Market Overview:

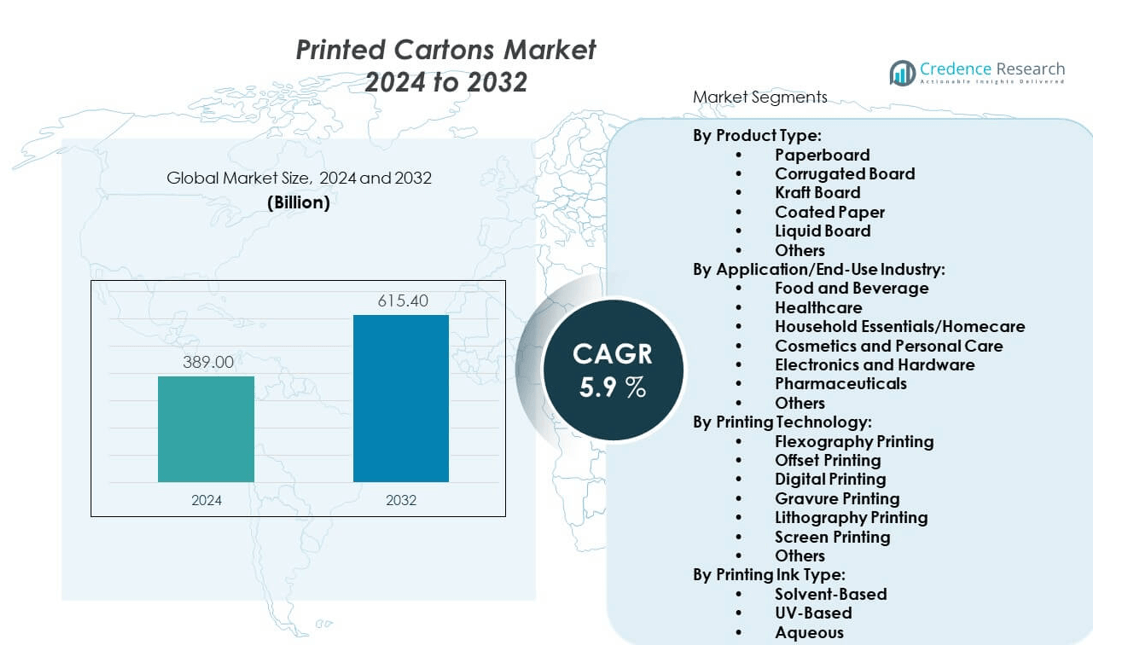

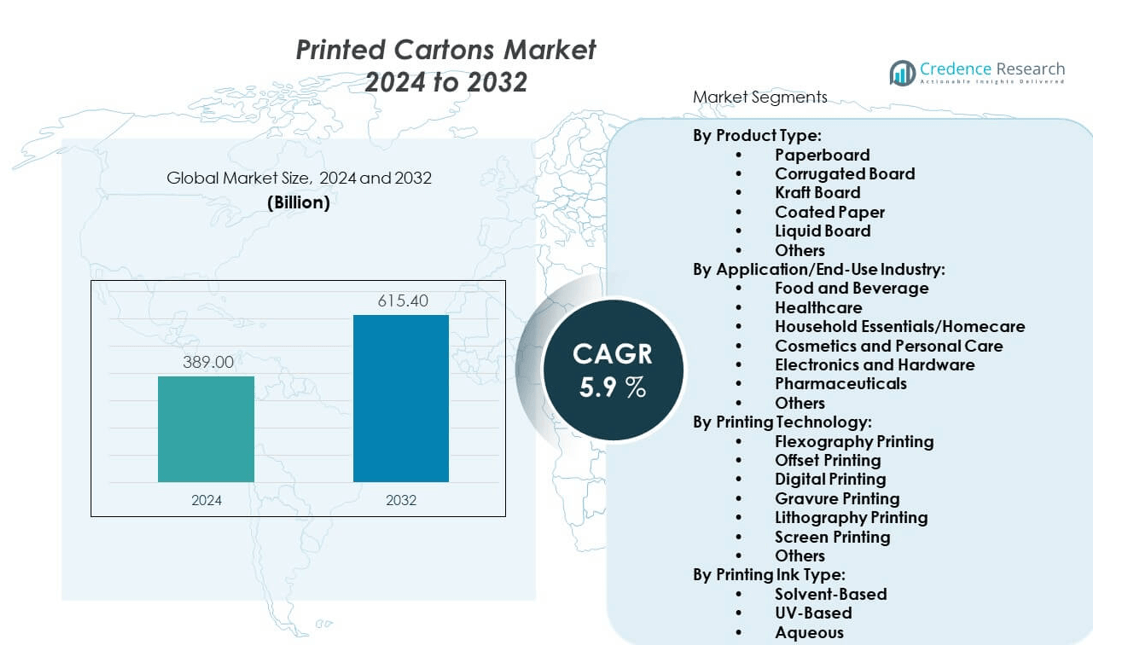

The Printed cartons market is projected to grow from USD 389 billion in 2024 to an estimated USD 615.4 billion by 2032, with a compound annual growth rate (CAGR) of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Printed Cartons Market Size 2024 |

USD 389 billion |

| Printed Cartons Market, CAGR |

5.9% |

| Printed Cartons Market Size 2032 |

USD 615.4 billion |

The market benefits from multiple drivers that actively reshape its dynamics. Increasing consumer preference for packaged and branded products fuels steady adoption of printed cartons. Companies use printed designs to enhance product visibility, support brand differentiation, and communicate sustainability commitments. Rising e-commerce activities further amplify demand for durable, lightweight, and visually appealing packaging solutions. At the same time, technological advancements in printing methods, such as digital and offset printing, improve quality and cost efficiency, encouraging manufacturers to expand printed carton applications across diverse industries.

Regionally, Asia-Pacific leads the printed cartons market, supported by rapid urbanization, population growth, and a surge in packaged food and beverage consumption in countries like China and India. Europe and North America remain strong markets, driven by strict sustainability regulations, high consumer awareness, and strong adoption of recyclable packaging. Latin America and the Middle East & Africa are emerging markets, where rising retail expansion, evolving consumer lifestyles, and growing manufacturing activities stimulate demand for printed cartons, offering significant growth opportunities for packaging providers.

Market Insights:

- The printed cartons market was valued at USD 389 billion in 2024 and is projected to reach USD 615.4 billion by 2032, growing at a CAGR of 9% during the forecast period.

- Rising demand for packaged food, beverages, pharmaceuticals, and personal care products drives the adoption of printed cartons as a versatile, durable, and branding-focused packaging solution.

- Strong emphasis on sustainability and eco-friendly materials accelerates the shift toward recyclable, biodegradable, and lightweight carton packaging formats across industries.

- High raw material price volatility and supply chain disruptions remain major restraints, creating challenges for manufacturers in managing costs and ensuring steady production.

- Asia-Pacific leads the market with strong consumption in China and India, supported by rapid urbanization, population growth, and expanding retail sectors.

- North America and Europe remain mature markets driven by regulatory compliance, sustainability initiatives, and advanced printing technologies.

- Latin America and the Middle East & Africa are emerging markets, gaining momentum through rising consumer demand, retail growth, and industrial expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Food and Beverage Packaging Enhances Printed Cartons Adoption:

The printed cartons market gains momentum from increasing consumption of packaged food and beverages, where brands rely on visually distinctive and durable packaging formats. It benefits from rising urban populations that demand convenient and ready-to-eat meals packaged in lightweight, recyclable cartons. It supports product differentiation by providing flexible printing options that showcase logos, nutritional details, and sustainability claims. It ensures strong shelf appeal, which influences consumer purchase decisions in competitive retail environments. It delivers cost-effective branding opportunities for manufacturers across large product portfolios. It aligns with growing sustainability regulations that encourage the use of recyclable and biodegradable packaging formats. It adapts to shifting lifestyle patterns where consumers prefer hygienic, secure, and branded food packaging. It positions cartons as a central solution in balancing functionality with marketing impact.

- For instance, Amcor’s advanced coating facility in Malaysia, opened in early 2025, enhances production capabilities specifically for healthcare packaging, supply chains and improved sustainability compliance.

Growth in Pharmaceutical Sector Boosts High-Quality Printed Carton Utilization:

The printed cartons market expands with rising pharmaceutical demand, where secure and informative packaging is critical for patient safety and regulatory compliance. It ensures precision by supporting clear dosage instructions, barcoding, and anti-counterfeit features embedded into carton designs. It strengthens supply chain visibility through track-and-trace solutions, which improve distribution efficiency for pharmaceutical companies. It plays a role in safeguarding sensitive medicines, as printed cartons provide protective layers against contamination and damage. It caters to the rising demand for personalized medicine, which requires flexible printing capabilities for smaller batch production. It meets compliance with stringent labelling standards imposed by global health authorities. It supports innovation in child-resistant and tamper-evident designs that improve patient trust. It positions printed cartons as an indispensable part of pharmaceutical packaging strategies.

- For instance, WestRock’s deployment of enhanced tamper-evident folding cartons for pharmaceutical clients in 2025 includes integrated serialization features that comply with global track-and-trace mandates, improving patient safety and regulatory adherence.

Expansion of E-Commerce Platforms Drives Broader Printed Carton Applications:

The printed cartons market grows with the accelerating expansion of e-commerce platforms, where packaging serves both protective and promotional functions. It addresses consumer expectations for safe delivery of goods by providing durable and lightweight structures. It enhances unboxing experiences through customizable printing that increases brand recognition and customer loyalty. It integrates QR codes and digital links to offer interactive engagement and detailed product information. It plays a critical role in reducing logistics costs by offering compact, stackable, and lightweight packaging. It adapts to the rise in small parcel deliveries, where efficient use of materials ensures protection and sustainability. It serves as a communication medium for companies to display promotions, offers, or safety instructions. It reflects the growing reliance on printed cartons for modern retail ecosystems.

Sustainability Regulations and Eco-Friendly Consumer Choices Encourage Market Expansion:

The printed cartons market benefits from increasing environmental awareness and stricter government mandates encouraging recyclable packaging. It aligns with global consumer demand for eco-friendly products, creating opportunities for bio-based inks and renewable raw materials. It allows manufacturers to respond to extended producer responsibility (EPR) policies that require sustainable packaging solutions. It enables companies to reduce carbon footprints by adopting lightweight and recyclable carton options. It helps brands strengthen corporate social responsibility (CSR) goals by adopting green printing practices. It ensures compatibility with circular economy principles by supporting recycling and reuse. It drives investment in advanced printing technologies that minimize waste and energy consumption. It positions printed cartons as one of the most sustainable options across industries.

Market Trends:

Adoption of Smart Packaging Features Enhances Consumer Engagement:

The printed cartons market observes strong growth in the integration of smart packaging technologies, including QR codes, RFID tags, and augmented reality elements. It creates new opportunities for consumer interaction by providing digital content through printed cartons. It enhances transparency by enabling instant access to product origins, sustainability certifications, and usage instructions. It offers supply chain benefits by improving tracking and monitoring efficiency. It fosters stronger brand loyalty through interactive campaigns that transform packaging into a marketing tool. It reflects a growing emphasis on digital transformation across packaging industries. It helps companies differentiate themselves in crowded retail spaces. It positions smart packaging as an evolving trend reshaping consumer experience and industry competitiveness.

Premiumization of Consumer Goods Strengthens Demand for High-End Printed Cartons:

The printed cartons market witnesses increasing demand for premium packaging in cosmetics, luxury goods, and specialty food segments. It supports brand strategies that rely on high-quality visuals, embossed logos, and metallic finishes. It enables customization for limited edition or seasonal products, which attract high-value consumers. It leverages advanced printing technologies like UV coating and 3D printing to create striking shelf appeal. It complements the luxury positioning of premium brands by delivering superior aesthetics and tactile effects. It raises consumer perception of quality through refined carton designs. It stimulates investments in specialty inks and advanced materials. It highlights premiumization as a vital trend that accelerates innovation within printed carton solutions.

- For instance, Mondi completed the acquisition of Schumacher Packaging’s Western Europe assets in early 2025, enabling expanded capacity for high-end UV-coated and embossed carton production tailored for luxury cosmetic brands demanding avant-garde finishing technologies.

Technological Advancements in Printing Improve Speed, Quality, and Cost Efficiency:

The printed cartons market is reshaped by rapid technological advancements in digital, offset, and flexographic printing techniques. It ensures high-speed production with precise graphic quality that meets evolving customer needs. It allows manufacturers to achieve cost efficiency through reduced waste and shorter turnaround times. It supports flexibility in small-batch or large-scale production, catering to diverse industries. It facilitates vibrant, multi-color printing with improved accuracy. It contributes to meeting rising demand for customized packaging solutions. It allows for faster product launches with streamlined production cycles. It positions advanced printing technology as a core trend driving growth and transformation.

Increased Focus on Personalization and Customization in Carton Designs:

The printed cartons market experiences a surge in personalized packaging demand driven by consumer preference for unique and tailored experiences. It encourages companies to adopt variable data printing for individual names, designs, or localized content. It enhances emotional connections between brands and customers by delivering personalized messages. It supports direct-to-consumer strategies where packaging becomes an extension of brand identity. It enables regional campaigns with language-specific or culturally adapted graphics. It boosts consumer loyalty by creating memorable unboxing experiences. It strengthens competitiveness by helping brands stand out in saturated markets. It marks personalization as an important trend shaping future carton applications.

Market Challenges Analysis:

Volatile Raw Material Costs and Supply Chain Disruptions Limit Growth:

The printed cartons market faces significant challenges due to fluctuating costs of raw materials such as paperboard, inks, and adhesives. It impacts profit margins for manufacturers who struggle to absorb rising expenses without passing them to consumers. It complicates supply chain management, particularly during global disruptions that delay production and distribution. It increases reliance on efficient procurement strategies and supplier diversification. It forces companies to adopt risk-mitigation measures to stabilize operations. It creates uncertainty that slows investment in capacity expansions. It raises concerns about affordability in price-sensitive markets. It underscores the vulnerability of the industry to economic and geopolitical volatility.

Intense Competition and Sustainability Pressures Create Strategic Strain:

The printed cartons market encounters strong competition from alternative packaging materials such as flexible pouches, plastics, and rigid containers. It pressures manufacturers to continually invest in innovation and cost reduction to retain customers. It demands consistent improvements in recyclability and eco-friendly materials to meet sustainability expectations. It raises operational costs as companies comply with strict environmental regulations. It challenges firms to balance affordability with sustainability commitments. It limits the entry of smaller players who lack resources for advanced technology adoption. It forces established firms to differentiate through design, innovation, and service excellence. It illustrates the growing intensity of competition shaping market outcomes.

Market Opportunities:

Expansion of Emerging Markets Provides Significant Growth Potential:

The printed cartons market finds growth opportunities in rapidly industrializing regions where rising disposable incomes and urbanization drive packaged goods consumption. It benefits from increasing demand in Asia-Pacific, Latin America, and parts of Africa where retail infrastructure is expanding. It allows companies to tap into untapped demographics with affordable, branded packaging. It helps industries strengthen supply chain presence in new regions. It positions printed cartons as a cost-effective and scalable solution for evolving markets. It highlights the role of demographic expansion in sustaining long-term growth. It creates strategic opportunities for global packaging firms to diversify revenue streams. It underscores geographic expansion as a vital driver of opportunity.

Rising Demand for Sustainable and Innovative Designs Creates New Pathways:

The printed cartons market also benefits from growing consumer preference for eco-friendly and innovative packaging solutions. It creates opportunities for firms to invest in biodegradable coatings, renewable materials, and recyclable printing inks. It supports brands in promoting sustainability credentials while meeting regulatory standards. It encourages the adoption of creative structural designs that combine functionality with aesthetics. It strengthens differentiation in highly competitive markets where packaging influences brand loyalty. It enhances opportunities for cross-industry collaboration in green packaging technologies. It helps brands leverage sustainability as a marketing advantage. It positions innovative and sustainable carton solutions as central to future growth.

Market Segmentation Analysis:

By Product Type

The printed cartons market shows strong adoption of paperboard and corrugated board, valued for their versatility, durability, and recyclability. Kraft board gains traction where higher strength is required, while coated paper and liquid board cater to premium packaging and beverage industries. It also includes other specialized substrates that meet unique demands across sectors, ensuring broad product adaptability.

- For instance, the American Forest & Paper Association (AF&PA) reported an operating rate increase to 87.5% for U.S. paper and paperboard capacity in 2024, signaling increased manufacturing efficiency and output across various board types used in printed cartons.

By Application/End-Use Industry

Food and beverage packaging dominates due to the rising need for branded and convenient products, while healthcare and pharmaceuticals emphasize safety, compliance, and detailed labelling. Cosmetics and personal care adopt printed cartons to enhance shelf appeal, while electronics and household essentials depend on cartons for secure, lightweight protection. It strengthens brand presence across diverse industries.

- For instance, Smurfit Kappa Group produced printed cartons tailored for the healthcare and cosmetics sectors in 2024, incorporating advanced barrier coatings and precise printing quality to meet safety and aesthetic requirements.

By Printing Technology

Flexography and offset printing remain widely used for large-scale, high-quality production, while digital printing grows quickly with demand for personalization and smaller batch sizes. Gravure, lithography, and screen printing retain importance in specialty and premium applications. It ensures a balance between speed, precision, and customization.

By Printing Ink Type and Feature

Aqueous inks dominate with eco-friendly benefits, while solvent-based and UV-based inks meet durability and advanced graphic needs. Features such as disposability, biodegradability, and recyclability define consumer and regulatory expectations. It aligns with sustainability goals, driving innovation in materials and design, and ensuring printed cartons maintain relevance as a critical packaging solution.

Segmentation:

By Product Type:

- Paperboard

- Corrugated Board

- Kraft Board

- Coated Paper

- Liquid Board

- Others

By Application/End-Use Industry:

- Food and Beverage

- Healthcare

- Household Essentials/Homecare

- Cosmetics and Personal Care

- Electronics and Hardware

- Pharmaceuticals

- Others

By Printing Technology:

- Flexography Printing

- Offset Printing

- Digital Printing

- Gravure Printing

- Lithography Printing

- Screen Printing

- Others

By Printing Ink Type:

- Solvent-Based

- UV-Based

- Aqueous

- Others

By Feature:

- Disposable

- Biodegradable

- Recyclable

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe

The printed cartons market in North America holds 28% share, supported by mature packaging industries, high consumption of packaged food and beverages, and strong pharmaceutical demand. It benefits from advanced printing technologies and sustainability-focused regulations that drive innovation in recyclable and biodegradable cartons. The U.S. leads the region with strong investments from key packaging companies and widespread adoption of digital printing solutions. Europe captures 25% share, driven by strict environmental mandates, consumer preference for eco-friendly packaging, and growth in premium carton applications across cosmetics and personal care. The U.K., Germany, and France lead developments, while Eastern Europe shows steady expansion supported by retail and e-commerce. It remains a hub for innovation in sustainable packaging formats.

Asia Pacific

Asia Pacific dominates the printed cartons market with 32% share, making it the largest regional contributor. It benefits from rapid urbanization, rising disposable incomes, and expanding consumption of food, beverage, and household products in China and India. The region experiences significant growth in pharmaceuticals and healthcare packaging, where demand for secure, cost-effective solutions is rising. Japan and South Korea drive premium packaging innovations through advanced printing technologies and high consumer expectations for quality. It also benefits from a booming e-commerce sector, which increases demand for durable, lightweight cartons. Asia Pacific continues to offer the fastest growth potential, supported by manufacturing capacity and demographic strength.

Latin America and Middle East & Africa

Latin America contributes 8% share to the printed cartons market, driven by expanding retail sectors, rising middle-class population, and increasing demand for consumer goods packaging. Brazil and Mexico lead developments, with investments in cost-effective and branded carton solutions. The Middle East & Africa accounts for 7% share, with growth fueled by economic diversification, infrastructure development, and rising food and beverage consumption in the Gulf nations. South Africa shows steady expansion in healthcare and household packaging segments. It remains an emerging market where rising awareness of sustainability drives gradual adoption of recyclable and biodegradable solutions. Both regions create opportunities for global players to expand their geographic footprint through cost-effective packaging strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Plc (Australia/Switzerland)

- DS Smith Plc (U.K.)

- Huhtamaki Oyj (Finland)

- International Paper Co. (U.S.)

- Mondi Plc (U.K.)

- Nippon Paper Industries Co. Ltd. (Japan)

- Pactiv Evergreen Inc. (U.S.)

- SIG Combibloc Group Ltd. (Switzerland)

- Smurfit Kappa Group (Ireland)

- Tetra Laval SA (Switzerland)

- WestRock Co. (U.S.)

Competitive Analysis:

The printed cartons market is highly competitive, shaped by global leaders and regional players focusing on innovation, sustainability, and design differentiation. It is driven by strong participation from companies such as Amcor Plc, Smurfit Kappa, WestRock, DS Smith, and Tetra Laval, which dominate through large-scale production and advanced printing capabilities. Smaller firms strengthen their position through customized and localized offerings, targeting niche applications in food, cosmetics, and healthcare. It reflects intense rivalry where companies invest heavily in recyclable materials, digital printing, and eco-friendly inks to retain market share. The competition is defined by mergers, acquisitions, and partnerships that expand capacity, enhance technology adoption, and increase geographic reach.

Recent Developments:

- In August 2025, International Paper announced the agreed sale of its global cellulose fibers division to American Industrial Partners for $1.5 billion, as part of its strategy to focus solely on packaging solutions.

- In July 2025, Huhtamaki Oyj launched new compostable ice cream cups made from responsibly sourced, certified paperboard with a bio-based coating. These cups are both home and industrial compostable as well as recyclable, expanding Huhtamaki’s sustainable packaging portfolio for the ice cream sector.

- In April 2025, Mondi Plc completed the acquisition of Western Europe packaging assets from Schumacher Packaging. The integration and delivery of synergies are on track, with strong performance in corrugated and flexible packaging contributing to significant EBITDA growth.

- In April 2025, Novolex completed the acquisition of Pactiv Evergreen Inc., creating a leader in food, beverage, and specialty packaging products. This combination enhances product offerings, manufacturing expertise, and R&D capabilities, positioning Novolex for growth and sustainability.

Market Concentration & Characteristics:

The printed cartons market demonstrates moderate to high concentration, with global leaders controlling significant market share across North America, Europe, and Asia Pacific. It benefits from scale advantages, advanced technology adoption, and integrated supply chains. It is characterized by rising focus on sustainable and recyclable packaging, with companies aligning with circular economy goals. Innovation in printing technologies such as digital and flexographic systems enhances competitiveness by improving speed, quality, and cost efficiency. The market also reflects a dual structure, where multinational firms dominate large industries, while regional players serve specialized and localized needs.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, printing technology, ink type, and feature. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Sustainability will remain the central growth driver, increasing adoption of recyclable and biodegradable cartons.

- Digital printing will expand with personalization and faster turnaround requirements.

- E-commerce packaging demand will boost lightweight and durable carton adoption.

- Premiumization in cosmetics and food sectors will support high-quality carton printing.

- Healthcare and pharmaceutical sectors will increase demand for secure labeling and anti-counterfeit features.

- Asia Pacific will continue to lead growth with urbanization and retail expansion.

- Strategic mergers and acquisitions will strengthen geographic presence and capabilities.

- Innovation in inks and coatings will enhance visual appeal and eco-friendliness.

- Smart packaging features will gain traction in consumer engagement strategies.

- Regional players will find growth opportunities in niche markets with customized designs.