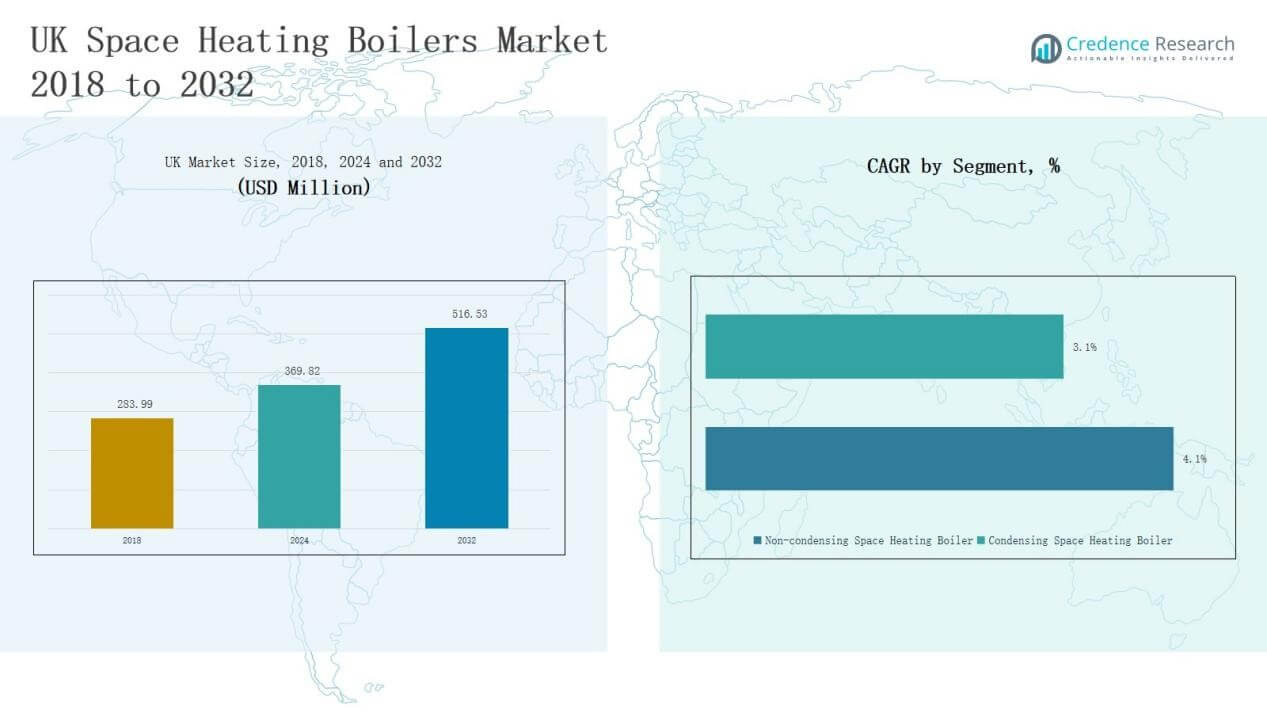

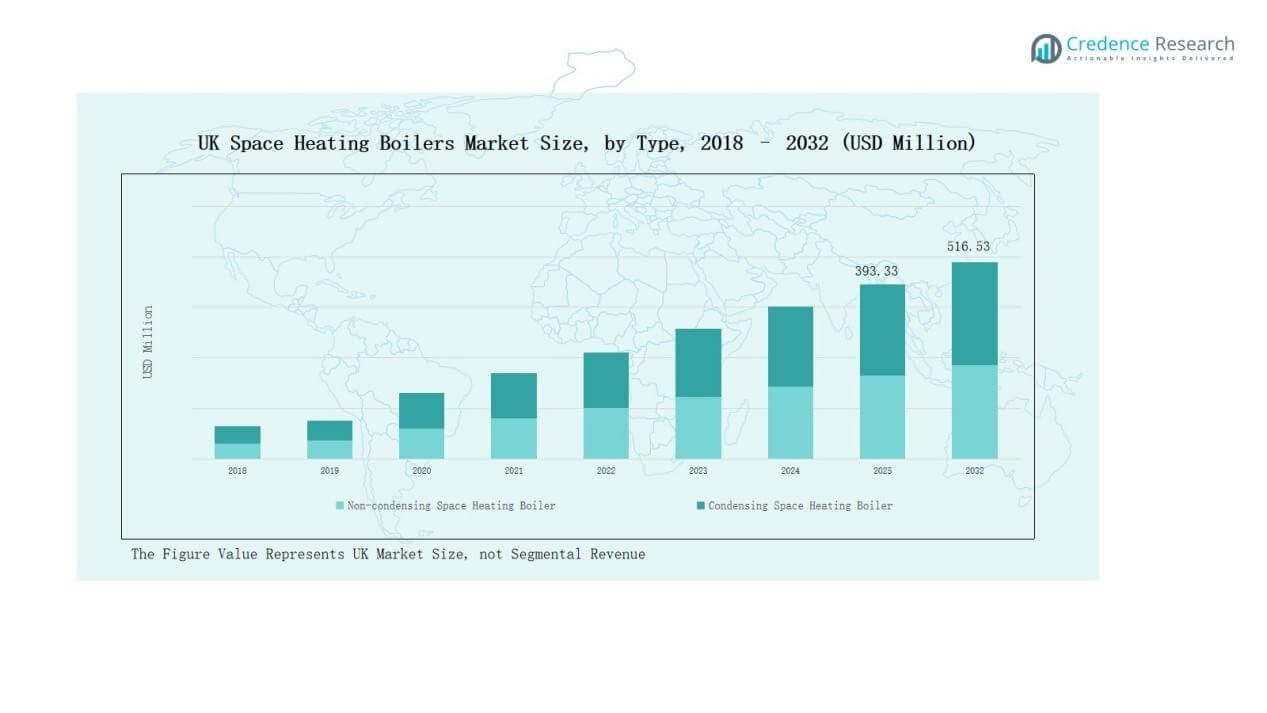

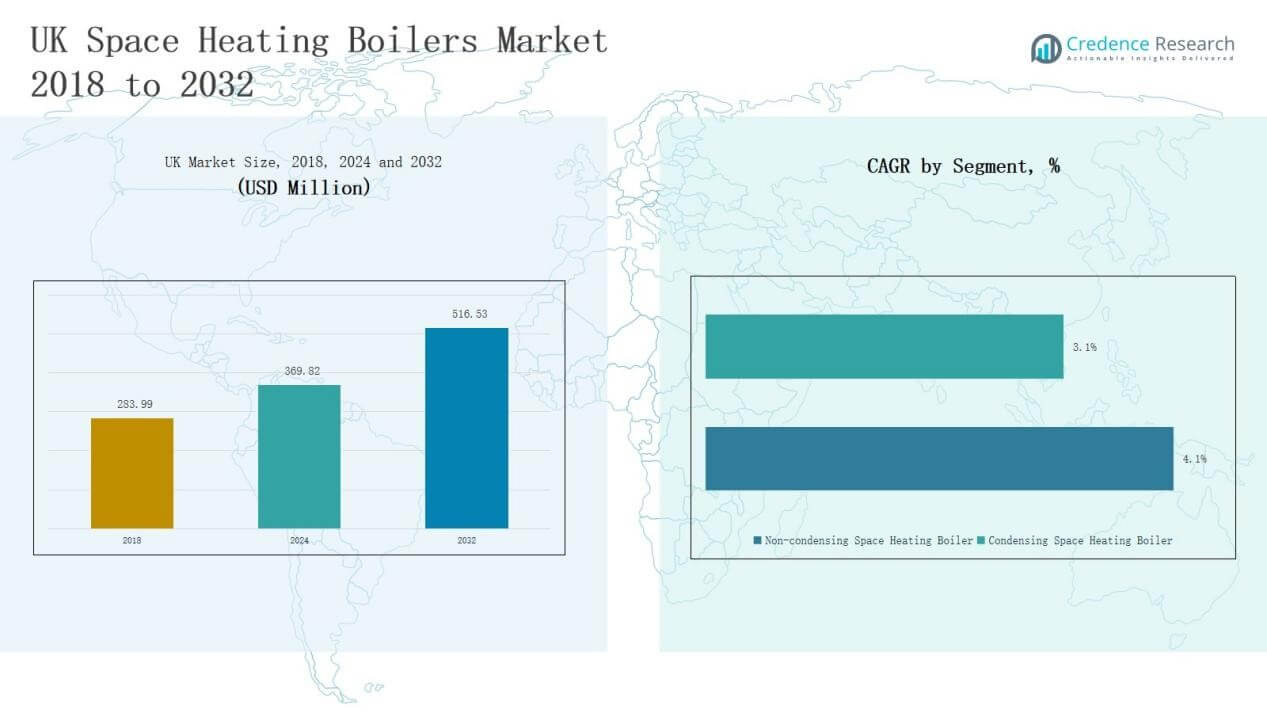

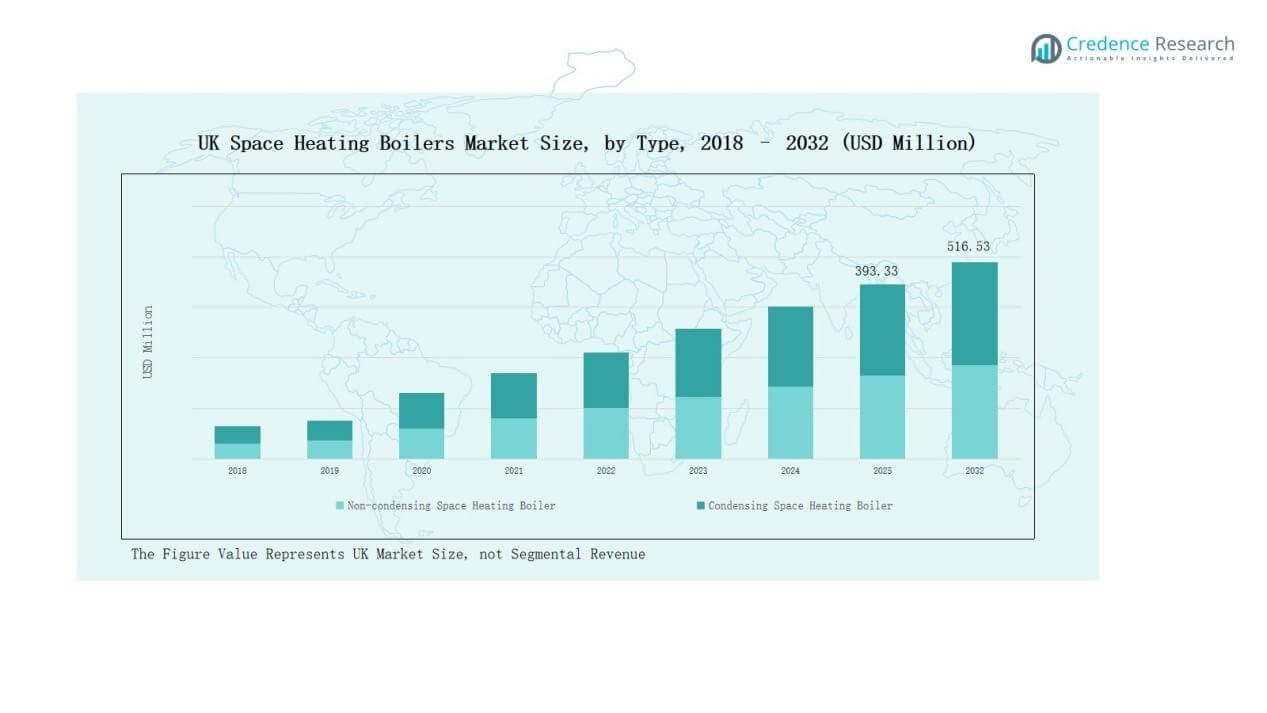

UK Space Heating Boilers Market size was valued at USD 283.99 million in 2018 to USD 369.82 million in 2024 and is anticipated to reach USD 516.53 million by 2032, at a CAGR of 3.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Space Heating Boilers Market Size 2024 |

USD 369.82 Million |

| UK Space Heating Boilers Market, CAGR |

3.97% |

| UK Space Heating Boilers Market Size 2032 |

USD 516.53 Million |

The UK Space Heating Boilers Market is highly competitive, with top players such as Viessmann Group, Bosch Thermotechnology, Vaillant Group, Worcester Bosch, Ideal Boilers, Baxi Heating, Ariston Thermo Group, Ferroli, Atlantic Group, and De Dietrich Thermique driving innovation and market expansion. These companies focus on condensing technology, digital integration, and hybrid solutions to align with national energy efficiency goals and consumer demand for sustainable heating. England emerged as the leading region in 2024, commanding a 58% market share, supported by dense urban populations, established gas infrastructure, and strong replacement demand, making it the central hub for boiler adoption and technological advancements in the UK.

Market Insights

- The UK Space Heating Boilers Market grew from USD 283.99 million in 2018 to USD 369.82 million in 2024 and is expected to reach USD 516.53 million by 2032, registering steady expansion at a CAGR of 3.97%.

- Leading companies including Viessmann Group, Bosch Thermotechnology, Vaillant Group, Worcester Bosch, Ideal Boilers, Baxi Heating, Ariston Thermo Group, Ferroli, Atlantic Group, and De Dietrich Thermique drive growth through condensing technology, digital integration, and hybrid solutions.

- By type, condensing boilers dominate with 68% share in 2024, supported by strict energy efficiency rules and government incentives, while non-condensing boilers continue to decline.

- By application, the residential sector leads with 61% share in 2024, followed by commercial at 26% and industrial at 13%, driven by high heating demand and infrastructure renewal.

- By region, England holds the largest share at 58% in 2024, followed by Scotland at 17%, Wales at 13%, and Northern Ireland at 12%, reflecting diverse heating needs and fuel reliance.

Market Segment Insights

By Type

Condensing boilers dominate the UK Space Heating Boilers Market with around 68% share in 2024. Their growth is supported by strict energy efficiency regulations and government incentives that encourage carbon reduction. Non-condensing boilers hold the remaining share but continue to decline due to lower efficiency and tighter environmental standards. The widespread replacement of older systems accelerates the shift toward condensing technology across residential and commercial properties.

- For instance, Baxi has introduced condensing models compatible with hydrogen-blend operation, aligning with the UK government’s “Hydrogen Ready Boiler” roadmap aimed at decarbonising domestic heating.

By Application

The residential sector accounts for nearly 61% share of the UK market in 2024, making it the leading application segment. High household heating demand, aging infrastructure, and adoption of energy-efficient boilers drive this dominance. Commercial applications contribute around 26% share, with steady uptake in schools, offices, and healthcare facilities. Industrial use stands at about 13%, supported by process heating requirements but limited compared to domestic demand.

By Operation

Gas-fired boilers lead the UK Space Heating Boilers Market with approximately 72% share in 2024. This dominance comes from the country’s established gas network, consumer familiarity, and affordable operating costs. Electric boilers represent close to 15% share, gaining momentum in urban areas and new builds due to zero on-site emissions. Oil-fired units hold 8% share, primarily in rural locations lacking gas infrastructure. Coal and other boiler types together account for the remaining 5%, showing a steady decline under sustainability goals and policy restrictions.

- For instance, Vaillant launched its aroTHERM plus air-to-water heat pump in the UK in 2020, directly targeting the same urban households that increasingly consider electric boilers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Overview

Key Growth Drivers

Government Energy Efficiency Regulations

Stringent UK energy policies push adoption of high-efficiency condensing boilers. Programs like the Boiler Upgrade Scheme and strict building codes create incentives for households and businesses to replace outdated units. These regulations not only reduce carbon emissions but also lower operating costs for consumers. The drive for net-zero carbon by 2050 further accelerates demand for boilers meeting advanced efficiency standards. This regulatory landscape ensures a consistent market push toward sustainable heating technologies across both urban and rural regions.

- For instance, Worcester Bosch introduced its Greenstar 4000 boiler range in 2021, designed with up to 94% efficiency and compatibility with hydrogen-blend gas, aligning with UK decarbonization goals.

High Replacement Demand

The UK has a large installed base of aging boilers, many beyond their recommended operational life. Replacement cycles create steady demand, with homeowners opting for modern condensing systems offering better efficiency and digital integration. Frequent breakdowns of older systems encourage upgrades to reliable and cost-saving solutions. The residential sector, representing the largest user base, remains the strongest contributor to replacement-driven sales. This continuous need for system renewal strengthens market stability and underpins sustained revenue growth.

Rising Residential Heating Needs

Cold weather conditions and high heating intensity make residential demand a critical growth driver. Households increasingly seek efficient systems to reduce energy bills while maintaining comfort. Demand rises in both existing properties and new housing projects supported by government construction initiatives. Awareness of sustainable living and interest in smart heating solutions further encourage adoption. The residential market’s dominance ensures that improvements in boiler design, connectivity, and efficiency directly translate to stronger adoption rates across the country.

- For instance, Viessmann introduced its Vitodens 100-W gas condensing boiler in 2023 with an integrated WiFi interface, enabling homeowners to optimize energy use through remote control apps.

Key Trends & Opportunities

Shift Toward Electrification and Low-Carbon Heating

The UK market shows growing interest in electric and hybrid boilers, driven by decarbonization goals. Electric models gain ground in urban areas and new housing projects due to ease of installation and absence of direct emissions. Hybrid systems combining boilers with heat pumps represent a transitional opportunity, helping users reduce emissions while retaining reliable heating. As electricity grids integrate more renewables, the opportunity for electric boilers strengthens, positioning them as a strategic growth area for manufacturers.

- For instance, Vaillant launched its aroTHERM plus hybrid solutions in the UK, pairing a heat pump with a gas or electric boiler for homes not yet ready to fully electrify.

Integration of Smart and Connected Technologies

Smart boilers with IoT-enabled controls are gaining traction across residential and commercial applications. Consumers prefer connected systems that allow remote monitoring, predictive maintenance, and optimized energy use. Manufacturers leverage this trend to differentiate products and add value through advanced features. The integration of AI-driven diagnostics and energy-saving controls creates opportunities to capture tech-savvy buyers. As demand for home automation expands, connected boiler solutions are expected to play a significant role in future growth.

- For instance, according to the U.S. Department of Energy, IoT-driven predictive maintenance can reduce maintenance costs by 25–30%, eliminate 70–75% of breakdowns, and reduce downtime by 35–45%, showcasing significant benefits from AI-enabled diagnostics in boilers.

Key Challenges

Transition Toward Renewable Alternatives

The UK’s decarbonization agenda emphasizes renewable heating technologies like heat pumps, which compete with boilers. Growing subsidies for alternatives challenge long-term demand for gas-fired units. While boilers remain dominant, their role may decline in new installations as policy incentives and consumer interest shift toward low-carbon options. This transition requires manufacturers to diversify product portfolios and invest in hybrid or renewable-compatible solutions to remain competitive in the evolving heating landscape.

High Upfront Costs for Advanced Systems

Although condensing and smart boilers reduce long-term energy costs, their upfront prices remain high for many consumers. Budget-conscious households may delay replacements, relying on older, less efficient systems. Limited financial flexibility slows adoption, particularly in low-income regions where heating demand is high. Even with government rebates, affordability remains a barrier. Addressing cost concerns through financing options and targeted incentives is crucial to accelerate adoption of advanced boiler technologies across all customer groups.

Dependence on Gas Infrastructure

The UK’s reliance on natural gas networks supports the dominance of gas-fired boilers but creates vulnerability. Volatile gas prices, supply chain disruptions, or geopolitical tensions can impact affordability and availability. This dependence also conflicts with the government’s long-term decarbonization objectives, which target reduced gas use in heating. Shifting away from gas reliance requires infrastructure transformation, which poses risks for boiler manufacturers dependent on traditional gas models. Balancing short-term demand with long-term energy transition goals is a major challenge.

Regional Analysis

England

England dominates the UK Space Heating Boilers Market with a 58% share in 2024. Its leadership is driven by dense urban populations, older housing stock, and strong replacement demand. Government energy efficiency regulations and rebate programs strengthen adoption of condensing boilers in residential and commercial segments. Rising demand for smart heating systems also supports growth across urban households. England’s established gas infrastructure ensures continued reliance on gas-fired boilers, though electric systems are emerging in new builds. It remains the central hub for manufacturers and innovation in the UK market.

Scotland

Scotland holds a 17% share in 2024, supported by colder climates and higher per capita heating demand. Rural regions rely heavily on oil-fired boilers, while urban centers show greater adoption of condensing units. Government decarbonization programs encourage households to switch to efficient boilers or hybrid systems. Local housing associations play a significant role in driving bulk replacements. It benefits from active policy support aimed at reducing carbon emissions. Scotland remains a strong market for manufacturers seeking to expand beyond England.

Wales

Wales accounts for 13% share in 2024, with growth driven by older housing structures and rural heating needs. Oil-fired and gas-fired boilers dominate installations, while electric systems gain ground in new construction projects. The government’s energy efficiency campaigns and local grant schemes stimulate replacement of non-condensing units. Demand is strong in residential applications, reflecting Wales’ reliance on efficient space heating. It continues to show stable adoption trends, supported by consumer preference for lower energy bills. Wales provides consistent opportunities for manufacturers targeting both rural and semi-urban households.

Northern Ireland

Northern Ireland represents 12% share in 2024, with the market shaped by heavy reliance on oil-fired boilers. Limited gas network coverage makes oil the dominant option, though high costs are pushing interest toward electric and hybrid models. Government subsidies encourage replacement of inefficient boilers, supporting adoption of condensing technology. The residential sector remains the largest contributor, reflecting the high heating requirements of households. It shows gradual transition toward low-carbon systems, though affordability challenges persist. Northern Ireland is an important market for suppliers offering alternatives to traditional oil systems.

Market Segmentations:

By Type

- Condensing Boilers

- Non-Condensing Boilers

By Application

- Residential

- Commercial

- Industrial

By Operation

- Gas-Fired Boilers

- Electric Boilers

- Oil-Fired Boilers

- Coal Boilers

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Space Heating Boilers Market is characterized by intense competition among global and domestic players focusing on efficiency, innovation, and sustainability. Leading companies such as Viessmann Group, Bosch Thermotechnology, Vaillant Group, Worcester Bosch, Ideal Boilers, and Baxi Heating dominate the market with strong brand presence and extensive distribution networks. These firms emphasize condensing technology, digital integration, and hybrid solutions to align with UK energy efficiency targets and net-zero goals. Mid-tier players including Ariston Thermo Group, Ferroli, and Atlantic Group compete by offering cost-effective models tailored to residential demand. Niche manufacturers and regional suppliers cater to specific segments like oil-fired and electric boilers, particularly in rural areas. Partnerships with housing associations, installers, and government-backed programs enhance reach and market penetration. The competitive landscape remains shaped by replacement demand, regulatory compliance, and growing consumer preference for connected and eco-friendly heating solutions that deliver both reliability and lower carbon footprints.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Rheem Manufacturing Company

- Navien Inc.

- Daikin Industries, Ltd.

- Mitsubishi Electric Corporation

- Lochinvar, LLC

- Groupe Atlantic

- Hoval Group

- ACV International

- Rinnai Corporation

- Noritz Corporation

- Fondital S.p.A.

- ECR International

- O. Smith Corporation

- KD Navien

- Burnham Holdings, Inc.

Recent Developments

- In 2025, ACV UK introduced the EVO S, a new wall-hung boiler featuring stainless-steel plate-heat-exchange technology designed to enhance efficiency and durability.

- In 2024, Viessmann Climate Solutions UK partnered with APP Plumbing & Heating. The collaboration allows independent merchants nationwide to access Viessmann’s boilers, heat pumps, and commercial systems with next-day delivery and advanced fulfillment.

- In June 2025, Luthmore, founded by two former Dyson engineers, launched a new zero-emissions boiler designed to replace traditional gas combi boilers. This product aims to offer simplicity of installation and an improved customer experience.

- In June 2025, British Gas formed a partnership with Navien. The collaboration combines Navien’s heating innovation with British Gas’s national engineering network. It expands support across Navien’s gas, oil boilers, heat pumps, and smart controls with faster repairs and improved technical care.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Operation and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for condensing boilers will strengthen due to stricter efficiency regulations.

- Gas-fired boilers will remain dominant, but their share will decline over time.

- Electric boilers will expand adoption in urban areas and new housing projects.

- Oil-fired boilers will lose share as consumers shift toward cleaner alternatives.

- Smart and connected boilers will gain traction across residential and commercial sectors.

- Hybrid solutions combining boilers with heat pumps will see growing interest.

- Replacement demand will continue to drive stable market growth in residential applications.

- Government decarbonization programs will push adoption of low-carbon and renewable-compatible systems.

- Regional differences in fuel availability will shape adoption patterns across the UK.

- Manufacturers will invest in digital services and partnerships to strengthen market positioning.