Market Overview

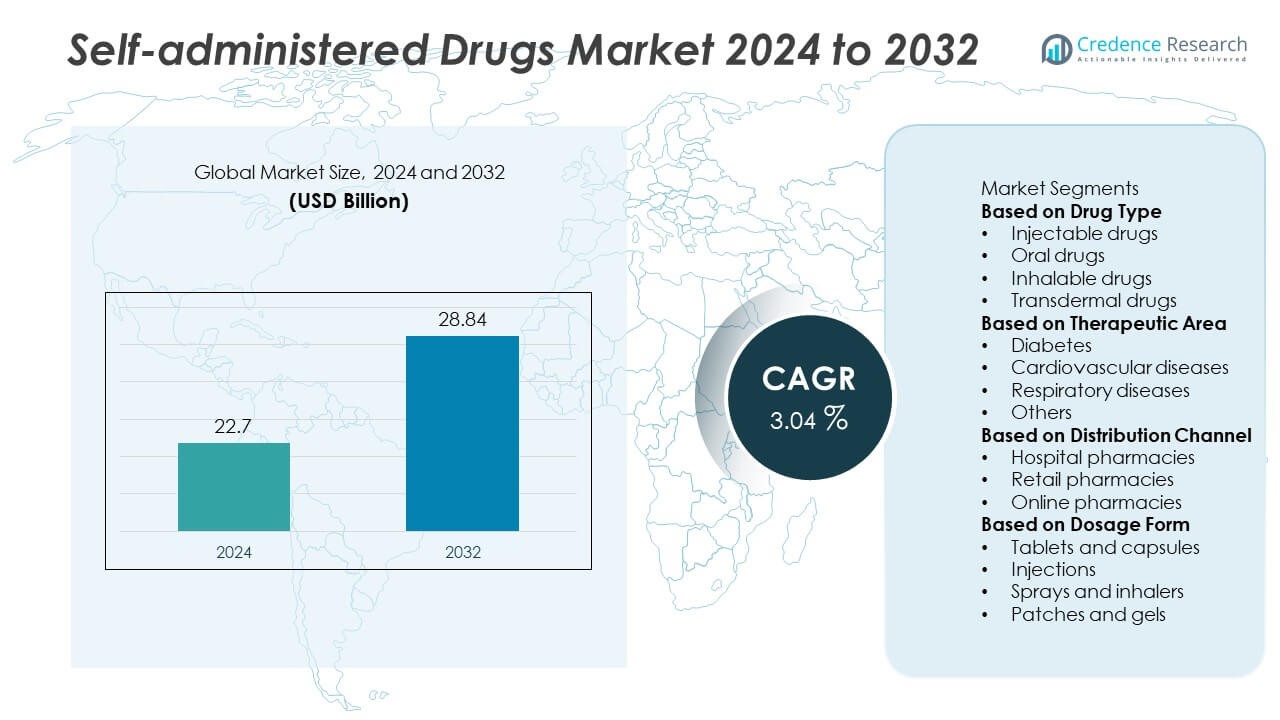

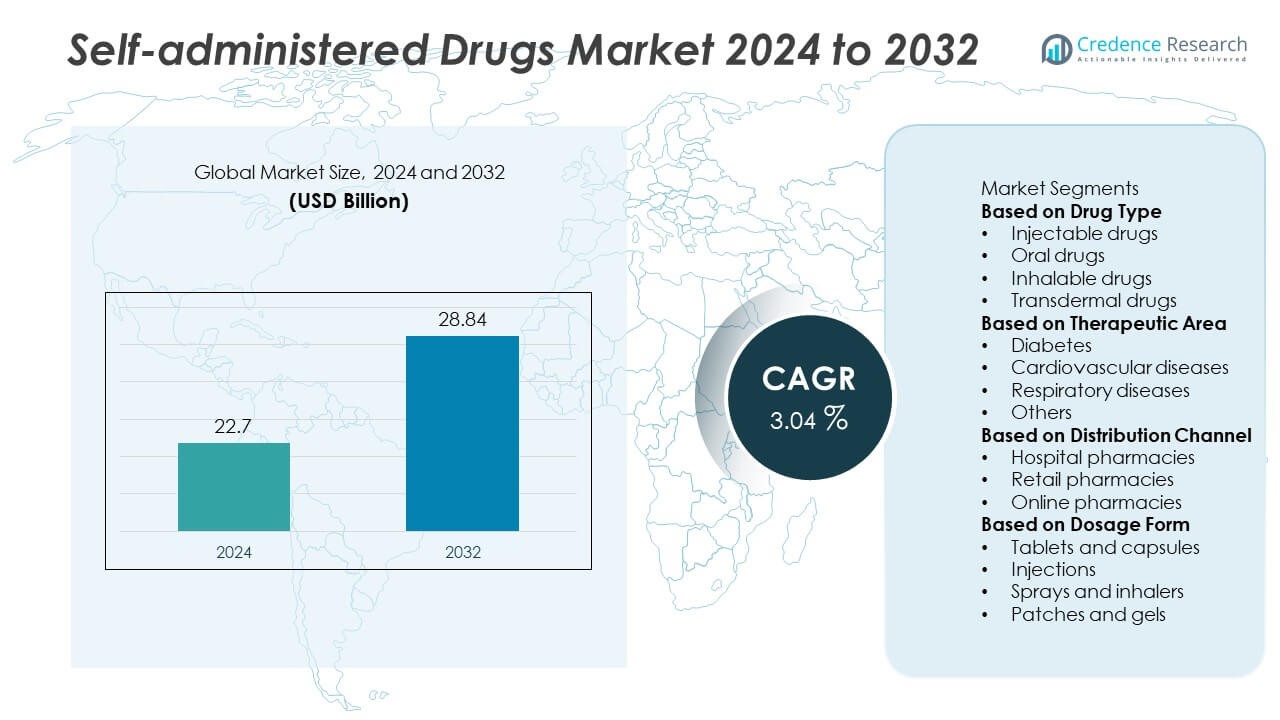

The Self-Administered Drugs Market was valued at USD 22.7 billion in 2024 and is projected to reach USD 28.84 billion by 2032, growing at a CAGR of 3.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Self-Administered Drugs Market Size 2024 |

USD 22.7 Billion |

| Self-Administered Drugs Market, CAGR |

3.04% |

| Self-Administered Drugs Market Size 2032 |

USD 28.84 Billion |

The self-administered drugs market is led by major companies such as Pfizer Inc., Novartis AG, Amgen Inc., AstraZeneca plc, Johnson & Johnson, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., GlaxoSmithKline plc, and Sanofi S.A. These players dominate through strong R&D pipelines, innovation in drug delivery systems, and global distribution networks. Focus on biologics, auto-injectors, and connected drug delivery devices has enhanced patient adherence and treatment efficiency. North America emerged as the leading region with a 39.6% market share in 2024, supported by advanced healthcare infrastructure, high prevalence of chronic diseases, and strong adoption of home-based care solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The self-administered drugs market was valued at USD 22.7 billion in 2024 and is projected to reach USD 28.84 billion by 2032, growing at a CAGR of 3.04% during the forecast period.

- Rising prevalence of chronic diseases such as diabetes and cardiovascular disorders is driving strong demand for convenient, at-home treatment options.

- Market trends highlight increased adoption of smart injectors, prefilled syringes, and wearable drug delivery systems that enhance patient adherence and safety.

- Leading players such as Pfizer Inc., Amgen Inc., and Novartis AG focus on product innovation, biologics expansion, and strategic collaborations to strengthen their market presence.

- North America led with a 39.6% share in 2024, followed by Europe with 28.4%, while Asia-Pacific held 23.8% as the fastest-growing region; the injectable drugs segment dominated with a 47.2% share, driven by rapid adoption of auto-injectors and self-injection devices.

Market Segmentation Analysis:

By Drug Type

The injectable drugs segment dominated the self-administered drugs market with a 47.2% share in 2024, driven by the growing adoption of auto-injectors and prefilled syringes for chronic disease management. The increasing prevalence of diabetes, multiple sclerosis, and rheumatoid arthritis has accelerated the demand for convenient and precise delivery systems. Technological advancements such as wearable injectors and needle-free systems are improving patient compliance and safety. Oral drugs continue to hold significant demand due to ease of use, while inhalable and transdermal formulations are gaining traction for faster onset and targeted delivery.

- For instance, Amgen Inc. launched the Enbrel Mini® single-dose prefilled cartridge for use with the AutoTouch® reusable autoinjector. The device administers a 50 mg dose, features visual and audible cues to confirm the injection is complete, and includes a sensor to detect placement on the skin.

By Therapeutic Area

The diabetes segment held the largest share of 38.5% in 2024, fueled by the rising global burden of diabetic patients and the widespread use of self-injection insulin pens and GLP-1 agonists. The convenience of at-home glucose monitoring and self-dosing solutions enhances adherence and disease control. Cardiovascular diseases follow closely, with patients increasingly using oral and transdermal therapies for long-term management. Growth in respiratory diseases such as asthma and COPD also supports demand for portable inhalation devices, enabling better self-management and reducing healthcare system dependency.

- For instance, Novo Nordisk’s FlexTouch® insulin delivery system enables precise dosing up to 80 units with a single injection and uses a spring-loaded mechanism requiring a consistently low injection force. The non-extending dose button and low force make it suitable for patients with limited hand dexterity.

By Distribution Channel

The retail pharmacies segment accounted for a 52.8% share in 2024, as they remain the primary access point for prescription and over-the-counter self-administered medications. Expanding pharmacy networks and pharmacist-led patient education programs are improving accessibility and awareness of home-based therapies. Hospital pharmacies cater to specialized treatments and chronic disease follow-ups, while online pharmacies are rapidly expanding due to digitalization and e-prescription adoption. The convenience of doorstep delivery and availability of a wide product range continue to position online channels as a fast-growing distribution segment in the self-administered drugs market.

Key Growth Drivers

Rising Prevalence of Chronic Diseases

The growing incidence of chronic conditions such as diabetes, cardiovascular diseases, and autoimmune disorders is driving strong demand for self-administered drugs. Patients increasingly prefer home-based treatments to minimize hospital visits and reduce healthcare costs. Self-administration enhances convenience, independence, and adherence, particularly for long-term therapies. The rising global geriatric population, which requires continuous medication, further accelerates the adoption of self-dosing solutions, supporting steady market growth across both developed and emerging economies.

- For instance, Eli Lilly and Company supplies Trulicity® (dulaglutide) pens for type 2 diabetes management. It is available in various once-weekly dosages, including 0.75 mg, 1.5 mg, 3 mg, and 4.5 mg. Each single-use pen features a pre-attached, hidden 29-gauge needle and a single-step activation process designed to improve the self-administration experience.

Advancements in Drug Delivery Technologies

Technological innovation in drug delivery systems is a major driver of market expansion. The development of auto-injectors, prefilled syringes, and wearable injectors enables precise dosing and reduces user errors. These devices enhance comfort and safety, encouraging patient acceptance of injectable therapies. Pharmaceutical companies are also integrating digital features for dose tracking and connectivity, improving treatment adherence. Such innovations are transforming traditional medication delivery into patient-centric, technology-driven solutions, strengthening long-term therapy outcomes and market competitiveness.

- For instance, Amgen Inc. introduced the Neulasta® Onpro® wearable injector, which is capable of delivering a 6 mg dose subcutaneously over approximately 45 minutes after a preset 27-hour delay. This device eliminates the need for next-day clinical visits for pegfilgrastim administration, which represents a shift toward automated self-administration for some patients.

Shift Toward Home-Based Healthcare

The global shift toward home-based care is significantly increasing demand for self-administered therapies. Patients and healthcare systems prefer remote treatment models that reduce hospital dependency and enhance convenience. Rising healthcare costs, combined with advancements in telemedicine and remote monitoring, further encourage self-administration. The pandemic accelerated this trend, promoting the use of easy-to-use formulations and devices that ensure safe home-based drug delivery. This shift aligns with the broader trend of personalized and patient-managed healthcare, expanding opportunities for pharmaceutical manufacturers.

Key Trends & Opportunities

Integration of Smart and Connected Drug Delivery Devices

The emergence of smart injectors and connected inhalers is revolutionizing patient engagement and compliance. These devices record dosing data, send reminders, and communicate with healthcare platforms for real-time monitoring. Integration with mobile apps and telehealth solutions enables remote supervision and personalized dosing. The combination of drug therapy and digital health improves treatment accuracy and adherence, providing new revenue streams for manufacturers and creating opportunities in the rapidly evolving digital healthcare ecosystem.

- For instance, AstraZeneca introduced the smart inhaler version of its Symbicort® Turbuhaler equipped with a built-in digital sensor developed by Propeller Health. The device tracks inhalation frequency and transmits data via Bluetooth to a mobile application, enabling clinicians to monitor adherence remotely. Clinical evaluations show a 35% improvement in inhaler usage consistency among patients with asthma and COPD using this connected platform.

Growing Adoption of Biologics and Personalized Medicine

The rising use of biologics in treating chronic and autoimmune disorders is creating new opportunities for self-administered drug systems. As these therapies often require long-term dosing, patient-friendly delivery options like prefilled pens and auto-injectors are becoming essential. Personalized medicine initiatives further support customized dosing and delivery designs tailored to individual needs. This trend promotes innovation in formulation stability, device compatibility, and patient usability, reinforcing market expansion in high-value therapeutic areas.

- For instance, Johnson & Johnson introduced Tremfya® One-Press, a self-administered biologic injection device designed for patients with plaque psoriasis and psoriatic arthritis. The system delivers a 100 mg dose in a single push without visible needles and maintains a consistent flow rate of 0.5 mL over 30 seconds. More than 1.5 million Tremfya® injections have been administered globally through this platform, reflecting strong patient acceptance for home-based biologic therapy.

Key Challenges

Complex Drug Formulations and Handling Difficulties

Many biologic and injectable drugs require specialized storage, handling, and administration techniques, which can limit patient adoption. Improper use may lead to underdosing, overdosing, or contamination, affecting treatment safety and outcomes. Training and user education remain critical but are not always accessible, especially in remote regions. Manufacturers are addressing these challenges through intuitive device design and user-friendly packaging, but the complexity of certain formulations continues to restrain wider adoption of self-administered therapies.

Regulatory and Reimbursement Barriers

Stringent regulatory requirements for combination drug-device approvals and inconsistent reimbursement policies pose major challenges to market growth. The need to comply with varying international standards delays product launches and increases development costs. Moreover, limited insurance coverage for home-based treatments in certain regions restricts patient access to advanced self-administration devices. To overcome these barriers, companies are collaborating with healthcare authorities and insurers to establish standardized frameworks that support affordability, accessibility, and faster market entry.

Regional Analysis

North America

North America dominated the self-administered drugs market with a 39.6% share in 2024, driven by a high prevalence of chronic diseases and widespread adoption of advanced drug delivery systems. The U.S. leads the region due to strong healthcare infrastructure, patient awareness, and technological advancements in biologics and injectable devices. Increasing preference for home-based treatments, coupled with high healthcare spending, supports sustained market demand. Major pharmaceutical players and ongoing innovation in connected drug delivery solutions further strengthen North America’s position as the leading hub for self-administered drug development and adoption.

Europe

Europe accounted for a 28.4% share in 2024, supported by a strong regulatory framework, well-established healthcare systems, and growing use of biologics for chronic disease management. Countries such as Germany, France, and the U.K. are at the forefront, focusing on patient-centric care and self-medication initiatives. The region’s emphasis on safety, drug-device integration, and user-friendly packaging is encouraging wider adoption among elderly populations. Government programs promoting cost-effective home healthcare and increased reimbursement for self-administration devices continue to drive market expansion across the European region.

Asia-Pacific

Asia-Pacific held a 23.8% share in 2024, emerging as the fastest-growing region due to expanding healthcare access, large patient populations, and rising prevalence of diabetes and cardiovascular disorders. Countries like China, Japan, and India are witnessing increasing demand for self-injectable and oral therapies as healthcare systems transition toward outpatient care. Growing investments in pharmaceutical manufacturing and awareness of patient self-management are further boosting adoption. The rapid digitalization of healthcare and expansion of online pharmacy platforms continue to enhance accessibility and affordability across the Asia-Pacific market.

Latin America

Latin America captured a 5.1% market share in 2024, driven by increasing healthcare modernization and growing awareness of self-administered treatments. Brazil and Mexico lead the region, supported by rising chronic disease incidence and expanding pharmaceutical distribution networks. Governments are promoting initiatives to improve access to essential medications and reduce hospital dependency. Although limited by affordability concerns in low-income populations, the growing availability of cost-effective generics and local production of self-administration devices are expected to support long-term market growth across Latin America.

Middle East & Africa

The Middle East & Africa accounted for a 3.1% share in 2024, supported by ongoing improvements in healthcare infrastructure and a gradual shift toward patient self-management. The UAE, Saudi Arabia, and South Africa are key markets, with increasing adoption of insulin pens, oral therapies, and transdermal products. Rising investments in healthcare facilities and pharmaceutical imports are improving access to advanced drug delivery systems. Despite limited awareness and affordability challenges in rural areas, expanding digital health initiatives and government-led chronic disease programs are driving steady market growth in the region.

Market Segmentations:

By Drug Type

- Injectable drugs

- Oral drugs

- Inhalable drugs

- Transdermal drugs

By Therapeutic Area

- Diabetes

- Cardiovascular diseases

- Respiratory diseases

- Others

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

By Dosage Form

- Tablets and capsules

- Injections

- Sprays and inhalers

- Patches and gels

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The self-administered drugs market is highly competitive, featuring key players such as Pfizer Inc., Novartis AG, Amgen Inc., AstraZeneca plc, Johnson & Johnson, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., GlaxoSmithKline plc, and Sanofi S.A. These companies lead through innovation in drug delivery technologies, such as auto-injectors, prefilled syringes, and wearable systems. Strategic collaborations and investments in biologics are expanding their market presence. Companies are focusing on patient-centric solutions that enhance convenience and adherence while reducing healthcare costs. Expanding digital health integration, R&D in controlled-release formulations, and improved access to personalized therapies further enhance competitiveness. The growing shift toward home-based care and telemedicine platforms provides new opportunities for market leaders to strengthen distribution networks and optimize patient engagement strategies globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- Pfizer Inc.

- Novartis AG

- Amgen Inc.

- AstraZeneca plc

- Johnson & Johnson

- Eli Lilly and Company

- Teva Pharmaceutical Industries Ltd.

- Merck & Co., Inc.

- GlaxoSmithKline plc

- Sanofi S.A.

Recent Developments

- In October 2025, Eli Lilly and Company secured US approval for its subcutaneous regimen of Omvoh® (mirikizumab-mrkz) — a single 200 mg/2 mL injection once monthly for adult ulcerative colitis maintenance therapy.

- In June 2023, Pfizer Inc. obtained approval for NGENLA™, a once-weekly treatment for pediatric growth hormone deficiency, reducing injection frequency compared with daily alternatives.

- In February 2023, AstraZeneca plc and Amgen Inc. gained US approval for TEZSPIRE® (tezepelumab) as a pre-filled single-use pen and auto-injector for self-administration in patients aged 12 and older with severe asthma.

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Therapeutic Area, Distribution Channel, Dosage Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for home-based treatment solutions will continue to rise due to growing chronic disease cases.

- Development of smart injectors and wearable drug delivery systems will enhance treatment convenience.

- Pharmaceutical innovation will focus on biologics and patient-friendly formulations for self-use.

- Integration of mobile apps and digital monitoring will improve adherence and remote supervision.

- Rising healthcare costs will push patients toward self-managed therapies for affordability.

- Regulatory support for connected and personalized drug delivery will accelerate product approvals.

- Asia-Pacific will experience strong growth due to increasing healthcare access and awareness.

- Manufacturers will invest in ergonomic device designs to simplify drug administration.

- Partnerships between pharma and tech companies will drive digital health ecosystem expansion.

- Growth in online pharmacy distribution will improve availability and global reach of self-administered drugs.