Market Overview:

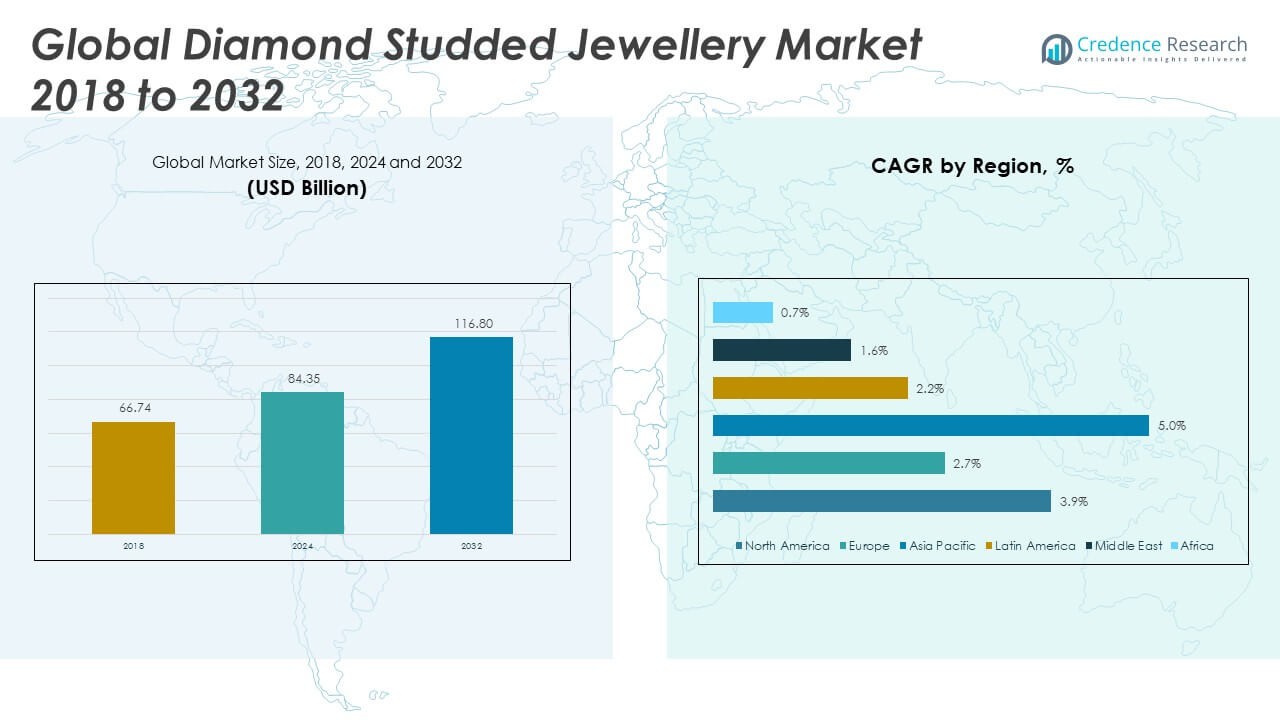

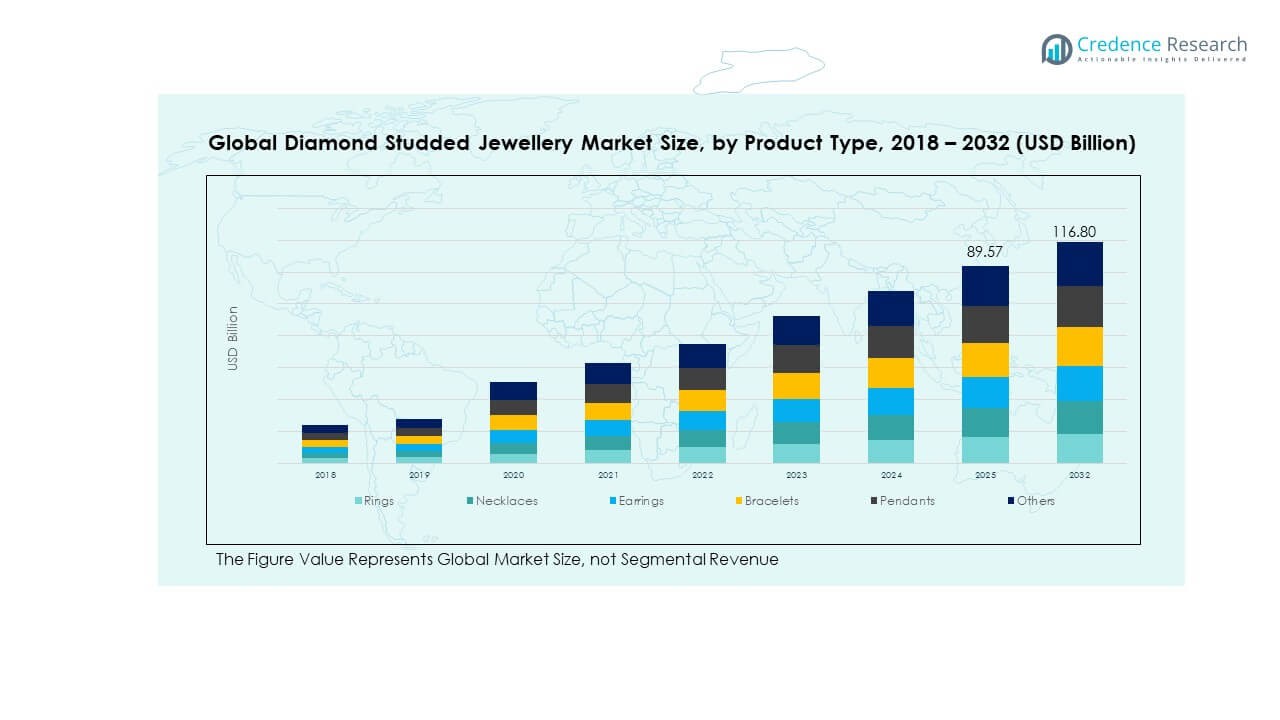

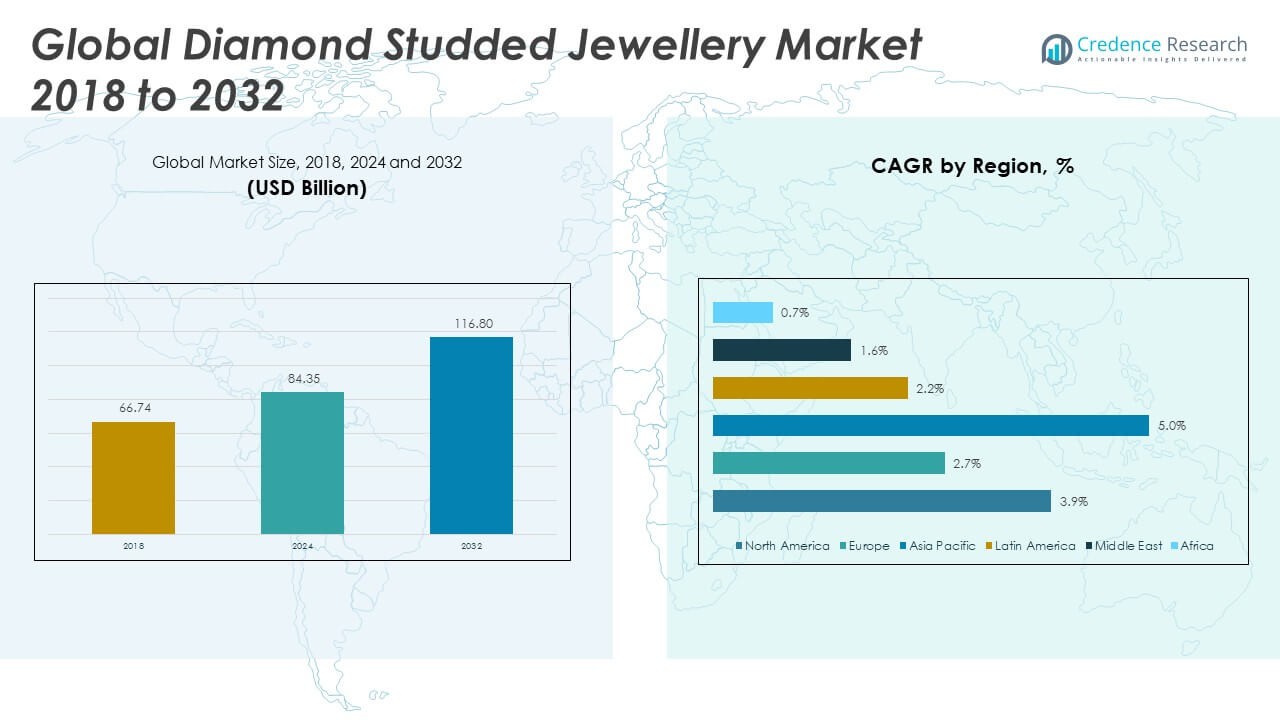

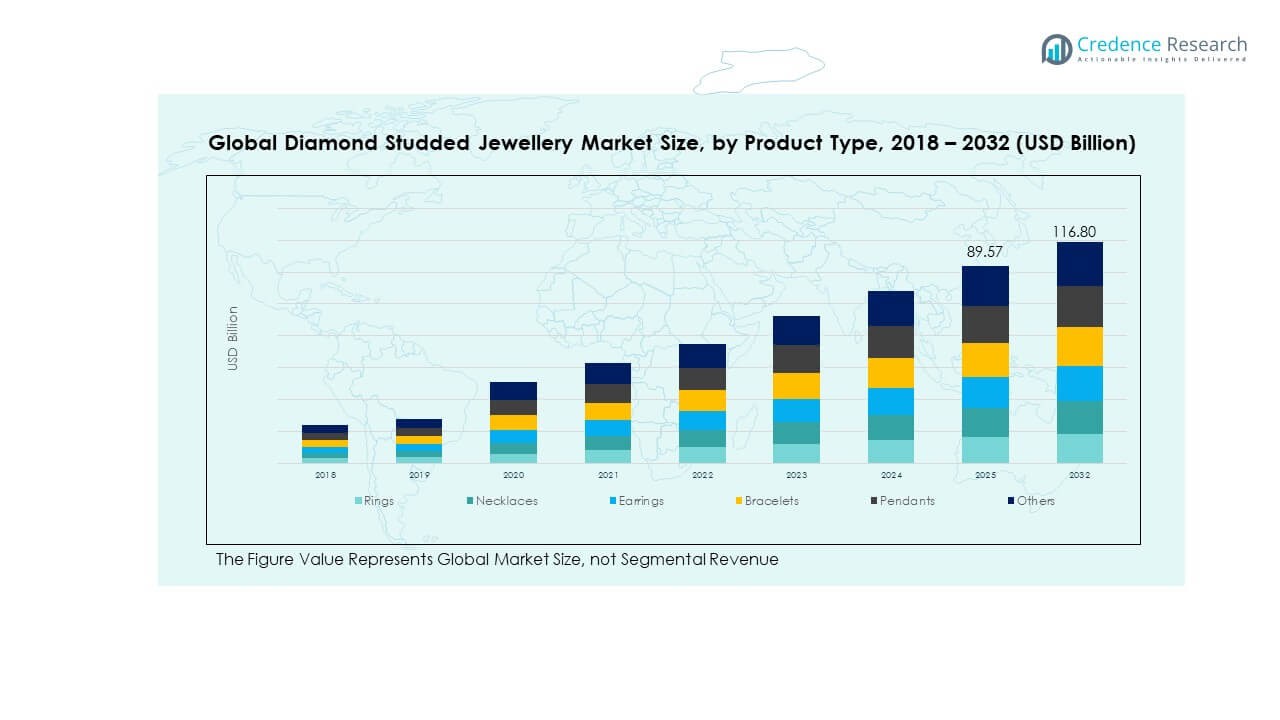

The Global Diamond Studded Jewellery Market size was valued at USD 66.74 million in 2018 to USD 84.35 million in 2024 and is anticipated to reach USD 116.80 million by 2032, at a CAGR of 3.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diamond Studded Jewellery Market Size 2024 |

USD 84.35 Million |

| Diamond Studded Jewellery Market, CAGR |

3.87% |

| Diamond Studded Jewellery Market Size 2032 |

USD 116.80 Million |

The market is driven by rising consumer preference for luxury goods, increasing disposable incomes, and growing gifting culture across both developed and emerging economies. Demand is supported by fashion-conscious millennials and Gen Z, who view diamond jewellery as a symbol of prestige and investment. Expanding product innovation, customization trends, and the growth of branded retail outlets further strengthen market development. Rising popularity of lab-grown diamonds also broadens the consumer base, offering affordable yet appealing options without reducing aspirational value.

Geographically, North America leads the market with strong demand from the United States, fueled by established luxury retail networks and high spending power. Europe follows with steady growth, supported by cultural affinity for fine jewellery in countries such as Italy, France, and the UK. Asia-Pacific is emerging as the fastest-growing market, driven by rising wealth in China and India, coupled with expanding e-commerce adoption. Middle East markets show potential due to cultural significance of jewellery, while Latin America and Africa represent growing opportunities with expanding urban middle-class populations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Diamond Studded Jewellery Market was valued at USD 66.74 billion in 2018, reached USD 84.35 billion in 2024, and is projected to attain USD 116.80 billion by 2032, expanding at a CAGR of 3.87% during 2024–2032.

- North America holds 34% share, driven by strong luxury retail networks and high consumer purchasing power. Europe follows with 28%, supported by cultural affinity for fine jewellery. Asia-Pacific captures 25%, propelled by rapid urbanization and growing disposable incomes in China and India.

- Asia-Pacific is the fastest-growing region with a 25% share, expanding due to rising wealth, e-commerce penetration, and increasing demand for bridal jewellery.

- Rings account for the largest segment at 30%, reflecting their dominance in wedding and engagement traditions globally.

- Necklaces hold 25% share, driven by their cultural significance in Asia-Pacific and popularity in Western luxury fashion trends.

Market Drivers:

Rising Disposable Incomes and Expanding Luxury Spending Patterns Across Key Demographics:

The Global Diamond Studded Jewellery Market benefits from rising disposable incomes across both developed and emerging economies. Middle-class households are increasingly directing higher portions of earnings toward luxury products, creating sustained demand for premium jewellery. Growth in urbanization and the global shift toward aspirational lifestyles reinforce this consumption trend. Consumers view diamond jewellery as both a status symbol and a store of value, aligning with cultural traditions of gifting during weddings, anniversaries, and festivals. Retailers capitalize on this demand by offering tailored collections that balance elegance with affordability. It strengthens brand recognition while broadening access to younger buyers. Strong marketing campaigns also influence purchasing behavior, ensuring consistent growth across diverse income groups.

- For instance, De Beers’ ORIGIN program has registered nearly 3 million diamonds on its blockchain-based Tracr platform since 2022, enhancing transparency and appealing to consumers valuing traceability from mine to retail.

Strong Cultural Affinity for Diamond Jewellery in Weddings, Gifting, and Celebrations:

Cultural and social traditions remain key demand drivers for the Global Diamond Studded Jewellery Market. Weddings, festivals, and family milestones drive consistent consumption, particularly in regions like India, China, and the Middle East. Diamonds hold symbolic significance of wealth, love, and heritage, making them integral to celebratory events. Retailers build on this emotional connection by introducing collections aligned with regional customs and traditions. Evolving consumer expectations push brands to innovate designs that preserve cultural values while adding modern aesthetics. It ensures that diamond jewellery remains central in both traditional and contemporary settings. Strong gifting culture in Western markets also sustains year-round demand. Growing brand loyalty around heritage jewellery houses reinforces long-term revenue.

- For example, Cartier introduced four new Tank à Guichets watch models in 2025 with precision crafting, cases just 6mm thick, and precious metals matched with unique numeral colors, blending heritage design with modern luxury to appeal to tradition-respecting consumers.

Expanding Presence of Organized Retail and Branded Jewellery Stores Globally:

The Global Diamond Studded Jewellery Market benefits from the growth of organized retail and branded stores across key economies. Established brands expand physical and online footprints to provide authenticity and trust to buyers. Organized retail enhances transparency in pricing and quality certification, reducing consumer concerns over counterfeit products. Buyers increasingly prefer branded showrooms and trusted retailers, reinforcing structured distribution networks. It allows global players to strengthen presence in urban centers while reaching semi-urban clusters. Branded outlets also emphasize design innovation and certification processes, adding confidence for first-time buyers. Expanding retail networks combine with e-commerce channels, creating hybrid purchasing options. The model provides both in-store experience and digital convenience, widening consumer access globally.

Rising Demand for Lab-Grown Diamonds and Affordable Luxury Alternatives:

Growing acceptance of lab-grown diamonds provides a critical growth driver for the Global Diamond Studded Jewellery Market. Consumers seeking affordable luxury embrace synthetic diamonds, which offer comparable visual appeal at lower costs. Younger demographics, especially millennials and Gen Z, are more receptive due to ethical sourcing and sustainability concerns. Retailers respond with curated collections featuring lab-grown diamonds, targeting eco-conscious buyers. It expands the customer base beyond high-income groups into broader demographics. Lab-grown options also reduce entry barriers for first-time jewellery purchasers. They encourage gifting at lower price points while maintaining aspirational value. Market acceptance of these alternatives ensures steady long-term demand diversification.

Market Trends:

Growing Integration of Digital Platforms and Virtual Try-On Technologies in Jewellery Sales:

The Global Diamond Studded Jewellery Market experiences rapid adoption of digital technologies to enhance shopping experiences. Virtual try-on tools, 3D product visualizations, and AI-driven recommendations improve consumer engagement. Online platforms provide convenience while ensuring wide product access across global regions. E-commerce channels attract younger customers who prefer seamless, technology-enhanced shopping. It helps brands personalize experiences and build long-term loyalty. Social media campaigns amplify brand visibility, driving impulse purchases and trend adoption. Digital integration also creates efficiency in customer service and after-sales engagement. This technological evolution positions jewellery brands at the forefront of luxury retail innovation.

- For instance, In a June 2025 case study by DigitalDefynd, Tiffany & Co. was cited for its successful deployment of AI-driven personalization. By providing tailored product recommendations based on real-time data, the company achieved several reported gains, including a 40% increase in average order value (AOV) by cross-selling matching items.

Increasing Preference for Customization and Personalized Diamond Jewellery Offerings:

Consumers in the Global Diamond Studded Jewellery Market increasingly demand customized and personalized jewellery. Buyers seek products that reflect individuality, heritage, or emotional value. Retailers offer bespoke services, including tailored cuts, engravings, and unique designs to capture this demand. It creates higher margins while deepening brand-customer connections. Advanced manufacturing techniques and CAD design enable brands to deliver personalized collections with faster turnaround. Luxury houses highlight exclusivity through limited editions, further strengthening brand prestige. Rising popularity of personalized gifting also contributes to long-term revenue. Customization emerges as a defining trend shaping consumer expectations in modern jewellery retail.

- For instance, Bvlgari’s Connected Jewels platform launched in 2025 uses AI-powered optical character recognition to assign digital IDs to jewels via serial numbers as small as 0.7mm, enabling clients to access personalized care, provenance, and aftercare via smartphone—combining craftsmanship with advanced technology to heighten exclusivity and personalization.

Expansion of Sustainable Jewellery Practices and Ethical Sourcing Transparency:

Sustainability and ethical sourcing emerge as defining trends in the Global Diamond Studded Jewellery Market. Consumers increasingly demand clarity on sourcing practices and environmental impact. Jewellery houses adopt conflict-free certifications, recycled gold usage, and sustainable packaging initiatives. It strengthens brand credibility while addressing the growing concerns of eco-conscious buyers. Transparency in sourcing drives consumer confidence, especially in premium jewellery purchases. Brands align with international standards and showcase sustainability as a competitive differentiator. Growing acceptance of lab-grown diamonds also reflects this sustainability orientation. The industry evolves toward a more transparent, ethical, and eco-friendly value chain.

Influence of Global Fashion Trends and Celebrity Endorsements on Consumer Choices:

The Global Diamond Studded Jewellery Market is strongly shaped by global fashion trends and celebrity endorsements. Luxury brands collaborate with fashion houses and celebrities to promote signature collections. Red-carpet appearances, social media promotions, and collaborations with influencers generate aspirational value. It drives younger buyers to align with high-fashion jewellery trends. Global fashion movements also influence design innovations, encouraging experimentation with bold cuts, colors, and settings. It sustains excitement in the market and diversifies product offerings. Jewellery houses leverage these endorsements to expand global visibility. Fashion-led jewellery designs strengthen market relevance in competitive luxury retail.

Market Challenges Analysis:

Rising Price Volatility in Raw Materials and Supply Chain Vulnerabilities:

The Global Diamond Studded Jewellery Market faces challenges due to fluctuations in diamond prices and raw material costs. Supply chain disruptions caused by geopolitical conflicts, mining restrictions, or trade policies impact pricing stability. Uncertainty reduces consumer confidence and complicates long-term planning for manufacturers. Retailers find it difficult to manage inventory costs under such volatility. It creates challenges for smaller players competing against established jewellery houses. Global dependency on limited diamond-producing nations further heightens risks. Sustaining affordability without compromising quality remains a major concern for industry stakeholders. Price volatility continues to pressure profitability across the value chain.

Counterfeit Jewellery and Consumer Trust Issues in Growing Online Channels:

The Global Diamond Studded Jewellery Market is also challenged by rising cases of counterfeit products, especially in online sales. Consumers face risks of misrepresentation in quality, authenticity, and certification. Such concerns undermine trust in digital platforms, despite their convenience. Small-scale vendors often lack standardization in quality checks, creating uneven experiences. It impacts customer loyalty and hinders broader e-commerce growth in jewellery. Brands respond with certification processes, blockchain-based authenticity checks, and stronger guarantees. It adds operational costs but helps rebuild trust with buyers. Combating counterfeit products remains critical to sustaining online jewellery expansion.

Market Opportunities:

Expansion into Emerging Markets with Rising Middle-Class Wealth and Urbanization:

The Global Diamond Studded Jewellery Market has strong opportunities in emerging regions with expanding middle-class populations. Rising incomes in Asia-Pacific, Latin America, and Africa create significant potential for new demand. Urbanization and lifestyle changes reinforce aspirations for luxury jewellery. It positions global and local retailers to tap into diverse cultural gifting traditions. Growing exposure to branded retail and e-commerce channels strengthens accessibility in these regions. Brands can capture new revenue streams by aligning with local cultural preferences. Expanding into these markets ensures sustained global market growth.

Leveraging Lab-Grown Diamonds and Sustainability for Long-Term Market Differentiation:

The Global Diamond Studded Jewellery Market also benefits from rising acceptance of lab-grown diamonds. They appeal to eco-conscious consumers prioritizing ethical sourcing and affordability. It provides an opportunity for retailers to target broader demographics with accessible luxury. Brands emphasizing sustainable practices and eco-friendly certifications gain stronger competitive positioning. Lab-grown options also expand jewellery gifting beyond high-value events into everyday luxury purchases. Market differentiation through sustainability ensures long-term trust and brand loyalty. Companies adopting this approach secure opportunities in both mature and developing regions.

Market Segmentation Analysis:

By Product Type

The Global Diamond Studded Jewellery Market shows strong demand across all product categories, with rings holding the largest share. Rings remain central to cultural traditions, weddings, and engagements, making them the most purchased category worldwide. Necklaces follow closely, driven by their role in both traditional ceremonies and contemporary fashion statements. Earrings contribute significantly as they are widely adopted across age groups and income levels, reflecting their versatility and affordability. Bracelets gain momentum as lifestyle and fashion trends encourage buyers to explore beyond traditional categories. Pendants attract steady demand, supported by gifting culture and symbolic appeal. The “others” category, which includes innovative and fusion designs, highlights how evolving consumer tastes push jewellery houses toward more creative offerings. It indicates a broader shift from conventional preferences to diversified product portfolios.

- For instance, Cartier’s 2025 Tank à Guichets watches exemplify innovation in form and materials, popularizing slim profiles (6mm thickness) and unique time display layouts that complement jewellery offerings, symbolizing the evolving aesthetics consumers desire.

By Sales Channel

Traditional jewellery stores dominate sales, reflecting consumer reliance on trusted retailers for authenticity and personalized service. Specialty stores add value by offering curated and niche collections tailored to evolving fashion demands. Online stores represent the fastest-growing channel, supported by virtual try-on tools, wide product access, and competitive pricing. Younger demographics, particularly millennials and Gen Z, favor digital channels for convenience and transparency. Departmental stores contribute to product visibility and accessibility, though their market presence is less pronounced compared to traditional and online outlets. It underscores how a balance of physical and digital channels strengthens overall market performance.

- For instance, Signet Jewelers reported a negative 8.9% same-store sales growth in fiscal Q1 2025. However, in fiscal Q1 2026, the company posted a 2.5% same-store sales increase, fueled by double-digit e-commerce growth across its three largest brands. This turnaround, following strategic initiatives, projected the company’s online sales to increase, with one industry projection suggesting they could reach $1.66 billion in 2025. This demonstrates the potential for digital channels to drive recovery and growth.

Segmentation:

By Product Type

- Rings

- Necklaces

- Earrings

- Bracelets

- Pendants

- Others

By Sales Channel

- Traditional Jewellery Stores

- Online Stores

- Specialty Stores

- Departmental Stores

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Diamond Studded Jewellery Market size was valued at USD 29.45 billion in 2018 to USD 36.83 billion in 2024 and is anticipated to reach USD 51.15 billion by 2032, at a CAGR of 3.9% during the forecast period. North America holds 43.8% share in 2024, making it the largest regional market. The region benefits from a strong luxury retail network, high consumer purchasing power, and cultural emphasis on engagement and wedding jewellery. The U.S. drives most demand, supported by well-established jewellery brands and marketing campaigns targeting millennials and Gen Z. It also sees rising demand for lab-grown diamonds due to affordability and ethical sourcing concerns. Canada and Mexico contribute through expanding urban populations and increasing luxury consumption. North America remains a mature but stable market, combining tradition with innovation in jewellery design.

Europe

The Europe Diamond Studded Jewellery Market size was valued at USD 12.84 billion in 2018 to USD 15.37 billion in 2024 and is anticipated to reach USD 19.42 billion by 2032, at a CAGR of 2.7% during the forecast period. Europe accounts for 18.4% share in 2024, supported by a strong cultural affinity for fine jewellery across Italy, France, and the UK. The market benefits from heritage jewellery houses and high spending on luxury goods. Demand for exclusive collections and bespoke designs sustains growth despite slower economic expansion. It is shaped by fashion influences and partnerships between jewellery brands and luxury fashion houses. Germany and Spain contribute with rising consumer interest in modern jewellery trends. Europe remains a steady market, driven by a balance of tradition and evolving luxury preferences.

Asia Pacific

The Asia Pacific Diamond Studded Jewellery Market size was valued at USD 18.58 billion in 2018 to USD 24.84 billion in 2024 and is anticipated to reach USD 37.62 billion by 2032, at a CAGR of 5.0% during the forecast period. Asia Pacific holds 29.4% share in 2024, making it the fastest-growing regional market. China and India dominate demand, driven by weddings, cultural traditions, and rising middle-class wealth. Japan and South Korea contribute through luxury consumption patterns and innovative design preferences. It is also boosted by rapid adoption of online retail platforms and strong gifting cultures. Consumers show increasing acceptance of lab-grown diamonds, expanding the affordable luxury segment. Australia and Southeast Asia add momentum with urbanization and exposure to global fashion trends. Asia Pacific emerges as the growth engine of the industry.

Latin America

The Latin America Diamond Studded Jewellery Market size was valued at USD 3.09 billion in 2018 to USD 3.85 billion in 2024 and is anticipated to reach USD 4.71 billion by 2032, at a CAGR of 2.2% during the forecast period. Latin America holds 4.6% share in 2024, with Brazil leading regional consumption. Demand is driven by urbanization, rising disposable incomes, and cultural traditions involving jewellery in celebrations. Argentina and Mexico contribute with niche luxury markets and growing exposure to international brands. It is shaped by increasing e-commerce activity, particularly among younger demographics. Currency fluctuations and economic instability remain challenges but do not prevent gradual growth. Latin America continues to evolve as a secondary market with emerging opportunities in premium jewellery.

Middle East

The Middle East Diamond Studded Jewellery Market size was valued at USD 1.82 billion in 2018 to USD 2.10 billion in 2024 and is anticipated to reach USD 2.45 billion by 2032, at a CAGR of 1.6% during the forecast period. The Middle East accounts for 2.5% share in 2024, with demand concentrated in GCC countries. Jewellery holds deep cultural and social significance, particularly in weddings and religious celebrations. The region favors high-value purchases and luxury brands, supported by wealthy consumer bases. It benefits from Dubai’s role as a global jewellery trading hub. Israel and Turkey contribute with manufacturing and design excellence. It faces slower growth due to economic diversification pressures and global trade volatility. The Middle East remains a niche but culturally significant jewellery market.

Africa

The Africa Diamond Studded Jewellery Market size was valued at USD 0.96 billion in 2018 to USD 1.35 billion in 2024 and is anticipated to reach USD 1.46 billion by 2032, at a CAGR of 0.7% during the forecast period. Africa holds 1.6% share in 2024, making it the smallest regional market. Demand is concentrated in South Africa, which has strong cultural affinity for jewellery and serves as a production hub for diamonds. Egypt contributes through its urban luxury consumer base. It faces challenges from limited retail infrastructure and lower disposable incomes across many countries. Growth is gradual but supported by urbanization and the rise of middle-class consumers in selected economies. Africa remains underpenetrated yet strategically important due to its role in the diamond supply chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- De Beers plc

- Tiffany & Co.

- Cartier

- Bulgari S.p.A.

- Signet Jewelers

- Pandora Jewellery, LLC

- Chow Tai Fook Jewellery Group

- Swarovski AG

- Petra Diamonds Limited

- Trans Hex Group

Competitive Analysis:

The Global Diamond Studded Jewellery Market is highly competitive, characterized by the presence of global luxury brands and regional players. Leading companies such as De Beers, Tiffany & Co., Cartier, Bulgari, and Chow Tai Fook dominate through strong brand equity, diversified portfolios, and expansive retail networks. It is shaped by heritage houses that maintain exclusivity alongside rising brands targeting millennials with modern and affordable collections. The market also witnesses active competition from players adopting lab-grown diamonds to meet ethical and sustainability preferences. Retailers invest heavily in digital platforms, omnichannel strategies, and collaborations to attract younger demographics. Innovation in design, product customization, and celebrity endorsements serve as key differentiators. It reflects a landscape where heritage, brand loyalty, and innovation combine to sustain market leadership.

Recent Developments:

- In August 2025, Tiffany & Co. returned to the US Open with a reimagined pop-up experience featuring a bespoke diamond-studded HardWear tennis racket and cutting-edge digital interaction, celebrating both craftsmanship and innovation during the event. Earlier in April 2025, Tiffany & Co. unveiled their Blue Book 2025 high jewellery collection “Sea of Wonder,” inspired by the ocean’s beauty. They also launched a collaborative artistic partnership with Daniel Arsham in June 2025, revealing a limited-edition HardWear necklace and bronze vessel.

- In July 2025, De Beers reported a loss of $189 million for the first half of 2025 due to subdued demand and a deliberate reduction in diamond mining. The company mined 10.2 million carats in the period, down 23% year on year, and plans to increase production in the coming years while aiming for a recovery in the diamond market. In August 2025, De Beers announced a significant discovery of a new kimberlite field in Angola, marking their first such discovery in three decades, showing ongoing exploration efforts.

- Cartier in 2025 launched refined new watch models, including the historic Tank à Guichets with a digital time display, showcased at Watches and Wonders in April 2025. This collection blends heritage designs with modern technology and craftsmanship, capturing collector interest.

Report Coverage:

The research report offers an in-depth analysis based on product type (rings, necklaces, earrings, bracelets, pendants, others) and sales channels (traditional jewellery stores, online stores, specialty stores, departmental stores). It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for lab-grown diamonds will widen the consumer base for diamond jewellery.

- Increasing disposable incomes will continue to drive purchases in emerging economies.

- Luxury retail expansion in Asia-Pacific will accelerate regional market dominance.

- Digital transformation and virtual try-on features will reshape consumer engagement.

- Customization and personalized jewellery will gain stronger momentum among younger buyers.

- Sustainability and ethical sourcing will become central to brand positioning.

- Strategic collaborations with fashion houses and celebrities will drive aspirational value.

- Traditional jewellery stores will remain key, but online channels will expand faster.

- Innovation in design and craftsmanship will maintain competitiveness among global players.

- The market will balance heritage-driven luxury with modern affordability and accessibility.