Market Overview:

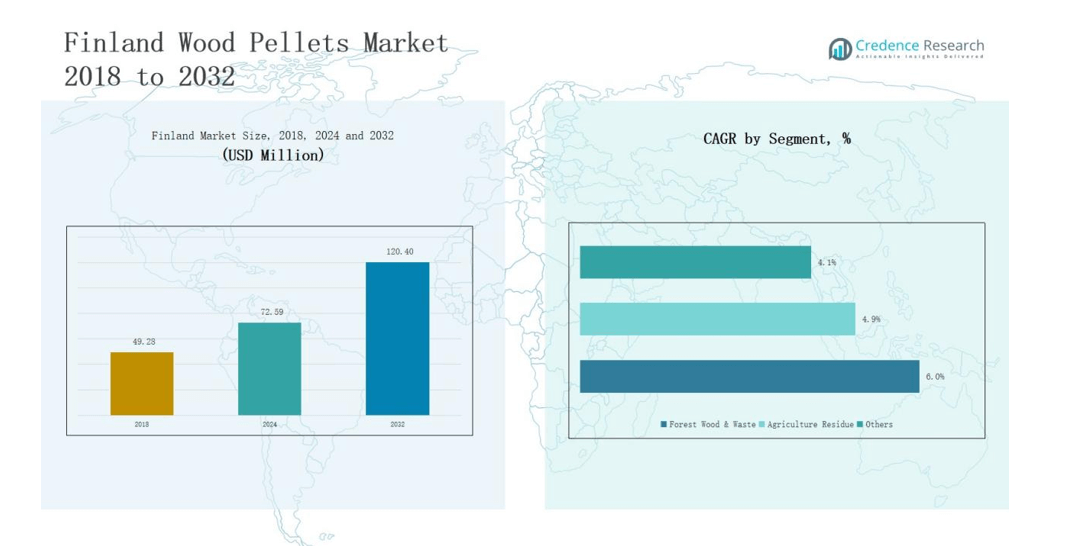

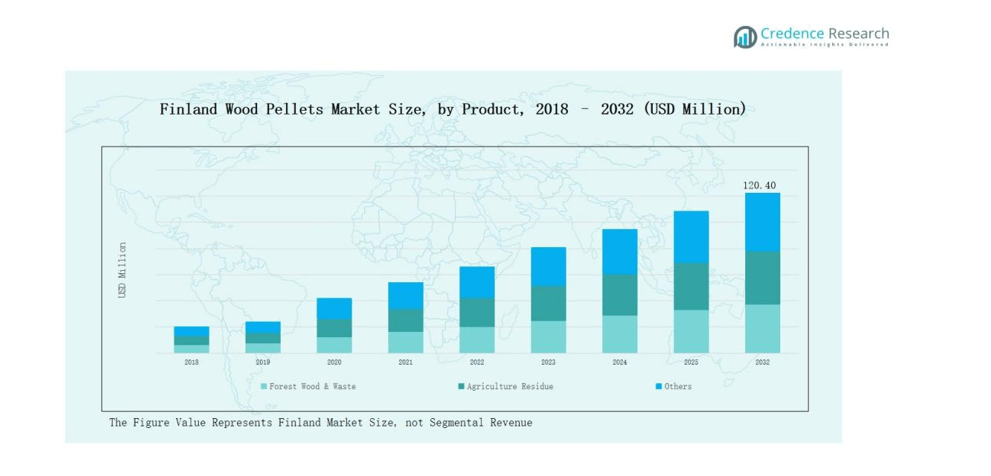

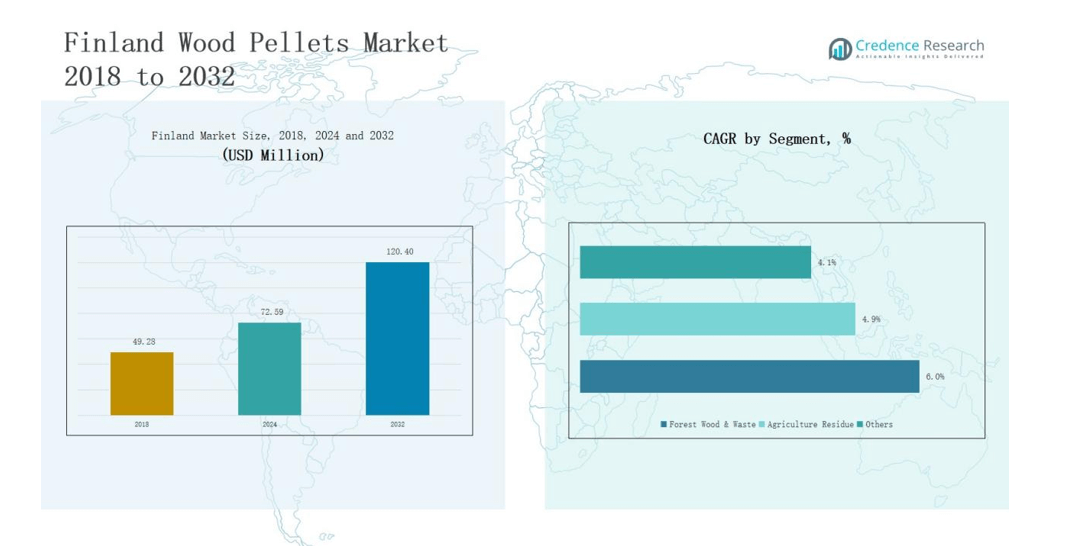

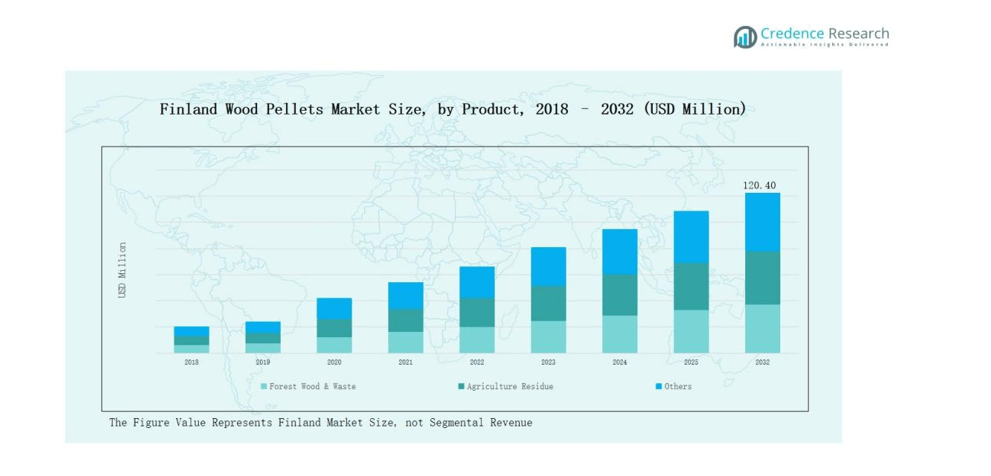

Finland Wood Pellets Market size was valued at USD 49.28 million in 2018 to USD 72.59 million in 2024 and is anticipated to reach USD 120.40 million by 2032, at a CAGR of 6.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Finland Wood Pellets Market Size 2024 |

USD 72.59 million |

| Finland Wood Pellets Market, CAGR |

6.08% |

| Finland Wood Pellets Market Size 2032 |

USD 120.40 million |

The Finland Wood Pellets Market is shaped by prominent players such as UPM-Kymmene, Stora Enso Metsä, Metsä Fibre, Oulun Energia, Biowatti Oy, Perhon Pellettitehdas Oy, Metsäpellets Oy, and Pohjois-Pohjanmaan Pellets Oy, which leverage advanced production capacity, strong forestry resources, and established supply chains. Large companies secure industrial and district heating contracts, while mid-sized firms focus on residential and commercial markets with ENplus-certified products. Competition centers on sustainability, cost efficiency, and long-term partnerships with energy utilities. Regionally, Northern Finland leads the market with 42% share in 2024, supported by dense forestry resources, modern pelletizing facilities, and robust district heating infrastructure, positioning it as the country’s dominant production and distribution hub.

Market Insights

- Finland Wood Pellets Market grew from USD 49.28 million in 2018 to USD 72.59 million in 2024 and will reach USD 120.40 million by 2032.

- Leading companies include UPM-Kymmene, Stora Enso Metsä, Metsä Fibre, Oulun Energia, Biowatti Oy, Perhon Pellettitehdas Oy, Metsäpellets Oy, and Pohjois-Pohjanmaan Pellets Oy.

- By product, forest wood & waste dominates with 72% share in 2024, followed by agriculture residue at 19% and others at 9%

- By application, industrial pellets for CHP/district heating lead with 58% share, residential/commercial heating holds 27%, co-firing 10%, and others 5%.

- Regionally, Northern Finland leads with 42% share, followed by Southern Finland at 29%, Western Finland at 19%, and Eastern Finland at 10%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

The Finland wood pellets market is dominated by forest wood & waste, accounting for nearly 72% share in 2024. Abundant forestry resources and Finland’s strong sustainable forest management practices drive this leadership. The segment benefits from consistent raw material supply, ENplus-certified quality, and integration with domestic pellet plants. Agriculture residue holds about 19% share, supported by the use of crop waste and residues in rural regions. The others category, contributing 9% share, includes recovered wood and blends, which remain niche due to limited availability and quality variation.

- For instance, UPM Kymmene has utilized forest residues and byproducts from its sawmills to produce ENplus-certified wood pellets, ensuring a steady feedstock supply for both domestic heating and district energy systems.

By Application

Within applications, industrial pellets for CHP/district heating lead the Finland market with nearly 58% share in 2024, driven by the country’s extensive district heating infrastructure and strong policy support for renewable energy. Pellets for heating residential and commercial use follow with about 27% share, supported by widespread adoption of pellet stoves and boilers in households and small businesses. Industrial pellets for co-firing hold around 10% share, reflecting gradual substitution in coal-fired plants under decarbonization policies. The others segment captures about 5% share, covering niche applications such as small-scale power generation and export-focused demand.

- For instance, Vaskiluodon Voima’s Vaasa power plant-Finland’s largest biomass gasification facility-integrates wood pellets with coal, cutting CO₂ emissions by up to 230,000 tons annually.

Market Overview

Key Growth Drivers

Expanding District Heating Networks

Finland’s wood pellets market is strongly driven by the expansion of district heating networks, which supply a large share of residential and industrial heat demand. Pellets provide a sustainable and cost-effective alternative to fossil fuels, particularly in urban centers where heating demand is high. Government policies promoting renewable energy integration strengthen this adoption. Increasing investments in combined heat and power (CHP) plants also fuel demand for industrial-grade pellets, ensuring a steady growth trajectory for the market.

- For instance, the Lahti Energia Kymijärvi II power plant uses wood-based fuels, including pellets, to generate both electricity and district heat.

Abundant Forestry Resources

The availability of extensive forestry resources is a major growth driver for the Finland wood pellets market. Sustainable forest management practices and an efficient supply chain guarantee continuous access to high-quality raw materials. Finland’s large-scale logging operations produce significant forest residues, which are directly utilized for pellet manufacturing. This natural advantage reduces production costs and enhances competitiveness in both domestic and export markets. The reliance on forest wood and waste also aligns with strict EU renewable energy standanrds.

- For instance, Stora Enso has integrated wood by-products from its sawmills into pellet production, reducing waste while supplying households and district heating plants.

Strong Policy and Regulatory Support

Government incentives and regulatory frameworks strongly support pellet adoption across Finland. National energy strategies emphasize reducing carbon emissions, increasing renewable energy share, and achieving climate neutrality by 2035. Subsidies for pellet-based heating systems, coupled with tax benefits, encourage households and businesses to switch from oil or coal. EU directives on renewable energy and Finland’s bioenergy action plan further reinforce this transition. These policy-driven measures create a favorable environment for long-term pellet market expansion.

Key Trends & Opportunities

Rising Demand for Residential Heating

A growing trend in the Finland wood pellets market is the rising adoption of pellet heating in residential and commercial spaces. Consumers are increasingly investing in pellet stoves and boilers due to lower operational costs and strong environmental appeal. The shift from oil-based heating to renewable sources provides significant opportunities for pellet producers. As Finland’s households seek efficient and eco-friendly heating alternatives, demand in this segment is expected to accelerate, complementing the dominance of industrial pellet consumption.

- For instance, Valmet Oyj developed advanced pellet boilers that improve energy efficiency by up to 15%, helping households reduce operational costs.

Export Market Expansion

Finland’s wood pellet producers are increasingly eyeing export opportunities in Europe, where countries such as Denmark, Sweden, and Germany show rising pellet demand. With abundant forestry resources and advanced production capacity, Finnish companies are well-positioned to supply high-quality pellets abroad. EU-wide renewable energy commitments further support this cross-border trade. Export growth diversifies revenue streams, reduces reliance on domestic consumption cycles, and strengthens Finland’s position as a competitive pellet supplier in the European market.

- For instance, Vapo Oy (Neova Group) reported that its pellet production facilities in Finland supply both domestic heating needs and exports, particularly to Sweden and Denmark, where district heating systems rely heavily on biomass.

Key Challenges

High Production and Logistics Costs

Despite resource availability, high production and logistics costs challenge pellet manufacturers in Finland. Energy-intensive pelletizing processes, coupled with rising labor and transportation expenses, increase overall costs. Transporting pellets across long distances within the country and to export markets further strains profitability. These factors make price competitiveness difficult, especially against imported pellets from countries with lower operational expenses, limiting market margins.

Competition from Alternative Biofuels

The Finland wood pellets market faces competition from alternative renewable sources such as biogas, wood chips, and other biomass solutions. District heating networks, in particular, often rely on wood chips due to their lower processing needs and reduced costs. Growing investments in biogas production also present an alternative for both heating and electricity generation. This competition pressures pellet producers to innovate, reduce costs, and highlight efficiency advantages to maintain market share.

Market Volatility in Raw Material Supply

While Finland has abundant forestry resources, fluctuations in raw material supply present a challenge for consistent pellet production. Competing uses of wood residues, including pulp, paper, and bioenergy industries, create supply pressure. Seasonal variations in logging and potential changes in forestry regulations can further limit availability. Such volatility raises input costs and risks production slowdowns, ultimately affecting both domestic supply stability and export competitiveness.

Regional Analysis

Northern Finland

Northern Finland leads the Finland Wood Pellets Market with a 42% share in 2024. The region benefits from dense forestry resources and advanced pellet production facilities. Strong district heating infrastructure and high energy demand from industrial clusters support pellet consumption. Local producers emphasize sustainable sourcing and ENplus-certified products, ensuring quality and competitiveness. Cross-border trade with Sweden and Norway also strengthens demand. It continues to act as the primary hub for both domestic distribution and export-focused operations.

Southern Finland

Southern Finland holds a 29% share in 2024, driven by its concentration of urban populations and industrial facilities. The region shows strong demand for residential and commercial pellet heating due to policy incentives and consumer awareness of renewable energy. Major ports in the south support export logistics, making it an important gateway for pellet trade. Producers leverage proximity to markets and efficient supply networks to enhance competitiveness. It remains a key growth driver for both domestic consumption and export potential.

Western Finland

Western Finland accounts for a 19% share in 2024, supported by its mix of agricultural residues and forestry-based pellet production. Rural communities in this region adopt pellet heating systems at a steady pace. Proximity to coastal shipping routes facilitates both domestic supply and export to nearby European markets. Investments in small and medium-scale pellet plants sustain local employment and energy security. It plays a vital role in balancing supply across the national pellet market.

Eastern Finland

Eastern Finland represents a 10% share in 2024, with demand primarily driven by small-scale residential and commercial pellet use. The region has a moderate forestry base, which supports localized production. Cross-border energy cooperation with Russia historically influenced pellet trade, though recent shifts in supply patterns have changed dynamics. Growth remains steady as consumers seek alternatives to oil-based heating. It serves as a niche but consistent contributor to overall pellet demand in the country.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By Region

- Northern Finland

- Southern Finland

- Western Finland

- Eastern Finland

Competitive Landscape

The Finland Wood Pellets Market is moderately fragmented, with competition shaped by both large integrated forestry companies and smaller regional producers. Leading players such as UPM-Kymmene, Stora Enso Metsä, Metsä Fibre, and Oulun Energia leverage extensive forestry resources, advanced pelletizing capacity, and established distribution networks to secure long-term supply contracts with industrial and district heating operators. Mid-sized firms, including Perhon Pellettitehdas Oy, Biowatti Oy, and Metsäpellets Oy, focus on residential and commercial markets, offering ENplus-certified pellets through retail and direct sales channels. Competition is driven by sustainability, cost efficiency, and reliable logistics, with producers emphasizing carbon neutrality and compliance with EU renewable energy targets to strengthen their market positions. Regional firms in Northern Finland gain a competitive edge through proximity to raw materials and strong export links to Sweden and Norway. Innovation in pellet quality, energy efficiency, and supply chain integration continues to define the evolving market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In April 2025, Helen, Helsinki’s energy group, shut down Finland’s last coal-fired power and heat plant. In its transition strategy, the company adopted wood pellets and wood chips alongside electricity, heat pumps, and waste heat for clean energy generation. This move highlights a significant step toward sustainable heating in Finland.

- In January 2024, Versowood Oy signed a business purchase agreement to acquire the Turenki pellet factory from Vapo Terra Oy (a Neova Oy subsidiary) .

- In August 2025, Valmet and Helen signed a four-year service agreement to support a newly converted wood-pellet boiler at Helen’s Salmisaari power plant in Helsinki. The partnership ensures reliable and safe operations, strengthening Helen’s transition from coal to sustainable wood-based fuels.

- In June 2025, Joensuu Biocoal, together with ANDRITZ, started operating an industrial-scale torrefaction reactor at Savon Voima’s CHP site. The facility can produce up to 60,000 tonnes of biocoal annually, expanding Finland’s advanced biomass fuel capacity

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow through expansion of district heating networks across major cities.

- Producers will strengthen export capacity to meet rising European pellet demand.

- Forest wood and waste will remain the leading raw material for pellet production.

- Investments in pelletizing technology will improve efficiency and product quality.

- Residential pellet adoption will increase as households shift from oil-based heating.

- Policy support for carbon neutrality will drive consistent growth in pellet usage.

- Competition from biogas and wood chips will push producers to innovate and reduce costs.

- Strategic partnerships with energy utilities will secure long-term supply contracts.

- Northern Finland will continue to dominate production due to resource availabilit

- Sustainability certification will remain a critical factor for market competitiveness.