Market Overview:

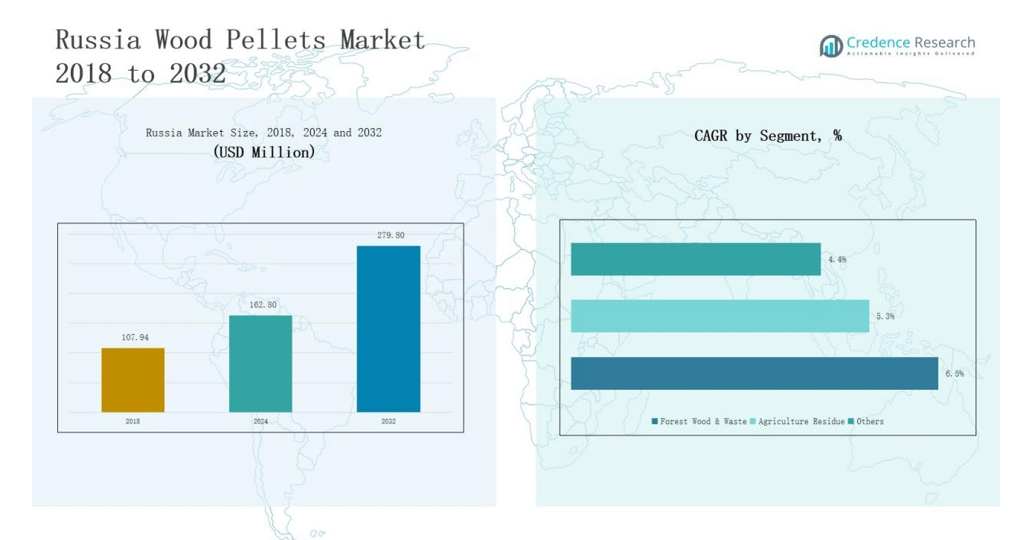

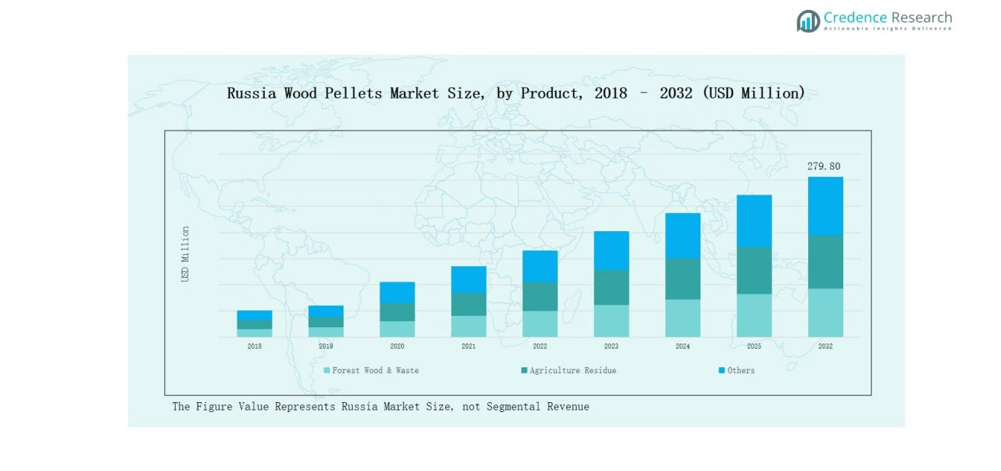

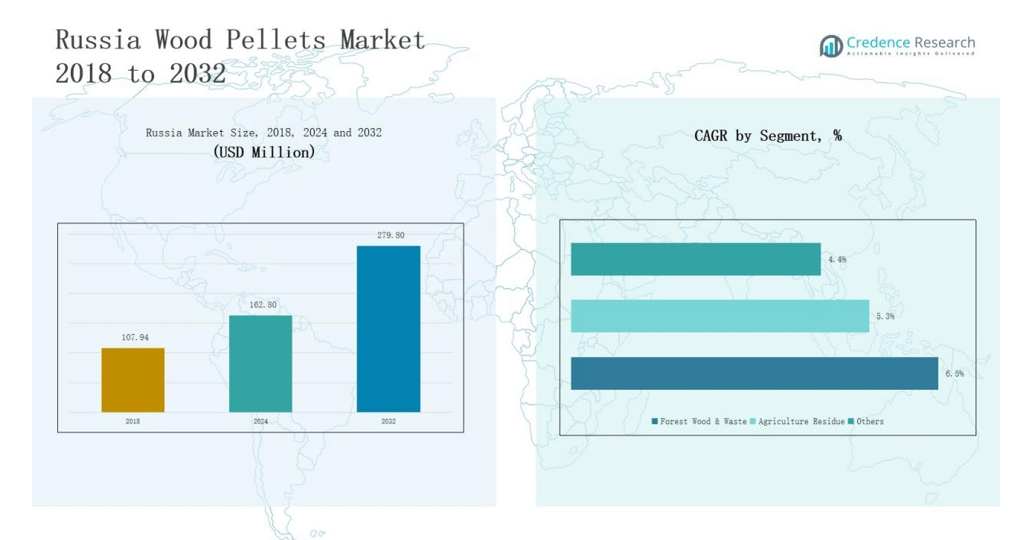

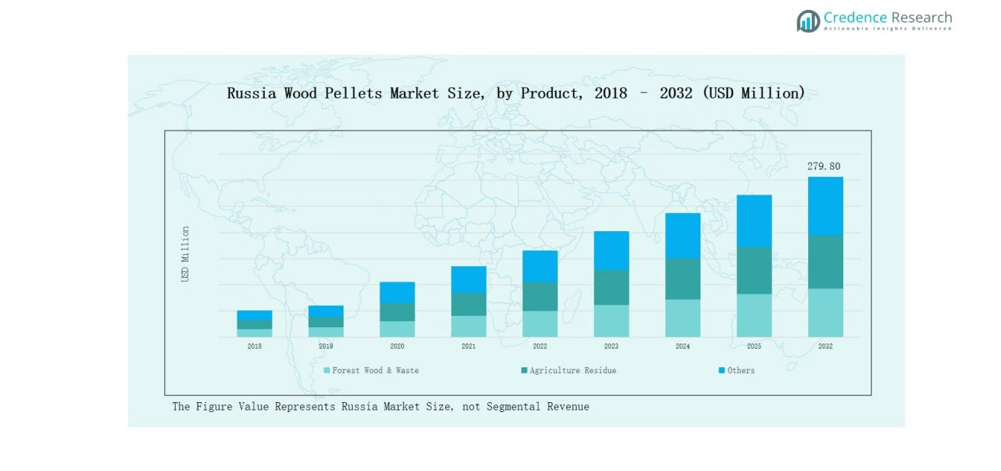

Russia Wood Pellets Market size was valued at USD 107.94 million in 2018 to USD 162.80 million in 2024 and is anticipated to reach USD 279.80 million by 2032, at a CAGR of 6.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Russia Wood Pellets Market Size 2024 |

USD 162.80 million |

| Russia Wood Pellets Market, CAGR |

6.52% |

| Russia Wood Pellets Market Size 2032 |

USD 279.80 million |

The Russia Wood Pellets Market is shaped by major players such as Segezha Group, Ilim Group, Syktyvkar Forest Industry, Arkhangelsk Pulp and Paper Mill, Ust-Ilimsk Pulp and Paper Mill, Mondi Group Russia, Vyborgskaya Cellulose, and Vologda Pulp and Paper Mill, which dominate through integrated forestry operations, large-scale pelletizing capacity, and established export networks. These companies secure long-term contracts with European and Asian buyers by leveraging sustainable sourcing, advanced production technologies, and strong logistics infrastructure. Among regional markets, Northern Russia leads with 42% share in 2024, supported by vast forest reserves, modern processing facilities, and proximity to major export terminals, making it the central hub of production and distribution within the Russia Wood Pellets Market.

Market Insights

- The Russia Wood Pellets Market grew from USD 107.94 million in 2018 to USD 162.80 million in 2024 and will reach USD 279.80 million by 2032 at 6.52% CAGR.

- Leading players include Segezha Group, Ilim Group, Syktyvkar Forest Industry, Arkhangelsk Pulp and Paper Mill, Ust-Ilimsk Pulp and Paper Mill, Mondi Group Russia, Vyborgskaya Cellulose, and Vologda Pulp and Paper Mill.

- By product, Forest Wood & Waste dominates with 80% share in 2024, followed by Agriculture Residue at 15% and Others at 5%.

- By application, Industrial Pellet for CHP/District Heating leads with 50% share, Co-Firing holds 25%, Residential/Commercial Heating accounts for 20%, and Others cover 5%.

- Regionally, Northern Russia leads with 42% share in 2024, followed by Central Russia at 28%, Eastern Russia at 18%, and Southern Russia at 12%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

The Forest Wood & Waste segment dominates the Russia Wood Pellets Market, accounting for nearly 80% share in 2024. Russia’s extensive forest reserves, well-developed logging industry, and integration with pulp and paper operations drive this dominance. Agriculture residue holds around 15% share, supported by local use of crop residues in regions with limited forestry access. The Others category contributes close to 5%, including blends of sawdust and industrial waste wood, serving niche domestic demand.

- For instance, Ilim Group, Russia’s largest pulp and paper producer, operates sawmill by-products recovery systems that channel residues into pellet production.

By Application

The Industrial Pellet for CHP/District Heating segment leads with about 50% market share in 2024, reflecting Russia’s strong district heating infrastructure and export supply to Europe. The Industrial Pellet for Co-Firing segment holds nearly 25% share, supported by the transition of coal plants toward biomass blending. Residential/Commercial Heating follows with close to 20% share, driven by adoption of pellet boilers and stoves in colder regions. The Others category contributes around 5%, covering agricultural drying and specialty industrial heating needs.

- For instance, Drax Power Station in the UK, Europe’s largest biomass consumer, has converted four of its six generating units from coal to pellets, blending imports sourced partly from Russia before 2022 trade restrictions.

Market Overview

Expansive Forestry Resources

Russia holds one of the world’s largest forest reserves, providing an abundant supply of raw material for wood pellet production. The availability of cost-effective forest wood and waste strengthens the supply chain and lowers production costs. These vast forestry resources also support large-scale industrial pellet plants, enabling consistent exports to Europe and Asia. The secure and sustainable forest base continues to be the primary growth engine of the Russia Wood Pellets Market.

- For instance, the Vyborgskaya Cellulose plant in Leningrad Region operates one of the largest pellet facilities in Russia, with an annual capacity exceeding 900,000 tons, much of which is shipped to European countries.

Rising Export Demand

Strong demand from the European Union and Asia significantly boosts Russia’s wood pellet market. European countries rely on Russian biomass to meet renewable energy targets and reduce carbon emissions, while Asia’s growing shift toward cleaner fuels drives further export opportunities. Russia’s proximity to major demand hubs and well-developed port infrastructure enhances competitiveness. Export-driven growth remains central, with long-term contracts ensuring revenue stability for large producers.

- For instance, Denmark’s Ørsted sourced Russian pellets to replace coal at plants such as Avedøre before 2022 trade restrictions, supporting its carbon-neutral generation targets.

Government Policies and Energy Transition

Supportive policies promoting renewable energy and the gradual transition away from coal strengthen market prospects. Government initiatives to encourage biomass-based power generation and district heating systems create consistent demand for pellets. Favorable trade policies and sustainability certifications also improve Russia’s position in global biomass markets. These policy-driven factors not only secure domestic consumption but also expand international opportunities, reinforcing growth momentum in the coming years.

Key Trends & Opportunities

Expansion of District Heating Networks

District heating remains a cornerstone of Russia’s energy system, and modernization of these networks creates new opportunities for pellet demand. Cities are increasingly replacing coal or oil with biomass to meet environmental regulations. Wood pellets, with their high calorific value and carbon neutrality, are emerging as the preferred choice. This transition offers pellet producers long-term supply contracts and stable revenue streams, reinforcing the importance of CHP and district heating in overall market growth.

- For instance, Onega-Energy JSC in northwest Russia invested over 200 million rubles to commission a fourth biomass boiler with a 14 MW capacity, replacing coal-fired boilers and supplying heat to 80% of Onega town residents.

Technological Advancements and Efficiency Gains

The adoption of advanced pelletizing technology, automation, and improved logistics is reshaping Russia’s wood pellet industry. New processing equipment ensures higher energy efficiency, consistent pellet quality, and reduced production costs. At the same time, better storage and transportation solutions enhance export reliability. These advancements provide producers with competitive advantages in global markets, where sustainability certifications and product consistency play a vital role in securing large-scale contracts with international energy utilities.

- For instance, Segezha Group JSC, a major Russian pellet exporter, upgraded covered storage and loading facilities at Baltic ports to reduce pellet moisture exposure during long shipments to Europe.

Key Challenges

Geopolitical and Trade Barriers

Sanctions and geopolitical tensions create uncertainty for Russia’s wood pellet exports, especially to European markets. Restrictions on trade can disrupt established supply chains and force producers to find alternative buyers in Asia or the Middle East. These sudden shifts increase risks for producers that rely heavily on long-term European contracts. Sustaining export volumes in such conditions is a major challenge for the Russia Wood Pellets Market.

Infrastructure Limitations

While Russia has vast forestry resources, underdeveloped transport and logistics infrastructure limits efficient pellet distribution. Long distances between production facilities, forests, and export terminals increase costs and reduce competitiveness. Seasonal challenges, such as frozen waterways and harsh winters, further complicate transportation. Improving infrastructure remains critical for maximizing market potential and ensuring reliable supply to both domestic and international customers.

Sustainability and Certification Requirements

Global buyers increasingly demand sustainable sourcing and strict compliance with international standards like ENplus and FSC certification. Meeting these requirements is challenging for smaller producers that lack resources for audits and process upgrades. Failure to comply may restrict access to premium international markets. As environmental standards tighten, producers must invest in transparency and certification to remain competitive in the global biomass industry.

Regional Analysis

Northern Russia

Northern Russia leads the Russia Wood Pellets Market with a 42% share in 2024. It benefits from dense forestry reserves and proximity to key export terminals, making it the hub of production and distribution. Large-scale pelletizing plants and integrated pulp and paper facilities enhance output efficiency. The region supplies both domestic CHP plants and major European importers. Strong district heating networks further support pellet consumption. It remains the dominant region due to resource availability and well-established infrastructure.

Central Russia

Central Russia accounts for 28% share in 2024, supported by its industrial base and strong domestic demand. The region has significant pelletizing facilities linked with pulp and paper mills. Its geographic position offers favorable access to both western export routes and domestic distribution channels. The presence of biomass-based district heating plants increases steady consumption. Producers in this region focus on supplying urban heating needs and regional co-firing projects. It continues to play a critical role in balancing domestic and export markets.

Eastern Russia

Eastern Russia holds 18% share in 2024, driven by growing demand from Asia-Pacific importers such as Japan and South Korea. The region leverages proximity to Pacific ports, enabling efficient exports to Asia. Forestry resources are abundant, though infrastructure development remains ongoing. Investments in pellet production capacity are rising to meet export commitments. Domestic utilization is limited, but export-oriented growth is strong. It has become an emerging hub for future expansion in the Russia Wood Pellets Market.

Southern Russia

Southern Russia contributes 12% share in 2024, with smaller production volumes compared to other regions. Its role is mainly focused on serving residential and commercial heating demand. The region has fewer forestry reserves, limiting its large-scale industrial pellet output. Localized pellet producers cater to regional consumption rather than exports. Despite lower production, demand for pellet boilers and stoves supports steady growth. It remains a secondary region, contributing to market diversity within the Russia Wood Pellets Market.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By Region

- Northern Russia

- Central Russia

- Eastern Russia

- Southern Russia

Competitive Landscape

The Russia Wood Pellets Market is characterized by the presence of large integrated forestry companies, pulp and paper mills, and specialized biomass producers that collectively shape the industry’s competitive environment. Major players such as Segezha Group, Ilim Group, Arkhangelsk Pulp and Paper Mill, Ust-Ilimsk Pulp and Paper Mill, Mondi Group Russia, Vyborgskaya Cellulose, and Vologda Pulp and Paper Mill dominate production capacity through access to vast forest reserves and established export infrastructure. These firms secure long-term supply agreements with European and Asian buyers, leveraging scale, sustainability certifications, and modern pelletizing technology. Competition centers on maintaining quality standards, reducing logistics costs, and expanding export destinations amid shifting geopolitical conditions. Mid-sized regional producers serve localized heating demand and smaller utilities, contributing to market diversity. The industry remains moderately consolidated, with top producers holding a significant share, while smaller firms focus on niche segments and domestic consumption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Segezha Group

- Ilim Group

- Syktyvkar Forest Industry

- Arkhangelsk Pulp and Paper Mill

- Ust-Ilimsk Pulp and Paper Mill

- Mondi Group Russia

- Vyborgskaya Cellulose

- Vologda Pulp and Paper Mill

- Others

Recent Developments

- August 14, 2025, Ilim Group launched a new bleached softwood pulp brand named Polar Bear, aimed at the Chinese market for premium paper and packaging use

- On October 4, 2023, Mondi completed the sale of its Mondi Syktyvkar operations, marking its exit from Russia.

- In August 2025, Segezha Group announced that pellet production at its Siberian plants doubled in the first half of the year, reaching 61,000 tonnes compared to 31,000 tonnes in H1 2024. The company also recorded strong export growth to South Korea and a fivefold increase in domestic deliveries.

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for wood pellets will grow as Europe seeks renewable energy alternatives.

- Exports to Asian markets such as Japan and South Korea will continue expanding.

- District heating modernization will drive steady domestic consumption of pellets.

- Producers will invest in advanced pelletizing technology to improve efficiency.

- Sustainability certifications will become essential for securing global contracts.

- Smaller producers will focus on meeting regional residential and commercial heating needs.

- Infrastructure upgrades will enhance transportation and reduce supply chain costs.

- Policy support for renewable energy will strengthen biomass adoption across Russia.

- Competition will intensify as new players enter with export-oriented strategies.

- Market reliance on forestry resources will encourage better forest management practices.