Market Overview

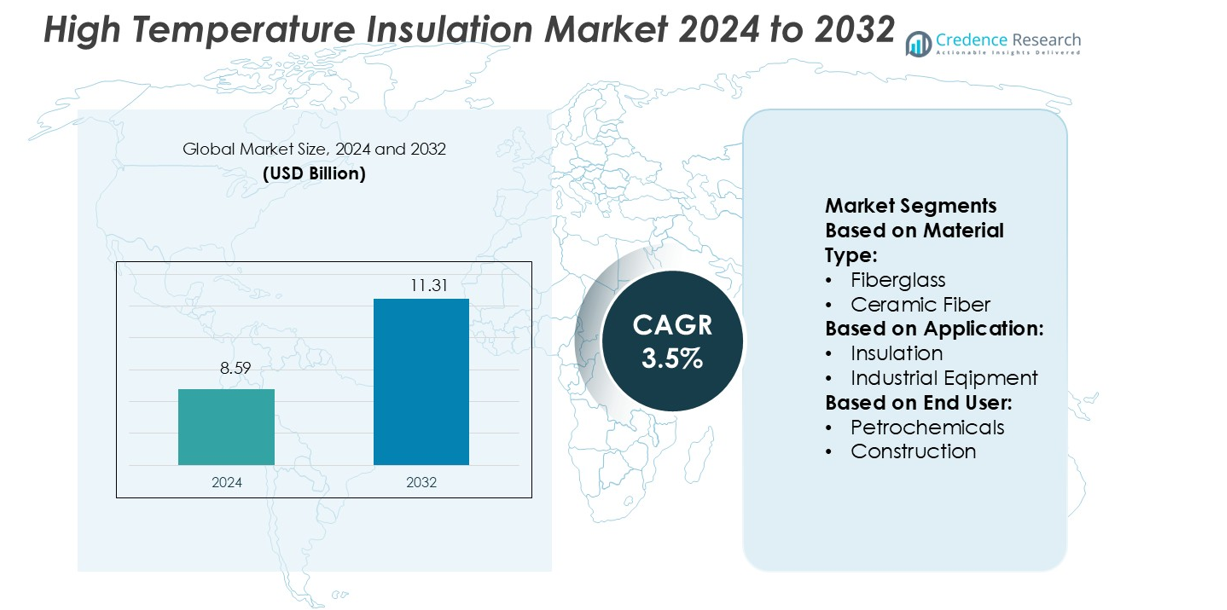

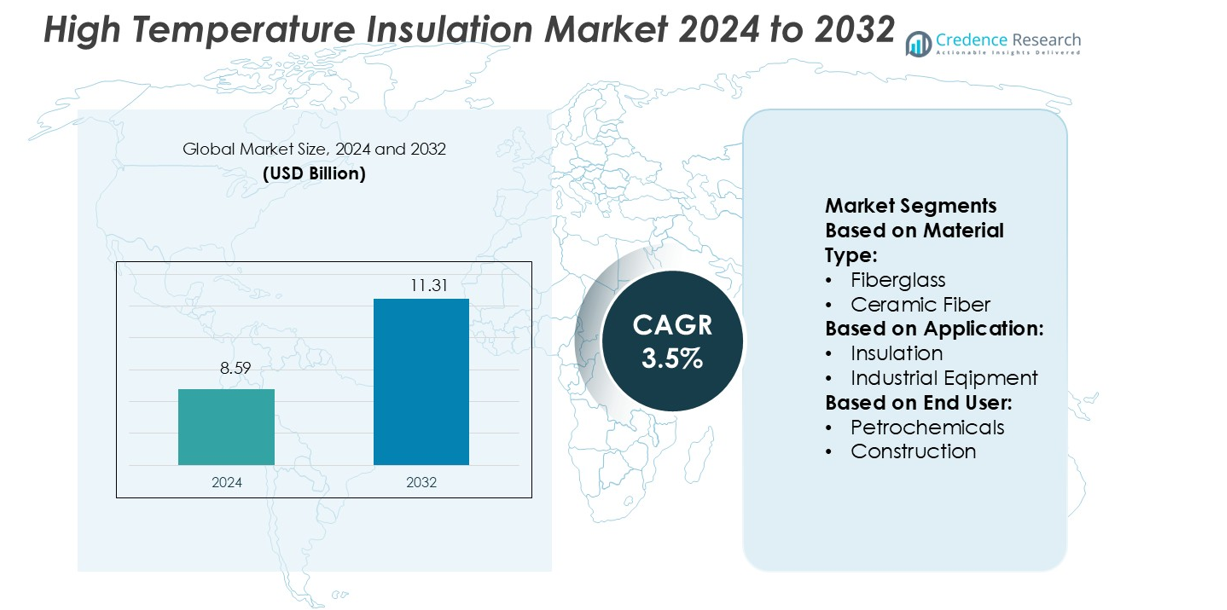

High Temperature Insulation Market size was valued USD 8.59 billion in 2024 and is anticipated to reach USD 11.31 billion by 2032, at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Temperature Insulation Market Size 2024 |

USD 8.59 billion |

| High Temperature Insulation Market, CAGR |

3.5% |

| High Temperature Insulation Market Size 2032 |

USD 11.31 billion |

The high temperature insulation market is driven by leading companies such as Insulcon Group, Aspen Aerogels, Inc., Almatis GmbH, Unifrax LLC, ADL Insulflex Inc., Morgan Advanced Materials, Zircar Zirconia, Inc., Rath Group, Hi-Temp Insulation, Inc., and 3M Company. These players focus on product innovation, expanding global distribution, and enhancing thermal performance to meet strict energy efficiency standards. Strategic partnerships with industrial sectors support strong market positioning and technology advancements. Asia Pacific leads the global market with a 34% share in 2024, driven by rapid industrialization, rising infrastructure investments, and government support for energy-efficient solutions across petrochemical, power, and manufacturing industries.

Market Insights

- The high temperature insulation market was valued at USD 8.59 billion in 2024 and is projected to reach USD 11.31 billion by 2032, growing at a CAGR of 3.5%.

- The market growth is driven by strong demand from petrochemical, power, and manufacturing industries focused on energy efficiency and operational cost reduction.

- Key players invest in product innovation and partnerships to enhance performance, expand distribution, and strengthen their competitive position globally.

- Asia Pacific holds a 34% share, followed by North America at 29% and Europe at 27%, with Asia Pacific leading due to rapid industrial expansion and energy regulations.

- Ceramic fiber insulation holds the dominant segment share, supported by its high thermal resistance and cost-effectiveness, while growing use of advanced aerogels and microporous products further boosts market opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Ceramic fibre leads the High Temperature Insulation Market with a 38% share in 2024. Its dominance comes from superior thermal stability, low thermal conductivity, and resistance to chemical wear. Ceramic fibre materials operate effectively at temperatures above 1,000°C, making them ideal for industrial furnaces, kilns, and turbines. Fiberglass and mineral wool follow due to their use in construction and industrial insulation systems. Rising demand for lightweight and energy-efficient insulation products across petrochemical and power generation industries further boosts ceramic fibre adoption, as manufacturers focus on improved performance and energy cost reduction.

- For instance, FLSmidth offers its HPGR Pro line with various models, including the PM10 30/20 with 2,000 mm roll widths. A rotating side-plates upgrade for the HPGR Pro can yield up to 20% higher throughput and extend roll wear life by up to 30% under certain operating conditions.

By Application

The insulation segment holds the largest share of 44% in the market. High temperature insulation materials are widely used in furnace linings, boilers, and heat treatment equipment to minimize energy loss and enhance process efficiency. This segment benefits from stricter energy regulations and the push toward sustainable industrial operations. Industrial equipment follows as a key application area, supported by expanding manufacturing activities. Growing investment in energy-intensive industries such as steel, cement, and glass further fuels demand for advanced insulation solutions to improve operational safety and cost savings.

- For instance, Quintus Technologies’ press releases show their High-Pressure Processing (HPP) “QIF 400L” or “QIF 600L” vessels have a diameter of 47 cm (18.5 in), allowing larger product volumes per cycle. The QIF 150L model, intended for smaller-scale production, has a vessel diameter of 30.6 cm (12 in).

By End-User

The petrochemical industry dominates the market with a 36% share in 2024. High temperature insulation plays a critical role in refineries, cracking units, and steam reformers, where process temperatures often exceed 800°C. These materials reduce heat loss, improve energy efficiency, and ensure worker safety in harsh operating environments. The construction sector follows due to growing demand for fireproofing and thermal efficiency in commercial buildings. Transportation also contributes steadily as insulation is used in aerospace and automotive applications to improve thermal performance and safety under extreme conditions.

Key Growth Drivers

Rising Demand in Energy-Intensive Industries

High temperature insulation is gaining traction in power generation, petrochemicals, and steel industries. These industries require stable heat management to reduce operational costs and enhance equipment life. Insulation materials enable energy conservation, minimize heat loss, and support efficient thermal processing. Increasing investments in advanced manufacturing and refinery expansions globally strengthen this demand. The drive to achieve lower energy costs and comply with emission standards further supports the adoption of high temperature insulation solutions across multiple industrial operations.

- For instance, Pulsemaster offers a range of PEF systems that apply microsecond high-voltage pulses. The company’s industrial products include systems with power ranges up to 100 kW and different processing capacities.

Stringent Environmental and Energy Efficiency Regulations

Global environmental policies are driving industries toward energy-efficient solutions. High temperature insulation plays a critical role in reducing energy waste and carbon emissions. Governments in North America, Europe, and Asia are promoting industrial sustainability through stricter thermal efficiency standards. This has led industries to upgrade or replace outdated insulation systems with advanced, eco-friendly materials. The regulatory push also encourages the development of innovative insulation products with improved thermal resistance, supporting market expansion across various heavy industries.

- For instance, Stansted Fluid Power products production homogeniser unit with flow rates up to 375 L/h at pressures up to 58,000 psi (400 MPa), capable of CIP (Clean-in-Place) and SIP (Sterilization-in-Place) for easier maintenance.

Technological Advancements and Material Innovation

Continuous innovation in insulation materials is boosting market growth. Manufacturers are focusing on developing lightweight, durable, and high-performance insulation solutions that withstand extreme operating temperatures. Advanced materials such as aerogels, ceramic fibers, and microporous insulation offer superior thermal efficiency and longer service life. These innovations help reduce energy losses, enhance operational safety, and lower maintenance costs. The growing adoption of smart manufacturing technologies further accelerates the integration of advanced insulation systems across industrial infrastructure.

Key Trends & Opportunities

Expansion of Industrial Infrastructure in Emerging Economies

Rapid industrialization in Asia Pacific, Latin America, and the Middle East presents strong growth opportunities. Countries like India and China are expanding their energy, steel, and chemical sectors. This expansion creates high demand for efficient heat management solutions. Infrastructure development projects, including refineries, power plants, and process industries, are driving large-scale adoption of high temperature insulation. Companies are increasingly targeting these markets through strategic partnerships and capacity expansion to strengthen their global presence.

- For instance, Kobe Steel Ltd. manufactures high-pressure processing (HPP) systems with proven operational capacity at 686 MPa, specifically designed for food safety and preservation applications.

Growing Focus on Sustainability and Energy Conservation

Sustainability goals are influencing insulation choices across industries. Manufacturers are developing eco-friendly and recyclable insulation products that align with global climate goals. This trend is supported by rising awareness of energy savings and operational efficiency among end-users. Green certifications and building codes also encourage the use of energy-efficient insulation. As industries seek cost-effective ways to reduce emissions, sustainable insulation materials offer long-term value and regulatory compliance advantages, positioning them as a preferred solution.

- For instance, Thyssenkrupp-Uhde’s HPP systems operate at pressures of 6,000 bar (≈ 600 MPa) during processing, applied via water‐filled vessels. In their “Uhde 700-60 TWIN” unit, throughput reaches over 3,200 kilograms per hour under those conditions.

Integration of Digital Monitoring and Smart Systems

The adoption of digital technologies is transforming insulation management. Smart monitoring systems allow real-time tracking of heat loss, insulation performance, and energy usage. This improves maintenance planning and reduces operational downtime. Industries are investing in digital tools to optimize thermal performance and extend equipment life. The integration of insulation with IoT platforms enhances energy management strategies, creating new business opportunities for advanced insulation manufacturers focused on smart solutions.

Key Challenges

High Initial Installation and Maintenance Costs

One of the major challenges in this market is the high upfront cost of advanced insulation materials. Products like aerogels and microporous insulation, though efficient, require significant capital investment. Industries often face budget constraints when upgrading existing infrastructure. Additionally, specialized installation and maintenance processes increase overall operational expenses. These factors may limit adoption, especially among small and medium-sized industries, slowing market growth despite long-term energy savings.

Fluctuating Raw Material Prices and Supply Chain Issues

Raw material price volatility poses a significant challenge for insulation manufacturers. Materials such as ceramic fibers and mineral wool are affected by global supply chain disruptions and rising energy costs. Sudden fluctuations impact production costs and profit margins. Dependence on imported materials in certain regions adds further risk. Supply chain instability, combined with regulatory compliance costs, makes it difficult for manufacturers to maintain pricing stability and meet growing demand efficiently.

Regional Analysis

North America

North America holds a 29% share of the global high temperature insulation market in 2024. Strong demand comes from petrochemical plants, refineries, and power generation facilities. The U.S. leads regional growth, supported by investments in LNG and renewable energy infrastructure. Rising energy efficiency regulations drive the adoption of advanced insulation solutions with superior thermal resistance. Manufacturers focus on lightweight, low-conductivity products to reduce energy loss. Canada contributes through mining and heavy industrial applications, creating consistent product demand. Strategic partnerships between insulation producers and engineering firms enhance supply chain integration and support market expansion across key states and provinces.

Europe

Europe accounts for a 27% share of the high temperature insulation market in 2024. The region benefits from stringent emission regulations and decarbonization goals driving insulation adoption in manufacturing, chemicals, and metallurgy. Germany, France, and Italy lead with increased investments in green steel and energy-efficient production facilities. High adoption of ceramic fibers and microporous insulation supports process optimization and carbon footprint reduction. EU energy directives further boost demand for thermal management systems. Manufacturers expand R&D to improve thermal conductivity performance and durability. The shift toward low-emission technologies strengthens market opportunities for innovative insulation materials across multiple industrial sectors.

Asia Pacific

Asia Pacific dominates the high temperature insulation market with a 34% share in 2024. Rapid industrialization in China, India, and Japan drives strong demand across petrochemical, power, and metal processing sectors. Government initiatives supporting energy conservation and clean manufacturing boost product adoption. China leads the region with large-scale steel, cement, and chemical production facilities integrating high-performance insulation solutions. Japan and South Korea emphasize advanced thermal control in high-tech industries. Local players expand production capacity to meet rising demand, while global manufacturers invest in joint ventures. Infrastructure expansion and rising energy efficiency standards make the region a key growth hub.

Latin America

Latin America represents a 6% share of the global high temperature insulation market in 2024. Brazil and Mexico lead regional demand, driven by growth in oil refining, cement, and power generation. Investments in petrochemical and energy infrastructure boost the need for efficient insulation solutions. Local manufacturers increase capacity to serve heavy industries while international players target the market through distribution partnerships. Regulatory emphasis on energy conservation encourages the use of advanced thermal materials. Although adoption is slower than in developed regions, rising industrial output and modernization projects offer strong opportunities for future market expansion across key economies.

Middle East & Africa

The Middle East & Africa holds a 4% share of the high temperature insulation market in 2024. The demand is primarily driven by oil and gas, power generation, and cement industries. Saudi Arabia and the UAE lead regional growth with ongoing infrastructure and energy diversification projects. High operating temperatures in energy and petrochemical plants increase the need for durable insulation solutions. Governments push energy efficiency goals, creating opportunities for advanced ceramic and fiber-based insulation. Growing partnerships between regional EPC firms and global insulation suppliers strengthen supply chains. Expanding industrial capacity positions the region as a growing strategic market.

Market Segmentations:

By Material Type:

By Application:

- Insulation

- Industrial Eqipment

By End User:

- Petrochemicals

- Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The high temperature insulation market is shaped by key players including Insulcon Group, Aspen Aerogels, Inc., Almatis GmbH, Unifrax LLC, ADL Insulflex Inc., Morgan Advanced Materials, Zircar Zirconia, Inc., Rath Group, Hi-Temp Insulation, Inc., and 3M Company. The high temperature insulation market is driven by innovation, sustainability, and energy efficiency. Companies focus on developing advanced insulation materials with improved thermal resistance and reduced heat loss to meet strict regulatory standards. Product differentiation through lightweight, durable, and high-performance solutions supports strong market positioning. Strategic collaborations with EPC contractors and end-use industries help expand global reach. R&D investments target ceramic fibers, aerogels, and microporous insulation to enhance temperature stability and operational efficiency. Expanding distribution networks in Asia Pacific and Europe further strengthens market penetration. Competitive intensity remains high, with firms prioritizing technological advancements, sustainability alignment, and cost optimization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Insulcon Group

- Aspen Aerogels, Inc.

- Almatis GmbH

- Unifrax LLC

- ADL Insulflex Inc.

- Morgan Advanced Materials

- Zircar Zirconia, Inc.

- Rath Group

- Hi-Temp Insulation, Inc.

- 3M Company

Recent Developments

- In December 2024, Carlisle Companies Inc. announced that it has agreed to acquire the expanded polystyrene (EPS) insulation segment of PFB Holdco, Inc., a portfolio company of the Riverside Company.

- In October 2024, Knauf Insulation signed a deal with Texnopark, securing Texnopark’s Rock Mineral Wool insulation division. This acquisition includes a state-of-the-art Tashkent, Uzbekistan plant boasting electric melting technology that significantly reduces CO2 emissions during production.

- In June 2023, PPG Industries, Inc. introduced PPG ENVIRO-PRIME EPIC 200R coatings, a range of electrocoat (e-coat) products that offer lower temperature curing compared to alternative technologies. These coatings deliver sustainability advantages to customers by reducing energy consumption and minimizing CO2 emissions during the manufacturing process.

- In June 2023, Sherwin-Williams introduced a new line of Heat-Flex CUI-mitigation coatings. The line features Heat-Flex ACE (Advanced CUI Epoxy), an ultra-high-solids epoxy novolac with a specialized chemical enhancement for effective corrosion under insulation (CUI) mitigation

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth due to rising industrial energy efficiency demands.

- Advanced insulation materials will gain traction for their high thermal resistance and lightweight design.

- Rapid adoption in petrochemical, power, and manufacturing industries will strengthen global demand.

- Stringent emission regulations will drive innovation in eco-friendly and low-emission insulation solutions.

- Asia Pacific will remain the dominant regional hub with increasing production capacity.

- Digital monitoring and smart insulation systems will enhance operational efficiency.

- Sustainability-focused product development will shape future market strategies.

- Strategic mergers and acquisitions will expand product portfolios and market reach.

- Research in ceramic fibers and aerogels will lead to performance improvements.

- Infrastructure modernization and industrial expansion will create new growth opportunities.