Market Overview:

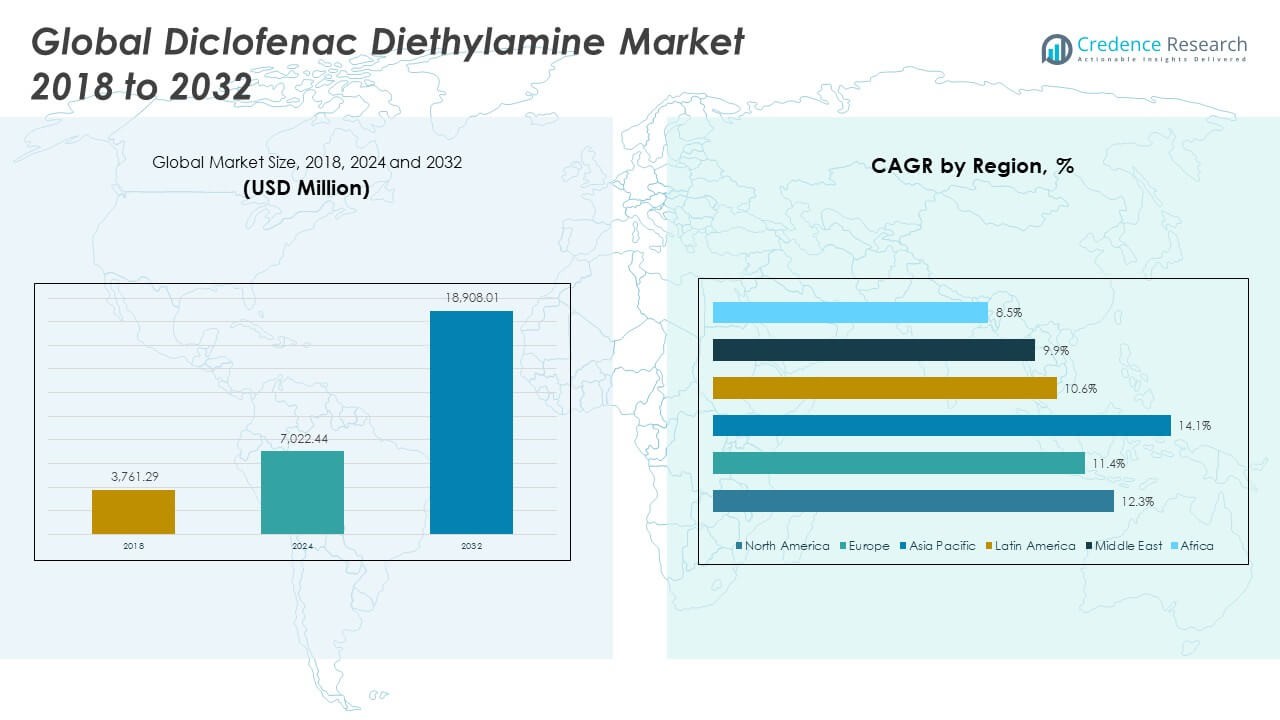

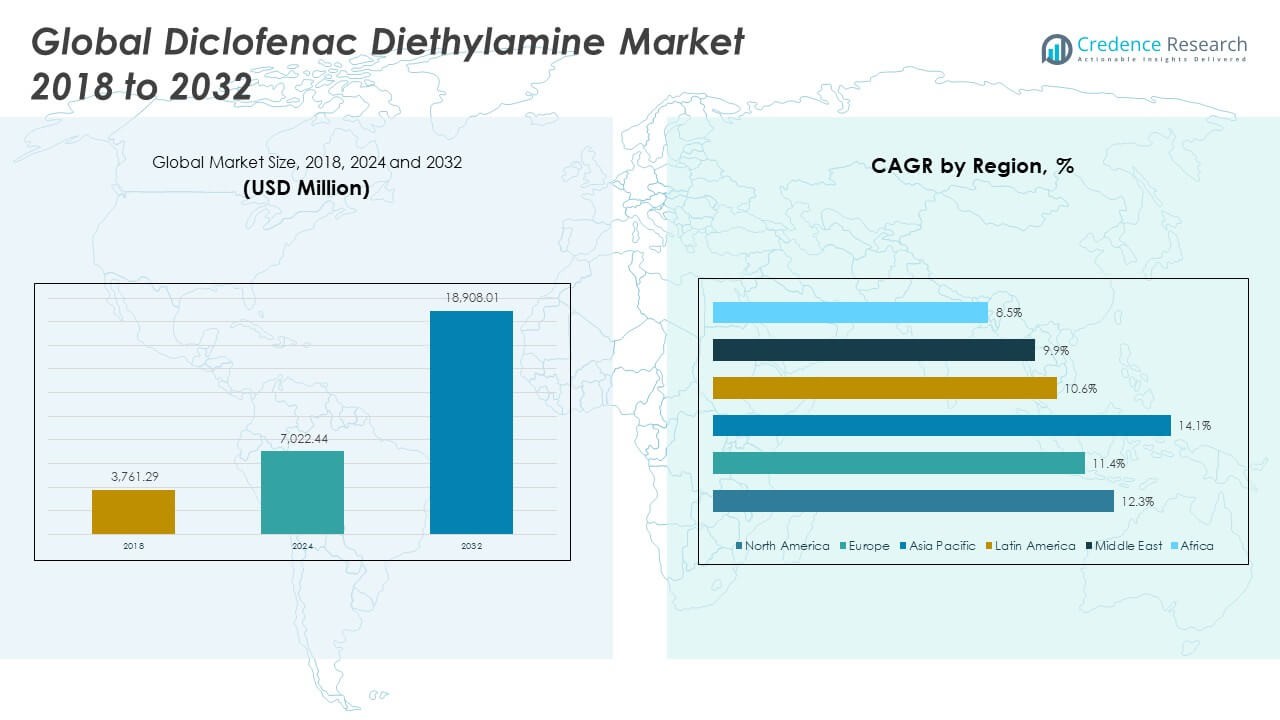

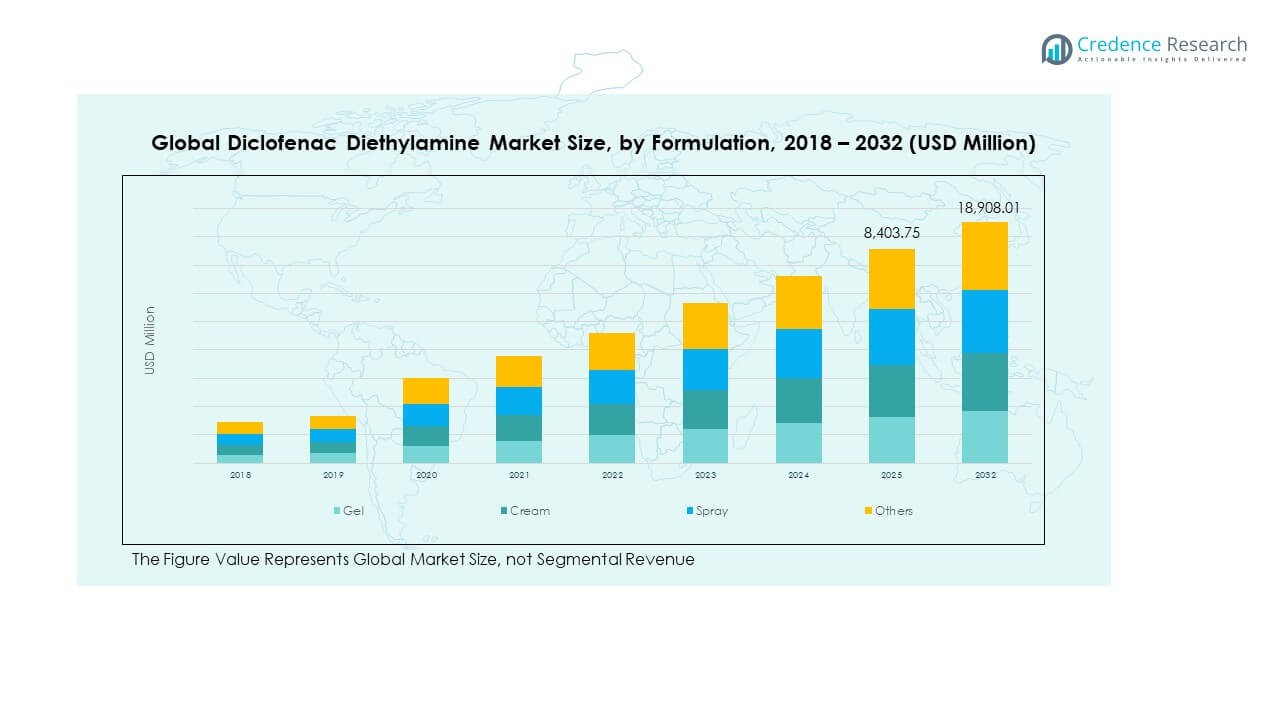

The Global Diclofenac Diethylamine Market size was valued at USD 3,761.29 million in 2018 to USD 7,022.44 million in 2024 and is anticipated to reach USD 18,908.01 million by 2032, at a CAGR of 12.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diclofenac Diethylamine Market Size 2024 |

USD 7,022.44 Million |

| Diclofenac Diethylamine Market, CAGR |

12.28% |

| Diclofenac Diethylamine Market Size 2032 |

USD 18,908.01 Million |

The market growth is driven by increasing demand for topical pain relief solutions, rising cases of arthritis and musculoskeletal disorders, and a growing preference for over-the-counter (OTC) medications. Expanding awareness about the benefits of diclofenac-based gels and creams for joint and muscle pain management supports adoption. The pharmaceutical sector’s emphasis on effective, non-invasive treatment options further boosts demand. Moreover, lifestyle-related ailments and aging populations across major economies accelerate consumption, making diclofenac diethylamine formulations widely used in both prescription and non-prescription segments.

Regionally, North America and Europe dominate due to high healthcare expenditure, advanced pharmaceutical infrastructure, and greater awareness of pain management solutions. Asia-Pacific is emerging as the fastest-growing market, driven by large patient pools, expanding access to healthcare, and increasing OTC product availability in countries such as India and China. Latin America and the Middle East & Africa present gradual growth opportunities, supported by improving medical distribution channels and a rising focus on cost-effective topical treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Diclofenac Diethylamine Market size was valued at USD 3,761.29 million in 2018, reached USD 7,022.44 million in 2024, and is projected to hit USD 18,908.01 million by 2032, growing at a CAGR of 12.28%.

- North America (32%), Europe (28%), and Asia-Pacific (24%) hold the largest shares due to advanced healthcare infrastructure, strong regulatory support, and high demand for topical pain relief solutions.

- Asia-Pacific, with a 24% share, is the fastest-growing region, driven by expanding patient pools, rising OTC adoption, and broader access to affordable healthcare products.

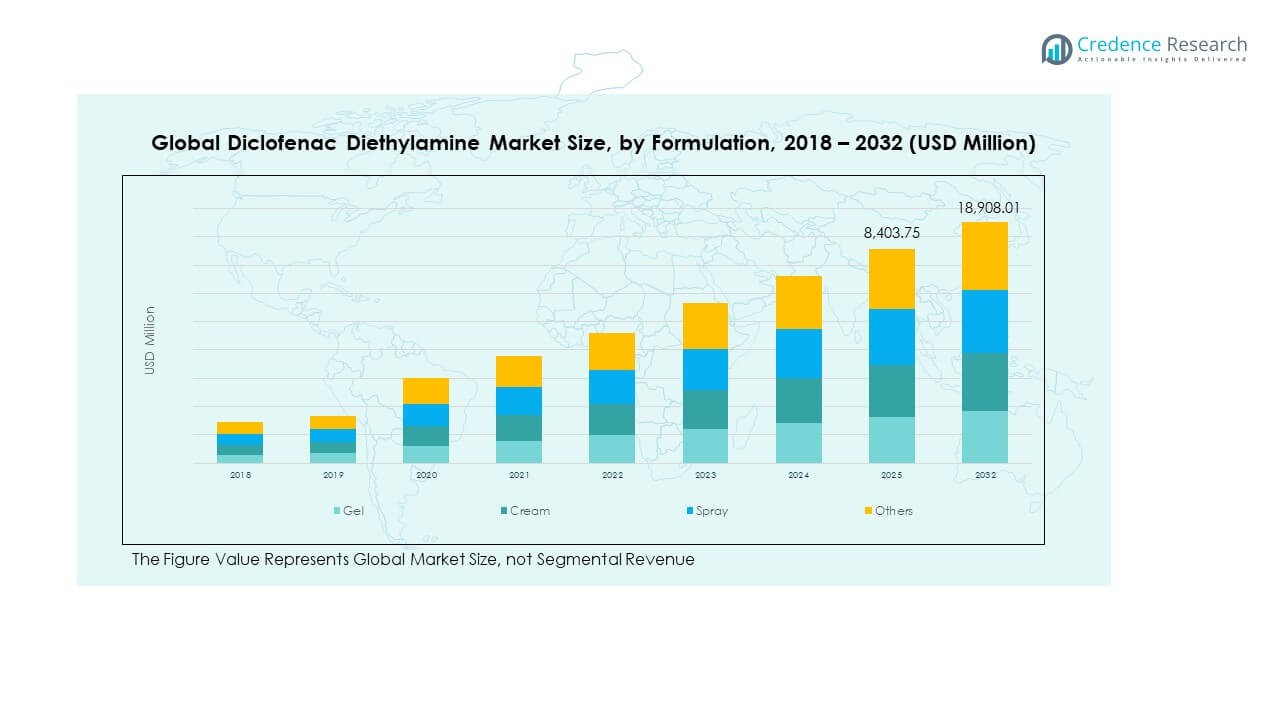

- From the formulation perspective, Gels account for around 45% share, making them the dominant category owing to higher consumer preference and proven efficacy in localized pain relief.

- Creams hold nearly 30% share, supported by widespread use in both prescription and OTC segments, while sprays and others cover the remaining market space.

Market Drivers:

Rising Prevalence of Musculoskeletal Disorders and Expanding Use of Topical Pain Relief Products:

The Global Diclofenac Diethylamine Market is driven by increasing cases of arthritis, back pain, and musculoskeletal disorders affecting millions worldwide. Patients seek fast and effective topical solutions, leading to higher adoption of diclofenac-based gels and creams. Healthcare providers recommend these products for non-invasive pain relief, reducing dependency on oral medications. Growing awareness about the benefits of topical formulations encourages wider usage across both urban and rural populations. It benefits from the rising trend toward self-medication and OTC pain relief solutions. Aging populations in major economies further amplify demand due to chronic pain conditions. Strong recommendations from orthopedic specialists also push usage in rehabilitation therapies. The combination of efficacy and convenience strengthens the position of diclofenac diethylamine in modern healthcare.

- For instance, GlaxoSmithKline conducted a controlled clinical trial involving about 300 patients to demonstrate that their diclofenac diethylamine 2.32% gel provided effective pain relief with a statistically significant margin, validating its fast absorption and local efficacy in musculoskeletal injury treatment.

Increasing Preference for Over-the-Counter (OTC) Medications and Accessibility in Pharmacies:

OTC sales have become a significant growth driver, supporting easy availability of topical analgesics without prescriptions. Pharmacies stock diclofenac diethylamine gels widely, making them accessible to patients with mild to moderate pain conditions. Consumers prefer OTC solutions due to lower costs and the convenience of quick purchase. It gains market traction from healthcare systems that promote self-care and reduce hospital visits for minor conditions. Retail chains, supermarkets, and online pharmacies expand accessibility and promote awareness through visibility and marketing campaigns. The Global Diclofenac Diethylamine Market benefits from these expanding distribution channels, ensuring greater product penetration. Awareness programs about safe usage and correct dosages also encourage wider adoption. The strong regulatory approval of OTC pain relief products underlines their safety profile and drives consumer trust.

Expanding Geriatric Population and Higher Incidence of Age-Related Pain Disorders:

Aging populations create strong demand for pain management therapies tailored to chronic conditions. Elderly patients frequently suffer from osteoarthritis, rheumatism, and back pain, requiring effective topical relief. Diclofenac diethylamine formulations offer localized treatment with minimal systemic side effects, making them suitable for older adults. It becomes a preferred choice for long-term management due to fewer gastrointestinal risks compared to oral NSAIDs. Hospitals, nursing homes, and assisted living facilities adopt these products to improve quality of life for senior citizens. The Global Diclofenac Diethylamine Market leverages this demographic shift as a steady growth contributor. Family caregivers increasingly depend on topical pain relief solutions for convenience and safety. Rising healthcare expenditure on geriatric care also fuels consistent product demand across regions.

Expanding Role of Sports Medicine and Growing Incidence of Lifestyle-Related Injuries:

Athletes and active individuals face muscle sprains, ligament strains, and overuse injuries requiring fast relief solutions. Diclofenac diethylamine gels are widely recommended in sports medicine due to their rapid action. Fitness centers and rehabilitation clinics support product adoption among younger demographics. It caters to a growing base of sports enthusiasts and recreational athletes, broadening consumer profiles. The Global Diclofenac Diethylamine Market benefits from partnerships between sports institutions and healthcare providers. Rising fitness trends and exercise-related injuries drive steady usage beyond clinical settings. Marketing campaigns highlighting quick pain relief during training and recovery also influence consumer decisions. Broader participation in physical activities globally reinforces demand for accessible topical pain management products.

Market Trends:

Growing Focus on Natural Formulations and Combination Therapies in Pain Relief Products:

Consumer preference for natural and herbal ingredients has influenced the pharmaceutical industry’s strategy. Manufacturers explore combining diclofenac diethylamine with herbal extracts to appeal to health-conscious users. It reflects a broader shift toward safer, sustainable solutions that limit chemical exposure. The Global Diclofenac Diethylamine Market responds to this demand by introducing formulations that integrate botanical components with proven NSAID efficacy. Product differentiation becomes a competitive strategy in crowded markets. Healthcare professionals support combination therapies for improved therapeutic outcomes in chronic conditions. Emerging product lines featuring innovative delivery methods, such as herbal-infused gels, enhance consumer appeal. Growing trust in natural solutions drives product diversification across global regions.

- For instance, Teva holds approvals for various formulations but no newly approved diclofenac diethylamine topical gel or cream recorded in FDA databases for 2025. Teva’s Biologic Licensing Application for other drug types is documented.

Expansion of E-Pharmacy Platforms and Digital Awareness Campaigns for Pain Management Solutions:

Digital transformation in healthcare distribution supports wider consumer access to topical pain relief solutions. Online pharmacies offer competitive pricing, doorstep delivery, and subscription models for consistent supply. The Global Diclofenac Diethylamine Market adapts to this trend by collaborating with e-pharmacy platforms for stronger presence. It benefits from increasing consumer comfort with digital health purchases. Educational campaigns on social media and online platforms highlight the correct use of topical products. Virtual healthcare consultations further encourage patients to adopt OTC pain relief options for non-severe conditions. Younger consumers rely on digital platforms to compare products, boosting brand competition. Expansion of e-pharmacy infrastructure in emerging markets accelerates product penetration across underserved regions.

- For instance, Viatris markets diclofenac sodium topical gels such as Fenac®, with FDA approvals continuing from earlier years.

Rising Research in Transdermal Drug Delivery Systems and Advanced Formulations:

Pharmaceutical R&D increasingly emphasizes transdermal delivery systems for more effective topical treatments. Enhanced absorption technologies improve efficacy of diclofenac diethylamine gels. It enables longer-lasting relief and faster onset of action, creating strong appeal among chronic pain patients. The Global Diclofenac Diethylamine Market integrates advanced formulation techniques to remain competitive. Encapsulation methods, nanoemulsions, and polymer-based gels enhance performance and patient compliance. Healthcare professionals recognize the value of research-backed formulations in reducing systemic risks. Improved formulations create opportunities for premium product positioning in developed markets. The trend toward innovation ensures product relevance in highly regulated healthcare environments.

Strengthening Role of Preventive Healthcare and Rising Awareness of Pain Management Practices:

Preventive healthcare initiatives encourage individuals to address musculoskeletal health proactively. Patients adopt topical solutions for early intervention in mild pain and stiffness. The Global Diclofenac Diethylamine Market aligns with this approach, offering effective and affordable prevention-focused therapies. It supports growing awareness about lifestyle-driven conditions such as posture-related pain. Governments and healthcare organizations emphasize preventive care to reduce healthcare burdens. Pain management campaigns in schools, workplaces, and communities improve acceptance of topical analgesics. Manufacturers highlight preventive benefits in marketing, aligning with evolving healthcare narratives. The focus on preventive care drives consistent product demand across both developed and emerging economies.

Market Challenges Analysis:

Regulatory Restrictions and Safety Concerns Associated with Non-Steroidal Anti-Inflammatory Drugs (NSAIDs):

The Global Diclofenac Diethylamine Market faces challenges linked to regulatory oversight of NSAID-based products. Concerns over side effects, especially with misuse, drive strict approval processes across regions. It requires manufacturers to maintain rigorous testing standards and clear labelling to ensure compliance. Regulatory bodies impose restrictions on dosage limits and packaging, impacting product accessibility. Negative publicity around NSAID-related risks influences consumer perception, reducing confidence in some cases. Healthcare providers may limit recommendations for long-term use due to safety considerations. These restrictions slow product launches in certain markets, delaying expansion plans. Compliance costs for manufacturers also rise significantly, increasing pressure on margins and profitability.

Rising Competition from Alternative Pain Relief Therapies and Generic Substitutes:

Competition from generic substitutes and alternative pain relief methods challenges market growth. Generic brands offer low-cost formulations that capture price-sensitive consumer segments. It reduces the market share of premium and branded diclofenac diethylamine products. The Global Diclofenac Diethylamine Market also contends with rising adoption of alternative therapies such as physiotherapy, acupuncture, and herbal remedies. Growing consumer awareness of natural solutions diverts attention from conventional topical NSAIDs. Competitive dynamics intensify as pharmaceutical companies introduce innovative pain relief alternatives. Price wars and shrinking differentiation among topical gels further affect profitability. Manufacturers must emphasize brand loyalty and innovation to retain competitive advantage in a saturated market.

Market Opportunities:

Expansion into Emerging Economies with Growing Healthcare Access and OTC Adoption:

The Global Diclofenac Diethylamine Market has significant opportunities in emerging economies with expanding healthcare infrastructure. Rising urbanization and increasing disposable incomes improve access to OTC pain relief products. It benefits from greater consumer awareness and wider distribution channels in countries such as India, Brazil, and Southeast Asian nations. Local manufacturing partnerships reduce costs and expand product availability across remote regions. Strengthening pharmacy networks and online platforms ensure broader product reach. Government initiatives to promote affordable healthcare further support penetration of topical analgesics. Growing populations in these regions guarantee a steady demand base for pain management solutions.

Product Innovation and Strategic Collaborations to Strengthen Market Position Globally:

Innovation in formulations, packaging, and delivery methods creates opportunities for differentiation. It enables manufacturers to position products as more effective, safer, and consumer-friendly. The Global Diclofenac Diethylamine Market benefits from strategic collaborations between pharmaceutical companies and research institutions. Partnerships support R&D investment for advanced formulations with faster absorption and enhanced safety. Co-branding initiatives with sports and wellness organizations expand product visibility. Integration of eco-friendly packaging solutions improves sustainability credentials, resonating with environmentally conscious consumers. These strategies enhance global competitiveness and unlock new revenue streams across established and emerging markets.

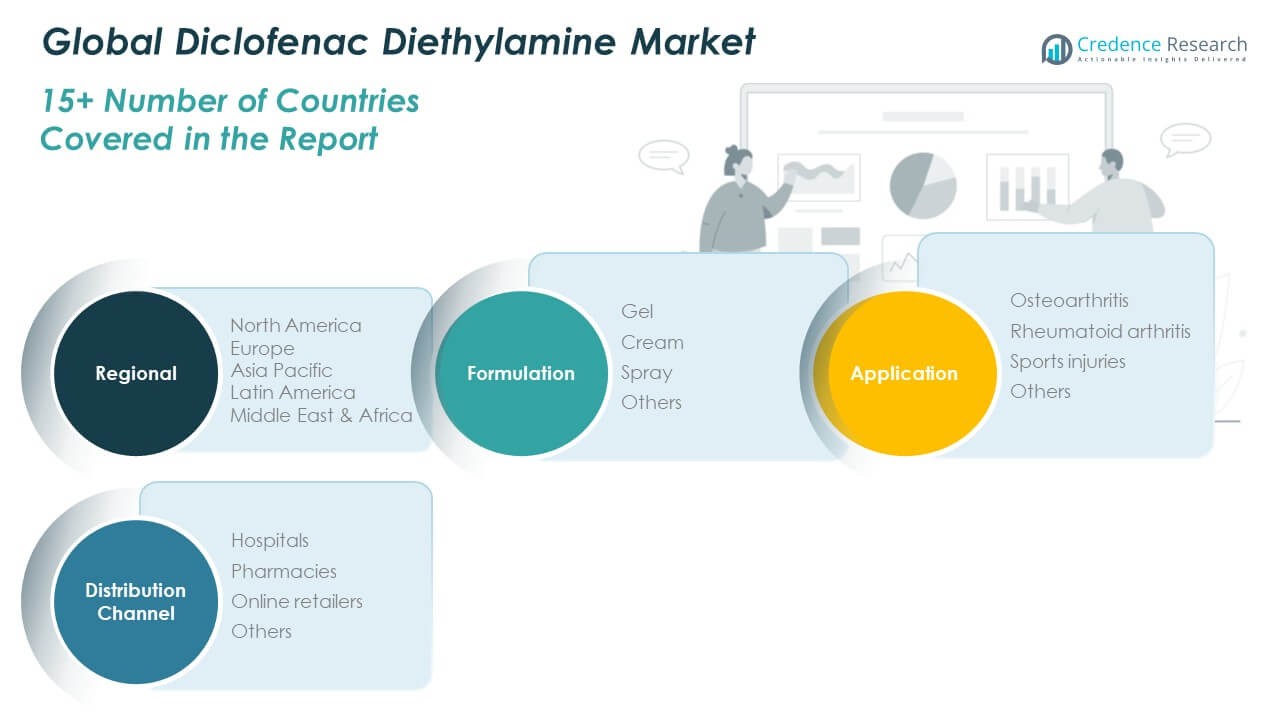

Market Segmentation Analysis:

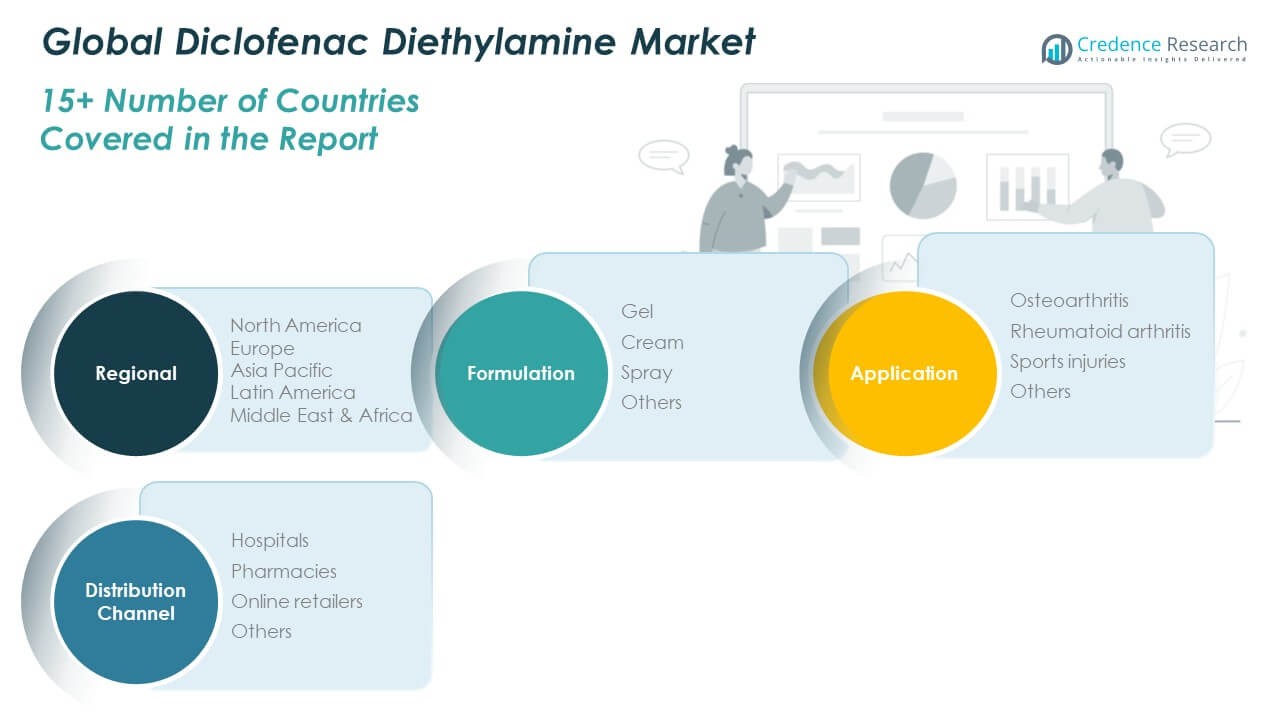

By Formulation

The Global Diclofenac Diethylamine Market is segmented into gel, cream, spray, and others. Gel dominates due to its high absorption rate, fast action, and consumer preference for topical relief. Cream follows closely, supported by wide use in both prescription and OTC channels. Spray caters to patients seeking convenience and quick application, while other formats contribute to niche demand in specific regions.

- For instance, Teva Pharmaceutical’s marketed formulations include specialized gel and cream delivery systems engineered for enhanced skin penetration and patient compliance, verified through pharmacokinetic profiles and patient feedback studies.

By Application

The market by application covers osteoarthritis, rheumatoid arthritis, sports injuries, and others. Osteoarthritis holds the largest share due to rising cases among aging populations and the need for long-term pain management. Rheumatoid arthritis applications contribute steadily, supported by growing awareness and treatment adoption. Sports injuries drive strong demand among younger and active demographics. Other uses, including general musculoskeletal pain, expand the market’s reach across diverse patient groups.

- For instance, Lupin Limited received USFDA approval for its generic version of diclofenac capsules (18 mg and 35 mg) for osteoarthritis pain management in December 2016. The company has since gained numerous additional approvals, including Risperidone long-acting injectable in September 2025. While Lupin continues to expand its broad portfolio, figures like “202 FDA-approved drugs and 139 pending filings” are outdated, as they reference company-reported data from December 2016.

By Distribution Channel

The distribution channel includes hospitals, pharmacies, online retailers, and others. Pharmacies lead the segment owing to strong consumer reliance on OTC availability and accessibility. Hospitals support demand through prescriptions for chronic pain cases and post-surgical recovery. Online retailers gain traction with digital health adoption, competitive pricing, and doorstep delivery. Other channels, including specialized clinics, sustain regional adoption in developing markets.

Segmentation:

By Formulation

By Application

- Osteoarthritis

- Rheumatoid Arthritis

- Sports Injuries

- Others

By Distribution Channel

- Hospitals

- Pharmacies

- Online Retailers

- Others

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia-Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Diclofenac Diethylamine Market size was valued at USD 1,659.59 million in 2018, reached USD 3,066.66 million in 2024, and is anticipated to reach USD 8,279.72 million by 2032, at a CAGR of 12.3% during the forecast period. It accounts for nearly 44% of the global share in 2024. The region benefits from strong healthcare infrastructure, high awareness of topical therapies, and established distribution channels. Rising prevalence of osteoarthritis and musculoskeletal disorders supports consistent product demand. Patients show strong acceptance of OTC formulations, driving pharmacies and online sales. Hospitals also contribute to prescriptions in chronic cases. The Global Diclofenac Diethylamine Market in North America remains competitive due to advanced R&D, product innovation, and aggressive marketing by multinational players. Growing consumer preference for fast-acting pain relief solutions reinforces regional dominance.

Europe

The Europe Global Diclofenac Diethylamine Market size was valued at USD 1,069.09 million in 2018, reached USD 1,924.19 million in 2024, and is anticipated to reach USD 4,878.39 million by 2032, at a CAGR of 11.4% during the forecast period. It holds around 28% of the global share in 2024. The market is supported by high adoption of topical NSAIDs, strong regulatory frameworks, and favorable reimbursement systems in key countries. Rising geriatric population and high incidence of joint-related disorders push demand across the region. Pharmacies remain the dominant distribution channel, complemented by growing online retail adoption. Hospitals and clinics contribute through treatment of rheumatoid arthritis and post-surgical care. The Global Diclofenac Diethylamine Market in Europe benefits from established pharmaceutical players introducing advanced formulations. Increasing awareness of preventive pain management sustains market growth.

Asia Pacific

The Asia Pacific Global Diclofenac Diethylamine Market size was valued at USD 700.48 million in 2018, reached USD 1,421.12 million in 2024, and is anticipated to reach USD 4,349.01 million by 2032, at a CAGR of 14.1% during the forecast period. It represents nearly 20% of the global share in 2024 and is the fastest-growing region. Large patient pools, rising incidence of lifestyle-related injuries, and growing OTC product adoption drive market expansion. Rapid urbanization and expanding healthcare infrastructure in countries like India and China support product accessibility. Pharmacies and hospitals lead distribution, while online platforms expand strongly. The Global Diclofenac Diethylamine Market in Asia Pacific benefits from increasing sports activity and rising awareness of non-invasive pain relief. Local manufacturing and cost-effective products make the region a hub for affordable solutions.

Latin America

The Latin America Global Diclofenac Diethylamine Market size was valued at USD 177.66 million in 2018, reached USD 327.58 million in 2024, and is anticipated to reach USD 780.66 million by 2032, at a CAGR of 10.6% during the forecast period. It accounts for nearly 5% of the global share in 2024. Market growth is driven by increasing awareness of musculoskeletal health, wider distribution of OTC products, and expanding urban healthcare systems. Brazil dominates the region, supported by large pharmaceutical consumption. Pharmacies remain the primary distribution channel, while online retailers gradually gain traction. Hospitals contribute to treating chronic arthritis and sports injuries. The Global Diclofenac Diethylamine Market in Latin America faces pricing challenges but benefits from rising adoption of generic formulations. Expansion of e-pharmacy services further supports growth.

Middle East

The Middle East Global Diclofenac Diethylamine Market size was valued at USD 105.78 million in 2018, reached USD 180.60 million in 2024, and is anticipated to reach USD 410.62 million by 2032, at a CAGR of 9.9% during the forecast period. It captures around 2.5% of the global share in 2024. Market demand is fueled by growing investment in healthcare infrastructure, higher prevalence of joint-related disorders, and increasing consumer awareness of pain management therapies. GCC countries lead the region due to advanced healthcare services and high-income populations. Pharmacies and hospitals are the main distribution channels, while online sales remain limited but expanding. The Global Diclofenac Diethylamine Market in the Middle East grows steadily, driven by adoption of modern healthcare practices. Rising focus on wellness and fitness adds to long-term demand.

Africa

The Africa Global Diclofenac Diethylamine Market size was valued at USD 48.69 million in 2018, reached USD 102.28 million in 2024, and is anticipated to reach USD 209.60 million by 2032, at a CAGR of 8.5% during the forecast period. It holds close to 1.5% of the global share in 2024. Growth is supported by expanding healthcare access, rising awareness of affordable pain relief, and gradual improvement of distribution networks. South Africa leads the region with strong pharmaceutical penetration, followed by Egypt and Nigeria. Pharmacies dominate distribution, while hospitals account for smaller but steady demand. The Global Diclofenac Diethylamine Market in Africa faces challenges such as limited availability in rural areas and price sensitivity. Increasing efforts to strengthen healthcare systems enhance market potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Novartis Pharmaceuticals Corporation

- GlaxoSmithKline plc

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (Viatris Inc.)

- Aurobindo Pharma Limited

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Amneal Pharmaceuticals, Inc.

- B. Chemicals & Pharmaceuticals Ltd.

- Olon S.p.A.

Competitive Analysis:

The Global Diclofenac Diethylamine Market is characterized by intense competition among multinational and regional pharmaceutical companies. Leading players focus on expanding product portfolios, strengthening OTC availability, and introducing innovative formulations. It benefits from strategic collaborations, mergers, and partnerships aimed at expanding regional reach and driving brand visibility. Companies invest heavily in R&D to develop advanced topical delivery systems that enhance absorption and safety. Generic manufacturers increase market pressure by offering cost-effective alternatives in price-sensitive regions. Marketing strategies focus on brand loyalty and awareness campaigns highlighting fast-acting pain relief. Regulatory approvals and compliance play a central role in determining competitive advantage. Strong distribution networks across pharmacies, hospitals, and online platforms further differentiate key market players.

Recent Developments:

- In 2025, GlaxoSmithKline plc (GSK) is on track to launch five new products or line extensions, including Blenrep for multiple myeloma, depemokimab for severe asthma and chronic rhinosinusitis with nasal polyps, and Nucala approved for COPD. GSK also completed the acquisition of IDRx and formed a partnership with ABL Bio in neurodegenerative diseases, along with collaborations on shingles vaccination to potentially prevent dementia. The company has enjoyed pipeline growth, with multiple regulatory submissions under review and approvals in the EU, UK, Japan, and several other markets.

- Teva Pharmaceutical Industries Ltd. has shifted focus toward smaller mergers and acquisitions, moving away from previous large multi-billion dollar deals. Recent financial activities include a $2.3 billion bond offering in May 2025 to support its operations. The company is strategically adjusting its acquisition approach to prioritize impactful smaller deals over major blockbuster acquisitions.

- Aurobindo Pharma Limited received USFDA final approvals in 2025 for generic versions of drugs including Dasatinib tablets for blood cancer treatment and Rivaroxaban tablets used for stroke risk reduction and thrombosis treatment. These products, with large U.S. market potentials (e.g., Dasatinib estimated at $1.8 billion and Rivaroxaban at $447 million), are expected to launch in early fiscal 2026. The company continues expansion of its ANDA portfolio with a total of 540 approvals.

Report Coverage:

The research report offers an in-depth analysis based on formulation, application, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for OTC formulations will strengthen retail and pharmacy distribution networks.

- Increasing investments in R&D will improve topical delivery systems for higher absorption.

- Expanding awareness of preventive pain management will boost adoption in younger populations.

- Digital health and e-pharmacy platforms will accelerate global product penetration.

- Emerging economies will present strong growth opportunities due to wider healthcare access.

- Strategic collaborations between pharma companies will enhance global competitiveness.

- Rising prevalence of musculoskeletal disorders will sustain steady product demand.

- Generic competition will continue to influence pricing dynamics in developing regions.

- Technological advancements in nanoemulsions and encapsulation will improve efficacy.

- Strong regulatory compliance will remain a decisive factor for market expansion.