Market Overview:

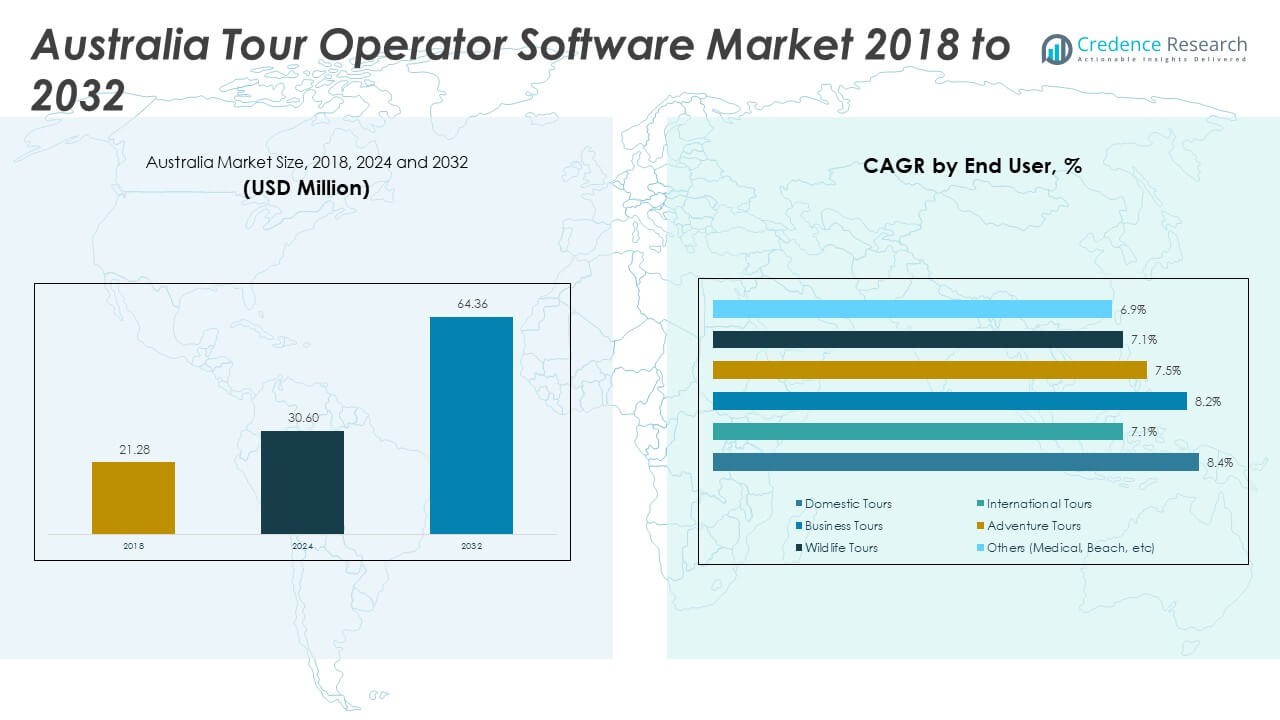

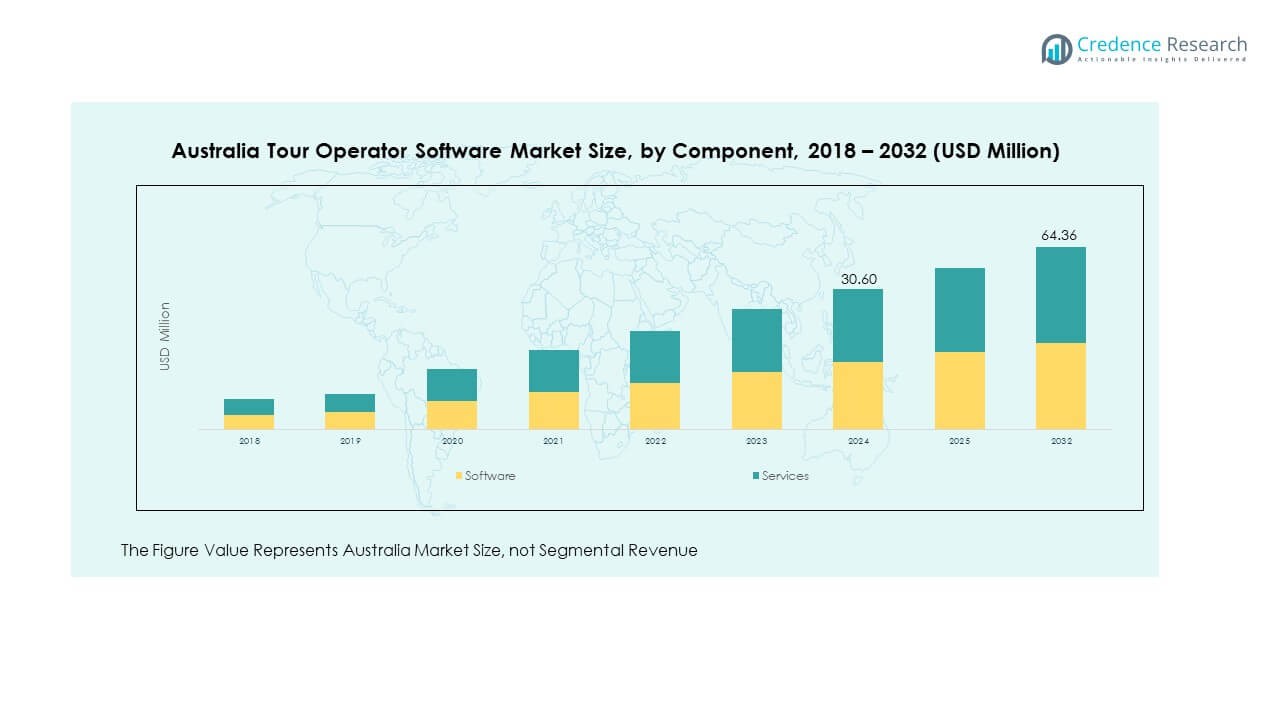

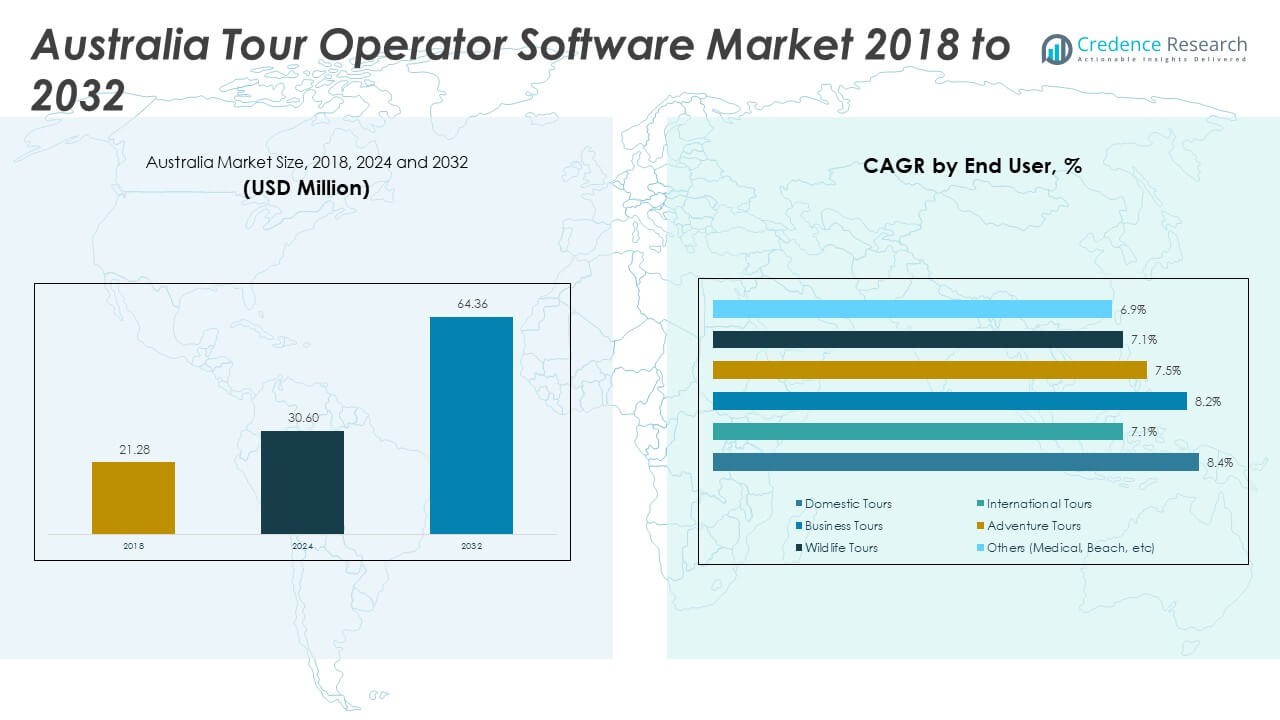

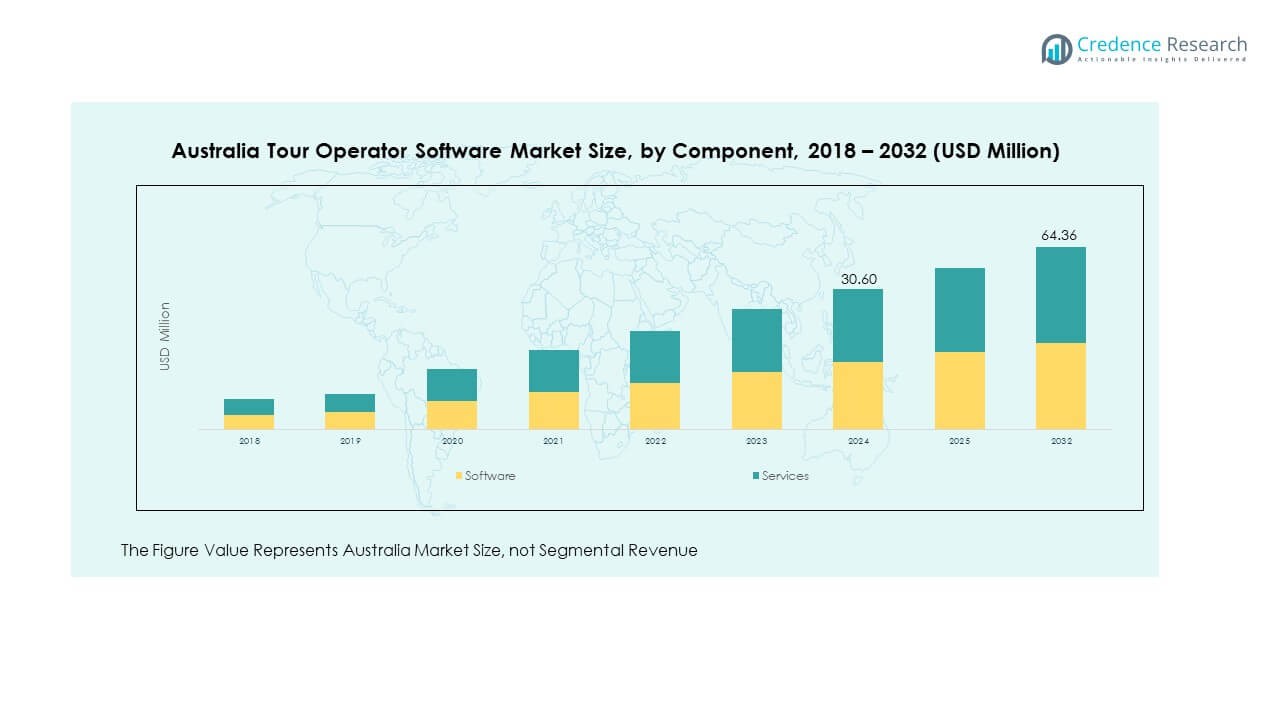

The Australia Tour Operator Software Market size was valued at USD 21.28 million in 2018 to USD 30.60 million in 2024 and is anticipated to reach USD 64.36 million by 2032, at a CAGR of 9.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Tour Operator Software Market Size 2024 |

USD 30.60 Million |

| Australia Tour Operator Software Market, CAGR |

9.74% |

| Australia Tour Operator Software Market Size 2032 |

USD 64.36 Million |

Growing tourism demand in Australia is driving software adoption. Operators rely on automation to improve booking management, streamline customer communication, and enhance travel experiences. Rising digital penetration and preference for online bookings are further fueling the need for efficient software. Enterprises are also adopting advanced platforms with integrated payment systems and analytics. These factors are shaping strong market growth and expanding the software’s role in improving operational efficiency across the tourism sector.

Geographically, market adoption is strongest in major urban hubs like Sydney and Melbourne, which serve as leading tourism gateways. Regional destinations, including Queensland and Tasmania, are emerging as promising markets due to rising adventure, wildlife, and cultural tourism. Growing inbound and domestic travel supports expansion across both developed and regional markets. Software providers are tailoring solutions to regional needs, ensuring scalability and flexibility for operators of varying sizes and specialties.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Tour Operator Software Market was valued at USD 21.28 million in 2018, reached USD 30.60 million in 2024, and is projected to grow to USD 64.36 million by 2032 at a CAGR of 9.74%.

- North America, Europe, and Asia-Pacific command the top three regional shares, holding 32%, 29%, and 26% respectively, driven by established tourism networks and strong digital adoption.

- Asia-Pacific is the fastest-growing region with 26% share, supported by rising inbound tourism, expanding domestic travel demand, and accelerated digital transformation among operators.

- Software accounted for around 55% of the Australia Tour Operator Software Market in 2024, reflecting higher demand for booking, payment, and itinerary management platforms.

- Services represented about 45% share in 2024, fueled by strong uptake of customization, training, and support packages that enhance operator efficiency.

Market Drivers:

Growing Tourism Demand and the Push for Digital Transformation:

The Australia Tour Operator Software Market benefits from rising inbound and domestic tourism, creating a need for streamlined operations. Companies are integrating automation to manage bookings, itineraries, and payments with higher efficiency. Digital adoption is accelerating as travelers prefer online booking systems over traditional channels. Businesses require software capable of handling large volumes of customer data securely. It is also supporting enhanced personalization, allowing operators to offer tailored experiences. Expanding smartphone use increases accessibility to booking platforms. A rising focus on user-friendly interfaces improves customer satisfaction and retention. The market thrives on software providers enhancing scalability and performance.

- For instance, With 28% of Australians now using AI to book holidays, up 73% from the previous year, companies increasingly integrate automation to manage bookings, itineraries, and payments with higher efficiency. Manual travel planning and invoicing are being replaced by automated solutions like OTRAMS and Lemax, which control group bookings and supplier processes, reducing errors and increasing accuracy.

Integration of Advanced Technologies in Booking Platforms:

The adoption of AI, machine learning, and cloud computing is driving transformation. The Australia Tour Operator Software Market benefits from predictive analytics that forecast demand and optimize pricing strategies. Integration with CRM systems allows operators to manage customer relations more effectively. It is creating opportunities for automation in marketing campaigns and targeted promotions. Cloud-based solutions enhance scalability while reducing infrastructure costs. Operators can now manage multi-destination tours and dynamic pricing with precision. Security features like fraud detection are improving reliability. Growing adoption of APIs enables integration with third-party platforms, including hotels, airlines, and payment gateways.

- For instance, Cloud-based solutions ensure scalability and reduce infrastructure costs, with Australian enterprises set to spend nearly AUD 26.6 billion on public cloud services in 2025, an 18.9% increase from 2024. Cloud enhances remote access, real-time management, and collaboration between partners, while security features such as fraud detection improve system reliability.

Rising Demand for Seamless Customer Experiences Across Travel Services:

Customer experience remains central to market growth, with personalization leading adoption trends. The Australia Tour Operator Software Market is shaped by tools that enhance service delivery and streamline real-time updates. Operators rely on chatbots and virtual assistants to improve communication. It supports multilingual platforms, catering to international travelers. Enhanced mobile-first designs help customers book and modify tours easily. Reviews and feedback integration foster trust and transparency. Loyalty programs embedded in software solutions retain customers. By supporting better travel planning, software adoption continues to expand across operators of all sizes.

Expansion of Small and Medium Enterprises in the Tourism Sector:

Tourism SMEs are rapidly adopting cost-effective software to scale operations. The Australia Tour Operator Software Market sees strong demand from independent and mid-sized operators. It allows them to compete with large travel agencies by providing professional-grade tools. Subscription-based pricing models reduce barriers to entry. Software vendors focus on delivering flexible solutions for diverse operator needs. These include adventure, wildlife, and cultural tours. Enhanced automation helps SMEs cut administrative costs. By enabling scalability, the market creates opportunities for niche operators. Strong government support for tourism boosts demand for software adoption in regional markets.

Market Trends:

Growing Popularity of Cloud-Based Deployment Models:

Cloud adoption is accelerating across the Australia Tour Operator Software Market, driven by cost and scalability benefits. Operators prefer SaaS platforms that reduce infrastructure expenses. It enables remote access and real-time booking management. Integration with digital payment platforms boosts convenience. Cloud systems enhance collaboration between travel partners and suppliers. Data storage scalability supports operators handling peak seasons. Enhanced uptime and reliability attract more tourism businesses. Growing cybersecurity advancements are strengthening trust in cloud-based models.

- For instance, SaaS platforms dominate, reducing infrastructure expenses and enabling remote booking management. Cloud supports storage scalability to handle peak tourism seasons, improves uptime and reliability, and fosters collaboration with suppliers.

Integration of Mobile-Friendly Features in Travel Platforms:

Mobile-first solutions are dominating the Australia Tour Operator Software Market, reflecting evolving traveler behavior. It ensures customers can access services anytime and anywhere. Features like instant booking, itinerary updates, and notifications enhance convenience. Mobile wallets and contactless payments improve transaction speed. Tour operators leverage mobile push notifications for marketing campaigns. User-friendly designs encourage adoption among younger demographics. Enhanced offline access supports travelers in remote destinations. Integration of social media sharing features boosts market visibility and user engagement.

- For instance, Mobile apps are vital in Australia, where travellers prefer booking travel arrangements via mobile platforms. User-friendly designs encourage adoption, especially among younger demographics, while offline access supports travellers in remote destinations. Integration of social media sharing boosts market visibility and user engagement.

Personalization Through Data-Driven Insights and Predictive Analytics:

Tour operators are increasingly relying on data-driven personalization strategies. The Australia Tour Operator Software Market is expanding with advanced analytics that recommend packages based on preferences. It supports demand forecasting to optimize tour capacity. Predictive tools guide pricing strategies, enhancing profitability. Operators track customer journeys to refine experiences. Loyalty and reward programs are tailored using analytics insights. Cross-selling and upselling opportunities grow through customer behavior data. It also improves retention by anticipating customer needs and preferences.

Partnerships with Hospitality and Transportation Service Providers:

Strategic collaborations strengthen the Australia Tour Operator Software Market by creating integrated travel ecosystems. It enables seamless booking of hotels, flights, and excursions. Partnerships expand service portfolios and attract wider audiences. Joint platforms reduce fragmentation and improve user experiences. APIs enable connectivity between tour operators and third-party systems. Multi-channel sales integration enhances booking flexibility. White-label solutions allow operators to offer diversified packages. These partnerships also increase visibility across global distribution systems. Growing emphasis on ecosystem-driven platforms accelerates expansion.

Market Challenges:

Rising Competition and Market Saturation:

The Australia Tour Operator Software Market faces increasing competition from global and regional players. It is challenging for smaller vendors to differentiate in a crowded space. Pricing pressure limits margins, especially for SMEs. Established companies invest heavily in product innovation, raising competitive barriers. Market saturation in urban centers slows growth opportunities. Customer loyalty shifts quickly with emerging platforms. Balancing cost efficiency with advanced features remains difficult. Vendors need unique strategies to sustain visibility and retain clients.

Concerns Over Data Security and Regulatory Compliance:

Data security poses a major challenge to the Australia Tour Operator Software Market, with operators handling sensitive traveler information. It requires strict compliance with data protection laws. Rising cyberattacks increase risks of financial and reputational losses. Operators must adopt advanced encryption and authentication protocols. Smaller players struggle to meet evolving compliance standards. Regulatory differences across regions complicate international operations. Customers demand transparency in data use, adding pressure on vendors. Building trust through security innovation is vital for market expansion.

Market Opportunities:

Expanding Role of AI and Automation in Travel Services:

The Australia Tour Operator Software Market is witnessing opportunities through AI-driven features that enhance customer engagement. It supports chatbots for instant assistance and predictive analytics for demand forecasting. Automation reduces human errors and operational costs. Personalized itineraries are becoming easier to generate. Integration of voice-assisted booking adds convenience. Operators can analyze traveler behavior to offer targeted promotions. Growing adoption of smart tools positions vendors for long-term growth.

Growth of Niche Tourism Segments in Regional Australia:

Niche markets like eco-tourism, adventure travel, and cultural experiences present new opportunities. The Australia Tour Operator Software Market benefits from solutions tailored for specialized operators. It supports customization for diverse packages across regional destinations. SMEs can attract international travelers with targeted offerings. Local tourism boards encourage digital adoption in smaller regions. Custom software modules cater to wildlife, adventure, and luxury travel segments. Vendors delivering specialized features are likely to gain competitive advantages.

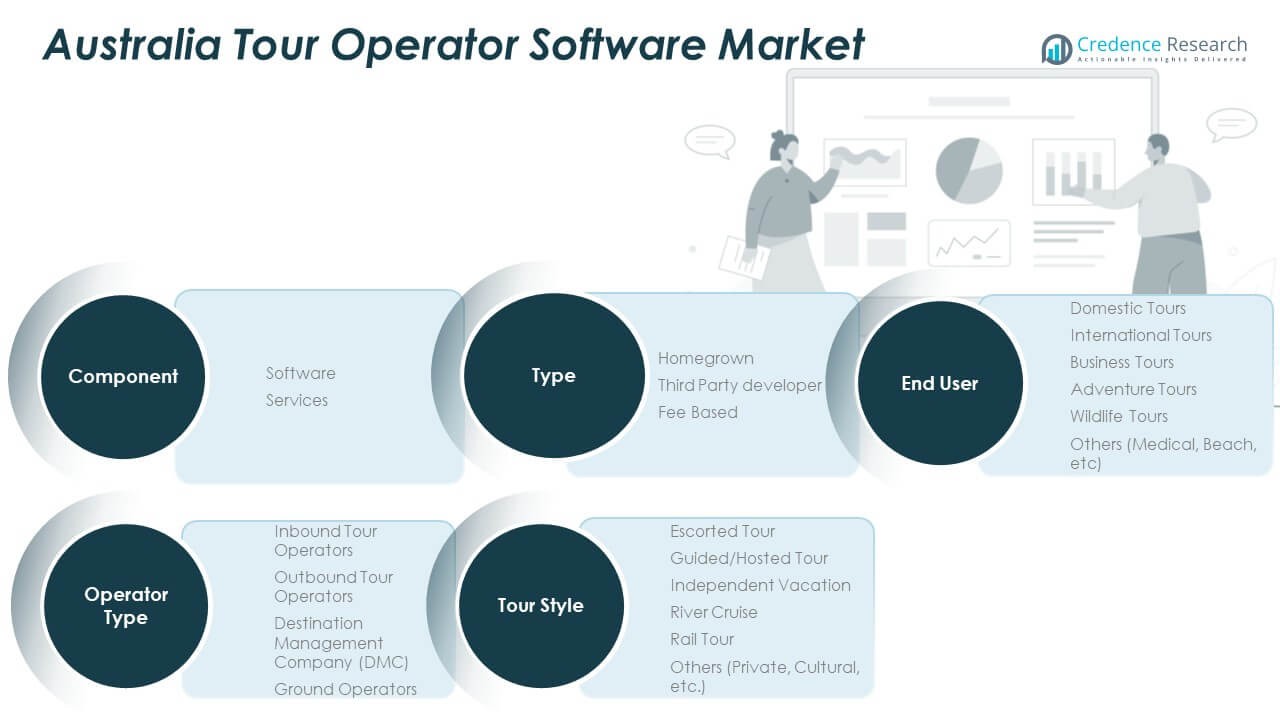

Market Segmentation Analysis:

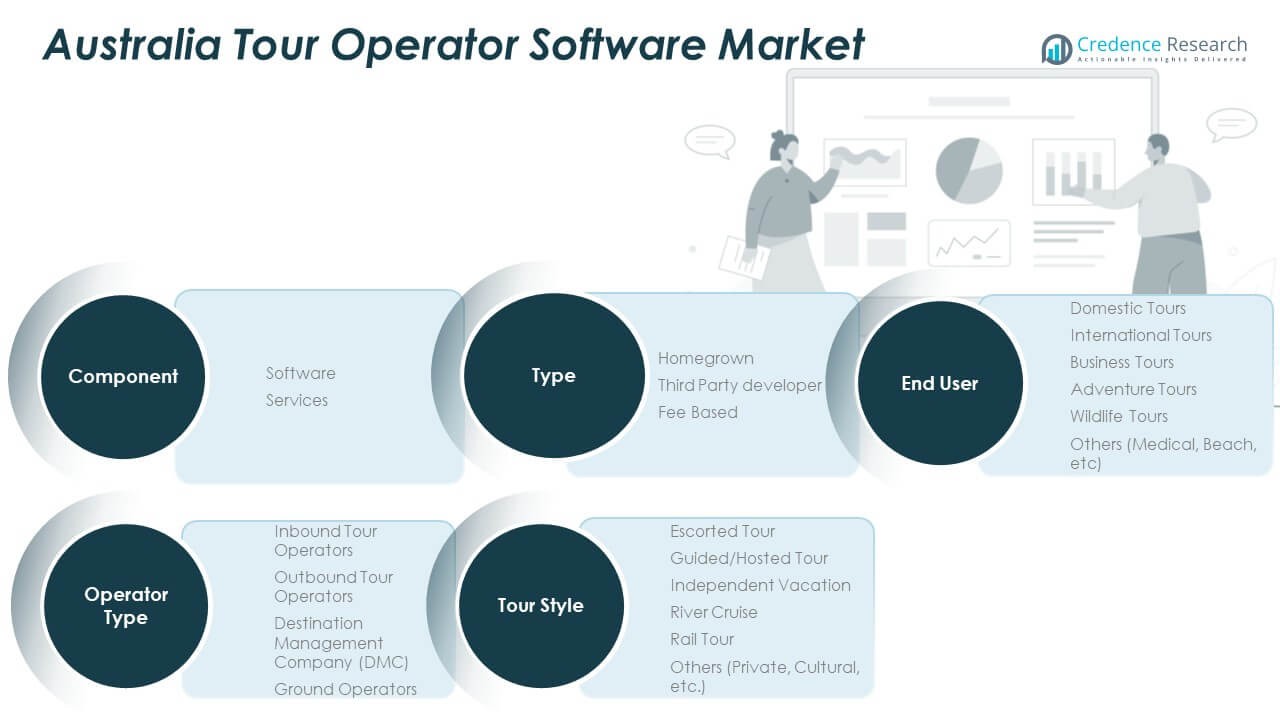

By Type

The Australia Tour Operator Software Market is divided into homegrown, third-party developer, and fee-based solutions. Homegrown systems are often favored by smaller operators for customized control and cost efficiency. Third-party developer platforms dominate due to scalability, integration options, and continuous innovation. Fee-based models gain traction among larger enterprises that require premium features, advanced analytics, and 24/7 support. Demand is shifting towards subscription-based platforms that lower upfront investment and provide flexibility.

- For instance, Fee-based models attract larger enterprises requiring premium features such as advanced analytics and 24/7 support. Subscription-based SaaS platforms gain demand, lowering upfront costs and enhancing flexibility.

By Component

Software holds a dominant share in this market, driven by rising adoption of cloud-based booking and management systems. Automation of tasks like itinerary planning, payments, and reporting supports efficiency. Services complement software adoption by offering training, customization, and ongoing technical support. Growing complexity of travel packages increases the need for integrated service solutions. Providers offering bundled software and service models gain a stronger competitive advantage.

- For instance, Automation of itinerary planning, payments, and reporting increases operational efficiency. Service components complement software adoption by offering training, customization, and technical support. The increasing complexity of travel packages requires integrated service solutions, with bundled software and services models providing a competitive edge.

By Operator Type

Inbound tour operators remain a key contributor, supported by international tourism growth in Australia. Outbound operators also represent a strong segment, catering to Australians traveling abroad. Destination Management Companies (DMCs) are gaining demand, especially in handling group tours and customized experiences. Ground operators rely on software for logistics management, ensuring efficiency in local travel services. Each operator type requires flexible features tailored to unique service models.

By Tour Style

Escorted and guided tours lead adoption as travelers seek structured itineraries with professional guidance. Independent vacations are also increasing in popularity, with software platforms enabling self-service booking and personalization. River cruises and rail tours contribute steadily, particularly in niche tourism segments. Others, such as private and cultural tours, grow with rising demand for unique travel experiences. Operators are leveraging software to cater to varied preferences, enhancing flexibility and convenience.

By End User

Domestic tours hold a large share due to strong demand within Australia, especially across regional and cultural destinations. International tours continue to expand, fueled by inbound tourism from Asia-Pacific and Europe. Business tours adopt advanced scheduling and corporate-focused features. Adventure and wildlife tours represent niche but fast-growing areas, leveraging specialized modules for safety compliance and customization. The “others” segment includes luxury and educational tours, supported by tailored booking platforms.

Segmentation:

- By Type

- Homegrown

- Third Party Developer

- Fee Based

- By Component

- By Operator Type

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Company (DMC)

- Ground Operators

- By Tour Style

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

- By End User

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

Regional Analysis:

New South Wales and Victoria – Leading Adoption Centers

The Australia Tour Operator Software Market records the highest adoption in New South Wales, contributing nearly 28% of the national share. Sydney acts as the key gateway for international travelers, creating strong demand for advanced booking and management systems. It supports a wide range of operators handling cultural, leisure, and business travel. Victoria follows with about 22% share, driven by Melbourne’s prominence in events, tourism, and hospitality services. Both states demonstrate strong digital maturity, encouraging rapid uptake of SaaS-based solutions. It highlights the dominance of large urban hubs in shaping the competitive landscape.

Queensland, Tasmania, and Western Australia – Expanding Growth Hubs

Queensland holds close to 20% share of the Australia Tour Operator Software Market, supported by eco-tourism, coastal travel, and adventure-based experiences. Brisbane, Gold Coast, and Cairns remain central to demand, requiring platforms that handle diverse packages. Tasmania and Western Australia are emerging contributors, adding value through cultural and wildlife tours. It reflects the rising interest in regional tourism, where operators seek tailored solutions. Vendors are customizing offerings to meet the needs of small and mid-sized businesses. These regions provide balanced opportunities across mainstream and niche markets.

South Australia and Northern Territory – Niche Tourism Segments

South Australia and the Northern Territory together account for nearly 10% of the national market share. They are driven by unique tourism themes such as outback expeditions, Aboriginal cultural tours, and wine-region travel. It highlights increasing adoption among operators seeking digital efficiency and customer engagement tools. Growth in adventure and wildlife tourism continues to accelerate software demand. SMEs in these regions rely on subscription-based models to reduce costs while accessing advanced features. Vendors focusing on regional strategies and flexible platforms are well positioned to gain traction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Rezdy

- Amadeus IT Group

- FareHarbor (Booking Holdings)

- Bókun (Tripadvisor)

- TrekkSoft

- Lemax

- Open Destinations

- Inspiretec

- Intuitive Systems

- JTB Business Travel Solutions

Competitive Analysis:

The Australia Tour Operator Software Market features strong competition between global and regional providers. Established companies such as Rezdy, Amadeus IT Group, and FareHarbor hold a significant presence with advanced platforms, scalable solutions, and wide customer bases. It is shaped by technology integration, with players focusing on AI, cloud deployment, and data-driven personalization. Mid-sized vendors like TrekkSoft and Bókun compete by offering flexible packages for small and medium operators. Domestic players strengthen competitiveness with localized solutions tailored to unique travel demands in Australia. Partnerships with airlines, hotels, and payment providers enhance software adoption. Continuous investment in innovation, data security, and customer engagement drives differentiation in a crowded marketplace.

Recent Developments:

- On May 22, 2025, Amadeus IT Group entered a landmark partnership with Google Cloud, strengthening its commitment to cloud infrastructure and artificial intelligence. Through this deal, Amadeus will migrate parts of its technical platform to Google Cloud, leveraging advanced AI-driven solutions to enhance both operational efficiency and product innovation for the travel industry.

- In January 2025, Bókun, a Tripadvisor company, joined forces with Moder, a resort management system, to introduce a seamless integration for activity channel management. This partnership empowers hotels and resorts to distribute and manage activity sales with real-time inventory updates, enhancing the guest booking journey while boosting revenue and operational efficiency for hospitality providers.

- In January 2025, Lemax launched significant new product updates, introducing advanced filters for special offers and improved automated logging of reservation activity. These enhancements help users more efficiently manage bookings and capitalize on special offers, reflecting Lemax’s ongoing investment in product refinement to meet evolving market needs.

- On June 23, 2025, Open Destinations secured a significant investment from Insight Partners to fuel its next phase of growth. As a leading provider of reservation technology, this partnership with the global software investor is set to accelerate innovation and support expansion, strengthening Open Destinations’ role across the tour and travel sector.

- April 2025 saw Intuitive Systems, a UK-based leader in leisure travel booking software, acquired by Banyan Software. The move positions Intuitive for continued growth and international expansion under Banyan’s umbrella, further strengthening its strong presence in reservation platforms for tour operators and travel agents.

Report Coverage:

The research report offers an in-depth analysis based on type, component, operator type, tour style, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced booking platforms will continue to rise with growing domestic and international travel.

- Cloud-based deployment will dominate as operators seek scalable and cost-efficient solutions.

- AI-driven personalization will enhance customer experiences and strengthen loyalty across operators.

- Mobile-first platforms will remain essential as travelers prefer on-the-go booking convenience.

- Partnerships with airlines, hotels, and transport providers will expand integrated service ecosystems.

- Small and medium-sized operators will accelerate adoption through affordable subscription models.

- Cybersecurity advancements will become critical as data protection standards tighten further.

- Niche tourism such as adventure and cultural tours will drive software customization demand.

- Competition will intensify between global vendors and regional players offering localized solutions.

- Continuous innovation in analytics and automation will shape the long-term growth trajectory.