Market Overview:

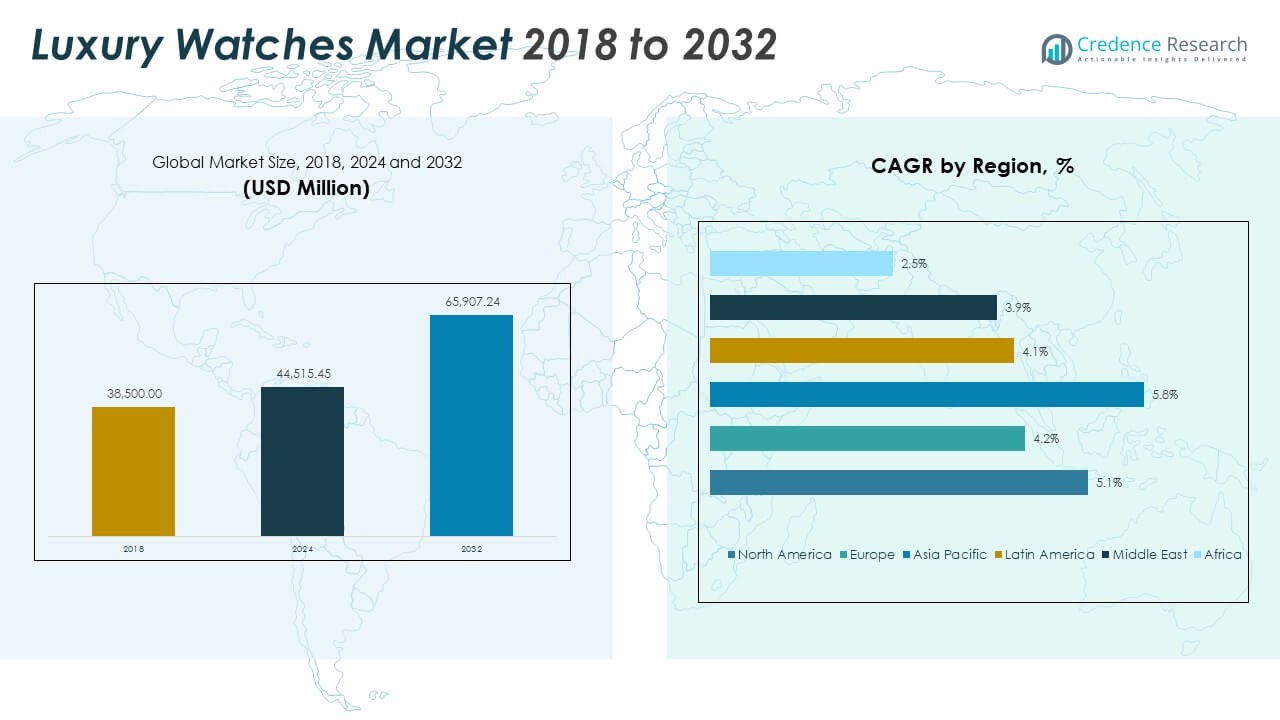

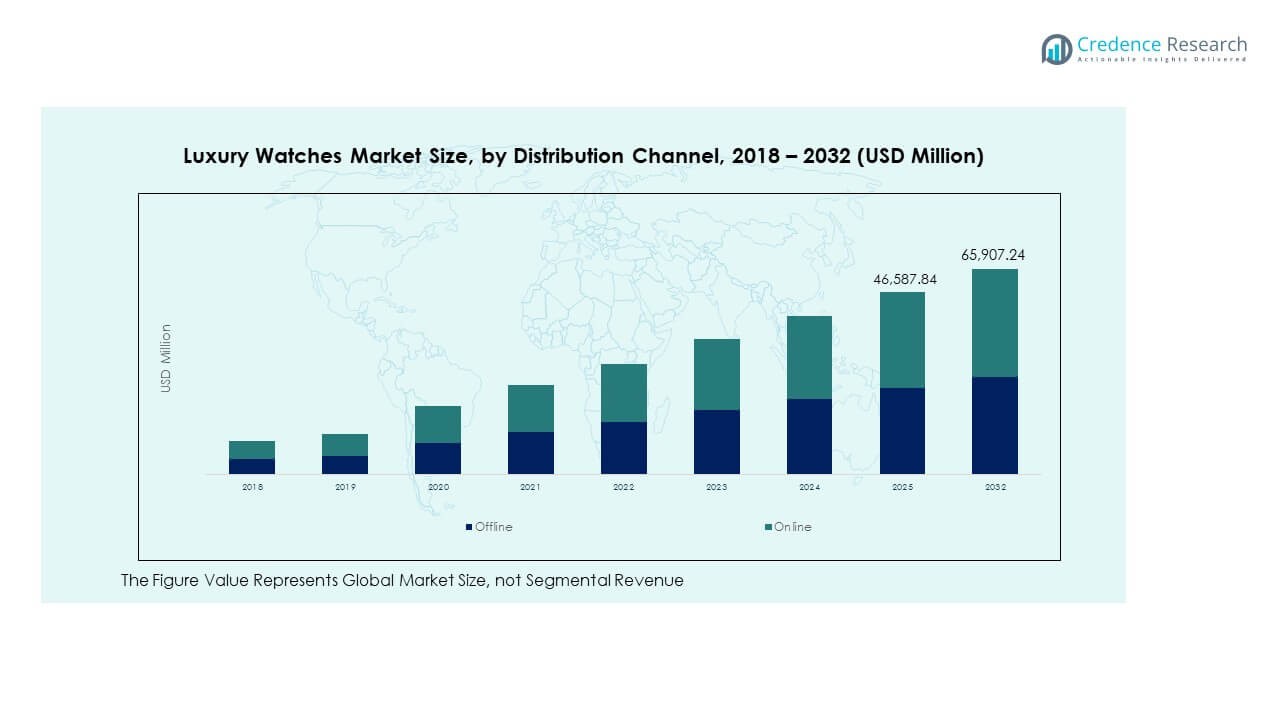

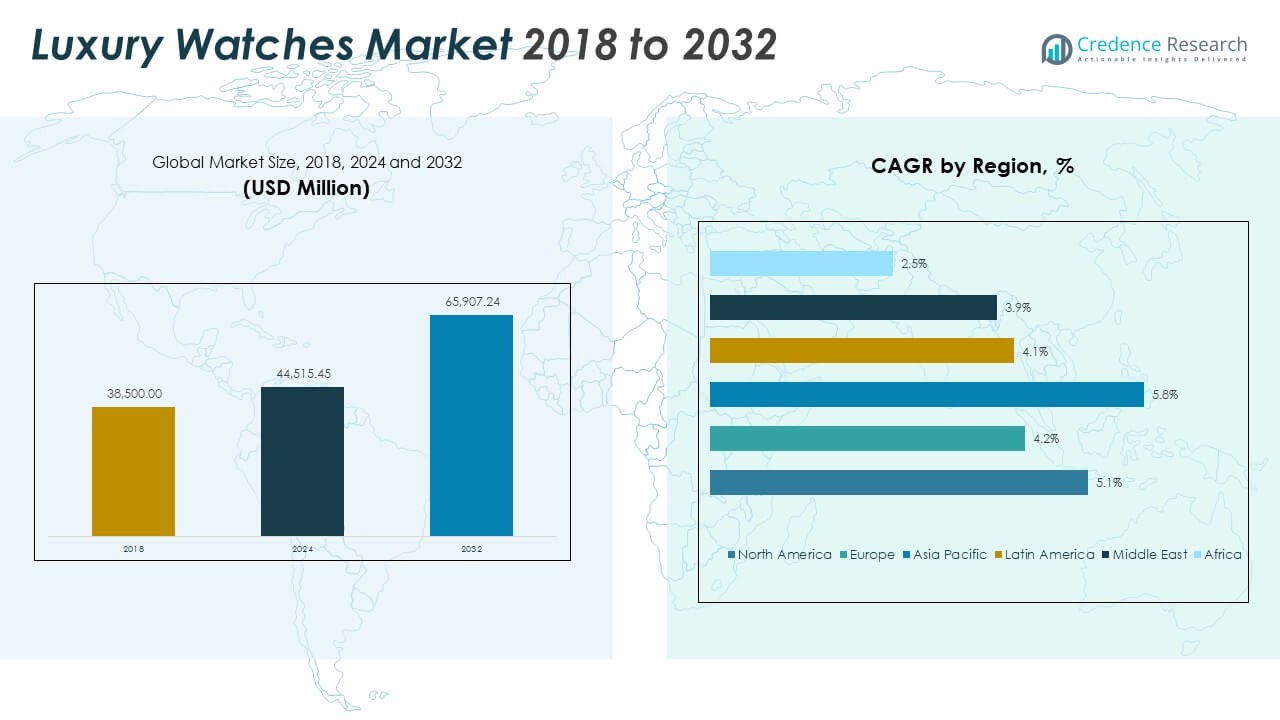

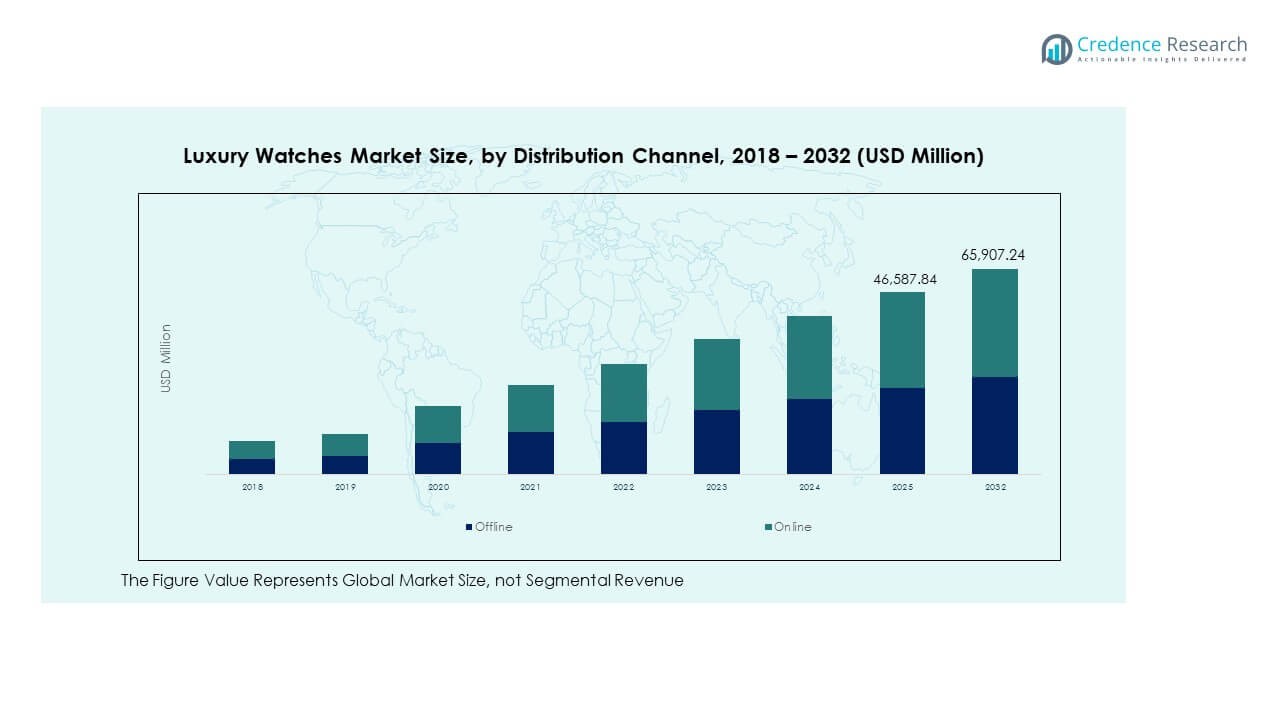

The Global Luxury Watches Market size was valued at USD 38,500.00 million in 2018, increased to USD 44,515.45 million in 2024, and is anticipated to reach USD 65,907.24 million by 2032, at a CAGR of 5.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Watches Market Size 2024 |

USD 44,515.45 Million |

| Luxury Watches Market, CAGR |

5.08% |

| Luxury Watches Market Size 2032 |

USD 65,907.24 Million |

The market is driven by rising consumer preference for premium timepieces as a symbol of status and craftsmanship. Growth in disposable income, expanding high-net-worth individual populations, and brand collaborations with celebrities enhance market visibility. Technological advances such as smart luxury watches and limited-edition collections attract younger consumers while maintaining exclusivity and prestige, fostering continued global demand.

Europe leads the market, supported by heritage brands from Switzerland, France, and Italy. North America follows with high luxury spending and strong retail presence. The Asia-Pacific region, particularly China, Japan, and India, is emerging rapidly due to urbanization, rising affluence, and a growing appetite for premium fashion goods. The Middle East also shows potential, driven by luxury tourism and brand-conscious consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Luxury Watches Market was valued at USD 38,500.00 million in 2018, projected to reach USD 44,515.45 million in 2024, and is expected to attain USD 65,907.24 million by 2032, expanding at a CAGR of 5.08% during the forecast period.

- Asia Pacific leads the market with about 47.0% share, driven by rising disposable incomes, fashion-conscious consumers, and strong luxury retail growth in China, Japan, and India.

- North America (21.0%) and Europe (20.8%) follow, supported by established luxury brands, high purchasing power, and mature retail infrastructure sustaining demand for premium timepieces.

- The Asia Pacific region, with its fastest growth rate of 5.8%, benefits from expanding urban populations, increasing brand penetration, and strong millennial demand for modern and hybrid designs.

- Based on the chart, offline distribution accounts for nearly 60% of market sales, reflecting brand trust and personalized buying experiences, while online channels contribute about 40%, fueled by digital retail expansion and virtual showroom accessibility.

Market Drivers:

Rising Global Affluence and Growing High-Net-Worth Population

The Global Luxury Watches Market benefits from an expanding base of affluent consumers worldwide. Economic growth in emerging economies has created a strong middle and upper-income class seeking high-end goods. Wealth accumulation among professionals and entrepreneurs increases demand for luxury accessories that reflect social status. It attracts consumers seeking craftsmanship, exclusivity, and prestige. Rising disposable income in regions like Asia-Pacific and the Middle East fuels purchase frequency. Luxury watch brands target this demographic through tailored marketing campaigns and limited editions. The industry’s appeal lies in emotional value and lifestyle association. The rise of high-net-worth individuals continues to strengthen market expansion.

- For instance, in 2024, Asia-Pacific represented 41.72% of luxury watch sales, with China and India leading new buyer growth and North American HNWIs (aged 18–39) reporting 44% making multiple watch purchases annually.

Strong Heritage Branding and Craftsmanship Appeal

The market is driven by heritage craftsmanship, precision engineering, and brand legacy. Consumers associate Swiss, Italian, and French luxury watches with artistry and technical excellence. Renowned brands maintain loyal clientele through quality assurance and timeless design. It sustains consumer trust by emphasizing handmade components and traditional production. Collectors view luxury watches as both wearable art and investment pieces. Marketing strategies focus on brand storytelling and authenticity. The emphasis on craftsmanship differentiates premium timepieces from mass-produced products. This commitment to legacy supports long-term brand equity.

- For instance, Swiss brands require “Swiss Made” certification, ensuring that at least 60% of a watch’s value is produced domestically, and that luxury mechanical watches contain up to 1,000+ hand-assembled components, each manufactured to micron tolerances.

Technological Integration and Product Innovation

Innovation in luxury watches enhances both functionality and appeal. The introduction of hybrid and smart-luxury watches attracts tech-conscious customers. The Global Luxury Watches Market integrates features like health monitoring, GPS, and connectivity without losing elegance. Brands experiment with sustainable materials, advanced alloys, and innovative mechanisms. It drives consumer engagement through customization and design flexibility. Product diversification ensures relevance across generations. Collaborations with tech companies open new customer segments. This synergy between tradition and innovation reinforces market competitiveness.

Expanding Retail Channels and Personalized Consumer Experience

Evolving retail infrastructure amplifies accessibility to luxury timepieces. Flagship stores, digital boutiques, and authorized dealers strengthen consumer reach. Personalized experiences, including private consultations and bespoke services, enhance exclusivity. The Global Luxury Watches Market leverages omnichannel strategies to blend digital and physical engagement. It encourages brand loyalty through online customization and post-sale care. Celebrity endorsements and influencer collaborations extend brand visibility. Premium after-sales services build repeat purchase intent. Continuous evolution of retail experience drives sustainable growth.

Market Trends:

Shift Toward Smart Luxury Watches and Hybrid Designs

Technological convergence shapes consumer preferences for luxury timepieces. Brands are integrating smart functionalities within classic designs to retain traditional aesthetics. The Global Luxury Watches Market embraces hybrid watches blending mechanical precision and digital intelligence. It appeals to younger consumers seeking modern practicality. Smart features like notifications and health tracking enhance daily utility. Leading players invest in R&D to innovate without compromising craftsmanship. Demand for connected luxury models is increasing across urban demographics. The fusion of elegance and technology defines this emerging trend.

Sustainability and Ethical Sourcing in Watchmaking

Environmental consciousness influences purchasing behavior among luxury consumers. Brands focus on sustainable materials, recycled metals, and traceable gemstones. The Global Luxury Watches Market adapts production processes to meet ethical standards. It prioritizes eco-friendly packaging and responsible supply chains. Consumers value transparency about origin and sustainability certifications. This shift strengthens brand image and attracts environmentally aware buyers. Companies are adopting circular design principles to minimize waste. Sustainability now represents a competitive advantage in luxury watchmaking.

- For instance, Panerai offers watches like the Submersible QuarantaQuattro eSteel™, which features a case made of a high percentage of recycled steel and a strap crafted from recycled PET bottles. Other brands such as Oris produce the Aquis Date Upcycle, which uses a unique dial made from recycled PET plastic recovered from ocean waste, and many Swiss plants now utilize renewable energy and implement refurbishment programs for certified pre-owned watches to minimize waste across the industry.

Rise of Limited Editions and Customization Culture

Exclusivity remains a strong selling factor for luxury watches. Brands are producing limited-edition collections to create scarcity and desirability. The Global Luxury Watches Market emphasizes personalization through engraving, color, and strap selection. It enhances emotional connection by allowing customers to co-create designs. Collectors appreciate unique releases tied to cultural or historical themes. Digital configurators empower clients to preview bespoke options. This personalization trend builds deeper engagement and loyalty. The focus on rarity strengthens the value perception of premium timepieces.

Digital Transformation and Growth of Online Luxury Retail

E-commerce reshapes how consumers access luxury brands. Online flagship stores and virtual showrooms improve convenience and brand experience. The Global Luxury Watches Market invests in secure digital platforms and AR try-on tools. It benefits from global online marketplaces targeting luxury buyers. Brands now engage customers through storytelling and social media platforms. Influencer collaborations boost visibility among tech-savvy audiences. The digital channel supports cross-border sales and faster outreach. Integration of digital retail ensures steady long-term growth.

Market Challenges Analysis:

Counterfeit Production and Pricing Pressure in Competitive Segments

The Global Luxury Watches Market faces significant challenges from counterfeit goods and imitation products. Counterfeits reduce brand value, confuse customers, and impact revenues. It forces brands to invest heavily in authentication and anti-counterfeit technologies. Parallel imports and grey-market sales further distort pricing structures. The presence of mid-range luxury competitors increases pricing pressure. Consumers expect exclusivity but also value practicality, forcing a delicate balance. Rising production costs due to premium materials add strain on profit margins. Maintaining brand prestige while expanding accessibility remains complex for major players.

Changing Consumer Preferences and Market Saturation Risks

Consumer behavior is evolving with shifting priorities toward smart and minimalist designs. The Global Luxury Watches Market must adapt to modern fashion cycles and digital lifestyles. It risks losing relevance among younger demographics preferring multifunctional devices. Rapid innovation cycles can dilute traditional craftsmanship appeal. Market saturation in developed regions limits new growth potential. Economic downturns or inflation can reduce discretionary luxury spending. Balancing innovation with brand heritage poses an ongoing strategic challenge. Companies must align product development with emerging lifestyle shifts to sustain appeal.

Market Opportunities:

Rising Demand in Emerging Economies and Youth-Oriented Segments

Emerging markets in Asia-Pacific, the Middle East, and Latin America present untapped growth avenues. Rising disposable incomes and urban lifestyles stimulate luxury consumption. The Global Luxury Watches Market capitalizes on aspirational buying behavior among younger consumers. It expands brand portfolios to target entry-level luxury buyers. Regional events and cultural endorsements enhance visibility. Expansion of local distribution networks strengthens reach. Brands emphasizing modern designs with heritage craftsmanship attract new demographics. Youth-driven demand continues to shape future market direction.

Expansion Through Digital Platforms and Experiential Retail Innovation

Digital transformation unlocks new opportunities for customer engagement. Virtual showrooms, metaverse retailing, and AR-enabled experiences redefine luxury purchasing. The Global Luxury Watches Market leverages these platforms to enhance accessibility without losing exclusivity. It utilizes data analytics for targeted marketing and personalized service. Hybrid retail experiences connect online convenience with in-store luxury. Innovative collaborations with fashion and technology sectors broaden customer bases. The expansion of digital ecosystems supports sustained brand relevance and profitability.

Market Segmentation Analysis:

By Product Type

The Global Luxury Watches Market is segmented into electronic and mechanical categories, reflecting evolving consumer preferences and technological integration. Electronic watches, driven by smart features and hybrid functions, attract younger buyers seeking convenience with luxury aesthetics. Mechanical watches remain dominant due to their craftsmanship, precision, and heritage appeal. Collectors and enthusiasts value manual and automatic timepieces as symbols of legacy and artistry. It sustains market balance by blending innovation with traditional excellence. The coexistence of both types supports broad demographic reach. Mechanical models reinforce brand prestige, while electronic variants ensure modernization and relevance.

- For instance, mechanical watches accounted for approximately 55% of global luxury watch production in 2024, while major brands expanded digital sales via AR-powered virtual showrooms alongside flagship boutiques to maximize reach.

By Distribution Channel

The market is segmented into offline and online channels, each contributing distinct advantages. Offline retail, through flagship stores and authorized dealers, remains vital for personalized luxury experiences. It enables direct brand engagement and trust through exclusivity and service quality. Online sales are growing rapidly, supported by secure e-commerce platforms and digital marketing strategies. Consumers increasingly prefer online channels for convenience, variety, and accessibility. The integration of virtual showrooms and augmented-reality tools enhances digital shopping. Leading brands leverage omnichannel approaches to reach global customers. The balance between offline luxury and online efficiency strengthens long-term growth potential.

Segmentation:

By Product Type

By Distribution Channel

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Luxury Watches Market size was valued at USD 8,277.50 million in 2018 to USD 9,374.69 million in 2024 and is anticipated to reach USD 13,847.23 million by 2032, at a CAGR of 5.1% during the forecast period. North America holds an estimated 21.0% market share of the Global Luxury Watches Market. Strong purchasing power, established retail networks, and consumer preference for premium accessories drive regional growth. The U.S. dominates with high brand penetration and luxury awareness. It benefits from a mature e-commerce infrastructure and expanding luxury watch collections. Canada and Mexico show rising demand supported by urbanization and income growth. Collaborations with local influencers enhance market reach. Technological integration and sustainability trends are influencing consumer choices across this region.

Europe

The Europe Luxury Watches Market size was valued at USD 8,932.00 million in 2018 to USD 9,872.31 million in 2024 and is anticipated to reach USD 13,692.40 million by 2032, at a CAGR of 4.2% during the forecast period. Europe commands around 20.8% market share, supported by strong heritage brands from Switzerland, France, Italy, and Germany. The region is home to major luxury houses with global brand equity. It benefits from a strong tourism sector and high consumer loyalty to legacy brands. Demand for mechanical watches remains dominant due to craftsmanship and tradition. It continues to drive exports through leading manufacturers. Rising demand from younger luxury consumers promotes hybrid designs. The European market remains a cornerstone for innovation and timeless artistry.

Asia Pacific

The Asia Pacific Luxury Watches Market size was valued at USD 16,632.00 million in 2018 to USD 19,713.48 million in 2024 and is anticipated to reach USD 30,930.32 million by 2032, at a CAGR of 5.8% during the forecast period. Asia Pacific leads the global market with an estimated 47.0% share, driven by expanding affluent populations in China, Japan, and India. The market thrives on rising disposable income, fashion consciousness, and rapid urban development. It benefits from growing luxury retail networks and digital adoption. China remains the largest consumer base for high-end timepieces. Japan and South Korea contribute significantly through design innovation and strong domestic demand. It witnesses surging interest from millennials and Gen Z segments. Regional luxury hubs continue to attract international investments and flagship expansions.

Latin America

The Latin America Luxury Watches Market size was valued at USD 2,348.50 million in 2018 to USD 2,688.29 million in 2024 and is anticipated to reach USD 3,682.24 million by 2032, at a CAGR of 4.1% during the forecast period. Latin America holds roughly 5.6% of the global share, fueled by Brazil, Mexico, and Argentina. Rising middle-class income and fashion exposure are increasing luxury demand. The market benefits from expanding retail infrastructure and digital channels. It experiences growing brand collaborations with local influencers. Currency volatility and import tariffs limit faster penetration. It continues to attract aspirational buyers seeking prestige and exclusivity. Luxury tourism and e-commerce advancements are enhancing accessibility across key cities.

Middle East

The Middle East Luxury Watches Market size was valued at USD 1,578.50 million in 2018 to USD 1,718.01 million in 2024 and is anticipated to reach USD 2,313.71 million by 2032, at a CAGR of 3.9% during the forecast period. The region accounts for about 3.5% of the global share, driven by the Gulf Cooperation Council (GCC) countries. Wealth concentration, cultural affinity for luxury, and strong retail networks sustain steady demand. It benefits from high-end tourism and international brand events in Dubai and Riyadh. The UAE remains a key hub for premium watch retailing. Regional consumers favor limited editions and exclusive launches. Diversification in retail formats supports growth. Growing youth interest in modern watch designs strengthens market opportunities.

Africa

The Africa Luxury Watches Market size was valued at USD 731.50 million in 2018 to USD 1,148.68 million in 2024 and is anticipated to reach USD 1,441.34 million by 2032, at a CAGR of 2.5% during the forecast period. Africa holds around 2.1% of the global share, led by South Africa, Egypt, and Nigeria. Economic expansion and urban development stimulate demand for premium accessories. It witnesses rising luxury retail investments in major cities. Affluent consumers prefer mechanical and Swiss-made timepieces. Currency fluctuations and limited brand presence restrict rapid growth. Online sales channels are expanding, improving product access. The region offers long-term potential as consumer purchasing power gradually improves.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Apple Inc.

- The Swatch Group Ltd

- Audemars Piguet Holding S.A.

- Fossil Group, Inc.

- Citizen Watch Company of America, Inc.

- Seiko Watch Corporation

- Compagnie Financière Richemont SA

- LVMH Moët Hennessy – Louis Vuitton

- Movado Group Inc.

- Ralph Lauren Corporation

Competitive Analysis:

The Global Luxury Watches Market is highly competitive, marked by established heritage brands and innovative entrants. It features key players such as Rolex, Patek Philippe, Audemars Piguet, LVMH, Richemont, and Swatch Group, which dominate through strong brand identity and craftsmanship. Companies compete on design excellence, exclusivity, and distribution expansion. It continues to evolve with smart-luxury integrations and sustainability-driven production. Strategic alliances, influencer partnerships, and limited-edition collections strengthen market visibility. Regional and independent brands are gaining traction through personalization and online presence. Continuous innovation and prestige-based marketing define the competitive landscape.

Recent Developments:

- In October 2025, TAG Heuer (under LVMH) launched its first “Made for iPhone” luxury smartwatch, transitioning away from Google’s Wear OS platform to a custom operating system for seamless digital integration with iOS users. This strategic product launch reflects LVMH’s ongoing focus on tech-enabled luxury.

- In September 2025, Apple Inc. launched the Apple Watch Series 11 and Watch Ultra 3, introducing advanced health features such as hypertension alerts, improved sleep tracking, 5G connectivity, and extended battery life. These new luxury models debuted alongside broader enhancements to Apple’s smartwatch lineup, marking a significant step in wearable technology for health-conscious and luxury consumers.

- In August 2025, Audemars Piguet acquired a majority stake in Swiss precision component supplier Inhotec SA, reinforcing its vertical integration and supporting the continuity of expertise for the haute horlogerie ecosystem. The acquisition ensures innovation and industrial strength in high-end watchmaking.

Report Coverage:

The research report offers an in-depth analysis based on product type and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for hybrid and smart-luxury watches will expand across younger demographics.

- Sustainability and ethical sourcing will become central to brand strategies.

- Asia-Pacific will remain the fastest-growing regional market.

- Personalization and limited editions will enhance customer engagement.

- Digital and omnichannel retail will drive new revenue streams.

- Innovation in materials and design will attract tech-savvy buyers.

- Heritage brands will retain dominance through authenticity and legacy.

- Collaborations between fashion and tech sectors will increase.

- Demand for certified pre-owned luxury watches will grow.

- Global tourism recovery will stimulate luxury retail performance.