Market Overview

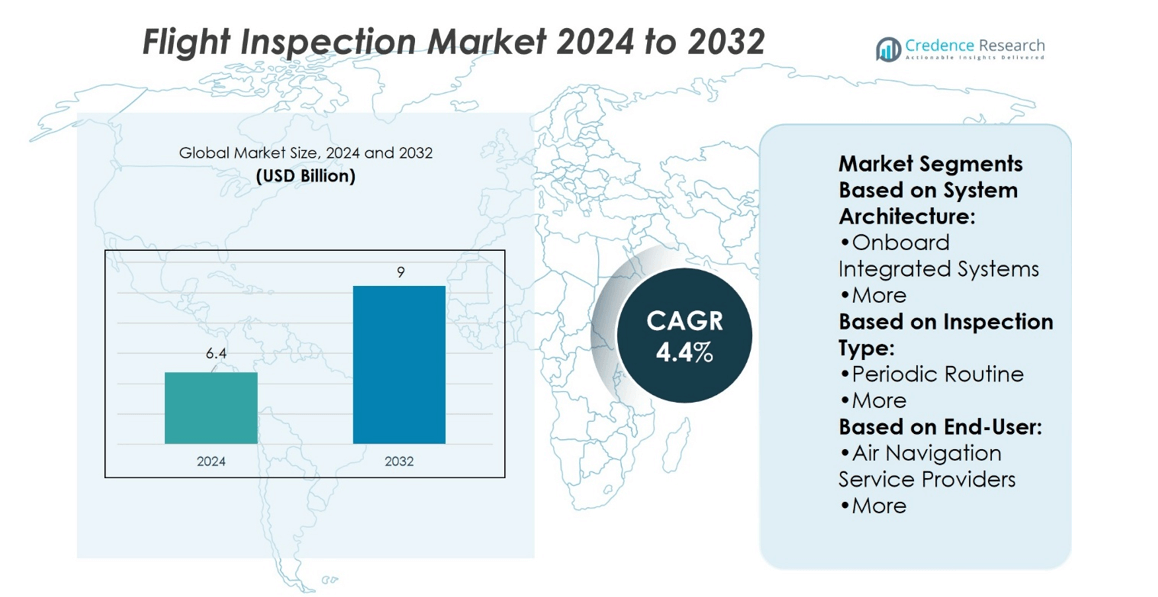

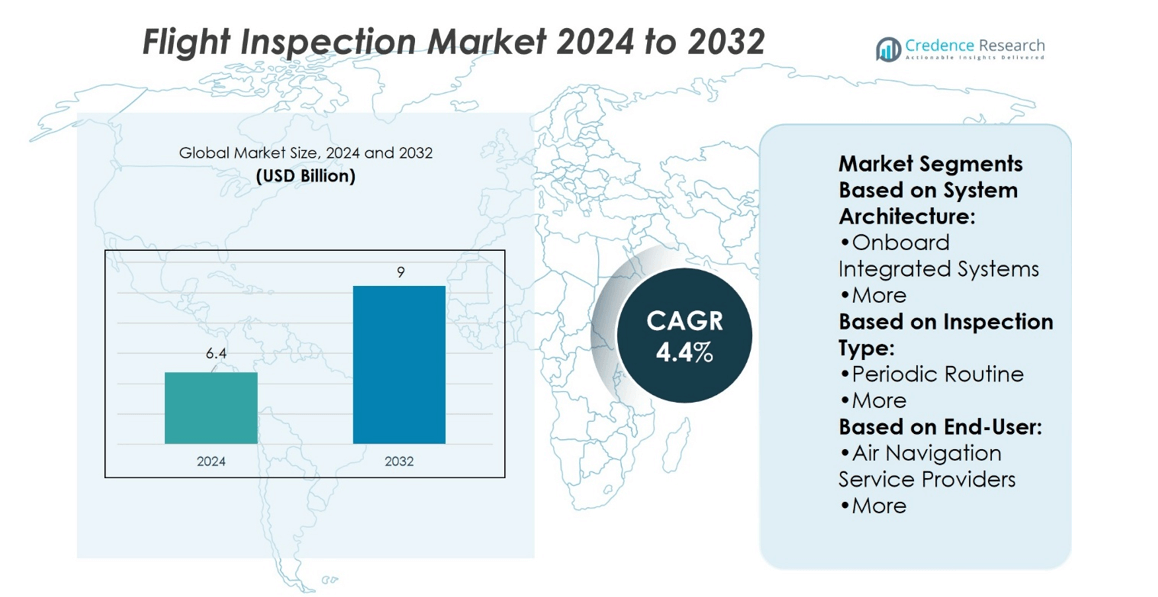

Flight Inspection Market size was valued at USD 6.4 billion in 2024 and is anticipated to reach USD 9 billion by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flight Inspection Market Size 2024 |

USD 6.4 billion |

| Flight Inspection Market, CAGR |

4.4% |

| Flight Inspection Market Size 2032 |

USD 9 billion |

The Flight Inspection Market grows through rising demand for airspace safety, stricter regulatory compliance, and expanding global passenger traffic. It gains momentum from government investments in airport modernization and integration of advanced navigation aids such as GNSS, ADS-B, and performance-based systems. Operators adopt automated platforms and data analytics to improve calibration efficiency and minimize downtime. Unmanned aerial systems enter inspection activities, offering cost savings and flexibility for routine and emergency checks. Sustainability also drives modernization, with stakeholders adopting fuel-efficient aircraft and hybrid propulsion technologies. Together, these drivers and trends reinforce flight inspection as a critical enabler of safe aviation operations.

North America holds the largest share of the Flight Inspection Market, supported by advanced aviation infrastructure and strict regulatory oversight, while Europe follows with strong investment in modernization and sustainability initiatives. Asia-Pacific shows rapid growth through expanding airport networks and rising passenger traffic, whereas Latin America and the Middle East & Africa contribute smaller but emerging shares. Key players actively shaping the market include Aerodata, Bombardier, Cobham, ENAV, Flight Calibration Services, Flight Precision, Radiola, Mistras Group, Norwegian Special Mission, and Airfield Technology.

Market Insights

- Flight Inspection Market size was valued at USD 6.4 billion in 2024 and is expected to reach USD 9 billion by 2032, at a CAGR of 4.4%.

- Rising demand for airspace safety, stricter regulatory compliance, and growing passenger traffic drive adoption.

- Automation and data analytics emerge as key trends improving efficiency and reducing downtime.

- Competition intensifies with companies advancing modular systems, UAV-based solutions, and hybrid inspection platforms.

- High operational costs and limited availability of specialized assets act as restraints.

- North America leads with advanced infrastructure, Europe follows with modernization focus, and Asia-Pacific shows fastest growth.

- Latin America and Middle East & Africa contribute smaller but expanding shares, supported by airport upgrades and defense aviation demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Need for Airspace Safety and Compliance with International Standards

The Flight Inspection Market advances through rising demand for safe and efficient airspace management. Regulators strengthen oversight of navigation aids, communication systems, and surveillance infrastructure. Compliance with ICAO and FAA standards drives consistent inspection cycles. Airlines and airports rely on inspection services to maintain certification and avoid penalties. It ensures reliable guidance for aircraft during takeoff, en-route navigation, and landing. Expansion of global passenger traffic amplifies the need for verified air traffic systems.

- For instance, Mistras Group engineers use Alternating Current Field Measurement (ACFM) probes capable of scanning metal surfaces at temperatures up to 900 °F, accurately sizing crack depth and length without needing to remove coatings. This enables reliable flaw detection even under harsh conditions.

Increasing Adoption of Advanced Navigation and Surveillance Technologies

Technological upgrades support growth within the Flight Inspection Market. Modern aircraft depend on GNSS, ADS-B, and performance-based navigation systems for accuracy. Inspection platforms validate signal integrity and detect interference before operations are compromised. It ensures safe deployment of satellite-based navigation across domestic and international routes. Hardware miniaturization and advanced calibration tools improve inspection accuracy in challenging environments. Greater reliance on automation enhances efficiency and reduces operational downtime.

- For instance, Bombardier’s Global 7500 business jet achieved over 100 officially recognized speed records, demonstrating unmatched performance during validation flight campaigns at test airports, and its inspection intervals are set at 850 flight hours or every 36 months, ensuring synchronized inspections of avionics and navigation systems.

Rising Investments in Airport Modernization and Infrastructure Development

Ongoing airport expansion projects strengthen demand in the Flight Inspection Market. Governments allocate funds for new runways, taxiways, and navigation infrastructure. It requires scheduled inspection of ILS, VOR, and DME systems. Contractors integrate inspection programs into development timelines to secure operational readiness. New airports in emerging economies drive procurement of inspection aircraft and equipment. Continuous upgrades at established hubs sustain recurring inspection service needs.

Strong Emphasis on Military and Defense Aviation Reliability

Defense agencies contribute significantly to the Flight Inspection Market through strict mission requirements. Military fleets demand precision in navigation aids for training, transport, and combat missions. It necessitates frequent inspection of tactical airbases and remote landing strips. Governments prioritize dedicated inspection aircraft to support strategic readiness. Dual-use platforms extend benefits to both civil and defense aviation sectors. Heightened geopolitical tensions accelerate investment in reliable inspection infrastructure.

Market Trends

Integration of Satellite-Based Navigation and Digital Air Traffic Systems

The Flight Inspection Market evolves through adoption of satellite-based navigation and digital air traffic technologies. Global airspace management shifts toward GNSS and ADS-B to replace conventional ground aids. Inspection operations confirm positioning accuracy and continuity across complex flight corridors. It ensures safety while enabling reduced separation between aircraft. Increasing reliance on space-based navigation requires more precise calibration of flight inspection systems. Air traffic authorities invest in digital transition strategies that sustain long-term demand.

- For instance, Airfield Technology’s AT-920DG system integrates DGPS with Real-Time Kinematic (RTK) corrections and synchronizes those with avionics sensor data. This setup delivers sub-meter positional accuracy (centimeter-level under certain conditions), enabling fully automated flight inspections even in low-visibility scenarios.

Growing Use of Unmanned Aerial Platforms for Inspection Activities

Unmanned aerial platforms influence growth within the Flight Inspection Market. Drones demonstrate value in validating navigation aids at lower operational costs. Compact payloads with advanced sensors collect real-time calibration data across airports and remote locations. It improves efficiency by reducing deployment of manned inspection aircraft for routine checks. Integration of UAV technology offers flexibility for temporary or emergency inspections. Operators explore hybrid models that combine traditional aircraft with drone-based support.

- For instance, Norwegian Special Mission collaborated with Primoco UAV to equip a One 150 drone—featuring a 150 kg maximum take-off weight—with the UNIFIS 1000 RPAS system. This setup supports full calibration of ILS, VOR, DME, NDB, PAPI, and other systems from a drone platform fully compliant with EASA drone regulations.

Advancement of Automation and Data Analytics in Inspection Processes

Automation and analytics transform practices in the Flight Inspection Market. Smart algorithms process large data volumes captured during inspection flights. It enhances detection of signal distortions and environmental anomalies. Predictive maintenance models reduce downtime by forecasting system performance issues. Cloud-based platforms support remote access to inspection data for regulators and operators. Continuous refinement of analytical tools strengthens accuracy and speeds up reporting cycles.

Sustainability Focus Driving Modernization of Inspection Fleets

Airlines and regulators bring sustainability into the Flight Inspection Market through fleet modernization. Operators retire older inspection aircraft in favor of fuel-efficient platforms. Hybrid and electric propulsion systems enter development for specialized missions. It supports carbon-reduction targets set by global aviation authorities. Lightweight avionics and optimized flight profiles further minimize environmental impact. Market participants align investment strategies with long-term sustainability goals.

Market Challenges Analysis

High Operational Costs and Limited Availability of Specialized Assets

The Flight Inspection Market faces constraints from high operational costs tied to specialized aircraft and equipment. Procurement of inspection fleets requires substantial capital, which restricts participation to well-funded organizations. It demands continuous investment in avionics, calibration tools, and certified crews. Smaller airports and emerging economies struggle to justify such expenses, creating service gaps. Limited availability of inspection aircraft further delays schedules and affects compliance timelines. Operational budgets remain under pressure as governments and private operators balance safety with financial sustainability.

Complex Regulatory Environment and Technological Transition Barriers

The Flight Inspection Market encounters difficulties from complex regulatory requirements across different regions. Each aviation authority enforces unique certification rules that complicate cross-border service delivery. It forces operators to adapt systems and retrain personnel for compliance. Transition toward satellite-based navigation and digital systems presents further challenges. Many operators lack technical capacity to upgrade inspection platforms at required pace. Delays in modernization slow adoption of next-generation air traffic solutions, increasing reliance on outdated infrastructure.

Market Opportunities

Expansion of Air Traffic Infrastructure in Emerging Economies

The Flight Inspection Market benefits from infrastructure investments in rapidly developing regions. Governments allocate resources for new airports, extended runways, and upgraded navigation systems. It creates sustained demand for inspection services to certify operational readiness. Emerging economies prioritize international connectivity, which requires reliable calibration of communication and surveillance aids. Growing fleets of commercial aircraft further intensify the requirement for consistent inspection. Service providers can expand presence in these markets by deploying cost-efficient inspection platforms.

Adoption of Next-Generation Technologies in Inspection Operations

The Flight Inspection Market gains opportunities from adoption of advanced technologies such as UAVs, automation, and satellite navigation. It enables operators to increase precision while reducing operational delays. Cloud-based data sharing offers regulators faster access to inspection results. Integration of AI-powered analytics enhances anomaly detection during calibration flights. Sustainability goals encourage use of fuel-efficient aircraft and hybrid propulsion systems for inspection tasks. Market participants can differentiate by combining technology with tailored inspection services across both civil and defense sectors.

Market Segmentation Analysis:

By System Architecture

The Flight Inspection Market segments by system architecture into onboard integrated systems and other configurations. Onboard integrated systems dominate due to their ability to provide real-time calibration of navigation aids. It improves efficiency by reducing reliance on ground-based systems and minimizing inspection time. Compact avionics packages support multiple functions such as ILS, VOR, and GNSS validation in a single flight. Operators benefit from reduced aircraft downtime and lower operational complexity. Alternative configurations, including portable ground-based systems, still serve smaller airports and regional facilities with limited traffic demand.

- For instance, ENAV operates a dedicated fleet of four Piaggio P.180 Avanti II aircraft, each equipped with the NSM UNIFIS 3000 console alongside all necessary receivers and antennas. These integrated systems enable real-time flight inspection checks.

By Inspection Type

Segmentation by inspection type highlights periodic routine inspections and specialized mission profiles. Periodic routine inspections remain the core requirement, mandated by regulators to ensure continued compliance of air navigation aids. It involves scheduled validation of systems such as DME, radar, and ADS-B. Regular cycles prevent operational disruptions and strengthen confidence in air traffic safety. Special missions, including commissioning of new airports or temporary systems, expand the demand profile. Emergency inspections following technical anomalies also require rapid deployment capabilities. Service providers with versatile fleets gain competitive advantage by handling both routine and specialized requirements.

- For instance, Cobham modified four Bombardier Challenger 604 jets with full search-and-rescue sensor suites and mission management systems. Each aircraft carries dual belly radomes (search radar and direction-finding), a retractable EO/IR tail camera, and high-vision windows.

By End-User

The Flight Inspection Market by end-user includes air navigation service providers, civil aviation authorities, military organizations, and airport operators. Air navigation service providers form the largest segment, managing calibration for national and international airspace systems. It ensures that communication, navigation, and surveillance aids meet regulatory standards. Civil aviation authorities commission inspections to uphold certification and operational safety for commercial air travel. Military users contribute steady demand, with missions requiring precise validation of tactical airbases and remote landing facilities. Airport operators also contract inspection services for modernized infrastructure projects and expansions. Diverse end-user demand secures recurring opportunities across global markets.

Segments:

Based on System Architecture:

- Onboard Integrated Systems

- More

Based on Inspection Type:

Based on End-User:

- Air Navigation Service Providers

- More

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Flight Inspection Market, accounting for 34%. The region leads through strong investments in advanced aviation infrastructure and strict adherence to FAA regulatory standards. It benefits from a high concentration of airports, both commercial and military, that require frequent calibration of navigation aids. The United States dominates regional activity, with the presence of specialized inspection aircraft fleets and certified service providers. Canada contributes with expansion of air traffic systems in remote and northern areas, where safety requirements are critical. It continues to attract investment in modernization projects that require both routine and specialized inspection missions. The demand is reinforced by rapid integration of satellite navigation systems and ongoing upgrades in civil and defense aviation.

Europe

Europe represents the second-largest market, contributing 28% of the Flight Inspection Market. The region’s growth is supported by strict EASA standards and consistent air traffic modernization programs. Countries such as Germany, the United Kingdom, and France invest heavily in both civil and military air navigation systems. It includes deployment of GNSS-based inspection solutions and enhanced automation in calibration processes. Eastern Europe also contributes with increased spending on airport infrastructure to improve regional connectivity. The European market emphasizes sustainability, with operators upgrading to fuel-efficient inspection aircraft and hybrid platforms. Strong defense aviation operations further expand recurring demand for specialized inspection services.

Asia-Pacific

Asia-Pacific accounts for 22% of the Flight Inspection Market, reflecting rapid expansion in aviation infrastructure. China, India, and Japan lead through large-scale airport construction, growing passenger traffic, and integration of performance-based navigation. It relies on flight inspection systems to ensure reliability in high-density corridors and expanding regional networks. Governments allocate substantial budgets for new runways, communication systems, and satellite-based navigation upgrades. Emerging economies in Southeast Asia also boost demand with growing airline fleets and increased regional air traffic. Military aviation inspection contributes additional share, particularly with strategic bases in the Pacific. The region’s long-term growth is fueled by modernization projects and a focus on global connectivity.

Latin America

Latin America holds 9% of the Flight Inspection Market, reflecting moderate but expanding demand. Brazil and Mexico lead regional adoption through major airport modernization and fleet expansion programs. It requires inspection services for both established hubs and new infrastructure projects in secondary cities. Regional governments emphasize improving compliance with ICAO standards to strengthen international operations. Operators face cost constraints, but recurring inspection needs create steady opportunities for service providers. Military aviation contributes a small portion of demand, mainly from Brazil’s active defense sector. Investment in air navigation safety continues to rise gradually, improving growth prospects across the region.

Middle East & Africa

The Middle East & Africa together represent 7% of the Flight Inspection Market. The Middle East demonstrates stronger growth through investments in international aviation hubs in the UAE, Saudi Arabia, and Qatar. It requires consistent inspection services for navigation aids supporting high volumes of long-haul traffic. Africa shows increasing reliance on external service providers due to limited domestic inspection capacity. It benefits from international aid projects supporting airport modernization and compliance with ICAO standards. Defense-related inspection demand adds value, particularly in the Gulf region. The market is smaller than other regions, but steady infrastructure development continues to create new opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Radiola

- Mistras Group

- Bombardier

- Airfield Technology

- Norwegian Special Mission

- ENAV

- Cobham

- Flight Calibration Services

- Aerodata

- Flight Precision

Competitive Analysis

The Flight Inspection Market include Radiola, Mistras Group, Bombardier, Airfield Technology, Norwegian Special Mission, ENAV, Cobham, Flight Calibration Services, Aerodata, and Flight Precision. The Flight Inspection Market is shaped by companies that focus on specialized aircraft platforms, advanced calibration systems, and certified services. Competition revolves around the ability to deliver precise, efficient, and regulatory-compliant inspection solutions across civil and defense aviation. Operators invest in modular avionics, AI-driven analytics, and multi-sensor integration to strengthen accuracy in diverse environments. Service providers differentiate through comprehensive inspection programs, long-term contracts with aviation authorities, and expansion into emerging markets. Innovation in sustainability, including fuel-efficient aircraft and hybrid propulsion systems, further defines competitive positioning. Strong collaborations with regulators and airports ensure recurring demand, creating a stable foundation for growth.

Recent Developments

- In June 2025, Thales Group and Qatar Airways agreed to create an IFE maintenance hub in Doha, signaling closer cooperation that could extend to regional flight-inspection support for the airline’s airport projects.

- In May 2025, BAM clinched several contracts for flight inspection services spanning Denmark, Norway, and Sweden. Its flight inspection team is set to calibrate navigational aids and approach systems at airports throughout the Nordic region.

- In January 2025, The Portuguese Air Force joined Embraer and the Brazilian Air Force in studies to integrate ISR mission kits into KC-390 aircraft, adding a flight-inspection-compatible sensor option.

- In September 2023, the Airport Authority of India (AAI) boosted its flight inspection abilities by adding two B-360 aircraft to its fleet. These planes have advanced flight inspection systems, helping AAI efficiently check the growing number of ground-based navigation aids at Indian airports.

Report Coverage

The research report offers an in-depth analysis based on System Architecture, Inspection Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with continuous modernization of global aviation infrastructure.

- Operators will adopt satellite-based navigation systems that require precise inspection validation.

- Automated data analytics will improve inspection accuracy and reduce reporting time.

- Unmanned aerial systems will play a growing role in routine calibration tasks.

- Demand will rise from emerging economies investing in new airports and air routes.

- Military aviation will continue to drive specialized inspection requirements for tactical airbases.

- Sustainability goals will push adoption of fuel-efficient inspection aircraft and hybrid propulsion systems.

- Cloud-based data sharing will improve regulatory oversight and operational transparency.

- Partnerships between civil authorities and private service providers will strengthen service availability.

- The market will benefit from rising passenger traffic that requires reliable air navigation systems.