Market Overview:

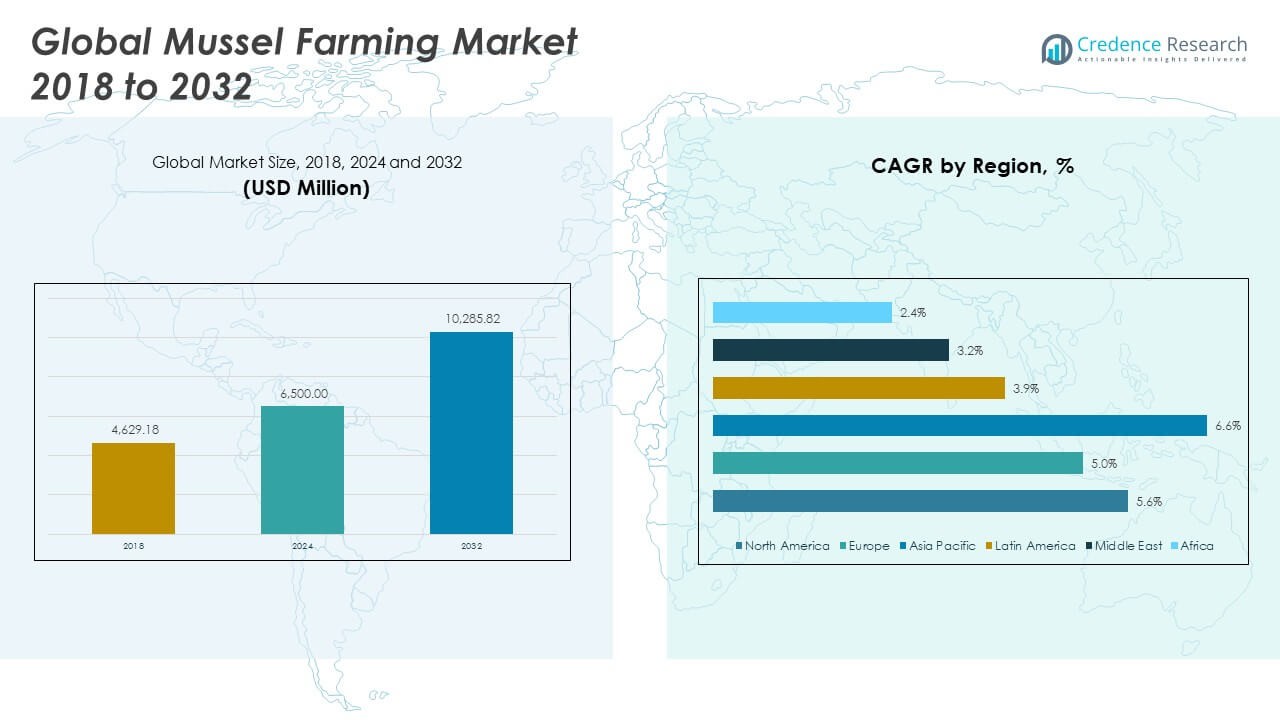

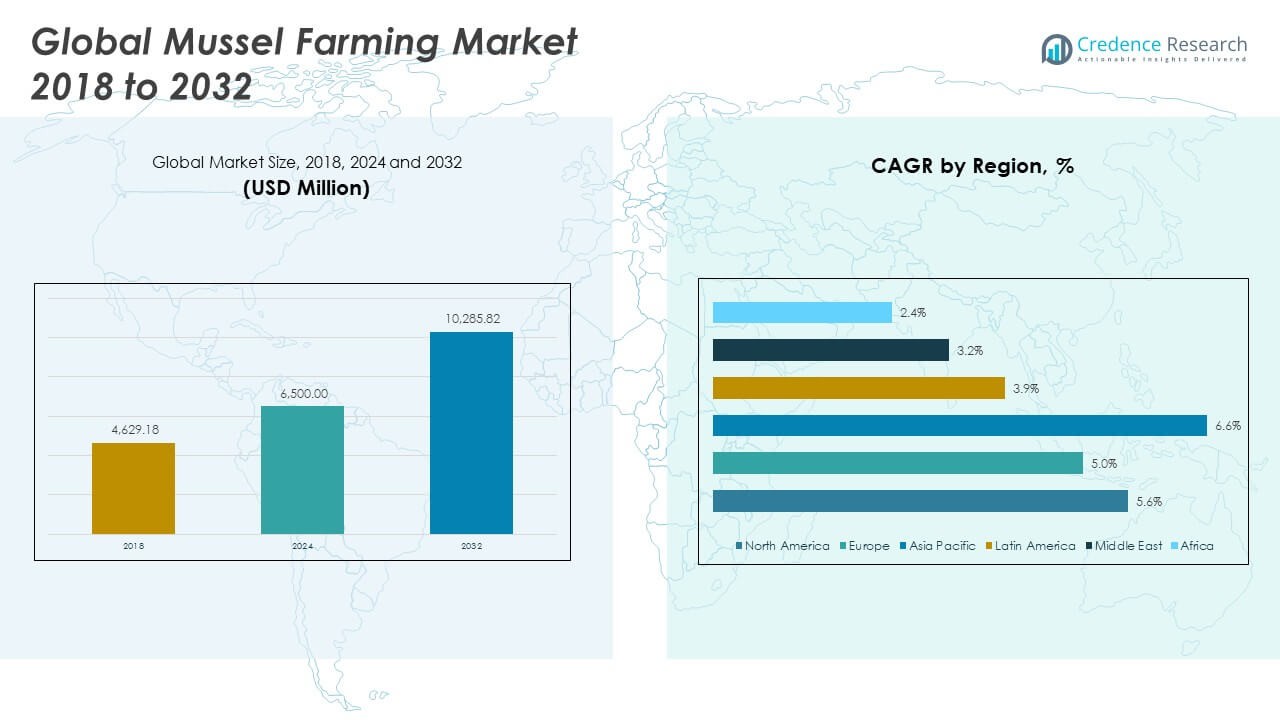

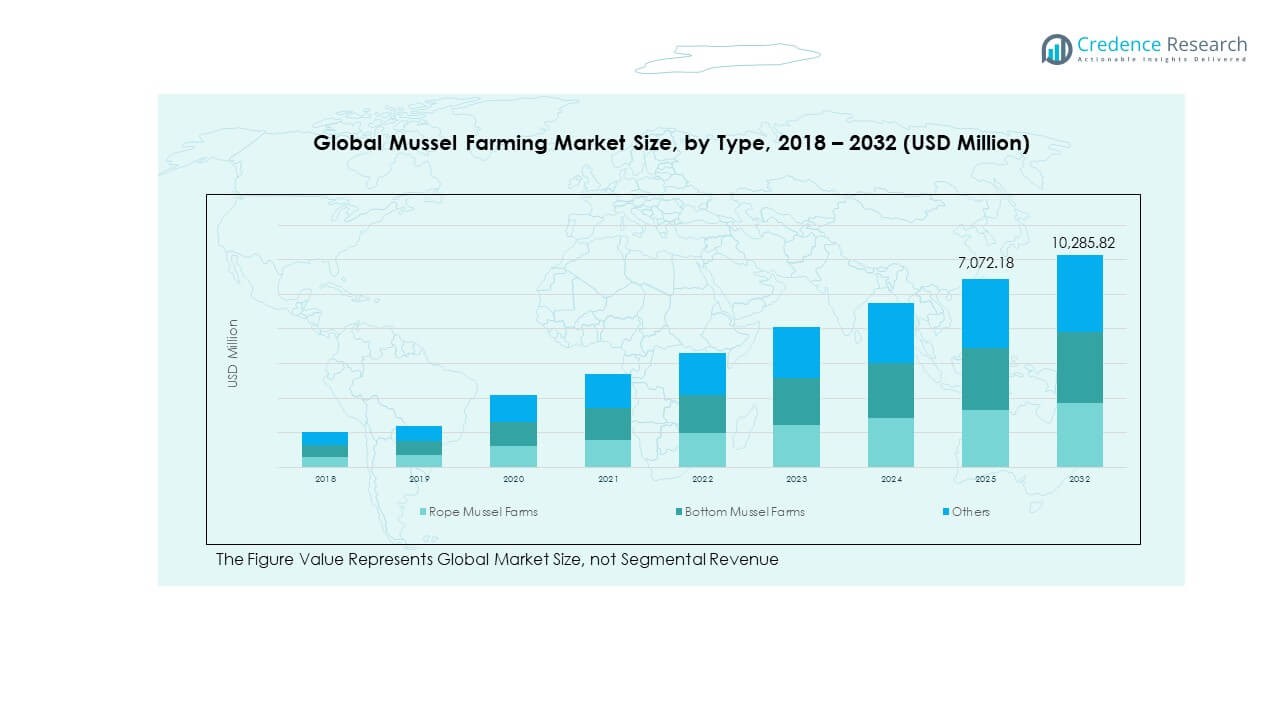

The Global Mussel Farming Market size was valued at USD 4,629.18 million in 2018 to USD 6,500.00 million in 2024 and is anticipated to reach USD 10,285.82 million by 2032, at a CAGR of 5.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mussel Farming Market Size 2024 |

USD 6,500.00 Million |

| Mussel Farming Market, CAGR |

5.50% |

| Mussel Farming Market Size 2032 |

USD 10,285.82 Million |

The Global Mussel Farming Market is driven by rising seafood consumption, increasing demand for sustainable protein sources, and expanding aquaculture practices. Consumers are shifting toward eco-friendly and nutritious food options, making mussels attractive due to their high protein and low environmental footprint. Advancements in farming technology and improved processing methods are supporting efficient production. Government initiatives promoting sustainable aquaculture further strengthen the market. Growing awareness of health benefits, coupled with cost-effectiveness compared to other seafood, also drives expansion.

Regionally, Europe leads the Global Mussel Farming Market due to strong aquaculture traditions in countries such as Spain, France, and the Netherlands. North America is showing steady growth, fueled by rising seafood demand and sustainable food awareness. Asia-Pacific is emerging as a significant market, with China and New Zealand expanding production capacity to meet global demand. Latin America presents new opportunities with supportive coastal ecosystems and government-backed aquaculture projects. The Middle East and Africa remain nascent markets but hold potential as demand for diverse protein sources grows.

Market Insights:

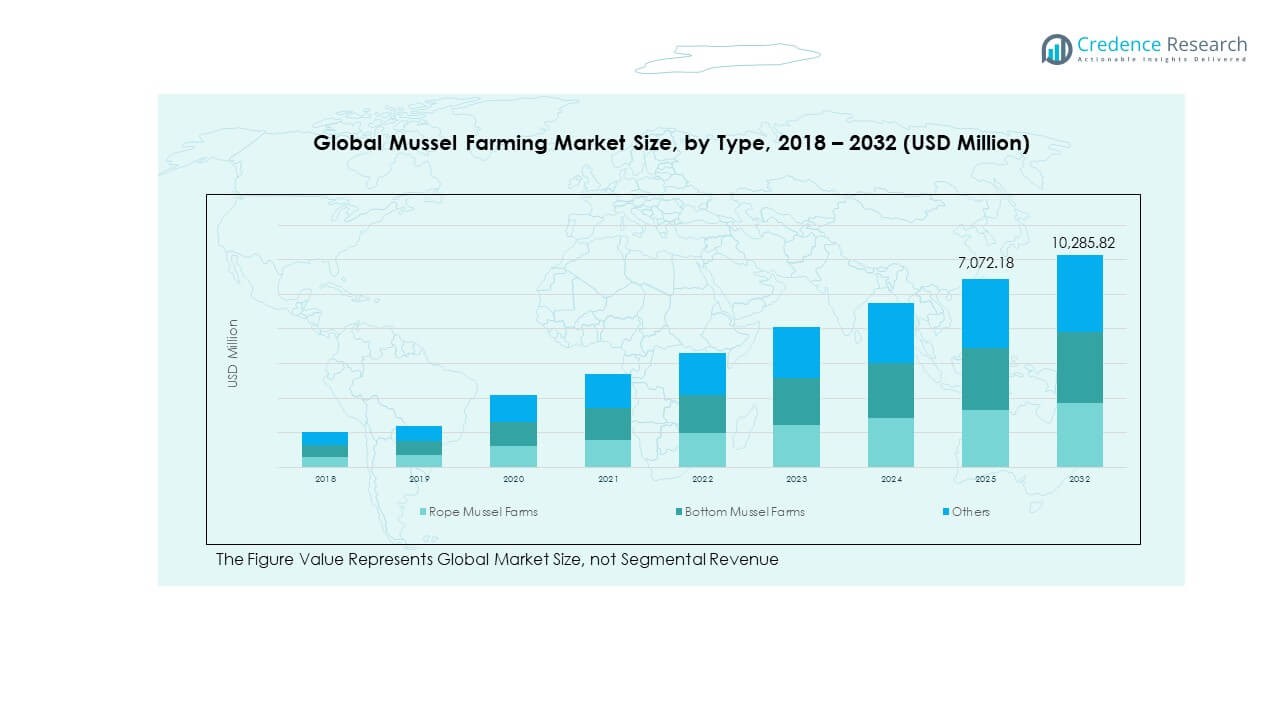

- The Global Mussel Farming Market was valued at USD 4,629.18 million in 2018, reached USD 6,500.00 million in 2024, and is projected to attain USD 10,285.82 million by 2032, growing at a CAGR of 5.50%.

- Europe leads with 42% share, driven by strong aquaculture infrastructure and seafood traditions, followed by North America with 28% share, supported by sustainable farming practices, and Asia-Pacific with 20% share, fueled by expanding production in China and New Zealand.

- Asia-Pacific is the fastest-growing region with 20% share, supported by abundant coastal resources, government aquaculture programs, and increasing export demand.

- Rope mussel farms dominate the market with 64% share, driven by higher yields, efficiency, and adoption in key producing countries.

- Bottom mussel farms account for 28% share, while other farming methods represent 8%, reflecting diversification and regional adaptation in farming practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable Protein Sources:

The Global Mussel Farming Market benefits from the increasing demand for sustainable protein alternatives. Mussels provide a rich source of lean protein, omega-3 fatty acids, and essential minerals. Consumers recognize mussels as a low-impact seafood option compared to meat and other aquaculture species. It offers low feed conversion ratios and requires minimal inputs, making mussels attractive to eco-conscious consumers. Governments promote mussel farming as part of sustainable food strategies, driving investments and policies. Retailers highlight mussels in health-focused product portfolios, further pushing demand. Growing health awareness among urban populations strengthens the appeal of mussels. Producers expand capacity to meet evolving consumer expectations and dietary shifts.

- For example, mussel farms like Blueshell Mussels have expanded with new workboats aiming to improve efficiency while supporting sustainability goals. Governments actively promote mussel farming within sustainable food strategies, driving investments and supportive policies

Expanding Aquaculture Infrastructure and Innovation:

Aquaculture infrastructure supports the steady expansion of mussel farming operations worldwide. The Global Mussel Farming Market gains from government-backed funding, modern processing units, and advanced hatchery technology. Farmers adopt mechanized harvesting systems to enhance productivity and reduce labor costs. It benefits from improved water monitoring technologies that reduce risks of disease and contamination. Partnerships between aquaculture firms and technology providers introduce innovation in farming systems. Coastal regions invest in marine farming zones that create stable environments for mussel production. Research institutions work on improving mussel breeds for resilience and higher yields. Such advancements encourage efficient large-scale operations while lowering production risks.

- For instance, regions like Shetland have seen investments in modern workboats to improve operational efficiency. Farmers widely adopt mechanized harvesting systems, reducing labor costs while boosting productivity.

Rising Popularity of Nutrient-Rich Diets:

Health-conscious consumers drive demand for nutrient-dense seafood products, giving mussels a unique advantage. The Global Mussel Farming Market is supported by growing awareness of mussels as a source of zinc, iron, and vitamin B12. Nutritionists and dieticians promote mussels as an immunity-boosting and heart-healthy food. It is increasingly included in balanced diet plans and recommended for weight management. Media campaigns highlight mussels’ benefits, influencing consumer preferences in both developed and emerging economies. The rise in flexitarian diets also contributes to rising demand for alternative protein options. Hotels and restaurants introduce mussel-based dishes to align with these health trends. Rising per capita seafood consumption reinforces market growth.

Government Support and Export-Oriented Growth:

Policies and subsidies strengthen mussel farming in many coastal economies. The Global Mussel Farming Market is supported by favorable regulations that encourage sustainable aquaculture practices. Governments in Europe and Asia promote exports to meet international seafood demand. It gains traction from certifications like MSC and ASC, boosting consumer trust in sustainability claims. Exporters expand their supply networks to North America and Middle Eastern markets. Trade agreements ease barriers, improving logistics and transportation routes for mussel shipments. Farmers invest in value-added processing to meet export standards and diversify product forms. Public-private collaborations further support expansion and global competitiveness.

Market Trends:

Technological Integration in Farming Practices:

The Global Mussel Farming Market is witnessing adoption of technology-driven solutions across production and monitoring. Farmers integrate IoT-based systems to track water quality, salinity, and nutrient levels. It helps reduce environmental risks while maintaining consistent yields. Automation supports large-scale production, with advanced machinery replacing manual labor in harvesting and sorting. Artificial intelligence is applied in farm management systems to predict growth cycles. Blockchain platforms are being used to strengthen traceability and ensure product authenticity. Start-ups introduce mobile platforms to connect small farmers with distributors and buyers. Adoption of technology creates higher efficiency and strengthens market reliability for consumers.

- Farmers implement IoT-based systems for real-time monitoring of water quality, salinity, and nutrient levels, reducing environmental risks and ensuring production consistency. Automation replaces manual labor in harvesting and sorting processes, enhancing operational scale.

Premiumization and Value-Added Products:

Consumer demand for premium seafood experiences influences product innovation in mussel farming. The Global Mussel Farming Market sees growth in ready-to-cook, frozen, and pre-flavored mussel products. Restaurants introduce mussels in gourmet dishes, making them attractive for higher-income consumers. It encourages farmers and processors to focus on value-added offerings for convenience. E-commerce platforms highlight pre-packaged mussels to meet urban consumer expectations. Certification-based labeling, such as organic or eco-friendly tags, enhances brand recognition. Growing focus on packaging innovation ensures freshness and extended shelf life. Rising global interest in gourmet seafood reinforces this trend across both developed and emerging markets.

- For instance, Restaurants include mussels in gourmet offerings, appealing to higher-income demographics and encouraging value-added product development. E-commerce platforms increasingly list pre-packaged mussels to cater to urban consumers’ preferences for convenience and freshness.

Rising Focus on Climate Adaptation Strategies:

Changing climatic conditions influence farming strategies and investments in aquaculture systems. The Global Mussel Farming Market is adapting by using selective breeding to produce resilient mussel varieties. Farmers adopt offshore farming systems to reduce vulnerability to coastal pollution. It relies on advanced research to understand mussel responses to ocean acidification. Governments fund adaptation programs to protect marine farming zones from temperature fluctuations. Producers diversify locations across regions to mitigate climate-related risks. Industry players partner with marine scientists to develop climate-resilient solutions. Adoption of these adaptation strategies strengthens the long-term sustainability of mussel farming operations.

Expansion in International Trade and Export Growth:

Export expansion defines a major trend shaping global mussel farming supply chains. The Global Mussel Farming Market is gaining international traction through rising exports to Asia and North America. Demand grows in regions with limited local production but high seafood consumption. It benefits from rising air-freight options, cold storage chains, and improved logistics. Trade agreements reduce tariffs and improve access for farmers targeting premium markets. Exporters focus on branding mussels as sustainable and nutritious food products. Multinational seafood distributors expand their networks to promote mussels globally. Internationalization drives producers to comply with stricter food safety and certification standards.

Market Challenges Analysis:

Environmental and Ecological Risks:

Environmental challenges remain a critical concern for mussel farmers worldwide. The Global Mussel Farming Market faces risks from pollution, rising sea temperatures, and ocean acidification. It also struggles with harmful algal blooms that damage water quality and reduce yields. Farmers invest in water monitoring, yet unpredictable weather still disrupts production cycles. Overfishing of natural mussel seed beds presents supply concerns for hatcheries. Expansion of coastal industries increases pollution, raising operational risks for farms. Biodiversity concerns pressure the industry to adopt stricter environmental standards. Such challenges limit scalability and affect overall farm profitability in several regions.

Operational Costs and Supply Chain Constraints:

High production costs and supply chain inefficiencies remain pressing challenges. The Global Mussel Farming Market contends with labor shortages in key producing regions. It experiences cost pressure from fuel prices, maintenance, and equipment upgrades. Exporters face rising compliance costs to meet international quality and safety standards. Transportation disruptions reduce timely delivery of fresh products. Limited cold chain infrastructure in developing markets restricts growth potential. Farmers need significant investment in processing technology to meet global expectations. Balancing costs with consumer price sensitivity remains a constant barrier for profitability and long-term sustainability.

Market Opportunities:

Rising Consumer Interest in Healthy Diets:

Health and wellness trends are creating strong opportunities in the seafood sector. The Global Mussel Farming Market is poised to benefit from increasing consumer interest in mussels as a high-protein, low-fat option. It is recognized for boosting immunity and supporting cardiovascular health, driving steady household adoption. E-commerce channels expand access, allowing consumers to purchase packaged mussels with ease. Restaurants and foodservice chains experiment with mussel-based recipes, boosting appeal among younger consumers. Dietary shifts toward natural and organic proteins open pathways for market expansion. Producers highlight certifications and eco-friendly practices to capture niche premium markets.

Emerging Growth in Developing Economies:

Emerging economies create untapped potential for mussel farming companies. The Global Mussel Farming Market is witnessing growing demand in Asia-Pacific, Latin America, and parts of Africa. It benefits from rising middle-class populations that seek affordable protein sources. Governments in these regions support aquaculture projects to strengthen food security and rural employment. Investments in infrastructure and training expand opportunities for small-scale farmers. Exporters partner with local players to build supply chains for global markets. Consumer interest in seafood variety reinforces demand for mussels across these emerging regions. Companies leveraging this opportunity secure long-term growth prospects.

Market Segmentation Analysis:

By Type

The Global Mussel Farming Market is segmented into rope mussel farms, bottom mussel farms, and others. Rope mussel farms dominate the segment due to efficiency, scalability, and consistent yields. Farmers adopt this method widely because it reduces environmental impact while ensuring high-quality output. Bottom mussel farms maintain relevance, especially in Europe and Asia, where seabed cultivation aligns with coastal ecosystems. It remains attractive for lower capital requirements, though yields fluctuate with environmental conditions. The “others” category covers hybrid and emerging farming models that explore innovation. It is gaining visibility in regions experimenting with advanced aquaculture diversification.

- For instance, Bottom mussel farms remain significant in Europe and Asia, where seabed cultivation suits local coastal ecosystems and involves lower capital investment, albeit with yield variability due to environmental factors. The “others” category includes hybrid and innovative farming models, gaining traction in experimental regions focused on aquaculture diversification.

By Product

By product, the Global Mussel Farming Market divides into marine water and fresh water. Marine water farming holds the largest share, supported by favorable coastal resources and strong export demand. It is dominant in Europe, North America, and Asia-Pacific, where supply chains are well established. Marine environments provide optimal growth conditions, reinforcing large-scale farming operations. Fresh water farming, while smaller, is expanding in regions with government-backed aquaculture projects. It supports localized consumption and opens opportunities for small-scale farmers in inland areas. It also plays a role in enhancing food security by diversifying production systems beyond coastal dependence.

- For instance, freshwater farming, though smaller, is expanding in areas with government-supported aquaculture initiatives, fostering localized consumption and offering new opportunities for small-scale inland farmers. This expansion also contributes to enhanced food security by diversifying production beyond coastal dependence.

Segmentation:

By Type

- Rope Mussel Farms

- Bottom Mussel Farms

- Others

By Product

By Region

- North America

- Europe

- UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific

- China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America

- Brazil, Argentina, Rest of Latin America

- Middle East

- GCC Countries, Israel, Turkey, Rest of Middle East

- Africa

- South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Global Mussel Farming Market size was valued at USD 894.00 million in 2018 to USD 1,225.82 million in 2024 and is anticipated to reach USD 1,952.13 million by 2032, at a CAGR of 5.6% during the forecast period. North America accounts for 19% of the global market share in 2024, driven by strong consumer preference for sustainable seafood. The U.S. leads production with advanced aquaculture technologies and rising demand for high-protein diets. Canada supports the industry with favorable coastal ecosystems and government-backed aquaculture programs. It also benefits from expanding distribution through supermarkets and foodservice chains. Environmental certifications and eco-labels help build consumer trust. Rising interest in traceable and premium seafood further supports demand. Growth in this region is steady, with investments focusing on scaling production and meeting export opportunities.

Europe

The Europe Global Mussel Farming Market size was valued at USD 1,977.75 million in 2018 to USD 2,710.55 million in 2024 and is anticipated to reach USD 4,124.69 million by 2032, at a CAGR of 5.0% during the forecast period. Europe holds 42% of the global market share in 2024, making it the leading region. Strong aquaculture traditions in Spain, France, and the Netherlands support dominance. It benefits from advanced infrastructure and integrated supply chains. Consumers value mussels as part of cultural diets, ensuring consistent domestic demand. Export capacity to non-European markets strengthens its competitive position. The region also enforces stringent sustainability and food safety standards, improving global credibility. Innovation in processing and packaging supports premiumization trends. Europe remains a stable growth hub with both volume and value expansion.

Asia Pacific

The Asia Pacific Global Mussel Farming Market size was valued at USD 1,338.40 million in 2018 to USD 1,984.18 million in 2024 and is anticipated to reach USD 3,424.13 million by 2032, at a CAGR of 6.6% during the forecast period. Asia Pacific secures 31% market share in 2024 and represents the fastest-growing region. China leads with large-scale production capacity supported by extensive coastal resources. New Zealand and Australia add significant value through premium mussel exports. It benefits from rising seafood consumption across growing middle-class populations. Government-backed aquaculture policies improve production efficiency and sustainability. Export potential to Europe and North America continues to expand. Investment in offshore farming technologies supports resilience against environmental changes. Asia Pacific remains a vital growth driver with both domestic and international demand.

Latin America

The Latin America Global Mussel Farming Market size was valued at USD 223.80 million in 2018 to USD 310.43 million in 2024 and is anticipated to reach USD 436.10 million by 2032, at a CAGR of 3.9% during the forecast period. Latin America accounts for 5% of the global market share in 2024, with Chile playing a leading role. Coastal ecosystems provide favorable conditions for mussel cultivation. It benefits from export demand, especially from North America and Europe. Government initiatives in aquaculture development provide long-term stability. Small-scale farmers expand participation with support programs and training. Consumer demand within domestic markets remains limited but growing steadily. Supply chain improvements enhance competitiveness in international trade. Latin America’s position is strengthening, with export potential as a primary driver.

Middle East

The Middle East Global Mussel Farming Market size was valued at USD 125.56 million in 2018 to USD 160.66 million in 2024 and is anticipated to reach USD 213.09 million by 2032, at a CAGR of 3.2% during the forecast period. The Middle East contributes 2% of the global market share in 2024. Limited natural resources constrain large-scale production, yet niche demand is growing. It is supported by rising urban populations and increasing seafood consumption. Gulf countries invest in aquaculture projects to diversify food supply chains. Imports dominate current supply, but gradual adoption of local mussel farming projects is underway. High-end restaurants and hotels drive demand for premium mussel products. Sustainability certifications play a growing role in consumer acceptance. The region is slowly evolving as a niche market with future expansion potential.

Africa

The Africa Global Mussel Farming Market size was valued at USD 69.67 million in 2018 to USD 108.37 million in 2024 and is anticipated to reach USD 135.69 million by 2032, at a CAGR of 2.4% during the forecast period. Africa holds 2% of the global market share in 2024, reflecting its early-stage development. South Africa leads production with favorable coastal waters and pilot aquaculture projects. It benefits from rising demand in urban centers, though supply remains limited. Investment is increasing in small-scale farming initiatives supported by international organizations. Local consumption is gradually expanding, driven by affordability and nutritional benefits. Infrastructure gaps and limited cold chain facilities restrict large-scale exports. Governments are exploring aquaculture as part of food security strategies. Africa remains a nascent but promising market with long-term growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Exmouth Mussels

- Sanford

- Blueshell Mussels

- Altomare

- Camanchaca

- Andrews

- Penn Cove Shellfish

- SUDMARIS

- Mussel Farms Ltd.

- Pacific Seafood Group

- Danish Shellfish Center

- Kongsberg Gruppen

Competitive Analysis:

The Global Mussel Farming Market features a moderately fragmented competitive landscape with regional leaders and globally recognized aquaculture firms. Europe and Asia-Pacific host the majority of producers, with companies focusing on sustainable practices, certifications, and value-added products. It is influenced by firms expanding through mergers, acquisitions, and partnerships to strengthen market presence. Leading players emphasize premium mussel varieties, efficient farming systems, and export-oriented strategies. Small and mid-sized operators play a critical role in serving local markets. The competitive edge often depends on quality assurance, environmental compliance, and distribution capabilities. Growing consumer demand for traceable and eco-friendly seafood continues to intensify competition.

Recent Developments:

- In January 2025, Blueshell Mussels, the UK’s largest mussel farming company, took ownership of two new workboats named Fruitful Harvest and Fruitful Bough, designed in collaboration with Macduff Ship Design. These vessels are operational in Shetland sites and are expected to improve their mussel farming processes.

- Camanchaca, a Chilean fishing and salmon-farming firm, doubled its profits in Q1 2025, largely driven by increased frozen horse mackerel sales and operational efficiencies in salmon farming. Their net profits for the quarter were $12.5 million, up from $6.4 million in Q1 2024. The company also reduced its net debt significantly. Further financial reports for H1 2025 indicated a 13% EBITDA growth despite slightly lower revenues, with the mussels division showing impressive gains.

Report Coverage:

The research report offers an in-depth analysis based on type and product segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer demand for sustainable seafood will expand farming operations.

- Investments in offshore farming will strengthen resilience against climate challenges.

- Certification programs will increase market credibility and consumer trust.

- Expansion of e-commerce platforms will boost accessibility for packaged mussels.

- Governments will intensify support for aquaculture infrastructure development.

- Premium and value-added mussel products will capture urban markets.

- Technological integration will enhance yield efficiency and monitoring systems.

- Emerging markets in Latin America and Africa will provide new growth avenues.

- Trade liberalization will strengthen exports from Asia-Pacific and Europe.

- Growing awareness of mussels’ nutritional benefits will support long-term demand.