Market Overview

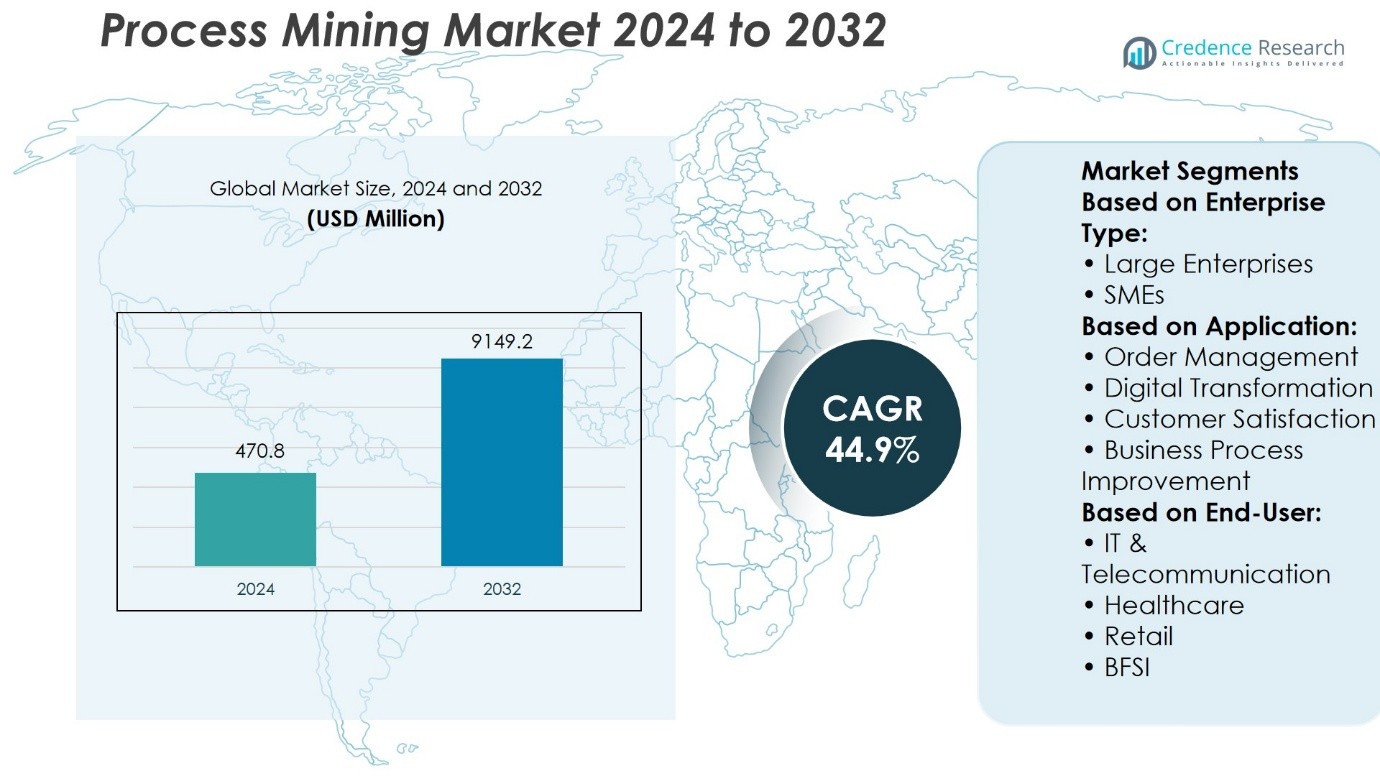

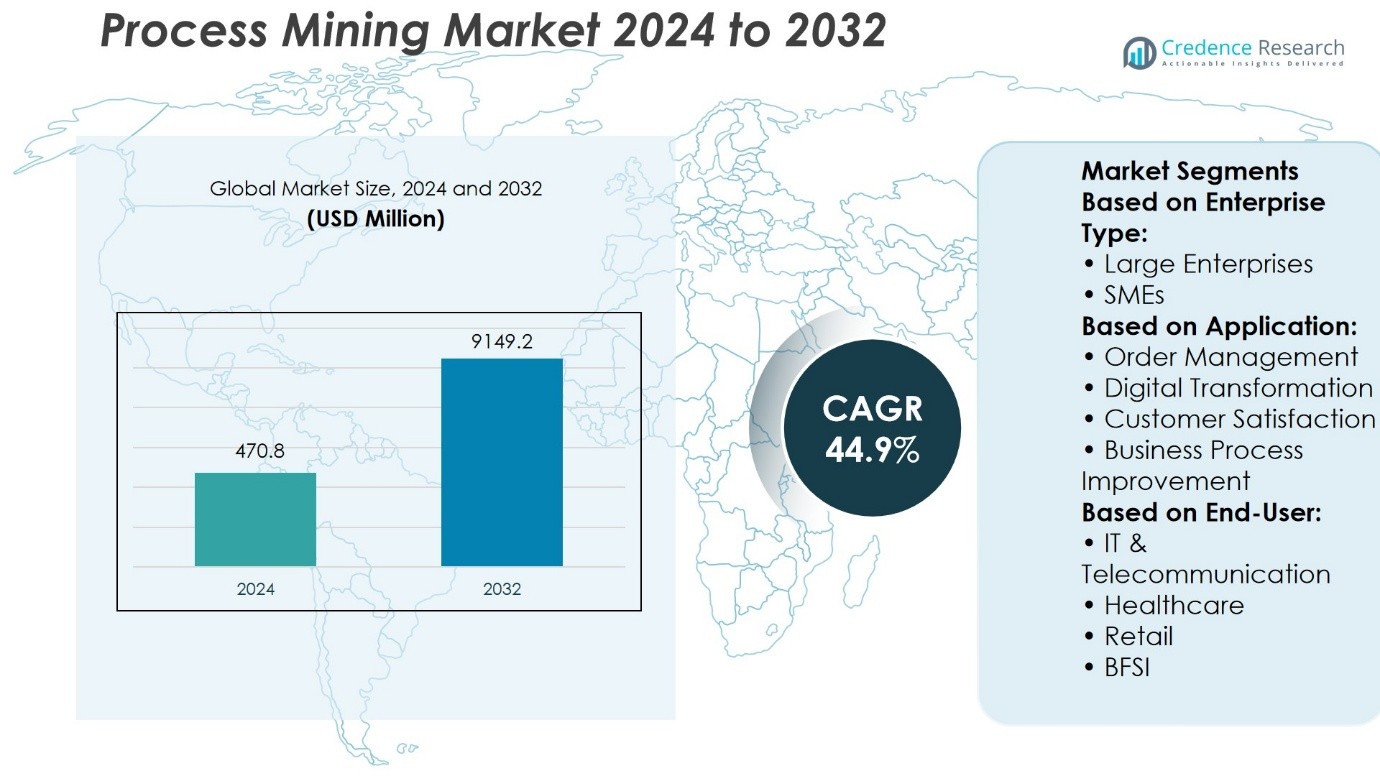

Process Mining Market size was valued at USD 470.8 million in 2024 and is anticipated to reach USD 9149.2 million by 2032, at a CAGR of 44.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

|

|

USD 470.8 Million |

| Process Mining Market, CAGR |

44.9% |

| Process Mining Market Size 2032 |

USD 9149.2 Million |

The Process Mining Market grows through strong drivers such as rising demand for data-driven decision-making, compliance management, and operational efficiency across industries. Organizations adopt these solutions to gain transparency, eliminate bottlenecks, and align processes with performance goals. It benefits from the rapid shift toward digital transformation and increasing integration with automation and AI technologies. Key trends include the expansion of cloud-based deployment models, real-time analytics for proactive insights, and the development of industry-specific applications. Together, these drivers and trends shape a competitive and innovation-focused market that continues to gain momentum across global enterprises.

The Process Mining Market shows strong geographical presence across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa, with Europe holding the largest share due to strict compliance needs and advanced digital adoption. North America follows with high investment in automation, while Asia Pacific emerges as the fastest-growing region. Leading players such as Celonis, SAP Signavio, IBM, Microsoft, UiPath, Software AG, ABBYY, Kofax, Apromore, and Mehrwerk drive competition through innovation, integration, and sector-specific solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Process Mining Market size was valued at USD 470.8 million in 2024 and is expected to reach USD 9149.2 million by 2032, growing at a CAGR of 44.9%.

- Rising demand for data-driven decision-making, compliance management, and operational efficiency drives market adoption across industries.

- Expansion of cloud-based deployment models, real-time analytics, and industry-specific applications defines the key market trends.

- Competitive landscape is shaped by innovation, integration with automation and AI, and strong presence of global and emerging players.

- High implementation costs, data complexity, and integration challenges act as restraints for broader adoption.

- Europe holds the largest share due to compliance needs, North America follows with high automation investment, and Asia Pacific is the fastest-growing region.

- Leading companies including Celonis, SAP Signavio, IBM, Microsoft, UiPath, Software AG, ABBYY, Kofax, Apromore, and Mehrwerk fuel growth through partnerships, acquisitions, and advanced solutions.

Market Drivers

Rising Adoption of Data-Driven Decision-Making Across Enterprises

The Process Mining Market gains traction as enterprises focus on data-driven strategies to improve operational efficiency. Organizations seek visibility into real workflows by analyzing event logs from enterprise systems. It enables management teams to identify inefficiencies, eliminate bottlenecks, and streamline resource allocation. The rising demand for process transparency across industries supports wider adoption of these tools. Growing volumes of digital transaction data make it feasible to track, measure, and optimize complex operations. By aligning processes with performance goals, enterprises achieve measurable productivity gains.

- For instance, Apromore, a provider of process mining software, closed its Series B funding round, securing 10.3 million in investments from Salesforce and GBTEC, a company supported by Main Capital Partners.

Growing Integration of Process Mining with Advanced Technologies

The integration of process mining with artificial intelligence, machine learning, and robotic process automation strengthens its value proposition. It improves predictive analytics by uncovering hidden trends and enabling proactive decision-making. Combining these technologies accelerates digital transformation programs in large organizations. Vendors are embedding advanced algorithms to enhance anomaly detection and compliance monitoring. Automated process discovery also reduces reliance on manual audits. The synergy with advanced technologies broadens applications across healthcare, manufacturing, and financial services.

- For instance, UiPath reported that its hyperautomation platform combining process mining, AI, and RPA—has been deployed across more than 7,000 enterprises, supporting automation design and execution in as little and actively used by over 90 U.S. federal agencies.

Increasing Focus on Compliance and Risk Management

Stricter regulations and rising compliance costs drive adoption of process mining solutions in highly regulated industries. It assists organizations in validating adherence to regulatory frameworks by providing transparent audit trails. Companies in banking, insurance, and healthcare use these tools to monitor compliance gaps in real time. Enhanced visibility helps mitigate financial risks and reputational damage from non-compliance. The technology also improves governance by aligning internal workflows with external regulatory standards. By reducing audit preparation time, enterprises realize both cost savings and risk resilience.

Rising Demand for Business Agility and Competitive Differentiation

Global competition pushes organizations to adopt process mining solutions that enhance agility and responsiveness. It allows leaders to adapt business operations quickly by detecting process inefficiencies early. Fast-changing customer expectations demand flexible and optimized workflows. By offering actionable insights, these tools improve customer experience and operational reliability. Adoption extends beyond large enterprises, with mid-sized firms leveraging cost-effective solutions to remain competitive. Continuous process improvement supported by process mining establishes long-term differentiation in dynamic markets.

Market Trends

Expansion of Cloud-Based Deployment Models for Scalable Adoption

The Process Mining Market shows a strong shift toward cloud-based platforms that provide scalability and flexibility. Organizations prefer cloud deployment to reduce infrastructure costs and enable remote accessibility. It allows enterprises to integrate process insights across distributed teams and global operations. Cloud solutions also support faster updates, ensuring access to advanced analytics and automation features. Vendors focus on offering hybrid options to balance security and agility. This trend positions cloud-based process mining as a central enabler of digital transformation strategies.

- For instance, a proof-of-concept by KYP.ai processed logs from 1,200 machines and captured over 100 event types, generating insights equivalent to 15 years of manual data analysis within just weeks.

Growing Use of Real-Time Analytics to Enhance Decision-Making

The demand for real-time process monitoring continues to expand across industries. The ability to capture and analyze event data instantly enables businesses to respond to inefficiencies with speed. It empowers leaders to optimize operations before minor issues escalate into major disruptions. Real-time analytics also supports predictive modeling, helping organizations anticipate performance gaps. This approach strengthens decision-making in sectors such as finance, healthcare, and logistics. The trend underscores a move toward proactive process intelligence rather than reactive analysis.

- For instance, Borusan Cat applied object-centric process mining to its after-sales service, analyzing a dataset of approximately 65,000 event records, which revealed inefficiencies across interlinked maintenance and spare-parts processes.

Integration with Business Intelligence and Enterprise Platforms

Organizations seek seamless integration of process mining with existing enterprise systems and business intelligence platforms. It enables decision-makers to combine process insights with broader organizational data for holistic analysis. This integration improves cross-departmental collaboration and aligns operational metrics with strategic objectives. Vendors enhance interoperability by designing connectors for ERP, CRM, and workflow management tools. The approach reduces data silos and accelerates adoption within large enterprises. This trend reflects the growing importance of unified platforms that deliver end-to-end visibility.

Rising Focus on Industry-Specific Applications and Customization

Vendors are tailoring solutions to meet the distinct needs of industries such as healthcare, banking, and manufacturing. It allows organizations to implement specialized process mining capabilities aligned with sector-specific regulations and workflows. Customization enhances usability and ensures higher return on investment. Industry-focused solutions address compliance, patient care efficiency, or supply chain resilience. By offering specialized features, vendors differentiate themselves in a competitive market. This trend highlights the transition from generic applications to targeted, value-driven solutions.

Market Challenges Analysis

Data Complexity and Integration Barriers Across Diverse Systems

The Process Mining Market faces challenges due to the complexity of handling vast and unstructured data sets. Enterprises often operate with multiple legacy systems, modern cloud platforms, and disparate databases, which complicates data integration. It requires significant effort to harmonize data sources and ensure accuracy for process analysis. Poor data quality or incomplete event logs can limit the effectiveness of insights generated. Organizations also struggle with technical expertise, as implementing process mining tools demands advanced analytical skills. These integration hurdles slow adoption, particularly for mid-sized enterprises with limited resources.

Concerns Over Security, Compliance, and Change Management

Security and compliance remain key obstacles for the widespread adoption of process mining solutions. It raises concerns over sensitive data exposure when event logs and business processes are analyzed. Companies in regulated industries must ensure strict adherence to data protection standards, which adds cost and complexity. Resistance to organizational change further limits adoption, as employees often perceive process mining as a monitoring tool rather than an enabler. Training and cultural alignment become essential to overcome these barriers. High implementation costs and lengthy deployment cycles also challenge organizations seeking rapid returns on investment.

Market Opportunities

Expansion into Emerging Industries and Untapped Business Functions

The Process Mining Market presents strong opportunities through expansion into industries that have not yet fully leveraged process intelligence. Sectors such as retail, energy, and telecommunications seek greater transparency in operations and customer-facing workflows. It enables organizations to optimize supply chains, service delivery, and customer engagement models. Beyond core functions like finance or compliance, adoption is growing in areas such as procurement, marketing, and human resources. Vendors can capture new demand by offering domain-specific features that address these business needs. This broadening scope positions process mining as a versatile solution with cross-industry potential.

Advancements in Automation and AI-Driven Insights

Opportunities emerge from the growing alignment of process mining with automation and artificial intelligence. It strengthens value delivery by not only identifying inefficiencies but also recommending corrective actions through intelligent analytics. Integration with robotic process automation creates a pathway for end-to-end digital transformation. AI-driven models enhance predictive capabilities, enabling businesses to anticipate risks and optimize outcomes. Enterprises adopting these advanced solutions gain significant competitive advantage in fast-moving markets. This convergence opens opportunities for vendors to differentiate through innovation and advanced functionality.

Market Segmentation Analysis:

By Enterprise Type

The Process Mining Market is segmented into large enterprises and small & medium enterprises. Large enterprises dominate adoption due to their complex operational structures, higher transaction volumes, and significant investment capacity in digital transformation. It allows them to uncover inefficiencies across global operations and optimize resource allocation at scale. Small & medium enterprises are also increasing adoption, driven by the availability of cost-effective cloud-based solutions. Their focus remains on improving process visibility and enhancing productivity with limited resources. The growing accessibility of user-friendly platforms accelerates adoption across both enterprise categories.

- For instance, Siemens implemented Celonis process mining across its global purchase-to-pay operations and analyzed more than 600 million transaction records, identifying over 20,000 automation opportunities that reduced process cycle times.

By Application

The market is divided into order management, digital transformation, customer satisfaction, business process improvement, auditing & compliance, and others. Business process improvement holds a significant share, as organizations seek to eliminate bottlenecks and drive operational efficiency. It plays a crucial role in digital transformation initiatives, where real-time analytics enable agile decision-making. Order management and customer satisfaction are gaining traction as enterprises prioritize seamless customer experiences and streamlined service delivery. Auditing & compliance applications also expand steadily due to rising regulatory scrutiny across sectors. The diverse applications ensure process mining remains integral to both strategic and operational objectives.

- For instance, Deutsche Telekom applied Celonis process mining to its order-to-cash workflows, analyzing transaction records across multiple subsidiaries, which helped it reduce average order handling time by more than 10,000 labor hours annually.

By End-User

The market is segmented into IT & telecommunication, healthcare, retail, BFSI, manufacturing, and logistics & transportation. IT & telecommunication leads adoption with its reliance on large-scale data-driven processes and the need for agility. Healthcare demonstrates rising demand as providers aim to enhance patient care and meet regulatory requirements. It finds strong application in BFSI, where process transparency and compliance remain critical. Manufacturing and logistics & transportation adopt these tools to optimize supply chains and improve throughput. Retail also shows growing interest as enterprises focus on enhancing customer journeys and operational alignment. The diverse end-user adoption reinforces the role of process mining as a transformative technology across industries.

Segments:

Based on Enterprise Type:

Based on Application:

- Order Management

- Digital Transformation

- Customer Satisfaction

- Business Process Improvement

Based on End-User:

- IT & Telecommunication

- Healthcare

- Retail

- BFSI

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 28% of the global Process Mining Market. The region leads due to strong digital transformation programs and high adoption by industries such as banking, healthcare, and IT & telecommunications. Large enterprises invest heavily in process optimization and compliance tools. It benefits from mature infrastructure and advanced analytics capabilities. Cloud-based platforms and AI integration drive further adoption. North America remains a key market with stable growth prospects.

Europe

Europe holds the largest share at 32%, making it the top region in the market. Countries such as Germany, the Netherlands, and the UK are early adopters of process mining tools. Strict regulations in finance, healthcare, and manufacturing push organizations to ensure transparency and compliance. It is widely used for quality improvement and efficiency gains across industries. Supportive government initiatives for Industry 4.0 also strengthen demand. Europe continues to dominate the market with strong maturity and adoption.

Asia Pacific

Asia Pacific represents about 25% of the global market and is the fastest-growing region. Demand is expanding rapidly in China, India, Japan, and South Korea due to industrial growth and digitalization. Small and medium enterprises adopt cost-effective cloud-based tools to improve customer service and supply chains. It benefits from strong government support for smart factories and digital infrastructure. Manufacturing, logistics, and retail show particularly strong adoption. Asia Pacific is expected to increase its market share in the coming years.

Latin America

Latin America holds roughly 8% of the market, reflecting steady but slower adoption. Brazil and Mexico are leading adopters, especially in banking, retail, and manufacturing. It helps companies streamline operations and improve compliance with local regulations. Cloud-based deployment models make adoption affordable for small and mid-sized enterprises. The region is still in the early stage of adoption, but awareness is increasing. Vendors are expanding through partnerships and localized offerings to tap into this growing market.

Middle East & Africa

The Middle East & Africa account for about 7% of the Process Mining Market. The UAE alone contributes around 1.5%, while South Africa shows strong growth potential. Key industries driving adoption include oil & gas, government, and financial services. It supports organizations in meeting governance requirements and improving efficiency. National digital transformation and smart city initiatives create opportunities for wider deployment. While the share remains modest, the region’s long-term outlook is positive with rising investment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Process Mining Market players such as ABBYY, Celonis, IBM Corporation, Microsoft Corporation, SAP Signavio, Software AG, UiPath, Mehrwerk, Apromore, Kofax. The Process Mining Market is defined by innovation, ecosystem integration, and differentiation through advanced technologies. Market leaders focus on combining process mining with automation, artificial intelligence, and business intelligence platforms to deliver end-to-end value. Vendors emphasize real-time insights, compliance monitoring, and predictive analytics to strengthen their positioning. Cloud-based deployment and industry-specific solutions are key strategies to address diverse enterprise needs. Competition is also shaped by partnerships, acquisitions, and product enhancements aimed at expanding market presence and driving adoption across sectors such as BFSI, healthcare, manufacturing, and telecommunications. The market continues to evolve with both global leaders and emerging players contributing to its dynamism.

Recent Developments

- In April 2025, Gartner’s 2025 Magic Quadrant highlights rapid growth in the process mining market, with increasing incorporation of AI, generative AI, and machine learning into vendor solutions. Market consolidation is ongoing, with acquisitions helping vendors scale offerings. Object-centric process mining (OCPM) and business operations intelligence (operational intelligence) are key emerging trends, alongside specialized vertical and horizontal solutions for SMEs and niche markets.

- In May 2023, Pegasystems Inc. launched an artificial intelligence-based Pega process mining system to offer a unified solution for seamless business. Its intuitive capabilities support clients and fix issues without hampering business operations.

- In May 2023, Mindzie launched an innovative business process mining platform fueled by generative AI. This cutting-edge technology transforms how organizations analyze, optimize & automate their business processes, enhancing efficiency, productivity, and cost-effectiveness significantly.

- In April 2023, UiPath and data cloud company, Snowflake, launched a business automation platform by integrating UiPath data with Snowflake Manufacturing Data Cloud. The platform includes UiPath’s process mining software to help align data left in the system.

Market Concentration & Characteristics

The Process Mining Market demonstrates moderate to high concentration, with a few global players holding significant influence through strong technological capabilities and extensive enterprise adoption. It is characterized by rapid innovation, frequent integration with automation and analytics platforms, and continuous expansion into new industry verticals. Vendors compete by enhancing features such as real-time monitoring, predictive insights, and seamless integration with enterprise systems, while smaller firms differentiate through niche applications and cost-effective offerings. The market reflects growing demand across large enterprises and small to medium businesses, supported by cloud deployment and AI-driven solutions. It also shows strong traction in regulated industries where compliance and transparency remain priorities. The combination of concentrated leadership, diverse regional adoption, and steady entry of specialized vendors defines its competitive dynamics and long-term growth potential.

Report Coverage

The research report offers an in-depth analysis based on Enterprise Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing integration of artificial intelligence and machine learning into process mining platforms.

- Cloud-based deployment will dominate as enterprises prefer scalable and cost-efficient solutions.

- Adoption will rise among small and medium enterprises seeking transparency and efficiency.

- Real-time analytics will become a standard feature for proactive decision-making.

- Industry-specific solutions will gain traction to meet regulatory and operational needs.

- Integration with robotic process automation will accelerate end-to-end digital transformation.

- Demand will increase in regulated sectors such as banking, healthcare, and insurance.

- Partnerships and acquisitions will strengthen vendor ecosystems and product capabilities.

- Emerging markets will contribute significantly through rapid digital transformation initiatives.

- Focus on customer experience optimization will drive innovation in process intelligence tools.