Executive summary:

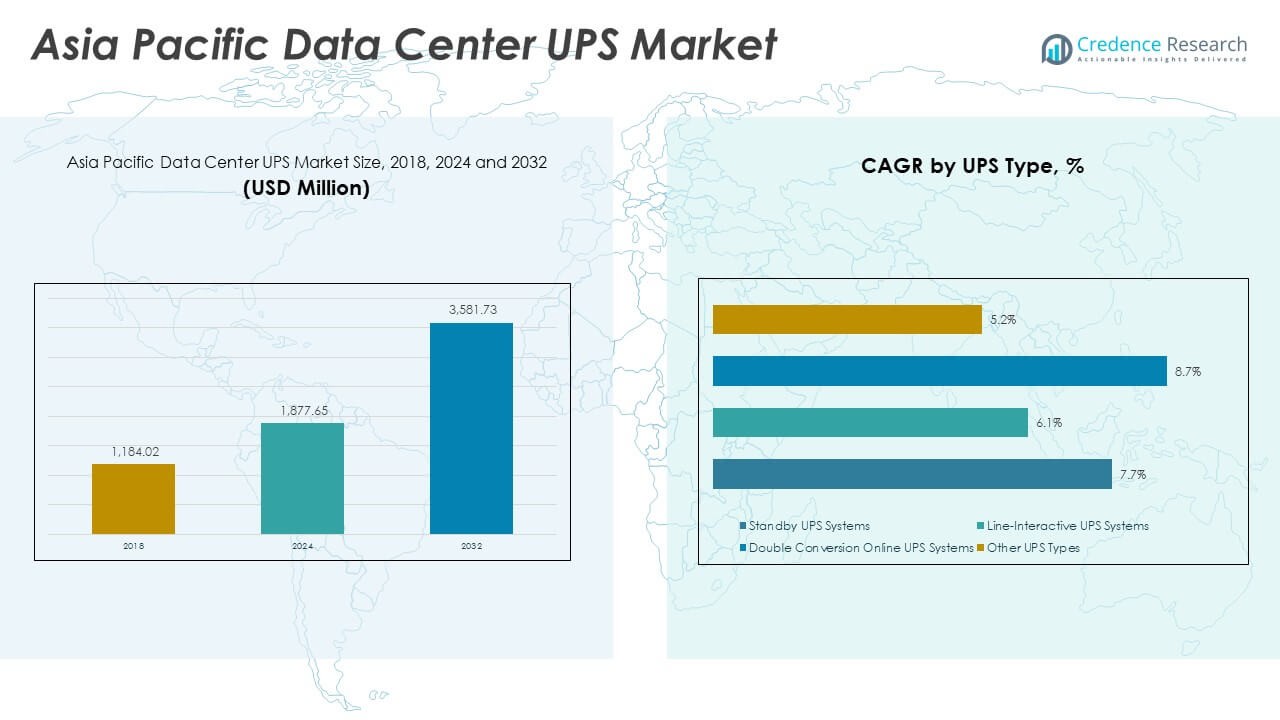

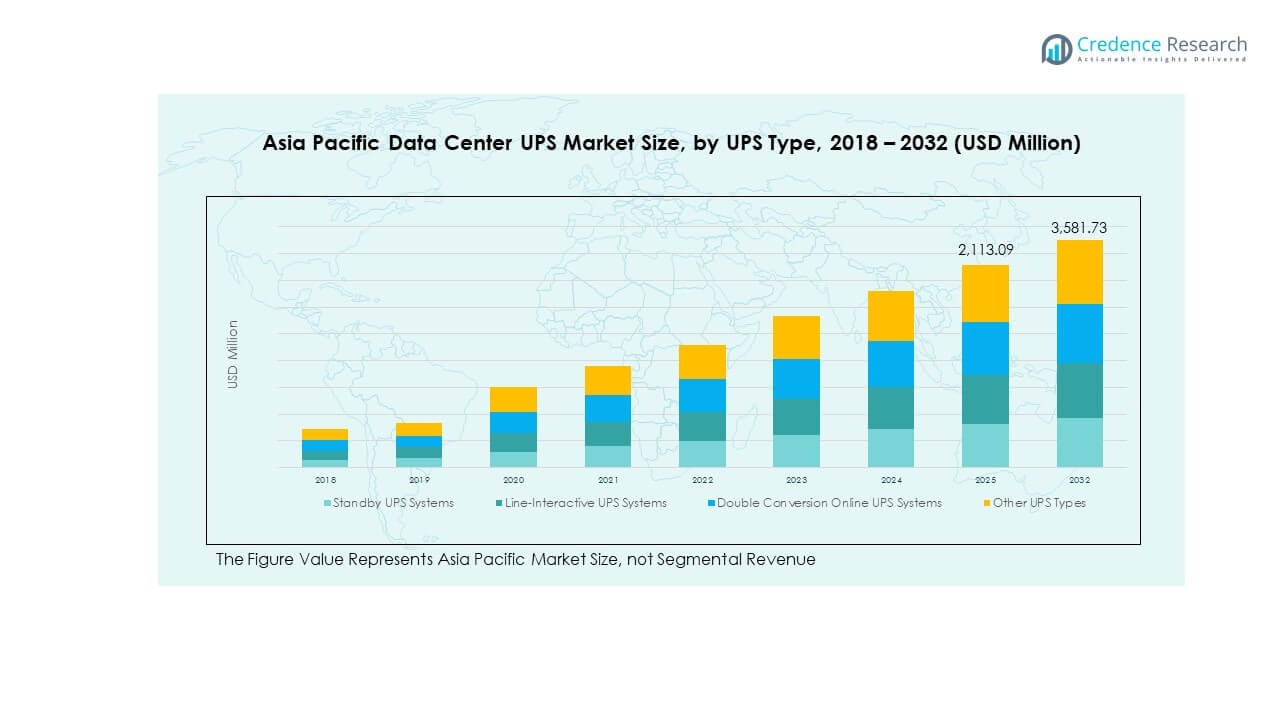

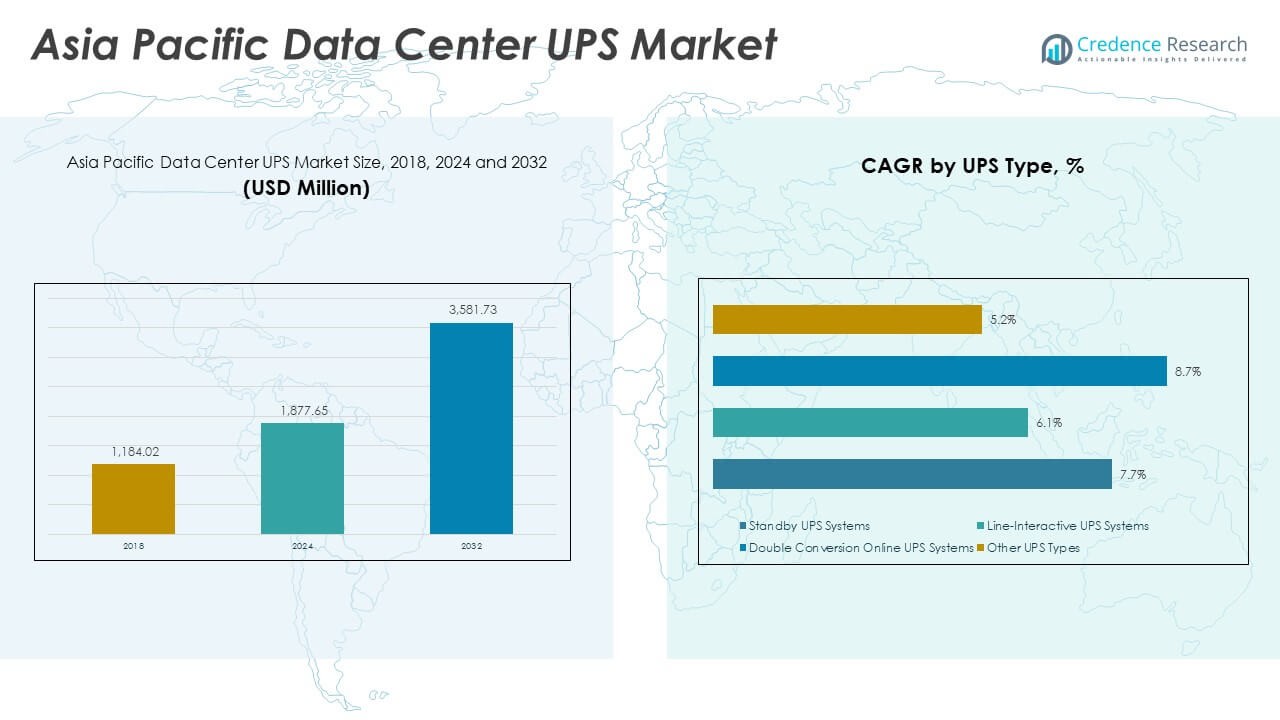

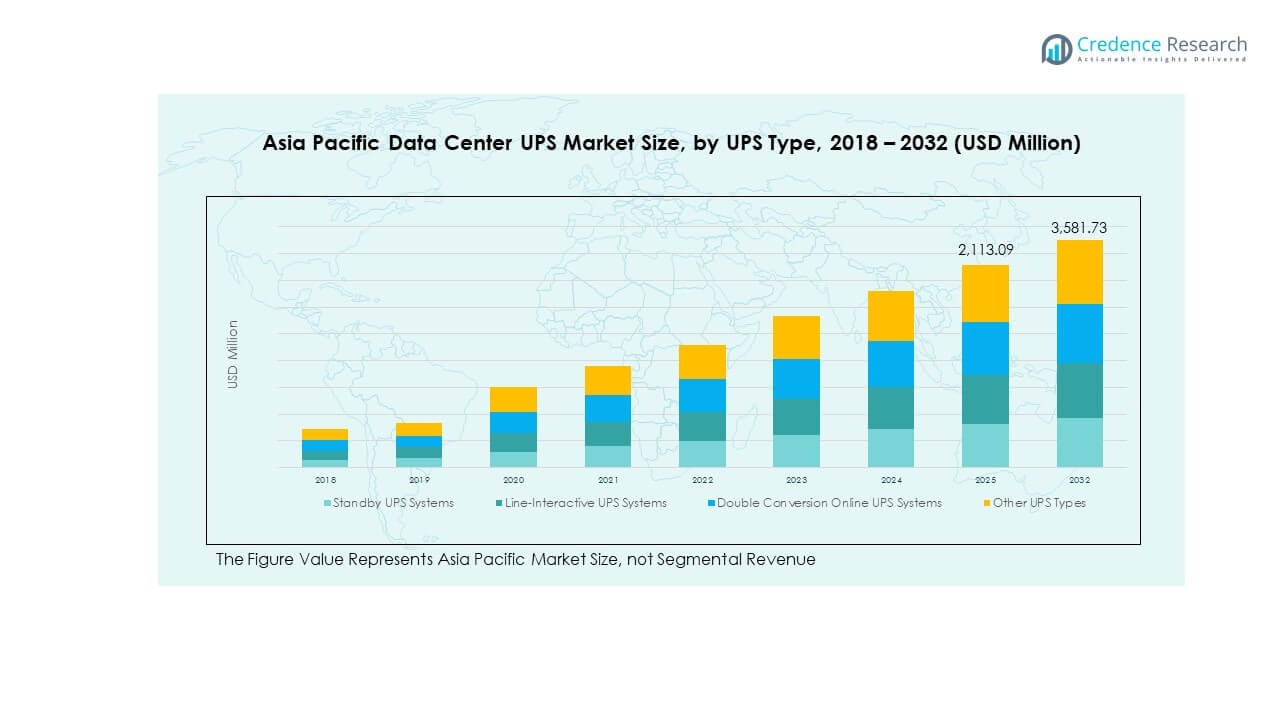

The Asia Pacific Data Center UPS Market size was valued at USD 1,184.02 million in 2020 to USD 1,877.65 million in 2025 and is anticipated to reach USD 3,581.73 million by 2035, at a CAGR of 7.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Data Center UPS Market Size 2025 |

USD 1,877.65 Million |

| Asia Pacific Data Center UPS Market, CAGR |

7.83% |

| Asia Pacific Data Center UPS Market Size 2032 |

USD 3,581.73 Million |

The market is experiencing strong growth driven by AI-ready infrastructure, hyperscale expansion, and cloud adoption. Companies are investing in modular and lithium-ion UPS systems to enhance energy efficiency and reliability. Integration with smart grid and digital monitoring platforms is improving operational resilience. It plays a strategic role for investors and operators aiming to support AI workloads, edge deployments, and uninterrupted data center operations.

China, Japan, and South Korea lead the market with advanced hyperscale campuses and stable power infrastructure. India and Southeast Asia are emerging rapidly due to growing colocation demand, supportive policies, and digital economy expansion. Australia and other Oceania countries strengthen regional connectivity through edge deployments and sustainable power solutions. This geographic spread creates balanced growth opportunities across the region.

Market Dynamics:

Market Drivers

Growing Demand for Reliable Power Infrastructure to Support Hyperscale and Edge Deployments

The Asia Pacific Data Center UPS Market is expanding with rising investments in hyperscale and edge facilities. Businesses seek uninterrupted power to ensure strong service delivery and system reliability. The shift toward cloud-based models creates high dependency on energy-efficient UPS systems. Technology providers are introducing modular and scalable designs to support flexible deployments. AI-driven monitoring improves fault detection and boosts operational efficiency. Investors view stable power backup as a critical enabler for digital infrastructure. Growing enterprise data needs further strengthen adoption. This factor increases the strategic value of the market for operators and investors.

- For instance, Schneider Electric launched its Galaxy VXL UPS in 2024, offering up to 1.25 MW per frame and 5 MW with four units in parallel. The system achieves 99% efficiency in eConversion mode and 97.5% in double conversion mode, supporting AI and hyperscale data center operations.

Rapid Digital Transformation Driving Innovation in Power Backup Solutions

The region is experiencing strong digital transformation, pushing data center operators to modernize backup systems. Enterprises require advanced UPS technologies to protect workloads from outages and voltage fluctuations. Innovation in lithium-ion battery systems reduces maintenance costs and increases energy density. Integration with smart grid infrastructure enhances response capabilities during power disruptions. Growing use of hybrid and modular UPS designs allows flexible capacity scaling. These innovations position UPS systems as vital infrastructure components. Investors view the market as a key segment for reliable data processing. Strong government support for digital growth fuels faster deployments.

Rising AI, IoT, and Cloud Adoption Reshaping Power Backup Requirements

The market is witnessing rising AI, IoT, and cloud workload demands, requiring efficient UPS systems. Smart applications drive continuous power usage, raising expectations for zero downtime. UPS manufacturers are integrating intelligent energy management systems to meet these needs. Software-defined power distribution improves visibility and control for operators. Advanced battery management reduces lifecycle costs and improves energy efficiency. Edge computing expansion amplifies the need for distributed power systems. Investors consider these shifts as opportunities to support scalable infrastructure. It strengthens the role of UPS systems in critical business continuity.

- For instance, Vertiv launched its Trinergy UPS in July 2024, featuring 500 kW self-isolated modular cores and system ratings from 1,500 kVA to 2,500 kVA. The platform delivers a projected 99.9999998% availability and supports AI and HPC workloads in Tier IV-class data centers globally.

Focus on Energy Efficiency and Sustainability Creating Strong Investment Momentum

Energy efficiency is becoming a key priority for data center operators and governments. Advanced UPS technologies with high conversion efficiency reduce operational costs and carbon emissions. The integration of renewable energy with UPS infrastructure supports green strategies. Modular and hot-swappable designs help minimize energy waste during maintenance. AI-powered energy optimization enhances long-term operational reliability. These solutions align with regional climate goals and business sustainability targets. Investors find the market attractive due to rising ESG compliance. This shift establishes UPS systems as a backbone for sustainable digital infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Trends

Widespread Adoption of Lithium-Ion UPS Systems for High-Efficiency Operations

The market is observing strong adoption of lithium-ion UPS solutions, replacing traditional VRLA systems. Lithium-ion offers higher energy density, longer lifecycle, and lower cooling demand. Operators favor compact, maintenance-free solutions that reduce downtime. UPS providers are focusing on modular integration to enable flexible capacity adjustments. This transition enhances system reliability and improves space utilization. The trend supports modern cloud and colocation facilities aiming for lean energy footprints. Investors see long-term value in advanced power technologies. It signals a decisive shift toward next-generation power resilience strategies.

Integration of AI and Predictive Analytics in Power Backup Management

Operators are using AI-based monitoring tools to predict failures and improve power performance. Intelligent UPS management platforms offer real-time visibility and automated fault detection. Predictive analytics lowers unplanned maintenance costs and strengthens operational uptime. The use of machine learning models improves forecasting accuracy for energy loads. Data centers benefit from improved planning and optimized energy usage. Vendors are embedding analytics capabilities into UPS hardware and software systems. This trend attracts investors focused on resilient infrastructure portfolios. It increases the operational intelligence of power systems across facilities.

Rising Deployment of Modular UPS Solutions in Colocation and Edge Facilities

Data center operators are deploying modular UPS systems to support rapid capacity expansion. Modular designs provide flexible scalability, faster installation, and reduced floor space usage. These solutions allow incremental growth without major infrastructure changes. Edge facilities particularly benefit from compact, energy-efficient UPS configurations. Operators prefer standardized components for easier maintenance and upgrades. This trend supports cost-efficient expansion in fast-growing digital economies. Investors view modular systems as low-risk, high-return assets. It enhances the adaptability of power infrastructure for evolving workloads.

Strong Focus on Green UPS Technologies and Renewable Energy Integration

Sustainability is emerging as a defining trend across the market. Operators are integrating UPS systems with renewable energy sources such as solar and wind. High-efficiency conversion technologies reduce carbon emissions and energy waste. Green UPS systems support corporate sustainability targets and regulatory compliance. Hybrid designs enable seamless energy switching between sources. This aligns with broader decarbonization goals set by regional governments. Businesses benefit from lower energy costs and improved brand positioning. It strengthens the market’s role in sustainable infrastructure development.

Market Challenges

High Capital and Operational Costs Limiting Broader Adoption in Developing Regions

The Asia Pacific Data Center UPS Market faces rising capital and maintenance costs. Advanced lithium-ion solutions and smart management systems require significant upfront investment. Smaller operators in developing economies face financial pressure to modernize power infrastructure. Operational costs for energy consumption and system maintenance remain high. The price gap between traditional and advanced UPS systems slows mass deployment. Energy price volatility in some countries adds further uncertainty. Limited access to low-cost financing options restricts scalability. These factors create a barrier to wider adoption among emerging players.

Complex Power Infrastructure Integration and Supply Chain Vulnerabilities

UPS integration within existing power infrastructure remains a challenge for operators. Complex facility designs require specialized installation and customization, raising technical hurdles. The region depends on imported components, exposing operators to supply chain disruptions. Shortages of batteries and power modules affect deployment timelines. Limited local manufacturing capabilities increase lead times and costs. Skilled labor shortages in advanced power engineering create additional constraints. These issues reduce operational flexibility and delay capacity expansion. It highlights the need for strategic planning and resilient sourcing networks.

Market Opportunities

Expansion of Edge Data Centers Creating Demand for Scalable UPS Solutions

Edge computing growth is creating new opportunities for UPS vendors across the region. Compact, modular, and energy-efficient solutions fit the needs of distributed architectures. Operators seek systems that support rapid deployment and low operational costs. Smart UPS platforms with remote monitoring enable better control of distributed assets. Vendors can capture emerging segments in telecommunications and industrial automation. Investors see strong potential in scalable power solutions supporting edge growth. It strengthens the strategic importance of power resilience in digital ecosystems.

Rising Focus on Sustainable Infrastructure Driving Adoption of Green UPS Systems

Sustainability initiatives present significant growth opportunities for power technology providers. Governments promote energy-efficient and low-emission technologies in digital infrastructure. Green UPS systems with renewable integration meet environmental compliance goals. Businesses view sustainability as a competitive advantage and brand strength factor. Vendors that deliver eco-friendly and cost-efficient solutions can gain a strong market position. It creates long-term growth prospects aligned with global climate goals. Investors favor green infrastructure portfolios for steady, sustainable returns.

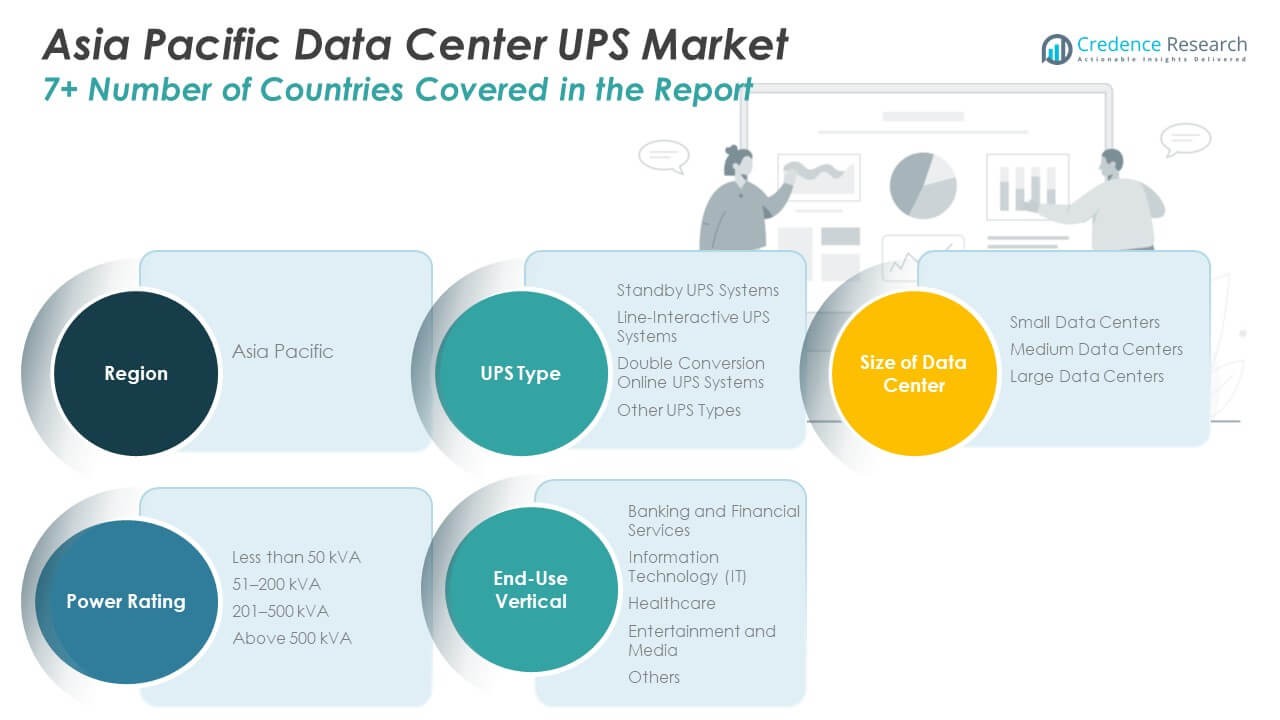

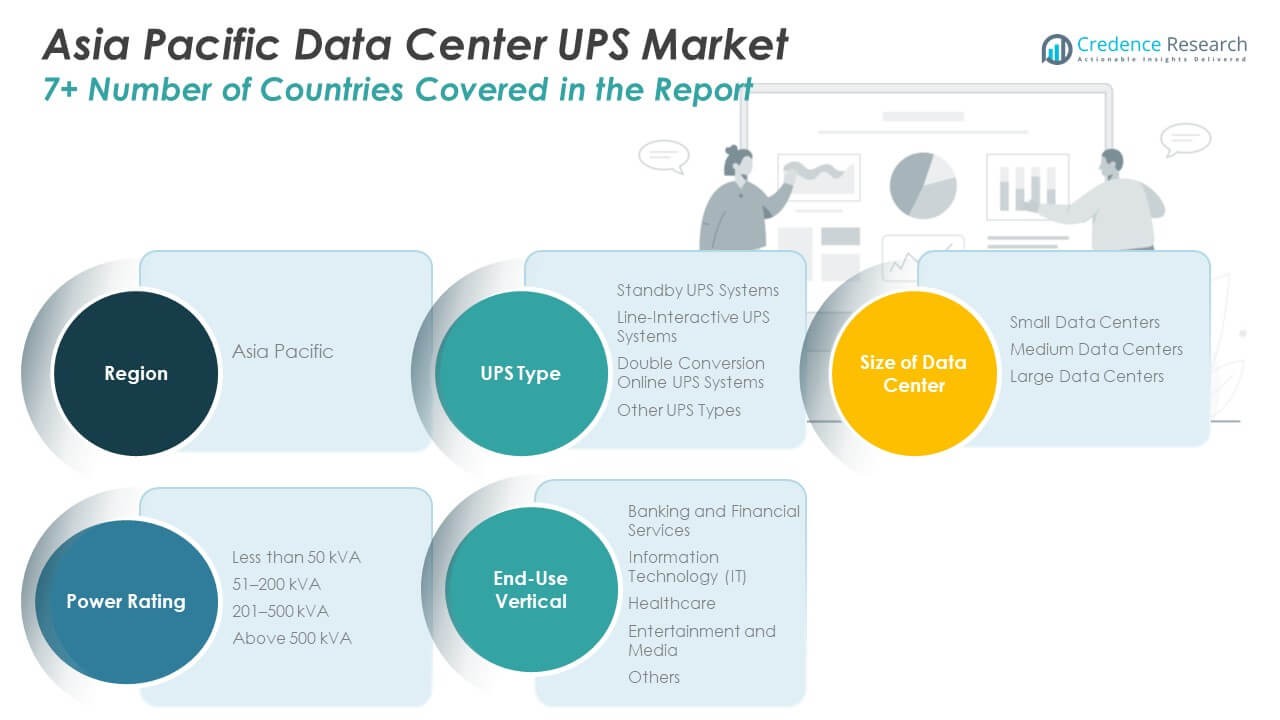

Market Segmentation:

By UPS Type

Double conversion online UPS systems lead due to high reliability and true isolation. Hyperscale and colocation sites prefer continuous power quality. Lithium-ion support improves lifecycle and TCO outcomes. Modular architectures enable hot-swap and N+1 resilience. Line-interactive units grow in edge rooms and SMB racks. Standby models serve non-critical loads and labs. Niche designs address harsh or space-constrained sites. The Asia Pacific Data Center UPS Market reflects premium demand for continuous, clean power.

By Size of Data Center

Large data centers hold the largest share on capacity buildouts. Hyperscale cloud and content firms drive multi-megawatt campuses. Carrier-neutral hubs add dense interconnect halls. Medium facilities expand for regional clouds and enterprises. Small sites rise at the edge for low-latency needs. Standardized reference designs speed rollout cycles. High rack density favors efficient, scalable backup. The Asia Pacific Data Center UPS Market tracks growth of hyperscale and edge footprints.

By Power Rating

201–500 kVA systems dominate core white-space blocks. These ratings balance scalability, footprint, and efficiency. Above 500 kVA grows in hyperscale power rooms. Less than 50 kVA supports remote edge, branches, and labs. The 51–200 kVA range fits modular pods and colocation suites. Lithium-ion adoption lifts availability across classes. High-efficiency topologies cut cooling and energy costs. The Asia Pacific Data Center UPS Market aligns with rising rack density and AI loads.

By End-Use Vertical

Information technology leads on cloud, SaaS, and managed hosting. Banking and financial services demand zero-downtime transaction platforms. Healthcare expands for imaging, EHR, and telemedicine workloads. Entertainment and media scale for streaming and CDN distribution. Public sector and education modernize digital services. “Others” covers manufacturing, retail, and telecom edge nodes. Compliance and ESG goals favor efficient backup designs. The Asia Pacific Data Center UPS Market mirrors digitalization across regulated and content-heavy sectors.

Regional Insights:

East Asia Leading With Strong Digital Infrastructure and Hyperscale Investments

East Asia dominates the Asia Pacific Data Center UPS Market with a 38.5% share. China, Japan, and South Korea host extensive hyperscale campuses and dense network interconnections. National digital strategies and data sovereignty frameworks drive investment in power resilience. Large operators deploy high-capacity UPS systems to ensure uninterrupted operations for AI and cloud workloads. Strong manufacturing bases support advanced power technology adoption. Rising demand for cloud, fintech, and media services fuels further capacity growth. It reflects strong synergy between industrial scale and digital transformation goals.

- For instance, Delta Electronics showcased its 1.5 MW Liquid-to-Liquid In-Row Coolant Distribution Unit (CDU) at CEATEC 2024 in Tokyo. The solution is designed for AI-driven data centers supporting rack densities above 100 kW and achieves 98% power efficiency, aligning with Japan’s Society 5.0 initiative.

South Asia and Southeast Asia Emerging as High-Growth Data Center Hubs

South Asia and Southeast Asia together hold a 33.2% market share. India leads with rapid hyperscale expansion supported by cloud adoption, edge computing, and AI workloads. Southeast Asia grows through government-backed digital corridor initiatives and strong colocation demand. Countries such as Singapore, Indonesia, and Malaysia attract international operators due to favorable policies and strategic connectivity. Modular UPS systems support quick capacity additions in these emerging hubs. Investors view these regions as critical expansion points for scalable infrastructure. It underscores their increasing relevance in global data flows.

Oceania Strengthening Regional Edge and Hyperscale Connectivity

Oceania accounts for 28.3% of the market share, led by Australia. The region benefits from strong renewable energy integration, reliable grid infrastructure, and growing hyperscale footprints. UPS deployments focus on energy efficiency and sustainability to align with ESG targets. Edge data center developments enhance connectivity for underserved areas and AI-driven workloads. Regulatory stability and advanced technology standards strengthen investment confidence. Rising demand from financial services, government, and cloud providers accelerates capacity growth. It positions the region as a resilient digital infrastructure hub.

- For instance, CtrlS Datacenters announced a 40-acre data center park near Hyderabad’s Chandanvelly Industrial Zone with a projected IT load capacity of over 600 MW and an initial sanctioned power of 250 MW. The facility integrates Gas Insulated Substations (GIS) and immersion cooling racks up to 300 kW each, reflecting India’s expanding hyperscale infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Competitive Insights:

The Asia Pacific Data Center UPS Market features global leaders and strong regional specialists. Tier-one vendors compete on efficiency, modularity, and lifecycle cost. Lithium-ion roadmaps and high-efficiency topologies set differentiation. Vendors bundle software, services, and analytics for resilience. Channel depth and local service networks influence wins. Government policy and data residency shape country playbooks. Strong players localize manufacturing and sourcing to reduce risk. Colocation and hyperscale buyers demand rapid deployment and standard SKUs. Edge growth favors compact, scalable designs with remote management. It rewards portfolios that balance performance, sustainability, and fast time-to-value.

Recent Developments:

- In October 2025, Eaton Corporation introduced its next-generation architecture designed to advance 800 VDC power infrastructure tailored for artificial intelligence (AI) factories and data-intensive computing facilities in the Asia Pacific region. Announced on October 13, 2025, this new architecture aims to enhance data center efficiency and scalability while accommodating next-gen demands from hyperscale and edge computing environments, marking a pivotal innovation for AI-ready power systems across Asia.

- In October 2025, Vertiv Holdings Co. announced the launch of its OCP-compliant rack, power, and cooling ecosystem at the 2025 OCP Global Summit, held from October 13 to 16. The new innovations—including the Vertiv SmartIT OCP rack and PowerIT PDUs support high-density workloads up to 142 kW and address AI infrastructure challenges through modular power and cooling integration.

- In May 2025, Schneider Electric SE unveiled a new end-to-end, AI-ready data center suite at Computex 2025 in Taiwan. This offering included the Galaxy VXL UPS series, capable of delivering up to 1.25 MW per unit, integrated with advanced monitoring through digital twin modeling and NVIDIA Omniverse-enabled simulation.