Market Overview

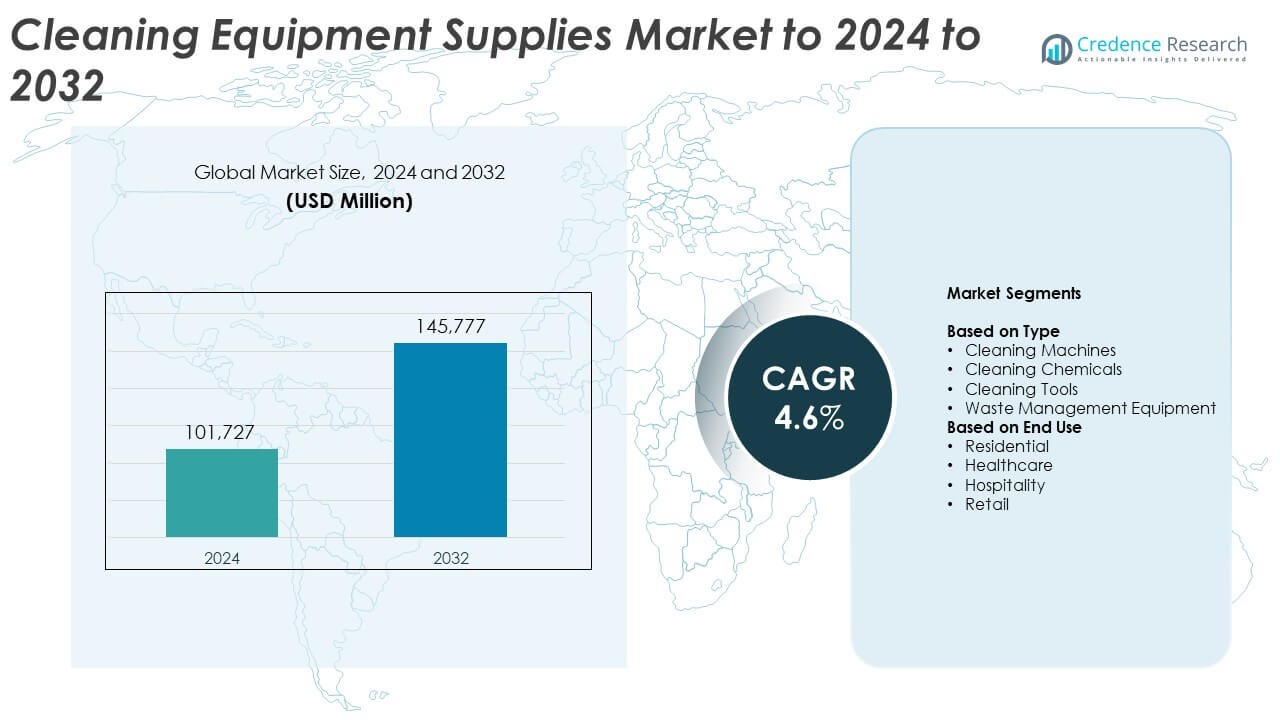

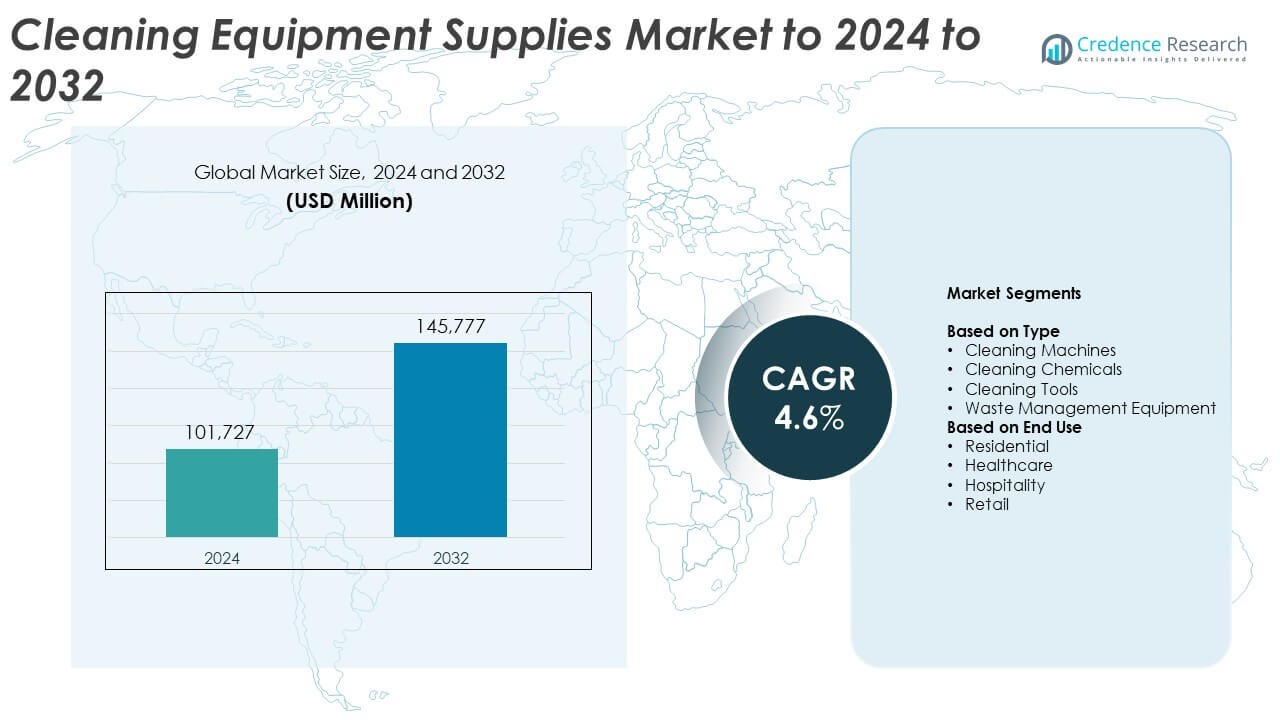

The Cleaning Equipment Supplies Market size was valued at USD 101,727 million in 2024 and is anticipated to reach USD 145,777 million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cleaning Equipment Supplies Market Size 2024 |

USD 101,727 Million |

| Cleaning Equipment Supplies Market, CAGR |

4.6% |

| Cleaning Equipment Supplies Market Size 2032 |

USD 145,777 Million |

The Cleaning Equipment Supplies Market is led by key players such as Ecolab, Nilfisk, Chemtronics, Procter and Gamble, Vileda, Solenis, Bissell, ITW, SC Johnson Professional, Diversey Holdings, Tennant Company, Alfa Laval, Karcher, Sealed Air, and 3M. These companies dominate through continuous product innovation, automation, and sustainable cleaning technologies. North America leads the global market with a 36.8% share, driven by high adoption of advanced cleaning systems and strong commercial infrastructure. Europe follows with 28.4%, supported by strict hygiene standards and eco-friendly practices, while Asia Pacific, holding 24.6%, remains the fastest-growing region due to rapid industrialization and urbanization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cleaning Equipment Supplies Market was valued at USD 101,727 million in 2024 and is projected to reach USD 145,777 million by 2032, growing at a CAGR of 4.6%.

- Growth is driven by increasing demand for automated and smart cleaning machines, which accounted for 46.2% of the market share in 2024. Rising hygiene awareness and regulatory standards across industries further support expansion.

- Key trends include the adoption of eco-friendly cleaning chemicals, IoT-enabled devices, and sustainable waste management systems across industrial and commercial sectors.

- The market is highly competitive with strong global presence from leading companies focusing on digitalization, innovation, and environmentally responsible product portfolios to maintain market leadership.

- Regionally, North America led with a 36.8% share in 2024, followed by Europe at 28.4%, while Asia Pacific, holding 24.6%, emerged as the fastest-growing market driven by rapid urbanization and commercial infrastructure development.

Market Segmentation Analysis:

By Type

The cleaning machines segment dominated the cleaning equipment supplies market in 2024 with a 46.2% share. Growth is driven by rising demand for automated and efficient cleaning solutions across commercial and industrial facilities. The adoption of robotic vacuum cleaners, floor scrubbers, and high-pressure washers is increasing due to labor cost optimization and hygiene compliance requirements. Manufacturers are integrating IoT-enabled systems and energy-efficient motors to improve operational efficiency and sustainability. Expanding smart facility management and urban infrastructure projects further support market growth for automated cleaning machines.

- For instance, Tennant’s T7 AMR lists autonomous productivity of 2,660 m²/hour and an estimated run time up to 4 hours per charge.

By End Use

The healthcare segment accounted for the largest market share of 38.4% in 2024, driven by strict hygiene regulations and infection control standards. Hospitals and clinics increasingly rely on advanced cleaning equipment, disinfectants, and waste management systems to maintain sterile environments. The rising prevalence of hospital-acquired infections and global focus on patient safety fuel demand for efficient cleaning processes. Growing investment in healthcare infrastructure and adoption of automated disinfection technologies enhance market expansion within the healthcare segment.

- For instance, STERIS AMSCO 7052/7053 washers process up to 300 DIN trays per 8-hour day with a fastest instrument cycle of 16 minutes and water use as low as 23–31 gal per cycle.

Key Growth Drivers

Rising Demand for Automated and Smart Cleaning Solutions

The adoption of automated cleaning systems, including robotic vacuum cleaners and floor scrubbers, is accelerating in both residential and commercial sectors. These systems reduce labor costs, enhance cleaning consistency, and improve operational efficiency. Increasing integration of IoT sensors and AI-driven navigation enables real-time monitoring and predictive maintenance. Growing demand for contactless and energy-efficient cleaning technologies further drives this segment’s dominance in smart facility management and public spaces.

- For instance, Brain Corp reports 250 billion sq ft cleaned, 37,000 robots deployed, and 19 million autonomous hours logged across its fleet.

Stringent Hygiene and Sanitation Regulations

Government and industry-specific hygiene standards are pushing organizations to adopt advanced cleaning equipment and eco-friendly supplies. The healthcare, hospitality, and food sectors face strict cleaning protocols to prevent contamination and ensure safety compliance. Manufacturers are focusing on chemical-free disinfectants and energy-efficient machines to meet these evolving norms. The continuous rise in awareness about workplace hygiene post-pandemic strengthens the regulatory-driven adoption of high-performance cleaning systems.

- For instance, Ecolab’s disinfectant achieved SARS-CoV-2 kill in 30 seconds in spray and electrostatic applications under EPA review.

Expansion of Commercial Infrastructure and Hospitality Sector

Rapid urbanization and growth in commercial establishments such as hotels, offices, and retail centers are fueling demand for large-scale cleaning solutions. Cleaning equipment suppliers are offering tailored solutions for high-traffic areas that require frequent sanitation. The global tourism recovery and expansion of luxury hospitality chains are further driving consistent product adoption. Continuous investments in sustainable and automated systems enhance operational productivity in commercial facilities.

Key Trends & Opportunities

Integration of Sustainable and Eco-Friendly Cleaning Technologies

The shift toward sustainability is reshaping the cleaning equipment supplies market. Manufacturers are developing biodegradable chemicals, water-efficient machines, and low-emission systems to minimize environmental impact. The rise in green building certifications and ESG-focused facility management practices accelerates adoption of eco-conscious cleaning solutions. Growing consumer preference for environmentally safe products provides long-term opportunities for innovation in cleaning supplies.

- For instance, Geldof delivered a 22,000 m³ cold ammonia tank with a carbon-steel inner shell and a concrete outer shell (a full containment design). The design follows EN 14620 requirements.

Adoption of IoT and Data-Driven Cleaning Systems

Smart cleaning technologies powered by IoT and data analytics are improving efficiency and resource management. Real-time tracking of equipment performance and maintenance schedules enhances productivity in commercial environments. Data-based optimization allows facilities to reduce operational costs and energy use while maintaining hygiene standards. The trend supports predictive maintenance, lowering downtime and extending product lifespan.

- For instance, ICE Cobotics’ Cobi 18 lists 800 m²/hour cleaning productivity with 90-minute run time and built-in fleet analytics that capture operational data each cycle.

Growth in Outsourced Cleaning Services

Increasing outsourcing of cleaning operations by corporate offices, healthcare centers, and public institutions is driving market growth. Professional cleaning service providers prefer advanced, multi-functional equipment to ensure quality outcomes. This shift opens new opportunities for manufacturers to supply integrated solutions that meet diverse client needs.

Key Challenges

High Initial Investment and Maintenance Costs

Advanced cleaning equipment, especially automated and robotic systems, requires significant upfront investment. Small enterprises often face financial constraints in adopting these technologies. Additionally, regular maintenance and software updates add to operational expenses. These costs limit widespread adoption, particularly in developing economies where price sensitivity remains high.

Environmental and Health Concerns from Chemical Cleaning Agents

Despite advancements, many cleaning chemicals still pose health and environmental risks. Exposure to harsh detergents can cause respiratory and skin issues among workers, while improper disposal contaminates water systems. Regulatory authorities are enforcing stricter controls on chemical formulations, compelling companies to invest in safer alternatives. Transitioning to eco-friendly chemicals remains challenging due to higher production costs and limited availability.

Regional Analysis

North America

North America dominated the cleaning equipment supplies market in 2024 with a 36.8% share. Growth is driven by strong adoption of automated and sustainable cleaning technologies across commercial and residential sectors. The United States leads regional demand due to stringent hygiene standards in healthcare and hospitality industries. Increasing investments in green cleaning products and smart janitorial systems further strengthen market expansion. Major manufacturers are focusing on energy-efficient and robotic cleaning equipment to support large-scale facility management needs across offices, airports, and institutional buildings.

Europe

Europe accounted for a 28.4% share of the cleaning equipment supplies market in 2024, supported by rising environmental regulations and sustainability goals. The region’s demand is led by Germany, France, and the United Kingdom, where professional cleaning services and eco-friendly products are widely adopted. Government initiatives promoting waste reduction and green cleaning chemicals drive consistent growth. The ongoing modernization of commercial infrastructure and emphasis on low-emission technologies further enhance equipment sales across industrial and residential applications.

Asia Pacific

Asia Pacific held a 24.6% market share in 2024, emerging as the fastest-growing regional market. Rapid urbanization, industrial expansion, and increasing health awareness are major growth drivers. China, Japan, and India are key contributors, with growing investments in cleaning automation and eco-friendly chemical manufacturing. Expanding commercial real estate, hospitality projects, and healthcare facilities accelerate product adoption. Rising demand for cost-effective and durable cleaning tools also supports strong regional performance.

Latin America

Latin America represented a 6.3% share of the cleaning equipment supplies market in 2024, driven by gradual improvements in sanitation standards and commercial infrastructure. Brazil and Mexico are major contributors, with increased adoption of industrial cleaning machines in manufacturing and hospitality sectors. Rising urban population and awareness of hygiene standards support market growth. However, limited access to advanced cleaning technologies and high import costs restrain broader adoption across small enterprises.

Middle East and Africa

The Middle East and Africa accounted for a 3.9% market share in 2024, supported by infrastructure development and growth in hospitality and healthcare projects. The United Arab Emirates and Saudi Arabia lead regional demand with large investments in commercial cleaning operations and smart city initiatives. Expanding tourism and construction activities drive adoption of advanced cleaning tools and waste management systems. Increasing focus on water-efficient technologies and energy-saving cleaning machines further contributes to gradual market expansion in the region.

Market Segmentations:

By Type

- Cleaning Machines

- Cleaning Chemicals

- Cleaning Tools

- Waste Management Equipment

By End Use

- Residential

- Healthcare

- Hospitality

- Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Leading companies such as Ecolab, Nilfisk, Chemtronics, Procter and Gamble, Vileda, Solenis, Bissell, ITW, SC Johnson Professional, Diversey Holdings, Tennant Company, Alfa Laval, Karcher, Sealed Air, and 3M collectively shape the competitive landscape of the cleaning equipment supplies market. The market is characterized by continuous innovation, strong product portfolios, and global distribution networks. Companies are focusing on automation, sustainable manufacturing, and smart cleaning solutions to enhance efficiency and reduce environmental impact. Strategic partnerships with commercial cleaning service providers and facility management firms are expanding market reach. Firms are also investing in R&D to introduce energy-efficient machines, biodegradable cleaning agents, and IoT-enabled monitoring systems. Competitive differentiation increasingly relies on product innovation, digital integration, and customer-focused service models. The growing shift toward green cleaning technologies and operational efficiency encourages both established brands and new entrants to adopt advanced, eco-conscious manufacturing practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ecolab

- Nilfisk

- Chemtronics

- Procter and Gamble

- Vileda

- Solenis

- Bissell

- ITW

- SC Johnson Professional

- Diversey Holdings

- Tennant Company

- Alfa Laval

- Karcher

- Sealed Air

- 3M

Recent Developments

- In 2024, Kärcher introduced a new generation of its professional high-pressure washers, featuring enhanced energy efficiency and IoT connectivity for fleet management and predictive maintenance.

- In 2024, Nilfisk showcased a new range of professional vacuum cleaners designed for hazardous dust, featuring them at industry events throughout the year

- In 2023, Solenis Completed the acquisition of Diversey Holdings, Ltd. in July 2023, merging Diversey’s cleaning and sanitation solutions into the Solenis portfolio to create a more comprehensive water and chemical treatment company.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong adoption of robotic and AI-powered cleaning systems.

- Demand for sustainable and biodegradable cleaning chemicals will continue to rise.

- Growth in commercial infrastructure will drive large-scale cleaning equipment sales.

- Integration of IoT and data-driven monitoring will enhance operational efficiency.

- Manufacturers will focus on developing low-noise, energy-efficient cleaning solutions.

- Outsourced cleaning services will expand across healthcare and hospitality sectors.

- Smart city initiatives will create new opportunities for automated waste management.

- E-commerce platforms will boost sales of residential cleaning tools and supplies.

- Stringent environmental regulations will accelerate innovation in green cleaning technologies.

- Emerging markets in Asia and the Middle East will experience rapid modernization in cleaning systems.