Market Overview

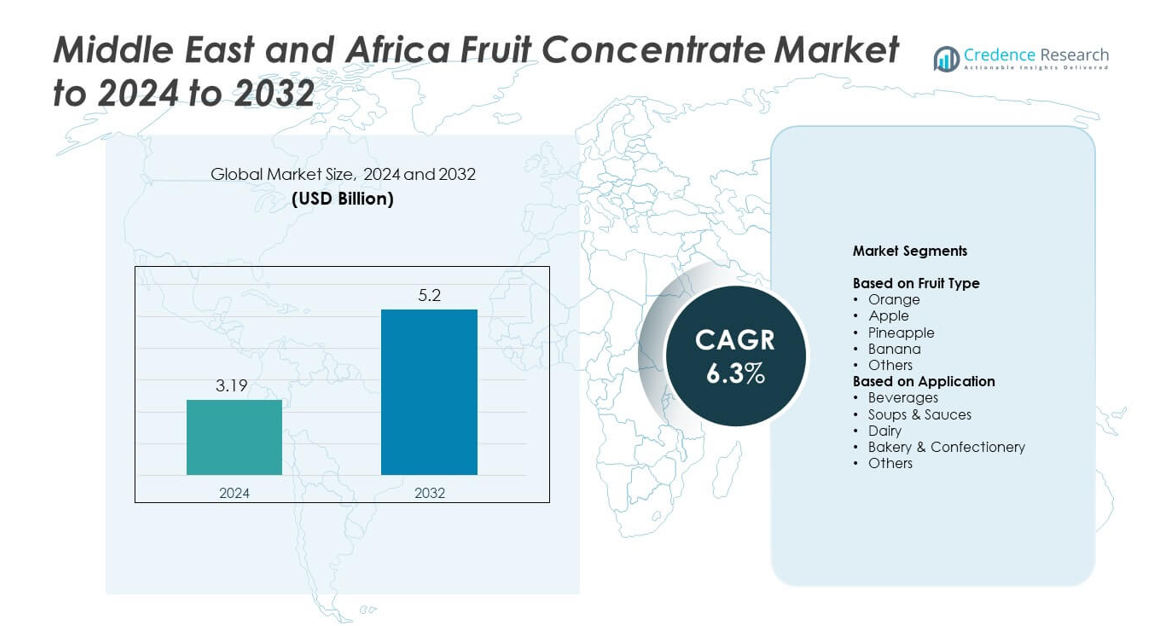

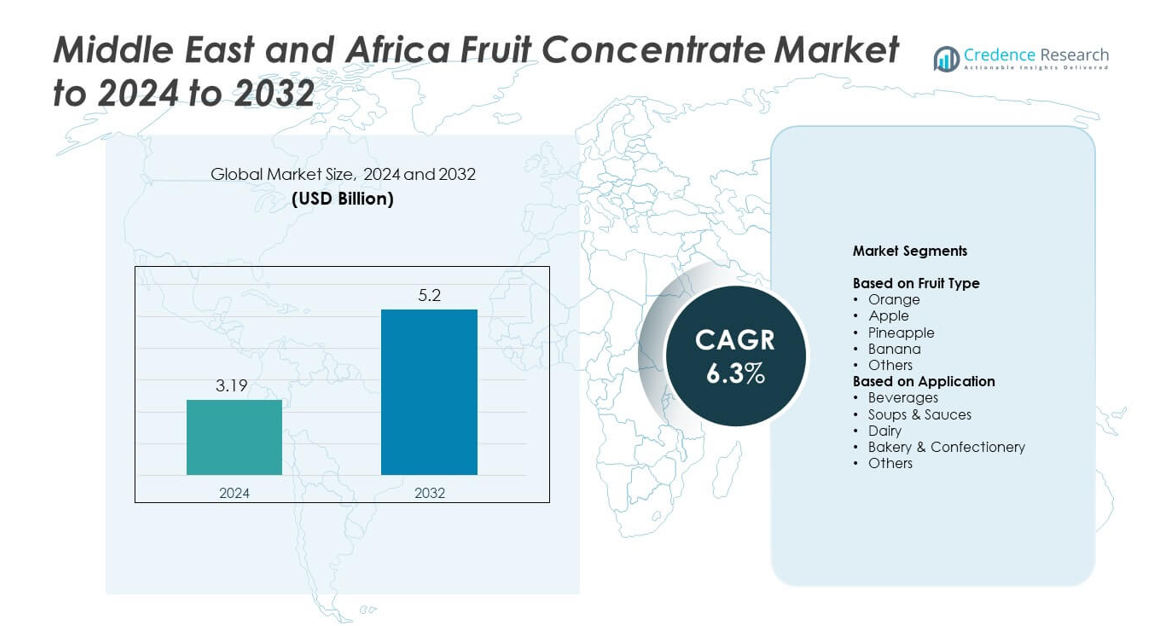

Middle East and Africa Fruit Concentrate Market size was valued at USD 3.19 Billion in 2024 and is anticipated to reach USD 5.2 Billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East and Africa Fruit Concentrate Market Size 2024 |

USD 3.19 Billion |

| Middle East and Africa Fruit Concentrate Market, CAGR |

6.3% |

| Middle East and Africa Fruit Concentrate Market Size 2032 |

USD 5.2 Billion |

The Middle East and Africa Fruit Concentrate Market includes major players such as Del-Monte Foods Inc., Argana Group, Rubicon Arabia, Diana Food, Almarai Company, Archer Daniels Midland Co., Alsafi Farmand, Dohler Company, SkyPeople Fruit Juice Inc., and Ingredion Incorporated. These companies strengthen market presence through advanced processing, wider distribution, and strong partnerships with beverage, dairy, and bakery manufacturers. South Africa leads the regional landscape with a 39% share in 2024 due to strong fruit production and developed processing facilities, followed by Saudi Arabia at 27% and the Rest of Middle East at 21%, driven by rising demand for packaged beverages and growing foodservice activity.

Market Insights

- Middle East and Africa Fruit Concentrate Market was valued at USD 3.19 Billion in 2024 and is projected to reach USD 5.2 Billion by 2032, growing at a CAGR of 6.3%.

- Market growth is driven by rising demand for affordable juices, expanding food processing activities, and increasing use of concentrates in dairy, bakery, and beverage formulations.

- Clean-label preferences and investment in local processing facilities shape market trends, while orange concentrate leads the fruit type segment with 38% share and beverages dominate applications with 46% share.

- Competition strengthens as regional and global producers upgrade processing technologies and expand distribution, though high production and logistics costs remain key restraints.

- South Africa holds 39% of the regional market, followed by Saudi Arabia at 27% and the Rest of Middle East at 21%, supported by strong beverage consumption and expanding foodservice sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fruit Type

Orange led the fruit type segment in 2024 with about 38% share of the Middle East and Africa Fruit Concentrate Market. Demand stayed strong because orange concentrate offers high versatility, long shelf life, and cost-efficient storage for beverage producers. Food manufacturers used orange concentrate in juices, flavored drinks, and sweet formulations due to its steady supply across regional processing hubs. Apple and pineapple concentrates also expanded as bakeries and dairy brands used these variants to enhance flavor stability and reduce seasonal dependence.

- For instance, at Citrosuco’s Matão plant in Brazil, about 100,000 oranges are processed every minute into juice and concentrate.

By Application

Beverages dominated the application segment in 2024 with nearly 46% share of the Middle East and Africa Fruit Concentrate Market. Growth accelerated as juice makers, soft drink producers, and nectar manufacturers relied on concentrates to reduce production costs and maintain consistent taste. Beverages remained the key driver because urban consumers preferred ready-to-drink products with longer shelf life. Dairy, bakery, and sauce manufacturers also increased uptake as they used concentrates to improve color strength, sweetness, and natural flavor profiles.

- For instance, Innocent Drinks’ “Blender” factory in Rotterdam is designed to produce around 400 million bottles of chilled juices and smoothies every year for multiple European markets.

Key Growth Drivers

Rising Demand for Affordable Processed Beverages

Growing interest in low-cost juices and flavored drinks boosts fruit concentrate use across the Middle East and Africa Fruit Concentrate Market. Producers rely on concentrates to manage price volatility and ensure year-round supply despite seasonal fruit shortages. Urban buyers choose ready-to-drink options due to busy routines, which strengthens demand from beverage companies. This shift increases investment in modern processing units and encourages manufacturers to expand flavor lines for mass-market consumption.

- For instance, Coca-Cola’s Cappy juice brand had expanded distribution to more than 25 countries by 2025, supporting wider access to processed fruit beverages.

Expansion of Food Manufacturing and Retail Networks

Food processors scale operations as supermarkets and convenience stores widen their presence across major MEA cities. These businesses use fruit concentrates in dairy, bakery, confectionery, and sauce products to maintain flavor consistency. Rising disposable income supports higher spending on packaged foods, pushing companies to adopt concentrates for better stability and lower waste. The expansion of cold chains and distribution systems further increases adoption among medium and large food manufacturers.

- For instance, Egyptian producer Domty planned to invest EGP 100 million in a new factory in 6th of October City, with the facility intended to cover an area of approximately 27,000 square meters.

Shift Toward Longer Shelf-Life Ingredients

Producers prioritize ingredients with better stability to reduce spoilage and extend product life. Fruit concentrates meet this need by offering higher solids, easier transport, and lower storage costs. Manufacturers in warm climates prefer concentrates because they withstand temperature fluctuations better than fresh juices. This preference encourages broader use across beverage, dairy, and bakery segments, supporting sustained growth in the Middle East and Africa Fruit Concentrate Market.

Key Trends & Opportunities

Growth in Clean-Label and Natural Product Lines

Demand rises for natural flavors and clean-label ingredients as consumers seek healthier choices. Fruit concentrates support this trend by offering color and sweetness without synthetic additives. Brands use these benefits to launch reformulated juices, dairy drinks, and plant-based products. This shift creates opportunities for producers to supply premium and minimally processed concentrates across both retail and industrial channels.

- For instance, Blue Skies switched to locally made, lighter-weight juice bottle preforms for its operations in Ghana. This strategic change reduced plastic use by about 5 tonnes(4,500 kg or approximately 9,920 pounds) every year across its operations while also reducing the number of trucks on the road needed to transport preforms to the factory.

Rising Investment in Local Processing Facilities

Governments and private investors expand local fruit-processing capacity to reduce dependence on imports. New plants improve access to orange, apple, and tropical fruit concentrates across domestic industries. Enhanced processing helps farmers gain higher value from surplus fruits and reduces post-harvest losses. Regional players use this advantage to strengthen supply stability and offer competitively priced concentrates for multiple applications.

- For instance, Sahara for Fruit Processing launched its state-of-the-art juice concentrate factory in Egypt with a capacity to process 150,000 tonnes of oranges annually, producing premium juice concentrates, purees, and oils for global markets.

Growing Use of Concentrates in Functional Foods

Producers develop fortified beverages, yogurt drinks, and energy blends using nutrient-rich concentrates. These products appeal to health-focused consumers who want natural ingredient bases. The trend opens opportunities for concentrates with higher vitamin retention and specialty blends. Companies use innovation to differentiate products in an increasingly competitive functional food market.

Key Challenges

Supply Instability and Seasonal Dependence

Local fruit production faces periodic shortages due to weather fluctuations, limited irrigation, and pest issues. These factors disrupt the consistent flow of raw materials required for concentrate manufacturing. Processors often resort to imports, increasing costs and exposure to global price swings. Smaller producers struggle to compete, which limits the pace of market expansion in some regions.

High Production and Logistics Costs

Energy-intensive processing, complex storage needs, and rising freight charges increase operational expenses. These costs reduce margins for concentrate manufacturers and limit affordability for downstream buyers. Infrastructure gaps in transport and cold chain systems add further pressure. Many small and medium businesses face difficulty scaling production due to these persistent cost barriers.

Regional Analysis

South Africa

South Africa held the leading position in the Middle East and Africa Fruit Concentrate Market in 2024 with about 39% share. Strong fruit production in apples, oranges, and tropical varieties supports stable concentrate supply for beverage, bakery, and dairy manufacturers. Local processors benefit from advanced facilities and export-focused networks that enhance product consistency. Rising consumption of packaged juices and flavored drinks strengthens market growth. Expanding retail chains and greater adoption of clean-label products further encourage manufacturers to introduce new formulations using concentrates.

Saudi Arabia

Saudi Arabia accounted for nearly 27% share of the Middle East and Africa Fruit Concentrate Market in 2024. Demand grows due to heavy reliance on imported concentrates and a rising shift toward value-added beverage products. Local food processors use concentrates to maintain uniform taste and reduce production costs in strict climate conditions. Expanding urban populations and higher consumption of ready-to-drink beverages push companies to scale operations. Government initiatives promoting domestic food processing also support ongoing growth across beverage and dairy applications.

Rest of Middle East

The Rest of Middle East region captured around 21% share of the Middle East and Africa Fruit Concentrate Market in 2024. Growth improves as beverage makers, confectionery producers, and dairy brands adopt concentrates to stabilize supply chains. Countries in this group depend significantly on imports due to limited fruit cultivation, which increases opportunities for global suppliers. Rising tourism and foodservice expansion boost demand for juice blends, sauces, and flavored products. Improved logistics and investment in food manufacturing strengthen long-term prospects for concentrate adoption across multiple applications.

Market Segmentations:

By Fruit Type

- Orange

- Apple

- Pineapple

- Banana

- Others

By Application

- Beverages

- Soups & Sauces

- Dairy

- Bakery & Confectionery

- Others

By Geography

- South Africa

- Saudi Arabia

- Rest of Middle East

Competitive Landscape

Del-Monte Foods Inc., Argana Group, Rubicon Arabia, Diana Food, Almarai Company, Archer Daniels Midland Co., Alsafi Farmand, Dohler Company, SkyPeople Fruit Juice Inc., and Ingredion Incorporated shape the competitive landscape of the Middle East and Africa Fruit Concentrate Market. The market features a mix of multinational suppliers and strong regional producers, each focusing on expanding processing capacity and improving product quality to meet rising demand from beverage, dairy, and bakery sectors. Companies invest in advanced concentration technologies to enhance flavor retention and shelf stability. Many players strengthen local sourcing networks to reduce reliance on imported raw materials, while others focus on developing clean-label and natural concentrate lines. Competition also increases as brands seek partnerships with large food manufacturers and expand distribution across retail and foodservice channels. Strategic moves such as facility upgrades, product diversification, and regional expansion continue to define the competitive direction of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Del-Monte Foods Inc.

- Argana Group

- Rubicon Arabia

- Diana Food

- Almarai Company

- Archer Daniels Midland Co.

- Alsafi Farmand

- Dohler Company

- SkyPeople Fruit Juice Inc.

- Ingredion Incorporated

Recent Developments

- In 2025, Almarai Co Ltd Introduced a premium organic fruit juice line in Saudi Arabia in February.

- In 2025, Rubicon Arabia Introduced “Rubicon Kids” juices in the UAE in August.

- In 2024, Döhler announced and inaugurated the expansion of its existing Paarl, South Africa manufacturing facility to enhance its African operations.

Report Coverage

The research report offers an in-depth analysis based on Fruit Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for affordable juice concentrates will rise as beverage brands expand product lines.

- Local processing capacity will grow due to new investments in fruit-handling facilities.

- Adoption of clean-label and natural concentrates will increase across major food categories.

- Import dependence will remain high in low-production areas, creating opportunities for global suppliers.

- Concentrates will gain wider use in dairy drinks, flavored yogurts, and functional beverages.

- Foodservice and tourism growth will boost demand for ready-to-use fruit bases.

- Supply chain upgrades will improve access to stable and high-quality concentrate stocks.

- Energy-efficient processing technologies will support cost reduction for manufacturers.

- Cross-border trade within the region will expand as logistics become more integrated.

- Rising health awareness will drive innovation in nutrient-rich and reduced-sugar concentrate blends.