Market Overview

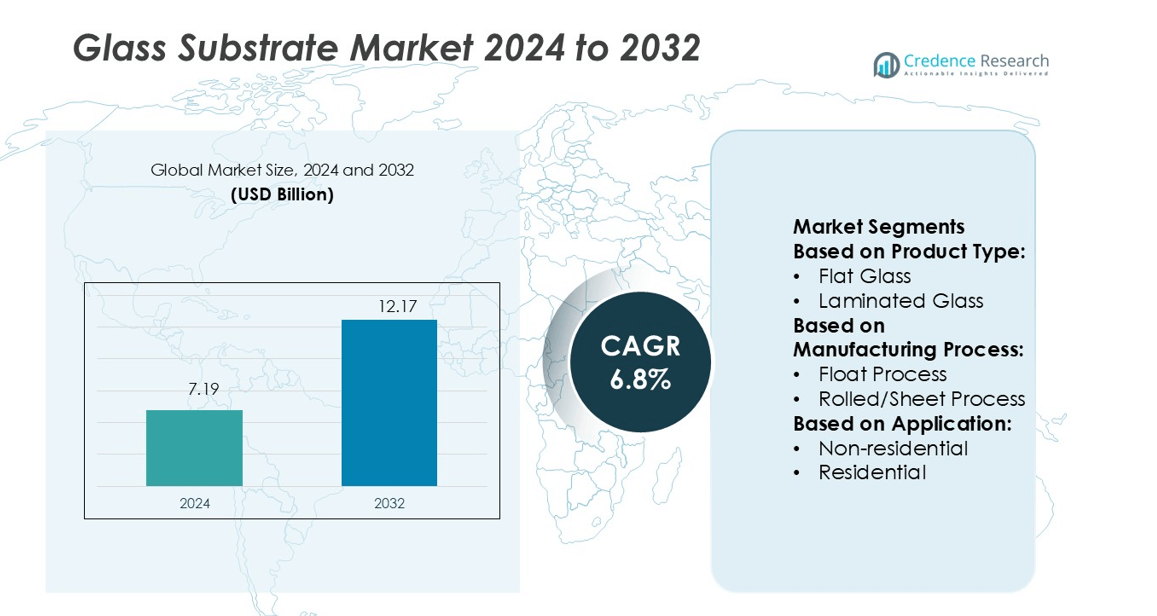

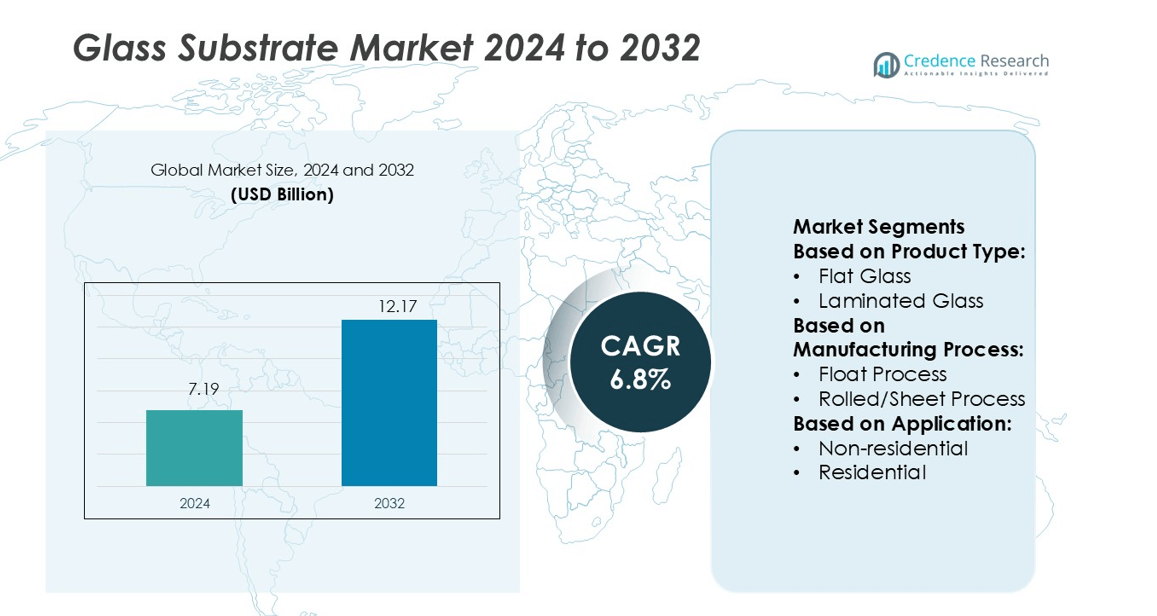

Glass Substrate Market size was valued USD 7.19 billion in 2024 and is anticipated to reach USD 12.17 billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glass Substrate Market Size 2024 |

USD 7.19 billion |

| Glass Substrate Market, CAGR |

6.8% |

| Glass Substrate Market Size 2032 |

USD 12.17 billion |

The Glass Substrate Market features strong competition among major players such as HOYA Corporation, Ohara, NOVA Electronic Materials, Guardian Industries, Nippon Electric Glass, Kyodo International, Corning, AGC, Applied Materials, and Absolics. These companies focus on advanced coating technologies, high-precision manufacturing, and product innovation to meet growing demand from electronics, solar, and construction sectors. Strategic investments in R&D and capacity expansion strengthen their market positions globally. Asia Pacific leads the market with a 36% share, supported by large-scale semiconductor and display manufacturing hubs in China, Japan, and South Korea. This regional dominance is reinforced by strong production capacity, cost advantages, and rapid adoption of next-generation technologies.

Market Insights

- The Glass Substrate Market was valued at USD 7.19 billion in 2024 and is expected to reach USD 12.17 billion by 2032, growing at a CAGR of 6.8%.

- Rising demand from electronics, solar energy, and construction sectors is driving product innovation and expanding application scope across multiple industries.

- Asia Pacific leads with a 36% regional share, supported by strong semiconductor and display manufacturing hubs in China, Japan, and South Korea.

- The float process segment dominates with a 71% share due to its ability to produce high-quality, cost-efficient substrates at scale.

- Strong competition among major players, high production costs, and technical challenges shape the market, while strategic investments in R&D and capacity expansion strengthen global positioning.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Special Glass dominates the Glass Substrate Market with a 34% share. Its superior thermal resistance, optical clarity, and strength make it ideal for electronics, semiconductors, and display applications. Flat glass and laminated glass follow due to their broad use in architecture and automotive. Low-e glass, both hard and soft coat, is gaining traction for energy-efficient buildings. Growing demand for high-performance displays, solar panels, and smart devices is driving product innovation. Manufacturers focus on thin, durable substrates to support advanced processing and high-resolution display technologies.

- For instance, HOYA Corporation developed a continuous glass melting system (150 feet long) that produces 20 tons of high-quality laser glass per month, contributing over 600 slabs to the NIF (National Ignition Facility) to meet stringent optical homogeneity requirements.

By Manufacturing Process

The float process leads this segment with a 71% share. This dominance comes from its ability to produce uniform, high-quality glass at large scales and lower costs. The process ensures smooth surfaces, making it suitable for displays, solar panels, and architectural glazing. Rolled or sheet processes are used for specialized applications but lack the consistency required for precision electronics. Rising investment in smart manufacturing and automation enhances float line efficiency, supporting high output volumes for rapidly expanding electronics and construction markets.

- For instance, Ohara uses continuous melting and other specialized systems to produce optical glass, with output often exceeding 300 tons per month, enabling a consistent supply for its optical and precision glass segments.

By Application

The non-residential segment holds a 62% share in the Glass Substrate Market. This includes commercial buildings, data centers, and industrial facilities where energy-efficient and durable materials are prioritized. The growing adoption of low-e and specialty glass in façade systems and solar installations boosts this segment. Residential applications are expanding steadily with green building standards and smart home technologies. Market growth is supported by rising construction activities, sustainability targets, and urban development projects across major economies.

Key Growth Drivers

Rising Demand from Consumer Electronics

The rapid expansion of display technologies is a key growth driver for the Glass Substrate Market. The increasing use of smartphones, tablets, and wearables boosts demand for thin, durable, and high-performance glass. Manufacturers focus on improving scratch resistance, transparency, and flexibility to support advanced OLED and microLED displays. High-quality glass substrates enable better pixel density and energy efficiency in screens. Expanding 5G networks and smart device adoption further amplify the requirement for precise, lightweight materials, driving large-scale production investments and product innovation.

- For instance, SCHOTT manufactures Borofloat 33 wafers, which can be chemically strengthened to be more damage resistant. These wafers are available in various thicknesses, with specialized processors able to offer them at thicknesses below 0.5 mm for optics and photonics clients.

Expanding Solar Energy Installations

The growing global shift toward renewable energy significantly supports market growth. Glass substrates are essential in photovoltaic modules due to their durability, light transmission, and weather resistance. Governments are investing heavily in solar projects, driving demand for tempered and coated glass. These substrates enhance panel efficiency and protect against environmental damage. Rising capacity additions in utility-scale solar farms and rooftop systems create steady demand for performance-focused glass solutions. Improved manufacturing processes are lowering costs, making advanced substrates more accessible for large installations.

- For instance, Guardian Industries supplies low-iron float glass, such as its UltraClear / UltraWhite product lines, to solar module makers. This glass is used to maximize light transmission and, together with other advanced components, helps produce high-efficiency panels, including those that exceed 400 W output.

Construction and Infrastructure Development

Rising urbanization and smart city initiatives increase the use of advanced glass substrates in modern infrastructure. Commercial buildings, data centers, and green buildings increasingly adopt low-e and specialty glass to meet energy efficiency standards. These products help reduce heat transfer, improve lighting, and support sustainable designs. Infrastructure investments across Asia Pacific, North America, and Europe strengthen demand. The material’s durability and aesthetic appeal make it a preferred choice for façades, windows, and structural glazing. This trend directly contributes to steady long-term market growth.

Key Trends & Opportunities

Adoption of Energy-Efficient Glass Solutions

A major trend in the market is the growing preference for energy-efficient glass technologies. Low-e coatings and advanced surface treatments help minimize heat loss and improve insulation. This shift aligns with stricter green building codes and net-zero energy goals. Companies are investing in new coating technologies and production lines to meet rising demand. Integration with smart building systems also enhances product value. The combination of performance and sustainability offers strong growth opportunities, especially in developed regions and emerging urban centers.

- For instance, Nippon Electric Glass (NEG) produces Dinorex® ultra-thin chemical strengthened cover glass with anti-reflection (AR) / anti-glare (AG) coatings, achieving surface roughness under 0.5 nm Ra and average reflectance of less than 0.7 % in visible range for 0.7 mm thickness.

Advancements in Thin and Flexible Glass Technology

The industry is witnessing a strong push toward ultra-thin and flexible glass development. These materials support foldable displays, lightweight solar panels, and miniaturized electronics. Their ability to maintain strength and clarity while reducing weight drives adoption in premium devices. Major manufacturers are focusing on scalable production methods to lower costs and increase capacity. The trend opens new opportunities in wearables, automotive displays, and aerospace applications. Flexible substrates also enable innovative designs, creating strong differentiation in competitive markets.

- For instance, Kyodo International offers glass substrates with nanoimprint services and mold replication that support layer thickness control at 20–50 nm for fine patterning.

Growing Integration with Semiconductor Manufacturing

The increasing use of glass substrates in semiconductor packaging creates new opportunities. Their thermal stability, smooth surfaces, and dimensional accuracy make them ideal for advanced chip production. This integration supports miniaturization and performance enhancement in next-generation devices. Demand from AI chips, sensors, and high-speed computing applications drives adoption. Companies are partnering with semiconductor firms to develop specialized materials with improved yield rates. This trend aligns with the growth of advanced manufacturing hubs in Asia and the U.S.

Key Challenges

High Production and Processing Costs

The production of high-performance glass substrates involves significant capital investment and complex processing. Specialized coatings, precision cutting, and thermal treatments increase costs. Manufacturers also face rising energy prices and material expenses. These factors make it challenging to offer competitive pricing, especially in cost-sensitive markets. Smaller producers struggle to match the scale and efficiency of major players. Balancing performance requirements with cost reduction remains a critical challenge, particularly as end-users demand thinner, stronger, and more advanced substrates.

Technical Limitations and Fragility

Despite advancements, glass substrates remain prone to damage during processing and handling. Thin and flexible glass, while innovative, has higher breakage risks compared to traditional materials. Precision manufacturing requires strict quality control and specialized equipment, limiting widespread adoption. Technical constraints in scaling production without compromising strength or clarity create further hurdles. These challenges impact yield rates and delay mass-market deployment in emerging applications such as flexible electronics and advanced solar modules, affecting overall market expansion.

Regional Analysis

North America

North America holds a 28% share of the Glass Substrate Market, driven by strong demand from consumer electronics, construction, and renewable energy sectors. The U.S. leads the region with advanced manufacturing facilities and a growing focus on energy-efficient building materials. Rising adoption of low-e and specialty glass in commercial and residential projects supports market expansion. Government incentives for solar energy installations further strengthen demand. Major electronics manufacturers and research institutions in the region continue to invest in high-performance substrates, enhancing production capacity and technological advancement. This positions North America as a key hub for innovation and large-scale adoption.

Europe

Europe accounts for 24% of the Glass Substrate Market, supported by strict energy-efficiency regulations and sustainable construction goals. Germany, France, and the UK drive demand through extensive use of coated glass in green buildings and advanced photovoltaic projects. The region benefits from mature infrastructure and strong R&D capabilities in specialty materials. Expansion of semiconductor and display manufacturing adds to market strength. Growing adoption of flexible glass in automotive and aerospace industries provides new growth avenues. Continuous innovation in coating and surface treatments reinforces Europe’s position as a leader in sustainable and high-performance glass applications.

Asia Pacific

Asia Pacific leads the Glass Substrate Market with a 36% share, fueled by rapid industrialization, construction boom, and large-scale electronics manufacturing. China, Japan, and South Korea dominate production due to strong semiconductor and display panel industries. The region also sees rising solar installations, especially in India and China, boosting demand for durable glass substrates. Growing urbanization supports wider use in commercial buildings and smart city projects. High investment in production lines and advanced coating technologies strengthens regional supply chains. Asia Pacific’s cost advantages and technology integration make it the most dynamic and fastest-growing regional market.

Latin America

Latin America holds a 7% share of the Glass Substrate Market, driven by increasing construction activities and renewable energy projects. Brazil and Mexico lead the region with growing demand for architectural glass and photovoltaic modules. Governments are encouraging energy-efficient infrastructure, boosting the adoption of coated glass solutions. The electronics sector remains small but is expanding with investment in manufacturing hubs. Rising demand for affordable, durable glass substrates in construction supports steady growth. However, limited local production capacity results in a high dependence on imports, creating opportunities for international manufacturers to expand their footprint.

Middle East & Africa

The Middle East & Africa region represents a 5% share of the Glass Substrate Market, supported by rising infrastructure investments and solar energy initiatives. Countries such as the UAE and Saudi Arabia lead with large-scale construction and smart city developments. The growing focus on green buildings and sustainable materials drives the use of low-e and laminated glass. Solar farms in desert regions further increase demand for durable substrates with high thermal resistance. Although manufacturing capacity is limited, ongoing investments in technology and regional collaborations are expected to strengthen local production capabilities in the coming years.

Market Segmentations:

By Product Type:

- Flat Glass

- Laminated Glass

By Manufacturing Process:

- Float Process

- Rolled/Sheet Process

By Application:

- Non-residential

- Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Glass Substrate Market is shaped by key players including HOYA Corporation, Ohara, NOVA Electronic Materials, Guardian Industries, Nippon Electric Glass, Kyodo International, Corning, AGC, Applied Materials, and Absolics. The Glass Substrate Market is defined by strong technological innovation, capacity expansion, and strategic collaborations. Companies focus on enhancing product quality through advanced coating technologies, improved thermal resistance, and greater flexibility to meet diverse application needs. Investments in R&D and smart manufacturing strengthen their ability to serve high-demand sectors such as electronics, solar energy, and construction. Partnerships with semiconductor and display industries support the development of next-generation substrates. Regional expansion strategies, including localized production and supply chain optimization, help maintain cost efficiency and market reach. This competitive intensity drives continuous product improvement and market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HOYA Corporation

- Ohara

- NOVA Electronic Materials

- Guardian Industries

- Nippon Electric Glass

- Kyodo International

- Corning

- AGC

- Applied Materials

- Absolics

Recent Developments

- In November 2024, AGC announced that its glass substrate M100/200 series for AR/MR glasses has been selected as an ‘Honoree’ in the CES 2025 Innovation Awards program. CES is a highly influential tech event held annually in Las Vegas, serving as a global platform for innovation.

- In September 2024, Corning unveiled Corning EXTREME ULE Glass, a next-generation material that will support chip manufacturers in meeting the rapidly growing demand for advanced and intelligent technologies. The new material is expected to help chipmakers improve photomasks – the stencils for chip design – which are critical for the mass production of today’s most advanced and cost-efficient microchips.

- In May 2024, Samsung Electro-Mechanics fast-tracked its venture into the semiconductor glass substrate market, advancing its equipment procurement and installation to September and starting to operate its pilot line in the fourth quarter, a quarter ahead of the initial plan. The company expects to start production of glass substrates for high-end system-in-packages in 2026.

- In April 2024, SCHOTT launched pilot projects on glass-ceramics and specialty glass for a more circular economy. SCHOTT is continuing its transformation into a sustainable company

Report Coverage

The research report offers an in-depth analysis based on Product Type, Manufacturing Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ultra-thin and flexible glass substrates will increase in electronics and wearables.

- Energy-efficient coated glass will gain wider adoption in commercial and residential buildings.

- Solar power expansion will drive strong demand for durable and high-transmission glass.

- Advanced glass substrates will support growth in semiconductor packaging and chip manufacturing.

- Automation and smart production technologies will improve manufacturing efficiency and yield.

- Strategic partnerships will expand supply chains and strengthen global market presence.

- R&D investment will focus on improving strength, optical clarity, and coating performance.

- Asia Pacific will remain the leading production hub due to cost and capacity advantages.

- Sustainable materials and green building standards will accelerate product innovation.

- Competitive pressure will increase, driving faster technology upgrades and capacity expansion.