Market Overview

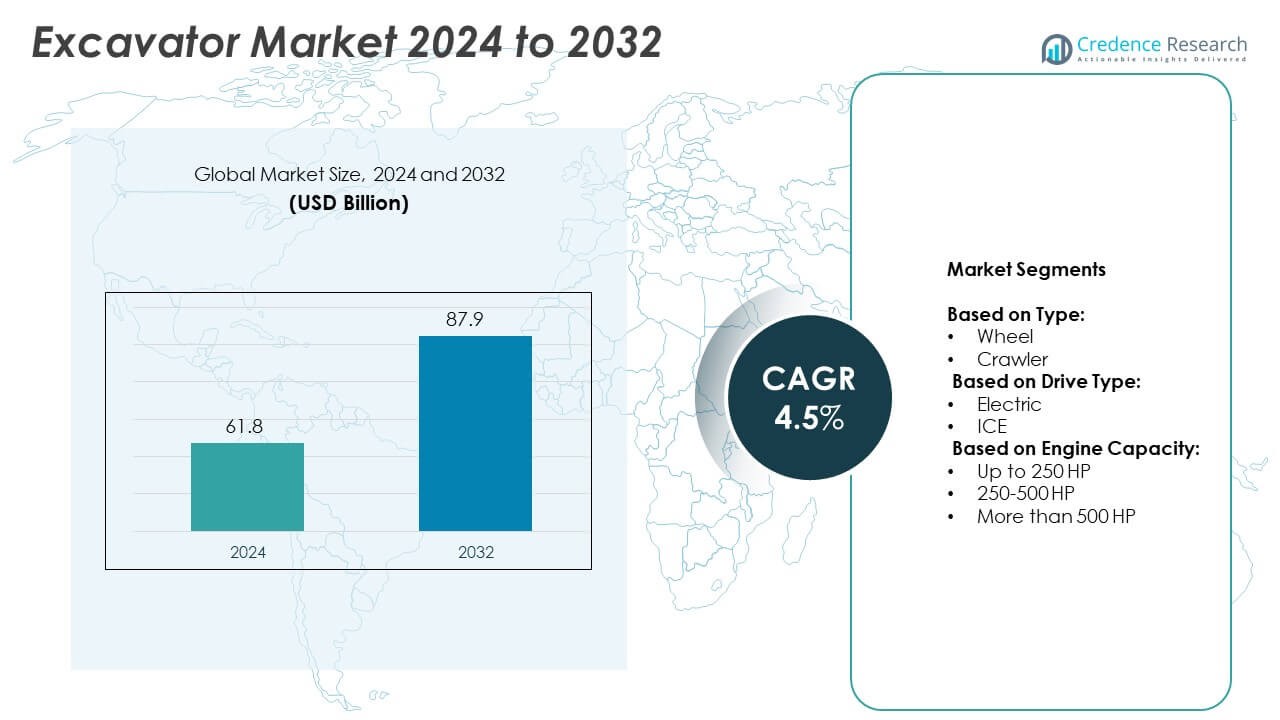

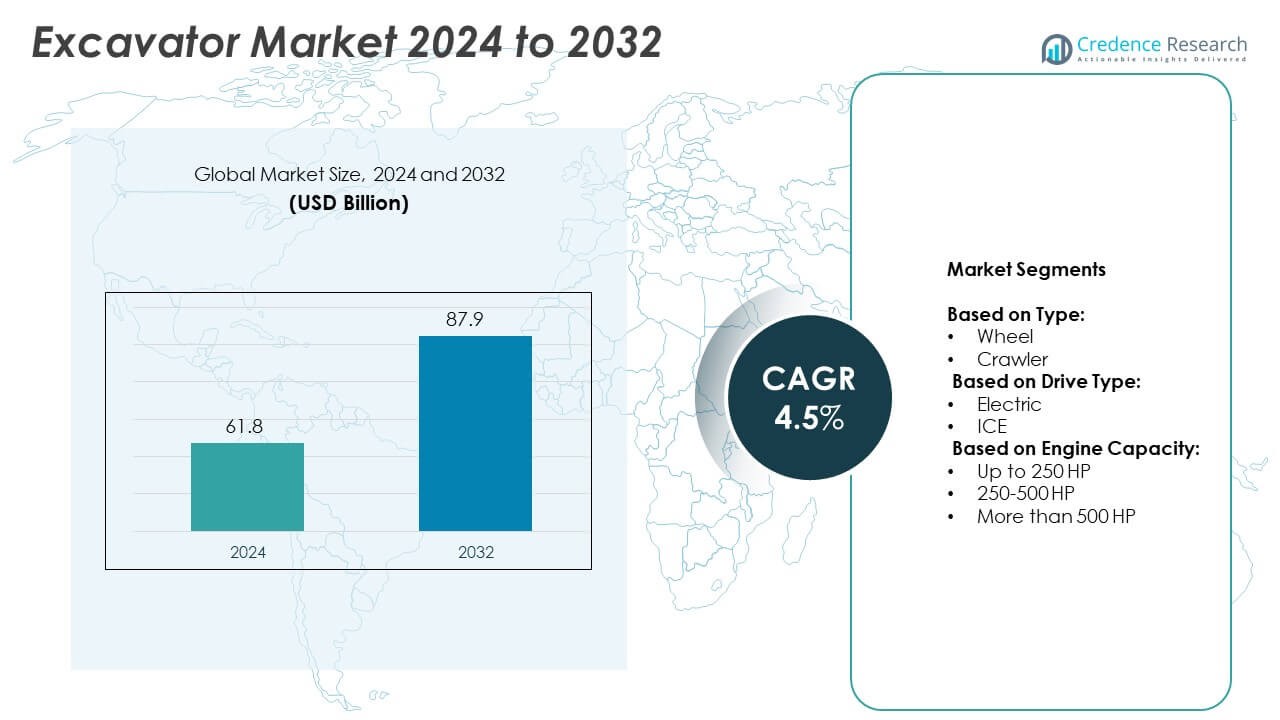

Excavator Market size was valued at USD 61.8 billion in 2024 and is anticipated to reach USD 87.9 billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Excavator Market Size 2024 |

USD 61.8 Billion |

| Excavator Market, CAGR |

4.5% |

| Excavator Market Size 2032 |

USD 87.9 Billion |

The Excavator market grows steadily due to rapid infrastructure expansion, urbanization, and increasing mining activities. Governments worldwide invest heavily in smart cities, highways, and energy projects, creating strong demand for advanced equipment. Rising focus on sustainable construction drives adoption of electric and hybrid excavators with lower emissions. It also benefits from integration of telematics, automation, and predictive maintenance, improving efficiency and safety. Demand for compact models in urban projects further supports growth, making excavators vital for modern construction needs.

North America and Europe show steady demand driven by infrastructure upgrades, while Asia Pacific leads growth with large-scale construction and mining projects. Latin America and the Middle East & Africa expand gradually through urban development and energy investments. The market benefits from advanced technologies such as hybrid powertrains and automation adopted across regions. Key players including Caterpillar Inc., Hitachi Construction Machinery, Hyundai Heavy Industries Ltd., and John Deere strengthen their positions through innovation, strategic partnerships, and strong distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Excavator market size was valued at USD 61.8 billion in 2024 and is projected to reach USD 87.9 billion by 2032, growing at a CAGR of 4.5%.

- Rapid urbanization and rising infrastructure investments in roads, railways, and airports drive steady demand for excavators worldwide.

- Adoption of hybrid and electric excavators reflects a clear trend toward sustainable construction practices and emission reduction goals.

- Leading players focus on innovation, automation, and strong after-sales support to maintain competitiveness and expand regional presence.

- High initial costs, stringent emission standards, and supply chain disruptions remain key restraints affecting overall market growth.

- Asia Pacific leads growth with large-scale construction and mining, while North America and Europe sustain demand through modernization projects.

- Latin America and Middle East & Africa offer emerging opportunities through resource extraction, housing projects, and mega infrastructure initiatives.

Market Drivers

Rising Infrastructure Development and Urbanization Worldwide

The Excavator market grows strongly due to rapid urbanization and large-scale infrastructure projects. Governments in emerging economies increase spending on smart cities, highways, rail networks, and airports. This investment pushes demand for earthmoving equipment in both residential and commercial construction. It provides strong support to contractors managing projects with strict timelines and quality standards. Infrastructure expansion in Asia and the Middle East drives high adoption rates. Urban housing needs also create steady demand for compact and mini excavators.

- For instance, In 2024, Caterpillar’s Construction Industries segment saw a 6% decrease in sales in the Asia/Pacific region, primarily due to lower sales volume and reduced dealer inventory, despite ongoing demand for equipment to support urbanization and infrastructure projects.

Advancements in Excavator Technology and Efficiency

Technological innovation reshapes the Excavator market with smarter, energy-efficient models. Manufacturers introduce hybrid and electric excavators that lower emissions and cut fuel costs. It improves operational safety through advanced telematics, GPS-based monitoring, and automation features. Smart control systems also optimize digging accuracy, reducing human error on worksites. Integration of IoT enables predictive maintenance, minimizing downtime for users. Robotics and semi-autonomous capabilities attract contractors focused on productivity and cost savings.

- For instance, In India, mini excavator sales were projected by market research firm Off-Highway Research to grow to approximately 3,150 units in 2023. This market segment represents a small fraction of the total Indian construction equipment market, highlighting that mini excavator sales are significantly smaller than the overall market size

Growing Demand from Mining and Resource Extraction

The Excavator market sees consistent growth from mining and quarrying activities. Global demand for metals, minerals, and aggregates continues to expand with industrial growth. It enables operators to handle large excavation volumes, ensuring higher productivity and faster material handling. Heavy-duty excavators support deep digging and removal of overburden in challenging conditions. Mining companies adopt advanced hydraulic models to improve efficiency and reduce fuel consumption. Rising exploration of rare earths and critical minerals further boosts equipment purchases.

Environmental Regulations and Sustainable Construction Practices

The Excavator market adapts to stricter emission rules and green construction trends. Governments enforce regulations encouraging adoption of cleaner engines and electrified models. It motivates companies to reduce carbon footprints while maintaining efficiency on-site. Construction firms increasingly choose equipment that supports sustainable building practices. Hybrid excavators gain traction for balancing performance with reduced environmental impact. This alignment with eco-friendly initiatives strengthens long-term market opportunities for innovative manufacturers.

Market Trends

Adoption of Electric and Hybrid Excavators for Cleaner Operations

The Excavator market experiences a clear shift toward electric and hybrid machines. Manufacturers focus on reducing emissions and fuel dependency with advanced powertrains. It addresses regulatory requirements while supporting contractors aiming for sustainable operations. Battery-powered excavators gain popularity in urban projects where noise and air quality standards are strict. Hybrid models provide longer operation hours with improved fuel efficiency. This transition creates opportunities for suppliers of charging infrastructure and energy-efficient components.

- For instance, Volvo Construction Equipment (Volvo CE) expanded its lineup of hydraulic hybrid excavators to include five new models, such as the EC400 and EC500 hybrid option would, deliver a 17% increase in fuel efficiency and a 15% reduction in CO2 emissions and fuel consumption

Integration of Digital Telematics and Smart Monitoring Systems

Digitalization trends redefine performance in the Excavator market through telematics and smart monitoring. Equipment is now equipped with real-time GPS tracking, machine health diagnostics, and remote monitoring systems. It enables operators to optimize fuel consumption, plan maintenance, and reduce downtime. Predictive analytics extend machine life by detecting faults early. Contractors gain better control over fleets and improve job-site efficiency. This trend builds a foundation for semi-autonomous and autonomous excavation technologies.

- For instance, the scale of Hitachi’s connectivity is evident from the fact that it had over 300,000 connected units in its global fleet as of 2022

Rising Popularity of Compact and Mini Excavators in Urban Projects

The Excavator market records growing adoption of compact and mini models for dense urban settings. These machines offer flexibility in narrow spaces without compromising power. It allows contractors to complete tasks efficiently in residential and small-scale commercial sites. Demand increases for landscaping, utility installation, and road repair projects requiring maneuverability. Compact machines also reduce transportation costs and enhance ease of operation. Manufacturers expand product lines to meet growing demand across construction segments.

Focus on Automation and Operator Safety Enhancements

Automation is shaping new trends within the Excavator market by improving precision and safety. Operators benefit from machine guidance systems that support accurate digging and grading. It reduces risks of accidents by integrating collision detection and safety alarms. Remote-controlled excavators also find demand in hazardous construction or mining zones. Automation not only boosts productivity but also addresses labor shortages in skilled operation. Industry leaders continue to invest in AI-driven control systems for advanced job-site applications.

Market Challenges Analysis

High Initial Investment and Maintenance Costs Limiting Wider Adoption

The Excavator market faces challenges from high purchase and ownership costs. Large hydraulic models require heavy upfront investments that strain smaller contractors and rental firms. It increases financial pressure when combined with regular expenses for fuel, spare parts, and skilled operators. Maintenance demands are significant, with downtime directly impacting project timelines and profitability. Limited access to financing in developing regions further restricts adoption of advanced equipment. These financial barriers slow modernization and encourage reliance on older fleets.

Stringent Emission Norms and Supply Chain Disruptions Impacting Growth

The Excavator market also encounters difficulties with tightening emission regulations across major regions. Manufacturers invest heavily in R&D to comply with standards, raising equipment prices. It forces many contractors to balance environmental compliance with budget constraints. Global supply chain disruptions for steel, semiconductors, and hydraulic systems affect delivery schedules. Rising raw material costs also reduce profit margins for manufacturers. Uncertainty in logistics and component shortages continue to challenge consistent production and timely supply.

Market Opportunities

Expanding Role of Electrification and Sustainable Construction Initiatives

The Excavator market presents strong opportunities through the global push for sustainability. Governments and private firms invest in eco-friendly equipment to reduce emissions in urban zones. It creates demand for electric and hybrid excavators suited for noise-sensitive and regulated environments. Incentives for adopting clean technologies encourage contractors to upgrade fleets with modern machinery. Infrastructure projects focused on green building further accelerate the use of energy-efficient models. Manufacturers offering innovative solutions gain a competitive edge in capturing new contracts.

Growth in Rental Services and Emerging Market Infrastructure Investments

The Excavator market also benefits from rising demand for rental services worldwide. Contractors prefer renting advanced machines to reduce capital expenses and improve project flexibility. It supports broader access to modern excavators, even for small and medium enterprises. Infrastructure expansion in Asia, Africa, and Latin America generates long-term opportunities for manufacturers and rental providers. Increasing investments in roads, ports, and housing projects boost demand across multiple applications. Strategic partnerships in these regions strengthen growth potential and market presence.

Market Segmentation Analysis:

By Type:

The Excavator market divides by type into wheel and crawler models. Crawler excavators dominate due to their superior stability and ability to handle heavy-duty applications. It supports mining, infrastructure, and large-scale construction projects where durability is critical. Wheel excavators gain traction in urban and road construction due to higher mobility. Their speed and flexibility make them ideal for projects requiring frequent relocation. Demand for both types grows with diversified applications across global construction and mining industries.

- For instance, In fiscal year 2024 (April 1, 2024–March 31, 2025), Komatsu’s Construction, Mining & Utility Equipment segment saw net sales increase by 5.1% over the previous fiscal year, reaching JPY 3,798.2 billion.

By Drive Type:

The Excavator market segments by drive type into electric and internal combustion engine (ICE) models. ICE excavators continue to lead due to established fueling infrastructure and proven performance. It remains the preferred option in remote projects and heavy industries. Electric excavators expand rapidly in urban projects under strict emission norms. Their low noise and reduced operating costs attract contractors focused on sustainability. Market players invest heavily in battery technology and charging systems to expand electric adoption.

- For instance, In 2024, HD Hyundai Infracore (DEVELON) expanded its electric equipment lineup, showcasing new electric and hydrogen-powered excavators at European trade shows like Intermat. Despite the company’s focus on next-generation technology, its consolidated sales decreased by 11.7% in 2024 due to overall market contraction.

By Engine Capacity:

The Excavator market also classifies by engine capacity into up to 250 HP, 250–500 HP, and more than 500 HP. Models up to 250 HP are widely used in urban housing, utilities, and landscaping projects. It offers flexibility and cost efficiency for contractors managing smaller-scale operations. Excavators with 250–500 HP dominate mid to large-scale infrastructure and industrial projects where higher power is required. Machines with more than 500 HP remain critical for mining, quarrying, and large excavation tasks. This segmentation highlights varied applications based on capacity, enabling manufacturers to address diverse customer needs.

Segments:

Based on Type:

Based on Drive Type:

Based on Engine Capacity:

- Up to 250 HP

- 250-500 HP

- More than 500 HP

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 28.5% of the global Excavator market in 2024. Strong investments in infrastructure modernization across the United States and Canada drive consistent demand for advanced excavators. Federal initiatives supporting road expansion, highway upgrades, and energy infrastructure projects strengthen market opportunities. It also benefits from high adoption of compact excavators in residential and commercial construction. Contractors in the region increasingly prefer machines with hybrid engines and telematics for operational efficiency. Mining activities in the U.S. and Canada add to the demand for large-capacity crawler excavators. With strong rental penetration and a mature construction industry, North America remains a steady growth contributor for global players.

Europe

Europe captured 24.1% of the global Excavator market in 2024. Government-led investments in green building, renewable energy projects, and retrofitting programs support long-term demand. It emphasizes sustainable construction practices, creating strong momentum for electric and hybrid excavators. Countries such as Germany, France, and the United Kingdom adopt advanced machinery to comply with emission standards. Compact excavators are highly popular in dense urban areas due to space constraints. Infrastructure upgrades, railway projects, and industrial expansion strengthen equipment requirements across the region. Europe’s market also benefits from strong technological adoption and advanced equipment financing options.

Asia Pacific

Asia Pacific dominated with 34.7% share of the global Excavator market in 2024. Rapid urbanization, population growth, and massive infrastructure spending in China, India, and Southeast Asia fuel demand. It leads in both crawler and mini-excavator adoption across construction, mining, and industrial applications. China continues to remain the largest market with state-led projects for roads, ports, and renewable energy. India’s Smart Cities Mission and rising housing demand add new opportunities for compact models. High mineral exploration and coal mining activities across Asia also increase sales of high-capacity excavators. With continuous industrialization, Asia Pacific sustains its position as the largest and fastest-growing regional market.

Latin America

Latin America held 6.8% of the global Excavator market in 2024. Ongoing investments in road connectivity, housing, and energy infrastructure projects drive moderate growth. Brazil and Mexico lead the region, supported by oil, gas, and mining sectors. It also benefits from demand for medium and large excavators used in quarrying and resource extraction. Compact machines record higher traction in urban housing projects and municipal works. Regional governments emphasize infrastructure expansion to support economic growth, offering opportunities for manufacturers. While economic instability presents challenges, demand remains steady due to ongoing industrial projects.

Middle East & Africa

Middle East & Africa contributed 5.9% of the global Excavator market in 2024. Construction of mega projects, including smart cities and energy hubs, drives demand in Gulf nations. It finds strong adoption in oil and gas projects requiring heavy-duty excavation equipment. Mining activities in South Africa, along with infrastructure development in Nigeria and Kenya, add to regional sales. Demand for crawler excavators dominates due to rugged terrain and large-scale projects. Compact excavators also gain popularity in urban development initiatives across major cities. With continued government spending on non-oil infrastructure, the region is expected to offer stable opportunities for manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Doosan

- CNH Global NV

- John Deere

- JC Bamford Excavators Ltd.

- Atlas Copco

- Caterpillar Inc.

- Kobelco

- Hyundai Heavy Industries Ltd

- Hitachi Construction Machinery

- Escorts Group

Competitive Analysis

Competitive landscape of the Excavator market features leading players including Doosan, CNH Global NV, John Deere, JC Bamford Excavators Ltd., Atlas Copco, Caterpillar Inc., Kobelco, Hyundai Heavy Industries Ltd., Hitachi Construction Machinery, and Escorts Group. These companies compete through product innovation, regional expansion, and strong after-sales support. Global leaders invest heavily in advanced technologies such as hybrid powertrains, automation, and telematics integration to improve machine efficiency and reduce operating costs. It reflects a clear trend toward sustainability, with manufacturers introducing electric excavators to align with emission norms and urban development needs. Strong R&D pipelines and partnerships with energy providers support adoption of cleaner equipment across developed regions. Market leaders also strengthen dealer networks and rental services to reach contractors with diverse needs. Emerging economies present further opportunities, driving focus on affordable yet durable models for infrastructure growth. While established brands dominate, regional players gain traction with cost-effective solutions in local markets. Competitive intensity remains high, as demand spans from compact units in urban settings to high-capacity machines in mining and industrial sectors. Strategic acquisitions, joint ventures, and consistent investment in operator safety and productivity ensure sustained leadership for the top manufacturers.

Recent Developments

- In 2025, Caterpillar Inc. introduced the new 330 UHD Ultra High Demolition Hydraulic Excavator.

- In 2025, Hyundai Heavy Industries Ltd. unveiled the HX230e full‑size electric crawler excavator concept at Bauma.

- In June 2025, Atlas Copco launched its largest container energy storage system (ESS), the ZBC 1000-1200.

Report Coverage

The research report offers an in-depth analysis based on Type, Drive Type, Engine Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric and hybrid excavators will rise with stricter emission regulations.

- Rental services will expand as contractors prefer flexible equipment access over ownership.

- Compact excavators will gain popularity in urban projects requiring high maneuverability.

- Smart monitoring and telematics will become standard features across new models.

- Automation will increase with semi-autonomous and remote-controlled excavators in high-risk sites.

- Mining expansion will drive demand for high-capacity crawler excavators in emerging economies.

- Sustainability initiatives will push adoption of eco-friendly engines and low-noise equipment.

- Infrastructure investments in Asia Pacific will sustain the region’s dominant market position.

- Manufacturers will focus on AI-driven systems to improve operator safety and precision.

- Strategic partnerships and mergers will strengthen global distribution and product innovation.