Market Overview:

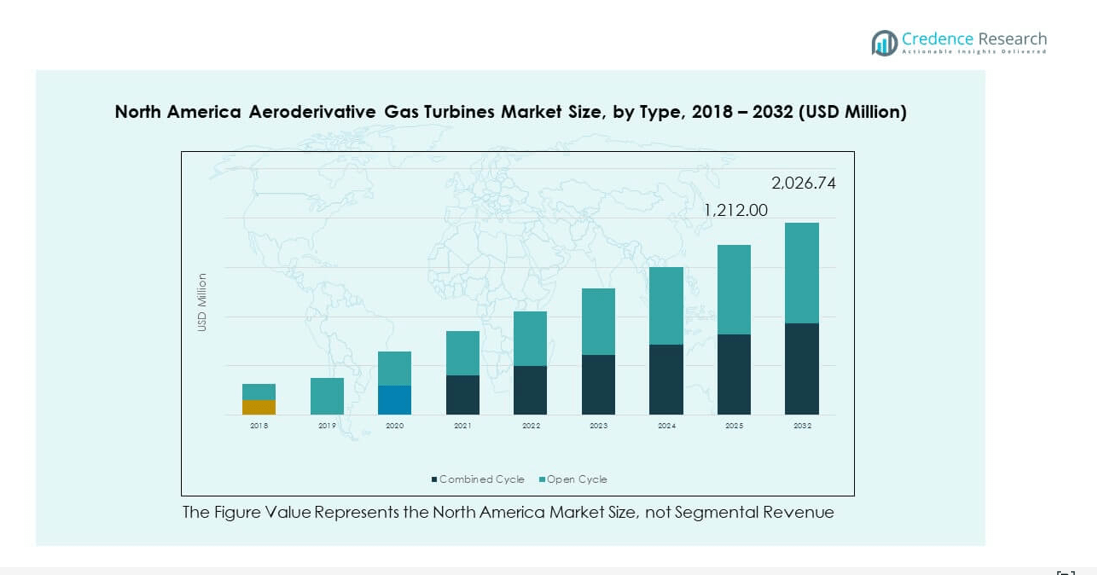

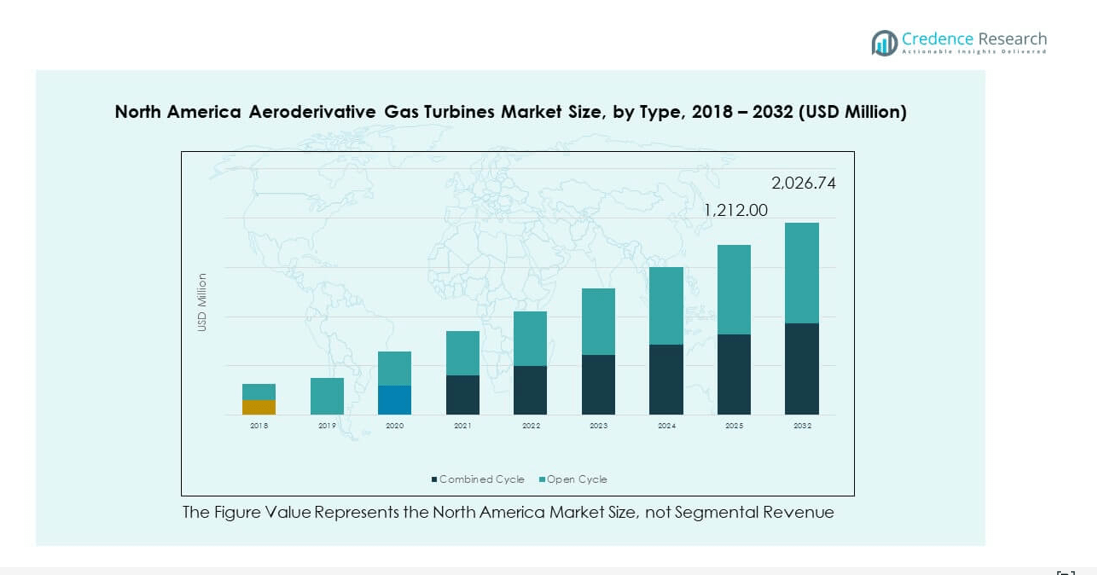

The North America Aeroderivative Gas Turbines Market size was valued at USD 722.72 million in 2018 to USD 1,128.24 million in 2024 and is anticipated to reach USD 2,026.74 million by 2032, at a CAGR of 7.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Aeroderivative Gas Turbines Market Size 2024 |

USD 1,128.24 million |

| North America Aeroderivative Gas Turbines Market, CAGR |

7.60% |

| North America Aeroderivative Gas Turbines Market Size 2032 |

USD 2,026.74 million |

Market growth is strongly driven by rising demand for flexible, efficient, and mobile power generation solutions across industrial, utility, and defense sectors. Aeroderivative turbines are increasingly preferred for their rapid start-up capabilities, lightweight design, and lower emissions compared to heavy-duty turbines. The expansion of distributed energy systems, coupled with the rising integration of renewable power sources, creates a need for fast-response backup generation. Furthermore, modernization of aging grid infrastructure and government emphasis on reducing carbon footprints support wider adoption of these turbines across the region.

Geographically, the United States dominates the North American market, supported by extensive investment in natural gas-fired generation and strong demand from the defense sector. Canada is emerging as a key market due to increased focus on energy diversification and expanding industrial applications. Mexico is also gaining momentum, supported by rising energy demand and modernization of power generation facilities. Together, these countries contribute to a dynamic regional landscape where mature markets drive innovation while emerging markets foster growth opportunities.

Market Insights:

- The North America Aeroderivative Gas Turbines Market was valued at USD 722.72 million in 2018, reached USD 1,128.24 million in 2024, and is projected to hit USD 2,026.74 million by 2032, at a CAGR of 7.60%.

- The Global Aeroderivative Gas Turbines Market size was valued at USD 2,288.5 million in 2018 to USD 3,617.3 million in 2024 and is anticipated to reach USD 6,608.2 million by 2032, at a CAGR of 7.85% during the forecast period.

- The United States held 72% share in 2024, driven by strong investment in power generation, defense, and data center growth; Canada followed with 18% share supported by oil and gas reliance and industrial adoption; Mexico captured 10% share with demand tied to infrastructure modernization.

- Mexico, with 10% share, is the fastest-growing subregion, supported by industrialization, energy reforms, and rising need for efficient distributed power.

- Combined cycle turbines accounted for roughly 60% share in 2024, reflecting higher adoption due to efficiency and suitability for both base-load and peak-load applications.

- Open cycle turbines represented nearly 40% share, benefiting from mobility and rapid-start features essential in defense, oil and gas, and emergency power use cases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Flexible Power Generation across Industrial and Utility Applications

The North America Aeroderivative Gas Turbines Market experiences growth driven by rising demand for flexible power generation. Industrial and utility operators prioritize turbines that can adjust rapidly to changing load requirements. It offers superior efficiency in handling peak power demand compared to heavy-duty gas turbines. The ability to deploy quickly strengthens its role in stabilizing grids with high renewable integration. Governments promote cleaner technologies that lower emissions while providing dependable energy. The market benefits from modernization of grid systems requiring fast and efficient solutions. Growing energy demand across data centers further amplifies the requirement for advanced turbine systems. It strengthens adoption by proving reliable, fast-starting performance in diverse applications.

- For instance, General Electric’s LM6000 aeroderivative gas turbine is designed to deliver up to 50 MW output, with a ramp rate capability of 50 MW per minute and start times of under 10 minutes, making it well suited for peaking operations, grid balancing, and data center backup applications.

Government Regulations and Policy Support Favoring Cleaner Power Technologies

Environmental regulations across North America encourage adoption of turbines with lower emissions. The North America Aeroderivative Gas Turbines Market gains momentum with policies supporting reduced carbon output. Governments promote technologies that balance energy reliability with environmental compliance. It enhances competitiveness of aeroderivative turbines that meet evolving air quality standards. Utility providers shift toward power solutions that comply with EPA and regional policies. Industrial operators adopt turbines to meet sustainability targets without sacrificing operational efficiency. These regulations position aeroderivative gas turbines as a cleaner alternative to conventional systems. It ensures stronger adoption within power and industrial infrastructure projects across the region.

- For instance, Siemens Energy developed the SGT-A45 TR aeroderivative turbine, capable of generating up to 44 MW with start-up times under 9 minutes. It features a dry low emissions system designed to achieve NOx as low as 25 ppm and CO near 10 ppm at full load, supporting cleaner and more flexible power generation.

Expanding Distributed Energy Systems and Growing Renewable Energy Integration

Distributed energy systems grow rapidly, requiring backup solutions that start quickly and operate flexibly. The North America Aeroderivative Gas Turbines Market supports renewable energy reliability by filling supply gaps. Intermittent sources like wind and solar necessitate fast-response power units. It becomes essential for balancing energy supply and demand during grid fluctuations. Companies invest in turbines to reduce dependency on conventional fossil-based backup solutions. Distributed power generation in remote and industrial zones strengthens adoption. The shift toward microgrids and localized power systems favors portable turbine solutions. It secures long-term demand by providing adaptable power support across multiple industries.

Increasing Adoption in Defense, Aviation, and Mobile Power Applications

Defense and aviation industries contribute significantly to the growth of aeroderivative turbines. The North America Aeroderivative Gas Turbines Market benefits from investments in mobile power units. Military operations require rapid deployment of lightweight turbines for remote or emergency use. It ensures efficient power supply for bases, ships, and critical operations. Aviation relies on turbine technology to maintain fuel-efficient, high-performance engines. Manufacturers strengthen their supply chains to meet demand for mobile and defense sectors. Growing focus on energy resilience during emergencies enhances interest in portable turbine systems. It positions aeroderivative turbines as vital for strategic defense and aviation infrastructure.

Market Trends

Advancements in Turbine Digitalization and Predictive Maintenance Technologies

The North America Aeroderivative Gas Turbines Market demonstrates a strong shift toward digital integration. Predictive maintenance platforms allow operators to reduce downtime through sensor-driven insights. It improves operational efficiency by predicting component wear before critical failure occurs. Digitalization also provides real-time analytics that optimize turbine performance. Manufacturers develop platforms offering AI-driven diagnostics and monitoring. This trend enhances lifecycle cost efficiency while improving energy output reliability. Increasing adoption of remote control solutions ensures stronger turbine performance across diverse applications. It secures future demand through integration with advanced data-driven systems.

Growing Focus on Hybrid Power Solutions Combining Turbines with Battery Storage

Hybrid solutions strengthen the efficiency of distributed power systems across North America. The North America Aeroderivative Gas Turbines Market adapts by integrating turbines with energy storage. It supports grid stability by managing renewable intermittency more effectively. Energy storage allows turbines to operate at optimal loads without constant cycling. Companies develop hybrid systems that combine turbines with lithium-ion or advanced batteries. This trend gains traction in industrial and utility applications seeking balanced power reliability. Hybrid integration improves fuel efficiency while reducing overall operating costs. It fosters broader deployment of turbines in modernized energy networks.

Rising Use of Aeroderivative Turbines in Offshore and Remote Energy Projects

Expansion of offshore and remote energy projects creates new applications for turbine technology. The North America Aeroderivative Gas Turbines Market witnesses’ adoption in oil platforms and isolated grids. It ensures dependable power where heavy-duty turbines are impractical. Remote mining and construction projects also adopt mobile turbine units. Lightweight and portable features allow efficient deployment under harsh conditions. Companies invest in rugged designs tailored for offshore and desert applications. Growing demand for resilient power in critical environments strengthens adoption. It highlights the importance of mobility and adaptability within turbine technology.

- For instance, GE Vernova’s TM2500 trailer-mounted aeroderivative turbines deliver up to 32 MW per unit and can be rapidly deployed within weeks. These mobile systems provide reliable temporary or remote power where grid infrastructure is limited, serving applications ranging from emergency backup to industrial and regional energy projects.

Strategic Collaborations and Supply Chain Investments by Major Turbine Manufacturers

Key turbine manufacturers pursue collaborations with energy operators to expand market reach. The North America Aeroderivative Gas Turbines Market benefits from stronger supplier ecosystems. It drives product availability and ensures efficient after-sales support. Joint ventures allow integration of turbines into renewable-based microgrids. Supply chain investments reduce lead times for critical components. Companies emphasize localized service networks to enhance customer confidence. Strategic agreements accelerate technology upgrades while strengthening regional market presence. It supports broader adoption through reliable partnerships between OEMs and energy providers.

- For instance, Rolls-Royce partnered with Purdue University through a University Technology Partnership focused on turbine and propulsion research. The collaboration supports advanced testing, innovation, and workforce development, strengthening the knowledge base for gas turbine and aeroderivative technologies in North America.

Market Challenges Analysis

High Initial Capital Investment and Competition from Alternative Technologies

The North America Aeroderivative Gas Turbines Market faces challenges due to high initial investment requirements. Capital costs often discourage adoption by smaller utility or industrial operators. It limits widespread deployment in cost-sensitive sectors. Alternative technologies such as reciprocating engines and heavy-duty turbines present strong competition. These solutions sometimes offer lower upfront costs or higher efficiency under steady loads. Investors often weigh risks associated with payback timelines against long-term efficiency gains. Price-sensitive markets face difficulties in adopting aeroderivative turbines at large scale. It creates barriers that slow market penetration across certain customer segments.

Supply Chain Vulnerabilities and Technical Limitations in Harsh Environments

Supply chain disruptions affect availability of critical turbine components across the region. The North America Aeroderivative Gas Turbines Market encounters delays due to reliance on specialized parts. It increases maintenance costs and affects delivery schedules. Technical performance in harsh environments such as extreme cold or desert conditions remains a challenge. Operators report difficulties in ensuring consistent output without advanced support systems. Complex installation processes also hinder adoption in remote areas. OEMs continue developing solutions but costs remain high for advanced designs. It restricts broader deployment in industries requiring rugged, long-lasting turbine systems.

Market Opportunities

Expansion of Microgrid Projects and Integration with Renewable Energy Systems

The North America Aeroderivative Gas Turbines Market holds significant opportunities in microgrid expansion. Growing demand for decentralized power systems creates space for fast-start turbine solutions. It ensures reliability when renewable sources cannot meet full demand. Industrial parks and campuses adopt microgrids with aeroderivative turbines for energy independence. Hybridization with renewable sources secures long-term growth potential. Governments support initiatives encouraging resilient local energy networks. This trend strengthens turbine deployment in both urban and rural energy systems. It ensures future market resilience through strong microgrid adoption rates.

Rising Potential in Emerging Industrial Applications and Cross-Sector Deployment

New industrial applications create growth avenues for turbine technology across the region. The North America Aeroderivative Gas Turbines Market benefits from sectors including oilfield services, data centers, and logistics. It ensures high-performance power for mission-critical operations in remote sites. Companies view turbines as essential for improving operational continuity. Expansion of LNG facilities also supports turbine deployment for energy needs. Growing demand for reliable power during extreme conditions enhances opportunity potential. Manufacturers capitalize by developing lightweight, portable, and fuel-efficient designs. It ensures wider adoption across diverse industries seeking mobile and efficient power solutions.

Market Segmentation Analysis:

The North America Aeroderivative Gas Turbines Market is segmented by type, capacity, and application, reflecting its diverse adoption across industries.

By type, combined cycle units dominate due to their higher efficiency and suitability for base-load and peak-load operations. Open cycle units maintain steady demand in mobile, emergency, and defense applications where rapid deployment is critical. This segmentation highlights the market’s balance between efficiency-focused projects and mobility-driven use cases.

By capacity, the ≤18 MW category serves distributed energy systems, industrial plants, and localized power facilities. The >18 MW segment caters to large-scale utilities, offshore projects, and aviation requirements where higher output is essential. It demonstrates flexibility by addressing both small-scale industrial needs and large power infrastructures. Growth is particularly strong in the higher capacity range, supported by demand for stable yet efficient grid support.

- For example, Siemens’ SGT-A05 aeroderivative turbine, derived from the Rolls-Royce 501-K, delivers between 4 and 5.8 MW of electrical output per unit. It is widely used in distributed energy and industrial sites, offering rapid-start capability with the ability to reach full output in just 1 minute.

By application, oil and gas holds a significant share, supported by offshore platforms and exploration activities requiring reliable power. Aviation relies heavily on aeroderivative turbines for engine technology and auxiliary power units. Power generation continues to be a critical segment, driven by increasing reliance on natural gas-fired plants and renewable integration backup. Marine and industrial sectors adopt turbines for portable, resilient energy in demanding conditions. Others include specialized defense and emergency applications that require lightweight, fast-starting solutions. This broad scope demonstrates how the market caters to both traditional and emerging energy demands.

- For instance, Siemens’ SGT-A35 RB aeroderivative turbine, derived from the RB211, delivers up to 38 MW of output with high power density. It has been widely deployed worldwide across oil and gas operations, including offshore platforms, where compact, efficient turbines are essential for reliable power generation.

Segmentation:

By Type

- Combined Cycle

- Open Cycle

By Capacity

By Application

- Oil & Gas

- Aviation

- Power Generation

- Marine

- Industrial

- Others

By Region

Regional Analysis:

The United States holds the dominant position in the North America Aeroderivative Gas Turbines Market, accounting for 72% of the regional share. Strong investment in natural gas-fired power generation and increasing integration of renewable sources drive turbine adoption. The defense sector also supports demand, with lightweight turbines deployed across naval, aviation, and mobile military operations. Data center growth strengthens reliance on efficient backup power units. It benefits from regulatory frameworks that encourage cleaner, more efficient energy solutions. Continuous innovation by domestic manufacturers further secures its leadership in the regional market.

Canada represents 18% of the North America Aeroderivative Gas Turbines Market, supported by its emphasis on sustainable energy diversification. The country’s oil and gas industry relies on aeroderivative turbines for offshore and remote operations requiring reliable and portable power solutions. Industrial expansion in mining and heavy manufacturing further supports market adoption. Canada’s regulatory environment promotes lower emissions, which positions aeroderivative units as a viable choice for balancing energy security and environmental compliance. It continues to build demand through investments in distributed energy systems and microgrid development. Collaborative projects between utilities and turbine manufacturers strengthen its market contribution.

Mexico accounts for 10% of the North America Aeroderivative Gas Turbines Market, driven by rising energy demand and modernization of power infrastructure. Industrialization and growth in energy-intensive sectors increase the need for efficient power generation. The oil and gas sector leverages turbine technology to support exploration and production activities. Mexico’s focus on improving grid reliability creates opportunities for open cycle and portable turbine solutions. It remains an emerging market where infrastructure upgrades and industrial projects shape long-term demand. Support from regional and global suppliers ensures greater access to advanced turbine technologies, strengthening Mexico’s position in the regional landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- General Electric

- Siemens

- Pratt & Whitney

- Baker Hughes Company

- Mitsubishi Heavy Industries, Ltd.

- Solar Turbines Incorporated

- Other Key Players

Competitive Analysis:

The North America Aeroderivative Gas Turbines Market is highly competitive, with established multinational companies driving innovation and shaping industry standards. General Electric and Siemens maintain strong positions by leveraging extensive product portfolios and service networks. Pratt & Whitney supports the aviation and defense sectors with advanced turbine technologies, while Baker Hughes focuses on energy applications including oil and gas. Mitsubishi Heavy Industries and Solar Turbines Incorporated expand their presence through strategic partnerships and regional service capabilities. It reflects a competitive environment where product differentiation, reliability, and performance are critical to securing contracts. Market players focus heavily on research and development to enhance turbine efficiency, reduce emissions, and expand digital integration. Mergers, acquisitions, and regional expansion strategies remain central to strengthening market reach. Manufacturers also emphasize customer support and lifecycle services to build long-term relationships with utilities, industrial clients, and defense organizations. Competition intensifies as companies seek to align offerings with renewable integration and distributed power systems. It highlights the growing importance of operational flexibility and cost efficiency in purchasing decisions.

Recent Developments:

- In July 2025, GE Vernova announced a major delivery agreement with Crusoe, a leading AI infrastructure provider, to supply 29 LM2500XPRESS aeroderivative gas turbine packages for Crusoe’s data centers, targeting rapid AI-driven energy demand and emissions mitigation.

- In April 2025, Duke Energy entered a notable partnership with GE Vernova to procure up to eleven American-produced GE Vernova natural gas turbines. This partnership aims to fulfill Duke Energy’s growing demands driven by economic development and the rise of data center power needs.

- In March 2024, TRS Services, a key provider specializing in maintenance, repair, and overhaul of component parts for industrial gas turbines, announced its acquisition by Battle Investment Group. The acquisition is designed to strengthen TRS’s operations and expand strategic growth, particularly in servicing aeroderivative gas turbines used across remote, mobile, and off-grid power solutions, crucial for distributed energy needs in North America

- In December 2024, Siemens Energy entered a strategic partnership with UK power giant SSE on the “Mission H2 Power” project, focused on developing combustion systems for the SGT5-9000HL gas turbine to operate 100% on hydrogen, supporting full decarbonization of SSE’s Keadby 2 Power Station.

Report Coverage:

The research report offers an in-depth analysis based on Type, Capacity and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America Aeroderivative Gas Turbines Market will expand steadily, driven by rising demand for efficient power generation.

- Integration of aeroderivative turbines with renewable energy systems will strengthen grid stability and enhance adoption.

- Increased deployment in defense and aviation will create consistent demand for lightweight, mobile power solutions.

- Oil and gas applications will remain critical, particularly in offshore and remote projects requiring reliable energy supply.

- Technological advancements in digital monitoring and predictive maintenance will lower operational costs and extend turbine life.

- Investments in microgrids and distributed energy infrastructure will generate new opportunities for compact turbine units.

- Industrial growth, particularly in data centers and manufacturing, will support steady expansion across diverse applications.

- Regulatory support for low-emission technologies will drive replacement of conventional power generation units.

- Regional collaborations and supply chain expansion will strengthen market presence for established manufacturers.

- Ongoing modernization of power infrastructure will secure long-term opportunities for aeroderivative turbine deployment.