Market Overview

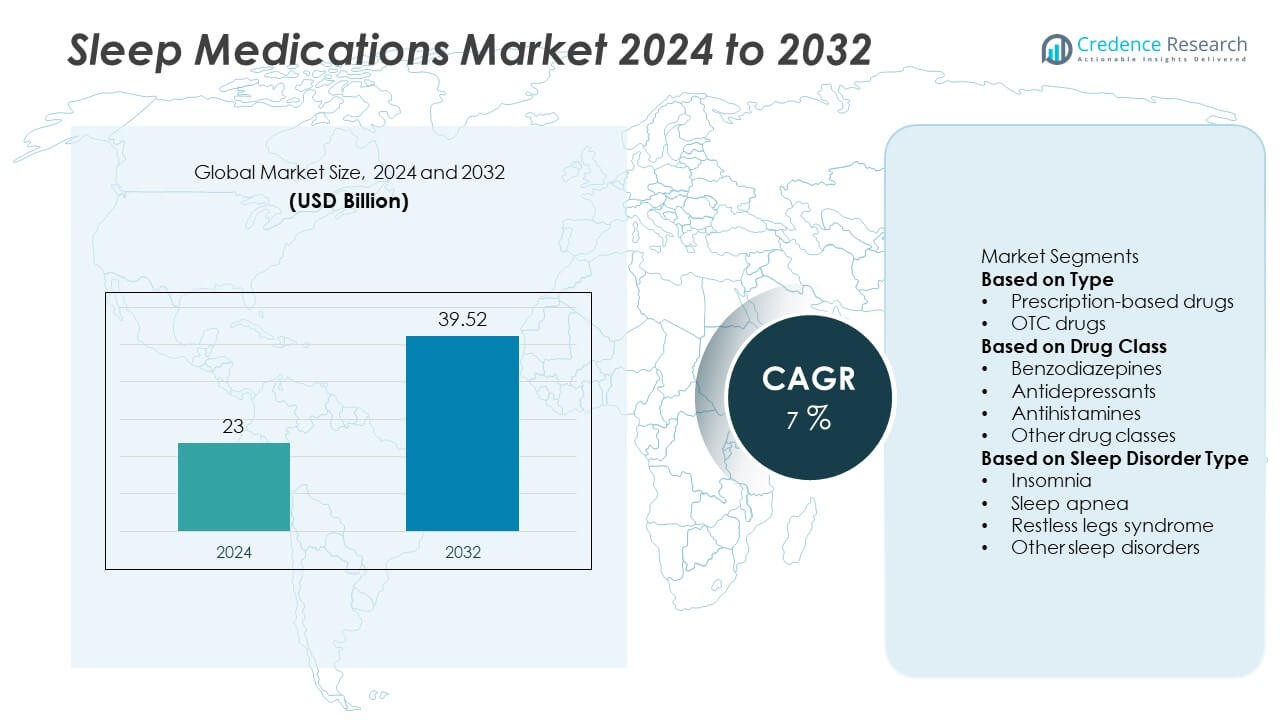

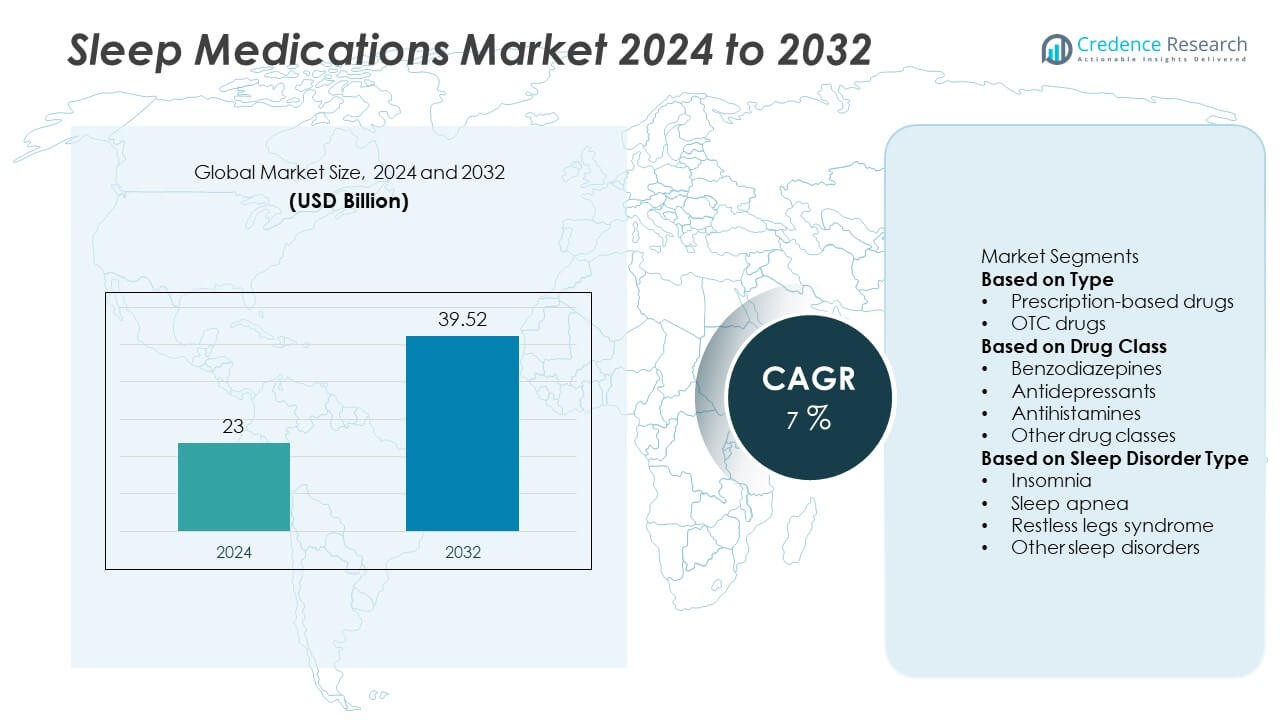

The Sleep Medications Market was valued at USD 23 billion in 2024 and is projected to reach USD 39.52 billion by 2032, growing at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sleep Medications Market Size 2024 |

USD 23 Billion |

| Sleep Medications Market, CAGR |

7% |

| Sleep Medications Market Size 2032 |

USD 39.52 Billion |

The sleep medications market is led by major companies such as Teva Pharmaceuticals, Pfizer Inc., Takeda Pharmaceutical Company Limited, Sunovion Pharmaceuticals Inc., Novartis A, Johnson & Johnson, Eisai Co., Ltd., Merck and Co Inc., Sanofi SA, and Vanda Pharmaceuticals. These players dominate through strong product portfolios, continuous R&D investments, and innovations in non-addictive and extended-release formulations. Strategic partnerships and the introduction of orexin receptor antagonists have enhanced their global market presence. North America emerged as the leading region with a 41.5% market share in 2024, driven by high insomnia prevalence, advanced healthcare infrastructure, and increasing adoption of both prescription and over-the-counter sleep aids.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The sleep medications market was valued at USD 23 billion in 2024 and is projected to reach USD 39.52 billion by 2032, growing at a CAGR of 7% during the forecast period.

- Increasing prevalence of insomnia, sleep apnea, and other sleep-related disorders is driving strong demand for both prescription and OTC medications worldwide.

- Market trends indicate a shift toward non-habit-forming and natural formulations, supported by advancements in digital sleep tracking and personalized treatment approaches.

- Key players such as Pfizer Inc., Teva Pharmaceuticals, and Merck & Co Inc. are focusing on new drug launches, partnerships, and R&D investments to strengthen their competitive edge.

- North America led with a 41.5% share in 2024, followed by Europe with 28.6%, while Asia-Pacific held 22.8% as the fastest-growing region; the prescription-based drugs segment dominated with a 67.4% share, driven by clinical efficacy and physician-recommended treatments.

Market Segmentation Analysis:

By Type

The prescription-based drugs segment dominated the sleep medications market with a 67.4% share in 2024, driven by rising diagnoses of chronic insomnia and sleep apnea. These medications are preferred for their clinically proven efficacy and physician-supervised use. Growing demand for targeted therapies, such as non-benzodiazepine hypnotics, supports sustained segment growth. The over-the-counter (OTC) segment is expanding steadily due to increasing consumer awareness and accessibility, especially for mild sleep disturbances. Retail pharmacies and e-commerce platforms further enhance OTC product reach across developed and emerging economies.

- For instance, Eisai Co., Ltd. distributes its prescription sleep medication Dayvigo® (lemborexant) in more than 25 countries, including the United States, with approved dosing of 5 mg and 10 mg once nightly.

By Drug Class

The benzodiazepines segment held the largest share of 38.9% in 2024, attributed to their effectiveness in treating severe insomnia and anxiety-induced sleep disorders. Despite concerns over dependency risks, their short-term therapeutic benefits maintain strong clinical demand. The antidepressant class is also witnessing growth due to dual benefits in managing depression-related sleep disturbances. Antihistamines are gaining traction as non-prescription alternatives for mild insomnia cases, supported by their safety and affordability. Continuous development of safer, extended-release formulations is driving innovation across all drug classes.

- For instance, Teva Pharmaceuticals manufactures clonazepam and temazepam formulations across its global portfolio in regulated GMP facilities. Temazepam has a mean half-life of 9 to 15 hours and is known for having a minimal “hangover effect,” reducing residual next-day sedation compared to some other longer-acting benzodiazepines.

By Sleep Disorder Type

The insomnia segment led the market with a 54.7% share in 2024, reflecting the high global prevalence of this condition driven by stress, lifestyle disorders, and mental health issues. Increasing awareness about the impact of sleep quality on overall health fuels demand for effective therapies. Sleep apnea follows as the second-largest segment, supported by growing use of adjunctive medications with CPAP therapy. Treatments for restless legs syndrome and other circadian rhythm disorders are expanding, driven by better diagnosis rates and ongoing research in neuropharmacology.

Key Growth Drivers

Rising Prevalence of Sleep Disorders

The global increase in sleep disorders such as insomnia, sleep apnea, and restless legs syndrome is driving strong demand for sleep medications. Sedentary lifestyles, high stress levels, and irregular work schedules contribute to poor sleep health. According to the American Sleep Association, nearly 30% of adults experience short-term insomnia, with 10% facing chronic forms. This growing patient pool, along with rising diagnosis and treatment awareness, is boosting prescription drug sales and supporting market expansion across both developed and emerging economies.

- For instance, Merck & Co., Inc. reported in clinical trials that its dual orexin receptor antagonist Belsomra® (suvorexant) demonstrated efficacy in treating insomnia. In one study in patients with mild-to-moderate Alzheimer’s disease and insomnia, Belsomra (at 10 mg or 20 mg) showed a mean increase in total sleep time of 28.2 minutes and an improvement in wake after persistent sleep onset (WASO) of 15.7 minutes compared to placebo.

Growing Awareness of Mental Health and Sleep Hygiene

Increased public awareness regarding the connection between mental health and sleep quality is fueling demand for effective therapeutic solutions. Consumers are becoming more proactive in seeking medical advice for sleep management, supported by educational campaigns and mental wellness initiatives. The inclusion of sleep health in global health policies and workplace wellness programs is also expanding market reach. Healthcare professionals increasingly recommend tailored pharmacological and behavioral therapies to manage chronic sleep disorders effectively.

- For instance, Johnson & Johnson has developed the investigational drug seltorexant for major depressive disorder with insomnia symptoms. In a Phase 3 clinical trial for adults, seltorexant was shown to improve depressive symptoms and sleep disturbances.

Advancements in Drug Development and Delivery Technologies

Pharmaceutical innovations are reshaping the sleep medications market by introducing safer, non-habit-forming alternatives. Companies are focusing on controlled-release formulations and novel mechanisms of action to enhance sleep duration and reduce dependency risks. Developments in melatonin receptor agonists and orexin antagonists offer better-tolerated treatment options. Furthermore, digital therapeutics and smart dosing systems are improving patient adherence and therapy outcomes. These advancements are expected to create long-term growth opportunities by addressing unmet clinical needs and enhancing overall sleep quality.

Key Trends & Opportunities

Shift Toward Non-Addictive and Natural Sleep Aids

Growing concerns about dependency and side effects associated with conventional sedatives are shifting consumer preference toward non-addictive and natural formulations. Melatonin-based supplements, herbal extracts, and CBD-infused sleep aids are gaining traction in both retail and online markets. Pharmaceutical companies are investing in plant-based active ingredients and low-risk compounds that provide mild sedation without withdrawal effects. This trend reflects a broader movement toward holistic and preventive sleep care, offering significant opportunities for product diversification and expansion into the wellness segment.

- For instance, Takeda Pharmaceutical Company Limited developed its investigational orexin receptor 2 agonist, Oveporexton (TAK-861), which demonstrated statistically significant and clinically meaningful improvements in excessive daytime sleepiness and cataplexy in patients with narcolepsy type 1 during Phase 3 clinical trials.

Integration of Digital Therapeutics and Personalized Sleep Solutions

The rise of digital therapeutics and wearable technology is transforming sleep disorder management. Apps and smart devices capable of tracking sleep patterns enable personalized medication schedules and behavioral insights. Pharmaceutical companies are collaborating with digital health platforms to develop integrated treatment models combining pharmacological and non-pharmacological approaches. AI-based diagnostics and predictive analytics further improve sleep disorder detection and therapy customization, opening new growth avenues for patient-centric sleep care solutions.

- For instance, digital therapeutics platform Kaia Health has demonstrated positive outcomes for sleep quality in studies related to its musculoskeletal (MSK) and Chronic Obstructive Pulmonary Disease (COPD) apps.

Key Challenges

Side Effects and Risk of Dependency

The long-term use of certain sleep medications, especially benzodiazepines and sedative-hypnotics, poses risks of tolerance, dependence, and cognitive impairment. These side effects limit prescription durations and discourage long-term usage. Healthcare authorities emphasize non-pharmacological therapies, such as cognitive behavioral therapy for insomnia (CBT-I), as first-line treatment. To overcome this, manufacturers are investing in developing safer compounds and extended-release formulations that minimize side effects while maintaining therapeutic efficacy and safety.

Stringent Regulatory Frameworks and Generic Competition

Stringent approval requirements and patent expirations challenge market growth and profitability. Regulatory agencies closely monitor the safety profiles and addiction potential of new sleep drugs, often prolonging approval timelines. Meanwhile, generic competition exerts pricing pressure on established brands, particularly in mature markets like the U.S. and Europe. Companies must balance innovation with affordability while maintaining compliance with international standards. Strategic differentiation and R&D in novel drug classes are essential to mitigate these challenges and sustain long-term competitiveness.

Regional Analysis

North America

North America dominated the sleep medications market with a 41.5% share in 2024, driven by high prevalence of insomnia and stress-related disorders. The U.S. leads the region with advanced healthcare infrastructure, strong awareness of sleep hygiene, and widespread access to prescription and OTC drugs. Rising adoption of digital health tools for sleep monitoring and increasing telemedicine consultations are further enhancing accessibility. The presence of leading pharmaceutical companies and active R&D in novel sleep therapeutics continue to strengthen North America’s position as the global leader in sleep disorder treatment.

Europe

Europe accounted for a 28.6% market share in 2024, supported by an aging population and growing cases of sleep apnea and depression-related insomnia. Countries such as Germany, France, and the U.K. are key contributors, driven by early diagnosis and healthcare reimbursement policies. The region’s strong regulatory framework promotes the development of safe and effective sleep medications. Increased focus on non-habit-forming drugs and integration of behavioral therapies alongside medication are enhancing treatment outcomes, positioning Europe as a mature and innovation-driven market for sleep-related therapeutics.

Asia-Pacific

Asia-Pacific held a 22.8% share in 2024, emerging as the fastest-growing region due to rising stress levels, changing lifestyles, and urbanization. Growing awareness of mental health, increasing healthcare access, and expanding pharmaceutical distribution networks are driving demand. China, Japan, and India lead regional growth with strong adoption of both prescription and herbal sleep aids. The rising prevalence of insomnia among working professionals and the expansion of online pharmacies are further supporting market development. Government initiatives addressing sleep health awareness continue to propel the region’s rapid expansion.

Latin America

Latin America captured a 4.5% market share in 2024, driven by growing healthcare infrastructure and increasing awareness of sleep-related health issues. Brazil and Mexico dominate the regional market, supported by rising access to over-the-counter medications and improved diagnostic capabilities. Expanding urban populations and changing work patterns are contributing to higher incidences of sleep disorders. Although pharmaceutical access remains limited in rural areas, multinational drug manufacturers are investing in market penetration strategies, offering affordable therapies and educational programs to support long-term sleep health management.

Middle East & Africa

The Middle East & Africa region accounted for a 2.6% market share in 2024, supported by rising lifestyle-related insomnia and growing awareness of mental well-being. The UAE, Saudi Arabia, and South Africa lead the market, with increasing investments in healthcare modernization and pharmacy expansion. Limited specialist availability remains a challenge; however, growing use of OTC sleep aids and herbal alternatives is boosting accessibility. Governments and healthcare providers are increasingly promoting awareness campaigns and partnerships to address sleep health, helping establish a gradual but steady market presence across the region.

Market Segmentations:

By Type

- Prescription-based drugs

- OTC drugs

By Drug Class

- Benzodiazepines

- Antidepressants

- Antihistamines

- Other drug classes

By Sleep Disorder Type

- Insomnia

- Sleep apnea

- Restless legs syndrome

- Other sleep disorders

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sleep medications market is highly competitive, featuring key players such as Teva Pharmaceuticals, Pfizer Inc., Takeda Pharmaceutical Company Limited, Sunovion Pharmaceuticals Inc., Novartis A, Johnson & Johnson, Eisai Co., Ltd., Merck and Co Inc., Sanofi SA, and Vanda Pharmaceuticals. These companies compete through innovation in drug development, expanding product portfolios, and strategic collaborations. Leading players focus on developing safer, non-habit-forming formulations, including melatonin receptor agonists and dual orexin receptor antagonists, to address unmet needs in insomnia and other sleep disorders. Ongoing R&D investments and clinical trials aim to enhance drug efficacy, safety, and patient compliance. Partnerships with digital health platforms and healthcare providers are strengthening integrated treatment approaches. Furthermore, the rise in generic drug competition and regional expansion initiatives drive continuous innovation and price optimization across both prescription and over-the-counter sleep medication markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Teva Pharmaceuticals

- Pfizer Inc.

- Takeda Pharmaceutical Company Limited

- Sunovion Pharmaceuticals Inc.

- Novartis A

- Johnson & Johnson

- Eisai Co., Ltd.

- Merck and Co Inc.

- Sanofi SA

- Vanda Pharmaceuticals

Recent Developments

- In September 2025, Vanda Pharmaceuticals Inc. published results in PLOS One indicating that its melatonin-agonist drug HETLIOZ® (tasimelteon) improved sleep among patients with primary insomnia, based on a multicenter, randomized, double-blind, placebo-controlled trial.

- In July 2025, Takeda Pharmaceutical Company Limited announced that its oral orexin-2 receptor agonist investigational drug Oveporexton (TAK‑861) met all primary and secondary endpoints in two Phase III studies in narcolepsy type 1, conducted across 19 countries.

- In May 2025, Eisai Co., Ltd. received approval in China for its orexin receptor antagonist Dayvigo® (lemborexant) for adult insomnia characterised by sleep-onset and/or sleep-maintenance difficulties.

Report Coverage

The research report offers an in-depth analysis based on Type, Drug Class, Sleep Disorder Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-addictive and extended-release sleep medications will continue to rise globally.

- Pharmaceutical innovation will focus on orexin receptor antagonists and melatonin-based compounds for safer use.

- Integration of digital therapeutics and wearable devices will enhance personalized sleep treatment.

- Over-the-counter and herbal sleep aids will see strong growth among health-conscious consumers.

- Strategic collaborations between pharma and tech companies will improve drug delivery and monitoring.

- Regulatory agencies will tighten oversight on dependency risks and clinical safety.

- North America will remain dominant, while Asia-Pacific will expand fastest with growing awareness.

- Companies will emphasize R&D for dual-action therapies addressing mental health and sleep.

- Generic drug entry will increase affordability but intensify pricing competition.

- Sustainability and eco-friendly production practices will shape the future of sleep medication manufacturing.