Market Overview

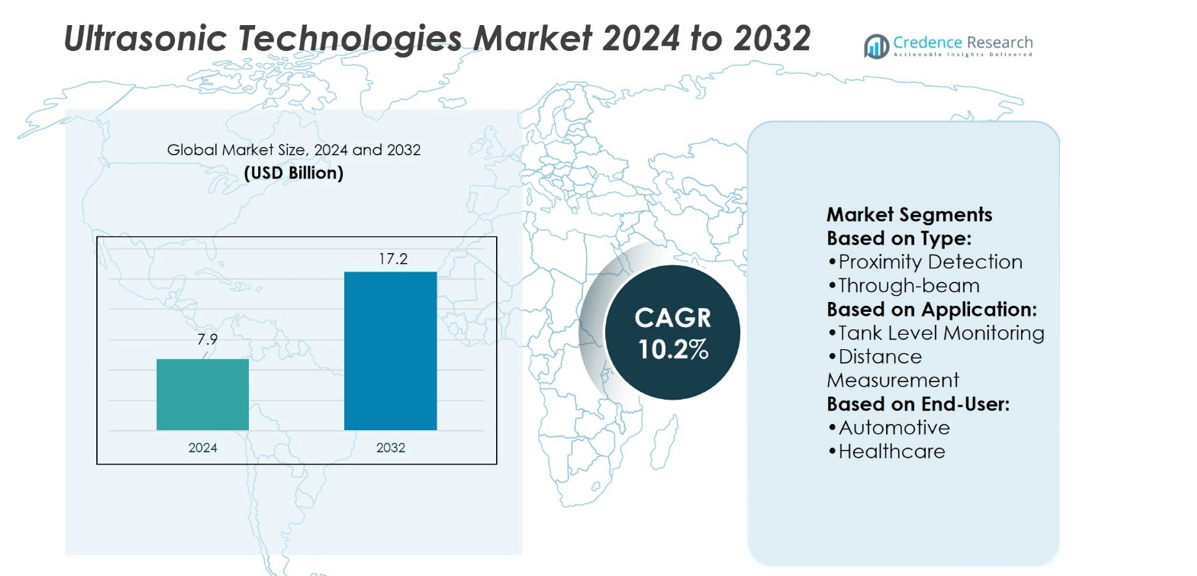

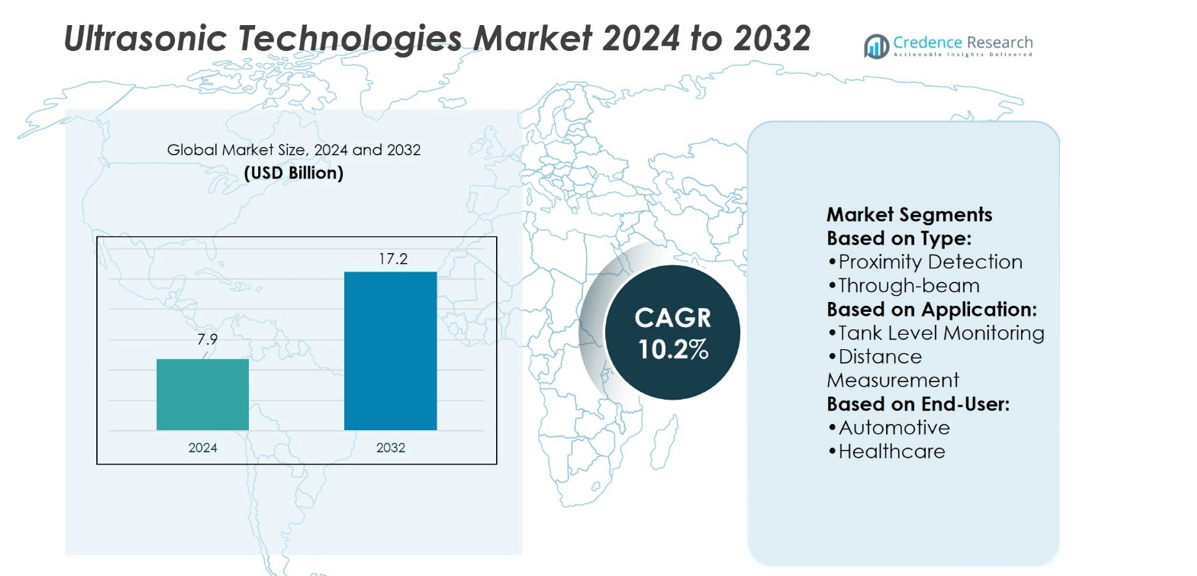

Ultrasonic Technologies Market size was valued at USD 7.9 billion in 2024 and is anticipated to reach USD 17.2 billion by 2032, at a CAGR of 10.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultrasonic Technologies Market Size 2024 |

USD 7.9 billion |

| Ultrasonic Technologies Market, CAGR |

10.2% |

| Ultrasonic Technologies Market Size 2032 |

USD 17.2 billion |

The Ultrasonic Technologies Market grows with rising demand across healthcare, automotive, and industrial sectors. Healthcare relies on ultrasound for advanced imaging, non-invasive diagnostics, and therapeutic applications, improving patient outcomes. Automotive manufacturers adopt ultrasonic sensors for driver assistance, parking systems, and collision avoidance, supporting road safety. Industrial sectors use ultrasonic testing for flaw detection, thickness measurement, and predictive maintenance, ensuring efficiency and reliability. The market benefits from miniaturization trends that enhance portability and expand access in remote areas. Integration with AI and IoT platforms strengthens data accuracy and real-time monitoring, driving broader adoption and shaping future innovation across industries.Top of Form

North America leads the Ultrasonic Technologies Market with strong adoption in healthcare, automotive, and aerospace, while Europe follows with significant demand in manufacturing and medical diagnostics. Asia-Pacific shows the fastest growth, driven by industrial expansion and rising healthcare access, with China, Japan, and India as key contributors. Latin America and the Middle East & Africa record smaller shares but show steady adoption in energy and healthcare. Leading players include Continental AG, Texas Instruments, Murata Manufacturing, Robert Bosch, VALEO, and Magna International.

Market Insights

- Ultrasonic Technologies Market size was valued at USD 7.9 billion in 2024 and is expected to reach USD 17.2 billion by 2032, growing at a CAGR of 10.2%.

- Rising demand across healthcare, automotive, and industrial sectors drives steady market expansion.

- Miniaturization and portability trends increase accessibility and adoption in remote and resource-limited areas.

- Strong competition exists with companies focusing on innovation, cost efficiency, and AI-based integration.

- High equipment cost and technical complexity remain key restraints in emerging economies.

- North America leads adoption, Europe shows strong growth, and Asia-Pacific emerges as the fastest-growing region.

- Latin America and Middle East & Africa hold smaller shares but grow steadily in healthcare and energy sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand in Medical and Industrial Applications

he Ultrasonic Technologies Market gains momentum through expanding use in medical imaging and diagnostics. Hospitals adopt ultrasound for non-invasive procedures that improve patient safety and efficiency. Industrial applications also grow, with ultrasonic testing ensuring structural integrity in aerospace and automotive sectors. It supports material flaw detection, welding quality control, and pipeline inspection. Rising demand from both healthcare and manufacturing strengthens adoption. This dual-sector growth highlights ultrasonic systems as versatile solutions across industries.

- For instance, Murata Manufacturing Co., Ltd’s MA48CF15-7N ultrasonic sensor can detect obstacles from 15 cm up to 550 cm, supporting precise scanning across both medical and industrial inspection devices.

Rising Focus on Precision and Non-Destructive Testing

A major driver is the emphasis on accuracy in non-destructive testing. Ultrasonic devices deliver detailed imaging without damaging materials or tissues. It helps companies reduce failure risks in safety-critical applications like energy and defense. Demand increases for equipment that provides real-time and precise results. The ability to perform testing on complex structures supports adoption in emerging industries. This precision-based approach continues to push market expansion.

- For instance, Robert Bosch GmbH’s Ultrasonic Sensor System – Premium Safe enables object localization and distance detection up to 550 cm and down to 15 cm, with a horizontal detection zone of ±70° and vertical of ±35°.

Integration with Smart and Digital Technologies

Smart connectivity enhances ultrasonic equipment performance across industries. Integration with IoT platforms allows predictive maintenance in manufacturing environments. It enables healthcare systems to connect imaging devices with advanced data platforms for improved diagnostics. Automation and AI-based data interpretation reduce error margins and increase reliability. Adoption of digital interfaces drives faster decision-making in both clinical and industrial settings. These technology advancements sustain market growth.

Environmental and Safety Regulations Driving Adoption

Stricter safety and environmental regulations stimulate the need for ultrasonic solutions. Governments push industries to adopt inspection methods that minimize risks and ensure compliance. It replaces older, invasive testing approaches that carry higher operational hazards. Energy sectors use ultrasonic methods for pipeline monitoring to prevent leaks and accidents. Environmental monitoring applications, including pollution detection, also gain attention. These factors collectively make ultrasonic technologies vital for regulated industries.

Market Trends

Advancements in Medical Imaging and Therapeutics

The Ultrasonic Technologies Market benefits from continuous innovation in healthcare applications. Advanced ultrasound systems now feature 3D and 4D imaging that improve diagnostic accuracy. It supports early disease detection and guides minimally invasive procedures with higher precision. Therapeutic uses such as targeted drug delivery and physiotherapy treatments expand adoption. Integration with portable and handheld ultrasound devices increases accessibility in remote healthcare settings. These advancements establish ultrasound as a central tool in modern medicine.

- For instance, Valeo’s USV10 ultrasonic sensor transmits 15 times more data than previous generations thanks to its upgraded data interface, enhancing signal detail and enabling software-defined validation tools.

Expansion of Industrial Non-Destructive Testing

Industrial applications remain a strong trend in ultrasonic technology adoption. Companies rely on ultrasonic testing for flaw detection, thickness measurement, and weld inspection. It ensures safety and efficiency in critical sectors such as aerospace, automotive, and energy. Growth in renewable energy projects raises demand for ultrasonic inspection of wind turbines and pipelines. The trend toward preventive maintenance strategies strengthens adoption of ultrasonic systems. Industries continue to prioritize safety and operational integrity, driving sustained use.

- For instance,Elmos’s E524.17 Smart Ultrasonic Sensor IC (DSI3 interface) operates between 30 kHz and 125 kHz, measures distances from 10 cm to 600 cm, functions on a supply voltage of 6 V to 24 V, and supports point-to-point or bus topology via a transformer interface.

Miniaturization and Portability of Devices

Manufacturers invest in compact and portable ultrasonic devices to meet diverse needs. Handheld systems improve mobility in healthcare and on-site industrial testing. It enables faster deployment in emergency care, home diagnostics, and field operations. Wearable ultrasound solutions are also under development, broadening applications in personalized healthcare. Portability lowers barriers to access while maintaining precision and accuracy. This miniaturization trend shapes the next generation of ultrasonic solutions.

Integration with Digital and AI Technologies

Digital transformation remains a defining trend across the ultrasonic market landscape. Integration with AI-driven software enhances image analysis and defect detection. It reduces human error and provides faster, more reliable outcomes. Cloud-based platforms allow remote access to diagnostic and testing data. Smart connectivity ensures interoperability with hospital systems and industrial networks. This integration supports efficiency and decision-making, reinforcing the value of ultrasonic technologies in multiple sectors.

Market Challenges Analysis

High Costs and Technical Complexity Restraining Adoption

The Ultrasonic Technologies Market faces challenges linked to high equipment costs and operational complexity. Advanced imaging systems and industrial testing devices require significant investment, limiting adoption among small and mid-sized organizations. It demands specialized training for technicians and healthcare professionals, creating barriers in resource-limited regions. Maintenance and calibration further increase operational expenses, adding to financial strain. Integration with digital platforms also raises compatibility and infrastructure costs. These factors collectively slow market penetration in developing economies.

Limited Penetration in Certain Applications

Another challenge lies in the limited effectiveness of ultrasonic technologies in specific scenarios. Dense materials, irregular surfaces, and deep tissue imaging can reduce accuracy. It restricts broader application in sectors that require precise measurements under challenging conditions. Competition from alternative technologies such as X-ray, CT, and MRI in healthcare also limits growth. Industrial sectors sometimes prefer radiographic testing for complex inspections, affecting adoption levels. Overcoming these limitations requires continuous research and innovation to improve versatility and performance.

Market Opportunities

Expanding Role in Healthcare and Emerging Therapies

The Ultrasonic Technologies Market presents strong opportunities in advanced healthcare applications. Demand grows for ultrasound in preventive diagnostics, prenatal care, and cardiovascular imaging. It also supports therapeutic uses such as targeted drug delivery, physiotherapy, and tumor ablation. Portable and handheld ultrasound systems extend accessibility to rural and remote regions, meeting global healthcare needs. Integration with AI-driven diagnostic platforms enhances clinical decision-making and reduces error margins. These advancements create new revenue streams in both developed and emerging healthcare markets.

Industrial Growth and Sustainability-Oriented Applications

Industrial sectors offer expanding opportunities for ultrasonic solutions in safety and sustainability. The technology aids in non-destructive testing for aerospace, automotive, and renewable energy projects. It enables predictive maintenance and real-time monitoring of pipelines, wind turbines, and manufacturing equipment. Environmental monitoring through ultrasonic sensors also gains attention for pollution and water quality assessment. Governments promote safer inspection methods, creating demand for compliant technologies. These opportunities position ultrasonic systems as vital enablers of industrial efficiency and environmental responsibility.

Market Segmentation Analysis:

By Type

The Ultrasonic Technologies Market segments by type into proximity detection, through-beam sensors, and retro-reflective sensors. Proximity detection holds significant demand due to its role in automation and robotics, where accurate object sensing is essential. Through-beam sensors provide long-range detection and higher precision, making them suitable for industrial automation and safety systems. Retro-reflective sensors gain adoption in logistics and packaging industries, where reliable distance monitoring supports efficiency. It demonstrates how sensor variations cater to specific industry requirements. Advancements in sensor performance continue to enhance their reliability across diverse environments.

- For instance,AG Electronics’ standard ultrasonic sensor module covers a sensing range from approximately 200 mm up to 6000 mm in a rugged PVC housing for both indoor and outdoor use. Users can specify an exact upper limit among 1000, 2000, 3000, 4000, 5000, or 6000 mm variants.

By Application

Applications cover tank level monitoring, distance measurement, object detection, collision avoidance, and others. Tank level monitoring remains important in oil, gas, and water treatment sectors for reliable fluid management. Distance measurement supports industrial automation, robotics, and quality control systems. Object detection shows growing use in manufacturing and consumer electronics, ensuring process safety and automation efficiency. Collision avoidance dominates in automotive and aerospace systems, where ultrasonic sensors prevent accidents and improve navigation. It highlights the technology’s ability to serve both safety and operational needs. The broad application base strengthens market opportunities across sectors.

- For instance, the Continental Ultrasonic Back-Up Sensor Kit includes four sensors, a control unit, and a speaker. Designed for retrofit or OEM use across commercial and off-highway vehicles, it detects obstacles from as far as 5.00 m (approx. 16 ft 6 in), and emits a faster audible alarm as the vehicle approaches an object within 3 m.

By End User

End users include automotive, healthcare, industrial automation, consumer electronics, aerospace and defense, and others. The automotive industry leads adoption through parking assistance, driver assistance systems, and collision prevention. Healthcare follows closely, where ultrasound imaging continues to expand in diagnostics and therapeutic applications. Industrial automation benefits from ultrasonic sensors that enable predictive maintenance and process efficiency. Consumer electronics show growth in smart devices and gesture recognition features. Aerospace and defense sectors integrate ultrasonic solutions for equipment testing and navigation support. It emphasizes the versatile adoption of ultrasonic technologies across both traditional and emerging industries.

Segments:

Based on Type:

- Proximity Detection

- Through-beam

Based on Application:

- Tank Level Monitoring

- Distance Measurement

Based on End-User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Ultrasonic Technologies Market at 38.9%. The United States is the leading contributor, driven by strong demand in healthcare, automotive, and aerospace industries. Hospitals widely use ultrasound imaging for non-invasive diagnosis and advanced therapeutic applications. Aerospace and automotive companies rely on ultrasonic testing to ensure safety and quality in manufacturing and maintenance. Strict regulations in safety and medical sectors encourage greater adoption of ultrasonic inspection systems. Canada supports growth through investments in energy, healthcare, and industrial automation. With established infrastructure, advanced research, and a skilled workforce, North America maintains its leadership position in global ultrasonic adoption.

Europe

Europe accounts for 26.8% of the global market, placing it second after North America. Germany, France, and the United Kingdom are key contributors due to their strong manufacturing bases. Automotive and aerospace industries in the region depend heavily on ultrasonic solutions for non-destructive testing and quality control. The healthcare sector also shows consistent growth, with ultrasound being a standard in diagnostics and patient monitoring. Strict European Union safety standards drive companies to integrate advanced inspection and monitoring systems. The packaging and automation industries also boost demand for ultrasonic sensors in production environments. With its balanced growth across healthcare and industry, Europe remains a critical player in the market.

Asia-Pacific

Asia-Pacific holds 25.5% of the market and demonstrates the fastest growth among all regions. China, India, Japan, and South Korea lead adoption through rapid industrial expansion and healthcare modernization. Manufacturing sectors rely on ultrasonic sensors for distance measurement, quality inspection, and automation. Healthcare institutions increasingly deploy portable and handheld ultrasound devices to improve access in both urban and rural areas. Rising consumer demand for electronics such as smartphones and smart devices also boosts ultrasonic applications. Governments promote smart industry initiatives, which encourage further deployment of ultrasonic solutions. With strong momentum, Asia-Pacific is expected to increase its market share in the coming years.

Latin America

Latin America accounts for 6.8% of the market, reflecting moderate adoption. Brazil and Mexico are the leading markets, supported by demand in oil, gas, and mining industries. Ultrasonic testing plays an important role in maintaining safety standards for pipelines and industrial equipment. The healthcare sector shows gradual growth, with diagnostic ultrasound becoming more available in major hospitals and clinics. Infrastructure limitations and uneven funding slow adoption across smaller countries. Partnerships with international suppliers help improve access to advanced technologies. Latin America shows potential for stronger growth if regulatory frameworks and industrial modernization continue to expand.

Middle East & Africa

The Middle East & Africa holds 2% of the global market, making it the smallest regional contributor. Gulf countries such as Saudi Arabia and the UAE show higher adoption due to strong demand in the oil and gas industry. Ultrasonic testing is widely used for inspection of pipelines and energy infrastructure. Healthcare adoption is increasing in advanced hospital systems, particularly in urban centers of the Middle East. African nations see slower growth due to weaker infrastructure and limited resources, but portable ultrasound devices are gaining traction in rural healthcare. International collaborations and training programs improve adoption gradually. Though the share remains small, the region offers niche opportunities in both healthcare and energy industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Murata Manufacturing Co., Ltd (Japan)

- Robert Bosch GmbH (Germany)

- VALEO (France)

- Elmos Semiconductor SE (Germany)

- Magna International Inc. (Canada)

- AG Electronics (India)

- Continental AG (Germany)

- Texas Instruments Incorporated (U.S.)

- MInpin (China)

- TDK Electronics (Germany)

Competitive Analysis

The Ultrasonic Technologies Market include players such as Continental AG, Texas Instruments Incorporated, Murata Manufacturing Co., Ltd, AG Electronics, Robert Bosch GmbH, Magna International Inc., Elmos Semiconductor SE, TDK Electronics, VALEO, and MInpin. The Ultrasonic Technologies Market shows intense competition driven by innovation and regional specialization. Companies focus on advancing sensor accuracy, miniaturization, and integration with digital platforms. Automotive applications lead demand, with systems designed for driver assistance, parking, and collision avoidance. Healthcare adoption continues to expand through advanced imaging, portable devices, and therapeutic uses. Industrial sectors prioritize ultrasonic solutions for non-destructive testing, predictive maintenance, and quality control. Consumer electronics and automation further expand opportunities, supported by growing demand for smart and connected devices. Competition revolves around technological reliability, cost efficiency, and the ability to adapt solutions to diverse end-use industries.

Recent Developments

- In March 2025, Herrmann Ultrasonics announced the grand opening of its state-of-the-art Tech Center and laboratory in Monterrey, Mexico, scheduled. This milestone marks a significant step in supporting Mexico’s growing manufacturing sector and bringing advanced ultrasonic technologies closer to manufacturers and industry leaders in the region.

- In March 2025, the element14 Community, in partnership with TDK, launched the “In Reach! Ultrasonic Sensor Sensing Challenge”, inviting engineers, makers, and technology enthusiasts to create innovative projects using TDK’s waterproof ultrasonic range sensors. Participants will utilize the TDK USSM Plus-FS sensors, known for their accuracy and versatility, in real-world applications.

- In July 2023, Valeo, the global provider of automotive technology, opened a second production line in Gujarat to manufacture ultrasonic sensors. The inauguration of this assembly line was presided over by Marc Vrecko, President of Valeo’s Comfort and Driving Assistance Business Group.

- In June 2023, Murata Manufacturing Co., Ltd. unveiled a new ultrasonic sensor device designed for automotive applications. Known as the MA48CF15-7N, this sensor offers exceptional sensitivity and quick response times, and it comes encased in a hermetically sealed package to safeguard against liquid penetration.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption in automotive safety and driver assistance systems.

- Healthcare will continue to expand use of ultrasound imaging and therapeutic applications.

- Portable and handheld ultrasound devices will gain stronger demand in rural healthcare.

- Industrial automation will adopt more ultrasonic sensors for predictive maintenance and safety.

- Consumer electronics will integrate ultrasonic features in smart devices and wearables.

- Aerospace and defense will expand use in structural inspections and navigation systems.

- AI and digital platforms will enhance data accuracy and reduce error margins.

- Energy and utility sectors will deploy ultrasonic testing for pipelines and infrastructure monitoring.

- Environmental monitoring will use ultrasonic systems for pollution and water quality assessment.

- Research and development will focus on miniaturization and advanced integration with IoT networks.