Market Overview:

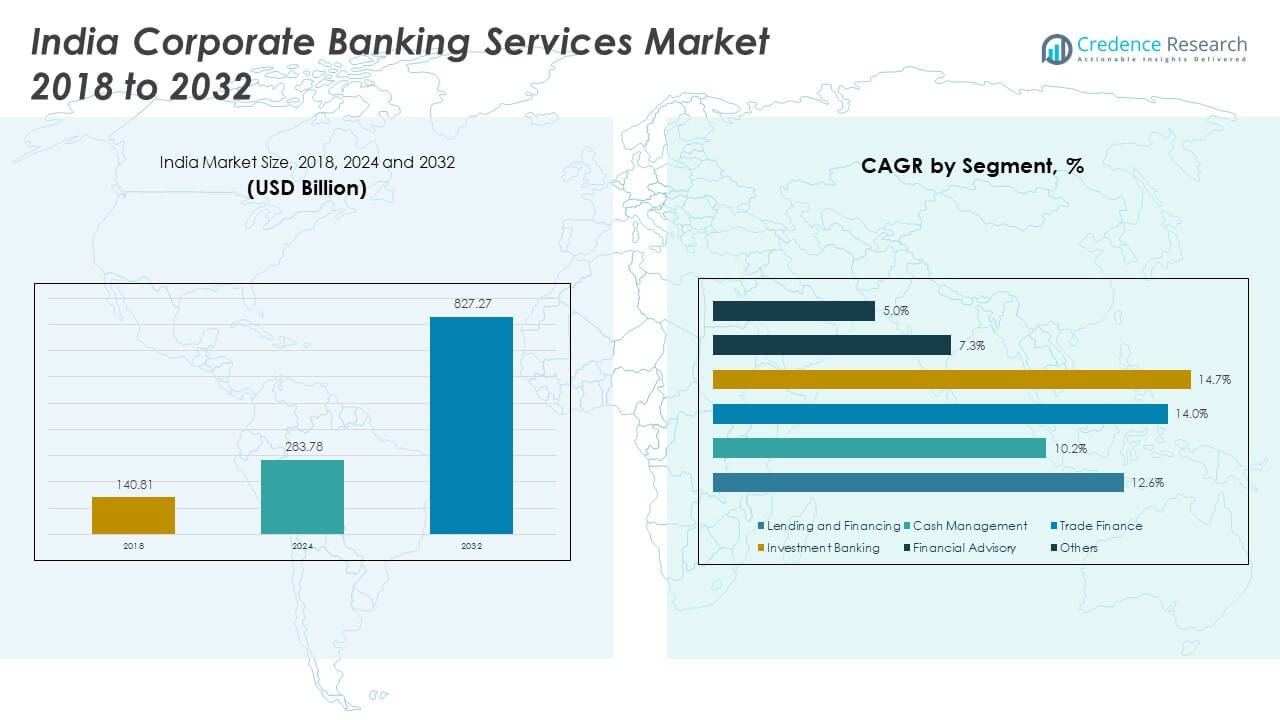

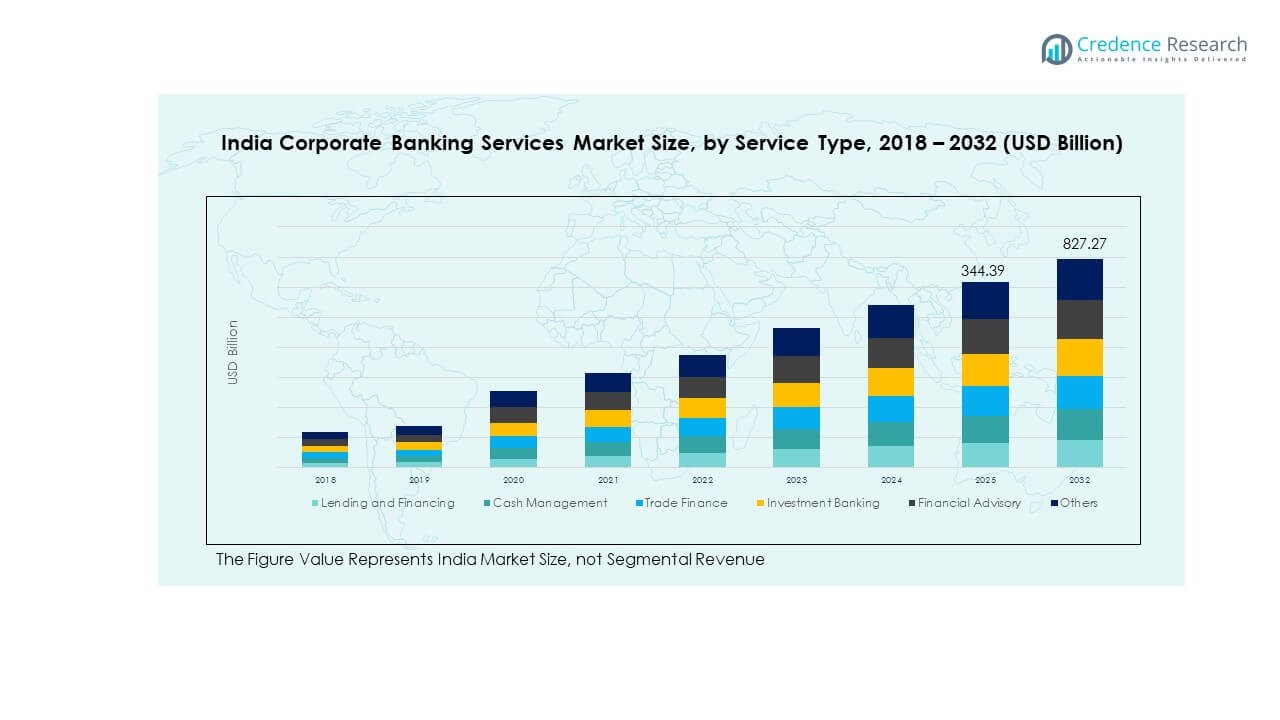

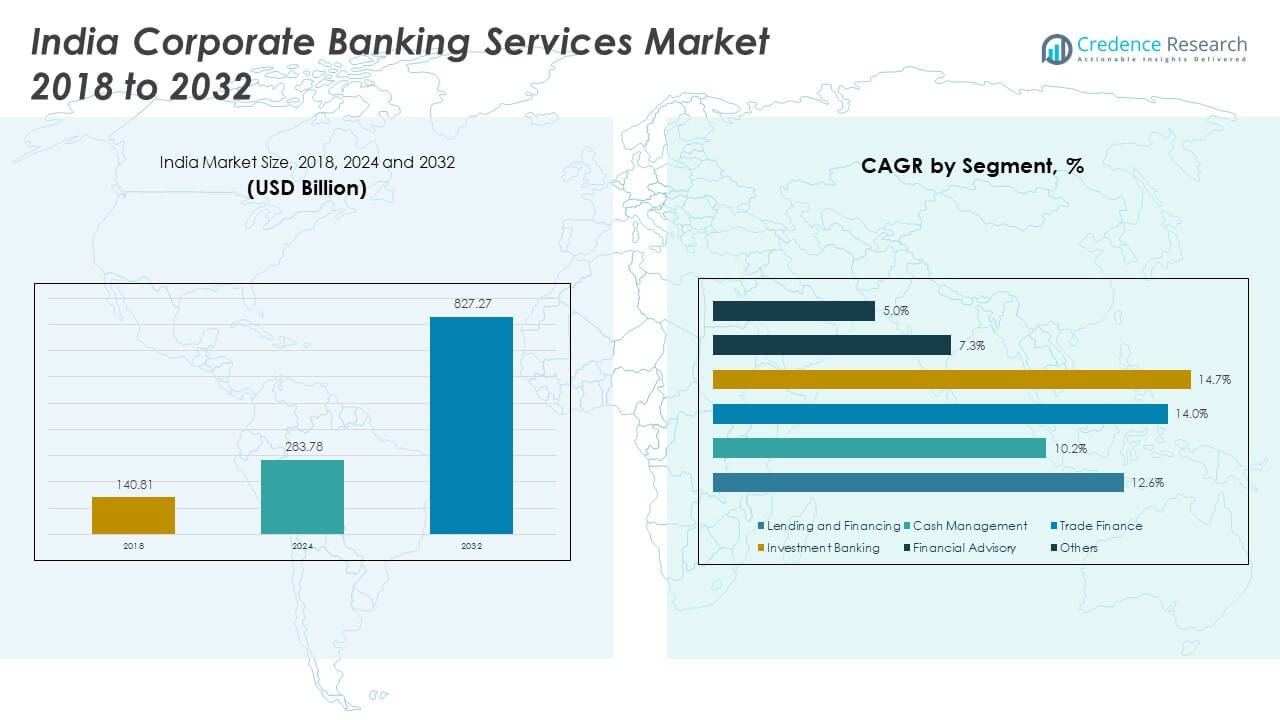

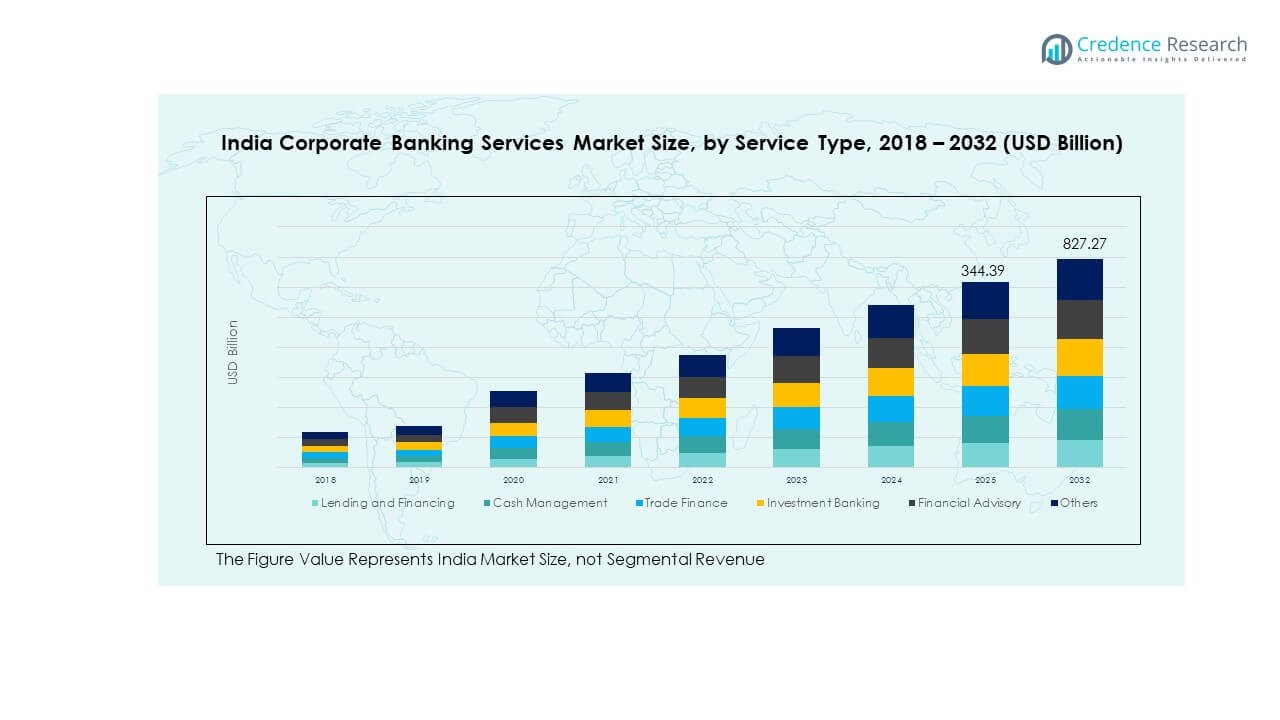

The India Corporate Banking Services Market size was valued at USD 140.81 billion in 2018 to USD 283.78 billion in 2024 and is anticipated to reach USD 827.27 billion by 2032, at a CAGR of 13.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Corporate Banking Services Market Size 2024 |

USD 283.78 Million |

| India Corporate Banking Services Market, CAGR |

13.34% |

| India Corporate Banking Services Market Size 2032 |

USD 827.27 Million |

The market growth is being driven by rising demand for digital banking platforms, rapid adoption of advanced technologies, and increased focus on customized financial solutions for large enterprises and SMEs. Strong credit demand, trade finance needs, and evolving treasury management requirements are further fueling expansion. Regulatory reforms promoting transparency and financial inclusion, coupled with growing collaboration between banks and fintech companies, are also strengthening service innovation and operational efficiency in the corporate banking sector.

Regionally, metropolitan hubs such as Mumbai, Delhi, and Bengaluru dominate the corporate banking services landscape due to their concentration of large corporates, multinational subsidiaries, and financial institutions. Tier II and Tier III cities are emerging as significant growth centers, supported by government-led digitalization initiatives and expanding SME networks. While urban regions lead in advanced product adoption, semi-urban and rural areas are gradually catching up as infrastructure improves and corporates extend operations beyond traditional business hubs, thereby broadening the geographic scope of the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The India Corporate Banking Services Market was valued at USD 140.81 billion in 2018, reached USD 283.78 billion in 2024, and is anticipated to hit USD 827.27 billion by 2032, growing at a CAGR of 13.34%.

- Western India led with 34% share in 2024 due to Mumbai’s role as the financial hub, Southern India followed with 27% share supported by technology and manufacturing clusters, and Northern India held 22% share driven by Delhi-NCR’s strong corporate presence.

- Eastern India, with a 10% share, is emerging as the fastest-growing region, fueled by infrastructure expansion, industrial corridors, and increased banking penetration in steel and mining industries.

- Lending and financing accounted for the largest segment in 2024, representing nearly 40% of the market, reflecting corporates’ demand for working capital, project loans, and syndicated lending.

- Cash management services contributed around 25% of the market, supported by growing adoption of digital payment ecosystems and the need for liquidity optimization among enterprises.

Market Drivers

Rising demand for digital transformation and customized solutions across corporates

The India Corporate Banking Services Market is witnessing strong momentum through the rising adoption of digital platforms and customized services tailored to enterprises. Large corporates and SMEs are demanding advanced online banking solutions that offer seamless access to trade finance, treasury management, and liquidity services. Banks are investing in automation and AI-driven platforms to reduce processing times and improve client experience. It is supported by increasing corporate expectations for real-time data, instant approvals, and transparent operations. Government-led digital finance programs are accelerating usage of technology-led services. Fintech collaborations are enhancing delivery of personalized solutions for corporates. The market continues to evolve with innovation in cash management and credit facilities. Such advancements are ensuring wider adoption across diverse industry verticals.

- For instance, ICICI Bank highlighted in its FY2024 disclosures that more than 70% of eligible trade transactions were processed digitally, supported by its Trade Emerge platform, which provides exporters in over 160 countries with integrated end-to-end trade finance solutions.

Expanding credit demand supported by infrastructure growth and trade activities

Corporate credit requirements are expanding due to strong investment activity in infrastructure, manufacturing, and trade. The India Corporate Banking Services Market benefits from rising demand for working capital loans, project financing, and syndicated lending. Rapid industrialization and increased cross-border trade have created higher reliance on structured financial products. It is being fueled by regulatory support for infrastructure investments and reforms that encourage transparency. Corporates require efficient credit delivery channels to meet expansion goals. Growing exports and imports necessitate banking support in the form of trade finance and risk management solutions. Banks are aligning products with industry-specific credit cycles to retain competitiveness. The environment of strong credit demand drives both revenue and service diversification.

- For instance, State Bank of India (SBI) reported in FY2024 that its total advances grew by 20.2% year-on-year, reaching ₹27.59 lakh crore, with corporate lending continuing to form a significant share of this portfolio.

Strengthened regulatory environment promoting transparency and stability

A stronger regulatory ecosystem is enhancing trust in the India Corporate Banking Services Market and reinforcing sustainable growth. Banking regulations that emphasize transparency, accountability, and risk management are improving customer confidence. It is evident through tighter compliance norms under the Reserve Bank of India and global financial reporting standards. Corporate clients expect clear frameworks for credit approval, loan restructuring, and compliance monitoring. The emphasis on financial inclusion is encouraging broader adoption among SMEs. This regulatory clarity attracts foreign investments and supports expansion of multinational operations. Stronger corporate governance and banking discipline create a reliable financial ecosystem. Banks are required to upgrade risk monitoring systems and reporting practices. Such measures build resilience against systemic risks and market fluctuations.

Strategic integration of technology and fintech partnerships driving innovation

Technology integration and fintech alliances are acting as key accelerators of growth in the India Corporate Banking Services Market. Banks are collaborating with fintech firms to introduce blockchain, AI, and machine learning-enabled services for corporate clients. It is reshaping payment processing, credit assessment, and treasury operations by making them faster and more efficient. Automation reduces manual errors and lowers operational costs. Corporates are adopting these advanced tools for predictive analytics and risk evaluation. Strategic partnerships are broadening the scope of product portfolios and enabling banks to remain competitive. Enhanced cybersecurity frameworks are reinforcing digital trust among corporate users. Banks that adopt innovation early gain a strong edge in customer acquisition. Such advancements are positioning the sector toward a technologically driven future.

Market Trends

Rising adoption of sustainable finance and green banking initiatives

The India Corporate Banking Services Market is shifting focus toward sustainable finance products and environmentally responsible practices. Banks are creating green bonds, sustainability-linked loans, and ESG-focused financial instruments for corporates. It is being fueled by government climate policies and investor expectations for sustainable investments. Corporates demand banking solutions that align with their environmental goals. Large enterprises are actively integrating ESG criteria into their financial planning. Sustainable financing is becoming a competitive differentiator in corporate banking. Banks are expanding portfolios with climate-conscious instruments. This trend is positioning corporate banking services as a critical enabler of long-term sustainable growth.

Growth in cashless ecosystems and real-time payment innovations

The India Corporate Banking Services Market is experiencing a strong transition toward cashless ecosystems supported by real-time digital payments. Corporates are embracing instant payment systems that streamline procurement, vendor payments, and payroll processes. It is enabling faster settlements, reducing dependency on physical transactions. National payment infrastructure upgrades are reinforcing adoption across industries. Cross-border payment solutions with real-time processing are strengthening international trade flows. Banks are investing in cloud-based platforms to provide seamless transactions at scale. Corporates are recognizing cost efficiencies from faster settlement systems. The movement toward cashless ecosystems is redefining the operational efficiency of corporate banking.

- For example, according to NPCI data, UPI processed over 13 billion transactions in March 2024, capturing around 81.8% of the total volume of India’s digital payments in that month.

Increasing importance of advanced data analytics in corporate decision-making

Data-driven decision-making is emerging as a key trend influencing the India Corporate Banking Services Market. Banks are using advanced analytics to assess creditworthiness, detect fraud, and design tailored solutions for corporates. It is enabling precise evaluation of financial risks and opportunities. Corporate clients expect predictive insights for liquidity management and investment planning. Data integration across treasury, credit, and risk functions is improving overall efficiency. Machine learning models are being applied to enhance real-time forecasting. Banks are leveraging big data to deepen client relationships and improve service delivery. This trend reflects a decisive shift toward knowledge-driven corporate banking.

- A leading example is DBS Bank, which operates across 19 markets including India. DBS developed the ADA (Analytics Data Architecture) and ALAN (AI & Learning Analytics Network) platforms by 2024, these platforms supported over 800 AI/ML models and 350 analytics use cases.

Expansion of sector-specific financial solutions tailored to industry requirements

Tailored financial solutions designed for industries such as manufacturing, IT, logistics, and infrastructure are shaping the India Corporate Banking Services Market. Banks are developing products aligned with unique operational cycles and funding requirements of each sector. It is allowing corporates to access credit and risk management that directly fit their industry demands. For example, export-oriented companies require specialized trade financing instruments. Technology-driven sectors need working capital with shorter repayment structures. Banks are offering flexible cash management solutions to improve sectoral competitiveness. These industry-specific products are building stronger corporate relationships. The trend highlights an evolution toward highly specialized service offerings.

Market Challenges Analysis

Intensifying competition from fintech disruptors and evolving client expectations

The India Corporate Banking Services Market faces growing challenges due to competition from fintech disruptors offering low-cost, technology-driven solutions. Traditional banks are under pressure to match the speed and agility of digital-first platforms. It is creating an environment where innovation and client-centricity are essential for survival. Corporates expect instant onboarding, real-time credit approvals, and seamless international transactions. Rising client expectations for advanced risk analytics and digital tools place additional strain on banks. The challenge lies in maintaining profitability while upgrading technology infrastructure. Competitive pricing models by fintech players increase stress on traditional fee-based revenue. Banks are forced to accelerate digital adoption without losing operational control. This competition intensifies market fragmentation and shifts power toward more agile entrants.

Compliance costs, cybersecurity risks, and operational complexity limiting scalability

Regulatory compliance and cybersecurity risks present major challenges to the India Corporate Banking Services Market. Banks face increasing expenses in upgrading compliance frameworks and monitoring mechanisms. It is compounded by rising threats of cyberattacks targeting corporate financial data. Maintaining data security while scaling digital infrastructure is complex and resource-intensive. Strict regulations mandate continuous system upgrades, which can strain profitability. Complex operational environments across diverse corporate sectors require significant customization of services. Balancing risk mitigation with service innovation is proving difficult for banks. Compliance obligations limit flexibility in product design and deployment. These challenges highlight the difficulty of scaling services while ensuring security and regulatory alignment.

Market Opportunities

Rising scope of SME-focused banking services and regional expansion

The India Corporate Banking Services Market holds significant opportunity through expansion into SME-focused services and regional growth. Banks are increasingly targeting small and medium enterprises that require credit, trade finance, and treasury solutions. It is supported by government programs that promote SME financing and entrepreneurship. Semi-urban and rural areas represent untapped markets with growing corporate presence. Expanding networks in these regions strengthens penetration. Banks can leverage technology-driven platforms to reach SMEs cost-effectively. Tailored financial products can enhance adoption across diverse geographies. This opportunity is positioning the sector toward wider inclusion of regional business ecosystems.

Strong potential for innovation-led growth in digital and sustainable solutions

Innovation in digital platforms and sustainable banking instruments creates major opportunities for the India Corporate Banking Services Market. Corporates are increasingly demanding solutions that integrate AI, blockchain, and ESG-focused finance. It is encouraging banks to create products that align with environmental goals and efficiency-driven operations. Digital-first credit and treasury solutions offer cost savings and faster processing. Sustainable financing instruments strengthen client relationships with global investors. Banks that invest in innovation and sustainability are well placed to capture long-term growth. Opportunities exist in cross-border digital solutions and climate-focused lending. Such initiatives create a diversified growth pathway for the corporate banking sector.

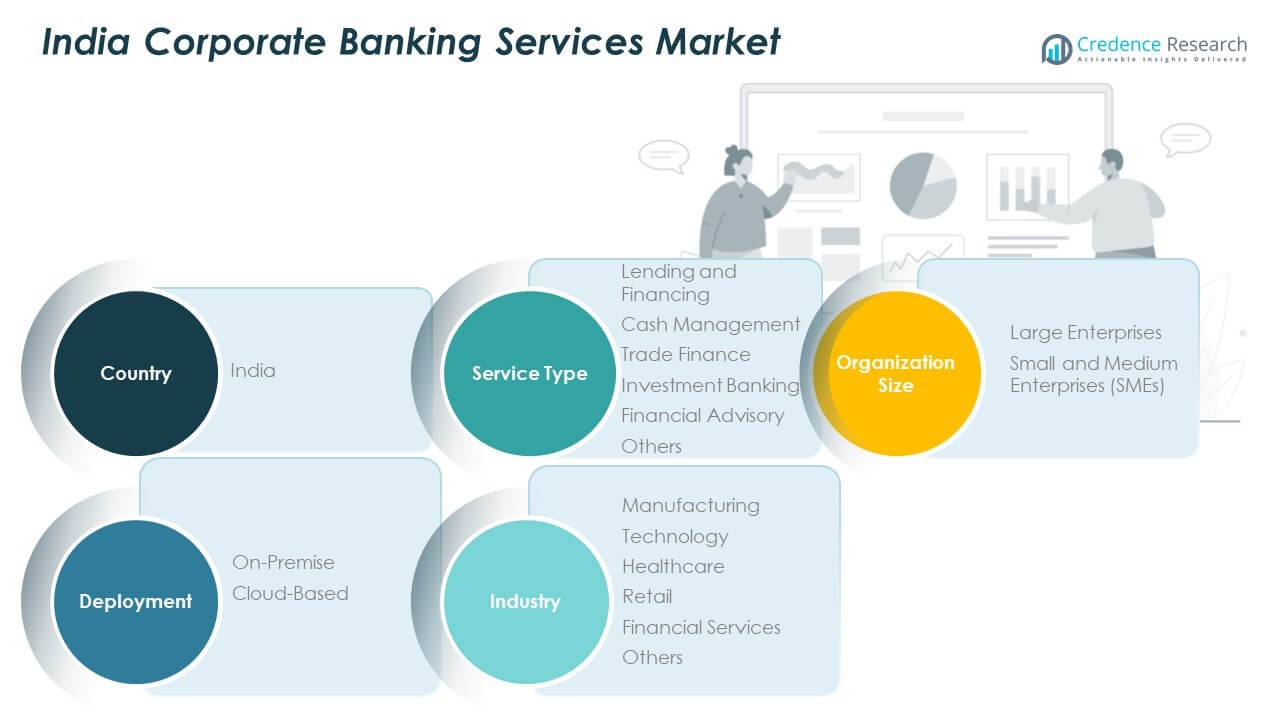

Market Segmentation Analysis:

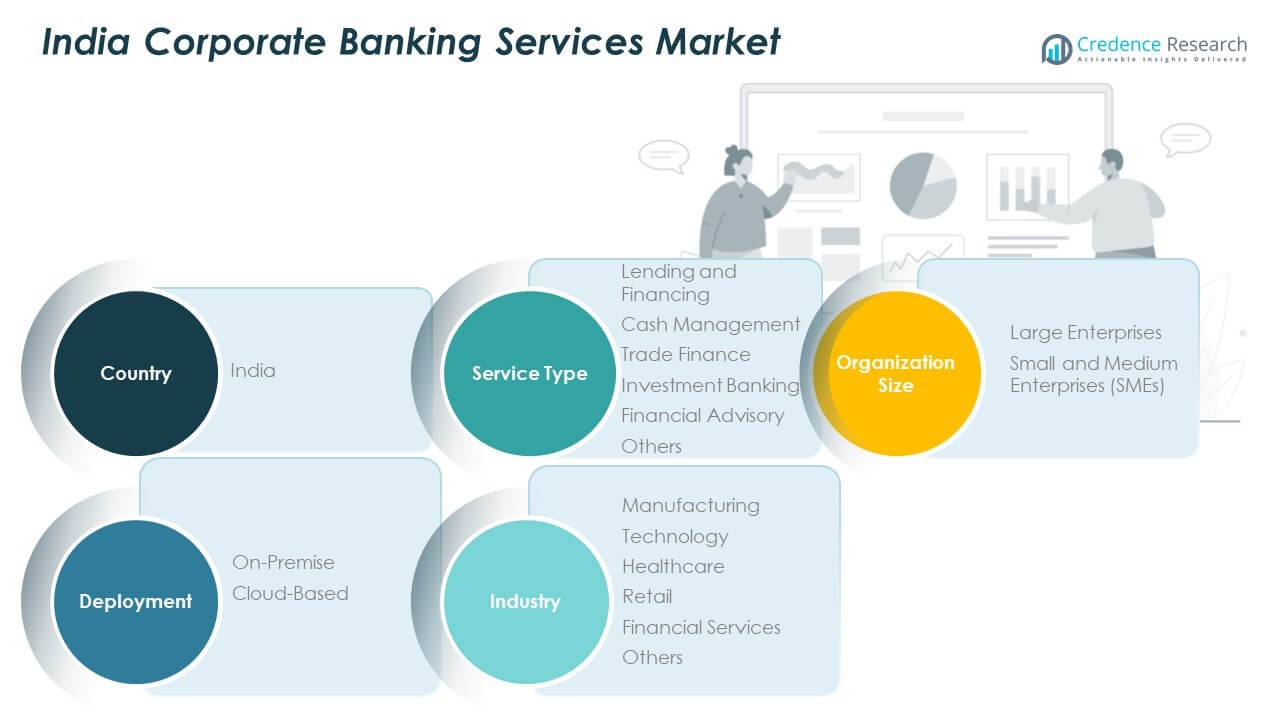

The India Corporate Banking Services Market demonstrates a diversified segmentation that reflects the evolving financial needs of corporates across industries.

By service type, lending and financing hold a strong share, driven by demand for project funding, working capital support, and syndicated loans. Cash management and trade finance services are gaining momentum with the rise of digital payment ecosystems and cross-border business activity. Investment banking and financial advisory segments are expanding in line with growing merger, acquisition, and capital-raising activities. Other specialized services such as risk management and treasury solutions strengthen banks’ value proposition to large and mid-tier clients.

- An example is Kotak Investment Banking’s role as one of the book running lead managers for the LIC IPO in 2022, which raised ₹20,557 crore and stood as the largest public listing in India, showcasing the significance of investment banking services in large-scale capital market transactions.

By organization size, large enterprises dominate due to their scale and consistent requirement for complex financial products. It is also seeing increasing adoption among SMEs, supported by government-backed credit programs and digital financial tools tailored to smaller firms.

By deployment, on-premise solutions maintain a strong presence, yet cloud-based platforms are emerging quickly, providing flexibility, scalability, and cost efficiency in transaction handling and compliance management.

By industry, financial services account for a significant share, supported by demand for structured lending, investment support, and treasury operations. Manufacturing companies depend heavily on trade finance and working capital solutions, while the technology sector drives growth in digital-first financial products. Healthcare and retail industries are increasingly seeking tailored advisory and financing models to support expansion. Other sectors, including logistics and infrastructure, contribute to the broader adoption of innovative corporate banking solutions across the country.

- For example, Axis Bank, in its FY2024 disclosures, highlighted the expansion of its wholesale banking and structured credit portfolio, serving large corporates in infrastructure, manufacturing, and services. The bank emphasized the role of its digital transaction platforms and supply chain finance solutions in enhancing credit delivery efficiency while meeting sector-specific financing requirements with tailored solutions.

Segmentation:

By Service Type

- Lending and Financing

- Cash Management

- Trade Finance

- Investment Banking

- Financial Advisory

- Others

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Deployment

By Industry

- Manufacturing

- Technology

- Healthcare

- Retail

- Financial Services

- Others

Regional Analysis:

The India Corporate Banking Services Market is concentrated in metropolitan regions, with Western India holding the largest share of 34%. Mumbai, the country’s financial hub, anchors this dominance with the presence of major banks, financial institutions, and multinational corporate headquarters. Strong demand for trade finance, investment banking, and treasury management in this region drives steady revenue growth. Southern India follows with 27% market share, led by Bengaluru, Chennai, and Hyderabad, where technology, manufacturing, and retail corporates are expanding financial requirements. It benefits from a strong base of SMEs adopting digital banking solutions. These urban hubs create a competitive environment where banks actively launch tailored digital and credit services.

Northern India accounts for 22% of the market, driven by corporate activity in Delhi-NCR and surrounding industrial clusters. The region benefits from strong government presence, infrastructure-led financing, and the rise of service-driven industries. It reflects growing reliance on corporate credit lines and cash management services to support trade, logistics, and real estate development. Eastern India contributes 10% of the share, supported by demand from steel, mining, and heavy industries. It shows gradual adoption of modern financial products due to infrastructure expansion and industrial corridor development. Banks are extending their footprints in this region to capture growth from emerging corporates.

Tier II and Tier III cities collectively contribute 7% of the India Corporate Banking Services Market, reflecting the early stage of penetration. It is influenced by government initiatives to promote SME financing, digital inclusion, and credit accessibility in smaller urban centers. The growing presence of corporates in semi-urban areas creates demand for lending, trade finance, and digital payment services. Banks are investing in branch expansion, mobile platforms, and cloud-based delivery models to strengthen their presence. Over time, these regions are expected to capture a larger share as enterprises diversify operations beyond metro hubs. This evolving landscape highlights the geographic spread and future potential of corporate banking services across India.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- State Bank of India (SBI)

- HDFC Bank

- ICICI Bank

- Axis Bank

- Kotak Mahindra Bank

- Punjab National Bank (PNB)

- Bank of Baroda

- Union Bank of India

- Canara Bank

- IDFC First Bank

Competitive Analysis:

The India Corporate Banking Services Market is highly competitive with a strong presence of both public and private sector banks. State Bank of India, HDFC Bank, ICICI Bank, and Axis Bank dominate the market with extensive networks, diversified service portfolios, and strong digital platforms. It is characterized by strategic expansions, digital innovations, and collaborations with fintech firms to strengthen offerings in trade finance, cash management, and lending. Kotak Mahindra Bank, Punjab National Bank, and Bank of Baroda continue to expand corporate client portfolios by introducing specialized credit products and treasury solutions. Union Bank of India, Canara Bank, and IDFC First Bank are focusing on SME-centric services and digital-first banking models. Recent developments include the launch of blockchain-enabled trade platforms, growth in sustainable finance instruments, and mergers among public banks to enhance operational scale. Competitive intensity is driving continuous investments in technology, product diversification, and customer relationship management. Banks are positioning themselves as strategic partners to corporates by delivering end-to-end solutions that integrate lending, advisory, and risk management.

Recent Developments:

- In August 2025, Tata Consultancy Services (TCS) partnered with Google Cloud and inaugurated the Google Cloud Gemini Experience Center at its Banking, Financial Services and Insurance (BFSI) Innovation Lab in Bengaluru. This collaboration indicates a deepening focus on deploying AI-driven solutions to accelerate financial services innovation, directly impacting the digital transformation journey of corporate banking providers across India.

- In August 2025, Honda Motor Co. established a new subsidiary in India named Honda Finance to expand its presence in the retail financing and corporate banking services sector. Honda Finance aims to broaden lending services targeted at both retail and corporate customers, leveraging Honda’s brand strength and digital infrastructure for financial service distribution.

- In August 2025, State Bank of India (SBI) partnered with VinFast Auto India to provide retail car financing for VinFast’s exclusive electric vehicle dealer network. Under the agreement, SBI will offer tailored financing solutions such as attractive interest rates, flexible repayment options, up to 100% on-road funding, and dedicated support at VinFast showrooms across India.

- In June 2025, HDFC Bank formed a strategic partnership with PhonePe to launch the new ‘PhonePe HDFC Bank Co-branded Credit Card’, which operates on the RuPay network and offers users significant benefits on UPI and PhonePe-related spends. Available in ‘Ultimo’ and ‘UNO’ variants, the card gives up to 10% rewards on select categories and is integrated for seamless UPI payments across PhonePe’s ecosystem.

Market Concentration & Characteristics:

The India Corporate Banking Services Market reflects moderate to high concentration, led by a few dominant banks that control a significant share of corporate lending, trade finance, and cash management. It is characterized by the dual presence of large public sector institutions with extensive branch networks and agile private sector players with advanced digital platforms. Market growth is shaped by strong credit demand from large enterprises, while SMEs are emerging as a vital customer segment. Technology adoption and fintech partnerships define the competitive edge, driving service innovation and client-centric solutions. The industry displays a mix of traditional relationship-driven banking and modern digital-first models, creating a balanced competitive structure that emphasizes scale, trust, and innovation.

Report Coverage:

The research report offers an in-depth analysis based on service type, organization size, deployment, and industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The India Corporate Banking Services Market will see accelerated digital transformation as banks strengthen AI, blockchain, and data-driven platforms to meet corporate client expectations.

- Sustainable finance instruments will expand further, with green bonds, ESG-linked loans, and responsible financing solutions becoming mainstream offerings.

- Banks will increase their focus on SME financing, leveraging government initiatives and digital platforms to improve accessibility and coverage.

- Cloud-based deployment models will gain prominence, allowing scalability, operational flexibility, and cost optimization across banking functions.

- Trade finance solutions will evolve with real-time cross-border payment systems, supporting India’s growing global trade integration.

- Corporate banking will see deeper integration with fintech firms, creating collaborative ecosystems that combine speed, innovation, and scale.

- Risk management and compliance frameworks will strengthen, driven by regulatory requirements and growing cybersecurity concerns.

- Data analytics and predictive modeling will become core tools for credit assessment, treasury planning, and fraud detection.

- Regional penetration will expand beyond metros, with Tier II and Tier III cities contributing more significantly to service adoption.

- The market will continue to shift toward relationship-based banking, where advisory-led and industry-specific solutions reinforce long-term corporate partnerships.