Market Overview

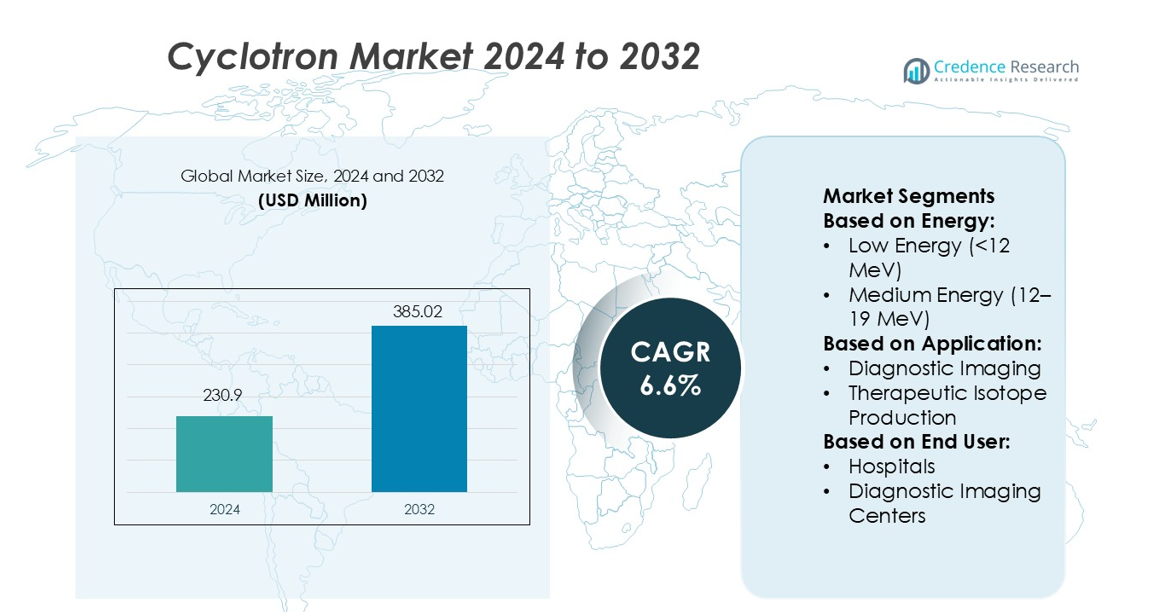

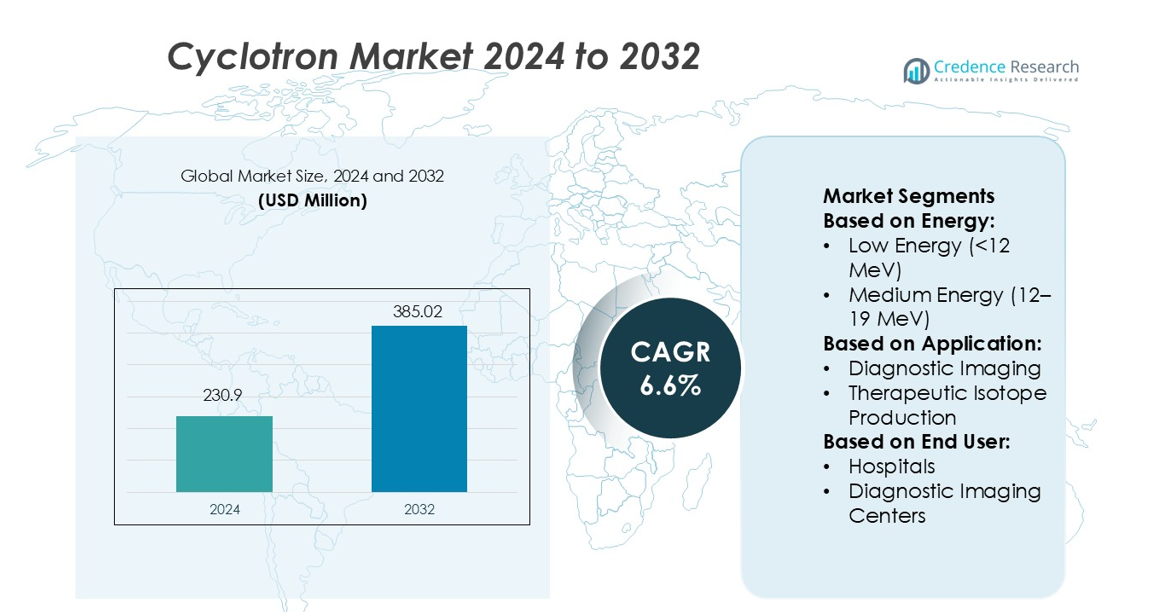

Cyclotron Market size was valued USD 230.9 million in 2024 and is anticipated to reach USD 385.02 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cyclotron Market Size 2024 |

USD 230.9 million |

| Cyclotron Market, CAGR |

6.6% |

| Cyclotron Market Size 2032 |

USD 385.02 million |

The cyclotron market is characterized by strong competition among leading manufacturers focused on innovation, automation, and compact system design. Top players emphasize precision engineering, energy efficiency, and enhanced isotope production capabilities to cater to the expanding needs of diagnostic and therapeutic applications. Companies are investing heavily in R&D to improve system reliability, reduce operational costs, and ensure compliance with global radiation safety standards. Strategic collaborations between medical institutions and technology providers strengthen their market positions. North America leads the global cyclotron market with a 36% share, supported by advanced healthcare infrastructure, high adoption of nuclear medicine imaging, and strong government support for isotope production initiatives.

Market Insights

- The Cyclotron Market was valued at USD 230.9 million in 2024 and is projected to reach USD 385.02 million by 2032, growing at a CAGR of 6.6%.

- Increasing demand for PET and SPECT imaging drives market growth, supported by expanding use of diagnostic and therapeutic isotopes in oncology and cardiology.

- Continuous advancements in compact and automated cyclotron designs enhance isotope yield, improve safety, and reduce operational costs, strengthening adoption across hospitals and research centers.

- High installation costs and strict radiation safety regulations act as restraints, limiting market penetration in low-income regions with limited nuclear medicine infrastructure.

- North America leads with 36% market share, followed by Europe at 29% and Asia-Pacific at 24%, while the medium-energy segment remains dominant due to its suitability for producing key medical isotopes and supporting advanced nuclear imaging applications globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Energy

The medium-energy segment (12–19 MeV) holds the dominant share in the cyclotron market. Its high adoption stems from optimal isotope yield, manageable operational costs, and compatibility with widely used radioisotopes such as fluorine-18 and carbon-11. Medium-energy cyclotrons are ideal for PET imaging centers and research institutes due to their reliability and compact size. The growing use of PET-based diagnostics in oncology and cardiology further drives installations. Manufacturers focus on integrating automation and energy-efficient designs to enhance throughput and reduce radiation exposure during isotope production.

- For instance, IBA’s Cyclone® 18/9 system delivers up to 9,000 µA beam current for efficient F-18 production while reducing shielding requirements by 30%.

By Application

Diagnostic imaging is the leading application segment in the cyclotron market, accounting for the largest market share. The demand is fueled by rising PET and SPECT imaging procedures for cancer detection, neurology, and cardiovascular diseases. Cyclotrons enable consistent production of short-lived isotopes, ensuring reliable diagnostic operations. The growing prevalence of chronic diseases and expansion of nuclear medicine departments in hospitals further support this segment’s growth. Advancements in isotope purity and production efficiency also encourage healthcare providers to adopt advanced cyclotron systems for clinical imaging.

- For instance, LG Chem’s Life Sciences division reports that their radiopharmaceutical manufacturing platform achieved a radiochemical purity of 99.8% for their FDG (fluorodeoxyglucose) batches and reduced synthesis time to 37 minutes per batch, which enabled production of 12,000 GBq of FDG in a single 8-hour run (as stated in their official company introduction).

By End User

Hospitals dominate the end-user segment due to their growing in-house isotope production capabilities and integration of PET/CT facilities. Establishing on-site cyclotron units allows hospitals to reduce dependency on third-party suppliers and ensure a continuous supply of radioisotopes for diagnostic and therapeutic purposes. Increasing investment in nuclear medicine infrastructure and government-funded programs enhance accessibility to radiopharmaceuticals. Diagnostic imaging centers also show steady growth as private healthcare facilities expand their imaging services. The trend toward cost-effective, high-performance compact cyclotrons further supports adoption across both hospital and independent diagnostic networks.

Key Growth Drivers

Rising Demand for Diagnostic Radioisotopes

Growing use of PET and SPECT imaging in oncology, neurology, and cardiology drives cyclotron installations. These machines produce key isotopes such as fluorine-18 and gallium-68 essential for early disease detection. The expansion of nuclear medicine facilities worldwide enhances the need for reliable, on-site isotope production. Additionally, the rise in chronic disease prevalence and focus on precision diagnostics push hospitals and research centers to invest in cyclotron technology to ensure consistent and high-purity isotope availability.

- For instance, Huntsman’s Araldite® EP 300 adhesive system reports a compressive strength of 11,000 psi (≈75.8 MPa) after cure at 77 °F (25 °C) for 5 days, supporting structural bonding in imaging-equipment assemblies.

Technological Advancements in Cyclotron Design

Continuous innovation in cyclotron design improves efficiency, reliability, and safety. Compact and automated cyclotrons enable faster isotope production while reducing operational complexity. Features like integrated shielding and remote control minimize radiation exposure for operators. Leading manufacturers focus on enhancing energy efficiency and output capacity to meet growing clinical demands. These innovations reduce maintenance costs, improve system uptime, and expand usability across both large hospitals and small imaging facilities, strengthening the market’s technological foundation.

- For instance, Siemens’ “Eclipse” cyclotron system delivers a maximum extracted proton current of 150 µA at 11 MeV (dual beam mode: two × 75 µA) for optimized isotope production.

Expansion of Nuclear Medicine Infrastructure

Governments and private healthcare organizations are investing heavily in nuclear medicine facilities. This expansion supports increased accessibility to radiopharmaceuticals and accelerates the adoption of cyclotron systems. Public–private partnerships encourage local isotope production and reduce import dependency. In emerging economies, favorable policies and funding initiatives promote PET/CT center development. These infrastructure upgrades not only enhance diagnostic capabilities but also establish new regional hubs for radioisotope supply, contributing to the steady growth of the cyclotron market globally.

Key Trends & Opportunities

Shift Toward Compact and Cost-Effective Cyclotrons

Manufacturers are developing compact, self-shielded cyclotrons to serve hospitals and smaller research facilities. These systems require less space and lower installation costs, making them attractive for decentralized healthcare setups. Portable cyclotrons support on-site isotope production and reduce logistical challenges associated with short-lived isotopes. This miniaturization trend opens opportunities for broader adoption in developing regions where large-scale infrastructure is limited, enabling more localized and timely access to diagnostic isotopes.

- For instance, IBA Cyclone® KEY 9.2 MeV medical cyclotron ranges from EUR 1.9 million to EUR 3.2 million (approximately USD 2.0 million to USD 3.4 million, exchange rates vary), depending on the specific configuration and options included.

Growing Research in Therapeutic Isotope Production

The expansion of theranostic applications, combining diagnosis and targeted therapy, boosts demand for cyclotrons capable of producing therapeutic isotopes like copper-67 and zirconium-89. Research organizations and pharmaceutical companies are investing in advanced cyclotron facilities to develop precision radiopharmaceuticals. This growing focus on personalized treatment approaches creates opportunities for cyclotron manufacturers to introduce systems tailored for both diagnostic and therapeutic isotope production, strengthening their role in modern nuclear medicine.

- For instance, GE HealthCare’s PETtrace 800 Series cyclotron provides proton beam options up to 160 µA (PETtrace 890 model) and offers a dual-beam mode allowing simultaneous irradiation of two targets.

Key Challenges

High Initial Investment and Maintenance Costs

The substantial capital required for cyclotron installation, facility shielding, and regulatory compliance remains a key barrier. Small hospitals and diagnostic centers often face challenges in securing funds for setup and ongoing maintenance. High energy consumption and the need for specialized operators add to operational expenses. These financial and technical constraints limit market penetration, particularly in developing countries with limited healthcare budgets or infrastructure for nuclear medicine.

Regulatory and Safety Constraints

Cyclotron operations involve strict regulatory oversight due to radiation safety concerns and isotope transport rules. Obtaining necessary licenses and approvals can delay project implementation. Variations in regional regulatory frameworks further complicate cross-border isotope supply. Inadequate operator training and non-compliance risks can result in costly penalties or operational shutdowns. Addressing these regulatory complexities is essential for ensuring sustainable growth and maintaining trust in cyclotron-based radioisotope production.

Regional Analysis

North America

North America dominates the cyclotron market with a 36% share, driven by well-established nuclear medicine infrastructure and high adoption of PET/CT imaging. The United States leads regional demand due to increasing investments in oncology diagnostics and isotope production facilities. Government support for medical radioisotope self-sufficiency further strengthens market growth. Key manufacturers and research institutes actively collaborate to enhance isotope yield and distribution efficiency. Canada also contributes significantly with public–private initiatives aimed at expanding domestic isotope production capabilities, ensuring a steady supply chain for clinical and research applications across the region.

Europe

Europe accounts for a 29% market share, supported by strong regulatory frameworks and advanced healthcare infrastructure. Countries such as Germany, the UK, and France are major contributors due to the growing use of PET-based diagnostics and cancer imaging programs. Collaborative research between medical institutes and cyclotron manufacturers enhances technology adoption. The European Commission’s initiatives to boost nuclear medicine innovation and radiopharmaceutical research also propel growth. Increasing investments in compact cyclotron installations across hospitals and research centers further strengthen the region’s focus on self-sustained isotope production and medical imaging expansion.

Asia-Pacific

Asia-Pacific holds a 24% market share, emerging as the fastest-growing region in the cyclotron market. Rapid healthcare infrastructure development and rising demand for diagnostic imaging in China, Japan, India, and South Korea drive expansion. Governments in the region support local isotope production to reduce reliance on imports. Technological advancements, combined with growing awareness of nuclear medicine’s clinical value, fuel equipment installation across both public and private sectors. Increasing partnerships between cyclotron manufacturers and healthcare providers strengthen the regional ecosystem, promoting localized production and accessibility of radioisotopes for clinical and research use.

Latin America

Latin America represents a 7% market share, with Brazil, Mexico, and Argentina driving growth through expanding nuclear medicine programs. Rising investments in healthcare modernization and regional partnerships with global cyclotron suppliers support the establishment of PET imaging centers. Government initiatives aimed at improving cancer diagnostics are promoting local isotope production. However, limited infrastructure and skilled workforce availability remain challenges. Continuous efforts by research institutes and public–private collaborations are expected to enhance accessibility and affordability, supporting gradual growth of the cyclotron market across the region’s developing healthcare landscape.

Middle East & Africa

The Middle East & Africa region accounts for a 4% market share, supported by increasing healthcare investments and the introduction of advanced diagnostic technologies. Countries such as the UAE, Saudi Arabia, and South Africa are investing in nuclear medicine facilities to strengthen cancer detection and treatment capabilities. Regional collaborations with international cyclotron manufacturers are enabling knowledge transfer and equipment deployment. Despite limited isotope production infrastructure, government-led healthcare modernization programs and rising private-sector participation are expected to accelerate market penetration, improving access to nuclear imaging services across key urban healthcare centers.

Market Segmentations:

By Energy:

- Low Energy (<12 MeV)

- Medium Energy (12–19 MeV)

By Application:

- Diagnostic Imaging

- Therapeutic Isotope Production

By End User:

- Hospitals

- Diagnostic Imaging Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cyclotron market features key players such as Haltermann Carless, LG Chem, Prasol Chemicals Pvt. Ltd., SK Global Chemical Co., Ltd., DYMATIC Chemicals, Inc., Merck KGaA, Huntsman Corporation, INEOS, Chevron Phillips Chemical Company LLC, and Eastman Chemical Company. The cyclotron market is defined by continuous technological advancement, strategic collaborations, and expanding global reach. Leading manufacturers focus on developing compact, energy-efficient cyclotrons to meet the growing demand for diagnostic and therapeutic radioisotopes. Companies are investing in R&D to improve isotope yield, reduce operational costs, and enhance automation for safer and faster production. Partnerships between healthcare institutions and technology providers drive innovation in isotope supply chains and system integration. Moreover, regional expansion initiatives and compliance with stringent radiation safety standards help strengthen market presence. The emphasis on sustainability, precision engineering, and long-term reliability continues to shape competition in this dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Haltermann Carless

- LG Chem

- Prasol Chemicals Pvt. Ltd.

- SK Global Chemical Co., Ltd.

- DYMATIC Chemicals, Inc.

- Merck KGaA

- Huntsman Corporation

- INEOS

- Chevron Phillips Chemical Company LLC

- Eastman Chemical Company

Recent Developments

- In August 2024, INVISTA expanded its nylon 6,6 polymer facility at the Shanghai Chemical Industry Park, effectively doubling its annual output to 400,000 metric tons. The project aimed to boost local supply capacity and meet the rising demand for nylon-based products, especially in sectors that depend on cyclohexanone.

- In May 2024, Nylon Corporation of America (NYCOA) launched NY-Clear, a next-generation amorphous 6I/6T nylon developed for packaging and precision-molded uses. This transparent material delivers outstanding clarity and enhanced barrier performance, offering up to 30% greater resistance to oxygen, carbon dioxide, and water vapor transmission than alternative materials.

- In February 2023, HCS Group has launched a new low-carbon pentane product range that includes Cyclopentane, n- and iso-Pentane and their blends. This new product range is ISCC PLUS certified and has been introduced by the company for customers aiming to reduce their carbon footprint in specialty applications and industries.

Report Coverage

The research report offers an in-depth analysis based on Energy, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing use of PET and SPECT imaging will continue to boost cyclotron demand.

- Compact and self-shielded cyclotrons will gain traction in hospitals and research centers.

- Integration of automation and AI will enhance isotope production efficiency and safety.

- Rising investments in nuclear medicine infrastructure will support broader regional adoption.

- Demand for therapeutic isotopes will grow with advancements in targeted cancer therapies.

- Partnerships between manufacturers and healthcare providers will strengthen supply chains.

- Technological innovation will focus on reducing maintenance costs and energy consumption.

- Emerging economies will witness accelerated installation of small and mid-range cyclotrons.

- Regulatory harmonization across regions will simplify equipment approvals and exports.

- Sustainability-focused manufacturing practices will shape future cyclotron design and operations.