Strategic product development and partnerships with food innovators can open new revenue streams.

Rising Demand for Biodegradable Inputs in Sustainable Packaging and Materials:

Global efforts to reduce plastic pollution and adopt circular economy models create strong demand for biodegradable and bio-based inputs. Linseed oil is gaining attention as a component in natural resins, bio-laminates, and eco-friendly sealants. The Global Linseed Oil Market has the opportunity to supply raw materials for sustainable packaging solutions that align with regulatory and environmental goals. It enables product innovation across automotive, electronics, and consumer goods sectors where green alternatives are in demand. Investments in industrial R&D and product certifications can enhance competitiveness in this emerging domain.

Market Segmentation Analysis:

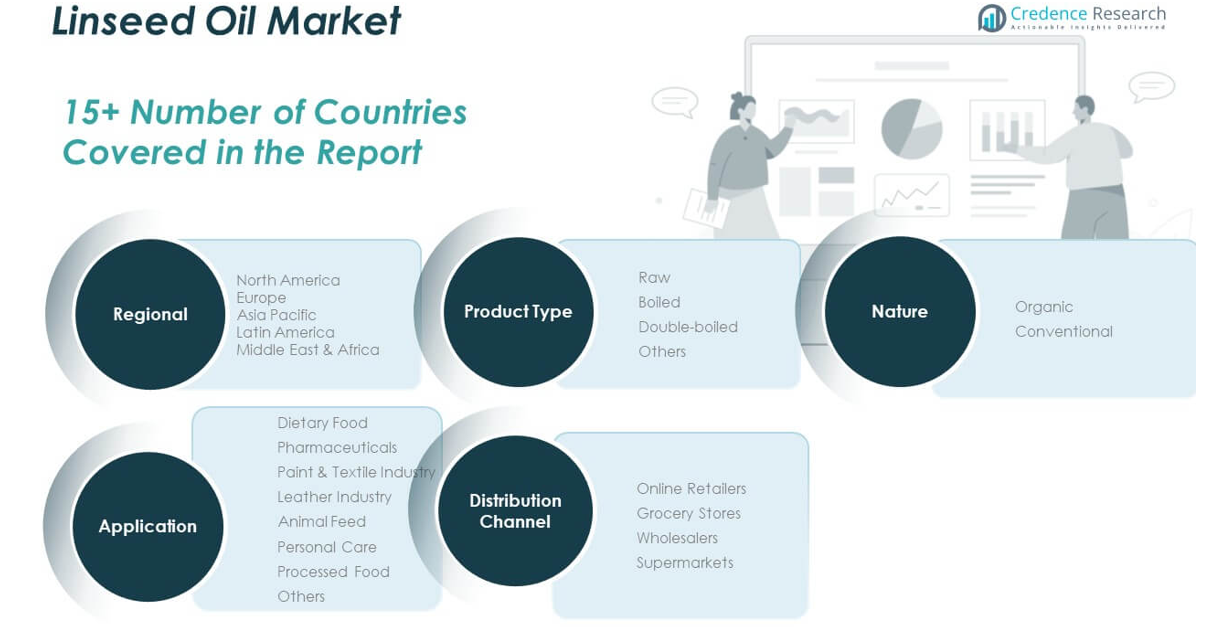

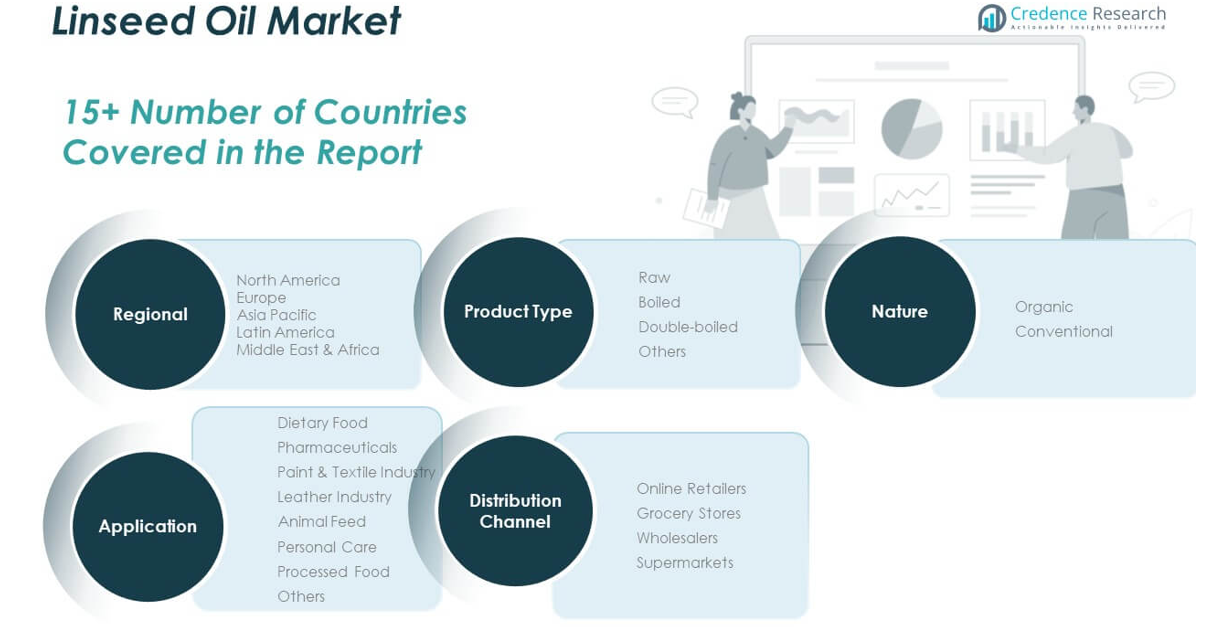

By Product Type

The market is segmented into raw, boiled, double-boiled, and others. Raw linseed oil holds a notable share due to its wide use in dietary, pharmaceutical, and industrial formulations. Boiled and double-boiled linseed oils are widely used in the paint, varnish, and wood finishing sectors for their superior drying and film-forming properties.

- For instance, boiled linseed oil products, as used in industrial wood finishing, can reduce drying times to 12–24 hours compared to several days for raw linseed oil. This acceleration is achieved through the use of metallic catalysts, providing enhanced film hardness and durability for paints and coatings applications.

By Nature

Based on nature, the market is divided into organic and conventional segments. Organic linseed oil is gaining preference among health-conscious consumers seeking clean-label products. However, conventional linseed oil continues to dominate in industrial applications where cost-effectiveness and large-scale availability are key factors.

- For instance, Cargill’s organic linseed oil production facilities in North America have increased output over the past two years, supplying certified organic oils with consistent alpha-linolenic acid content, while their conventional linseed oil products maintain broad industrial usage due to competitive pricing and supply reliability.

By Application

The application segment includes dietary food, pharmaceuticals, paint & textile industry, leather industry, animal feed, personal care, processed food, and others. The paint and textile industry represents a significant share due to the oil’s functional benefits. Dietary and pharmaceutical applications are expanding rapidly owing to its omega-3-rich profile and associated health benefits.

By Distribution Channel

The distribution channel is segmented into online retailers, grocery stores, wholesalers, and supermarkets. Wholesalers and supermarkets remain dominant in volume sales, while online retailers are experiencing steady growth driven by digital transformation and consumer convenience.

Segmentation:

By Product Type

- Raw

- Boiled

- Double-boiled

- Others

By Nature

By Application

- Dietary Food

- Pharmaceuticals

- Paint & Textile Industry

- Leather Industry

- Animal Feed

- Personal Care

- Processed Food

- Others

By Distribution Channel

- Online Retailers

- Grocery Stores

- Wholesalers

- Supermarkets

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Linseed Oil Market size was valued at USD 2,417.52 million in 2018, reached USD 2,654.12 million in 2024, and is anticipated to reach USD 4,186.65 million by 2032, growing at a CAGR of 5.9% during the forecast period. North America leads the Global Linseed Oil Market, driven by strong industrial demand and a well-established flaxseed supply chain, particularly in the U.S. and Canada. It benefits from growing consumption in dietary supplements, eco-friendly coatings, and organic personal care products. The market shows strong alignment with sustainability trends and regulatory support. The region also supports advanced distribution and branding infrastructure. Product innovation and clean-label preferences enhance market value. It continues to attract investment across food, pharma, and cosmetic applications.

Europe

The Europe Linseed Oil Market size was valued at USD 2,530.08 million in 2018, reached USD 2,725.10 million in 2024, and is anticipated to reach USD 4,098.60 million by 2032, growing at a CAGR of 5.3% during the forecast period. Europe holds the second-largest share of the market, supported by its strong bioeconomy framework and preference for sustainable materials. Germany, France, and the UK lead consumption across industrial and consumer applications. High demand for organic and cold-pressed variants supports expansion in health and beauty segments. Regulatory standards encourage use in paints, coatings, and pharmaceutical products. The market benefits from high consumer awareness and diversified applications. It maintains steady growth through product differentiation and eco-friendly innovation.

Asia Pacific

The Asia Pacific Linseed Oil Market size was valued at USD 2,427.60 million in 2018, reached USD 2,808.20 million in 2024, and is anticipated to reach USD 4,828.90 million by 2032, growing at a CAGR of 7.0% during the forecast period. Asia Pacific is the fastest-growing region in the Global Linseed Oil Market, with strong demand across China, India, and Japan. Industrial expansion, health awareness, and dietary diversification drive usage across food, pharma, and coatings. Local cultivation of flaxseed is increasing but remains supplemented by imports. Online retail and brand-led marketing improve accessibility. Personal care and dietary oil products are rapidly gaining popularity. Strong growth potential exists across functional food and natural health segments.

Latin America

The Latin America Linseed Oil Market size was valued at USD 421.68 million in 2018, reached USD 464.43 million in 2024, and is anticipated to reach USD 666.99 million by 2032, growing at a CAGR of 4.7% during the forecast period. Latin America is gradually expanding, with Brazil leading regional consumption. Key applications include dietary health, pharmaceuticals, and industrial coatings. Demand for natural oils is rising in urban markets, supported by health trends and growing awareness. Import reliance remains high, though domestic production is improving. Retail channels are expanding through digital platforms and health-focused outlets. The market offers opportunities for organic and value-added linseed oil products.

Middle East

The Middle East Linseed Oil Market size was valued at USD 365.40 million in 2018, reached USD 384.86 million in 2024, and is anticipated to reach USD 556.52 million by 2032, growing at a CAGR of 4.8% during the forecast period. The Middle East shows increasing demand for linseed oil in wellness, beauty, and dietary applications. The UAE and Saudi Arabia drive regional growth through retail modernization and rising disposable incomes. Imports dominate supply chains, but demand for quality plant-based oils continues to rise. Industrial use in coatings and leather processing is also contributing. Health-conscious consumers are influencing product placement and packaging. Regional trade channels are supporting wider product penetration.

Africa

The Africa Linseed Oil Market size was valued at USD 237.72 million in 2018, reached USD 328.77 million in 2024, and is anticipated to reach USD 461.27 million by 2032, growing at a CAGR of 4.0% during the forecast period. Africa represents an emerging region with growing interest in dietary oils, animal feed, and pharmaceutical-grade applications. South Africa and Egypt lead demand, driven by urbanization and increasing awareness. The market faces supply limitations but shows promise in wellness and natural beauty segments. Imports fulfill much of the regional demand, but localized distribution is expanding. Retail infrastructure is improving gradually. Continued education and brand investment could accelerate regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cargill Inc.

- Archer Daniels Midland Company

- Gustav Hesse GmbH

- Henry Lamotte Oils GmbH

- Krishi Oils Limited

- Natrol LLC.

- AOS Products Pvt. Ltd.

- Jajjo Brothers

- OPW Ingredients

- Spectrum Chemical Mfg. Corp.

- Sanmark Corp.

- Sarika Ventures Pvt. Ltd.

- Alberdingk Boley GmbH

- Hangzhou Choisun Bio-tech Co. Ltd.

- ECO Overseas

- G. Industries

- Vandeputte Group

- Bartolini Ltd.

- Grupo Plimon

Competitive Analysis:

The Global Linseed Oil Market is moderately fragmented, with a mix of multinational corporations and regional players competing on quality, pricing, and distribution. Leading companies such as Cargill Inc., Archer Daniels Midland Company, and Henry Lamotte Oils GmbH maintain a strong presence through integrated supply chains and diversified product portfolios. It sees rising competition from niche manufacturers focusing on organic and cold-pressed variants, which appeal to health-conscious and premium consumer segments. Companies invest in extraction technologies, packaging innovation, and clean-label certifications to gain market share. Strategic partnerships with food, pharmaceutical, and cosmetic brands enhance distribution and visibility. Local firms in emerging markets compete through cost efficiency and domestic sourcing. The market dynamics are shaped by brand positioning, regulatory compliance, and responsiveness to evolving consumer preferences. It continues to evolve through innovation and targeted expansion in high-growth regions, particularly in Asia Pacific and Latin America.

Recent Developments:

- In May 2025, Cargill was recognized as the world’s leading edible oil supplier for removing industrial trans fats from its entire portfolio, including linseed oil. This achievement reflects Cargill’s ongoing innovation and commitment to healthier, safer food ingredients. The company’s bioindustrial division continues to offer a range of linseed oil products for industrial and food applications, focusing on sustainability and compliance with global health standards.

- In March 2023, Archer Daniels Midland Company (ADM) launched the Knwble Grwn brand, featuring sustainably produced, plant-based food ingredients such as flaxseed and flax oil (linseed oil). This product line is aimed at environmentally conscious consumers and highlights ADM’s commitment to sustainability and direct-to-consumer sales in the linseed oil segment.

Market Concentration & Characteristics:

The Global Linseed Oil Market exhibits moderate market concentration, with a balanced presence of global corporations and specialized regional producers. It is characterized by diversified applications across industrial, dietary, pharmaceutical, and cosmetic sectors. The market favors vertically integrated players with strong control over raw material sourcing and processing. It supports both bulk commodity production and value-added segments such as organic and cold-pressed oils. Product differentiation, regulatory compliance, and sustainability alignment shape competitive positioning. It demonstrates steady demand across mature markets while offering high growth potential in developing economies. The market structure allows for innovation, private-label growth, and partnerships across multiple distribution channels.

Report Coverage:

The research report offers an in-depth analysis based on product type, nature, application, distribution channel, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Linseed Oil Market is expected to maintain steady growth driven by rising demand across industrial, dietary, and personal care applications.

- Expansion of functional foods and plant-based supplements will strengthen market penetration in health-conscious consumer segments.

- Advancements in cold-press and solvent-free extraction will improve product quality, enabling premium positioning.

- Increased preference for biodegradable raw materials will elevate linseed oil usage in paints, coatings, and natural polymers.

- Growth in organic product demand will boost adoption of certified linseed oil across food and cosmetics.

- Asia Pacific will continue to lead in growth rate, supported by industrial expansion and rising wellness trends.

- Strategic partnerships and mergers are likely to enhance global supply chains and product innovation.

- E-commerce and digital distribution will improve market access, particularly in underpenetrated regions.

- Sustainability regulations and clean-label preferences will shape new product development and branding.

- Continued investment in R&D and processing infrastructure will drive efficiency and market competitiveness.