Market Overview:

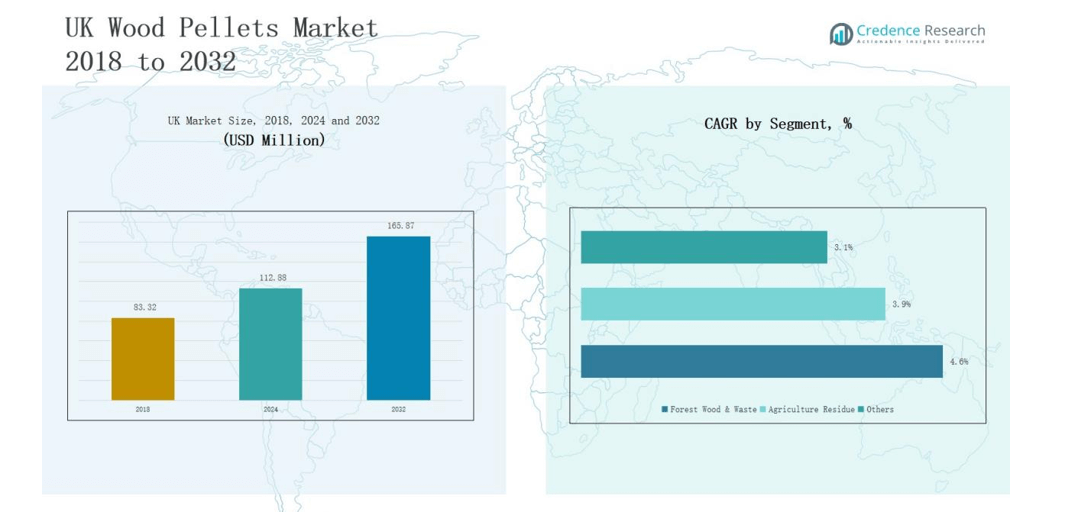

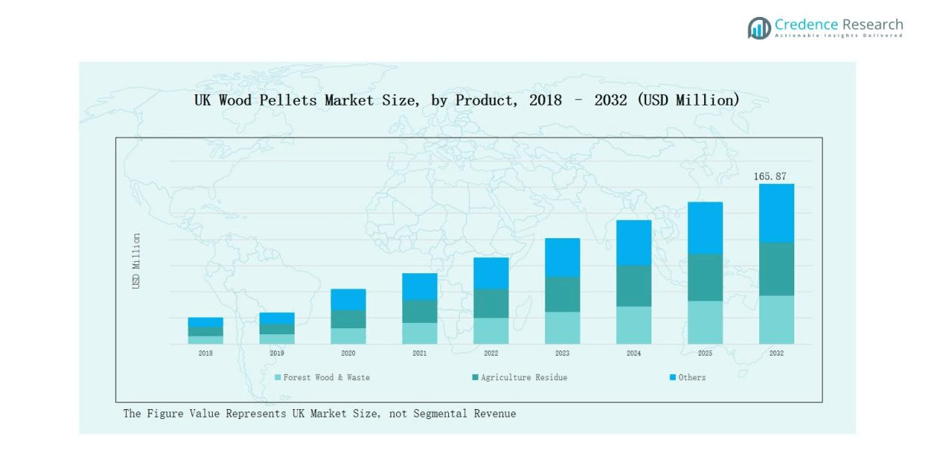

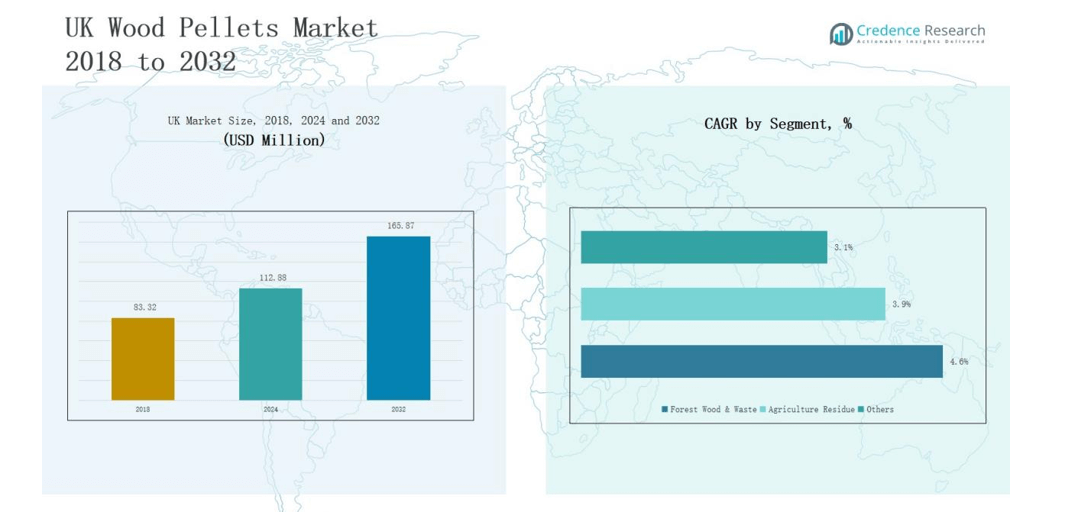

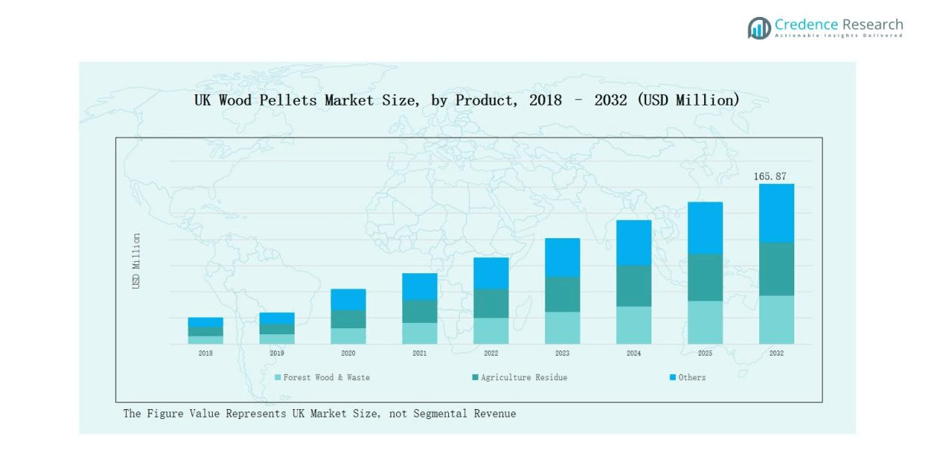

UK Wood Pellets Market size was valued at USD 83.32 million in 2018 to USD 112.88 million in 2024 and is anticipated to reach USD 165.87 million by 2032, at a CAGR of 4.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Wood Pellets Market Size 2024 |

USD 112.88 million |

| UK Wood Pellets Market, CAGR |

4.59% |

| UK Wood Pellets Market Size 2032 |

USD 165.87 million |

The UK Wood Pellets Market features a competitive mix of domestic producers and international suppliers, with key players including Land Energy, Pure Biofuel, Hayes Fuels, PBE Fuels Ltd, Cornish Firewood, Bawtry Sawdust Company Limited, Blazers Fuels Ltd, and The Pellet Company Limited. These companies strengthen their positions through reliable supply chains, certified sustainable sourcing, and contracts with heating utilities. Smaller firms focus on localized distribution and niche residential demand, while larger players cater to industrial heating and CHP networks. Among regional markets, England leads with a 55% share in 2024, supported by its concentration of biomass power plants, extensive district heating projects, and large-scale pellet import terminals that ensure steady supply. This regional dominance reinforces England’s position as the core hub for both consumption and trade within the UK market.

Market Insights

- The UK Wood Pellets Market grew from USD 83.32 million in 2018 to USD 112.88 million in 2024 and is projected to reach USD 165.87 million by 2032 at a CAGR of 4.59%.

- Forest wood and waste dominate with 70% share in 2024, supported by steady sawmill supply and government incentives, while agriculture residue holds 20% and others 10%.

- By application, industrial pellets for CHP and district heating lead with 45% share, followed by co-firing at 30%, residential/commercial heating at 20%, and others at 5%.

- England leads regionally with 55% share in 2024, supported by biomass plants, district heating projects, and pellet import terminals, reinforcing its position as the market hub.

- Key players include Land Energy, Pure Biofuel, Hayes Fuels, PBE Fuels Ltd, Cornish Firewood, Bawtry Sawdust Company Limited, Blazers Fuels Ltd, and The Pellet Company Limited.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

Forest wood and waste dominate the UK wood pellets market, accounting for nearly 70% of total revenue in 2024. This segment benefits from abundant forestry resources, steady supply from sawmills, and strong compliance with sustainability standards. Its growth is driven by consistent demand from large-scale biomass plants and government incentives for renewable energy adoption. Agriculture residue holds around 20% share, supported by initiatives to utilize crop by-products for energy production. However, limited collection infrastructure and inconsistent feedstock quality constrain expansion. The Others segment, including industrial wood waste and blends, represents roughly 10% share, catering to niche applications and smaller producers focused on cost optimization.

- For instance, Land Energy Ltd produces premium-grade wood pellets in Scotland using mixed wood waste streams to supply local heating networks and smaller-scale energy customers.

By Application

Industrial pellets for CHP and district heating lead the UK wood pellets market with an estimated 45% share in 2024. High adoption in urban heating networks and combined heat and power plants drives this dominance, as the segment aligns with decarbonization goals and energy efficiency mandates. Industrial pellets for co-firing contribute around 30% share, supported by coal plant conversions and policies encouraging renewable integration into traditional energy systems. Residential and commercial heating pellets hold approximately 20% share, driven by demand for eco-friendly alternatives to oil and gas boilers in households and small enterprises.

- For instance, Drax Power Station in North Yorkshire, one of the UK’s largest biomass users, supplies renewable electricity to millions of homes by co-firing and fully converting several units from coal to sustainable biomass pellets.

Market Overview

Rising Demand for Renewable Energy

The UK wood pellets market benefits from the government’s strong focus on renewable energy transition. Wood pellets play a central role in replacing fossil fuels across heating and electricity generation. Policy frameworks such as the Renewable Heat Incentive (RHI) and subsidies for biomass-based power plants encourage adoption. Large utilities and district heating networks prefer pellets for their cost-efficiency and carbon neutrality. This rising demand provides long-term stability and growth, positioning wood pellets as a sustainable cornerstone in the UK’s energy mix.

Expansion of District Heating and CHP Systems

Combined heat and power (CHP) and district heating systems are expanding in the UK, driving pellet consumption. These systems deliver efficiency by producing electricity and heat simultaneously, reducing overall fuel use. The scalability of CHP systems makes them suitable for both urban and industrial applications. Wood pellets are the preferred fuel due to their consistent energy output and compatibility with advanced boiler technologies. Growing urban infrastructure projects and decarbonization targets continue to fuel demand for this segment, solidifying its dominant share.

- For instance, Dalkia UK, a subsidiary of EDF Energy, operates biomass CHP plants that supply low‑carbon heat and power to multiple industrial facilities, cutting energy use by nearly 30%.

Focus on Carbon Emission Reduction

The UK’s ambitious net-zero targets significantly influence wood pellet adoption. Biomass energy derived from wood pellets emits far less CO₂ compared to coal or natural gas. Their carbon-neutral nature supports compliance with international climate commitments, such as the Paris Agreement. Many industries, particularly energy and manufacturing, are increasingly investing in pellet-based systems to offset emissions. As businesses face stricter environmental regulations, wood pellets emerge as a practical alternative that balances sustainability with operational efficiency, reinforcing their role in the green energy transition.

- For instance, IKEA has shifted several of its UK retail outlets to biomass-based heating systems, reducing reliance on fossil fuels while aligning operations with its 2030 climate-positive goal.

Key Trends & Opportunities

Growing Role of Sustainable Sourcing

Sustainability certifications such as FSC and PEFC are gaining importance in the UK wood pellets market. Buyers increasingly prefer certified pellets to ensure environmental responsibility and traceability. Producers focusing on sustainable sourcing are gaining competitive advantages and building stronger customer trust. This trend also aligns with evolving EU and UK regulations that mandate sustainable supply chains. The opportunity lies in expanding certified production capacity, which can enhance export potential and strengthen long-term partnerships with major utilities and heating projects.

- For instance, Woodlets produces all its premium wood pellets using timber exclusively sourced from FSC-certified forests, ensuring woodlands are sustainably managed under third-party verification.

Technological Integration in Pellet Production

Technological innovation is reshaping pellet production and distribution in the UK. Automation, AI-driven monitoring, and improved pelletizing equipment are enhancing efficiency and quality consistency. Companies adopting advanced drying and densification technologies reduce costs while improving fuel performance. Integration of smart logistics systems also optimizes supply chain operations, ensuring timely delivery and lower emissions. This trend presents opportunities for firms investing in modern technologies to achieve higher yields, lower waste, and stronger compliance with energy efficiency goals.

- For instance, at Land Energy’s Girvan plant, pellet output reaches 100,000 tonnes per annum, powered entirely by its biomass CHP system—delivering zero fossil fuel input to production

Key Challenges

Supply Chain Vulnerabilities

The UK wood pellets market faces supply chain challenges due to reliance on imports. A significant proportion of pellets are sourced from North America and Europe, making supply vulnerable to shipping delays, trade restrictions, and geopolitical disruptions. Rising transportation costs further strain profit margins, especially during high demand seasons. Local production remains insufficient to fully meet national consumption. Addressing these vulnerabilities requires investment in domestic capacity and diversified sourcing strategies to ensure consistent availability.

High Production and Logistics Costs

Despite demand growth, high production and logistics costs limit market competitiveness. Pellet manufacturing requires significant capital investment in drying, processing, and storage infrastructure. Rising energy and raw material costs add further pressure on margins. Transportation, especially bulk shipping and inland logistics, contributes heavily to the final price of pellets in the UK. These cost challenges often make alternative fuels appear more affordable. Producers need to adopt cost-optimization measures and technological advancements to remain competitive in the energy market.

Policy and Regulatory Uncertainty

Policy support has been a major driver of wood pellet adoption, but regulatory uncertainty poses risks. Changes in subsidies, renewable energy incentives, or sustainability criteria can disrupt market dynamics. Investors and producers hesitate to commit to large projects without clear long-term policies. Stricter sustainability regulations may also increase compliance costs for manufacturers and importers. This uncertainty creates volatility in demand projections and impacts strategic planning. Ensuring stable policy frameworks is essential for sustained growth in the UK wood pellets market.

Regional Analysis

England

England dominates the UK Wood Pellets Market with a 55% share in 2024. The region benefits from a strong concentration of biomass power plants and extensive district heating projects. High urban population density supports consistent demand for residential and commercial heating solutions. It continues to attract investment in sustainable energy infrastructure, supported by government incentives. The presence of large-scale pellet import terminals also strengthens England’s supply security. It remains the central hub for both consumption and trade, reinforcing its leadership position.

Scotland

Scotland holds 20% share in the UK Wood Pellets Market, supported by abundant forestry resources and renewable energy policies. The region emphasizes biomass as part of its low-carbon energy strategy. It leverages local raw materials, reducing dependence on imports compared to other regions. Growing interest in district heating networks across rural and semi-urban areas boosts pellet demand. Companies in Scotland focus on sustainable sourcing and certified production practices to meet regulatory standards. It continues to position itself as a reliable supplier within the market.

Wales

Wales contributes 15% share to the UK Wood Pellets Market, driven by rising adoption in residential and small commercial heating applications. The region shows increasing interest in renewable heating systems to reduce reliance on oil-based solutions. Expansion of pellet distribution networks improves accessibility for households and small businesses. It faces challenges from limited large-scale production capacity but benefits from policy-driven incentives. Growing awareness of carbon-neutral fuels strengthens the demand outlook. It remains an important contributor to the overall market growth.

Northern Ireland

Northern Ireland accounts for 10% share of the UK Wood Pellets Market, supported by both industrial and residential usage. The region relies on a mix of imports and local suppliers to meet growing demand. It has shown steady growth due to government schemes promoting biomass heating in rural areas. Small and medium enterprises are increasingly adopting pellets for cost-effective and sustainable heating. Investments in storage and distribution infrastructure are improving supply chain reliability. It continues to expand its role within the broader UK market framework.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Wood Pellets Market is characterized by moderate fragmentation, with a mix of domestic producers and international suppliers competing for market share. Leading players such as Land Energy, Pure Biofuel, Hayes Fuels, and Blazers Fuels Ltd hold strong positions due to established production facilities, secure supply chains, and long-term contracts with heating utilities. Smaller firms, including Cornish Firewood and The Pellet Company Limited, cater to niche residential and commercial segments, focusing on quality and localized distribution. International suppliers like Enviva Partners LP and Drax Biomass Inc also play a key role by ensuring steady imports that balance domestic shortfalls. Competition is shaped by price fluctuations, raw material availability, and sustainability certifications, which increasingly influence consumer choice. Companies are investing in capacity expansion, certified sourcing, and advanced logistics to strengthen competitiveness. It remains a market where supply reliability, cost efficiency, and environmental compliance define strategic positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Land Energy

- Pure Biofuel

- Hayes Fuels

- PBE Fuels Ltd

- Cornish Firewood

- Bawtry Sawdust Company Limited

- Blazers Fuels Ltd

- The Pellet Company Limite

- Others

Recent Developments

- In February 2025, the UK government decided to halve subsidies for Drax Group plc covering the 2027–2031 period, while also mandating the exclusive use of sustainably sourced biomass.

- In early 2025, Innasol (UK-Ireland biomass boiler distributor) acquired Y Pellets, a £4 million-turnover wood pellet supplier based in Goole, East Yorkshire. The Y Pellets brand continues under Innasol Group.

- In December 2024, Drax Group and Pathway Energy LLC signed heads of terms for a multi-year deal. Drax will supply over 1 million tonnes per year of sustainable biomass pellets to Pathway’s planned sustainable aviation fuel (SAF) plant in Texas.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with continued focus on renewable energy adoption across the UK.

- District heating and CHP systems will remain the largest consumers of wood pellets.

- Imports will continue to play a key role in meeting national pellet requirements.

- Certified sustainable sourcing will become a standard expectation among buyers.

- Technological improvements will enhance pellet production efficiency and reduce costs.

- Residential adoption will grow as households shift from oil and gas heating.

- Policy support and clear incentives will shape future investment decisions in the sector.

- Companies will expand storage and distribution networks to ensure reliable supply.

- Competition will intensify between domestic producers and international suppliers.

- The market will align closely with the UK’s carbon neutrality and net-zero goals.