Market Overview

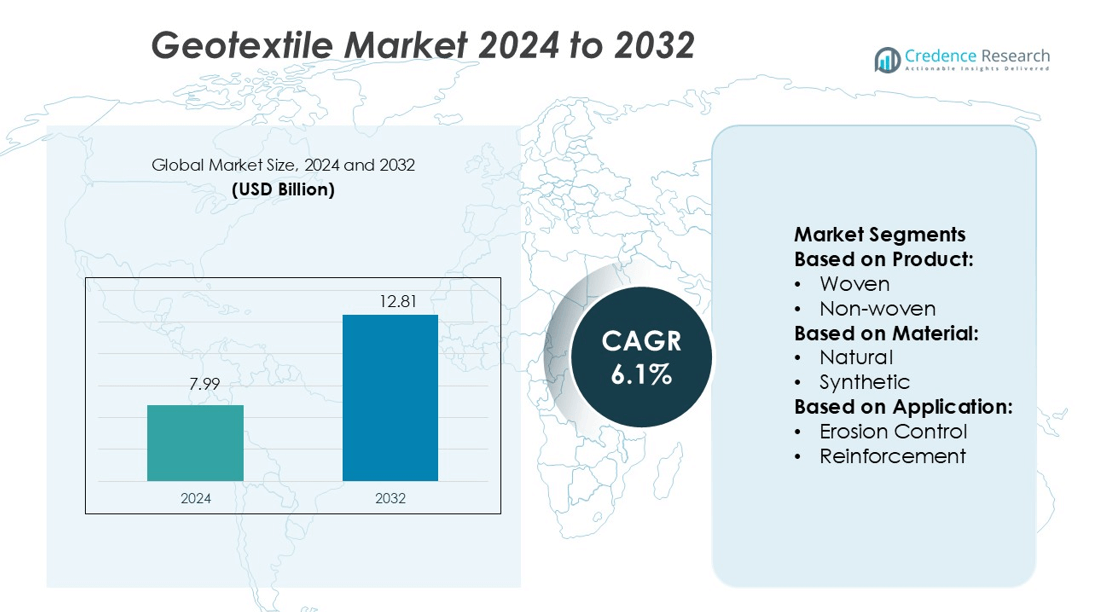

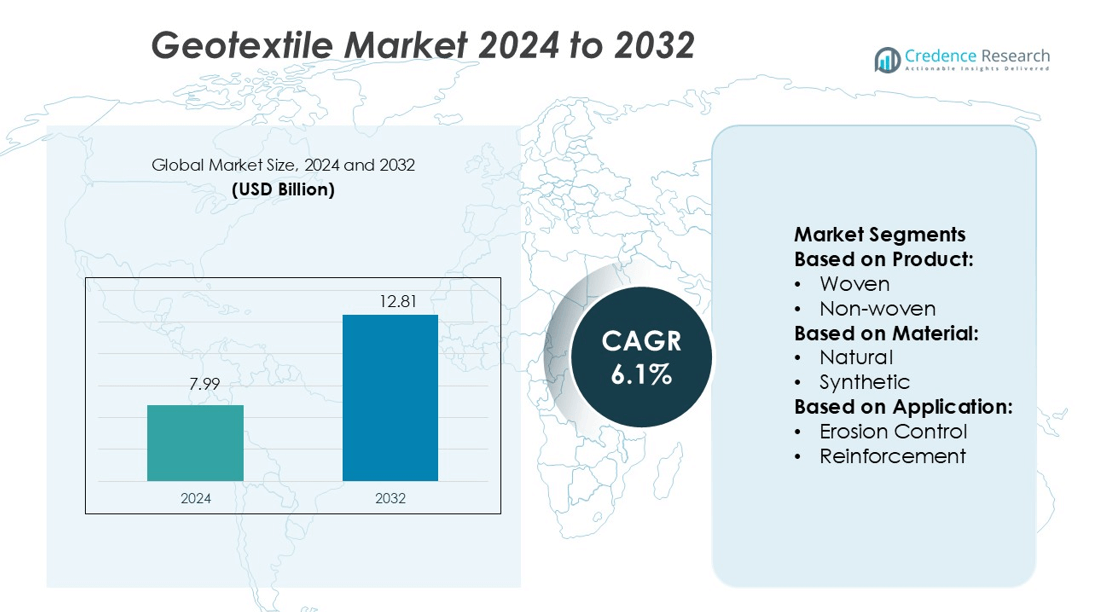

Geotextile Market size was valued USD 7.99 billion in 2024 and is anticipated to reach USD 12.81 billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Geotextile Market Size 2024 |

USD 7.99 billion |

| Geotextile Market, CAGR |

6.1% |

| Geotextile Market Size 2032 |

USD 12.81 billion |

The geotextile market is highly competitive, with top players including AGRU America, Low and Bonar PLC, Propex Operating Company, LLC, Fibertex Nonwovens A/S, Officine Maccaferri S.p.A., GSE Holdings, Inc., TENAX Group, Global Synthetics, Koninklijke Ten Cate B.V., and NAUE GmbH & Co. KG. These companies focus on advanced manufacturing technologies, sustainable product innovations, and strategic collaborations to strengthen their global market presence. Asia Pacific leads the market with a 34% share, supported by rapid infrastructure development, strong government initiatives, and expanding applications in road construction, agriculture, and water management. This leadership is reinforced by growing investment in sustainable and cost-efficient construction materials.

Market Insights

- The geotextile market size was valued at USD 7.99 billion in 2024 and is projected to reach USD 12.81 billion by 2032, growing at a CAGR of 6.1%.

- Rising investments in infrastructure projects and erosion control initiatives are driving steady demand for geotextiles across multiple industries.

- Sustainability and innovation are shaping market trends, with increasing adoption of biodegradable and recycled geotextiles in construction and environmental protection.

- The market is highly competitive, with key players focusing on advanced manufacturing technologies and strategic collaborations to expand their global presence.

- Asia Pacific leads with a 34% share, followed by North America at 26% and Europe at 24%, while non-woven geotextiles dominate product segments with strong application in road construction and water management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Woven geotextiles hold the largest market share of 61%. These products are widely used in infrastructure projects due to their superior tensile strength and long service life. They effectively stabilize soil and enhance load distribution in road and rail construction. The durability of woven geotextiles reduces maintenance costs, which attracts transportation and construction industries. Non-woven geotextiles are gaining traction in drainage and filtration applications because of their permeability. Growing investments in road expansion projects and soil reinforcement are driving the strong demand for woven geotextiles in emerging economies.

- For instance, Finland’s Ministry of Defense signed a Letter of Intent with ICEYE to acquire Synthetic Aperture Radar (SAR) satellites that deliver 25-centimeter ground resolution. The agreement leverages ICEYE’s large constellation of SAR satellites, which includes the 54 satellites launched as of June 2025.

By Material

Synthetic geotextiles dominate the market with a 78% share. Their superior strength, chemical resistance, and durability make them the preferred choice in large-scale infrastructure and erosion control applications. These materials perform consistently under harsh weather and high-pressure conditions, improving structural stability. Natural geotextiles, though eco-friendly, are mainly used in temporary erosion control due to lower durability. The rising focus on infrastructure modernization and regulatory support for long-lasting geosynthetic solutions drives the strong preference for synthetic geotextiles.

- For instance, Planet’s Pelican‑3 and Pelican‑4 satellites—launched in August 2025—deliver up to 40 cm‑class resolution imagery across six multispectral bands and each hosts an NVIDIA Jetson AI module for real‑time on‑orbit processing.

By Application

Reinforcement is the leading application segment with a 54% market share. Geotextiles are used to strengthen soil structures in roads, embankments, and retaining walls, enhancing load-bearing capacity. Their use minimizes settlement, improves pavement performance, and extends infrastructure lifespan. Erosion control applications are also growing as governments focus on flood prevention and coastal protection projects. Strong demand from transportation, energy, and mining sectors continues to support the reinforcement segment’s dominance, backed by the increasing adoption of advanced geosynthetic technologies.

Key Growth Drivers

Infrastructure Expansion and Road Development Projects

The rapid growth of global infrastructure projects is driving geotextile demand. Governments and private developers are investing heavily in road construction, railways, and drainage systems. Geotextiles improve soil stability, enhance drainage, and extend infrastructure lifespan. Their use lowers maintenance costs and reduces erosion, making them a preferred choice in civil engineering. Expanding smart city initiatives and rural connectivity projects further increase their application in embankments, pavements, and retaining structures. These factors are strengthening the market position of geotextiles across multiple regions.

- For instance, SIC provides products with GSDs down to 30 cm from satellites such as WorldView-3 and Pléiades Neo. The GSD can be up to 2 meters depending on the product and application.

Sustainability and Environmental Regulations

Growing environmental awareness and stricter regulations are boosting geotextile adoption. Geotextiles reduce soil erosion, manage stormwater, and enhance green construction outcomes. Their use supports sustainable practices by replacing conventional concrete-based solutions. Governments are promoting eco-friendly infrastructure through regulatory standards, creating steady demand. Manufacturers are introducing biodegradable and recycled polymer geotextiles to meet these requirements. The strong alignment with green building and environmental protection goals positions geotextiles as an essential material in future construction projects.

- For instance, Honeywell’s JetWave system achieved full-duplex data rates exceeding 40 megabits per second during airborne tests using both GEO and MEO satellites, with seamless switching between orbits in under 30 seconds.

Rising Adoption in Agricultural and Coastal Protection Projects

The use of geotextiles is increasing in agriculture and coastal protection due to their versatility. In farming, geotextiles control soil moisture, improve drainage, and prevent erosion. In coastal and riverbank projects, they offer stability and protect against wave action and flooding. Governments are investing in flood control and shoreline defense programs to combat climate change impacts. These initiatives are expanding the market beyond traditional infrastructure applications, supporting strong demand growth in both developed and developing economies.

Key Trends & Opportunities

Shift Toward Biodegradable and Recycled Geotextiles

Sustainability trends are driving innovation in biodegradable and recycled geotextiles. Manufacturers are using natural fibers and recycled polymers to reduce carbon footprints. These products meet environmental standards and offer the same performance as synthetic alternatives. This shift creates opportunities for companies to expand in regions with strict green regulations. Growing public infrastructure investments aligned with net-zero targets further strengthen this trend.

- For instance, Viasat’s IoT Nano service, powered by ORBCOMM’s OGx technology, supports two-way, non-IP messaging with message sizes up to 1 megabyte. Small event messages typically arrive with latency under 15 seconds.

Technological Advancements and Smart Geotextiles

Smart geotextiles with embedded sensors are gaining traction in monitoring soil conditions. These materials provide real-time data on load, pressure, and moisture, improving structural reliability. Technological advancements also enhance durability and performance under extreme conditions. This innovation supports predictive maintenance, lowering long-term costs for infrastructure operators. The integration of geotextiles with digital monitoring systems presents a strong growth opportunity for advanced construction projects.

- For instance, Qualcomm teamed up with Ericsson and Thales Alenia Space and successfully executed a 5G NR non-terrestrial network (NTN) call over a simulated LEO channel, managing Doppler shifts and handovers in a controlled lab environment—with real-time voice and video possible during the trial.

Expanding Use in Water Management Systems

Water scarcity and flooding risks are increasing the demand for geotextiles in drainage and water management. These materials help in filtration, separation, and water flow control in canals, reservoirs, and stormwater systems. Urban expansion is driving large investments in flood control and water infrastructure. Geotextiles offer cost-effective and long-lasting solutions, making them a preferred choice for municipal and industrial applications.

Key Challenges

Volatility in Raw Material Prices

The geotextile market depends heavily on polymers like polypropylene and polyester. Fluctuations in crude oil prices directly affect raw material costs. These variations increase production expenses, reducing profit margins for manufacturers. Smaller companies face challenges in maintaining competitive pricing during such volatility. This cost uncertainty can limit investments in capacity expansion and new product development.

Low Awareness and Adoption in Emerging Economies

Limited awareness among contractors and government agencies in emerging markets slows adoption. Many infrastructure projects still use conventional methods due to lack of technical knowledge. Inadequate training and weak regulatory enforcement further restrict market penetration. This gap reduces demand potential in high-growth regions, particularly in rural and underdeveloped areas. Overcoming this challenge requires stronger outreach, training programs, and policy support.

Regional Analysis

North America

North America holds a 26% market share in the geotextile market, supported by strong infrastructure investments and strict environmental regulations. The United States leads the region due to extensive highway construction, flood control systems, and erosion protection programs. Government initiatives such as highway modernization and wetland restoration drive geotextile usage in construction and environmental applications. Canada’s emphasis on sustainable infrastructure and green building standards also boosts market penetration. Technological advancements and wide adoption in drainage and road reinforcement projects strengthen the region’s competitive position in the global geotextile industry.

Europe

Europe accounts for a 24% market share, driven by well-established infrastructure networks and advanced environmental standards. Countries such as Germany, France, and the Netherlands are leading adopters due to their focus on sustainable construction and flood protection systems. The European Union’s green policies and strong regulatory framework promote the use of eco-friendly geotextiles. Investments in coastal reinforcement, railway upgrades, and smart water management further enhance market growth. Continuous research and development in biodegradable geotextiles also support innovation, making Europe one of the key contributors to global market expansion.

Asia Pacific

Asia Pacific dominates the global geotextile market with a 34% market share, fueled by rapid urbanization, infrastructure expansion, and government-backed development programs. China and India are the major contributors due to large-scale investments in road networks, river embankments, and coastal protection. Growing adoption of geotextiles in agriculture, water management, and erosion control strengthens regional demand. Government initiatives such as India’s Bharatmala project and China’s flood prevention infrastructure play a key role. The availability of cost-effective raw materials and expanding manufacturing capacity further enhance the region’s strong market position.

Latin America

Latin America represents a 9% market share, supported by increasing investments in transportation and water infrastructure. Countries such as Brazil and Mexico are focusing on road rehabilitation, flood control, and erosion prevention. Geotextiles are gaining traction in drainage, embankment reinforcement, and soil stabilization projects. Rising environmental concerns and regulatory improvements are gradually encouraging wider adoption. Limited domestic production remains a challenge, but expanding partnerships with global suppliers is improving accessibility. The region offers untapped potential for geotextile manufacturers seeking growth in emerging markets.

Middle East & Africa

The Middle East & Africa region holds a 7% market share, driven by infrastructure development, water scarcity management, and soil stabilization projects. Countries such as Saudi Arabia, the UAE, and South Africa are investing in large-scale transportation and irrigation networks. Geotextiles are used extensively in desert road construction, drainage systems, and erosion control. Urban expansion and climate resilience initiatives are further boosting demand. While awareness levels and manufacturing capacity remain lower than in other regions, growing investments and government-led infrastructure projects offer promising opportunities for market expansion.

Market Segmentations:

By Product:

By Material:

By Application:

- Erosion Control

- Reinforcement

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the geotextile market is shaped by key players such as AGRU America, Low and Bonar PLC, Propex Operating Company, LLC, Fibertex Nonwovens A/S, Officine Maccaferri S.p.A., GSE Holdings, Inc., TENAX Group, Global Synthetics, Koninklijke Ten Cate B.V., and NAUE GmbH & Co. KG. The geotextile market is characterized by strong innovation, capacity expansion, and sustainability-focused strategies. Manufacturers are investing in advanced polymer processing, improved nonwoven technologies, and product customization to meet diverse application needs. Companies are prioritizing research and development to enhance product performance in soil stabilization, erosion control, and water management. Strategic collaborations with infrastructure developers and government agencies are helping expand market reach and project participation. Mergers, acquisitions, and regional expansions are common as firms seek to strengthen their global footprint. The rising demand for eco-friendly and high-durability geotextiles continues to drive competition and technological advancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AGRU America

- Low and Bonar PLC

- Propex Operating Company, LLC

- Fibertex Nonwovens A/S

- Officine Maccaferri S.p.A.

- GSE Holdings, Inc.

- TENAX Group

- Global Synthetics

- Koninklijke Ten Cate B.V.

- NAUE GmbH & Co. KG

Recent Developments

- In April 2025, HUESKER completed the acquisition of Sineco International, adding proprietary drainage and dewatering products to its portfolio. The transaction signals aggressive portfolio diversification into complementary geosynthetic niches.

- In March 2025, Thales Alenia Space (TAS) signed a significant agreement with SKY Perfect JSAT Corporation for building JSAT-32, a geostationary-earth-orbit (GEO) satellite.

- In February 2025, Japan’s Ministry of Defense awarded Astroscale Japan Inc., a division of Astroscale Holdings Inc. (“Astroscale”), a contract worth (taxes included) to construct a prototype of a demonstration satellite with a responsive space system.

- In December 2024, Solmax confirmed plans to consolidate its EMEA non-woven geotextile capacity in a new state-of-the-art facility. The move aims to streamline supply for European landfill projects and shorten delivery cycles for BABA-compliant exports

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increasing demand from large-scale infrastructure development projects worldwide.

- Sustainable and biodegradable geotextiles will gain stronger adoption in green construction.

- Technological advancements will enhance product durability, permeability, and strength.

- Integration with smart monitoring systems will improve real-time soil and structure analysis.

- Asia Pacific will continue to lead due to rapid industrialization and urban expansion.

- Europe and North America will focus on regulatory compliance and environmental goals.

- Emerging economies will offer new growth opportunities through infrastructure modernization.

- Strategic mergers and partnerships will help companies expand their global presence.

- Investments in flood control and erosion prevention projects will support steady growth.

- Product diversification across agriculture, drainage, and coastal protection will strengthen market potential.