Market Overview:

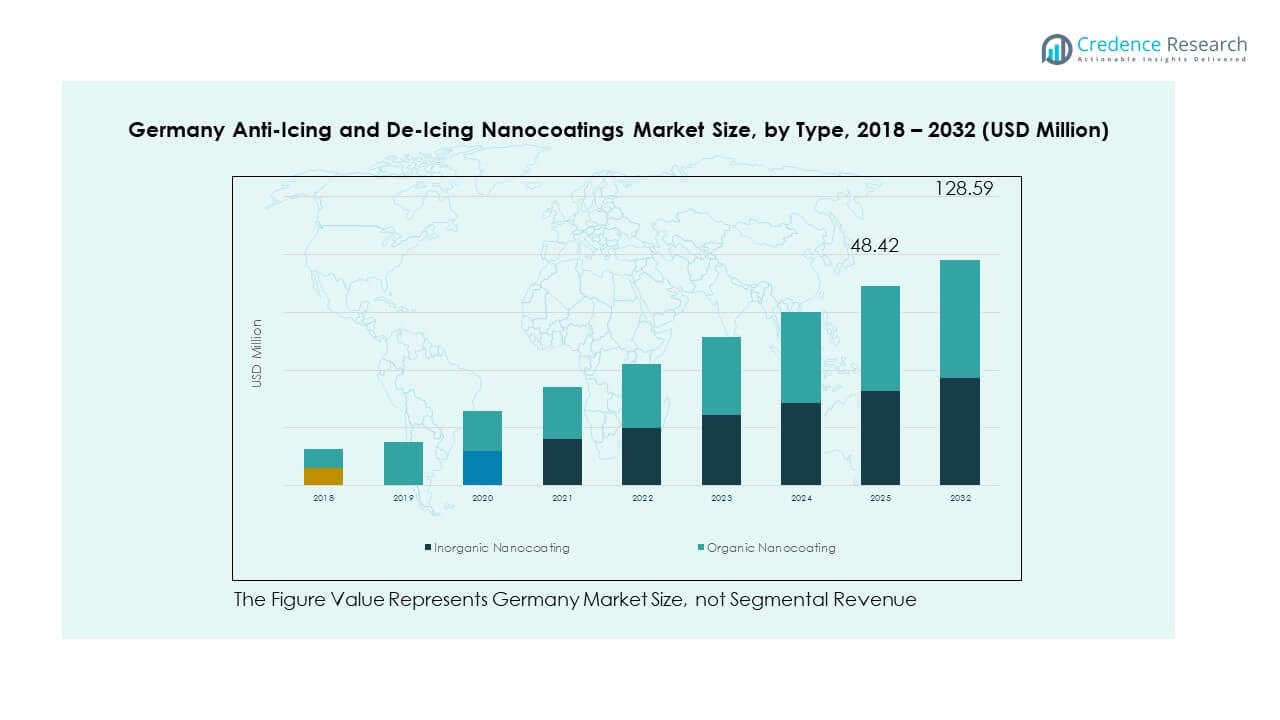

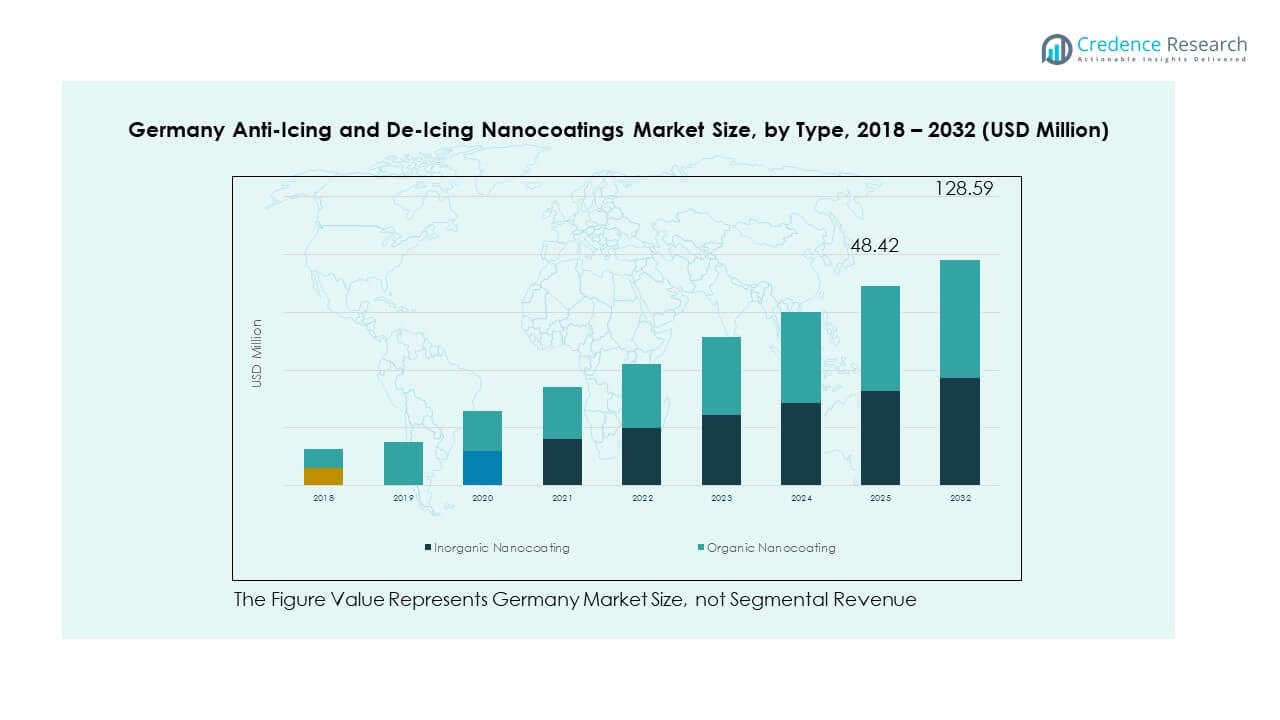

The Germany Anti-Icing and De-Icing Nanocoatings Market size was valued at USD 18.31 million in 2018 to USD 42.41 million in 2024 and is anticipated to reach USD 128.59 million by 2032, at a CAGR of 15.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Anti-Icing and De-Icing Nanocoatings Market Size 2024 |

USD 42.41 Million |

| Germany Anti-Icing and De-Icing Nanocoatings Market, CAGR |

15.0% |

| Germany Anti-Icing and De-Icing Nanocoatings Market Size 2032 |

USD 128.59 Million |

Growth in the market is driven by rising demand for advanced coatings across aviation, transportation, and renewable energy sectors. Germany’s strong aerospace industry is integrating nanocoatings to improve safety and efficiency by reducing ice formation on aircraft surfaces. Wind energy projects in colder regions also increasingly adopt these solutions to enhance turbine performance and reduce downtime. The automotive sector further supports adoption by applying nanocoatings to vehicles, ensuring operational reliability during harsh winters.

Geographically, Germany holds a leading role in the European market due to its advanced industrial base and emphasis on innovation. Neighboring countries in Northern and Eastern Europe are emerging as growth hubs, particularly due to their exposure to severe winter conditions and expanding renewable energy installations. Western Europe continues to lead in adoption because of its mature aerospace and automotive sectors, while Nordic countries represent high-potential markets driven by strong wind energy deployment and infrastructure investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Anti-Icing and De-Icing Nanocoatings Market was valued at USD 18.31 million in 2018, grew to USD 42.41 million in 2024, and is projected to reach USD 128.59 million by 2032, registering a CAGR of 15.0%.

- Southern Germany led with 38% share in 2024, driven by its aerospace, automotive, and renewable energy hubs; Northern Germany followed with 27% share due to offshore wind capacity and logistics; Western and Eastern Germany together held 35% share, supported by infrastructure and industrial applications.

- Northern Germany is the fastest-growing region with 27% share, fueled by expansion of offshore wind farms, maritime industries, and port-related infrastructure.

- In 2024, inorganic nanocoatings accounted for 55% share of the Germany Anti-Icing and De-Icing Nanocoatings Market, reflecting strong adoption in aerospace, energy, and defense sectors.

- Organic nanocoatings captured 45% share in 2024, supported by demand in textiles, electronics, and packaging where flexibility and cost-effectiveness are key drivers.

Market Drivers

Strong adoption of nanocoatings across Germany’s aerospace and aviation industry to improve safety and operational reliability

The aviation sector in Germany drives strong demand for anti-icing and de-icing nanocoatings due to strict safety requirements. Airlines and aerospace manufacturers deploy advanced nanocoatings to minimize ice accumulation on aircraft surfaces during cold-weather operations. This innovation reduces risks of flight delays and cancellations linked to ice buildup. It also improves energy efficiency by limiting de-icing fluid usage, which aligns with sustainability goals. German aerospace companies actively invest in surface engineering technologies to enhance product reliability. Government and EU aviation safety standards further encourage widespread adoption. The Germany Anti-Icing and De-Icing Nanocoatings Market benefits from strong support by aviation regulators and operators. It ensures reliable performance under Europe’s challenging winter climate conditions.

- For example, German research institutes, such as Fraunhofer IGB, have developed nanostructured superhydrophobic coatings that reduce ice adhesion on surfaces by over 90% compared to uncoated materials.

Expanding renewable energy projects in Germany driving adoption of nanocoatings for wind turbine performance improvement

Germany’s renewable energy sector fuels market expansion with heavy reliance on wind power. Wind turbine blades in colder regions face ice-related losses, reducing energy efficiency and causing mechanical stress. Nanocoatings applied to turbine surfaces reduce ice formation, ensuring steady power output. Energy companies adopt these coatings to extend turbine lifespan and cut maintenance costs. The government’s focus on clean energy and emission targets supports large-scale wind energy deployment. Ice-resistant turbine blades improve reliability of offshore and onshore wind farms in extreme weather. The Germany Anti-Icing and De-Icing Nanocoatings Market gains momentum from strong renewable energy adoption. It reflects Germany’s leadership in renewable technology and energy transition.

Increasing demand in automotive applications to improve winter performance and ensure reliable mobility in cold conditions

The automotive sector contributes to market growth by using nanocoatings for improved safety. Vehicles equipped with ice-resistant coatings experience fewer disruptions in winter operations. German automakers integrate nanocoatings in premium vehicles to deliver advanced safety features. Ice-prevention solutions for windshields, mirrors, and sensors support the rise of autonomous and electric vehicles. These features enhance driver safety and ensure consistent performance in extreme winter conditions. Rising consumer expectations for durable and weather-resistant vehicles increase adoption of these technologies. The Germany Anti-Icing and De-Icing Nanocoatings Market leverages strong automotive innovation and manufacturing capabilities. It highlights Germany’s advanced approach to automotive safety and reliability.

- For example, Hydrophobic and superhydrophobic nanocoatings have shown in lab tests the ability to reduce ice adhesion into the single- to tens-kPa range, with some advanced coatings achieving ultra-low values close to 1–2 kPa.

Growing focus on infrastructure resilience to ensure reliable operations during harsh winter conditions

Infrastructure development projects in Germany adopt nanocoatings to safeguard transport networks and public assets. Bridges, railway systems, and power lines face severe challenges from ice accumulation during winter. Nanocoatings extend material durability, reduce operational disruptions, and limit costly maintenance. Public sector investments in modernizing transportation networks boost demand for these advanced solutions. The construction sector integrates nanocoatings into surfaces requiring long-term resistance against ice damage. The Germany Anti-Icing and De-Icing Nanocoatings Market benefits from infrastructure policies supporting smart and sustainable development. It positions nanocoatings as a long-term solution for climate resilience. Urban planners and engineers adopt these solutions to reduce risks from weather extremes.

Market Trends

Rising integration of nanocoatings into defense and military applications for advanced operational readiness

Germany’s defense sector explores nanocoatings to improve equipment reliability in extreme environments. Military vehicles, aircraft, and naval systems require coatings to prevent ice buildup and maintain efficiency. The defense industry values durability, precision, and reduced maintenance needs in harsh climates. Advanced coatings improve mission readiness by preventing disruptions during cold-weather operations. Research institutions collaborate with defense contractors to advance specialized nanocoating solutions. The Germany Anti-Icing and De-Icing Nanocoatings Market benefits from government defense budgets that emphasize technology upgrades. It showcases the alignment of coatings innovation with national security needs. Long-term adoption ensures consistent growth within the defense segment.

Increasing application of nanocoatings in electronics and consumer goods to support weather-resistant product development

Electronics and consumer goods industries integrate nanocoatings to improve product durability against frost and moisture. Smartphones, sensors, and outdoor devices require protection for reliable performance in low temperatures. Nanocoatings reduce risks of malfunction, ensuring longer product lifecycles. German electronics firms invest in research to deliver products that withstand extreme climates. Consumer demand for weather-resistant wearables and gadgets supports this adoption. The Germany Anti-Icing and De-Icing Nanocoatings Market gains traction by diversifying into electronics. It highlights the transition of coatings from industrial to consumer-focused applications. Manufacturers view nanocoatings as a competitive advantage in global markets.

- For example, Actnano opened its Munich Center of Excellence in 2022 to support European clients. Its Advanced nanoGUARD nanocoating protects electronics in millions of vehicles and extends to consumer devices like phones, headphones, and wearables.

Growing collaboration between industry and research institutions to accelerate innovation and product customization

Germany fosters collaboration among universities, research institutes, and industry leaders to advance nanocoating applications. Joint projects accelerate innovation, testing, and scalability of new materials. Customized nanocoating solutions emerge for specific sectors such as aerospace, energy, and transportation. Partnerships ensure faster commercial adoption and technology transfer. Public research funding enhances innovation pipelines across German industries. The Germany Anti-Icing and De-Icing Nanocoatings Market strengthens through collaborative ecosystems. It reflects Germany’s strong focus on research-led industrial progress. These alliances expand the scope of nanocoating technologies beyond traditional applications.

- For example, the Centre for Nanointegration Duisburg-Essen (CENIDE) and the University of Duisburg-Essen host the €46 million NanoEnergy Technology Centre. This facility supports both fundamental and applied nanotechnology research across multiple fields.

Increasing influence of sustainability goals driving eco-friendly nanocoating formulations across industrial applications

Sustainability goals shape material development strategies in the coatings industry. Manufacturers design eco-friendly nanocoatings that reduce reliance on chemical de-icing agents. These solutions align with EU regulations promoting green technologies. Companies adopt water-based and biodegradable formulations to reduce environmental impact. The Germany Anti-Icing and De-Icing Nanocoatings Market embraces innovation that balances performance with sustainability. It demonstrates Germany’s leadership in responsible industrial practices. Growing corporate and consumer awareness supports greener product adoption. Regulatory frameworks push the coatings sector to meet higher environmental standards.

Market Challenges Analysis

High production costs and scalability issues limiting widespread adoption of nanocoatings across end-use industries

The industry faces high production costs linked to advanced nanomaterial synthesis. Expensive manufacturing processes restrict large-scale adoption by mid-tier companies. Limited economies of scale slow down broader commercial deployment across industries. German firms struggle with balancing performance benefits and affordability in mass-market applications. High initial costs hinder adoption in sectors like automotive and consumer electronics. The Germany Anti-Icing and De-Icing Nanocoatings Market experiences delays in achieving cost competitiveness. It requires further R&D investments to improve production efficiency and cost control. Pricing challenges remain a critical barrier to expansion.

Stringent regulatory compliance and performance validation requirements creating barriers for new entrants and smaller firms

Nanocoatings face strict EU regulations regarding chemical composition and environmental impact. Compliance with these standards requires extensive testing and certification. Startups and smaller firms encounter financial and technical hurdles to meet compliance demands. Proving long-term performance in varied environmental conditions slows commercialization timelines. Certification delays increase time-to-market for innovative products. The Germany Anti-Icing and De-Icing Nanocoatings Market is shaped by regulatory oversight ensuring product safety. It creates a challenging entry path for new players seeking growth. Regulatory hurdles intensify the need for large-scale R&D collaboration.

Market Opportunities

Expansion of nanocoating applications into new industrial sectors creating untapped opportunities for innovation and growth

Nanocoatings are moving beyond aerospace and energy into new industrial domains. Healthcare, textiles, and logistics sectors explore nanocoatings for frost-resistant solutions. Textile firms adopt coatings for outdoor apparel with advanced ice-repellent performance. Logistics operators consider coatings for vehicles and containers to prevent weather-related delays. The Germany Anti-Icing and De-Icing Nanocoatings Market captures growth by diversifying into non-traditional industries. It strengthens its base through innovations tailored to unique needs. Future adoption may extend toward healthcare devices requiring frost-resistant properties. This diversification ensures sustained demand across multiple verticals.

Rising export potential for German nanocoating technologies in global markets with cold climate conditions

German firms hold strong opportunities to expand exports of nanocoating solutions. Countries with severe winters such as Canada, Russia, and Nordic regions represent high-demand markets. German manufacturers enjoy competitive advantages with advanced R&D and quality standards. The Germany Anti-Icing and De-Icing Nanocoatings Market leverages Germany’s strong export-oriented industrial base. It demonstrates international potential as climate challenges expand globally. Export growth creates stronger revenue streams for German suppliers. Partnerships with global aerospace and energy firms boost visibility of German innovations. The opportunity enhances Germany’s role as a global nanocoatings leader.

Market Segmentation Analysis:

By type, the Germany Anti-Icing and De-Icing Nanocoatings Market is divided into inorganic and organic coatings. Inorganic nanocoatings hold strong adoption due to their durability, chemical resistance, and ability to perform under extreme conditions. They are widely applied in aerospace, wind energy, and defense sectors where long-term reliability is essential. Organic nanocoatings gain traction for their flexibility, lightweight nature, and cost-effectiveness. They are preferred in consumer-oriented industries such as textiles, packaging, and electronics where ease of application and adaptability are valued. Both categories support innovation in performance and sustainability.

- For example, research indicates that ZnO nanoparticles especially those produced via green synthesis can impart antimicrobial and UV protection to textiles.

By application, transportation remains a dominant segment, driven by demand in aviation, automotive, and railways to reduce ice accumulation and improve safety. The energy sector follows with strong uptake in wind power projects, especially in colder regions, to ensure reliable turbine operation. Textiles show rising adoption through weather-resistant fabrics for outdoor wear and protective gear. Electronics benefit from coatings that shield sensitive sensors and components from frost and moisture damage. Food and packaging industries apply nanocoatings for extended product life and resistance to harsh storage conditions. Other applications, including infrastructure and logistics, reflect growing interest in surface protection. The Germany Anti-Icing and De-Icing Nanocoatings Market demonstrates broad application potential across industrial and consumer sectors, driven by performance needs and climate challenges.

- For instance, research in aviation explores nanocoatings for reducing drag, improving efficiency, and enhancing safety, with potential applications extending to automotive sectors.

Segmentation:

By Type

- Inorganic Nanocoating

- Organic Nanocoating

By Application

- Transportation

- Textiles

- Energy

- Electronics

- Food & Packaging

- Others

Regional Analysis:

Southern Germany holds 38% share of the Germany Anti-Icing and De-Icing Nanocoatings Market, driven by its strong automotive and aerospace hubs in Bavaria and Baden-Württemberg. These regions integrate nanocoatings to improve safety and performance across high-value industries. Wind energy deployment in Bavaria further supports adoption for turbine blades exposed to cold climates. Strong collaborations with research institutes in Munich and Stuttgart advance coating innovations and commercialization. The industrial strength of Southern Germany ensures consistent demand across both consumer and industrial applications. It benefits from a mix of manufacturing expertise and R&D intensity, making the region a leader in market adoption.

Northern Germany accounts for 27% share, with demand largely supported by the presence of offshore and onshore wind farms in Schleswig-Holstein and Lower Saxony. The ports of Hamburg and Bremen serve as gateways for export and logistics activities, creating opportunities for infrastructure coatings. Aerospace maintenance and maritime industries in this subregion adopt nanocoatings to improve resilience against harsh winter conditions. Universities and research clusters in Hamburg contribute to material testing and field validation. The Germany Anti-Icing and De-Icing Nanocoatings Market in this region reflects strong ties between renewable energy, logistics, and industrial applications. It highlights Northern Germany as a hub for sustainable technology adoption.

Western and Eastern Germany together represent 35% share, with applications spread across transportation, energy, and industrial infrastructure. Western Germany benefits from its industrial base in North Rhine-Westphalia, where coatings are applied to vehicles, bridges, and rail networks. Eastern Germany demonstrates rising adoption through renewable energy projects, particularly wind installations in Brandenburg and Saxony-Anhalt. Research institutions in Berlin foster innovation and partnerships with coating developers. It strengthens product testing and accelerates technology transfer into practical use cases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Battelle

- AkzoNobel

- Fraunhofer

- Hygratek

- NanoSonic

- Luna Innovations

- Nanovere Technologies

- NEI Corporation

- Cytonix

- Other Key Players

Competitive Analysis:

The Germany Anti-Icing and De-Icing Nanocoatings Market features a mix of global corporations, specialized coating firms, and research-driven organizations. Leading players such as AkzoNobel, Battelle, and Fraunhofer strengthen their position through extensive R&D capabilities and strong partnerships with aerospace, automotive, and energy industries. Companies such as NanoSonic, NEI Corporation, and Nanovere Technologies focus on niche innovations, delivering tailored solutions for defense, wind energy, and electronics applications. Competitive strategies often revolve around new product launches, advanced material formulations, and sustainability-driven coatings that align with EU regulations. It reflects a highly innovation-oriented competitive landscape with emphasis on performance validation and compliance. The market demonstrates a balance between established multinationals and emerging technology firms. Larger corporations leverage their financial strength and distribution networks to dominate in high-demand sectors such as aviation and energy. Smaller firms target specialized applications and build competitive advantage through agility and customization. The Germany Anti-Icing and De-Icing Nanocoatings Market experiences continuous collaborations between universities, research institutions, and private companies, ensuring faster innovation cycles. It highlights strong competition focused on technological leadership, product differentiation, and global expansion opportunities. Strategic mergers, acquisitions, and partnerships remain central in shaping the market’s competitive direction.

Recent Developments:

- In February 2025, PPG introduced its non-BPA HOBA Pro 2848 coatings for aluminum bottles at Paris Packaging Week, reinforcing its commitment to sustainable and innovative coating solutions while strengthening its position in advanced coatings markets.

- In January 2025, a Riga-based nanocoating startup, Naco Technologies, secured €1.5 million in a pre-Series A funding round co-led by Radix Ventures. It will use the funding to build a production facility in Poland and accelerate its international expansion, especially for coatings that improve hydrogen production efficiency.

- In October 2024, PPG announced a strategic portfolio shift by agreeing to sell its US and Canada architectural coatings business to American Industrial Partners, with the deal expected to close by early 2025. The move allows PPG to redirect resources toward high-growth segments such as advanced coatings, including anti-icing nanocoatings designed for Nordic climates.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany Anti-Icing and De-Icing Nanocoatings Market is expected to expand with wider aerospace adoption to enhance flight safety and operational reliability.

- Growing reliance on renewable energy will increase the use of nanocoatings in wind turbines to prevent ice-related performance losses.

- Automotive manufacturers are likely to accelerate integration of nanocoatings for windshields, mirrors, and sensors to support advanced mobility solutions.

- Expansion of infrastructure modernization projects will create consistent demand for coatings on bridges, railways, and public transport networks.

- Defense and military sectors will invest in specialized coatings to ensure equipment durability and mission readiness in cold climates.

- Consumer electronics and wearable devices will adopt frost-resistant coatings, supporting product longevity and enhanced user experience.

- The market will witness stronger collaboration between German research institutes and industry leaders to drive material innovations.

- Eco-friendly nanocoating formulations will gain preference, aligning with EU regulations and Germany’s sustainability objectives.

- Export opportunities will grow as German suppliers expand their footprint in regions facing severe winter challenges.

- Competitive intensity will rise, with both large corporations and smaller innovators pursuing differentiation through technology and customization.