Market Overview

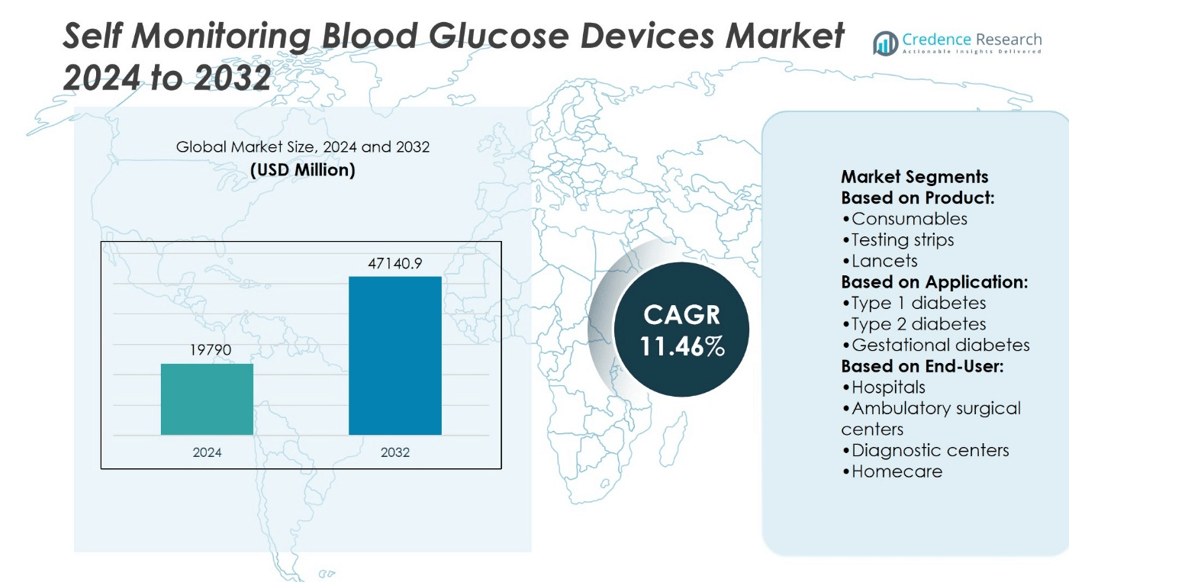

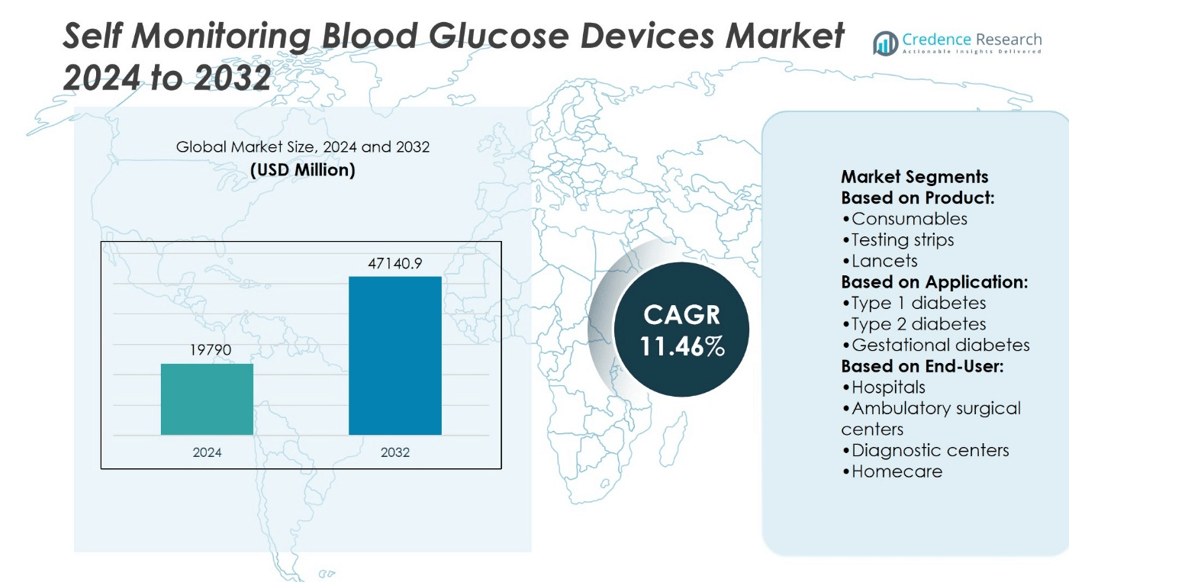

Self-Monitoring Blood Glucose Devices Market size was valued at USD 19790 million in 2024 and is anticipated to reach USD 47140.9 million by 2032, at a CAGR of 11.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Self-Monitoring Blood Glucose Devices Market Size 2024 |

USD 19790 million |

| Self-Monitoring Blood Glucose Devices Market, CAGR |

11.46% |

| Self-Monitoring Blood Glucose Devices Market Size 2032 |

USD 47140.9 million |

The Self-Monitoring Blood Glucose Devices Market grows through rising diabetes prevalence, greater patient awareness, and stronger emphasis on early disease management. Demand increases as patients seek reliable, maintenance-free solutions for daily monitoring and better treatment adherence. Technological progress in biosensors, wireless connectivity, and mobile app integration enhances device accuracy and usability. Non-invasive innovations and compact designs support higher compliance, particularly among aging and tech-savvy populations. The market also reflects broader healthcare trends, with cloud-based platforms, AI-driven insights, and remote monitoring strengthening personalized care and expanding adoption across homecare, hospitals, and diagnostic settings.

The Self-Monitoring Blood Glucose Devices Market shows strong geographical presence, with North America leading due to advanced infrastructure, followed by Europe with supportive healthcare systems and Asia-Pacific showing rapid growth from large diabetic populations. Latin America and the Middle East & Africa demonstrate steady adoption driven by rising awareness. Key players shaping the market include Abbott Laboratories, F. Hoffmann-La Roche, Ascensia Diabetes Care Holdings, LifeScan, Arkray, Bionime Corporation, DarioHealth, AgaMatrix, All Medicus, and B. Braun Melsungen.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Self-Monitoring Blood Glucose Devices Market was valued at USD 19,790 million in 2024 and is expected to reach USD 47,140.9 million by 2032, at a CAGR of 11.46%.

- Rising diabetes prevalence and growing patient awareness drive strong demand for reliable self-monitoring solutions.

- Advancements in biosensors, wireless connectivity, and mobile applications enhance device performance and usability.

- Increasing focus on non-invasive technologies and compact designs supports higher compliance among diverse patient groups.

- Competition intensifies as leading players invest in innovation, partnerships, and digital health integration.

- High costs of consumables and inconsistent insurance coverage limit adoption in some regions.

- North America leads the market, Europe shows steady growth, Asia-Pacific expands rapidly, while Latin America and the Middle East & Africa display gradual adoption supported by awareness initiatives.

Market Drivers

Rising Diabetes Prevalence and Growing Patient Awareness

The Self-Monitoring Blood Glucose Devices Market benefits from the rising number of people diagnosed with diabetes globally. Urbanization, sedentary lifestyles, and dietary changes drive higher incidence rates across both type 1 and type 2 diabetes. Healthcare systems promote early detection and self-management to reduce complications. Patients show stronger awareness of blood glucose control and actively adopt digital tools. Governments and medical associations run campaigns that highlight the risks of uncontrolled diabetes. This expanding awareness base creates consistent demand for self-monitoring solutions.

- For instance, Bionime launched the RIGHTEST GM700 SB Bluetooth glucometer in July 2017, designed for high accuracy and seamless connectivity. The device transmits each test result via Bluetooth 4.0 to the Rightest CARE mobile app, supporting long-term tracking and remote sharing with healthcare providers. It stores 500 test results in its internal memory, giving patients a detailed glucose history for trend analysis.

Technological Advancements in Monitoring Accuracy and Connectivity

The Self-Monitoring Blood Glucose Devices Market advances through innovation in sensor accuracy, wireless connectivity, and compact designs. Manufacturers introduce products with shorter response times and higher reliability for clinical and personal use. Wireless integration with smartphones and health apps enhances tracking and data sharing with providers. It strengthens personalized treatment planning and patient compliance. Cloud platforms and AI-driven analytics extend device functionality beyond simple measurement. These improvements differentiate offerings and raise adoption among both patients and physicians.

- For instance, LifeScan OneTouch Ultra 2 meter produces a blood glucose result in 5 seconds. This quick turnaround improves responsiveness for users. For tracking and sharing data with providers, the meter uses a download port to transfer results via a cable to a computer.

Supportive Healthcare Policies and Insurance Reimbursement Models

The Self-Monitoring Blood Glucose Devices Market gains momentum through favorable healthcare policies and structured reimbursement programs. Governments expand coverage for testing supplies and devices to reduce patient costs. Insurance payers recognize the long-term benefits of improved glucose control and support adoption. Hospitals and clinics incorporate self-monitoring into standard care protocols to lower complication risks. It enables broader access in developed and developing markets. Policy alignment with public health strategies ensures a stable foundation for sustained market growth.

Expansion of Homecare and Preference for User-Friendly Devices

The Self-Monitoring Blood Glucose Devices Market sees strong growth from the expansion of homecare settings. Patients prefer devices that are portable, simple, and minimally invasive. User-friendly interfaces and fast test strips increase convenience for regular monitoring. It empowers individuals to manage health outside clinical environments. Aging populations with chronic conditions further strengthen this trend. The shift toward at-home care and personalized monitoring solutions continues to reinforce long-term demand.

Market Trends

Integration of Digital Health Platforms and Mobile Applications

The Self-Monitoring Blood Glucose Devices Market evolves through integration with digital health platforms. Devices now connect seamlessly with smartphones, tablets, and cloud-based systems. Mobile applications support trend analysis, reminders, and physician access to patient data. It improves real-time decision-making and encourages better disease management. Patients benefit from data visualization and tailored health recommendations. This trend reflects the broader movement toward connected healthcare ecosystems.

- For instance, DarioHealth’s system uses a 0.3‑microliter blood sample and delivers glucose results in six seconds, syncing instantly with its mobile app. The apps support trend analysis, reminders, and physician access.

Growing Demand for Minimally Invasive and Non-Invasive Technologies

The Self-Monitoring Blood Glucose Devices Market demonstrates rising demand for user comfort and less invasive testing. Needle-free technologies and continuous sensors gain preference among patients. Companies focus on reducing pain, sample size, and device footprint. It aligns with patient-centered care and supports higher compliance rates. Non-invasive approaches attract attention due to their potential to simplify testing routines. This transition reshapes consumer expectations and accelerates product innovation.

- For instance, Abbott’s FreeStyle Libre 3 sensor is just 2.9 mm thick and 21 mm in diameter, with the filament inserted only about 5 mm under the skin. This compact design reduces physical discomfort and supports discreet monitoring. While not non-invasive, its minimal invasiveness and easier routines meet patient expectations.

Increasing Adoption of Continuous Monitoring with Advanced Sensors

The Self-Monitoring Blood Glucose Devices Market benefits from continuous monitoring technologies. Advanced biosensors provide real-time glucose values and predictive alerts. It enhances safety for patients managing fluctuating glucose levels. Continuous tracking supports tighter control for high-risk groups, including children and elderly patients. Integration with insulin pumps further demonstrates system efficiency. This ongoing shift positions continuous monitoring as a cornerstone of market growth.

Expansion of Personalized Care and Remote Patient Management

The Self-Monitoring Blood Glucose Devices Market reflects the expansion of personalized care models. Remote monitoring platforms enable healthcare providers to supervise patients beyond clinical visits. Telemedicine integration ensures timely interventions and treatment adjustments. It reduces hospital admissions and supports long-term cost savings. Data-driven personalization strengthens engagement by addressing individual health needs. This trend secures a larger role for self-monitoring devices within modern healthcare delivery.

Market Challenges Analysis

High Cost of Devices and Limited Accessibility in Emerging Economies

The Self-Monitoring Blood Glucose Devices Market faces constraints due to high product and maintenance costs. Test strips, lancets, and advanced sensors often carry recurring expenses that burden patients. Insurance coverage remains inconsistent across regions, creating gaps in affordability. It restricts adoption in low- and middle-income countries where diabetes prevalence is rising. Distribution networks in rural areas lack adequate reach, further limiting accessibility. Manufacturers encounter difficulty balancing innovation with cost efficiency while meeting consumer expectations.

Technical Limitations, Accuracy Concerns, and User Compliance Issues

The Self-Monitoring Blood Glucose Devices Market also contends with technical challenges that impact adoption. Accuracy variations between brands and models reduce physician confidence and affect patient trust. It complicates treatment decisions when data does not align with laboratory results. Many users struggle with calibration, proper handling, and storage requirements for devices. Inconsistent user compliance weakens long-term effectiveness of monitoring programs. Battery life, sensor wear, and environmental conditions add to device limitations. These issues highlight the need for continuous improvements in design, durability, and ease of use.

Market Opportunities

Expansion Potential in Emerging Economies and Untapped Demographics

The Self-Monitoring Blood Glucose Devices Market presents strong opportunities in emerging economies with growing diabetic populations. Rising awareness, government health campaigns, and improving healthcare infrastructure create favorable conditions for adoption. It enables manufacturers to expand distribution and tailor cost-effective devices to local markets. Untapped demographics such as rural communities and younger age groups also represent potential demand. Companies that focus on localized education and partnerships with healthcare providers strengthen outreach. Strategic investment in these regions positions brands to capture long-term growth.

Innovation in Non-Invasive Technologies and Connected Ecosystems

The Self-Monitoring Blood Glucose Devices Market also benefits from innovation in painless and user-friendly technologies. Non-invasive monitoring solutions appeal to patients seeking comfort and convenience. It creates a path for higher compliance and frequent usage among diverse age groups. Integration with connected health ecosystems enhances real-time data access for providers and caregivers. Advancements in biosensors, AI-driven analytics, and wearable formats expand product appeal. These innovations establish opportunities for differentiation and stronger market competitiveness.

Market Segmentation Analysis:

By Product

The Self-Monitoring Blood Glucose Devices Market divides into meters, consumables, testing strips, and lancets. Self-monitoring meters remain the foundation, offering digital accuracy and portable use for daily management. Testing strips hold the largest recurring demand due to single-use application and high consumption rates among patients. Lancets form another critical category, supporting regular sampling and safe handling. Consumables overall dominate revenue streams, driven by replacement cycles and rising diabetic populations. It underscores the importance of reliable supply chains and consistent quality standards across product categories.

- For instance, Roche’s Accu-Chek Guide test strips need only 0.6 µL of blood and deliver a result in under 4 seconds. Its Safe-T-Pro Plus lancet offers 3 depth settings of 1.3 mm, 1.8 mm, and 2.3 mm, supporting accurate and safe sampling.

By Application

The market segments by application into type 1 diabetes, type 2 diabetes, and gestational diabetes. Type 2 diabetes dominates due to higher global prevalence and ongoing lifestyle-related risk factors. Patients with type 1 diabetes rely on frequent monitoring to manage insulin therapy effectively. Gestational diabetes contributes a growing share with rising maternal age and increased screening programs. Each segment emphasizes continuous monitoring to prevent complications and improve treatment outcomes. It highlights how device design and accuracy play vital roles in managing diverse patient needs.

- For instance, Arkray’s GLUCOCARD S meter needs only 0.3 µL of blood and delivers results in 5 seconds, supporting frequent monitoring in type 1 patients. The same device also suits type 2 and gestational diabetes with minimal discomfort.

By End User

The Self-Monitoring Blood Glucose Devices Market divides by end user into hospitals, ambulatory surgical centers, diagnostic centers, homecare, and other uses. Hospitals remain a central hub for adoption, supported by integrated patient management systems. Diagnostic centers contribute through early detection and ongoing testing services. Ambulatory surgical centers rely on monitoring for perioperative diabetic management. Homecare shows rapid growth as patients seek independence and convenience in disease control. It reflects the broader transition toward decentralized care and patient empowerment. Other end uses contribute niche demand where specialized monitoring is required, strengthening the market’s diversity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Product:

- Consumables

- Testing strips

- Lancets

Based on Application:

- Type 1 diabetes

- Type 2 diabetes

- Gestational diabetes

Based on End-User:

- Hospitals

- Ambulatory surgical centers

- Diagnostic centers

- Homecare

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Self-Monitoring Blood Glucose Devices Market, accounting for around 38% of the global market. The region benefits from advanced healthcare infrastructure, strong insurance coverage, and high patient awareness. The United States leads adoption with a large diabetic population and continuous product innovation. Canada also contributes significantly with government-supported diabetes management programs. Companies in the region focus on integrating digital platforms and remote monitoring features, supporting higher compliance. It demonstrates a well-established ecosystem that supports both clinical and home-based monitoring. The strong regulatory framework ensures device quality, accuracy, and patient safety, reinforcing North America’s leadership.

Europe

Europe represents the second-largest share, with around 27% of the global market. Widespread healthcare coverage, public health initiatives, and aging populations drive demand. Germany, France, and the United Kingdom lead in adoption due to robust hospital networks and advanced clinical practices. The region sees strong emphasis on patient education and preventive care, increasing routine monitoring. It also benefits from growing use of digital health tools integrated with self-monitoring systems. EU regulations ensure strict quality standards, boosting consumer confidence in device performance. Europe’s position remains strong due to a blend of established demand and ongoing innovation in patient-centric solutions.

Asia-Pacific

Asia-Pacific accounts for nearly 24% of the Self-Monitoring Blood Glucose Devices Market, making it a high-growth region. China, India, and Japan dominate demand due to large diabetic populations and increasing healthcare expenditure. Rising urbanization and dietary changes accelerate the prevalence of diabetes across the region. Governments focus on expanding access to affordable monitoring devices, particularly in public health programs. It shows rapid growth in homecare adoption as patients seek convenient disease management solutions. Local manufacturing and cost-effective product offerings expand accessibility across developing markets. Asia-Pacific stands out as a dynamic region with significant long-term potential.

Latin America

Latin America holds about 6% of the global market share. Countries such as Brazil, Mexico, and Argentina drive adoption with increasing awareness and expanding healthcare access. The region still faces challenges with affordability and uneven insurance coverage. It demonstrates steady demand growth as healthcare systems focus on early diagnosis and chronic disease management. International players expand partnerships with local distributors to improve availability. Homecare adoption gains pace as patients adopt user-friendly and portable devices. Latin America continues to evolve as a market with rising importance for global manufacturers.

Middle East and Africa

The Middle East and Africa contribute nearly 5% of the total market. The Gulf Cooperation Council (GCC) countries lead adoption due to high prevalence of diabetes and modern healthcare infrastructure. South Africa and other African nations show gradual uptake as awareness campaigns expand. It faces obstacles in affordability and limited distribution across rural areas. Governments in the Middle East promote screening initiatives and subsidize diabetic care. Partnerships with regional healthcare providers improve availability of advanced monitoring solutions. While relatively smaller in share, the region presents untapped opportunities for future growth.

Key Player Analysis

Competitive Analysis

The Self-Monitoring Blood Glucose Devices Market companies include Abbott Laboratories, AgaMatrix, All Medicus, Arkray, Ascensia Diabetes Care Holdings, B. Braun Melsungen, Bionime Corporation, DarioHealth, F. Hoffmann-La Roche, and LifeScan. The Self-Monitoring Blood Glucose Devices Market remains highly competitive, driven by continuous innovation and patient-focused solutions. Companies invest in advanced sensor technologies, wireless integration, and user-friendly designs to enhance accuracy and convenience. The market emphasizes digital connectivity, with devices increasingly linked to smartphones, apps, and cloud platforms for real-time monitoring and data sharing. Affordability and accessibility also influence competitive strategies, especially in emerging economies where demand is rising. Firms pursue regulatory approvals and partnerships to expand reach, while also focusing on improving patient compliance through minimally invasive or non-invasive solutions. The competitive landscape centers on differentiation in technology, reliability, and integration with broader digital health ecosystems, ensuring sustained growth opportunities across global regions.

Recent Developments

- In November 2024, Ascensia Diabetes Care collaborated with Fitterfly Healthtech to develop a free 21-day Diabetes Management Program offered on Ascensia glucometer devices. It is anticipated that diabetes care will be more effective with this program.

- In March 2023, Abbott received U.S. FDA approval for the integration of its FreeStyle Libre 3 and FreeStyle Libre 2 integrated continuous glucose monitoring (iCGM) system sensors with automated insulin delivery (AID) systems. Both the FreeStyle Libre 3 and FreeStyle Libre 2 sensors are currently accessible in the U.S., with approval for use in individuals aged four years and older.

- In February 2023, Ascensia Diabetes Care Holdings AG, the developer of the CONTOUR BGM system portfolio, globally partnered with SNAQ, a mobile application offering nutritional insights for individuals managing diabetes.

- In February 2023, according to Bloomberg, Apple is progressing towards developing a non-invasive blood glucose monitoring device that could be incorporated into the Apple Watch. The non-invasive device will use lasers to detect glucose levels, replacing the traditional finger prick test. It is currently in the early stage and could be made commercially available once it is made smaller.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see higher adoption of connected devices with mobile health integration.

- Continuous innovation in minimally invasive and non-invasive technologies will shape future demand.

- Patient preference for compact and user-friendly devices will influence product design.

- Cloud-based platforms will expand data accessibility for patients and healthcare providers.

- Remote monitoring and telemedicine support will strengthen device relevance in chronic care.

- Emerging economies will offer strong growth opportunities through rising diabetic populations.

- Regulatory focus on accuracy and safety will drive product improvements and compliance.

- Aging populations worldwide will increase demand for home-based monitoring solutions.

- Artificial intelligence and predictive analytics will enhance personalized disease management.

- Strategic collaborations and partnerships will accelerate innovation and global market penetration.