Market Overview:

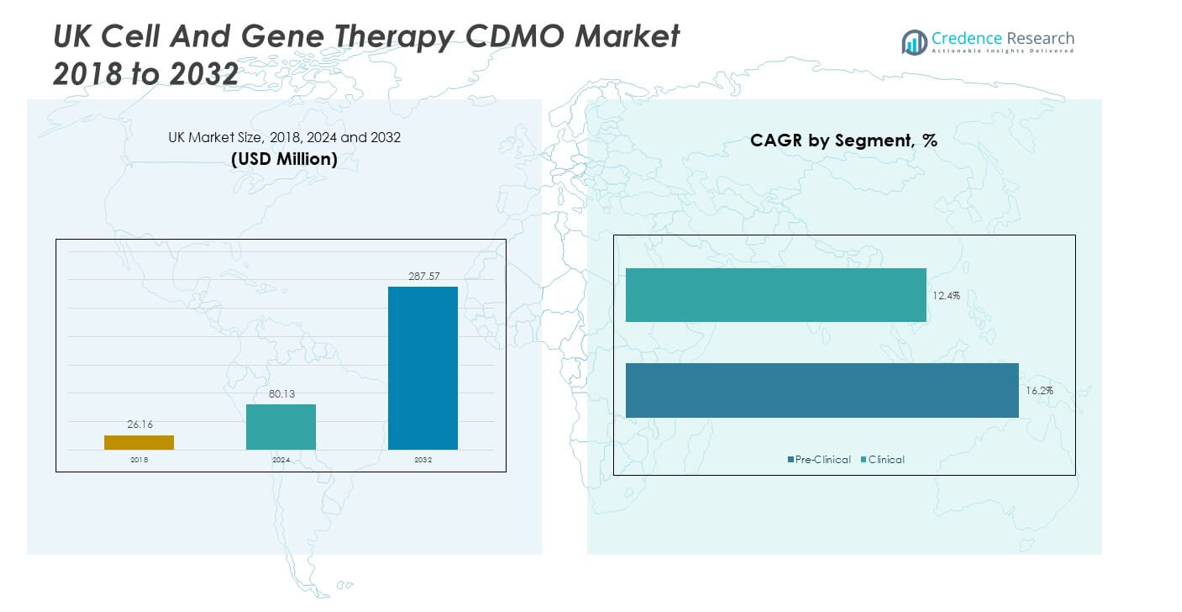

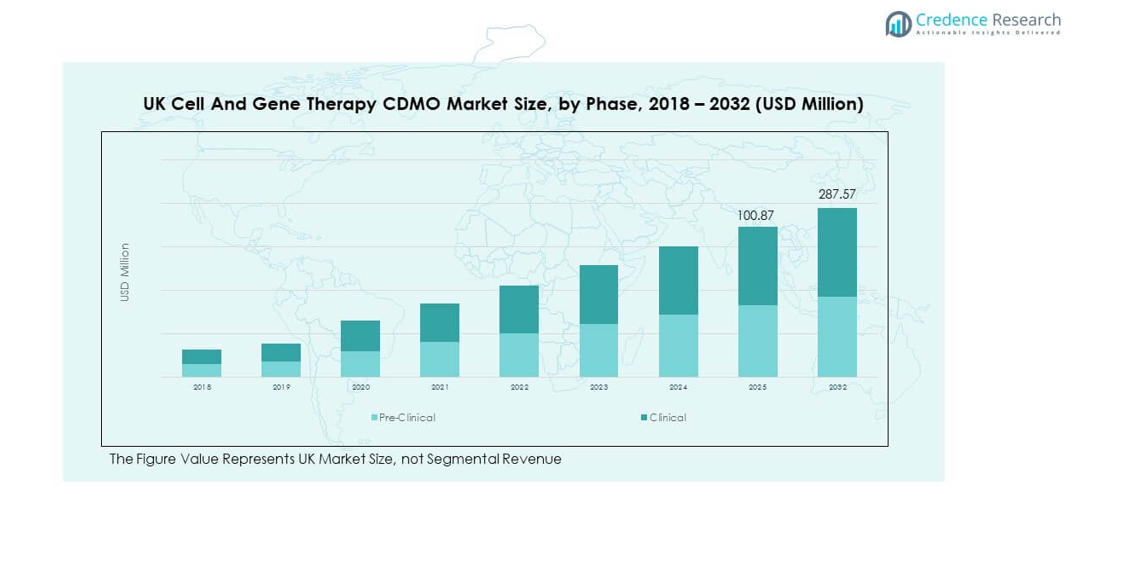

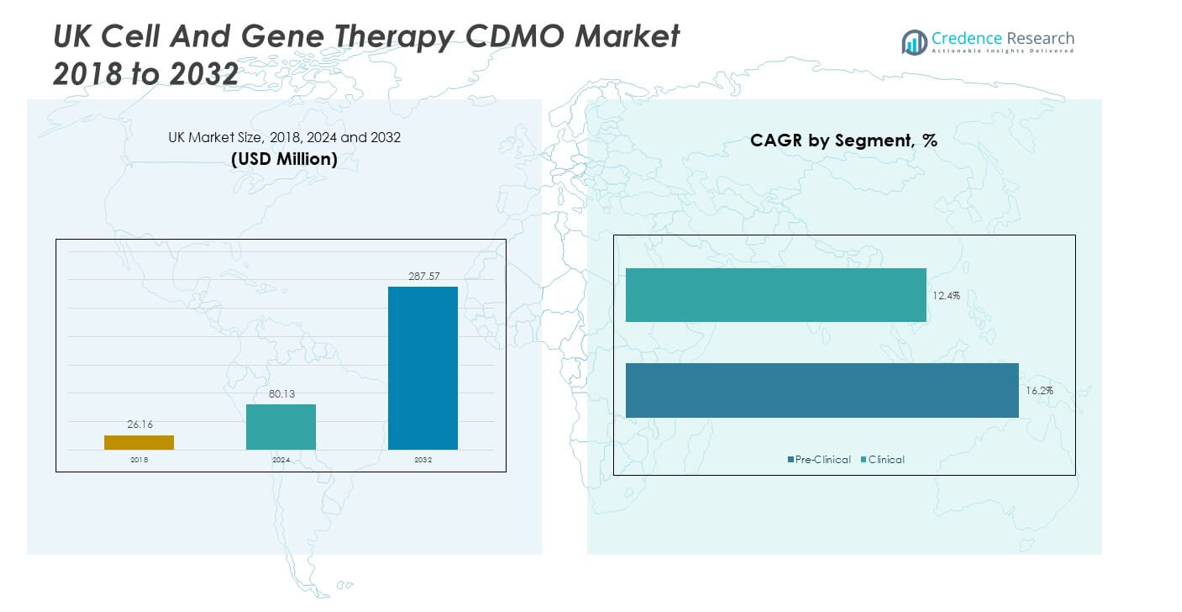

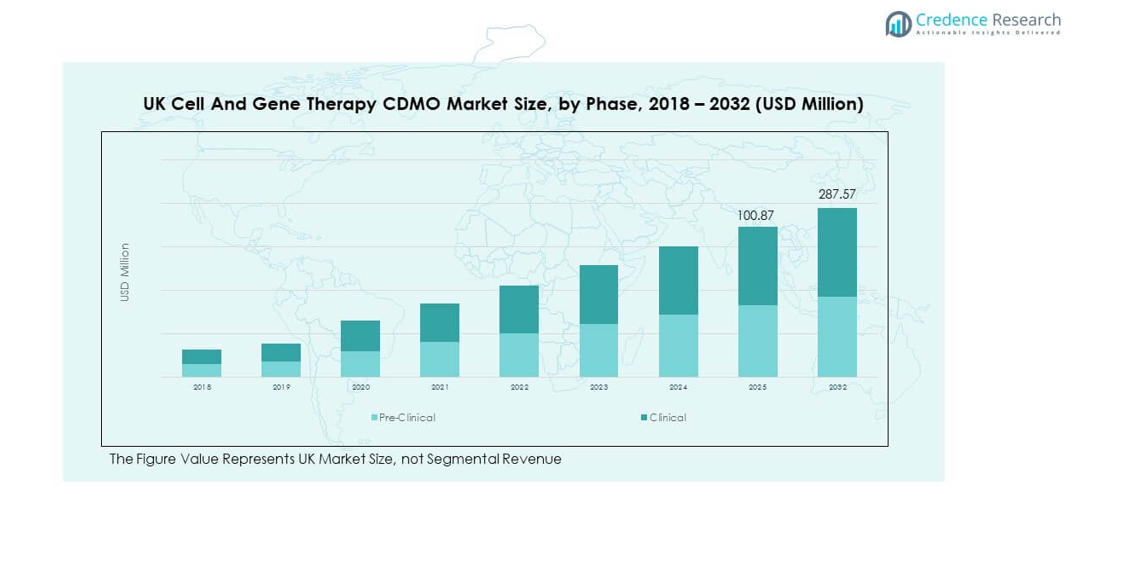

The UK Cell and Gene Therapy CDMO Market size was valued at USD 26.16 million in 2018 to USD 80.13 million in 2024 and is anticipated to reach USD 287.57 million by 2032, at a CAGR of 16.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Cell and Gene Therapy CDMO Market Size 2024 |

USD 80.13 million |

| UK Cell and Gene Therapy CDMO Market, CAGR |

16.14% |

| UK Cell and Gene Therapy CDMO Market Size 2032 |

USD 287.57 million |

The market growth is driven by rising demand for advanced therapies, strong government support, and expanding investment in biopharmaceutical R&D. Increasing prevalence of genetic and rare diseases has encouraged partnerships between biotech firms and CDMOs to enhance scalability and reduce time-to-market. Growing funding for clinical trials and technological advancements in vector manufacturing are also strengthening market momentum. CDMOs are actively enhancing capabilities in process development, GMP compliance, and quality control to meet growing demand from pharmaceutical and biotechnology companies.

Geographically, the UK leads in Europe due to its strong innovation ecosystem, government-backed funding, and advanced clinical trial infrastructure. Other European countries are also expanding their CDMO services, but the UK retains a competitive edge through world-class research clusters and specialized facilities. Emerging regions in Asia-Pacific are investing heavily in cell and gene therapy infrastructure to capture future demand. Meanwhile, North America maintains steady growth, benefiting from established biotech hubs, high patient adoption, and strategic collaborations, positioning it as a key contributor to the global landscape.

Market Insights:

- The UK Cell and Gene Therapy CDMO Market was valued at USD 26.16 million in 2018, reached USD 80.13 million in 2024, and is projected to attain USD 287.57 million by 2032, expanding at a CAGR of 16.14%.

- England held the largest regional share at 62.4% in 2024, supported by strong research clusters and advanced GMP facilities, while Scotland followed with 18.7% due to its life sciences infrastructure, and Wales/Northern Ireland combined accounted for 18.9% with growing biotech clusters.

- Scotland is the fastest-growing subregion with an 18.7% share, driven by university-linked biotech initiatives, supportive policies, and expanding CDMO capabilities.

- Clinical phase services accounted for the majority roughly 60% in 2024, reflecting higher outsourcing demand for large-scale, GMP-compliant production.

- Pre-clinical services represented a smaller around 40% share, focused on early-stage process development and safety validation, supporting future growth pipelines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Advanced Therapeutics

The UK Cell And Gene Therapy CDMO Market is experiencing significant growth due to rising demand for advanced therapeutics targeting rare and chronic diseases. Growing recognition of personalized medicine has accelerated investments from pharmaceutical and biotechnology companies. Governments are actively funding programs that support the research and development of cell and gene therapies. Expanding clinical trial activities are creating high requirements for scalable, GMP-compliant manufacturing capabilities. Partnerships between CDMOs and biotech firms are strengthening production pipelines and reducing development risks. Demand for viral vector manufacturing is increasing due to their critical role in gene therapies. Regulatory agencies are emphasizing stricter safety standards, prompting CDMOs to invest in quality control processes. This combination of demand, funding, and compliance is driving sustained expansion of the sector.

- For example, in December 2021, Oxford Biomedica extended its supply agreement with Novartis to provide lentiviral vectors for CAR-T cell therapies, including Kymriah, produced at its Oxbox GMP facility. While Oxbox’s facilities are approved by the MHRA and FDA for GMP compliance, the exact floor space dedicated solely to viral vector production is less than stated.

Expanding Biopharma Collaborations and Funding

Biopharma companies are increasingly collaborating with CDMOs to access advanced capabilities without heavy capital investments. The UK is witnessing rising interest from global firms due to its mature regulatory landscape and strong scientific infrastructure. Growing demand for faster development timelines has made outsourcing an essential strategy. Academic institutions and CDMOs are forming partnerships to translate early-stage innovations into clinical solutions. Venture capital firms are channeling significant investments into biotech start-ups, fueling demand for CDMO services. Expanding pipeline portfolios across oncology, genetic disorders, and rare diseases continue to create growth opportunities. It reflects an environment where outsourcing becomes a strategic enabler for commercialization success. These factors position CDMOs as critical stakeholders in the broader healthcare ecosystem.

- For instance, Cobra Biologics and Touchlight Genetics collaborate on next-generation DNA vector (dbDNA™) manufacturing for AAV vectors, enabled by a £320,000 Innovate UK grant. The partnership leverages Touchlight’s enzymatic DNA synthesis platform and Cobra’s GMP production infrastructure to accelerate manufacturing timelines and enable clinical supply for the UK and EU gene therapy sector.

Technological Advancements in Manufacturing

Advanced technologies are reshaping the UK Cell and Gene Therapy CDMO Market by improving efficiency and scalability. Automation and digital monitoring tools are being integrated into production workflows to enhance consistency. Single-use bioprocessing systems are gaining momentum due to their flexibility and cost advantages. Innovations in vector engineering are enabling more precise and effective gene therapy delivery. Advanced analytics and AI-driven quality monitoring are supporting compliance and efficiency. These advancements are reducing risks of contamination and improving batch yields. Demand for advanced facilities equipped with modern infrastructure is steadily rising. CDMOs that adopt new technologies are strengthening their competitive position and attracting global clients.

Rising Regulatory Support and Infrastructure Expansion

The UK government has created favorable policies that attract investment in advanced therapies. Strong regulatory frameworks are helping CDMOs meet global quality and safety standards. Expansion of GMP-compliant facilities across the country is addressing growing production requirements. Supportive initiatives are encouraging clinical translation and commercialization of new therapies. The presence of leading research clusters and innovation hubs is reinforcing market growth. It is creating an environment where companies can scale therapies from development to market with efficiency. Regional infrastructure upgrades are ensuring capacity to meet both domestic and international demand. Together, regulatory backing and infrastructure investments are establishing the UK as a global leader in advanced therapy manufacturing.

Market Trends:

Digitalization of CDMO Operations

The UK Cell and Gene Therapy CDMO Market is increasingly shaped by digitalization and smart manufacturing. Adoption of advanced automation platforms is transforming process control and reducing manual intervention. Artificial intelligence is being deployed to optimize batch monitoring and predictive quality assurance. Integration of digital twins in bioprocessing is enhancing real-time scenario testing and risk reduction. Cloud-based platforms are supporting secure data sharing across partners in the supply chain. Digital solutions are enabling faster scale-up and better resource utilization. It is also allowing CDMOs to maintain compliance while increasing throughput. The trend highlights a shift toward intelligent, data-driven manufacturing systems.

Rising Focus on Personalized Medicine

Growing demand for patient-specific therapies is creating a trend toward personalized manufacturing strategies. The UK is advancing in precision medicine due to strong clinical trial activity. CDMOs are adopting flexible production models to accommodate small-batch, customized therapies. Personalized therapy pipelines, especially in oncology, are driving demand for adaptive manufacturing solutions. Development of autologous therapies requires CDMOs to handle complex logistics and supply chain challenges. Partnerships with hospitals and academic centers are growing to integrate personalized therapies into clinical workflows. The UK Cell And Gene Therapy CDMO Market is reflecting this transition toward patient-centric models. It shows that tailored therapeutic development is shaping new service approaches.

Growing Global Collaborations and Outsourcing Models

The UK is emerging as a key hub for international collaborations in cell and gene therapies. Global pharmaceutical firms are outsourcing critical stages of production to leverage specialized CDMO expertise. Cross-border partnerships are enabling knowledge transfer and accelerating therapy commercialization. Outsourcing models are becoming more prevalent as companies prioritize efficiency and cost reduction. CDMOs in the UK are gaining visibility as reliable partners for multinational firms. Strategic alliances are strengthening innovation pipelines and increasing capacity utilization. It demonstrates how globalization is reshaping CDMO operating models. The trend underlines the importance of collaboration as a growth catalyst in the sector.

- For example, FUJIFILM Diosynth Biotechnologies operates a large-scale CDMO facility in Billingham, UK, equipped with single-use bioreactors up to 2,000 liters. Fujifilm has invested over $10 billion in its life sciences business over the past 15 years, supporting end-to-end cell and gene therapy services for global pharmaceutical clients.

Sustainability and Green Manufacturing Practices

Environmental sustainability is becoming a prominent trend across CDMO operations in the UK. Adoption of green technologies and energy-efficient systems is reducing carbon footprints. CDMOs are integrating waste management strategies into production workflows. Use of recyclable materials and single-use bioprocessing systems is gaining wider acceptance. Government policies are encouraging sustainable practices across biomanufacturing sectors. Global clients are increasingly choosing CDMOs that prioritize eco-friendly operations. The UK Cell And Gene Therapy CDMO Market is aligning with international ESG standards. This focus on sustainability is setting new benchmarks for competitive advantage.

- For example, the Centre for Process Innovation (CPI), a UK-based technology innovation centre, reported its greenhouse gas emissions for the fiscal year 2022–2023, including emissions across Scope 1, Scope 2, and certain Scope 3 categories. It uses this comprehensive dataset to set site-level decarbonisation targets and guide sustainable investment in its cell and gene therapy pilot-manufacturing programmes.

Market Challenges Analysis:

Infrastructure and Talent Shortages

The UK Cell And Gene Therapy CDMO Market faces challenges linked to limited infrastructure and skilled workforce availability. Despite growing investments, existing manufacturing capacity often struggles to meet rising demand. Shortage of trained professionals in advanced bioprocessing creates operational bottlenecks. High competition for specialized talent drives up hiring costs and reduces project efficiency. Expansion of GMP facilities requires significant capital, slowing scale-up for smaller CDMOs. Strict regulatory compliance adds further pressure to balance cost with quality. It highlights the pressing need for workforce development and infrastructure expansion. Without these improvements, the sector risks losing opportunities to global competitors.

Complex Supply Chain and High Production Costs

CDMOs in the UK encounter persistent challenges related to complex supply chains and elevated production costs. Securing consistent access to high-quality raw materials remains difficult due to global competition. Supply chain disruptions affect timelines and increase dependency on imports. High costs of vector development and clinical-grade materials limit scalability. Small and mid-sized CDMOs face difficulties in managing cost-intensive technologies. It raises barriers for new entrants and restricts competitiveness in global markets. Stringent safety regulations add to production expenses, increasing financial pressure. The industry must address cost optimization and secure supply networks to remain sustainable.

Market Opportunities:

Expansion into Global Partnerships

The UK Cell and Gene Therapy CDMO Market presents opportunities through expansion into international collaborations. Global pharmaceutical companies are seeking specialized expertise for scaling advanced therapies. Strategic partnerships with CDMOs in the UK provide access to world-class infrastructure and regulatory compliance. It offers UK-based providers a chance to capture outsourcing demand from North America, Europe, and Asia. Growing emphasis on rare diseases and genetic disorders will expand outsourcing opportunities further. Increased cross-border clinical trials also support the role of UK CDMOs in global development. Enhanced visibility in international markets will strengthen the UK’s leadership in advanced therapies.

Investment in Next-Generation Technologies

Emerging technologies offer significant opportunities for CDMOs to advance their service capabilities. Adoption of AI-driven platforms, single-use bioprocessing, and next-generation sequencing can improve efficiency. The UK Cell And Gene Therapy CDMO Market can benefit from investments in digital twins and advanced analytics. Expanding technological adoption will support faster scale-up and improve regulatory compliance. Demand for innovative solutions in autologous and allogeneic therapies will open new service lines. CDMOs that embrace these technologies will differentiate themselves and attract global contracts. It is creating a pathway for future competitiveness and long-term growth.

Market Segmentation Analysis:

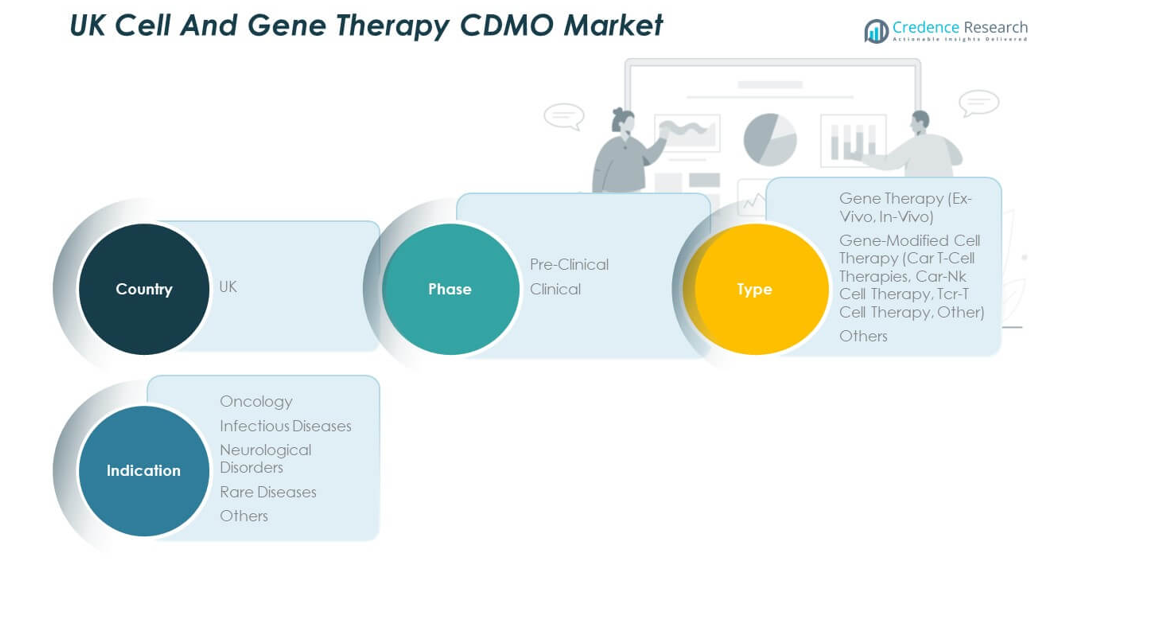

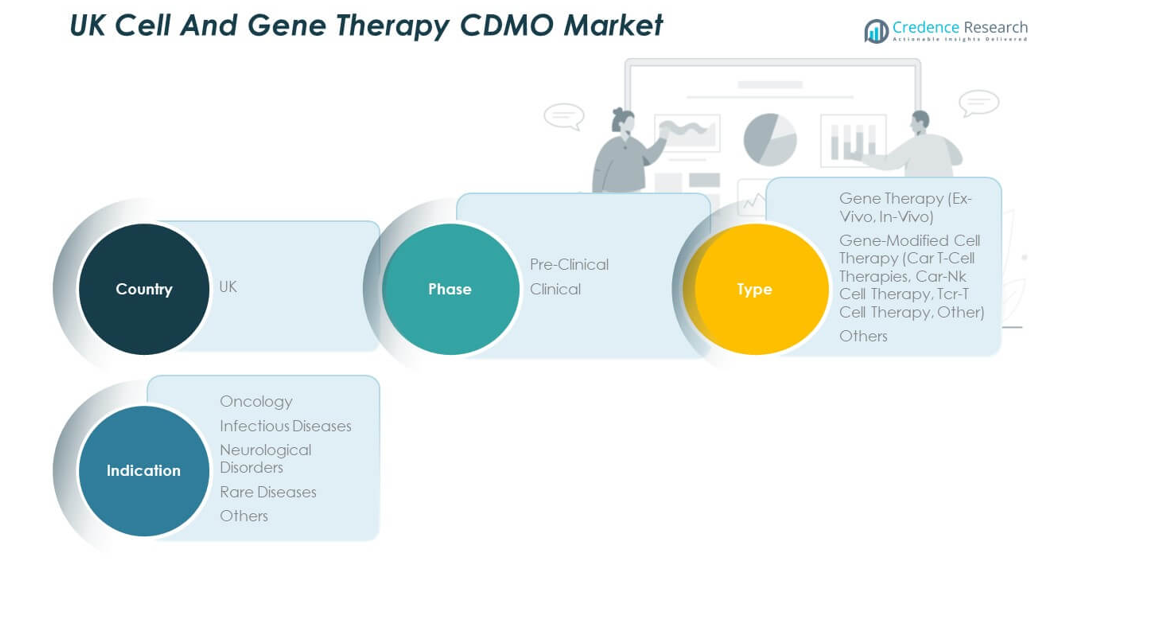

The UK Cell and Gene Therapy CDMO Market is segmented

By phase into pre-clinical and clinical categories. Pre-clinical services focus on process development, safety validation, and early research support. Clinical services dominate revenue contribution due to large-scale production needs, GMP compliance, and advanced regulatory oversight. It demonstrates a growing preference for outsourcing across late-stage development to reduce timelines and costs. CDMOs with integrated pre-clinical and clinical platforms are well-positioned to capture expanding demand from biotech and pharmaceutical companies.

By type, the market covers gene therapy and gene-modified cell therapy alongside other categories. Gene therapy includes both ex-vivo and in-vivo methods, with ex-vivo gaining prominence in controlled applications like genetic disorders. Gene-modified cell therapy includes CAR T-cell, CAR-NK cell, and TCR-T cell therapies, which are shaping oncology pipelines. CAR T-cell therapies remain the largest sub-segment due to their adoption in blood cancer treatments. It highlights the growing investment in advanced immune-cell-based approaches and customized patient-specific solutions.

- For instance, Autolus Therapeutics’ obecabtagene autoleucel (“obe-cel,” AUCATZYL®) received FDA approval in 2024 for treating aggressive blood cancers (B-ALL). This next-generation CAR-T cell therapy, developed and manufactured in the UK, offers improved safety and greater persistence in patients compared to prior therapies, and is now used in major oncology clinical centers

By indication, oncology represents the leading segment due to a high number of approved and pipeline therapies. Infectious diseases are expanding as gene therapy applications evolve against viral and bacterial threats. Neurological disorders are gaining momentum with increased research in gene-modifying techniques. Rare diseases are a major focus due to strong government incentives and orphan drug designations. It reflects a market where oncology dominates, but rare and chronic conditions are emerging as high-growth segments.

- For example, the University of Portsmouth and University of Southampton received £1.1 million MRC funding in 2025 to study rare genetic diseases. Since 2020, their Xenopus-based diagnostics have identified over 30 rare conditions, including a novel DDX17-related neurological disorder.

Segmentation:

By Phase

By Type

- Gene Therapy

- Gene-Modified Cell Therapy

- CAR T-Cell Therapies

- CAR-NK Cell Therapy

- TCR-T Cell Therapy

- Others

- Others

By Indication

- Oncology

- Infectious Diseases

- Neurological Disorders

- Rare Diseases

- Others

Regional Analysis:

England holds the largest share of the UK Cell and Gene Therapy CDMO Market, accounting for 62.4% of total revenue in 2024. London and the Oxford-Cambridge corridor are central hubs due to their world-class research universities, innovation clusters, and advanced GMP facilities. Strong government funding and a favorable regulatory ecosystem reinforce the region’s leadership in advanced therapy development. It benefits from a concentration of leading CDMOs and global partnerships that support commercialization and clinical trial activities. The region continues to attract international biopharma investments, strengthening its role as a European leader in cell and gene therapy.

Scotland represents 18.7% of the market, driven by its growing life sciences sector and specialized CDMO facilities in areas like Edinburgh and Glasgow. The region’s supportive policies, innovation parks, and university-linked biotech initiatives are enabling expansion in research and manufacturing capacity. It is gaining recognition for expertise in bioprocessing and early-stage therapy development. The presence of collaborative ecosystems between academic institutions and CDMOs creates momentum for scaling cell and gene therapy projects. Scotland is also fostering talent development programs that support long-term sustainability of advanced therapy manufacturing.

Wales and Northern Ireland collectively contribute 18.9% to the UK Cell And Gene Therapy CDMO Market. Wales has developed focused biotech clusters in Cardiff and Swansea, supported by government-backed initiatives to expand GMP capacity. Northern Ireland is emerging with targeted investments in biotech infrastructure and clinical research partnerships. It is creating opportunities for CDMOs to extend specialized services in process development and niche therapeutic areas. The combined growth of these subregions is strengthening overall national capacity and diversifying the UK’s geographic footprint in advanced therapy outsourcing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AGC Biologics

- WuXi Advanced Therapies

- Oxford Biomedica

- Novasep

- Recipharm

- CEVEC Pharmaceuticals

- Bayer AG

- Cell and Gene Therapy Catapult

- BioElpida

- Cell Medica

Competitive Analysis:

The UK Cell And Gene Therapy CDMO Market is highly competitive, shaped by a mix of global players and regionally focused companies. Established CDMOs such as AGC Biologics, WuXi Advanced Therapies, and Oxford Biomedica dominate through large-scale capabilities, advanced infrastructure, and strong regulatory compliance. Smaller firms like BioElpida and Cell Medica strengthen competition by offering specialized services, niche expertise, and flexible outsourcing models. It reflects a market where consolidation and strategic alliances are central to maintaining long-term competitiveness. Companies are actively pursuing mergers, acquisitions, and capacity expansions to meet growing demand for scalable cell and gene therapy solutions. Competitive intensity is also driven by investments in new technologies, digitalized manufacturing systems, and advanced vector development platforms. Market leaders are differentiating through GMP-certified facilities, end-to-end service portfolios, and international collaborations with biopharma firms. The UK’s supportive regulatory environment and research ecosystem provide advantages to domestic CDMOs seeking global partnerships. It creates opportunities for both multinational and local firms to expand their presence in high-demand segments such as CAR-T therapies and rare disease solutions.

Recent Developments:

- In September 2025, eXmoor Pharma, an integrated cell and gene therapy CDMO with embedded consultancy expertise, announced a strategic partnership with Anthony Nolan Cell Therapy & Laboratory Services (CT&LS). This collaboration brings together two UK-based advanced therapy organizations with complementary capabilities, offering an end-to-end, ethically-driven support system for developers of autologous and allogeneic cell therapies.

- In July 2025, Cellular Origins, Cell and Gene Therapy Catapult (CGT Catapult), and Resolution Therapeutics formed a consortium to deliver a fully automated, scalable cell therapy manufacturing platform. Supported by a £1 million Smart Grant from Innovate UK, this cross-industry project aims to develop a globally unique, hyper-efficient, fully automated solution for cell and gene therapy manufacturing.

- In June 2025, Oxford Biomedica (OXB), a leading UK-based cell and gene therapy CDMO, acquired the remaining 10% stake in its US subsidiary from Q32 Bio, Inc. This acquisition brings OXB US LLC under full ownership and furthers OXB’s global reach, integrating its US and UK-based advanced therapy manufacturing capabilities, especially in AAV and lentiviral vectors, for comprehensive cell and gene therapy solutions.

Report Coverage:

The research report offers an in-depth analysis based on Phase, Type and Indication. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Cell And Gene Therapy CDMO Market will benefit from continued government funding and policy support.

- Demand for outsourcing services will expand with the growth of personalized therapies and rare disease solutions.

- Clinical stage services will dominate as biotech firms scale therapies toward commercialization.

- Ex-vivo platforms will gain traction due to their application in oncology and genetic disorders.

- CAR-T therapies will remain the largest focus area, while CAR-NK and TCR-T therapies build momentum.

- Oncology will lead indications, but rare and neurological disorders will emerge as promising segments.

- England will sustain leadership through strong infrastructure, with Scotland and Wales expanding their presence.

- Competition will intensify as global players invest in UK-based facilities and partnerships.

- Adoption of digital manufacturing and AI-driven monitoring will strengthen efficiency and compliance.

- Sustainability initiatives will shape future operations, aligning CDMOs with global ESG expectations.