Market Overview

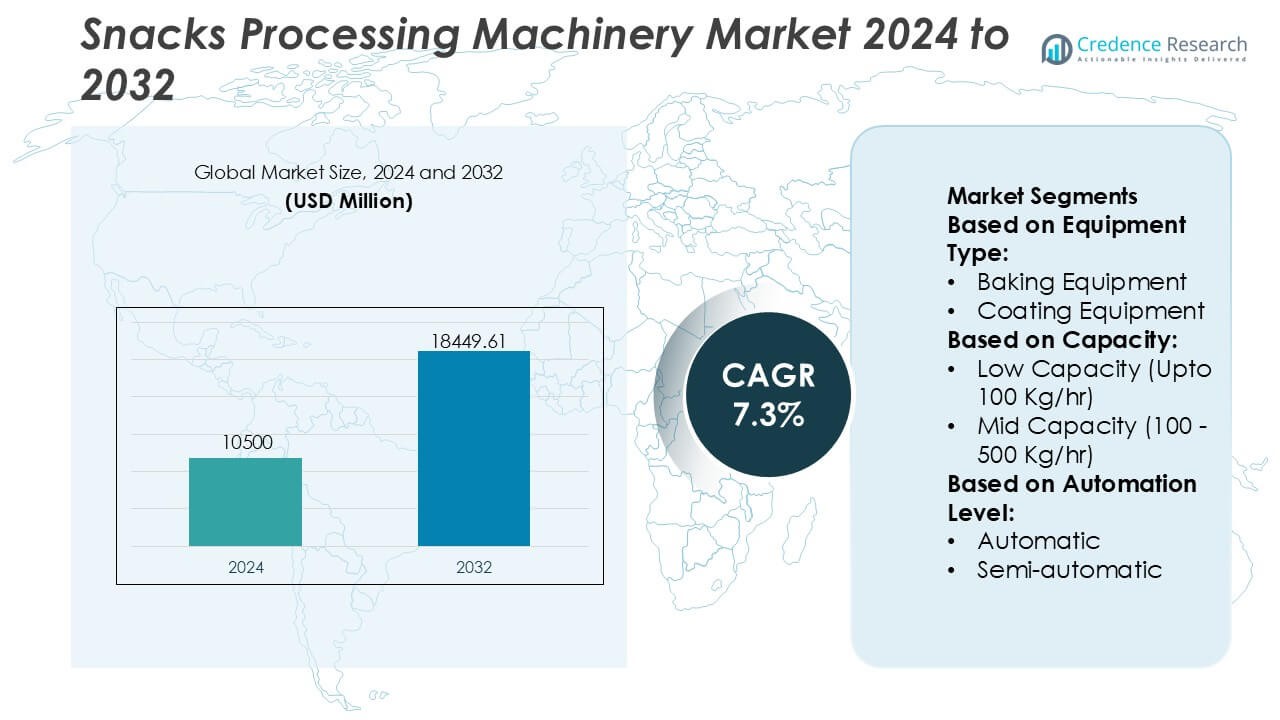

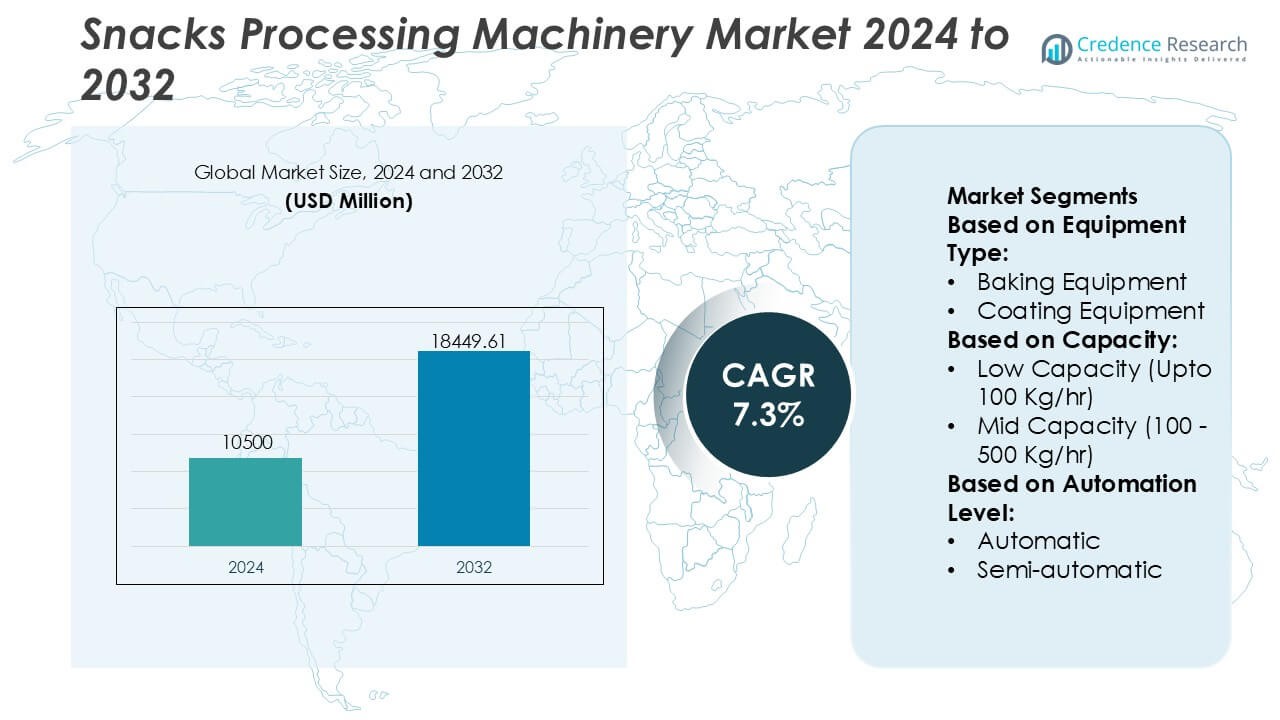

Snacks Processing Machinery Market size was valued USD 10500 million in 2024 and is anticipated to reach USD 18449.61 million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Snacks Processing Machinery Market Size 2024 |

USD 10500 Million |

| Snacks Processing Machinery Market, CAGR |

7.3% |

| Snacks Processing Machinery Market Size 2032 |

USD 18449.61 Million |

The Snacks Processing Machinery Market is shaped by leading global players such as Douglas Machine Inc., Krones AG, Maillis Group, Tetra Laval International S.A., Syntegon Technology GmbH, I.M.A. Industria Macchine Automatiche S.p.A., Rovema GmbH, Langley Holding plc, KHS Group, and SIG, each advancing technological capabilities through automation, energy-efficient designs, and integrated processing solutions. These companies focus on intelligent monitoring systems, high-precision extrusion lines, and modular equipment tailored to expanding snack portfolios. Asia-Pacific holds the leading regional position with an exact 34% market share, driven by strong consumer demand, rapid industrial expansion, and rising investments in high-capacity, automated snack manufacturing facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Snacks Processing Machinery Market size reached USD 10,500 million in 2024 and is projected to hit USD 18,449.61 million by 2032 at a 7.3% CAGR, reflecting steady long-term expansion.

- Strong demand for high-capacity extrusion, frying, and packaging systems drives market growth, supported by rising consumption of ready-to-eat and functional snacks across global markets.

- Leading players, including Douglas Machine Inc., Krones AG, Maillis Group, and others, strengthen competitiveness through automation, energy-efficient machinery, and modular system integration.

- Capital-intensive equipment costs and the need for skilled operators remain key restraints, limiting adoption among small and mid-scale processors and slowing modernization cycles.

- Asia-Pacific leads with a 34% share, while extrusion equipment holds the dominant segment share, supported by large-scale manufacturing expansion and strong demand for diverse snack formats.

Market Segmentation Analysis:

By Equipment Type

The Snacks Processing Machinery Market demonstrates strong traction across multiple equipment categories, with Extrusion Equipment holding the dominant position with an estimated 32% market share. Its leadership emerges from high throughput efficiency, uniform product shaping, and compatibility with diverse snack formulations, including puffed snacks and ready-to-eat extruded products. Baking and coating systems gain demand from the rising shift toward healthier, non-fried snacks, while frying and roasting equipment remains essential for traditional product lines. Packaging Equipment shows stable adoption due to the need for speed, precision, and shelf-life extension. Growth across categories is reinforced by automation upgrades and the need for energy-efficient machinery.

- For instance, Douglas Machine Inc. enhanced throughput capability in its automated washdown-duty packaging platforms, such as the Vectra cartoner, by integrating servo-driven motion control systems that can achieve cycle rates of up to 300 cartons per minute.

By Capacity

In terms of production capacity, the High-Capacity segment dominates the market with approximately 46% share, supported by large-scale snack manufacturers expanding throughput to meet rising consumption in urban and export-driven markets. High-capacity machinery delivers consistent output, reduced unit production costs, and superior operational reliability, making it the preferred choice for established players. Mid-capacity systems experience demand among mid-sized processors seeking flexible scaling, while low-capacity units attract small enterprises or startups entering niche snack categories. Capacity selection strongly reflects production goals, energy optimization needs, and evolving consumer preferences favoring diversified snack formats.

- For instance, Krones AG Varioline modular packaging system integrates multi-format handling with an output capability of up to 104,000 containers per hour or 720 cycles per hour in returnable applications, and supports numerous format changeovers per line.

By Automation Level

Across automation levels, the Automatic segment leads with nearly 54% market share, driven by processors prioritizing labor reduction, improved hygiene, and higher operational precision. Automatic systems support continuous processing, real-time quality control, and faster changeovers, making them ideal for high-volume snack production. Semi-automatic machinery remains relevant for regional manufacturers balancing cost and efficiency, while manual equipment caters to small operators producing artisanal or customized snack variants. The shift toward data-enabled, fully automated machinery accelerates due to rising food safety requirements, demand for consistent product quality, and the industry’s focus on minimizing operational downtime.

Key Growth Drivers

Rising Demand for Ready-to-Eat and Convenience Snacks

Growing global consumption of ready-to-eat and convenience snack products significantly accelerates demand for advanced processing machinery. Manufacturers adopt high-efficiency extruders, fryers, and coating systems to support large-volume, continuous production and maintain consistent product quality. Changing lifestyles, rapid urbanization, and increased snacking frequency strengthen the need for automated, reliable machinery capable of producing diverse formats. Consumers favor baked, puffed, and functional snacks, driving investment in flexible equipment that supports quick recipe changeovers and innovation-focused production cycles.

- For instance, Maillis Group reports verified performance data on its MOSCA-based strapping and end-of-line automation systems, where its SoniXs MP-6 T model integrates ultrasonic sealing with a documented cycle rate of up to 58 cycles per minute and achieves a typical seal joint strength of up to 80% of the strap’s tensile strength.

Expansion of Automated and Integrated Processing Lines

The industry experiences strong growth momentum due to rising adoption of fully automated production lines that enhance output, reduce human intervention, and improve hygiene standards. Automated systems enable real-time monitoring, precise ingredient dosing, and uniform frying or extrusion, elevating production efficiency. Food processors increasingly integrate robotics and sensor-enabled controls into mixing, forming, and packaging units to minimize operational errors. This shift toward automation strengthens long-term cost efficiency and supports consistent quality demanded by global and regional snack brands.

- For instance, Tetra Laval International S.A., through Tetra Pak, documents that its Tetra Pak® Continuous Freezer integrates an automated air-incorporation control system capable of maintaining overrun accuracy within (pm 0.5) units, while the Tetra Pak® High Shear Mixer delivers verified batch homogenization using a rotor-stator design to generate intense shear forces efficiently.

Innovation in Healthy and Functional Snack Formulations

Health-aware consumers fuel demand for machinery that supports the production of low-oil, baked, high-fiber, and protein-enriched snacks. Equipment manufacturers respond by developing energy-efficient ovens, precision coating systems, and advanced extruders capable of handling alternative grains and plant-based ingredients. Growing interest in gluten-free, clean-label, and nutrient-enhanced snacks expands machinery requirements for gentle processing, controlled moisture management, and improved texturization. This trend encourages manufacturers to prioritize modular, flexible equipment that enables continuous product innovation.

Key Trends & Opportunities

Growing Adoption of IoT, AI, and Smart Monitoring Technologies

The industry witnesses a surge in digitalization, with IoT-enabled sensors, AI-driven process optimization, and predictive maintenance tools enhancing machine performance. These technologies help reduce downtime, improve temperature and moisture control, and support end-to-end traceability. Smart machinery strengthens preventive maintenance cycles, lowers operational risks, and provides manufacturers with data-driven insights to improve throughput and reduce waste. This advancement aligns with the sector’s growing focus on intelligent, automated processing environments.

- For instance, IMA claims extensive experience and innovation: the IMA Group reports having over 600 granted patents and more than 60 years of experience in automation and packaging machinery design and manufacturing.

Shift Toward Sustainable and Energy-Efficient Machinery

Rising energy costs and stricter environmental standards create strong opportunities for sustainable processing machinery. Manufacturers increasingly develop low-emission fryers, heat-recovery baking systems, and optimized ventilation units that reduce fuel consumption. Demand grows for equipment designed to minimize oil usage, improve waste handling, and support recyclable or biodegradable packaging materials. Sustainability-driven innovation strengthens competitive positioning while addressing the environmental expectations of global snack producers and retailers.

- For instance, Rovema’s broad commitment to sustainable packaging materials through its technical centre in Fernwald, the company conducts over 130 application tests annually with alternative, renewable or recyclable packaging films to verify seal integrity, output rate, and compatibility allowing clients to switch to thin or mono-material films without compromising performance.

Key Challenges

High Capital Investment for Advanced Machinery

The cost of purchasing technologically advanced, automated processing equipment presents a major challenge for small and mid-sized manufacturers. High initial investment, installation costs, and the need for skilled operators restrict adoption, particularly in emerging markets. Companies face difficulty justifying expenditures without guaranteed volume growth or stable demand cycles. Limited access to financing further slows modernization efforts, widening the technology gap between large corporations and smaller local processors.

Stringent Food Safety and Regulatory Compliance Requirements

Compliance with evolving food safety regulations places operational pressure on manufacturers to maintain rigorous cleanliness, traceability, and machine sanitization standards. Equipment must meet strict guidelines related to material safety, contamination control, and hygienic design. Failure to align with regulatory expectations can lead to product recalls, penalties, or operational disruptions. Meeting these standards requires continuous upgrades, specialized maintenance, and investments in sanitary automation, challenging companies with limited resources.

Regional Analysis

North America

North America holds roughly 28% of the Snacks Processing Machinery Market, supported by strong demand for convenient, premium, and functional snack products. Large-scale manufacturers prioritize automated extrusion, frying, and packaging systems to maintain consistent quality and reduce labor dependency. High investment capacity accelerates the adoption of IoT-enabled machinery and predictive maintenance technologies. The region’s mature snack industry, coupled with stringent food safety regulations, drives continuous equipment upgrades. Innovation in plant-based and clean-label snacks further strengthens machinery demand across both established brands and emerging specialty processors.

Europe

Europe captures approximately 24% of the global market, driven by increasing preference for healthy, baked, and low-fat snack varieties. Manufacturers invest in sustainable and energy-efficient machinery to comply with strict environmental and food safety standards. Growth in extruded snacks, gourmet varieties, and organic private-label products fuels demand for flexible, modular processing lines. Technological adoption remains strong in Germany, the U.K., Italy, and France, where producers emphasize automation and precision control. The region’s advanced engineering base supports high-quality equipment manufacturing, reinforcing Europe’s influence in machinery innovation and exports.

Asia-Pacific

Asia-Pacific leads the market with an estimated 34% share, driven by rapid urbanization, expanding middle-class consumption, and increasing snack production capacity across China, India, Japan, and Southeast Asia. Manufacturers adopt high-capacity extrusion, frying, and packaging systems to meet large-volume domestic demand. Cost-competitive machinery production in China strengthens regional supply capabilities. Rising preference for Western-style snacks, along with strong growth in traditional savory formats, accelerates machinery upgrades. Investments in automation and hygienic design increase as regional processors scale operations and pursue export-oriented manufacturing strategies.

Latin America

Latin America accounts for nearly 8% of the market, supported by growing snack consumption in Brazil, Mexico, Argentina, and Chile. Regional processors focus on mid-capacity machinery to balance affordability and efficiency. Expanding bakery snacks, corn-based extruded products, and flavored roasted snacks drive machinery modernization. Adoption of automated systems remains moderate but increases as manufacturers aim to improve hygiene, reduce waste, and enhance consistency. Local economic fluctuations influence investment cycles, yet rising urban demand and retail expansion sustain long-term machinery requirements.

Middle East & Africa

The Middle East & Africa region holds around 6% share, driven by rising demand for packaged snacks and increasing investments in local food processing facilities. Growth in fried snacks, baked snacks, and extruded products encourages adoption of versatile, low-maintenance equipment. The UAE, Saudi Arabia, and South Africa lead technological adoption, while emerging markets focus on cost-effective systems. Expanding retail channels, tourism-driven food consumption, and government initiatives to strengthen domestic manufacturing support machinery demand. Infrastructure challenges and limited access to high-end automation restrain faster penetration but present long-term growth opportunities.

Market Segmentations:

By Equipment Type:

- Baking Equipment

- Coating Equipment

By Capacity:

- Low Capacity (Upto 100 Kg/hr)

- Mid Capacity (100 – 500 Kg/hr)

By Automation Level:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Snacks Processing Machinery Market features a diverse mix of global leaders, including Douglas Machine Inc., Krones AG, Maillis Group, Tetra Laval International S.A., Syntegon Technology GmbH, I.M.A. Industria Macchine Automatiche S.p.A., Rovema GmbH, Langley Holding plc, KHS Group, and SIG. These companies strengthen their market positions through continuous technological upgrades, automation-driven machinery portfolios, and energy-efficient system designs tailored to high-volume snack production. Leading manufacturers focus on smart processing lines, advanced extrusion and frying solutions, and integrated packaging machinery that support precision, hygiene, and operational flexibility. Many players invest in digital monitoring platforms, predictive maintenance tools, and IoT-enabled components to improve production reliability and reduce downtime. Strategic partnerships, regional expansions, and targeted acquisitions allow these firms to expand their global footprint and enhance after-sales service networks. Their innovation capabilities, combined with strong engineering expertise, create a competitive environment centered on quality, efficiency, and modular manufacturing solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2024, Amcor partnered with Lorenz Snacks to unveil its new recycle-ready packaging while Lorenz Lentil Coated Peanuts, furthering Lorenz’s moves towards improved sustainability. The new packaging Amcor created rests on its AmPrima® portfolio of recyclable mono-material solutions.

- In July 2024, Cama Group’s MTL (Monoblock Top Loader) is a highly advanced, modular secondary packaging machine, featuring an innovative magnetic trolley transport system (ACOPOStrak) for flexible handling of varied products, allowing up to three different product lines to feed a single loader for efficient variety packs, enhancing speed, minimizing footprint, and enabling quick, automated changeovers for the food & personal care industries.

- In June 2024, Bühler launched the Arrakis roller mill, a successor to the iconic Airtronic, enhancing efficiency and consistency in grain milling for snacks and bakery, featuring self-cleaning, easier upgrades, and improved food safety via patented scrapers for tighter tolerances and better product quality, aligning with Bühler’s broader goals for sustainability and innovation in the food processing sector.

- In February 2024, IMA Group, a producer of automatic machines for pharmaceutical, food, and battery processing and packaging, unveiled two artificial intelligence (AI). The group introduces two cutting-edge solutions: IMA Sandbox and IMA AlgoMarket, aiming to further enhance the efficiency and effectiveness of services offered.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Capacity, Automation Level and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for highly automated snack processing lines will accelerate to improve output consistency and reduce labor dependency.

- Adoption of IoT-enabled machinery will increase to support real-time monitoring and predictive maintenance.

- Manufacturers will invest in flexible equipment capable of handling healthier, baked, and functional snack formulations.

- Energy-efficient and low-emission machinery designs will gain stronger industry preference.

- Use of alternative grains and plant-based ingredients will drive innovation in advanced extrusion technologies.

- Processing lines with faster changeover capabilities will expand to support product diversification.

- Hygienic design improvements will strengthen machinery compliance with global food safety standards.

- Regional manufacturers will upgrade to mid- and high-capacity systems to meet rising production volumes.

- Integration of robotics in packaging and handling operations will increase across major facilities.

- Equipment suppliers will expand service ecosystems focused on digital support, optimization, and lifecycle management.