Market Overview

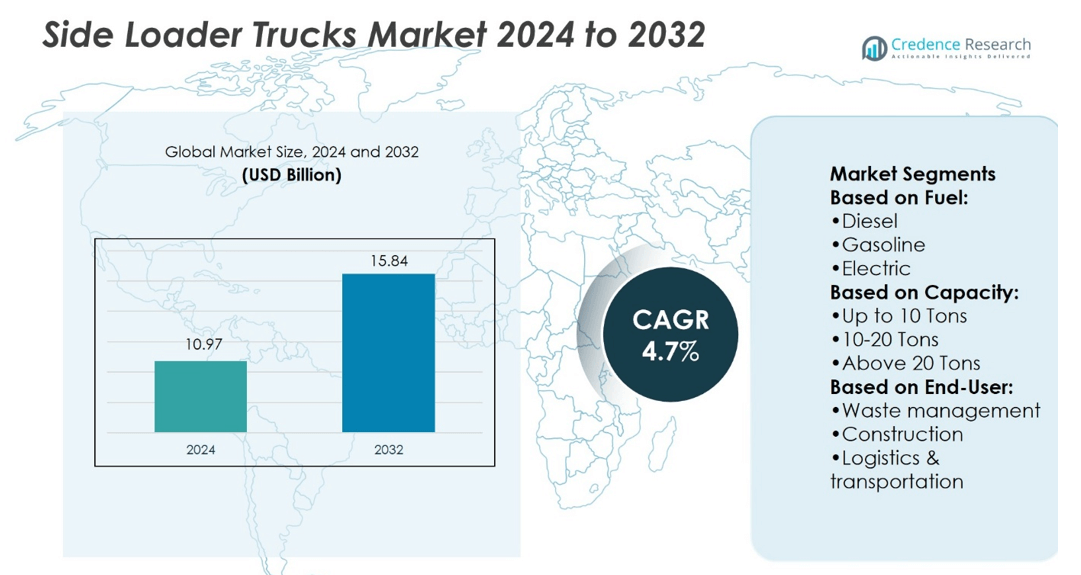

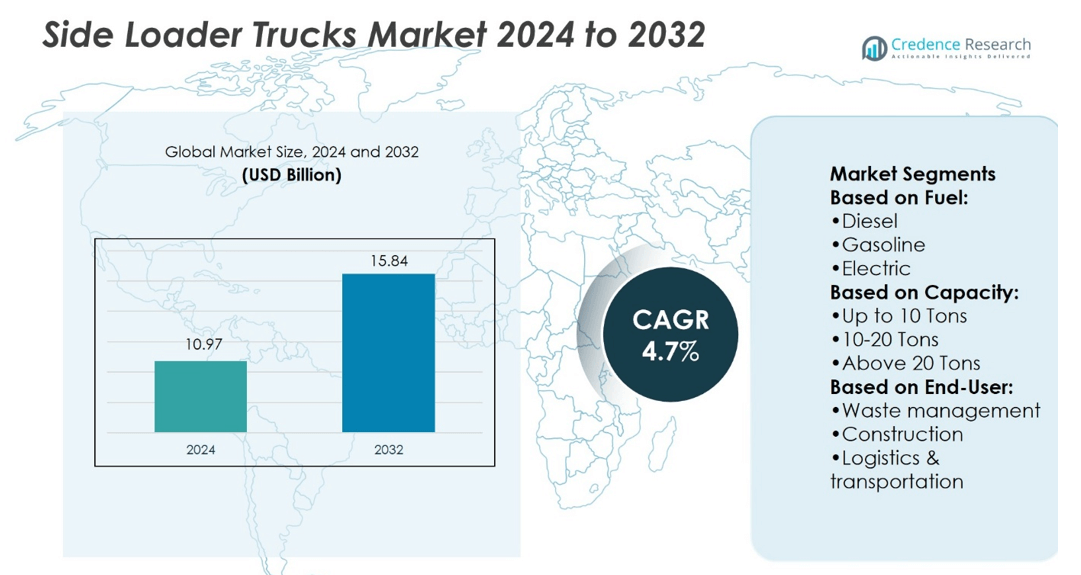

Side Loader Trucks Market size was valued at USD 10.97 billion in 2024 and is anticipated to reach USD 15.84 billion by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Side Loader Trucks Market Size 2024 |

USD 10.97 billion |

| Side Loader Trucks Market, CAGR |

4.7% |

| Side Loader Trucks Market Size 2032 |

USD 15.84 billion |

The Side Loader Trucks Market grows through strong drivers and evolving trends shaping global adoption. Rising urbanization and expanding municipal waste management needs fuel consistent demand for efficient trucks with side-loading capabilities. It supports faster collection cycles and safer operations in dense city environments. Sustainability policies push the shift toward electric and hybrid models, while automation and digital telematics enhance fleet efficiency. Ports and logistics hubs adopt heavy-duty side loaders to streamline container handling and reduce turnaround time. Continuous innovation in hydraulics, ergonomics, and smart monitoring strengthens the market’s alignment with modern operational and environmental requirements.

North America holds a strong share of the Side Loader Trucks Market, supported by advanced municipal waste systems and strict regulatory standards. Europe follows with growing adoption of electric and hybrid models under sustainability mandates. Asia-Pacific records the fastest expansion driven by urbanization, infrastructure growth, and rising industrial demand. Latin America and Middle East & Africa show steady but smaller adoption through fleet modernization programs. Key players focus on innovation, automation, and regional partnerships to strengthen global market presence.

Market Insights

- Side Loader Trucks Market size was valued at USD 10.97 billion in 2024 and is expected to reach USD 15.84 billion by 2032 at a CAGR of 4.7%.

- Rising urbanization and expanding municipal waste collection programs drive consistent adoption of side loader trucks.

- Electrification, automation, and digital telematics emerge as key trends enhancing efficiency and sustainability.

- The market is competitive with global players focusing on innovation, automation, and expanded service networks.

- High initial investment and limited infrastructure for electric models act as restraints in cost-sensitive regions.

- North America holds a strong share with advanced municipal systems, while Europe accelerates adoption under strict sustainability mandates.

- Asia-Pacific records the fastest growth, whereas Latin America and Middle East & Africa show steady expansion through modernization programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Efficient Urban Logistics Solutions

The Side Loader Trucks Market benefits from the rising need for efficient urban freight movement. Congested city environments require trucks that can load and unload from the side, reducing the space needed for operations. It supports faster turnaround for delivery companies and reduces disruption to traffic flow. Retail and e-commerce sectors rely heavily on flexible logistics equipment to keep pace with rising customer expectations. Governments are promoting smart city projects that emphasize efficient distribution systems. This alignment makes side loader trucks a preferred choice in metropolitan areas.

- For instance, Labrie’s Automizer side loader performs around 180 lift‑and‑compact cycles per hour, using a 12‑foot‑reach arm that handles containers weighing up to 1000 lb delivering strong productivity in tight spaces.

Rising Focus on Waste Management and Recycling Operations

Global emphasis on recycling and waste collection drives adoption of specialized side loader designs. Municipalities and private operators use these trucks to streamline residential and commercial waste handling. It allows faster and safer bin collection, improving efficiency in daily routes. Increasing regulations on waste segregation and disposal push cities to modernize fleets. Manufacturers offer automated loading systems to minimize labor costs and improve worker safety. The combination of technology and regulation creates strong momentum for the segment.

- For instance, Mack now offers the LRe (LR Electric refuse model) fitted with the fully electric Heil RevAMP Automated Side Loader body, enabling shake-free, 8-second arm cycles, powered by a 46 kWh body battery that supports more than 1,200 container pickups on a single overnight charge.

Expansion of Port and Container Handling Activities

Ports and logistics hubs demand vehicles that optimize container movement in restricted areas. The Side Loader Trucks Market gains from their ability to handle containers without cranes, reducing operational bottlenecks. It improves productivity for shippers by lowering handling times and operational risks. Expanding international trade and rising container volumes highlight the importance of side loader trucks in terminal operations. Fleet operators favor these trucks for their adaptability to diverse cargo types. The demand aligns with growing investment in port infrastructure worldwide.

Technological Advancements Enhancing Operational Performance

Manufacturers introduce advanced hydraulics, telematics, and automation features to strengthen product efficiency. It enables operators to monitor performance, reduce fuel consumption, and extend service life. Side loader trucks equipped with IoT systems help logistics managers track routes and optimize maintenance schedules. Electric and hybrid models reduce emissions, aligning with sustainability mandates in several regions. Ergonomic designs enhance driver comfort and safety, raising acceptance in both commercial and municipal use. Continuous innovation positions side loader trucks as essential assets for modern logistics networks.

Market Trends

Increasing Shift Toward Electrification and Sustainable Fleet Solutions

The Side Loader Trucks Market is witnessing a steady transition toward electric and hybrid-powered models. Governments are enforcing stricter emission norms, pushing fleet operators to adopt greener alternatives. It reduces operating costs over time through lower fuel consumption and simplified maintenance. Municipalities in major cities are integrating electric side loaders into waste collection fleets. The adoption of renewable energy infrastructure supports this trend further. Manufacturers invest heavily in battery technology to extend range and performance for urban logistics.

- For instance, FULONGMA’s BEV side-load electric truck, equipped with a CATL battery, offers a capacity of 218.54 kWh, supports a driving range of at least 420 km, and lifts approximately 4.5 m³ of waste. Its main motor delivers a peak power of 160 kW at 3000 rpm, while the lifting arm completes its cycle in under 20 seconds.

Integration of Digital Monitoring and Telematics Systems

Fleet operators prioritize visibility and control over daily operations, driving telematics integration. Side loader trucks equipped with IoT sensors and GPS provide real-time tracking of routes and performance. It allows managers to schedule preventive maintenance and reduce downtime. Data-driven insights improve decision-making, enhancing fuel efficiency and operational safety. Companies deploy software platforms that consolidate fleet information into actionable dashboards. The growing use of digital tools strengthens the long-term adoption of technologically advanced trucks.

- For instance, Dennis Eagle adopted a video-enabled driver protection solution for its service engineer vans. The system was rolled out to 112 vans operating from a network of 18 national sites.

Rising Customization for Industry-Specific Applications

Demand for tailored side loader designs is increasing across diverse industries. The Side Loader Trucks Market caters to ports, recycling operations, retail logistics, and heavy industry with specialized configurations. It enables operators to address unique cargo dimensions and space restrictions. Container handling trucks integrate reinforced frames for durability in port operations. Municipal models emphasize compact designs for narrow city streets. The trend toward customization ensures wider market penetration across both developed and emerging economies.

Expanding Role of Automation in Loading and Safety Features

Automation continues to transform side loader truck functionality. Semi-automated arms and hydraulic systems streamline waste collection and material handling. It reduces manual intervention, lowering labor risks and improving efficiency. Safety features such as collision sensors and camera-assisted navigation gain strong acceptance in urban settings. Automated systems also reduce cycle times, supporting faster logistics in dense environments. Continuous progress in automation ensures these trucks remain aligned with evolving industry needs.

Market Challenges Analysis

High Initial Costs and Infrastructure Limitations Restricting Broader Adoption

The Side Loader Trucks Market faces significant hurdles due to the high upfront investment required for advanced models. Electric and hybrid variants demand even higher capital, creating barriers for small fleet operators. It limits adoption in cost-sensitive regions where budget constraints dominate purchasing decisions. Infrastructure for charging and maintenance also remains underdeveloped in many countries, slowing the transition to sustainable fleets. Limited access to skilled technicians further increases operational challenges for advanced models. These factors collectively restrain rapid expansion despite rising global demand.

Regulatory Pressure and Operational Constraints Impacting Market Growth

Strict emission norms and safety regulations raise compliance costs for manufacturers and fleet operators. The Side Loader Trucks Market must adapt quickly to diverse regional policies, which often vary in complexity. It creates operational strain for global brands managing multi-country fleets. Urban restrictions on heavy vehicle movement during peak hours further reduce efficiency and utilization. Supply chain disruptions and volatility in raw material availability add to the cost burden. These regulatory and operational pressures challenge consistent growth and innovation in the industry.

Market Opportunities

Expansion into Emerging Economies and Growing Infrastructure Investments

The Side Loader Trucks Market presents strong opportunities across emerging economies where logistics and municipal services are expanding rapidly. Rising investments in smart city projects and port infrastructure create a favorable environment for adoption. It offers manufacturers the chance to introduce cost-efficient models that balance durability with advanced features. Growing demand for organized waste management in developing regions further enhances prospects. Urbanization and industrialization drive requirements for versatile equipment that can perform in constrained spaces. These factors collectively open new revenue streams for global and regional players.

Advancement in Green Technologies and Digital Integration

Technological innovation creates a significant opportunity for market participants to capture long-term growth. The Side Loader Trucks Market benefits from rising interest in electric and hybrid models that align with sustainability targets. It enables companies to differentiate through innovations in battery efficiency, automated systems, and digital fleet management tools. Integration of IoT and telematics strengthens customer value by improving operational visibility. Partnerships with governments and private operators for clean transport solutions expand growth potential. Continuous focus on digital and green technologies positions the sector for future resilience.

Market Segmentation Analysis:

By Fuel

The Side Loader Trucks Market divides into diesel, gasoline, and electric variants. Diesel trucks dominate current use due to their power and established fueling infrastructure. It ensures strong performance for heavy-duty operations across ports, waste collection, and construction. Gasoline-powered models remain limited but serve lighter operations where cost efficiency is critical. Electric side loader trucks are gaining visibility as governments enforce emission regulations and operators seek sustainable solutions. Manufacturers focus on improving battery range and charging networks to accelerate adoption in urban fleets.

- For instance, XCMG’s MQH37A Container Side Lifter supports both 20-ft and 40-ft containers with a maximum lifting capacity of 37,000 kg, a stabilizer outreach of 3,200 mm, and a working range of 4,000 mm, all housed in a unit weighing 7,000 kg.

By Capacity

Capacity segments include up to 10 tons, 10–20 tons, and above 20 tons. Trucks up to 10 tons serve compact urban routes and municipal waste operations where maneuverability is essential. It supports efficient collection in dense neighborhoods. The 10–20 tons category covers medium-duty applications, balancing payload with versatility across logistics and construction. Above 20 tons represents the heavy-duty range, vital for ports, industrial hubs, and large-scale projects. These trucks provide extended durability and higher operational efficiency in demanding environments. Each capacity band addresses distinct operational needs, ensuring broad market coverage.

- For instance, Bridgeport’s Ranger Automated Side Loader offers a 4 cubic yard hopper capacity, with an arm reach of 96 in, optional 144 in extended reach, and a cycle time of 7–8 seconds at 750 RPM.

By End-user

End-user segmentation highlights waste management, construction, and logistics and transportation. Waste management remains a dominant application, driven by rising urban population and strict regulations on waste collection. It benefits from automated side loader systems that reduce labor dependency. Construction activities generate strong demand for medium and heavy-capacity trucks to handle varied materials on-site. Logistics and transportation adopt side loaders for container movement, last-mile delivery, and specialized cargo handling. Growth in e-commerce and trade expansion reinforces their utility across multiple industries. These varied applications sustain long-term demand for innovative side loader designs.

Segments:

Based on Fuel:

Based on Capacity:

- Up to 10 Tons

- 10-20 Tons

- Above 20 Tons

Based on End-User:

- Waste management

- Construction

- Logistics & transportation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 34% share of the Side Loader Trucks Market, supported by established waste management systems and advanced logistics networks. Municipalities in the United States and Canada invest heavily in automated waste collection fleets, driving consistent demand for side loaders. It aligns with government sustainability mandates that push adoption of cleaner fuel technologies, including hybrid and electric variants. High urban density in major cities such as New York, Los Angeles, and Toronto amplifies the requirement for efficient vehicles that can operate in restricted spaces. The presence of leading manufacturers and technology developers ensures steady innovation in safety features, automation, and digital monitoring. North America remains a mature market where replacement demand and regulatory compliance sustain growth momentum.

Europe

Europe accounts for a 28% share of the Side Loader Trucks Market, reflecting the region’s strong regulatory environment and emphasis on sustainability. Strict emission standards under the European Union framework accelerate the transition toward electric and hybrid models. It creates opportunities for manufacturers to launch eco-friendly designs tailored for urban logistics and recycling operations. Countries such as Germany, France, and the United Kingdom invest in modernizing municipal fleets, integrating IoT and telematics into waste management. Ports in Rotterdam, Hamburg, and Antwerp also adopt heavy-duty side loaders for efficient container handling. The region’s commitment to circular economy practices continues to drive demand across multiple end-user segments.

Asia-Pacific

Asia-Pacific holds a 24% share of the Side Loader Trucks Market and demonstrates the fastest growth potential. Rapid urbanization in China, India, and Southeast Asia creates a surge in demand for efficient waste collection and logistics solutions. It aligns with rising investments in infrastructure, port expansion, and smart city projects. Domestic manufacturers in China and Japan introduce cost-effective designs, while global players expand partnerships to capture regional opportunities. Governments are encouraging adoption of clean fuel vehicles through incentive programs and subsidies, boosting interest in electric side loaders. The scale of e-commerce growth across Asia also reinforces the need for flexible logistics equipment. Asia-Pacific is positioned to lead long-term expansion of this industry.

Latin America

Latin America represents a 7% share of the Side Loader Trucks Market, shaped by gradual adoption of modern waste collection and logistics practices. Brazil and Mexico remain the largest contributors, investing in municipal fleet upgrades to meet urban waste challenges. It reflects a growing awareness of operational efficiency and worker safety in waste handling operations. However, budget constraints and infrastructure gaps slow wider adoption across smaller economies in the region. International players explore opportunities through public-private partnerships and pilot projects to introduce automated and electric side loaders. Latin America shows steady but slower progress compared to developed markets.

Middle East & Africa

The Middle East & Africa account for a 7% share of the Side Loader Trucks Market, with demand concentrated in urban centers and industrial hubs. Gulf countries such as the United Arab Emirates and Saudi Arabia prioritize modern waste management as part of sustainability agendas like Vision 2030. It drives adoption of side loader trucks with advanced features tailored for municipal services. Ports across the Middle East also create demand for heavy-duty models supporting container logistics. In Africa, South Africa and Egypt lead adoption, though infrastructure limitations restrict wider deployment. Despite challenges, rising investment in smart city and port development projects ensures long-term potential for growth in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Labrie Group

- Autocar, LLC

- Mack Trucks (AB Volvo)

- FULONGMA GROUP Co., Ltd.

- Dennis Eagle Inc.

- XCMG

- FAUN Umwelttechnik GmbH & Co. KG

- Kirchhoff Group

- Bridgeport Manufacturing

- Dongfeng Motor Corporation Ltd.

Competitive Analysis

The Side Loader Trucks Market include Labrie Group, Autocar, LLC, Mack Trucks (AB Volvo), FULONGMA GROUP Co., Ltd., Dennis Eagle Inc., XCMG, FAUN Umwelttechnik GmbH & Co. KG, Kirchhoff Group, Bridgeport Manufacturing, and Dongfeng Motor Corporation Ltd. The Side Loader Trucks Market demonstrates a competitive landscape shaped by innovation, sustainability, and regional expansion strategies. Leading manufacturers focus on developing electric and hybrid models to comply with strict emission norms while enhancing operational efficiency. It supports municipal authorities and private operators seeking cost-effective, low-maintenance solutions for waste management, logistics, and construction. Companies prioritize automation, integrating telematics, IoT, and advanced hydraulic systems to improve safety and productivity. Strong investment in research and development ensures continuous improvement in payload capacity, durability, and driver comfort. Global players also expand service networks and enter strategic partnerships to strengthen aftersales support and market reach. This blend of technological advancement and regional diversification defines the core of competition in the sector.

Recent Developments

- In August 2025, Mack Pioneer Trucks (AB Volvo) focus on robust and highly customizable side loader trucks for waste handling and construction applications, enhancing operational efficiency and driver safety through advanced automation and telematics.

- In June 2025, GFL Environmental Services acquired OSI, marking one of its first major deals since the company’s spin-off. This acquisition strengthens GFL’s market position and signals a renewed growth strategy post-restructuring.

- In January 2025, Amrep announced a new official dealer partnership with MTech, effective on January 15, 2025. With this agreement, MTech located in Cleveland, Ohio, will cover the Amrep front-end loaders, automated side loaders, and rear-loader refuse truck products for the entire Ohio, Michigan and Western Pennsylvania region.

- In September 2024, Casella Waste Systems announced the acquisition of Royal Carting and Welsh Sanitation, expanding its footprint in the Northeastern U.S. The move is expected to enhance operational efficiency and customer reach in key regional markets.

Report Coverage

The research report offers an in-depth analysis based on Fuel, Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric and hybrid models will expand with stricter global emission norms.

- Urbanization will increase reliance on compact and efficient side loader trucks.

- Automation and robotic arms will gain wider adoption in waste collection operations.

- Telematics and IoT integration will improve fleet management and operational efficiency.

- Ports and logistics hubs will drive demand for high-capacity side loader trucks.

- Municipal modernization programs will support consistent adoption in developed economies.

- Emerging markets will generate growth opportunities through infrastructure development projects.

- Sustainability mandates will accelerate innovation in lightweight and recyclable materials.

- Strategic collaborations will strengthen product portfolios and service capabilities worldwide.

- Continuous R&D investment will enhance safety, durability, and driver comfort features.